Global Aircraft Health Monitoring Systems Market Size, Share Analysis Report By Solution (Hardware (Sensors, Avionics, Flight Data Management Systems, Connected Aircraft Solutions, Grund Servers), Software (Onboard Software, Diagnostic Flight Data Analysis, Prognostics Flight Data Analysis Software), Services), By Installation (On-board, On-Ground), By System (Engine Health Monitoring, Structure Health Monitoring, Component Health Monitoring), By Technology (Diagnostics, Prognostics, Adaptive Control, Prescription), By End-User (OEMs, Airlines, MROs), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 127044

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- US Market Size

- By Solution: Hardware (47%)

- By Installation: On-board (63%)

- By System: Engine Health Monitoring (42%)

- By Technology: Diagnostics (38%)

- By End-User: Airlines (52%)

- Key Market Segments

- Emerging Trend

- Driver

- Restraint

- Market Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

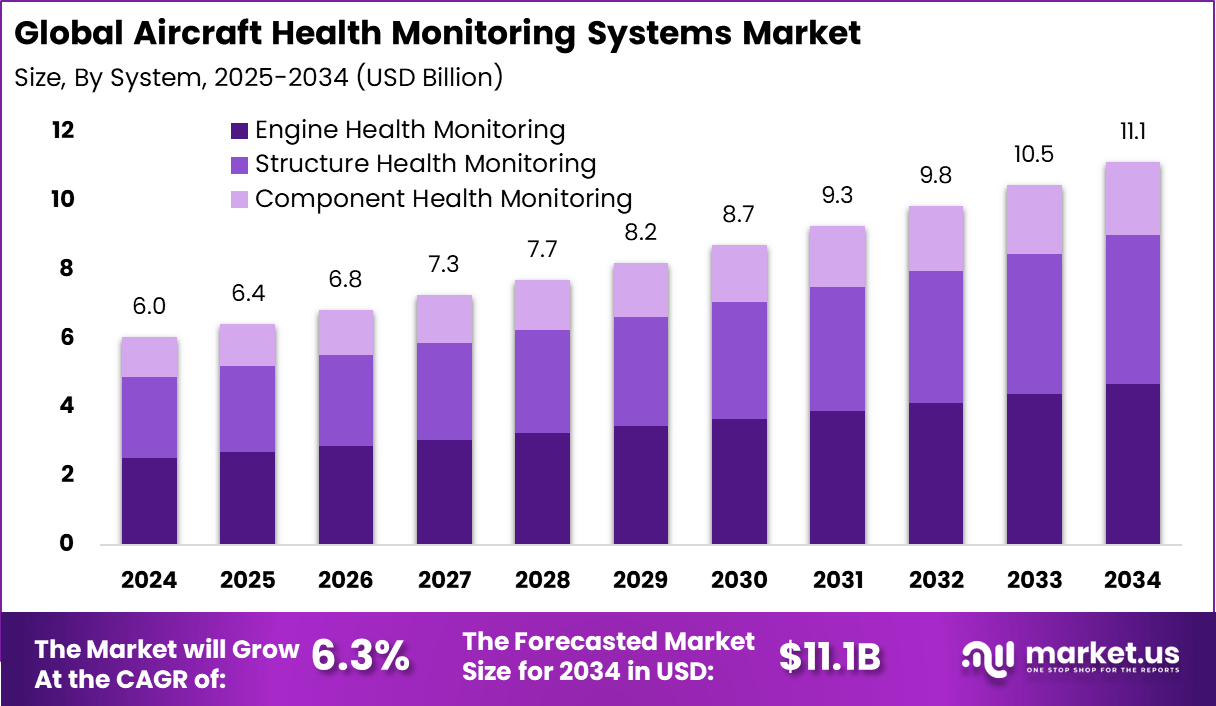

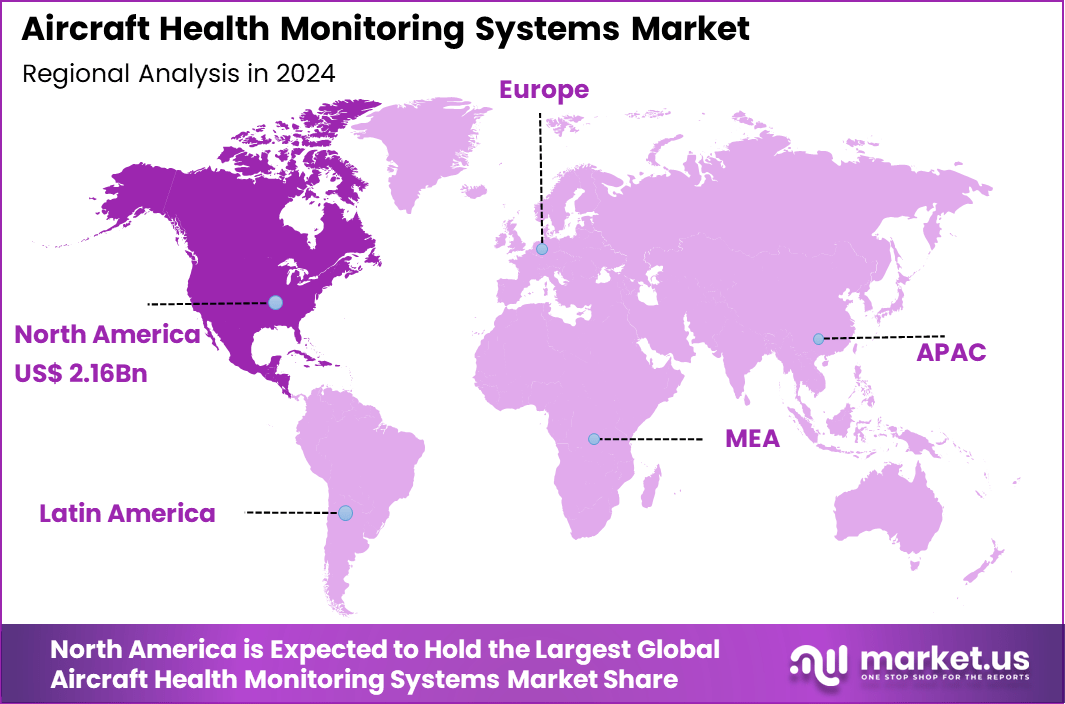

The Global Aircraft Health Monitoring Systems Market size is expected to be worth around USD 11.1 Billion By 2034, from USD 6.0 billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 2.16 Billion revenue.

