Global AI In Revenue Cycle Management Market By Product Type (Software and Services), By Technology (Integrated and Standalone), By Application (Claims Management, Revenue Integrity, Prior Authorization, Patient Eligibility Verification, Denials Management, Coding and Billing, and Others), By Delivery Mode (Web-Based and Cloud-Based), By End-User (Hospitals, Diagnostic Laboratories, Physician Practices, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153129

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Application Analysis

- Delivery Mode Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

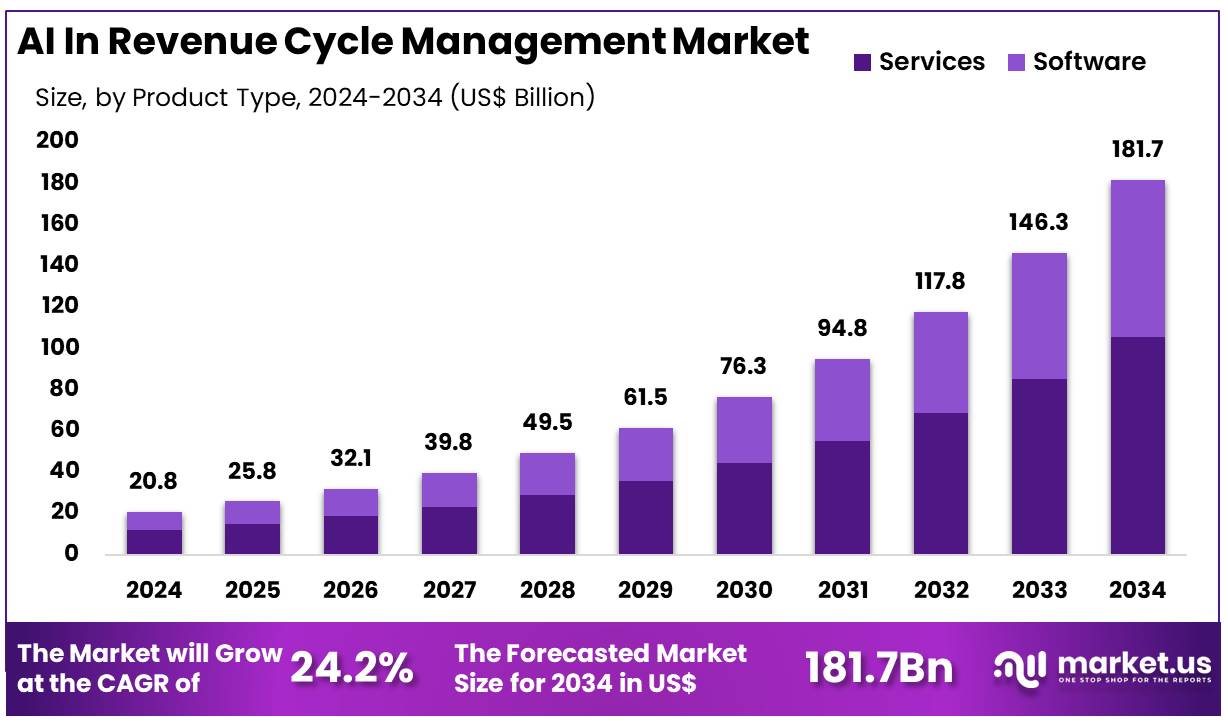

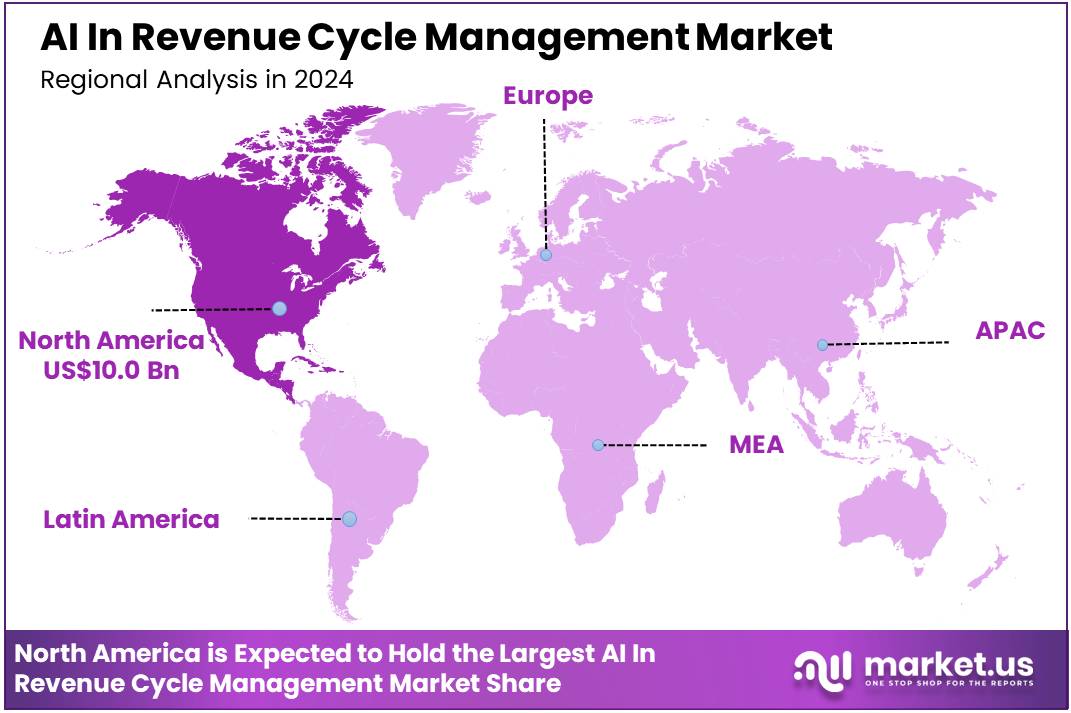

Global AI In Revenue Cycle Management Market size is expected to be worth around US$ 181.7 Billion by 2034 from US$ 20.8 Billion in 2024, growing at a CAGR of 24.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 48.1% share with a revenue of US$ 10.0 Billion.

Increasing pressure on healthcare providers to optimize operational efficiency and reduce costs is driving the adoption of AI in revenue cycle management (RCM). AI-powered solutions can streamline the complex and time-consuming processes involved in RCM, including billing, coding, claims processing, and payment collections.

These technologies leverage machine learning algorithms to analyze large datasets, identify patterns, and automate repetitive tasks, leading to faster and more accurate claims submissions. By reducing human errors, AI enhances the accuracy of medical coding, minimizing claim denials and rework while accelerating the reimbursement process. The growing volume of patient data and increasing complexity of healthcare billing make AI in RCM a crucial tool for healthcare providers to stay competitive.

Recent trends show significant investment in AI technologies aimed at improving coding accuracy, optimizing revenue collection, and enhancing patient experience through more transparent billing processes. In February 2024, Imagine Software and Maverick Medical AI collaborated to introduce an AI-based Autonomous Medical Coding Platform. This partnership aims to enhance operational scalability for healthcare providers by automating the medical coding process, ultimately improving RCM.

The use of AI also extends to predictive analytics, helping organizations forecast cash flow, identify billing inefficiencies, and reduce the administrative burden on staff. As healthcare systems increasingly shift toward value-based care, the ability to improve accuracy, efficiency, and financial performance through AI-driven RCM solutions presents substantial growth opportunities for the market. With the ongoing advancement of AI technologies, healthcare providers are better positioned to optimize their revenue cycle, reduce costs, and improve overall financial health.

Key Takeaways

- In 2024, the market for AI in revenue cycle management generated a revenue of US$ 20.8 billion, with a CAGR of 24.2%, and is expected to reach US$ 181.7 billion by the year 2034.

- The product type segment is divided into software and services, with services taking the lead in 2024 with a market share of 58.2%.

