Global AI Server Market Size, Share, Statistics Analysis Report By Server Type (AI Data, AI Training, AI Inference, Others), By Hardware (GPU, ASIC, FPGA, Others), By Industry (IT & Telecom, BFSI, Retail, Healthcare, Manufacturing, Other Industry Verticals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 119302

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

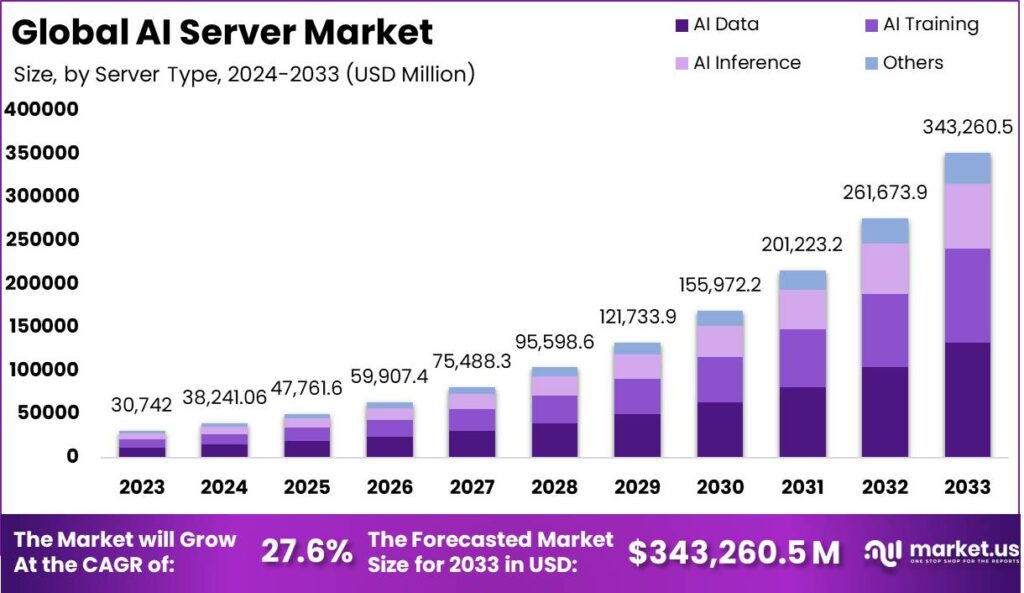

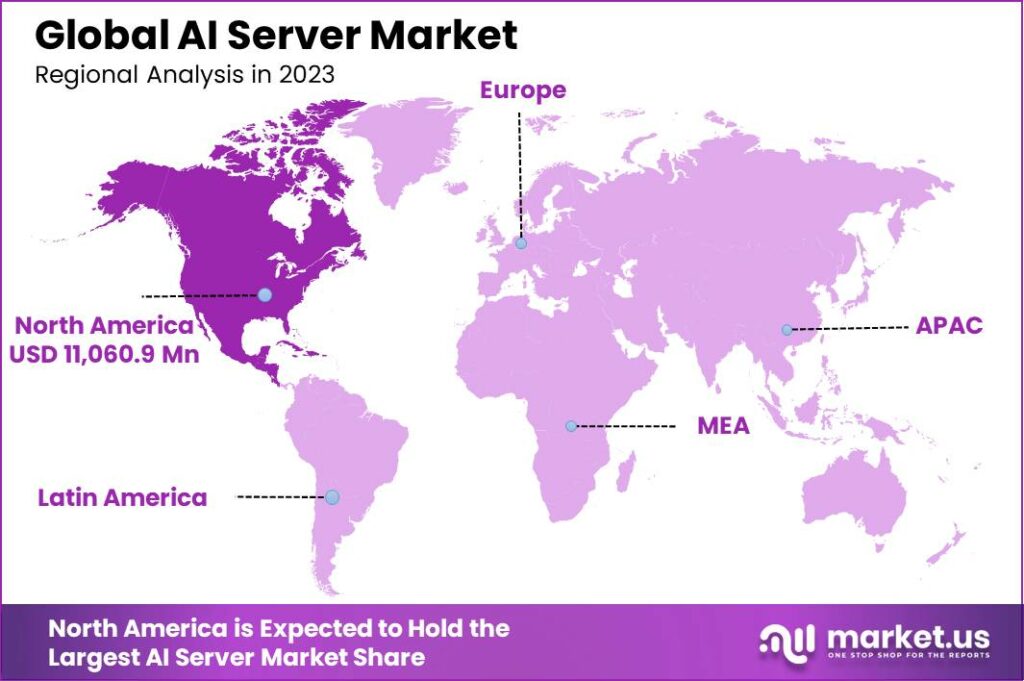

The Global AI Server Market size is expected to be worth around USD 343,260.5 Million by 2033, from USD 30,742.0 Million in 2023, growing at a CAGR of 27.6% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35.98% share, holding USD 11,060.9 Million revenue.

An AI server is a specialized computing system designed to handle the intensive computational tasks associated with artificial intelligence applications. Unlike standard servers, AI servers are optimized with high-performance hardware, such as Graphics Processing Units (GPUs), to efficiently process large volumes of data and execute complex algorithms. This optimization enables them to support various AI workloads, including machine learning, deep learning, and neural network training.

The AI server market is a segment within the broader technology sector focused on the production and distribution of servers optimized for AI tasks. This market has been expanding as businesses across various industries adopt AI technologies to improve efficiency, automate processes, and gain competitive advantages. The growing demand for AI servers is closely linked to the increased utilization of AI applications in areas such as data analytics, autonomous vehicles, healthcare, and financial services.

The primary drivers of the AI server market include the escalating need for high-speed data processing and the capability to perform complex computations efficiently. This demand is spurred by industries that are increasingly relying on AI to gain insights from big data and improve decision-making processes. As AI technologies advance, there is a parallel growth in demand for servers that can support intensive AI workloads with high performance and reliability.

The demand for AI servers is fueled by the need for high-performance computing solutions that can handle intensive AI tasks. Industries such as healthcare, finance, and automotive are increasingly relying on AI servers to improve decision-making processes and enhance service delivery. For example, in healthcare, AI servers process vast amounts of medical imaging data to assist in accurate diagnosis and treatment planning.