The Aircraft Health Monitoring Systems (AHMS) market represents a dynamic and rapidly evolving sector within the aviation industry, focused on the real-time surveillance and management of an aircraft’s operational health. These systems are designed to collect, analyze, and transmit critical data related to the performance and condition of various aircraft components, enabling predictive maintenance and early fault detection.

By shifting maintenance programs from reactive to proactive frameworks, AHMS not only enhances operational efficiency but also significantly improves safety standards. This market growth is propelled by the increasing sophistication of modern aircraft, rising air traffic demands, and the critical need for minimizing unscheduled downtime in the aviation sector.

Key drivers behind AHMS growth include escalating air traffic volumes and stringent safety regulations. The rising demand for predictive maintenance capabilities is prompting industry players to adopt real-time diagnostics and anomaly detection tools. Innovations in lightweight wireless sensors have further lowered integration barriers, enabling broader deployment of AHMS technologies.

Scope and Forecast

Report Features Description Market Value (2024) USD 6.0 Bn Forecast Revenue (2034) USD 11.1 Bn CAGR (2025-2034) 6.3% Largest market in 2024 North America [36% market share] Key Insight Summary

- The Global Aircraft Health Monitoring Systems market is projected to grow from USD 6.0 billion in 2024 to approximately USD 11.1 billion by 2034, registering a steady 6.3% CAGR, driven by increasing focus on operational safety, cost savings, and predictive maintenance in aviation.