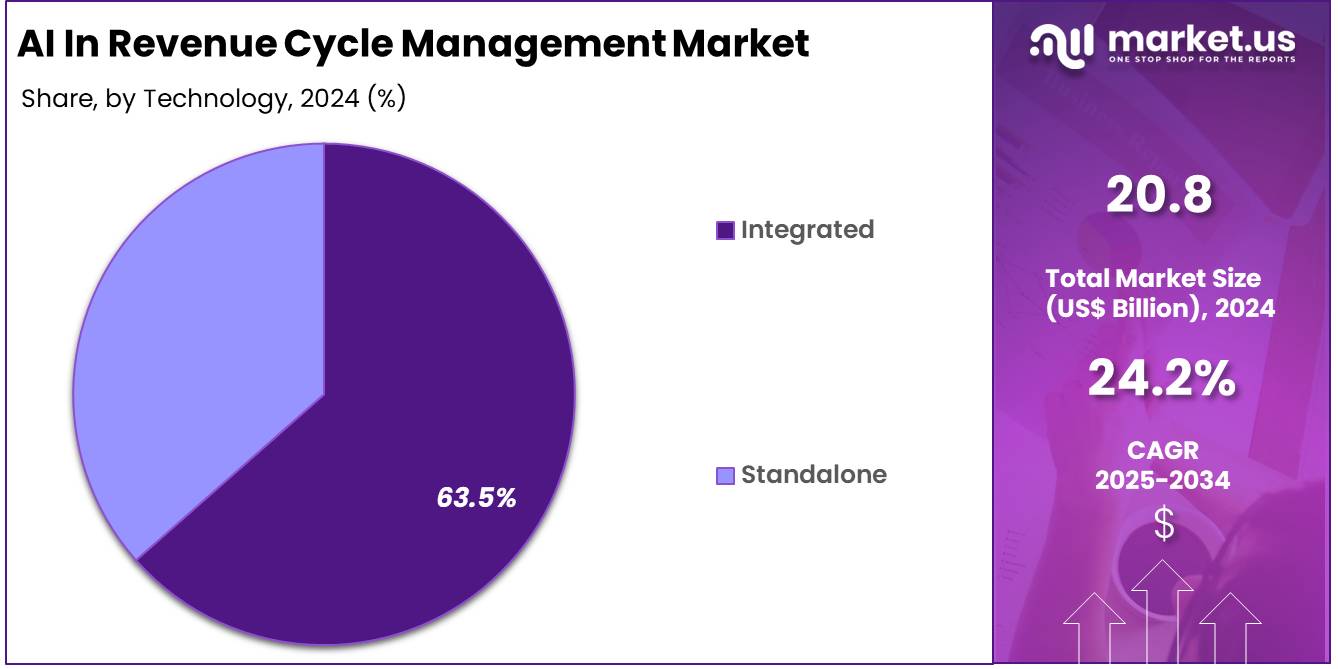

- Considering technology, the market is divided into integrated and standalone. Among these, integrated held a significant share of 63.5%.

- Furthermore, concerning the application segment, the market is segregated into claims management, revenue integrity, prior authorization, patient eligibility verification, denials management, coding and billing, and others. The claims management sector stands out as the dominant player, holding the largest revenue share of 25.5% in the AI in revenue cycle management market.

- The delivery mode segment is segregated into web-based and cloud-based, with the web-based segment leading the market, holding a revenue share of 54.1%.

- Considering end-user, the market is divided into hospitals, diagnostic laboratories, physician practices, and others. Among these, hospitals held a significant share of 45.3%.

- North America led the market by securing a market share of 48.1% in 2024.

Product Type Analysis

The services segment holds a dominant share of 58.2% in the AI in revenue cycle management (RCM) market. This growth is expected to continue as healthcare organizations increasingly rely on specialized services to optimize their revenue cycle processes. Services in AI-powered RCM solutions provide hospitals and clinics with end-to-end support, including billing, coding, claims management, and data analytics.

These services are anticipated to enhance operational efficiency by reducing errors, speeding up reimbursement processes, and ensuring compliance with regulatory requirements. The growing need for healthcare providers to improve financial performance and patient satisfaction is projected to further drive the demand for AI services in RCM.

