Global AI Server Hardware Market Size, Share, Statistics Analysis Report By Processor Type (GPU-Based Servers, FPGA-Based Servers, ASIC-Based Servers), By Function (Training, Inference), By Cooling technology (Air Cooling, Liquid Cooling, Hybrid Cooling), By End User (Cloud Service Providers, Enterprises (Healthcare, BFSI, Automotive, Retail & E-Commerce Media & Entertainment, Others), Government Organizations), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142098

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. AI Server Hardware Market

- Processor Type Analysis

- Function Analysis

- Cooling technology Analysis

- End User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

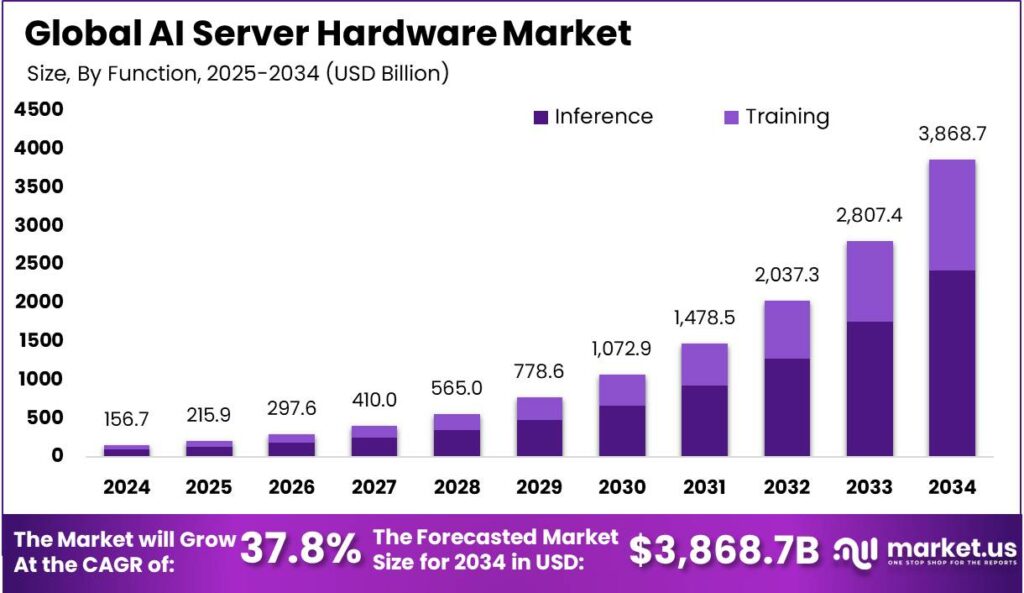

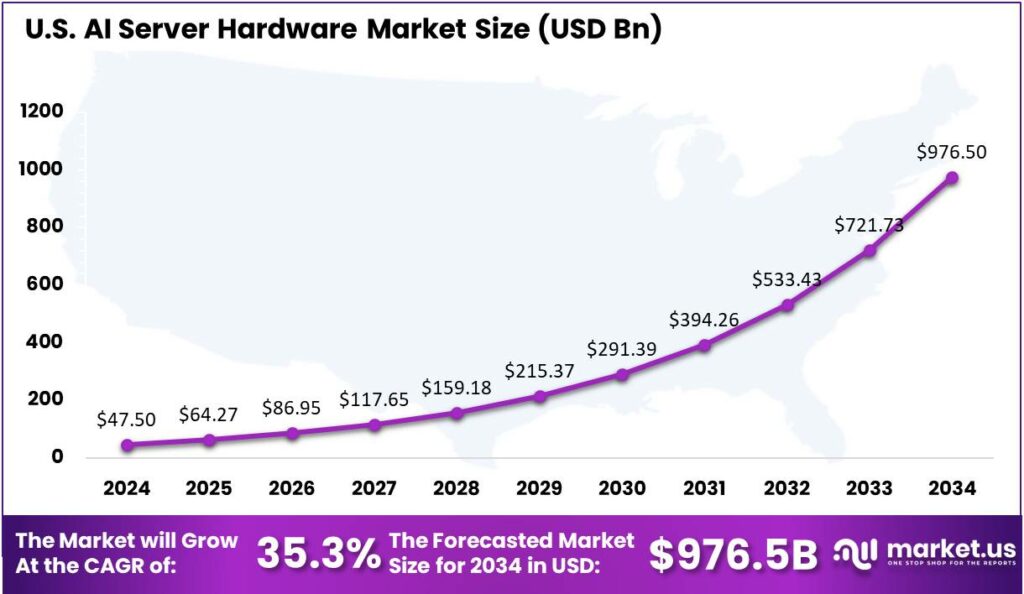

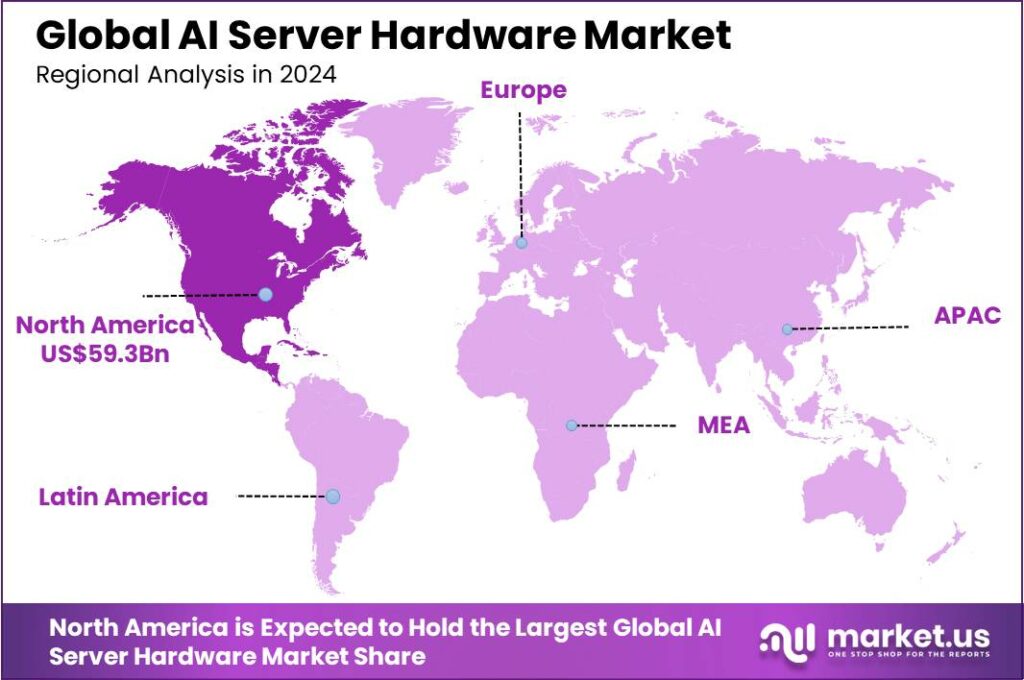

The AI Server Hardware Market size is expected to be worth around USD 3,868.7 Billion By 2034, from USD 156.7 Bn in 2024, growing at a CAGR of 37.80% during the forecast period. In 2024, North America led the AI server hardware market with over 37.9% share, generating revenues of upto USD 59.3 bn. The U.S. market was valued at USD 47.5 bn, growing rapidly with a CAGR of 35.3%.

AI server hardware refers to specialized computer systems designed to run artificial intelligence (AI) workloads efficiently. These servers are typically equipped with powerful processors, high-performance GPUs, massive storage, and enhanced memory systems to handle the complex computations required for AI models like machine learning, deep learning, and neural networks.

The market includes the sale of these servers to industries like healthcare, finance, automotive, and IT, where AI is used for data analysis, decision-making, and predictive modeling. The growth of the AI server hardware market is driven by key factors, including the increasing adoption of AI across various sectors, creating a demand for robust server infrastructures.

The primary drivers of the AI server hardware market include the escalating demand for high-speed data processing and the need for advanced AI capabilities in industries such as healthcare for diagnostics and automotive for autonomous driving technologies. Additionally, the increasing integration of IoT and smart technologies is pushing the demand for robust AI server infrastructures.