- In 2024, North America led the market with over 36% share, generating about USD 2.16 billion, supported by a large commercial and defense aircraft fleet and advanced maintenance infrastructure.

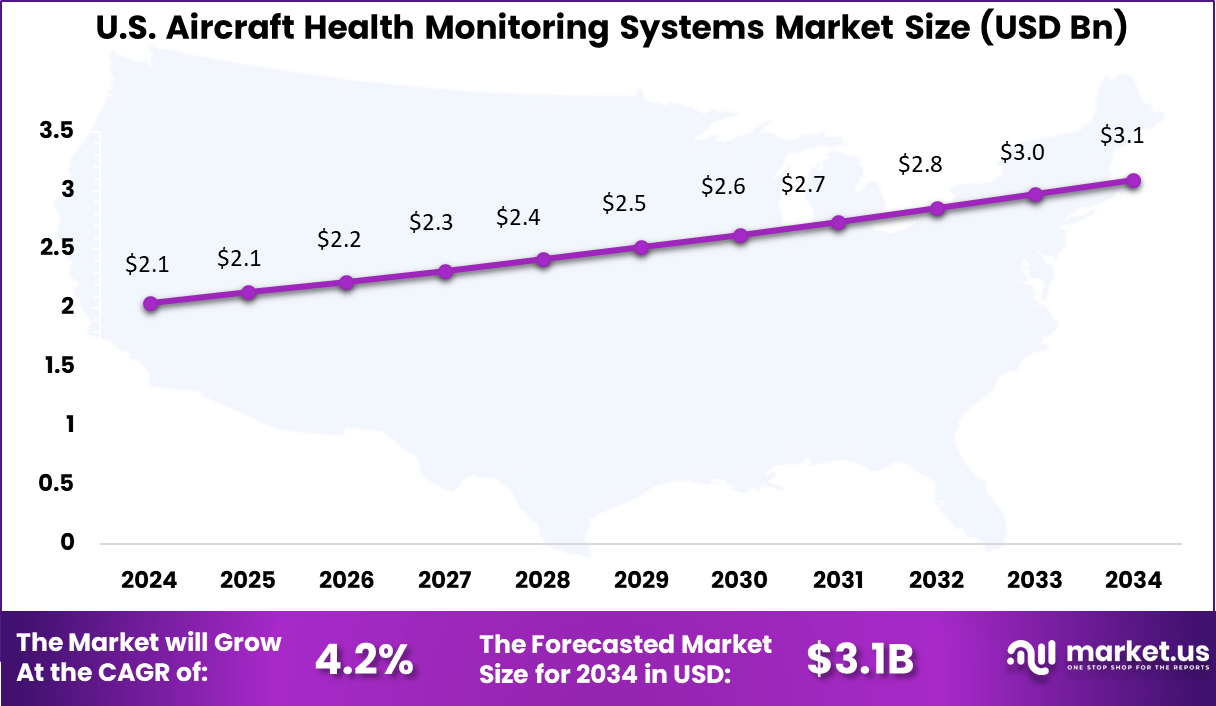

- The United States alone contributed nearly USD 2.05 billion, with a projected 4.2% CAGR, reflecting ongoing investments in fleet modernization and maintenance technologies.

- By solution, Hardware accounted for 47% share, highlighting strong demand for sensors and embedded monitoring devices.

- By installation, On-board systems dominated with 63% share, driven by the need for real-time data acquisition and analysis during flight operations.

- By system, Engine Health Monitoring led the market with 42% share, as engine reliability remains critical to safety and cost efficiency.

- By technology, Diagnostics held 38% share, reflecting its vital role in detecting faults and enabling timely corrective actions.

