Global Airline Boarding Passes Market By Boarding Type (Paper Ticket, e-Ticket, and Mobile Boarding Passes), By Distribution Channel (Airport Counters and Online Travel Agencies), By Passengers Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Trends, and Forecast 2023-2032

- Published date: Oct. 2023

- Report ID: 102947

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

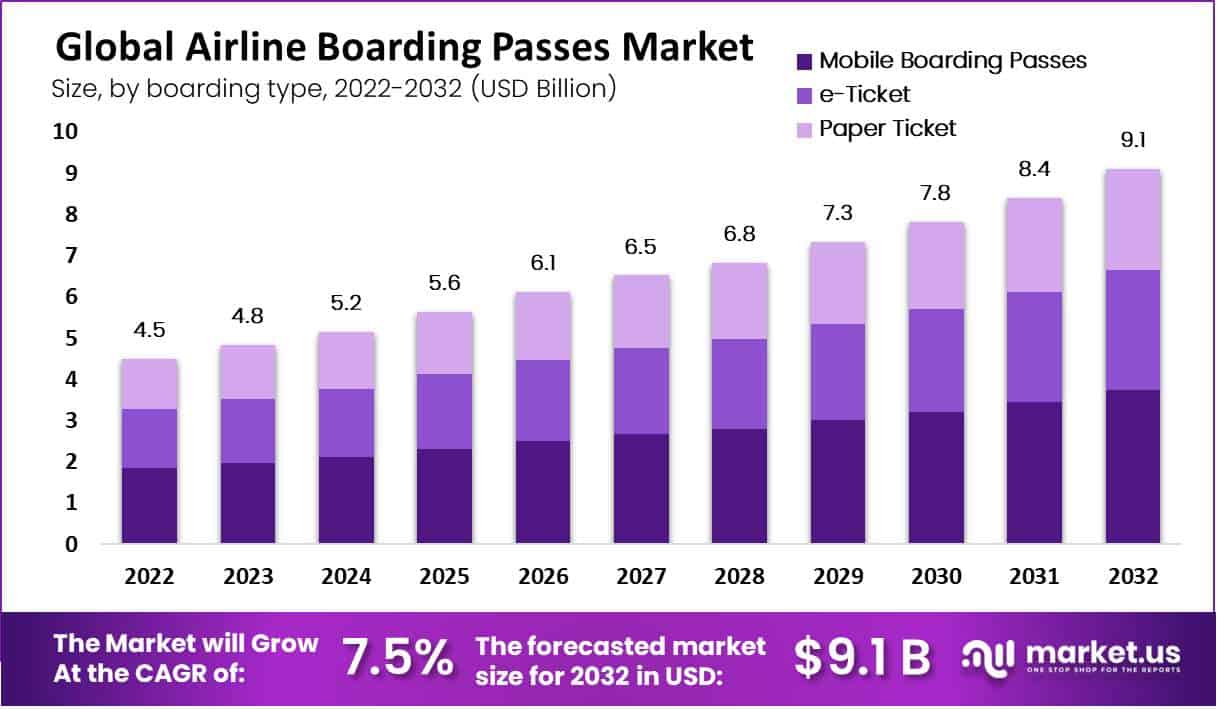

In 2022, the global airline boarding passes market was valued at USD 4.5 billion. This market is estimated to reach USD 9.1 billion at a CAGR of 7.5% between 2023 and 2032.

Airline boarding passes are essential documents that passengers must present to board a flight. Recently, there has been an evolution towards digital boarding passes which can be accessed and stored on passengers’ smartphones or tablets, providing greater convenience for travelers while saving airlines money.

The process of issuing airline boarding passes usually involves several steps. First, passengers make their reservations through an airline website or travel agency and receive either an electronic ticket or a paper ticket. They check in either online or at the airport using either a self-service kiosk or check-in counter. Upon completion of check-in, passengers receive their boarding pass either as a printed document or digital document on their smartphone. Finally, they present this boarding pass at the gate and board the aircraft.

Note: Actual Numbers Might Vary In The Final Report

The airline boarding pass market is driven by technology solutions such as check-in kiosks, printers, and mobile applications. Furthermore, factors like changing passenger preferences, security regulations, and the overall growth of the air travel industry influence demand for boarding passes.