Market opportunities for AI servers are vast, particularly in sectors looking to innovate and enhance operational efficiency through AI. The continuous advancements in AI and machine learning algorithms drive the need for servers that can rapidly process and analyze large datasets. Additionally, the push towards digital transformation by businesses globally offers significant opportunities for the deployment of AI servers to improve data processing capabilities and business intelligence.

AI software companies manage the operating system, drivers, resource planning, anomaly detection, and visualizing system monitoring to further optimize AI server performance. According to the research paper of Science Direct, around 75% of the data generated by businesses is created and processed outside the conventional data center due to the expansion of AI servers.

For instance, In November 2023, KX introduced the KDB.AI Server Edition, a high-performance, scalable vector database specifically designed for time-oriented generative AI and contextual search. This new release aims to address the challenges enterprises face in scaling AI applications, which is a common issue as reported by 76% of global C-suite executives according to a recent Accenture study.

According to a recent survey, AI servers comprised approximately 23% of the total server market in 2023, reflecting a significant presence in the industry. This share is anticipated to grow substantially in the coming years as the demand for AI-driven solutions continues to rise. Notably, AI servers are priced at approximately 15 to 20 times higher than traditional servers used by cloud service providers, underscoring the premium value and advanced capabilities they offer.

Technological advancements in AI server components such as GPUs and AI accelerators like TPUs (Tensor Processing Units) and NPUs (Neural Network Processing Units) are crucial. These advancements enhance the servers’ ability to perform AI tasks more efficiently, supporting more complex and demanding applications. Innovations in cooling technologies and energy efficiency also play a vital role, as AI servers typically require substantial power and cooling due to their high computational demands.

Key Takeaways

- The global AI server market is projected to grow significantly in the coming decade. It is expected to reach a valuation of USD 343,260.5 million by 2033, up from USD 30,742.0 million in 2023, demonstrating a robust compound annual growth rate (CAGR) of 27.6% between 2024 and 2033.