Demand for AI server hardware is driven by the need for efficient and fast processing capabilities that are required to manage large volumes of data and complex computations. Industries like healthcare, finance, and automotive are increasingly relying on AI servers to power real-time applications and analytics, enhancing decision-making processes and operational efficiencies.

According to Market.us, The Global AI Server Market is projected to reach USD 343,260.5 million by 2033, growing from USD 30,742.0 million in 2023 at a CAGR of 27.6% during the forecast period. The increasing adoption of AI-driven applications, machine learning workloads, and data-intensive computing is fueling this rapid market expansion.

meanwhile, The Edge Server Market is set to grow from USD 4.0 billion in 2023 to USD 91.1 billion by 2033, registering a CAGR of 36.7% during the forecast period. The increasing need for low-latency computing, IoT integration, and 5G expansion is accelerating demand for edge servers. North America maintained a leading position in 2023, capturing 38% of the market and generating USD 1.5 billion in revenue.

AI server hardware has gained popularity for supporting complex AI computations and large-scale data processing. Its prominence is driven by digital transformation efforts, as enterprises seek to leverage AI for a competitive edge, reflected in its adoption by cloud service providers, research institutions, and large corporations.

Key Takeaways

- The Global AI Server Hardware Market size is projected to reach USD 3,868.7 Billion by 2034, growing from USD 156.7 Billion in 2024, with a CAGR of 37.80% during the forecast period from 2025 to 2034.

- In 2024, the GPU-based servers segment led the market, accounting for more than 44.8% of the AI server hardware market share.

- The Inference segment held a dominant position in 2024, capturing over 62.7% of the AI server hardware market.

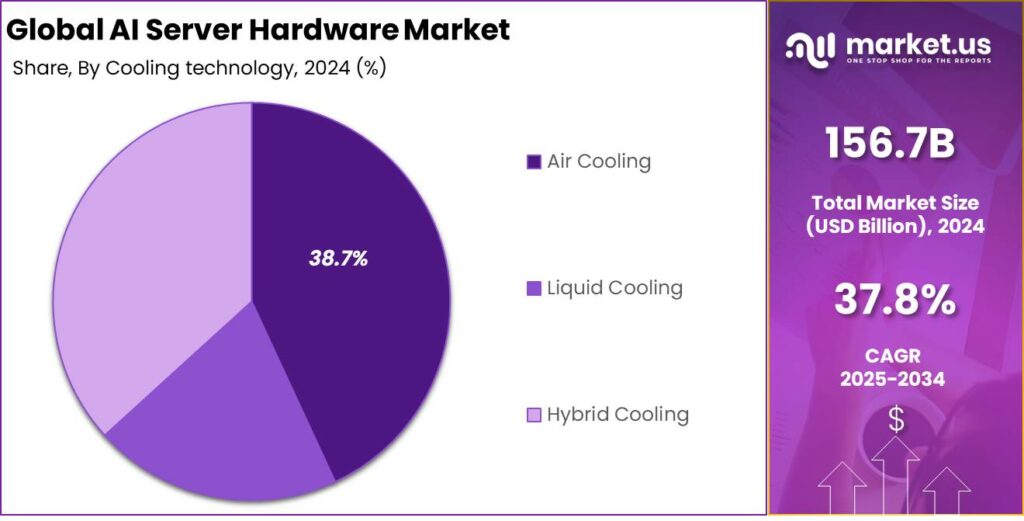

- The Air Cooling segment maintained a dominant market position in 2024, with more than 38.7% of the share in the AI server hardware sector.

- The Cloud Service Providers segment held a dominant market share in 2024, capturing more than 62.78% of the AI Server Hardware market.

- North America dominated the AI server hardware market in 2024, holding over 37.9% of the market share, with revenues reaching approximately USD 59.3 billion.

- In 2024, the U.S. market for AI server hardware was valued at USD 47.5 billion and is experiencing rapid growth, with a CAGR of 35.3%.

Analysts’ Viewpoint

The AI server hardware market offers numerous investment opportunities, particularly in developing regions and in sectors transitioning to digital and automated operations. Investments in cloud-based AI server solutions and green, energy-efficient server technologies also present promising prospects, given the global push towards sustainability.