Additionally, the increasing adoption of advanced machine learning models to predict denials, assess patient eligibility, and automate coding is expected to contribute to the growth of this segment. As healthcare systems strive to streamline administrative tasks and reduce costs, services offering tailored RCM solutions are likely to experience continued growth.

Technology Analysis

The integrated technology segment holds 63.5% of the market, driven by the increasing demand for seamless, unified solutions in revenue cycle management. Integrated AI solutions are expected to provide healthcare organizations with a single, cohesive platform that combines all necessary functions such as claims management, coding, billing, and patient eligibility verification. This approach allows for greater data visibility, consistency, and efficiency, significantly reducing the need for manual intervention and improving overall operational workflows.

The ability to integrate AI solutions with existing healthcare IT systems such as Electronic Health Records (EHR) and Electronic Medical Records (EMR) is likely to propel the growth of integrated technologies. The integration of these solutions also facilitates real-time data processing, making it easier for healthcare providers to make informed decisions and quickly address issues related to billing and insurance claims. As healthcare providers continue to prioritize interoperability and efficiency, integrated solutions are projected to see continued demand and growth in the market.

Application Analysis

Claims management is a key application segment, holding 25.5% of the market. The growing complexity of healthcare billing, coupled with an increase in denied claims and regulatory scrutiny, is driving the need for AI-driven claims management solutions.

AI technologies are expected to streamline the claims process by automating claim creation, submission, tracking, and follow-up. This will help reduce human error, ensure compliance with payer rules, and improve the speed and accuracy of claims submissions. Furthermore, AI algorithms can analyze historical data to predict claim denials, flag potential issues early in the process, and recommend corrective actions, enhancing overall claims success rates.

As healthcare providers seek to improve their revenue cycles and reduce administrative burdens, claims management solutions powered by AI are projected to grow significantly. The ability of AI to analyze large amounts of claims data and optimize reimbursement is anticipated to make claims management a critical area of focus for RCM solutions in the coming years.

Delivery Mode Analysis

Web-based solutions hold a significant share of 54.1% in the delivery mode segment of the AI in RCM market. This is expected to continue as healthcare organizations increasingly prefer the flexibility, scalability, and accessibility that web-based systems provide. Web-based platforms enable healthcare providers to access RCM tools and data remotely, allowing for better collaboration across teams, regardless of location.

The ability to operate without heavy IT infrastructure and maintenance costs is likely to drive further adoption of web-based solutions. Additionally, the ease of integration with existing healthcare management systems, such as hospital information systems (HIS) and electronic health records (EHR), is expected to make web-based AI tools more attractive to healthcare organizations. As the demand for cloud storage, remote access, and data security grows, web-based AI solutions are projected to dominate the RCM market due to their convenience and cost-effectiveness.

End-User Analysis

Hospitals represent the largest end-user segment in the AI in revenue cycle management market, with a share of 45.3%. This growth is expected to be driven by hospitals’ need to manage complex billing processes and improve revenue cycle operations. The increasing pressure on hospitals to reduce operating costs, improve reimbursement rates, and ensure compliance with regulations is likely to accelerate the adoption of AI-powered RCM solutions.

Hospitals are particularly interested in AI solutions that can automate time-consuming tasks such as coding, billing, and claims management, which helps to improve efficiency and reduce administrative costs. The growing number of patients and increasing complexity of claims further contribute to the need for advanced solutions that can handle large volumes of data quickly and accurately.

As hospitals continue to integrate AI technologies into their operations, the demand for AI-driven RCM solutions is expected to remain strong, ensuring continued growth in this segment.

Key Market Segments

By Product Type

- Software

- Services

By Technology

- Integrated

- Standalone

By Application

- Claims Management

- Revenue Integrity

- Prior Authorization

- Patient Eligibility Verification

- Denials Management

- Coding and Billing

- Others

By Delivery Mode

- Web-Based

- Cloud-Based

By End-User

- Hospitals

- Diagnostic Laboratories

- Physician Practices

- Others

Drivers

Rising Complexity of Claims Processing and High Denial Rates are Driving the Market

The increasing complexity of healthcare claims processing and the consistently high rates of claim denials are significant drivers propelling the AI in revenue cycle management (RCM) market. Healthcare providers face a challenging environment characterized by diverse payer rules, frequent changes in coding standards, and stringent documentation requirements. This complexity often leads to errors in billing and coding, resulting in a substantial number of denied claims.