Key Takeaway

- Market Growth: In 2023, the global airline boarding pass market was valued at USD 4.8 billion and is projected to reach USD 9.1 billion by 2032 with compound annual growth rate of 7.5%.

- Demand and Trends: Demand for airline boarding passes is expected to increase significantly due to rising air travel demand and growing adoption of self-service check-in kiosks. Mobile boarding passes have become more and more popular as an efficient means of boarding flights.

- Analysis by Boarding Type: Mobile boarding passes held a 41% market share within the Airline Boarding Passes market.

- By Analyzing Distribution Channels: Airline counters held 57% market share.

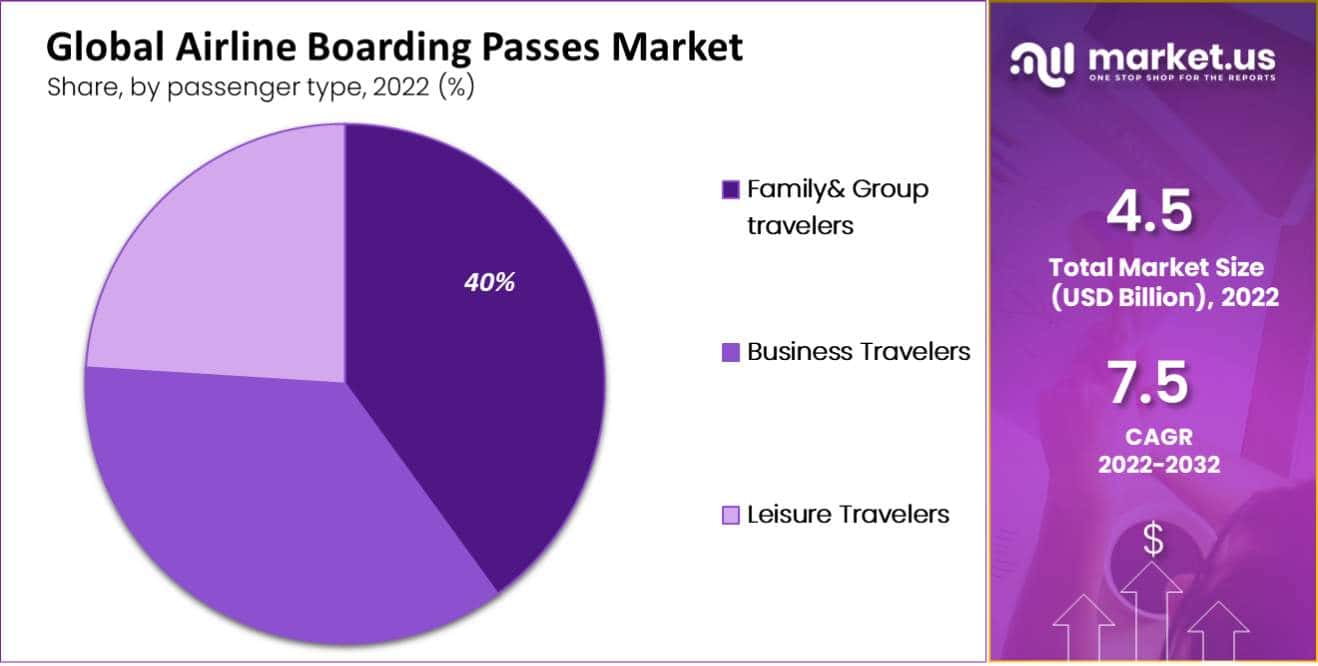

- By Passengers Type Analysis: Family and group travelers accounted for 40% of travel.

- Drivers: Rising Adoption of Mobile Boarding Passes and Growing Demand for Air Travel.

- Restrictions: Concerns related to security and lack of knowledge among older passengers regarding mobile boarding passes as possible solutions are key barriers.

- Opportunities: Integrating mobile boarding passes with other travel-related apps could create opportunities.

- Challenges: Securing mobile boarding passes while also informing passengers on the use of mobile boarding passes are two primary concerns when using them.

