Global Aircraft Mounts Market By Aircraft Type (Military, Commercial, and General Aviation), By Mount Type (Interior Mounts, Exterior Mounts), By Material(Rubber, Steel Alloys, Aluminum Alloys and Other Materials), By End-Use (Original Equipment Manufacturer and Replacement), by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2023

- Report ID: 74457

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

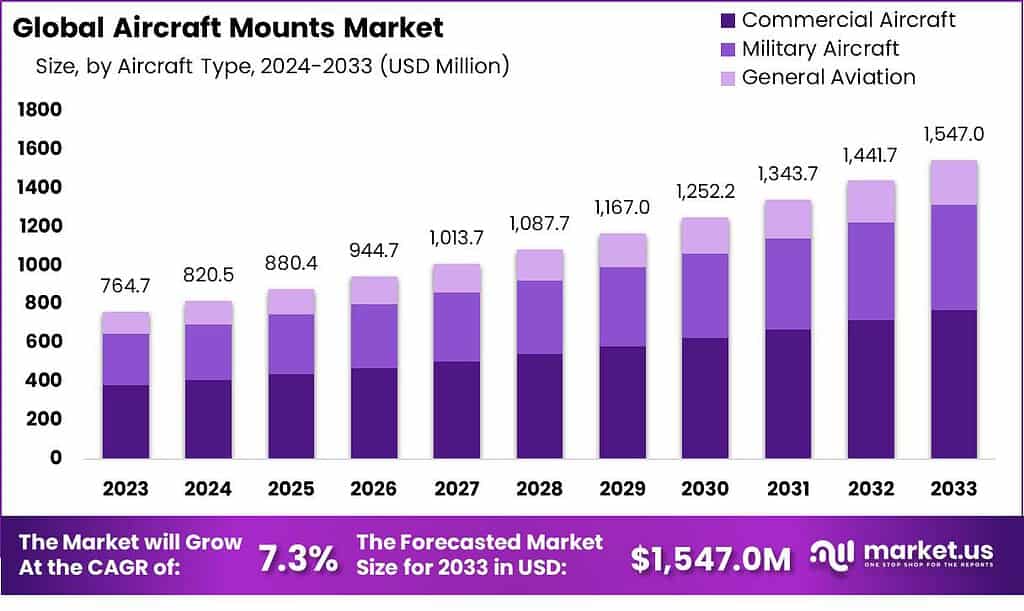

The Global Aircraft Mounts Market size is expected to be worth around USD 1,547.0 million by 2033 from USD 764.7 million in 2023, growing at a CAGR(compound annual growth rate) of 7.3% during the forecast period 2023 to 2032.”

Airplane engine mounts are essential components to its safe flight. Their purpose is to connect the aircraft engine to its main body while helping mitigate vibrations generated from within, dispersing them throughout for a smooth flight experience.

The increasing demand for high-quality aircraft mounts is being driven by passengers’ growing emphasis on comfort and safety during flights. In response to this demand, modern aircraft mounts, especially in commercial aviation, are designed to isolate engine vibrations and reduce stress, contributing to passenger comfort and the protection of critical aircraft systems.

Military aircraft are also adopting advanced aircraft mounts to meet the stringent requirements of military aerospace environments. These mounts effectively reduce the transfer of vibrations from engines or propellers to the airframe, enhancing pilot comfort, safeguarding aircraft systems, and ensuring structural integrity.

Note: Actual Numbers Might Vary In Final Report

It is anticipated that developing military-grade aircraft, such as jets, helicopters, choppers, and specialty fighter aircraft to strengthen the air forces will open up opportunities for the rising demand for mounts. Installing high-quality machinery in specialty aircraft will likely favor this market expansion. Commercial aircraft emerged as the most popular type of mount installation in the United States. The country’s well-established aviation aircraft sector and the rise in local and international passenger traffic are projected to boost demand for commercial flights, supporting market expansion.

Specialty fighter jets, choppers, and military-grade air vocations are predicted to be in high demand due to expanding military services around the world and the development of the defense system. Additionally, innovative specialized military equipment installed in military aircraft requires unique mounts. Thus they are anticipated to have beneficial aircraft mounts market trends. Due to the expansion of tourism, more people travel internationally, which has boosted the aviation industry. Additionally, customers’ demand for comfort and safety has forced airline companies to offer better services, fostering industry expansion.

The aircraft mounts market size is growing due to factors such as increased safety and comfort, noise pollution reduction by stringent regulations, penetration of internal mounts, and a widening range of applications of smart devices in operations.