- In 2023, North America emerged as the leading region, holding a market share of 35.98%, with revenue totaling USD 11,060.9 million. This dominance is attributed to the region’s advanced technological infrastructure and significant investments in AI research and development.

- The AI data segment captured a substantial market share of 37.72% in 2023. This growth highlights the increasing reliance on data-driven technologies and the rising demand for high-performance servers to handle large-scale AI workloads.

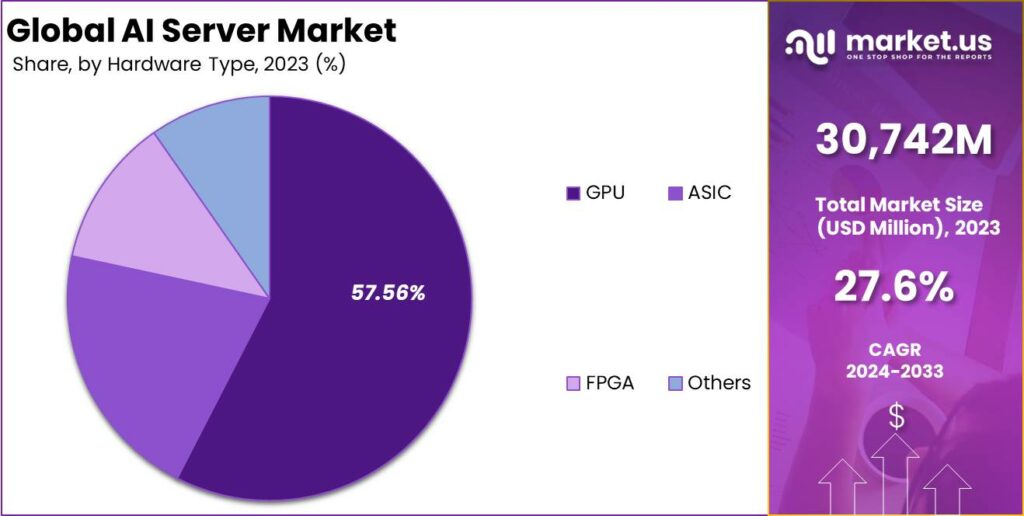

- Graphics Processing Units (GPUs) dominated the market in 2023, accounting for 57.56% of the share. GPUs are preferred for AI workloads due to their superior processing power and efficiency, particularly in machine learning and deep learning applications.

- Among end-user industries, the IT and telecom sector held a dominant share of 26.96% in 2023.

- The AI server market in Europe holds a share of 22.97%.

- Asia-Pacific leads the AI server market with a dominant share of 32.52%.

- The Latin American AI server market contributes 5.41% to the global share.

- The Middle East & Africa region accounts for 3.12% of the AI server market globally.

North America AI Server Market Size

North America In 2023, North America held a dominant market position in the AI server market, capturing more than a 35.98% share with revenue amounting to USD 11,060.9 million. This leadership can be attributed to several factors. The region is home to major technology giants and startups that are at the forefront of AI research and development, contributing to higher adoption rates of AI servers.

Additionally, North America boasts advanced IT infrastructure and substantial investments in cloud technologies, which are conducive to the deployment of AI servers. The presence of a robust financial sector and a highly digitalized healthcare industry also drives the demand for AI servers, as these sectors require substantial data processing capabilities to manage large volumes of data and complex computations.

Other Regions:

Europe accounts for a 22.97% share of the global AI server market, driven by its strong focus on data protection and the growing adoption of AI technologies in manufacturing and automotive industries. European companies are increasingly investing in AI to enhance operational efficiency and product quality, which in turn fuels the demand for powerful AI servers capable of handling sophisticated algorithms and data sets.

Asia-Pacific region holds a significant 32.52% market share, led by countries like China, Japan, and South Korea, which are heavily investing in technology infrastructure and AI capabilities. The region benefits from government initiatives supporting digital transformation and the adoption of AI technologies in sectors such as e-commerce, manufacturing, and automotive. This has resulted in a surge in demand for AI servers necessary to process and analyze large amounts of data generated by these industries.