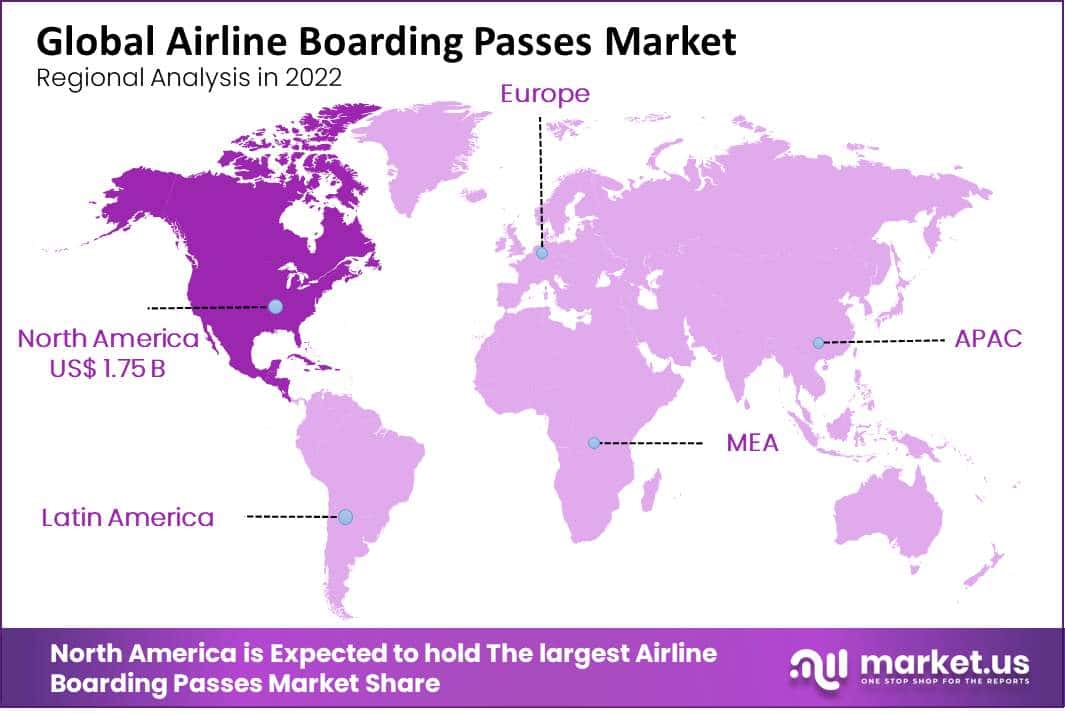

- Regional Analysis: North America has an extremely mature airline boarding pass market, while Asia-Pacific’s is quickly developing in response to an increase in air travel demand in that region.

- Top 9 Vendors: Amadeus, Sabre Corporation, IATA, SITA, DCS, NEC Corporation, Daifuku Co. Ltd., Conztanz, Unisys Corporation

Driving Factors

Mobile boarding passes have become possible thanks to the growing popularity of cell phones. By doing away with printed paper tickets, these digital tickets provide travelers with a practical and user-friendly choice for check-in as well as check-out boarding. Airlines are aiming to provide more tailored services to their customers, and boarding cards are no different.

Passengers’ experiences can be improved and made more memorable with personalized boarding tickets that include their names, seat allocations, and gate information. Boarding passes are a crucial component of aviation security, and airlines are always looking for ways to further secure their customers. To increase the level of security during boarding, cutting-edge technology like biometric boarding permits are being developed.

Airlines are constantly looking for methods to make the boarding process more effective, and boarding cards play a key role in this. Modern innovations like self-service kiosks and online check-in can hasten boarding and shorten passenger wait times. Boarding passes are no exception to the aviation industry’s growing awareness of its influence on the environment. Airlines are looking into ways to use less paper by creating digital boarding passes, which can lessen waste and its impact on the environment.

Restraining Factors

With the increasing emphasis on security measures at airports, boarding passes must have specific features and technologies to guarantee their authenticity and identity. This poses a challenge for airlines to implement and maintain, potentially placing restrictions on market growth. Boarding passes can be disrupted owing to technical problems like printer malfunctions, connectivity problems, or system errors.