Key Takeaways

- Market Growth: The Aircraft Mounts Market is expected to reach approximately USD 1,547.0 million by 2033, growing at an impressive CAGR of 7.3% during the forecast period.

- Passenger Comfort and Safety: Modern aircraft mounts, especially in commercial aviation, are designed to isolate engine vibrations and reduce stress, contributing to passenger comfort and the protection of critical aircraft systems.

- Military Adoption: Military aircraft are adopting advanced aircraft mounts to meet stringent aerospace requirements. These mounts effectively reduce the transfer of vibrations from engines or propellers to the airframe, enhancing pilot comfort, safeguarding aircraft systems, and ensuring structural integrity.

- Market Expansion Opportunities: Developing military-grade aircraft, such as jets, helicopters, and specialty fighter aircraft, is expected to open up opportunities for the rising demand for mounts.

- Commercial Aircraft Dominance: Commercial aircraft account for over 55% of the market share in 2023, driven by an increase in foreign travelers and a rising demand for safety and comfort.

- General Aviation Growth: General aviation types, including private jets, upscales, and helicopters, are projected to grow due to the increase in private aviation.

- Mount Type Preferences: In 2023, Exterior Mounts held the highest revenue share at 70%, while internal mounts are anticipated to grow due to their role in reducing shock and vibrations during takeoff and landing operations.

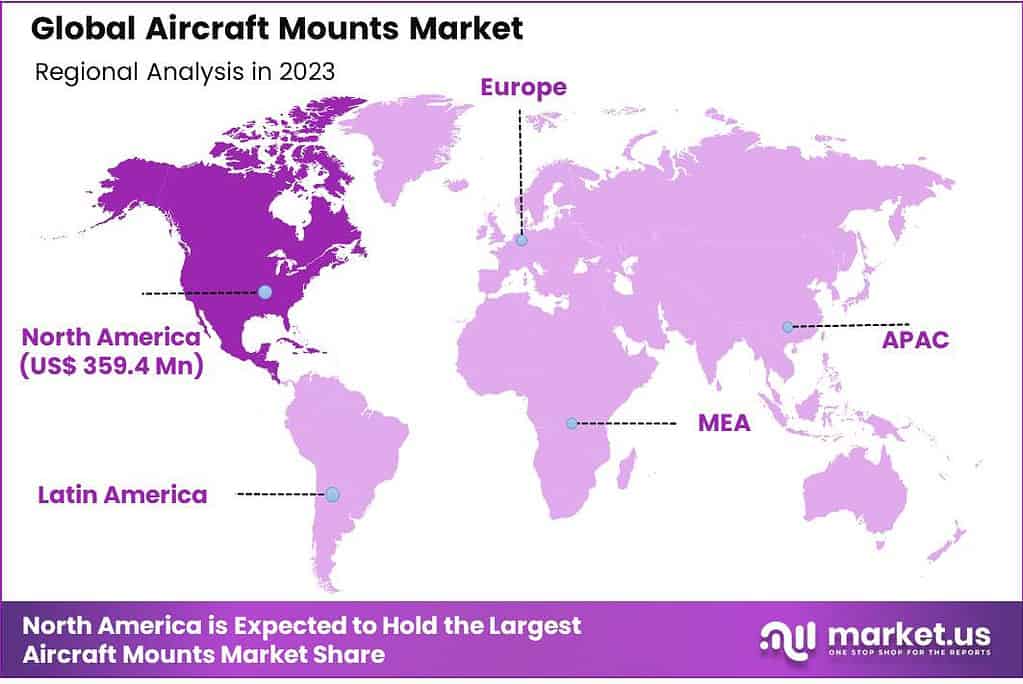

- Regional Dominance: North America dominated the aircraft mounts market with a 47% sales share in 2023, driven by extensive airline service providers and a well-established aviation industry.

- European Demand: The demand for external mounts in Europe contributed 86.7% of global revenue in 2022, with prospects for market expansion due to the presence of major aircraft manufacturers and improved manufacturing capacities.

- APAC Growth: The APAC aerospace manufacturing industry is anticipated to witness rising aircraft mounts market trends over the predicted period due to an increase in domestic and international commercial flight traffic and expanding tourism.

Aircraft Type Analysis

Based on the aircraft type segment, the market is segmented into military, commercial, and general aviation. Among them, the commercial aircraft type is predicated on accounting for the largest aircraft mounts market share of mounts, with a revenue share of over 55% in 2023. In the upcoming years, the segment’s expansion is projected to be fueled by an increase in foreign travelers and a rising demand for safety and comfort.

