Global AI-powered Animation Generator Market Size, Share and Analysis Report By Platform (App-based, Web-based), By Technology (Text-to-Video Generation Models, Image-to-Image Transformation Models, Image to Video Animation Models, Video to Video Models, Custom Models), By Application (Content Creation, Merchandising, Others), By End User (Individual Creators, Animation Studios, Game Developers, Advertising and Marketing Agencies, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173877

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Platform

- By Technology

- By Application

- By End User

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

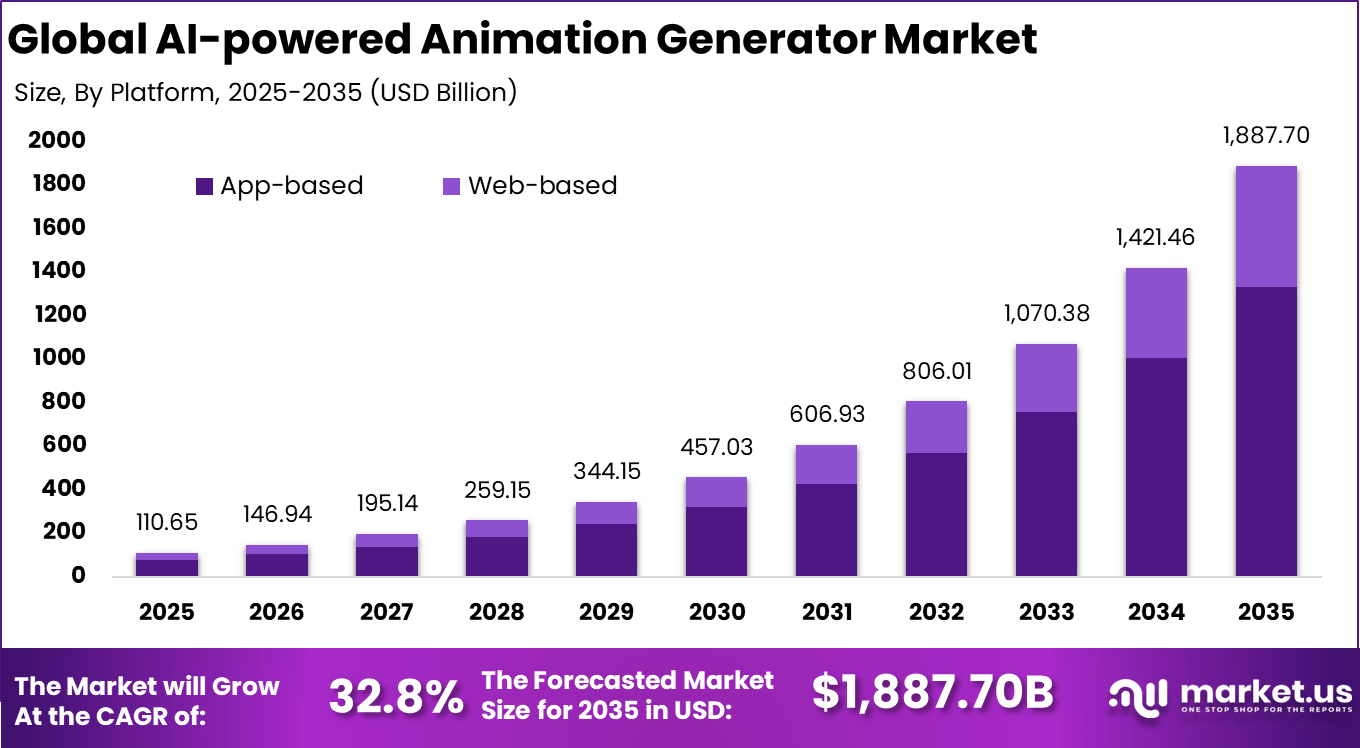

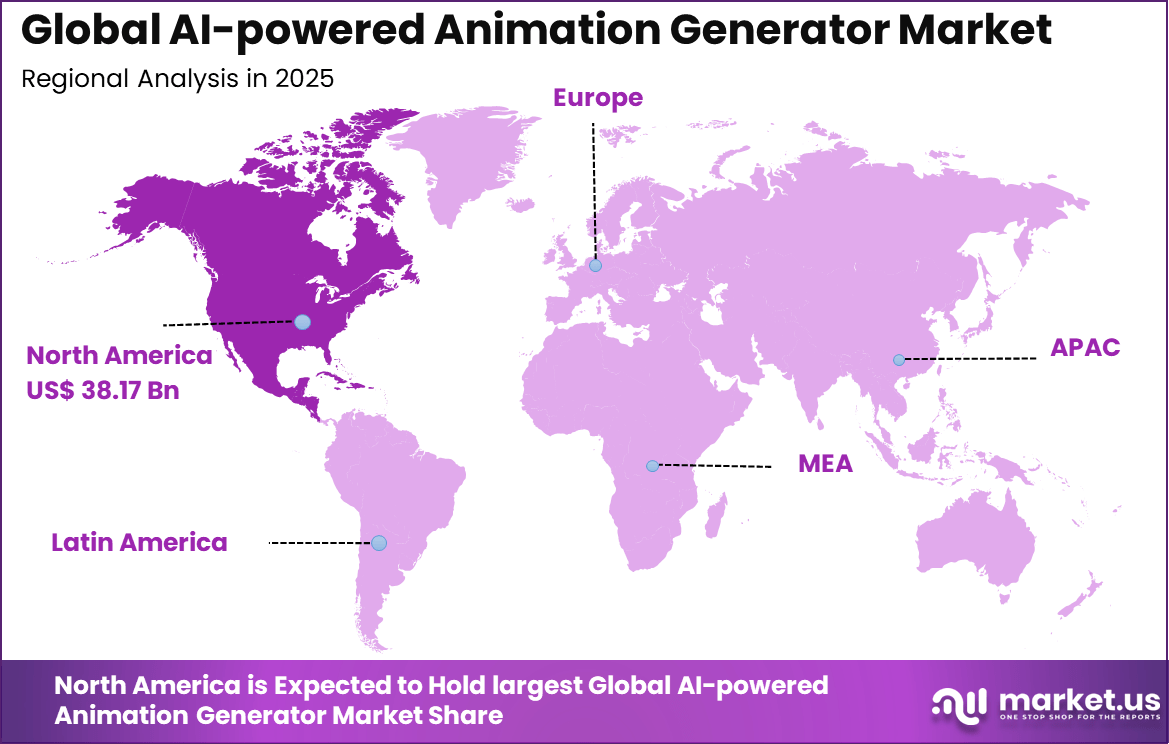

The Global AI-powered Animation Generator Market size is expected to be worth around USD 1,887.70 billion by 2035, from USD 110.65 billion in 2025, growing at a CAGR of 32.8% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 34.5% share, holding USD 38.17 billion in revenue.

The AI empowered animation generator market refers to software solutions that leverage artificial intelligence to create, enhance, and automate animation content without extensive manual effort. These platforms use ML, computer vision, natural language processing, and generative models to produce animated sequences from text descriptions, images, motion data, or existing video frames. Adoption spans media and entertainment studios, advertising agencies and brand marketers seeking scalable animation production.

One major driving factor of the AI powered animation generator market is the rising demand for personalized and interactive content. Brands and content creators seek engaging animation that can be tailored to specific audiences and contexts. AI tools accelerate customization by generating variations on demand and adapting creative assets to different formats. This flexibility improves content relevance and audience engagement.

For instance, in June 2025, Character Creator 4.54 launched with AI Smart Search, giving trial access to 130,000+ premium assets. Users can test content in-app before buying via faster DA Point purchases, huge for building animation libraries without upfront costs. Performance tweaks make it even smoother for daily use.

Demand for AI powered animation generators is influenced by the growth of the gaming and entertainment industries. Game developers and media studios use animation extensively within character design, storytelling, and environment creation. These sectors increasingly adopt AI tools to streamline production and reduce time to market. As franchises and multimedia projects expand, efficient animation generation becomes a strategic advantage.

Key Takeaway

- In 2025, the app based segment led the market with a 70.6% share, showing strong preference for easy to use platforms that allow creators to generate animations without advanced technical skills.

- Text to video generation models captured a 41.7% share, reflecting rising demand for tools that convert written prompts into animated visual content quickly and efficiently.

- The content creation segment held a dominant 48.9% share, supported by growing use of AI animation tools for social media, marketing videos, and digital storytelling.