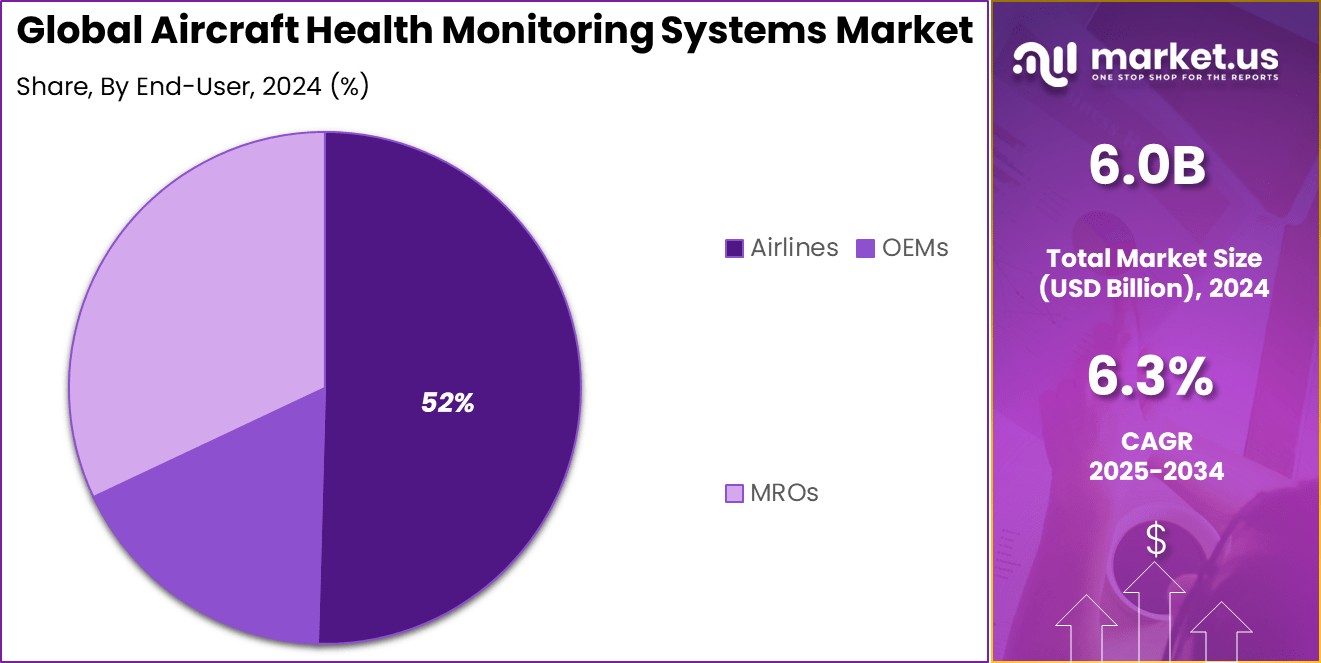

- By end-user, Airlines dominated with 52% share, underscoring their need to optimize fleet availability, reduce downtime, and improve safety compliance.

Analysts’ Viewpoint

Technology adoption within the AHMS market is characterized by the integration of several advanced components. Artificial intelligence plays a central role by interpreting sensor data to detect anomalies and forecast potential component failures. Wireless sensor networks facilitate the continuous collection of high-volume data from varied aircraft systems, while cloud computing enables scalable data processing and analytics.

The key reasons behind adopting Aircraft Health Monitoring Systems extend beyond safety enhancements. Operators gain the ability to perform condition-based maintenance, which avoids unnecessary part replacements and reduces maintenance labor and inventory costs. Real-time health data allows for swift decision-making during flight, improving operational flexibility and reducing schedule disruptions.

Investment opportunities in the AHMS market are significant and multifaceted. The continuous growth of the global aviation fleet, combined with ongoing modernization efforts, ensures sustained capital demand for advanced health monitoring technologies. Opportunities exist in the development of AI-powered diagnostic tools, sensor innovations, and data analytics platforms tailored for aerospace applications.

Furthermore, partnerships and collaborations between technology providers and aircraft manufacturers open avenues to integrate these systems into next-generation aircraft. Investors can also explore ancillary services such as data management, predictive maintenance software, and end-user training, expanding the value chain within the AHMS ecosystem.