Latin America, with a market share of 5.41%, shows potential for growth despite its smaller share. The region is seeing gradual increases in AI adoption across business sectors like telecommunications and finance. As local companies begin to recognize the benefits of AI, demand for AI servers is expected to rise, supported by improvements in technological infrastructure and increasing tech-savviness among the workforce.

Middle East and Africa region, holding a 3.12% share, is experiencing a slow but steady adoption of AI technologies. Growth is particularly notable in the Gulf Cooperation Council (GCC) countries, which are diversifying away from oil-dependent economies towards more tech-focused industries. Increased investment in smart city initiatives and a growing startup ecosystem also contribute to the rising demand for AI servers in the region.

Server Type Analysis

In 2023, the AI Data segment held a dominant market position, capturing more than a 37.72% share. This segment is integral to the AI server market, primarily because it supports the foundational needs of data storage, processing, and management that are essential for AI applications.

The growth of the AI Data segment can be attributed to the exponential increase in data volumes generated by digital transformations across various industries. This segment benefits from advancements in cloud computing and big data technologies, which have enhanced the efficiency of data storage and retrieval processes, making AI systems more accessible and cost-effective.

The prominence of the AI Data segment also stems from its pivotal role in training and deploying AI models. High-performance servers are crucial for handling complex algorithms and large datasets, where speed and accuracy are paramount. The increasing reliance on machine learning and deep learning technologies drives demand for robust server architectures that can manage and analyze vast amounts of data swiftly.

Moreover, regulatory compliance regarding data privacy and security has bolstered the growth of the AI Data segment. Businesses are investing in secure and reliable AI servers to safeguard sensitive information and adhere to stringent data protection laws. This trend is particularly pronounced in sectors like healthcare, finance, and telecommunications, where data integrity and security are critical.

Overall, the AI Data segment’s growth is driven by the critical need for powerful computational resources that can process and store large datasets efficiently. As industries continue to leverage AI for strategic insights and operational efficiencies, the demand for AI Data servers is expected to remain strong, underpinned by technological advancements and regulatory requirements. This segment is poised for sustained growth, reflecting the broader trends of digitalization and data-centric strategies in global markets.

Hardware Analysis

In 2023, the GPU segment held a dominant market position, capturing more than a 57.56% share. The substantial share of GPUs in the AI server market can be primarily attributed to their superior processing power and efficiency in handling complex mathematical calculations, which are essential for AI and machine learning workloads.

GPUs provide parallel processing capabilities that significantly accelerate the training and inference phases of machine learning models, making them indispensable for applications requiring real-time data processing and decision-making. The adoption of GPUs has been further propelled by their versatility in various applications, ranging from natural language processing and computer vision to deep learning tasks.

This adaptability has encouraged a broad spectrum of industries, including automotive, healthcare, and financial services, to implement GPU-based servers to enhance their AI capabilities. The continuous improvements in GPU architectures, with enhanced memory bandwidth and energy efficiency, also contribute to their growing market share.

Moreover, the development of AI-specific frameworks and libraries that are optimized for GPUs has lowered entry barriers for organizations looking to harness AI technologies. Companies like NVIDIA have led the way with GPU-accelerated frameworks, which are designed to maximize throughput and computational efficiency. This ecosystem support has not only solidified GPU’s dominance in the AI server market but has also driven innovation and competition among hardware manufacturers.

Overall, the GPU segment’s dominance in the AI server market is underpinned by its ability to meet the demanding requirements of modern AI applications. With ongoing advancements and the expanding scope of AI across various sectors, the reliance on GPU servers is expected to continue, ensuring sustained growth and technological progression in the AI landscape.

Industry Analysis

In 2023, the IT & Telecom segment held a dominant market position, capturing more than a 26.96% share in the AI server market. This sector’s significant share can be attributed to its rapid adoption of AI technologies to enhance network optimization, customer service, and operational efficiency.

The deployment of AI servers in IT & Telecom is crucial for handling the massive data traffic and complex network operations characteristic of this industry. AI-driven solutions enable telecom operators to predict network failures, optimize traffic management, and improve service delivery through predictive analytics and real-time decision-making.