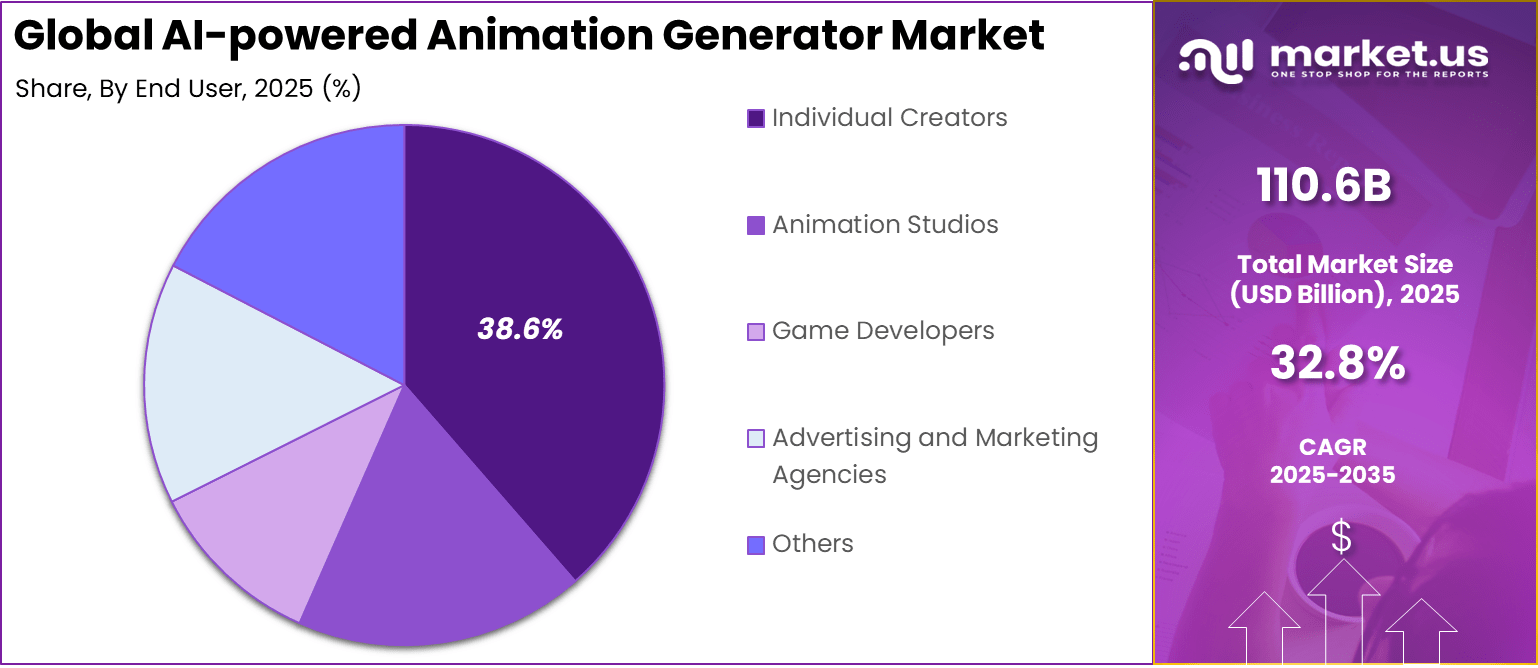

- Individual creators accounted for 38.6% of total adoption, highlighting the role of freelancers, influencers, and independent artists in driving early and large scale usage.