US Market Size

The U.S. Aircraft Health Monitoring Systems Market was valued at USD 2.1 Billion in 2024 and is anticipated to reach approximately USD 3.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 2.16 billion in revenue. This leadership can be attributed to the region’s strong presence of commercial aviation operators and military aircraft programs, alongside stringent regulatory frameworks emphasizing real-time safety monitoring.

The Federal Aviation Administration (FAA) and related bodies have pushed for early fault detection systems and predictive maintenance technologies, making Aircraft Health Monitoring Systems (AHMS) an integral part of fleet operations. Additionally, the mature infrastructure and high investment in aerospace R&D in countries like the United States continue to support innovation in sensor technologies and data analytics for aircraft diagnostics.

By Solution: Hardware (47%)

Within the Aircraft Health Monitoring Systems market, hardware stands out as the leading solution segment. Aircraft depend heavily on reliable and precise hardware components such as advanced sensors, data acquisition modules, and embedded systems to monitor health parameters in real time.

These devices collect and transmit crucial data from various parts of the aircraft, enabling ground teams and operators to make quick, informed decisions about maintenance and repairs. The dependency on hardware-driven solutions stems from the need to have immediate access to accurate health diagnostics, supporting safe and efficient flight operations.

Growth in the hardware segment can be attributed to the continuous evolution of sensor technologies and the demand for more integrated systems on aircraft. With aircraft becoming more technologically sophisticated, the push for new-generation hardware is evident, ensuring that operators are better equipped to prevent failures and avoid costly disruptions.

By Installation: On-board (63%)

On-board installation is the top method, firmly holding the majority share in how aircraft health monitoring systems are deployed. On-board systems offer the unique advantage of gathering data in real time during flight, providing immediate feedback and enabling proactive responses to potential issues.

By embedding monitoring technology directly into the aircraft, operators ensure continuous surveillance of critical systems, instead of waiting for post-flight ground inspections. This approach significantly reduces the risk of undetected faults, improves turnaround time between flights, and increases overall fleet reliability.

Real-time on-board data is crucial for predictive maintenance, as it aids in minimizing unexpected delays and keeping aircraft in optimal condition for longer periods. The preference for on-board setups highlights a broader industry move away from solely ground-based checks to fully integrated flight solutions.

By System: Engine Health Monitoring (42%)

Engine Health Monitoring leads as the most significant system deployed within Aircraft Health Monitoring. Aircraft engines are sophisticated and expensive components that require meticulous oversight to avoid failures or unplanned maintenance.

Implementing real-time engine health monitoring allows for the assessment of key engine metrics such as vibration, temperature, and pressure, providing early warning signs before more significant problems emerge.

The adoption of robust monitoring for engines contributes directly to safety, operational efficiency, and cost effectiveness. Engines are at the heart of every flight, so detecting potential issues early through detailed surveillance helps maximize uptime and minimize downtime. Airlines recognize that investing in advanced engine monitoring supports both passenger safety and operational profitability.

By Technology: Diagnostics (38%)

Diagnostics technology holds the foremost position for technology application in this market. Diagnostic systems are instrumental in analyzing sensor data to pinpoint issues or irregularities within the aircraft. This technology leverages algorithms and digital tools to provide maintenance teams with actionable insights, supporting both immediate troubleshooting and long-term strategic planning.

With a strong emphasis on smart diagnostics, operators can address minor anomalies before they escalate into critical failures. This technological focus directly impacts maintenance costs, aircraft safety, and regulatory compliance. By ensuring timely maintenance and accurate problem identification, diagnostic technologies are becoming the linchpin for overall aircraft health strategies.

By End-User: Airlines (52%)

Airlines represent the leading end-user segment, as they have the most direct interest in maintaining high standards of safety, reliability, and efficiency across large and diverse aircraft fleets. Health monitoring systems empower airlines to keep their operations running smoothly and avoid granular delays that could have a cascading effect on schedules and customer satisfaction.

Deployment of these systems gives airlines a competitive edge, as preventive and predictive maintenance helps limit ground time and maximize fleet utilization. Furthermore, by accessing instant health reports and maintenance alerts, airlines are better equipped to minimize accidents, manage costs, and comply with stringent aviation regulations.