Leading airline service providers worldwide concentrate on providing comfortable flights with improved storage and cutting-edge equipment. Major manufacturers such as Airbus and Boeing are hiding the amount of pending commercial orders, which would benefit the market. Thus aerospace producers are engaged in offering improved mounting.

The expansion of air force divisions and the increasing demand for specialized fighter planes, jets, choppers, and other aircraft are both results of strengthening the defense systems of significant countries. Military aircraft’s increasing demand for specialized and custom mounts is anticipated to sustain market expansion throughout the foreseeable future.

Due to the installation of premium and specialty components, general aviation types accounted for a significant portion of the consumption of amounts. Private jets, upscales, and helicopters are all included in the segment. The market is projected to grow in the near future due to the increase in private aviation.

Mount Type Analysis

In 2023, Exterior Mounts had the highest revenue aircraft mounts market share of 70% and are anticipated to rule this market for the foreseeable future. Most external mounts are installed in the business market due to the availability of contemporary storage options and comfortable passenger seating. In general and commercial aviation, the external mounts are fitted to improve storage capacity, passenger comfort, and seating arrangements. Multiplane mounts, pedestal mounts, shock mounts, sandwich mounts, platform mounts, and other external mounts are included.

Over the projected period, safety measures for critical aviation components are expected to promote industry growth rate. Due to the provision of protecting the engine as well as other parts installation, the internal mounts segment is anticipated to grow in the expected time. Additionally, internal mounts are built to lessen shock and vibrations during takeoff and landing operations. Due to the smooth operation of the aforementioned components in planes, the internal mounts require periodic servicing and replacement at set intervals. Furthermore, as the number of commercial flights rises, this segment is also anticipated to grow.

Material Analysis

In 2023, Aluminum Alloys emerged as the frontrunner in the Aircraft Mounts market, securing a commanding market share of over 60%. This dominance can be attributed to several key factors that make Aluminum Alloys the preferred choice in this segment.

Firstly, Aluminum Alloys exhibit exceptional lightweight properties, making them a go-to material for aircraft mounting applications. The aviation industry has a perpetual need for materials that can reduce overall weight without compromising structural integrity. Aluminum Alloys excel in meeting this requirement, contributing to enhanced fuel efficiency and operational cost savings for airlines.

Moreover, the corrosion-resistant nature of Aluminum Alloys is a significant advantage in the context of aircraft mounts. Given the exposure of aircraft to various environmental elements during flight, corrosion resistance is crucial for ensuring the longevity and reliability of mounting components. Aluminum Alloys’ innate ability to withstand corrosion adds to their appeal in this market segment.

Furthermore, these alloys offer an excellent strength-to-weight ratio, striking a balance between robustness and weight reduction. This characteristic is essential for aircraft mounts as it ensures the structural stability necessary to secure various components while adhering to weight limitations imposed by aircraft design specifications.

Another key advantage of Aluminum Alloys is their malleability and ease of fabrication. Aircraft mounting components often require intricate shapes and designs to accommodate specific aircraft configurations. Aluminum Alloys’ flexibility in manufacturing allows for the production of complex and tailored mounting solutions, meeting the diverse needs of different aircraft models.

In addition to these technical advantages, Aluminum Alloys align with the industry’s growing trend towards eco-friendly and sustainable materials. As the aviation sector increasingly emphasizes environmental responsibility, Aluminum Alloys’ recyclability and low environmental impact contribute to their sustained popularity.

Note: Actual Numbers Might Vary In The Final Report

End-Use

In 2023, Replacement secured a dominant position in the Aircraft Mounts market, commanding a substantial market share exceeding 75%. This remarkable dominance is indicative of several pivotal factors that underscore the significance of the Replacement segment within this industry.

The Replacement market segment within the Aircraft Mounts industry is characterized by the need to replace existing mounting components in aging aircraft fleets. The overwhelming prevalence of Replacement in 2023 reflects the substantial demand for retrofitting and upgrading aircraft structures with modern and improved mounts.

A primary driver behind the ascendancy of the Replacement segment is the unwavering commitment to safety and compliance within the aviation sector. As aircraft age, the wear and tear on mounting components become a critical concern. Airlines and operators prioritize the replacement of worn-out or outdated mounts to ensure the structural integrity and safety of their aircraft. This imperative focus on safety has fueled the substantial growth of the Replacement segment.

Furthermore, the advancement of technology and materials has revolutionized modern replacement mounts, making them more durable, lightweight, and efficient compared to their older counterparts. Aircraft operators increasingly opt for replacements to benefit from these technological enhancements, which can lead to improved fuel efficiency, reduced maintenance costs, and extended operational lifespans.