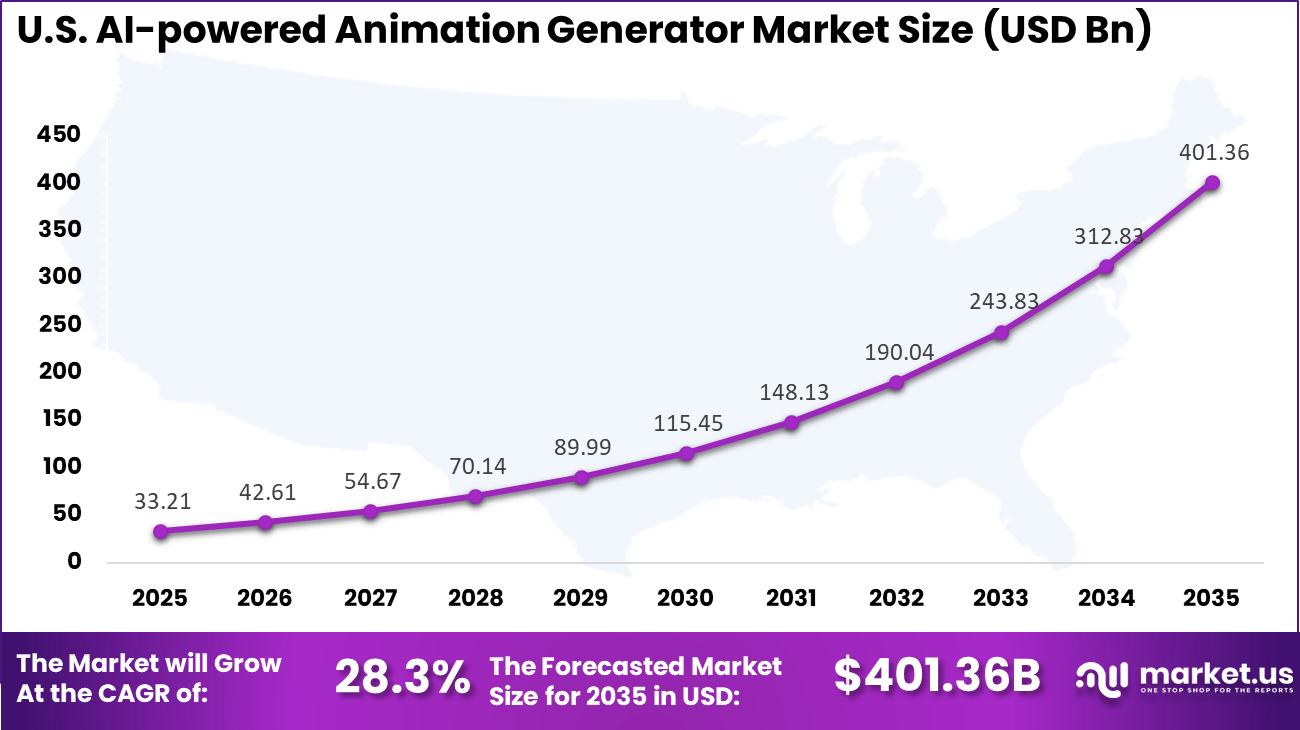

- The United States market was valued at USD 33.21 billion in 2025, expanding at a strong 28.3% growth rate due to high creator economy activity and rapid adoption of AI driven creative tools.

- North America maintained regional leadership with more than a 34.5% share, supported by advanced digital infrastructure, strong content monetization ecosystems, and early acceptance of AI based creative software.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Explosion of digital content demand High volume animation needs across platforms ~8.6% Global Short Term Advancements in generative AI Faster and low cost animation creation ~7.4% North America, Asia Pacific Short Term Growth of social media and video platforms Continuous need for engaging visuals ~6.2% Global Mid Term Adoption by non technical creators Democratization of animation tools ~5.7% Global Mid Term Enterprise marketing automation Branded animated content at scale ~4.9% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Copyright and IP concerns Ownership of AI generated content ~6.1% North America, Europe Short Term Content quality variability Inconsistent animation realism ~5.2% Global Short Term Regulatory uncertainty Evolving AI governance rules ~4.6% Europe, North America Mid Term High compute requirements Cost of large scale model training ~3.9% Global Mid Term Market saturation risk Rapid entry of similar tools ~3.1% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Ethical concerns Deepfake misuse and manipulation ~5.8% Global Short to Mid Term Skill transition challenges Learning curve for creative teams ~4.7% Global Mid Term Integration complexity Alignment with production pipelines ~3.9% Global Mid Term Pricing pressure Competition among AI platforms ~3.2% Global Long Term Infrastructure dependence Need for high performance compute ~2.6% Emerging Markets Long Term By Platform

In 2025, App-based platforms account for 70.6%, showing their strong dominance in the market. These platforms allow users to create animations directly on mobile or desktop applications. Easy access and simple interfaces support rapid content creation. App-based tools reduce the need for advanced technical skills. This improves adoption among a wide user base.

The dominance of app-based platforms is driven by convenience and speed. Users prefer tools that do not require complex installation. Frequent updates improve feature availability. App ecosystems support subscriptions and in-app services. This sustains strong platform preference.