Key Market Segments

By Solution

- Hardware

- Sensors

- Avionics

- Flight Data Management Systems

- Connected Aircraft Solutions

- Grund Servers

- Software

- Onboard Software

- Diagnostic Flight Data Analysis

- Prognostics Flight Data Analysis Software

- Services

By Installation

- On-board

- On-Ground

By System

- Engine Health Monitoring

- Structure Health Monitoring

- Component Health Monitoring

By Technology

- Diagnostics

- Prognostics

- Adaptive Control

- Prescription

By End-User

- Airlines

- OEMs

- MROs

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

AI & Machine Learning Integration

The most prominent shift occurring in the aircraft health monitoring sector stems from the adoption of artificial intelligence and machine learning. These technologies are transforming how aircraft maintenance is handled.

By processing massive amounts of sensor data collected during flights, predictive analytics can now flag performance anomalies and potential failures before they escalate. This leap to smart diagnostics is reducing both downtime and maintenance costs, fostering a move from reactive repairs to genuinely predictive maintenance strategies.

Driver

Demand for Predictive Maintenance

A core force behind the increasing use of aircraft health monitoring systems is the growing need for proactive, rather than reactive, maintenance methods. Airlines and operators are prioritizing safety, reliability, and efficiency as air traffic expands globally.

Predictive maintenance enabled by these systems lowers the risk of unexpected breakdowns, minimizes flight disruptions, and ensures passenger safety. The real-time insights derived from continuous monitoring allow for well-timed interventions, preventing costly issues before they affect operations.

Restraint

High Implementation Costs

The path to modern aircraft health monitoring is not without hurdles. One significant barrier is the high upfront cost of integrating advanced monitoring systems. These investments cover new sensors, digital platforms, system installations, and regular upgrades.

For smaller operators or those with older fleets, this financial burden can slow or outright limit system adoption, especially since ongoing costs such as maintenance and staff training further add up.

Market Opportunity

Uptake in Predictive Maintenance for Drones

A fresh growth area is the application of health monitoring systems to unmanned aerial vehicles and drones. With their growing presence in commercial, defense, and public services, the need to ensure drone reliability and longevity is greater than ever.

Health monitoring technologies are evolving to provide lightweight, intelligent solutions for drones, supporting advanced diagnostics for missions in diverse and often challenging environments. This segment is primed for rapid development as regulations become stricter and operational volumes rise.

Challenge

Integrating with Legacy Aircraft

Many airlines operate fleets containing older aircraft that lack modern digital infrastructure. Retrofitting these planes with cutting-edge health monitoring systems poses technical and financial challenges.

Modifying existing structures to support new sensors and processing capabilities can be costly and complex, often resulting in project delays and compatibility issues. These integration problems make it difficult for operators to uniformly upgrade their fleets, thus limiting the full potential benefits of new monitoring technologies.

Key Player Analysis

Leading aircraft OEMs such as Airbus SE and The Boeing Company have played a central role in advancing aircraft health monitoring systems (AHMS). Their integration of real-time diagnostics and predictive analytics into new-generation aircraft has set benchmarks for the aviation industry. These players focus on digital twins, IoT integration, and smart maintenance alerts.

Prominent engine and avionics providers like GE Aviation, Rolls-Royce, and Collins Aerospace have invested in health monitoring solutions tailored for propulsion systems and critical aircraft components. These firms have enabled condition-based maintenance through sensors and cloud-based analytics.

Honeywell International Inc. and Meggitt PLC are also contributing to onboard diagnostics, enhancing fuel efficiency and reducing unscheduled maintenance events. Their expertise in integrating software with legacy platforms continues to support fleet operators in meeting stringent safety and compliance standards.

Specialized solution providers such as FLYHT Aerospace Solutions Ltd, Curtiss-Wright Corporation, and Ultra Electronics Group offer advanced monitoring platforms that emphasize real-time data acquisition and fault detection. Meanwhile, Safran and Esterline Technologies Corporation are focusing on modular AHMS solutions compatible with civil and military aircraft.