Manually managing these denials is labor-intensive, costly, and significantly impacts the financial health of healthcare organizations. AI-powered RCM systems automate many of these tasks, including claim scrubbing, eligibility verification, and denial prediction, thereby reducing administrative burden and improving the accuracy of submissions.

According to data analyzed from the Centers for Medicare & Medicaid Services (CMS) Transparency in Coverage data for the 2023 plan year, HealthCare.gov issuers denied an average of 19% of in-network claims. This high denial rate underscores the persistent challenges in the RCM process.

Furthermore, a KFF analysis of the 2023 data reported that insurers received 425 million claims, with 73 million being denied. These figures highlight the massive volume of claims requiring careful processing and the significant financial impact of denials, compelling healthcare organizations to adopt AI solutions to streamline operations and safeguard revenue streams.

Restraints

Concerns over Data Security and Compliance are Restraining the Market

The significant concerns surrounding data security and the complexities of regulatory compliance, particularly regarding protected health information (PHI), pose a considerable restraint on the AI in revenue cycle management market.

Implementing AI solutions in RCM involves processing vast amounts of sensitive patient data, including billing information, medical history, and personal identifiers. This data must be protected under stringent regulations such as HIPAA in the US. Healthcare organizations are hesitant to adopt advanced AI technologies if they cannot guarantee compliance and robust security measures.

The risk of data breaches and the severe penalties associated with non-compliance create a significant barrier. According to the US Department of Health and Human Services (HHS) Office for Civil Rights (OCR), healthcare data breaches have shown an alarming trend in recent years.

The HIPAA Journal reported in January 2025 that in 2023, 725 data breaches of 500 or more records were reported to OCR, affecting more than 133 million records. While AI offers efficiency benefits, the substantial financial and reputational risks associated with these security vulnerabilities necessitate rigorous compliance protocols. This emphasizes the need for secure AI frameworks, which adds complexity and cost to implementation, thereby restraining the market’s growth among risk-averse providers.

Opportunities

Integration with Predictive Analytics for Denial Prevention is Creating Growth Opportunities

The integration of AI in revenue cycle management with advanced predictive analytics is creating significant growth opportunities in the market. By leveraging AI and machine learning, RCM systems can analyze historical claims data, identify patterns of denials, and predict the likelihood of future claims being rejected before they are even submitted. This capability allows healthcare providers to address potential issues proactively, such as incomplete documentation or coding errors, before they lead to lost revenue.

Predictive analytics not only helps in optimizing the claims submission process but also improves the accuracy of patient eligibility verification and patient payment estimation. A January 2024 article discussing medical billing trends noted that AI-driven software can process claims, verify patient eligibility, and manage denials with greater accuracy and efficiency.

Furthermore, predictive models can prioritize claims with the highest likelihood of denial, allowing RCM staff to focus their efforts on high-impact cases. This strategic application of AI enhances financial performance and operational efficiency, offering a compelling value proposition for healthcare organizations seeking to reduce administrative costs and increase reimbursement rates, thereby fostering substantial market expansion.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic shifts, including inflation and varying economic growth rates, influence the AI in revenue cycle management market by affecting healthcare organizations’ IT budgets and the cost of AI infrastructure. While healthcare spending generally grows, inflationary pressures can increase the cost of cloud computing services, specialized AI hardware, and skilled IT labor, which are essential for developing and deploying AI-powered RCM solutions. This can place strain on the capital expenditures of healthcare providers.

For instance, data from the US Centers for Medicare & Medicaid Services (CMS) reported in July 2025 indicates that US national health spending grew 8.2% in 2024, driven by increased utilization of services and goods. Despite this growth in overall spending, healthcare organizations remain highly focused on optimizing administrative costs.