Furthermore, the IT & Telecom industry is at the forefront of adopting new technologies such as 5G, which necessitates robust AI capabilities for network slicing and management. AI servers play a pivotal role in processing the vast amounts of data generated by mobile devices and IoT applications, helping to maximize network performance and reduce latency.

The growth in this segment is also driven by the increasing reliance on cloud-based services and the expansion of edge computing, where AI servers are deployed closer to the data source to facilitate faster processing and response times.

Additionally, AI in IT & Telecom not only enhances operational tasks but also offers significant improvements in customer experience management. Through AI servers, telecom companies can utilize advanced analytics to understand customer preferences and behaviors, leading to personalized service offerings and targeted marketing strategies. The integration of AI with existing CRM systems enables more efficient customer interaction and service personalization, which is vital in a highly competitive market landscape.

Overall, the IT & Telecom segment’s dominance in the AI server market is underpinned by its continuous push towards digital transformation, the adoption of next-generation network technologies, and the need to manage an ever-growing data ecosystem. With ongoing advancements in AI and machine learning, coupled with the expansion of digital communication networks, the demand within this segment is expected to remain robust, driving further innovation and growth.

Key Market Segments

By Server Type

- AI Data

- AI Training

- AI Inference

- Others

By Hardware Type

- GPU

- ASIC

- FPGA

- Others

By Industry Type

- IT & Telecom

- BFSI

- Retail

- Healthcare

- Manufacturing

- Others

Drivers

Growing demand for AI-based solutions in different industries

The AI Server market has grown as a result of various factors, including the growing use of artificial intelligence (AI) and machine learning (ML), supportive government regulations, advancements in GPU technology, increased R&D, the incorporation of AI into autonomous systems, and an increase in the number of people using big data analytics.

Businesses in various sectors such as IT, manufacturing, and others are realizing the importance of AI and ML technologies in terms of decision-making, process optimization, and competitive advantage. Large amounts of data are created and analyzed by enterprises, which has increased the demand for powerful computer capacity. AI servers are essential for fulfilling these processing demands since they are equipped with high-performance hardware and accelerators like GPUs and TPUs.

Due to the complexity of AI and ML algorithms, particularly when it comes to deep neural network training, specialized infrastructure with complicated computation and parallel processing capabilities is needed in the system. Therefore, as businesses invest in effective and scalable solutions to deploy, manage, and accelerate AI workloads, the market for AI servers is expanding.

Restraints

Lack of skilled workforce hampers the market growth

Since artificial intelligence is complex, firms that aim to create, manage, and implement artificial intelligence systems need to have a highly qualified workforce. Knowledge & hands-on experience with technologies like cognitive computing, machine learning (ML), deep learning, and image identification are essential for experts working with AI systems.

Furthermore, it is challenging for small enterprises to invest in R&D and patent applications to integrate Al technology into current systems. In addition, small errors might cause system malfunctions which can have a big impact on the intended outcomes. Additionally, as the need for customized AI processors with the help of ML is increasing, the requirement of experts including data scientists and developers is also increasing.

Companies in all sectors are implementing new technology to boost productivity and operational effectiveness, cut waste, protect the environment, and swiftly expand into untapped markets and customer bases quickly and conveniently while supporting process and product innovation.

Opportunities

Edge AI offers an attractive opportunity for market growth

The market for AI servers is expected to expand significantly due to its increasing use in various industries. AI server providers are booming due to the increasing demand for processing power to handle advanced AI algorithms. The need for AI servers, which allow for real-time data processing at the network edge, is also being driven by edge computing.

Additionally, there is a growing need for specialized hardware that is optimized for AI workloads as AI technologies like machine learning and deep learning are incorporated into routine tasks. As a result, the environment is more favorable for AI server providers to develop and satisfy the expanding demands of AI-based enterprises, encouraging growth and competitiveness in the market.

Challenges

Data security and privacy concern

However, there are several challenges impeding the market’s growth, including concerns about data security and privacy, the complexities of AI algorithms, and a lack of expertise. A significant obstacle to the market for AI servers is privacy and data security concerns, which keep the technology away from being widely adopted.