These delays cause inconvenience for passengers which could result in negative feedback and harm the airline’s reputation. Airlines must abide by various legal and regulatory requirements when issuing boarding passes, such as data privacy laws, airline regulations, and international travel requirements.

These restrictions can limit their capacity to innovate and implement new technologies that could hinder market growth. Implementing as well as maintaining boarding pass technology can be expensive, particularly for smaller airlines. This puts airlines under financial strain and inhibits their ability to invest in new technologies and offer budget-conscious boarding pass options for passengers.

By Boarding Type Analysis

Based on Boarding type, the market is segmented into paper tickets, e-tickets, and mobile boarding passes. With the advent of smartphones, mobile boarding passes dominated the Airline Boarding Passes market with a 41% market share. Many airlines have introduced mobile boarding passes that allow customers to check in, access their boarding passes, and even board the flight without having to print anything.

The market for mobile boarding passes is growing rapidly as customers increasingly prefer the convenience of carrying their boarding passes on their phones. Paper ticket boarding passes have been the standard for many years. Also, some customers still prefer them for various reasons, such as familiarity, ease of use, or not having a smartphone. The market for paper boarding passes is relatively stable, but it is gradually declining as more customers adopt mobile boarding passes.

By Distribution Channel Analysis

By Distribution Channel, the market is divided into airport counters and online travel agencies. Airlines counters dominated the market with 57% market share. airlines sell their boarding passes directly to customers through their websites, mobile apps, or at their ticket counters. Direct distribution allows airlines to have complete control over the customer experience, and they can offer personalized boarding pass features and benefits.

Many customers book their flights through online travel agencies such as Expedia, Booking.com, or Travelocity. In this case, the boarding passes are distributed by the airline to the OTA, and the OTA then provides them to the customer. The market for boarding passes through OTAs is significant, as many customers prefer to book their flights and boarding passes through one platform.

By Passengers Type Analysis

Based on passenger type, the market is further segmented into family & group travelers, business travelers, and leisure travelers. Family and group travelers dominated the market with a 40% share. Airlines typically allow families to book tickets together either online or through a travel agent, so it’s best to do so as early as possible so all family members can sit together on board. Most airlines allow young children to board early either before or after first-class passengers so they can settle into their seats and stow their luggage before other passengers board.

Business class tickets tend to be more expensive than economy class, but they offer additional amenities and services such as larger seats, more legroom, priority boarding, and access to airport lounges. Business classes can be booked either online or through a travel agent; it’s best to book them as early on in the process so there is availability. Business class passengers usually have priority boarding either before or after first-class passengers so they can settle into their seats and stow luggage before other passengers board.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Based on Boarding Type

- Paper Ticket

- e-Ticket

- Mobile Boarding Passes

Based on Distribution Channel

- Airline’s Counters

- Online Travel Agencies

Based on Passenger Type

- Business Travelers

- Leisure Travelers

- Family& Group travelers

Growth Opportunity

Airlines have the chance to offer mobile boarding cards given the rise in the use of smartphones and other mobile devices. Doing away with paper tickets, not only offers ease and flexibility to consumers, but it lowers expenses for airlines. Airlines can design boarding cards for passengers, providing a more individualized travel experience, using passenger data and analytics.

This might include suggestions for in-flight services and amenities as well as personalized messaging also seating arrangements. To improve security and speed up boarding, boarding permits can be combined with other technology, such as biometric authentication. Passengers benefit from a more simplified and effective travel experience as a result.

Latest Trends

Airline boarding passes have traditionally been physical documents that passengers receive at the airport check-in desk or self-service kiosk. But in recent years there has been an increasingly prevalent trend towards electronic boarding passes which can be accessed on a passenger’s mobile device or emailed directly to them. Electronic boarding passes have become increasingly popular due to their convenience for passengers, cost savings for airlines, and environmental concerns.

Passengers no longer need to wait in line for physical boarding passes to be collected; additionally, electronic boarding passes reduce printing expenses for airlines as well as paper waste production. Another trend in the airline boarding pass market is the implementation of biometric technology. Some airlines are testing facial recognition or fingerprint scanning to confirm passengers’ identities at various points during boarding. This can simplify things and eliminate manual document checks.