Top Key Players Covered

- Airbus SE

- The Boeing Company

- GE Aviation

- Collins Aerospace (United Technologies Corporation)

- Honeywell International Inc.

- Meggitt PLC

- Rolls-Royce

- FLYHT Aerospace Solutions Ltd

- Curtiss-Wright Corporation

- Safran

- Esterline Technologies Corpoartion

- Ultra Electronics Group

- Other Key Players

Recent Developments

- In March 2025, the European Defence Agency (EDA) initiated a research project focused on Prognostic Health Management (PHM) to monitor and predict the health of aircraft batteries. Targeting hybrid aircraft and UAVs, the project aims to extend battery lifespan and ensure reliable performance by forecasting safe usage limits and minimizing the risk of system failure.

- In April 2025, the Indian Air Force (IAF) invited industrial collaboration to develop a real-time in-flight health monitoring system, reinforcing its adoption of advanced technologies to protect aircrew in high-stress operational environments.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Hardware (Sensors, Avionics, Flight Data Management Systems, Connected Aircraft Solutions, Grund Servers), Software (Onboard Software, Diagnostic Flight Data Analysis, Prognostics Flight Data Analysis Software), Services), By Installation (On-board, On-Ground), By System (Engine Health Monitoring, Structure Health Monitoring, Component Health Monitoring), By Technology (Diagnostics, Prognostics, Adaptive Control, Prescription), By End-User (OEMs, Airlines, MROs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus SE, The Boeing Company, GE Aviation, Collins Aerospace (United Technologies Corporation), Honeywell International Inc., Meggitt PLC, Rolls-Royce, FLYHT Aerospace Solutions Ltd, Curtiss-Wright Corporation, Safran, Esterline Technologies Corpoartion, Ultra Electronics Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Aircraft Health Monitoring System?An Aircraft Health Monitoring System (AHMS) utilizes integrated systems and technologies to monitor and analyze the operational parameters of aircraft, enabling predictive maintenance and data-driven decision-making. This technology helps in enhancing safety, reducing downtime, and optimizing the operational efficiency of smart aircraft.

How big is Aircraft Health Monitoring System Market?The Global Aircraft Health Monitoring System Market size is expected to be worth around USD 10.4 Billion By 2033, from USD 5.2 Billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Aircraft Health Monitoring System Market?The Aircraft Health Monitoring Systems market is driven by the need for real-time data, cost reductions in maintenance, regulatory safety mandates, and advancements in IoT and AI technologies, enhancing safety and efficiency in aviation.

What are the emerging trends and advancements in the Aircraft Health Monitoring System Market?AI and machine learning enhance AHMS accuracy, while IoT and cloud solutions expand data handling and analytics. Predictive maintenance, environmental focus, and applications in UAVs drive AHMS advancements in aviation.

What are the major challenges and opportunities in the Aircraft Health Monitoring System Market?The AHMS market is expanding through advanced AI and IoT integration, enhancing maintenance efficiency and fuel optimization. However, challenges include costly integration of older fleets, regulatory hurdles, and cybersecurity risks.

Who are the leading players in the Aircraft Health Monitoring System Market?Airbus SE, Curtiss-Wright Corporation, FLYHT Aerospace Solutions Ltd., GE Engine Services LLC (General Electric Company), Honeywell Aerospace, Meggitt Plc, Rolls-Royce Plc, Safran, SITA N.V., The Boeing Company

Aircraft Health Monitoring System MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Aircraft Health Monitoring System MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Airbus SE

- The Boeing Company

- GE Aviation

- Collins Aerospace (United Technologies Corporation)

- Honeywell International Inc.

- Meggitt PLC

- Rolls-Royce

- FLYHT Aerospace Solutions Ltd

- Curtiss-Wright Corporation

- Safran

- Esterline Technologies Corpoartion

- Ultra Electronics Group

- Other Key Players