AI technology is influencing market trends by driving the development of more intelligent and autonomous systems. This includes advancements in edge computing, where AI servers process data at the source rather than in centralized data centers, significantly reducing latency and enhancing the efficiency of data-driven applications.

Technological advancements in AI server hardware focus on increasing computational power, energy efficiency, and reducing the physical footprint of servers. Innovations include the development of specialized processors for AI tasks and improvements in network connectivity and data transfer speeds, which are critical for supporting the complex requirements of modern AI applications.

The AI server market is subject to stringent regulations, particularly concerning data security, usage, and privacy. The development and deployment of AI technologies must comply with international standards and regulations, which vary significantly across regions. Compliance with these regulations ensures that AI deployments are secure and ethical, protecting user data and ensuring trust in AI systems.

U.S. AI Server Hardware Market

In 2024, the U.S. market for AI server hardware was estimated at USD 47.5 billion. This market is experiencing a significant growth trajectory, with a compound annual growth rate (CAGR) of 35.3%.

This robust growth is driven by several factors, including the rising adoption of AI technologies across sectors like healthcare, finance, and automotive, creating demand for advanced server hardware to handle complex tasks. Additionally, the expansion of data centers and the growing focus on cloud computing solutions are further accelerating market growth.

Advancements in AI technologies are driving the need for continual upgrades in server infrastructure to meet the growing computational and efficiency demands. This is spurring innovation among hardware manufacturers to develop more powerful and energy-efficient solutions. With a strong focus on AI from leading tech firms and government initiatives to enhance AI capabilities, the market is set for sustained growth in the coming years.

In 2024, North America held a dominant market position in the AI server hardware sector, capturing more than a 37.9% share with revenues reaching approximately USD 59.3 billion. This leading position is driven by major tech firms and strong technological infrastructure, enabling early adoption and integration of advanced AI technologies across industries.

North America’s dominance in the AI server hardware market is driven by a developed IT ecosystem and significant R&D investments from both public and private sectors, fueling innovation. Additionally, widespread adoption of cloud-based solutions accelerates demand for AI server hardware as businesses leverage AI for data analysis and customer insights.

The U.S. government’s supportive policies towards AI and machine learning are crucial for market growth. Initiatives that promote AI through funding and partnerships with tech giants drive further development and adoption. These factors ensure that North America continues to lead and expand its dominance in the AI server hardware market.

North America is expected to maintain its dominance, driven by ongoing technological advancements and strategic collaborations. As companies and governments focus on leveraging AI for economic and societal benefits, demand for advanced server hardware will grow, strengthening North America’s leadership in the global AI server hardware market.

Processor Type Analysis

In 2024, the GPU-based servers segment held a dominant market position, capturing more than a 44.8% share of the AI server hardware market. This segment’s leadership is due to the general-purpose nature of GPUs, which excel at handling the complex mathematical computations needed for AI and machine learning tasks.

GPU-based servers are increasingly prominent due to their ability to accelerate neural network training and inference, which are crucial for AI applications. The parallel processing capabilities of GPUs enable simultaneous execution of multiple operations, making them ideal for handling AI data efficiently.

The ecosystem around GPU technology is highly developed, with strong support from software developers and vendors. NVIDIA, a leading GPU manufacturer, has created a robust platform combining hardware and software to boost AI performance. Tools like CUDA and cuDNN optimize AI model development on GPU architectures, providing developers with streamlined resources.

GPU-based servers have gained market share due to their cost-effectiveness compared to FPGA or ASIC servers. Offering significant processing power at an affordable price, GPUs provide an excellent performance-to-cost ratio. This economic advantage makes them an attractive option for companies of all sizes, driving their dominance in the AI server hardware market.

Function Analysis

In 2024, the Inference segment held a dominant position in the AI server hardware market, capturing more than a 62.7% share. This segment’s leadership is primarily attributed to the widespread deployment of AI applications requiring real-time processing and decision-making capabilities.