The Replacement segment also benefits from the aviation industry’s unwavering commitment to regulatory compliance and adherence to evolving safety standards. As aviation authorities introduce updated regulations and requirements, aircraft owners and operators often turn to replacements to ensure their fleets remain fully compliant, mitigating potential regulatory risks.

Moreover, the Replacement market offers compelling economic advantages. Retrofitting older aircraft with new mounts can extend the service life of these planes, postponing the need for costly new aircraft acquisitions. This cost-effective approach to fleet management significantly contributes to the dominance of the Replacement segment.

Drivers

One of the primary drivers propelling the Aircraft Mounts market is the continuous expansion of the global aviation industry. As airlines expand their fleets and introduce new aircraft, there has been an increased need for advanced mounting solutions that support various components, such as engines, landing gear and avionics. Furthermore, light materials and advanced manufacturing techniques have led to innovative aircraft mount designs, furthering their adoption.

Restraints

Despite the market’s growth, several restraints pose challenges to its expansion. One significant restraint is the cyclical nature of the aviation industry, which can lead to fluctuations in demand for aircraft mounts. Economic downturns or geopolitical uncertainties can disrupt airline operations and, subsequently, affect the market for aircraft mounting solutions. Additionally, stringent regulatory requirements and safety standards can pose challenges for manufacturers in terms of compliance and certification.

Opportunities

The Aircraft Mounts market presents promising opportunities, driven by technological advancements and the increasing focus on sustainability. Opportunities lie in the development of innovative mounting solutions that offer enhanced strength-to-weight ratios, corrosion resistance, and durability. Furthermore, the industry’s shift towards eco-friendly materials and sustainable practices creates avenues for the development of greener and more efficient mounting systems, aligning with global environmental goals.

Challenges

Challenges in the Aircraft Mounts market include the need for continuous research and development to stay competitive in a rapidly evolving industry. Manufacturers must invest in cutting-edge materials and manufacturing processes in order to meet the stringent demands of aviation manufacturing. Furthermore, companies in this market face competition from alternative technologies, such as composite materials that pose threats to traditional steel or aluminum mounts. Economic uncertainties and supply chain disruptions can also challenge the market’s stability.

In conclusion, the Aircraft Mounts market is influenced by a dynamic interplay of drivers, restraints, opportunities, and challenges. Navigating these factors requires a combination of innovation, adaptability, and a keen understanding of market trends to capitalize on emerging opportunities while mitigating potential challenges.

Key Market Segments

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- General Aviation

By Mount Type

- Interior Mounts

- Exterior Mounts

By Material

- Rubber

- Steel Alloys

- Aluminum Alloys

- Other Materials

End-Use

- Original Equipment Manufacturer

- Replacement

Regional Analysis

North America dominated the aircraft mounts market size with a 47% sales share in 2023. The demand for aircraft mounts in North America was valued at US$ 359.4 Million in 2023 and is anticipated to grow significantly in the forecast period. The development has been fueled by the region’s extensive presence of airline service providers, affordable air travel, and the well-established aviation industry. Additionally, the region-wise need has increased due to the region’s expanding defense industry, particularly in the United States.

In 2022, the U.S. was the region’s biggest consumer, and it is anticipated that it will continue to lead in the upcoming years. The growth opportunities of international travelers and the well-established tourism industry have supported the market. However, the country’s ongoing COVID-19 outbreak has negatively impacted travel and tourism and hampered industry progress.

In 2022, this market for external mounts in Europe contributed 86.7% of global revenue. This demand is anticipated to increase until 2032. There are expected to be prospects for market expansion due to the presence of major aircraft manufacturers in the area and improved manufacturing capacities in countries such as Germany, France, Spain, Russia, and the United Kingdom.

Due to an increase in domestic and international commercial flight traffic, the APAC aerospace manufacturing industry is anticipated to have rising aircraft mounts market trends over the predicted period of time. In addition, the expanding tourism sector in the area, particularly in South East Asia, is expected to draw tourists from abroad, likely boosting the ultimatum for commercial aircraft and boosting market expansion.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

A key player emphasis is creating mounting components with high load-bearing capacity and enhanced durability. The installation and mounts’ structural design are the players’ main concerns. Additionally, these market players are spending a lot on research and development for raw materials. For mount production, composites and alloys are gaining popularity as a means of lowering aircraft weight. In addition, third-party production and mergers and acquisitions are considered for the market competitive landscape.

Маrkеt Kеу Рlауеrѕ

- Trelleborg AB

- GMT Rubber-Metal-Technic Ltd.

- Cadence Aerospace LLC Customization

- ESCO Technologies Inc.

- Shock Tech, Inc.

- Hutchinson Aerospace GmbH

- AirLoc Ltd.