For Instance, in November 2025, Krikey Inc. launched a 3D Cartoon Character Store as an app-based feature, allowing instant rigging and animation of characters. App users now access ready models for mobile video production, making professional animations accessible without desktop setups.

By Technology

In 2025, Text-to-video generation models represent 41.7%, making them the leading technology segment. These models convert written prompts into animated video outputs. Automation reduces production time significantly. Users can generate visuals without manual animation work. This supports efficient content development.

Adoption of text-to-video technology is driven by demand for faster creation cycles. Creators focus on storytelling rather than technical execution. Improved language understanding enhances output quality. Models continue to learn from user input. This keeps text-based generation widely adopted.

For instance, in December 2025, Runway AI introduced a Gen-4.5 text-to-video model, topping benchmarks for realistic motion and fidelity. The upgrade excels in temporal consistency, enabling precise text prompts for complex animations used in film and ads.

By Application

In 2025, Content creation accounts for 48.9%, highlighting its central role in market demand. Animation tools are widely used for videos, social media, and educational content. Automated animation supports frequent publishing needs. Visual content improves audience engagement. This makes animation tools essential for creators.

Growth in content creation usage is driven by digital media expansion. Platforms require constant visual updates. AI tools reduce creative workload. Faster turnaround improves productivity. This sustains strong application demand.

For Instance, in November 2025, Artbreeder rolled out the Wan 2.5 Animator model with sound for content videos. Creators animate static images into smooth clips with audio, ideal for social media and storytelling content.

By End User

In 2025, Individual creators represent 38.6%, making them a key end-user group. These users include freelancers, influencers, and independent artists. AI animation tools help them compete with larger studios. Affordable access supports creative independence. Ease of use remains important.

Adoption among individual creators is driven by monetization opportunities. Digital platforms reward consistent content output. AI tools lower production barriers. Creators rely on automation to scale output. This sustains strong individual user participation.

For Instance, in January 2026, Fotor AI launched AI News Anchor Generator for individual video content. Creators upload photos to make custom talking anchors, simplifying solo news-style clips for YouTube or social posts.

By Region

In 2025, North America accounts for 34.5%, supported by strong digital content ecosystems. The region has high adoption of creative software. Individual and professional creators actively use AI tools. Technology awareness supports rapid uptake. The region remains influential.

For instance, in December 2025, Runway unveiled a Gen 4.5 AI video model, outperforming competitors like Google and OpenAI in independent evaluations. With high-definition video from text prompts capturing physics and human motion, Runway powers Hollywood productions for Netflix and Disney, solidifying North America’s dominance in professional-grade AI animation generators.

In 2025, The United States reached USD 33.21 Billion with a CAGR of 28.3%, reflecting rapid market expansion. Growth is driven by creator economy growth. AI adoption accelerates content production. Demand for visual storytelling continues to rise. Market momentum remains strong.

For instance, in June 2025, Midjourney launched its first AI video generation model, V1, enabling users to transform images into 5-second animated videos with customizable motion settings. This advancement marks a significant step toward real-time AI simulations, reinforcing U.S. leadership in AI-powered animation tools.

Regional Driver Comparison

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Advanced generative AI adoption 34.5% USD 38.17 Bn Advanced Europe Creative industry digitalization 27.8% USD 30.77 Bn Advanced Asia Pacific Mobile first content creation 29.6% USD 32.75 Bn Developing to Advanced Latin America Social media driven animation use 4.7% USD 5.20 Bn Developing Middle East and Africa Early stage creator economy 3.4% USD 3.76 Bn Early Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Media and entertainment firms Very High ~38.9% Scalable animation production Platform wide adoption Digital marketing agencies High ~21% High volume creative output Subscription based Independent creators High ~18% Low cost content generation Tool driven adoption Enterprises Moderate ~14% Brand storytelling automation Phased deployment Educational institutions Low to Moderate ~9% Visual learning content Program based usage Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Generative adversarial networks Visual motion generation ~8.4% Growing Diffusion models High quality frame synthesis ~7.2% Growing Natural language to animation Script driven animation creation ~6.3% Developing Cloud based rendering Scalable animation processing ~5.1% Mature AI character modeling Automated rigging and motion ~4.0% Developing Emerging Trends

In the smartwatch market, one trend is the growing focus on health and biometric monitoring capabilities. Smartwatches increasingly offer features such as continuous heart rate monitoring, sleep tracking, and activity analysis. These capabilities support daily wellness tracking and long-term health awareness for users, helping them monitor patterns over time rather than solely at isolated moments.