The demand for inference hardware is also bolstered by its role in consumer electronics and edge devices, where immediate data processing is essential. These applications benefit from the low latency and high efficiency provided by optimized inference servers, enabling enhanced user experiences through faster and more accurate responses.

The Inference segment benefits from advancements in semiconductor technologies, including specialized inference chips that offer better performance and energy efficiency than general-purpose GPUs. These innovations make inference servers more appealing to businesses aiming to optimize operational costs, especially in energy-sensitive environments.

The dominance of the Inference segment in the AI server hardware market reflects the shift toward AI applications that require immediate outputs from trained models. As industries scale AI implementation, the need for efficient and effective inference hardware remains crucial, solidifying its leading position in the market.

Cooling technology Analysis

In 2024, the Air Cooling segment held a dominant market position in the AI server hardware sector, capturing more than a 38.7% share. This segment’s prominence is largely due to its cost-effectiveness and simplicity, making it a preferred choice for a wide range of applications.

Air cooling technology is the most widely used method for managing server heat due to its ease of implementation and maintenance, which lowers the total cost of ownership. It is highly adaptable, fitting various server configurations without needing extensive modifications or specialized infrastructure.

Moreover, the reliability of air cooling technology contributes to its leading position. Despite the development of more advanced cooling methods, air cooling’s long-standing track record of effective heat management assures businesses of its efficacy. This reliability is crucial in enterprise environments where server uptime is critical to operational continuity.

The air cooling segment is poised to maintain its dominance as innovations boost efficiency and sustainability. Advancements in air cooling technology are enhancing energy efficiency, aligning with global efforts to reduce electricity consumption and greenhouse gas emissions in data centers. This progress will likely reinforce its leading position in the AI server hardware market.

End User Analysis

In 2024, the Cloud Service Providers segment held a dominant market position in the AI Server Hardware market, capturing more than a 62.78% share. This substantial market share can be attributed to the increasing demand for cloud-based services and the scalability offered by cloud infrastructures.

The dominance of the Cloud Service Providers (CSP) segment is driven by ongoing advancements in AI and machine learning. CSPs invest heavily in cutting-edge hardware to meet the computational needs of AI models, improving service delivery and operational efficiency, while attracting a broader customer base with enhanced data analytics and machine learning services.

Strategic partnerships between cloud service providers and hardware manufacturers drive the segment’s growth by optimizing hardware solutions for AI operations. These collaborations enable CSPs to offer competitive, advanced services by customizing server architectures to meet the specific needs of AI applications, ensuring effective handling of AI workloads.

Regulatory compliance and data security are key factors in the leadership of Cloud Service Providers (CSPs) in the AI server hardware market. CSPs are adopting AI servers to meet data protection laws and enhance security, offering better data management and security features. This focus on compliance and security supports their market dominance and drives continued growth and innovation.

Key Market Segments

By Processor Type

- GPU-Based Servers

- FPGA-Based Servers

- ASIC-Based Servers

By Function

- Training

- Inference

By Cooling technology

- Air Cooling

- Liquid Cooling

- Hybrid Cooling

By End User

- Cloud Service Providers

- Enterprises

- Healthcare

- BFSI

- Automotive

- Retail & E-Commerce Media & Entertainment

- Others

- Government Organizations

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Adoption of AI Across Industries

The proliferation of artificial intelligence (AI) applications across various sectors is a significant driver for the AI server hardware market. Industries such as healthcare, finance, retail, and manufacturing are increasingly integrating AI to enhance operational efficiency, improve customer experiences, and drive innovation.

This widespread adoption necessitates robust server infrastructures capable of handling complex AI workloads, thereby boosting the demand for specialized AI server hardware. For instance, the healthcare sector utilizes AI for diagnostic imaging and patient data analysis, while the retail industry employs AI for personalized recommendations and inventory management. .

Restraint

Energy Consumption and Environmental Concerns

AI server hardware often requires substantial energy to operate, leading to increased operational costs and environmental concerns. The intensive computational processes associated with AI workloads demand significant power, resulting in higher electricity consumption and heat generation.