- Parker-Hannifin Corporation

- LORD Corporation

- RAM Mounts

- VMC GROUP

- Meeker Aviation

- Other Key Players

Recent Development

- In a significant move in June 2023, Spirit AeroSystems forged a strategic partnership with Joby Aviation, a prominent electric Vertical Takeoff and Landing (eVTOL) aircraft manufacturer. This collaboration aims to jointly develop and supply advanced composite structures, including mounts, specifically tailored for Joby’s revolutionary electric air taxi aircraft. This strategic alliance underscores the industry’s commitment to pioneering technology and sustainable transportation solutions.

- In April 2023, Safran and Dassault Aviation, two major players in the aerospace industry, joined forces in a strategic partnership. Their primary goal is to collaboratively innovate and manufacture cutting-edge propulsion systems, which encompass mounts and related components, primarily intended for future combat aircraft. This strategic union signifies a concerted effort to drive innovation and excellence in the realm of aviation propulsion systems.

- February 2023 witnessed Boeing’s strategic investment in Robotic Skies, a leading provider of Maintenance, Repair, and Overhaul (MRO) services for Unmanned Aircraft Systems (UAS). The investment is aimed at supporting the development of state-of-the-art technologies dedicated to UAS mounts and their associated components. This strategic financial commitment underscores Boeing’s commitment to advancing the field of unmanned aircraft systems.

- In November 2022, Collins Aerospace introduced its latest innovation in the form of next-generation nose landing gear mounts designed specifically for commercial aircraft. These mounts are engineered to enhance landing performance, reduce overall weight, and streamline maintenance procedures. Collins Aerospace’s forward-thinking approach demonstrates a commitment to improving safety and efficiency in the commercial aviation sector.

Report Scope

Report Features Description Market Value (2023) US$ 764.7 Mn Forecast Revenue (2033) US$ 1,547.0 Mn CAGR (2023-2032) 7.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Digital Type, Analog Type), By Application (Power Industry, Petrochemical Industry) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape By Aircraft Type (Military, Commercial, and General Aviation), By Mount Type (Interior Mounts, Exterior Mounts), By Material(Rubber, Steel Alloys, Aluminum Alloys and Other Materials), By End-Use (Original Equipment Manufacturer and Replacement) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is aircraft mounts?Aircraft mounts are structural components designed to support and attach various systems and equipment within an aircraft. They play a crucial role in ensuring the stability and proper functioning of onboard instruments and systems. These mounts are strategically placed to absorb vibrations, shocks, and other dynamic forces experienced during flight, safeguarding sensitive equipment from potential damage.

How big is Aircraft Mounts Market?The Global Aircraft Mounts Market size is expected to be worth around USD 1,547.0 million by 2033 from USD 764.7 million in 2023, growing at a CAGR(compound annual growth rate) of 7.3% during the forecast period 2023 to 2032."

What are the 4 categories of aircraft?Aircraft are commonly categorized into four main types based on their design and purpose:

- Fixed-wing Aircraft: This includes airplanes, which have wings that generate lift when moving through the air.

- Rotary-wing Aircraft: Helicopters and other rotorcraft fall into this category, using rotating wings or blades for lift.

- Lighter-than-air Aircraft: This category includes balloons and airships, which are lifted by gases such as helium or hot air.

- Unmanned Aircraft Systems (UAS): Also known as drones, these are aircraft without a human pilot on board, operated remotely or autonomously.

How is the aircraft mounts market influenced by the growth of the aviation industry?The aircraft mounts market is closely tied to the growth of the aviation industry. As air travel demand increases and new aircraft are developed, the demand for reliable and advanced aircraft mounts rises proportionally.

What role does technological advancements play in the evolution of aircraft mounts?Technological advancements play a significant role in the evolution of aircraft mounts. Innovations in materials, design, and manufacturing processes contribute to the development of mounts that are more efficient, durable, and adaptable to evolving aviation needs.

What are the key challenges faced by manufacturers in the aircraft mounts market?Key challenges faced by manufacturers in the aircraft mounts market include meeting stringent regulatory requirements, balancing the need for strength with lightweight design, and staying abreast of technological advancements to remain competitive.

-

-

- Trelleborg AB

- GMT Rubber-Metal-Technic Ltd.

- Cadence Aerospace LLC Customization

- ESCO Technologies Inc.

- Shock Tech, Inc.

- Hutchinson Aerospace GmbH

- AirLoc Ltd.

- Parker-Hannifin Corporation

- LORD Corporation

- RAM Mounts

- VMC GROUP

- Meeker Aviation

- Other Key Players