This environment creates a strong incentive for providers to adopt AI in RCM to improve efficiency and manage administrative expenses, which often represent a significant portion of healthcare expenditures. Geopolitical factors also impact global supply chains for IT components, introducing volatility and potential delays in AI implementation. Ultimately, the demand for AI solutions to reduce administrative burden during periods of economic volatility fosters market resilience and continued adoption.

Evolving US trade policies, including the imposition of tariffs on technology imports, are shaping the AI in revenue cycle management market by influencing the cost of necessary hardware and infrastructure. AI in RCM relies heavily on sophisticated computing power, including specialized graphics processing units (GPUs) and cloud servers.

Tariffs on these components, often sourced internationally, can increase the operational costs for both software developers and healthcare providers implementing AI solutions. A May 2025 analysis noted that escalating tariffs under the current US administration are increasing costs for AI servers and GPUs, potentially impacting demand and market outlooks. This rise in input costs may lead to higher prices for AI-RCM services or internal infrastructure, potentially slowing down adoption, especially for smaller providers.

Conversely, these trade dynamics often coincide with increased focus on domestic cybersecurity and data governance. While tariffs pose a financial challenge, the emphasis on robust data protection within the US regulatory framework encourages the development of secure and compliant AI-RCM systems, ultimately improving the trustworthiness and effectiveness of these solutions.

Latest Trends

Increased Adoption of Generative AI for Documentation and Coding is a Recent Trend

A significant recent trend impacting the AI in revenue cycle management market in 2024 and 2025 is the rapid adoption of generative AI and large language models (LLMs) for automating clinical documentation and coding. Generative AI tools are being utilized to analyze physician notes, extract relevant clinical information, and automatically generate accurate medical codes and billing summaries. This technology significantly reduces the manual effort required for documentation and coding, which are traditionally time-consuming aspects of the revenue cycle.

In 2024, early adopters in healthcare began showcasing the capabilities of generative AI to improve administrative workflows and reduce clinician burnout. For instance, several health technology companies introduced ambient listening technology that listens to patient-provider conversations in real time, extracting relevant information for clinical notes while meeting billing and coding requirements.

A January 2025 report highlighted that organizations are increasingly implementing these ambient listening solutions as a strategic first step into AI due to clear ROI in terms of clinical efficiency. This development not only streamlines the RCM process but also enhances the accuracy and speed of billing, reflecting a key shift towards advanced automation in the market.

Regional Analysis

North America is leading the AI In Revenue Cycle Management Market

North America dominated the market with the highest revenue share of 48.1% owing to healthcare providers’ and payers’ increasing need to enhance efficiency, reduce administrative burdens, and optimize financial performance. The inherent complexities of healthcare billing, coding, and claims processing, coupled with rising operational costs, have necessitated the adoption of advanced technological solutions.

Artificial intelligence offers capabilities such as predictive analytics for denial prevention, automated coding, and intelligent claims processing, which directly address these critical challenges. Major healthcare entities are actively investing in and implementing these sophisticated technologies. For instance, UnitedHealth Group, a prominent payer and provider, reported robust growth in its Optum segment, which includes digital services aimed at improving healthcare operations.

Optum’s full-year revenues reached US$253 billion in 2024, representing a significant increase from US$64.97 billion in 2023, reflecting ongoing efforts to enhance overall operational efficiency and financial outcomes.

The US Department of Health and Human Services (HHS) also acknowledges AI’s pivotal role in achieving its mission to enhance health and well-being, with its 2024 AI Use Case Inventory indicating the application of AI across various healthcare functions, including administrative and operational uses like revenue forecasting and patient payment plans.

The Centers for Medicare & Medicaid Services (CMS) reinforces the critical need for administrative efficiency by processing over one billion Medicare claims annually, further highlighting the immense potential for AI to optimize these high-volume processes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing digitalization initiatives in healthcare, a growing demand for cost-efficient administrative processes, and robust government support for advanced technology adoption across the region’s diverse healthcare systems. Countries such as India, China, and Australia are actively promoting digital transformation in their healthcare sectors, creating fertile ground for AI implementation in financial operations.