Regional Analysis

The largest share in the market will be dominated by North America with 39% of the market share owing to the high adoption rate boarding pass market is highly developed and established

The North America airline boarding pass market is highly developed and established. Major airlines like American Airlines, Delta, as well United have invested heavily in technology to streamline check-in and boarding procedures. Many passengers in North America now utilize mobile boarding passes while electronic boarding passes continue to gain traction.

The European airline boarding pass market is similar to North America in terms of the development and adoption of electronic boarding passes. Major airlines like Lufthansa, British Airways, and Air France-KLM have invested heavily in technology to enhance passenger experiences; many airports boast self-service kiosks as well as automated boarding gates for added convenience.

The Asia-Pacific market for airline boarding passes is expanding rapidly, driven by rising air travel demand in the region. While many passengers still use paper boarding passes, electronic boarding passes are becoming more widely adopted. Major airlines like China Southern, Cathay Pacific, and Singapore Airlines are investing heavily in technology to enhance passenger experiences; also many airports are upgrading their technology infrastructures to support electronic boarding passes.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

The details include information about the company’s financials, revenues generated, market potential, and investment in R&D. New market initiatives, global presence, production facilities and sites, production capacities, strengths and weaknesses of the company, product launch, product breadth, and breadth, as well as company dominance. This information is only relevant to the company’s attention to the global Airline Boarding Passes Market.

Listed below are some of the most prominent bio-based surface disinfectant industry players.

- Amadeus

- Sabre Corporation

- IATA

- SITA

- DCS

- NEC Corporation

- Daifuku Co. Ltd.

- Conztanz

- Unisys Corporation

- Other Key Players

Recent Developments

- August 2020: Beijing Capital International Airport (BCIA) recently implemented SITA Smart Path, a biometric contactless system. Now passengers at BCIA can navigate the airport using only their faces as passports or boarding cards thanks to SITA Smart Path technology. According to SITA, processing more than 400 passengers for an Airbus A380 aircraft took less than 20 minutes at BCIA.

Report Scope

Report Features Description Market Value (2022) USD 4.5 Bn Forecast Revenue (2032) USD 9.1 Bn CAGR (2023-2032) 7.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Boarding Type, By Distribution Channel, By Passengers Type Regional Analysis North America – The US, Canada,&Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, &Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, &Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, &Rest of MEA Competitive Landscape Amadeus, Sabre Corporation, IATA, SITA, DCS, NEC Corporation, Daifuku Co. Ltd., Conztanz, Unisys Corporation, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Airline Boarding Passes Market?In 2022, the global Airline Boarding Passes Market was valued at USD 4.5 billion.

What will be the market size for Airline Boarding Passes Market in 2032?In 2032, the Airline Boarding Passes Market will reach USD 9.1 billion.

What CAGR is projected for the Airline Boarding Passes Market?The Airline Boarding Passes Market is expected to grow at 7.5% CAGR (2023-2032).

List the segments encompassed in this report on the Airline Boarding Passes Market?Market.US has segmented the Airline Boarding Passes Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Boarding Type, market has been segmented into Paper Ticket, e-Ticket and Mobile Boarding Passes. By Distribution Channel, the market has been further divided into Airline’s Counters and Online Travel Agencies.

Which segment dominate the Airline Boarding Passes industry?With respect to the Airline Boarding Passes industry, vendors can expect to leverage greater prospective business opportunities through the Mobile Boarding Passes segment, as this dominate this industry.

Name the major industry players in the Airline Boarding Passes Market.Amadeus, Sabre Corporation, IATA, SITA, DCS, NEC Corporation, Daifuku Co. Ltd. and Other Key Players are the main vendors in this market.

Airline Boarding Passes MarketPublished date: Oct. 2023add_shopping_cartBuy Now get_appDownload Sample

Airline Boarding Passes MarketPublished date: Oct. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Amadeus

- Sabre Corporation

- IATA

- SITA

- DCS

- NEC Corporation

- Daifuku Co. Ltd.

- Conztanz

- Unisys Corporation

- Other Key Players