Another trend is the expansion of connectivity and standalone features. Devices are integrating cellular connectivity that allows calls, messages, and app use without requiring a paired smartphone. This shift supports more independent use cases and appeals to users who seek convenience and freedom from carrying a separate phone during activities such as exercise or travel.

Growth Factors

A key growth factor in the smartwatch market is the increasing consumer interest in personal health data and performance metrics. Individuals of diverse ages are adopting wearable technology to monitor steps, calories, heart metrics, and other indicators of physical activity. As lifestyle awareness grows, demand for devices that provide actionable insights continues to rise.

Another factor supporting growth is the advancement of sensor and battery technologies. Improved sensors deliver more accurate readings across various conditions, and more efficient power systems extend device operation between charges. These improvements enhance user satisfaction and support broader adoption across health, fitness, and daily use scenarios.

Key Market Segments

By Platform

- App-based

- Web-based

By Technology

- Text-to-Video Generation Models

- Image-to-Image Transformation Models

- Image to Video Animation Models

- Video to Video Models

- Custom Models

By Application

- Content Creation

- Merchandising

- Others

By End User

- Individual Creators

- Animation Studios

- Game Developers

- Advertising and Marketing Agencies

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI-powered Animation Generator Market is driven by creative AI platforms that simplify animation and visual content creation. Midjourney and Runway AI focus on generative models that support animation-ready visuals and video effects. Reallusion Inc. provides character animation tools widely used by independent creators and studios. Krikey Inc. emphasizes avatar-based animation and ease of use.

Specialized platforms strengthen the market through artistic and style-driven capabilities. Artbreeder enables collaborative character and scene generation. DeepArt focuses on style transfer for animated visuals. PaintsChainer, backed by Preferred Networks, Inc., automates line art coloring for animation workflows. Toonify supports cartoon-style facial animation.

Emerging and niche providers expand accessibility and consumer use cases. Waifu Labs targets anime-style character creation. Fotor AI, operated by Everimaging Science & Technology Co., Ltd, integrates animation-friendly design features. Other players continue to enter the market with focused solutions. This competitive landscape supports innovation, lowers production costs, and accelerates adoption across media, gaming, and digital marketing.

Top Key Players in the Market

- Midjourney

- Runway AI

- Reallusion Inc.

- Krikey Inc.

- Artbreeder

- DeepArt

- PaintsChainer (Preferred Networks, Inc.)

- Toonify

- Waifu Labs

- Fotor AI (Everimaging Science & Technology Co., Ltd)

- Others

Recent Developments

- In December 2025, Deep Art Effects released Creator Pro for desktop, an offline generative AI tool that turns text prompts into original artworks with upscaling and refinement. GPU acceleration on Apple Silicon or Nvidia makes it fast and private, perfect for artists wanting full control over animation-style visuals.

- In November 2025, Artbreeder debuted Animator with the Wan 2.5 model, adding native sound to video generation from images. Enhanced motion and prompt control open doors for storytelling, available to subscribers only. This update feels like a natural evolution for blending images into dynamic animations.

Report Scope

Report Features Description Market Value (2025) USD 110.6 Bn Forecast Revenue (2035) USD 1,887.7 Bn CAGR(2026-2035) 32.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (App-based, Web-based), By Technology (Text-to-Video Generation Models, Image-to-Image Transformation Models, Image to Video Animation Models, Video to Video Models, Custom Models), By Application (Content Creation, Merchandising, Others), By End User (Individual Creators, Animation Studios, Game Developers, Advertising and Marketing Agencies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Midjourney, Runway AI, Reallusion Inc., Krikey Inc., Artbreeder, DeepArt, PaintsChainer (Preferred Networks, Inc.), Toonify, Waifu Labs, Fotor AI (Everimaging Science & Technology Co., Ltd), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-powered Animation Generator MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-powered Animation Generator MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Midjourney

- Runway AI

- Reallusion Inc.

- Krikey Inc.

- Artbreeder

- DeepArt

- PaintsChainer (Preferred Networks, Inc.)

- Toonify

- Waifu Labs

- Fotor AI (Everimaging Science & Technology Co., Ltd)

- Others