For example, India’s Ayushman Bharat Digital Mission (ABDM), an initiative of the Government of India, aims to create a nationwide digital health ecosystem; by January 2025, it had successfully created over 730 million Ayushman Bharat Health Accounts (ABHA), which will likely facilitate more streamlined digital health transactions.

The Australian Digital Health Agency’s Corporate Plan for 2023-2024 outlines a significant investment of more than US$1 billion over four years to modernize national digital health infrastructure and drive real-time information sharing, which is anticipated to enhance the efficiency of billing and claims management.

Healthcare providers in the region, such as IHH Healthcare, reported a 16% increase in revenue, reaching RM24.4 billion in 2024, indicating their expanding operations and a corresponding need for advanced financial management tools. This strategic focus on digital transformation and operational efficiency will drive the adoption of AI tools to automate tasks, reduce errors, and accelerate payment cycles across the Asia Pacific healthcare landscape.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the AI-driven revenue cycle management (RCM) market employ various strategies to enhance operational efficiency and financial performance. They focus on integrating advanced AI technologies to automate billing, coding, and claims processing, reducing manual errors and accelerating reimbursement cycles.

Companies also prioritize the development of scalable, cloud-based platforms that offer real-time data analytics and seamless interoperability with existing electronic health record (EHR) systems. Strategic partnerships with healthcare providers and technology firms enable these companies to expand their market reach and enhance service offerings.

Additionally, they invest in user-friendly interfaces and mobile applications to improve accessibility and user experience. Geographical expansion, particularly in emerging markets, further contributes to their growth trajectory.

One key player, R1 RCM Inc., is a leading provider of technology-enabled revenue cycle management services. Headquartered in Murray, Utah, R1 RCM offers a comprehensive suite of services, including pre-registration, financial clearance, charge capture, coding, billing, and follow-up.

The company serves hospitals, health systems, and physician groups across the United States, employing over 30,000 people. In November 2024, R1 RCM was acquired by TowerBrook Capital Partners and Clayton, Dubilier & Rice in a deal valued at $8.9 billion, underscoring its significant position in the healthcare RCM industry.

Top Key Players

- Zentist

- RapidClaims

- Oracle (Cerner Corporation)

- McKesson Corporation

- Infinx

- eClinicalWorks

- CareCloud Corporation

- Adonis

Recent Developments

- In May 2025, Infinx acquired i3 Verticals’ healthcare revenue cycle management division. This acquisition is expected to strengthen Infinx’s market position and technological capabilities, allowing for the integration of scalable solutions and expert services throughout the revenue cycle to improve financial performance for healthcare organizations.

- In April 2025, RapidClaims raised US$ 11 million to further develop its AI-driven revenue cycle management platform and broaden its reach in the market.

- In June 2024, Adonis secured US$ 31 million to extend its AI-powered revenue cycle automation platform. The solution integrates seamlessly with more than 35 electronic health record (EHR) systems and clearinghouses, offering flexible, tailored solutions for healthcare providers of varying sizes.

- In April 2024, Zentist launched Cavi AR, an AI-powered revenue cycle management software focused on dental insurance accounts receivable (AR) and claims management.

Report Scope

Report Features Description Market Value (2024) US$ 20.8 Billion Forecast Revenue (2034) US$ 181.7 Billion CAGR (2025-2034) 24.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software and Services), By Technology (Integrated and Standalone), By Application (Claims Management, Revenue Integrity, Prior Authorization, Patient Eligibility Verification, Denials Management, Coding and Billing, and Others), By Delivery Mode (Web-Based and Cloud-Based), By End-User (Hospitals, Diagnostic Laboratories, Physician Practices, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zentist, RapidClaims, Oracle (Cerner Corporation), McKesson Corporation, Infinx, eClinicalWorks, CareCloud Corporation, Adonis. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI In Revenue Cycle Management MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

AI In Revenue Cycle Management MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zentist

- RapidClaims

- Oracle (Cerner Corporation)

- McKesson Corporation

- Infinx

- eClinicalWorks

- CareCloud Corporation

- Adonis