This not only escalates operational expenses but also raises sustainability issues, as increased energy usage contributes to a larger carbon footprint. The high upfront costs and energy demands of AI server hardware may slow AI adoption, particularly for businesses with limited financial resources. Additionally, increasing environmental concerns could discourage some organizations from adopting these technologies, thereby hindering market growth.

Opportunity

Development of Energy-Efficient AI Servers

The growing emphasis on sustainability and cost reduction presents an opportunity for the development of energy-efficient AI server hardware. Manufacturers can focus on designing servers that deliver high performance while minimizing energy consumption.

Innovations such as advanced cooling systems, low-power processors, and optimized hardware architectures can contribute to more sustainable AI infrastructures. By addressing energy efficiency, companies can reduce operational costs and appeal to environmentally conscious consumers, thereby gaining a competitive advantage in the market.

The integration of renewable energy sources and advanced cooling technologies could further enhance the environmental benefits, making AI adoption more attractive to organizations focused on reducing their carbon footprint.

Challenge

Rapid Technological Advancements Leading to Obsolescence

The AI server hardware market faces the challenge of rapid technological advancements, leading to concerns about hardware obsolescence. As AI technologies evolve swiftly, server hardware must keep pace to support new algorithms, models, and applications.

This rapid progression can render existing hardware outdated within a short period, necessitating frequent and costly upgrades for organizations. The challenge lies in developing scalable and adaptable hardware solutions that can accommodate future advancements without requiring complete overhauls, thereby ensuring long-term value and reducing total cost of ownership for businesses.

Emerging Trends

One prominent trend is the development of specialized AI chips. Companies are investing in custom processors tailored for AI workloads, enhancing performance and efficiency. This shift is particularly significant for developers looking to leverage emerging AI hardware for their applications.

DPUs are now being integrated into server architectures to offload networking and storage tasks from CPUs, enhancing data flow and reducing latency. This allows CPUs and GPUs to focus on AI-specific computations by handling lower-level duties like security, load balancing, and data routing.

The rise of AI-optimized supercomputers highlights the industry’s push to enhance computational power. For example, Amazon Web Services’ “Project Rainier,” featuring custom Trainium chips, aims to support large-scale AI model training, reflecting a broader trend toward infrastructure designed to meet the demands of modern AI applications.

Business Benefits

One significant benefit is the acceleration of AI model training. Servers equipped with high-performance GPUs and TPUs can process complex computations more rapidly than traditional servers, reducing the time required to develop and deploy AI solutions. This efficiency enables businesses to respond swiftly to market changes and customer needs.

Scalability is another critical advantage. AI servers are designed to handle increasing workloads, allowing businesses to expand their AI initiatives without substantial infrastructure overhauls. This flexibility supports growth and adaptation in dynamic markets, ensuring that computational resources align with evolving business objectives.

Moreover, the enhanced processing power of AI servers facilitates real-time data analysis, leading to more informed decision-making. For example, in the retail sector, AI servers can swiftly analyze customer behavior patterns, enabling personalized marketing strategies and improving customer engagement. This capability translates to increased sales and customer loyalty.

Key Player Analysis

Dell Inc. is a prominent player in the AI server hardware market, offering a wide range of solutions optimized for AI, machine learning, and big data analytics. Their PowerEdge server series is designed to handle complex AI workloads, providing scalability, flexibility, and performance. Dell’s partnership with NVIDIA enhances its AI offerings, allowing customers to deploy GPU-accelerated servers.

Hewlett Packard Enterprise (HPE) is another major player, providing high-performance AI server solutions through its Apollo and ProLiant server lines. HPE has made strides in integrating AI-specific technologies, such as AI accelerators and advanced storage systems, into its hardware offerings.

Lenovo has established itself as a strong competitor in the AI server hardware space with its ThinkSystem series. Lenovo’s AI servers are known for their performance, reliability, and affordability. The company offers customized solutions that are tailored to meet the needs of different industries, from healthcare to finance.

Top Key Players in the Market

- Dell Inc.

- Hewlett Packard Enterprise Development Lp

- Lenovo

- Huawei Technologies Co., Ltd.

- IBM

- Cisco Systems, Inc.

- Super Micro Computer, Inc

- Fujitsu

- Inspur Co., Ltd.