Large volumes of sensitive data are rapidly being used by AI systems for training and decision-making, which raises severe concerns about this data’s susceptibility. The use of AI server solutions carries a risk of exposing sensitive data to online attacks, which can cause businesses serious financial and reputational harm.

Growth Factors

The AI server market is poised for significant growth, driven primarily by the escalating demand for AI capabilities across various industries, including healthcare, automotive, and finance. This demand is fueled by the need for high-performance computing solutions that can efficiently handle complex AI workloads such as machine learning model training and large dataset processing. The increasing sophistication of AI applications necessitates robust server capabilities that can manage extensive computational tasks swiftly and effectively.

Another vital growth factor is the continuous technological advancements in server hardware, such as GPUs and ASICs, which are crucial for AI operations. Innovations in these components not only boost the processing power but also improve the energy efficiency and capability of AI servers to handle more complex algorithms and larger data volumes. This technological progression supports the deployment of advanced AI applications, thereby expanding the market demand.

Emerging Trends

Emerging trends in the AI server market include the rise of edge AI, which involves processing data at the edge of the network, closer to where it is generated. This trend is increasingly relevant due to its ability to facilitate real-time data processing, reduce latency, and enhance privacy by processing data locally rather than sending it to centralized data centers. Edge AI requires specialized AI servers that are capable of operating in a variety of environments and handling real-time AI tasks effectively.

Furthermore, the adoption of AI in cloud computing is also a significant trend. Cloud-based AI servers offer scalable resources for AI tasks, allowing businesses to manage costs effectively while accessing powerful computing capabilities. The integration of AI into cloud services is being propelled by its potential to enhance business processes and drive innovation across sectors.

Business Benefits of AI Servers

AI servers offer numerous business benefits, including enhanced performance and efficiency. They are specifically designed to handle large and complex datasets quickly, allowing businesses to accelerate their operations and improve productivity. The high computational power of AI servers enables organizations to perform tasks that were previously unfeasible, such as deep learning and real-time analytics, leading to more informed decision-making and improved business outcomes.

Additionally, AI servers contribute to cost efficiency by optimizing resource allocation and reducing operational overheads associated with data processing. Their ability to scale based on the workload helps companies avoid unnecessary expenditure on infrastructure, thereby optimizing their investment in AI technologies. The security features integrated into modern AI servers also help in protecting sensitive data, which is crucial for maintaining compliance with data protection regulations and safeguarding business information.

Key Players Analysis

The market for AI servers is extremely competitive, and businesses are continuously coming up with new ideas to boost workload scalability, power efficiency, and performance. Partnerships and new competitors can also alter market dynamics.

Advancements in technology, strategic alliances, and market trends affecting the adoption of AI and ML in numerous industries are influencing the competitive landscape for the market. Businesses across the globe are actively participating in this competitive environment to offer solutions that address the evolving requirements of AI-based applications.

Top Key Players in the Market

- ADLink Technologies

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM Corporation

- NVIDIA Corporation

- Aivres

- Super Micro Computer, Inc.

- ZTE Corporation

- Other Key Players

Recent Developments

- In March 2024, NVIDIA launched the Blackwell GPU Platform that helps in computing, data processing, electronic design automation and various other activities.

- In January 2024, Deloitte launched a new Gen AI powered solution on RelativityOne and Relativity servers to help firms manage the employees’ concerned activities such as employee investigation, document review, and others.

Report Scope

Report Features Description Market Value (2023) USD 30,742.0 Mn Forecast Revenue (2033) USD 343,260.5 Mn CAGR (2024-2033) 27.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Server (AI Data, AI Training, AI Inference, Others), By Hardware (GPU, ASIC, FPGA, Others), By Industry (IT & Telecom, BFSI, Retail, Healthcare, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ADLink Technologies, Dell Technologies, Hewlett Packard Enterprise, Huawei Technologies, IBM Corporation, NVIDIA Corporation, Aivres, Super Micro Computer, Inc., ZTE Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADLink Technologies

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM Corporation

- NVIDIA Corporation

- Aivres

- Super Micro Computer, Inc.

- ZTE Corporation

- Other Key Players