- Nvidia Corporation

- Adlink Technology Inc.

- Advanced Micro Devices, Inc.

- Quanta Computers

- Wistron Corporation

- Gigabit Technologies Pvt Ltd.

- Asustek Computer Inc.

- Wiwynn Corporation

- Mitac Computing Technology Corporation

- NEC Corporation

- Others

Top Opportunities Awaiting for Players

The AI server hardware market is poised for significant growth, driven by several key opportunities across different sectors.

- Expansion in Healthcare and Pharmaceuticals: The healthcare sector is increasingly adopting AI servers to enhance data processing capabilities for applications like patient data management, diagnostic analysis, and personalized medicine. Companies like ASUS are integrating AI solutions within their servers to cater specifically to the needs of the healthcare industry.

- Advanced Hardware Development: Innovations in hardware, such as GPUs and ASICs, are crucial for the efficient operation of AI servers. NVIDIA and Cisco’s collaboration to create AI servers optimized for heavy GPU tasks exemplifies industry efforts to meet the escalating demand for powerful AI computing solutions.

- Sustainable and Energy-Efficient Solutions: There is a rising demand for AI servers that are not only powerful but also energy-efficient. Major companies like Super Micro and Fujitsu are focusing on developing liquid-cooled systems and other energy-saving technologies to address environmental concerns and reduce operational costs.

- Growth in Edge AI Applications: The deployment of AI at the edge of networks is growing, requiring servers that can process data closer to the source with minimal latency. This is particularly relevant in sectors such as telecommunications and transportation where real-time data processing is critical.

- Government and Regulatory Support: Increasing support from governments worldwide for AI research and implementation provides a fertile environment for the growth of the AI server market. This includes funding initiatives and regulatory frameworks conducive to technological advancements and adoption across various industries.

Recent Developments

- September 2024: HPE reported significant growth in AI server orders, reaching $6.2 billion, with AI systems revenue at $1.3 billion.

- October 2024: Dell expanded its Dell AI Factory with new PowerEdge servers featuring AMD 5th Generation EPYC processors, enhancing AI performance and efficiency. These servers support a wide range of AI workloads and simplify server management and security.

- November 2024: Dell introduced new liquid and air-cooled PowerEdge XE servers for AI, machine learning and high-performance computing. They also enhanced Dell Data Lakehouse for efficient data access and AI compute.

Report Scope

Report Features Description Market Value (2024) USD 156.7 Bn Forecast Revenue (2034) USD 3,868.7 Bn CAGR (2025-2034) 37.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Processor Type (GPU-Based Servers, FPGA-Based Servers, ASIC-Based Servers), By Function (Training, Inference), By Cooling technology (Air Cooling, Liquid Cooling, Hybrid Cooling), By End User (Cloud Service Providers, Enterprises (Healthcare, BFSI, Automotive, Retail & E-Commerce Media & Entertainment, Others), Government Organizations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dell Inc., Hewlett Packard Enterprise Development Lp, Lenovo, Huawei Technologies Co., Ltd., IBM, Cisco Systems, Inc., Super Micro Computer, Inc, Fujitsu, Inspur Co., Ltd., Nvidia Corporation, Adlink Technology Inc., Advanced Micro Devices, Inc., Quanta Computers, Wistron Corporation, Gigabit Technologies Pvt Ltd., Asustek Computer Inc., Wiwynn Corporation, Mitac Computing Technology Corporation, NEC Corporation , Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Server Hardware MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

AI Server Hardware MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dell Inc.

- Hewlett Packard Enterprise Development Lp

- Lenovo

- Huawei Technologies Co., Ltd.

- IBM

- Cisco Systems, Inc.

- Super Micro Computer, Inc

- Fujitsu

- Inspur Co., Ltd.

- Nvidia Corporation

- Adlink Technology Inc.

- Advanced Micro Devices, Inc.

- Quanta Computers

- Wistron Corporation

- Gigabit Technologies Pvt Ltd.

- Asustek Computer Inc.

- Wiwynn Corporation

- Mitac Computing Technology Corporation

- NEC Corporation

- Others