AI In Healthcare Market By Product Type (Hardware, Software, Services, By Technology (Machine Learning, Natural Language Processing, Context-aware Computing, Computer Vision, By Application (Robot-assisted Surgery, Virtual Assistants, Administrative Workflow Assistants, Fraud Detection, Cybersecurity, Others, By End-Use (Healthcare Companies, Healthcare Providers, Patients, Healthcare Payers, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152526

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

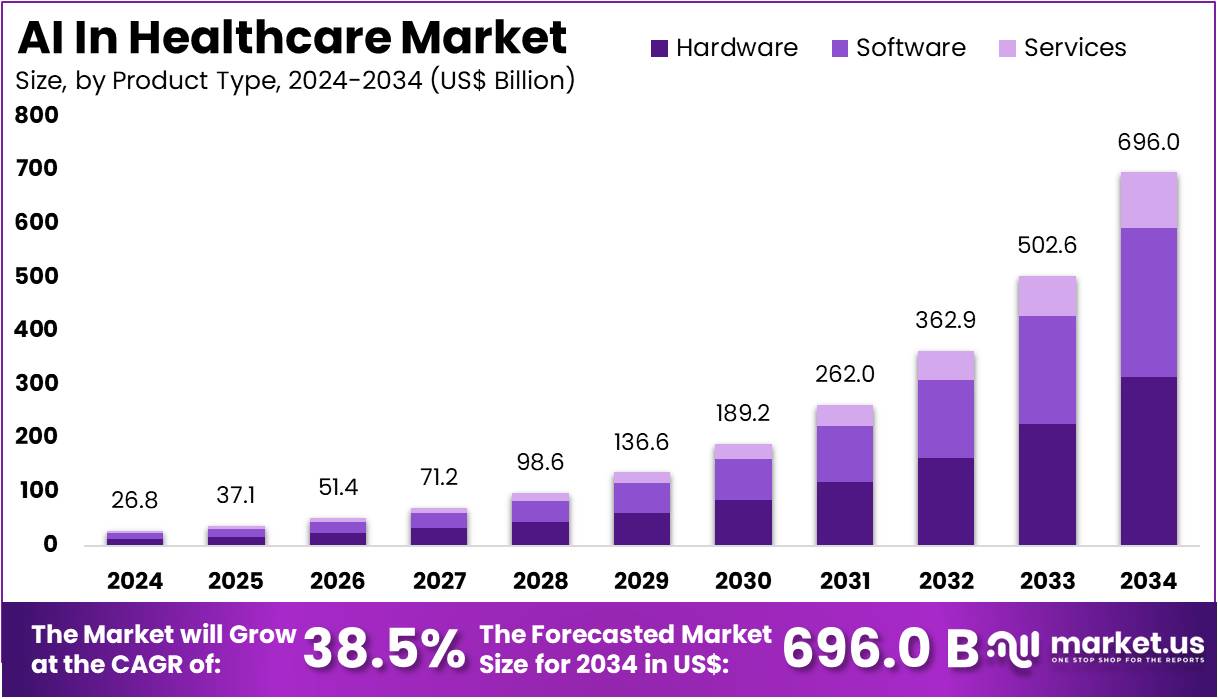

The AI In Healthcare Market Size is expected to be worth around US$ 696.0 billion by 2034 from US$ 26.8 billion in 2024, growing at a CAGR of 38.5% during the forecast period 2025 to 2034.

Rising demand for efficient, accurate, and scalable healthcare solutions is driving the growth of AI in healthcare. Artificial intelligence technologies are increasingly being integrated into various healthcare applications, ranging from medical imaging and diagnostics to personalized medicine and drug discovery. AI’s ability to process vast amounts of data quickly and accurately allows healthcare professionals to make more informed decisions and provide faster treatment, improving patient outcomes.

One of the key drivers is the need for improved diagnostic accuracy, particularly in fields like radiology, where AI can assist in detecting abnormalities such as tumors, fractures, or infections with higher precision. Additionally, AI-powered predictive models are helping identify at-risk patients and optimize treatment plans.

In July 2024, Microsoft partnered with Mass General Brigham and the University of Wisconsin-Madison to develop AI models for medical imaging, aimed at diagnosing over 23,000 medical conditions. This partnership underscores the growing role of AI in enhancing the efficiency of radiologists and medical professionals, contributing to better patient care. The market also benefits from AI’s ability to streamline administrative tasks, including scheduling, billing, and patient records management, reducing the administrative burden on healthcare providers.

As AI technologies advance, healthcare providers are presented with new opportunities to enhance clinical decision-making, improve operational efficiency, and expand access to high-quality care. Moreover, AI’s integration into telemedicine platforms is enabling remote patient monitoring and virtual consultations, further expanding the accessibility of healthcare services. The ongoing advancements in AI algorithms and their applications in healthcare present substantial opportunities for innovation, leading to more precise, efficient, and affordable healthcare solutions.

Key Takeaways

- In 2024, the market for AI in healthcare generated a revenue of US$ 26.8 billion, with a CAGR of 38.5%, and is expected to reach US$ 696.0 billion by the year 2034.

- The product type segment is divided into hardware, software, and services, with hardware taking the lead in 2023 with a market share of 45.3%.

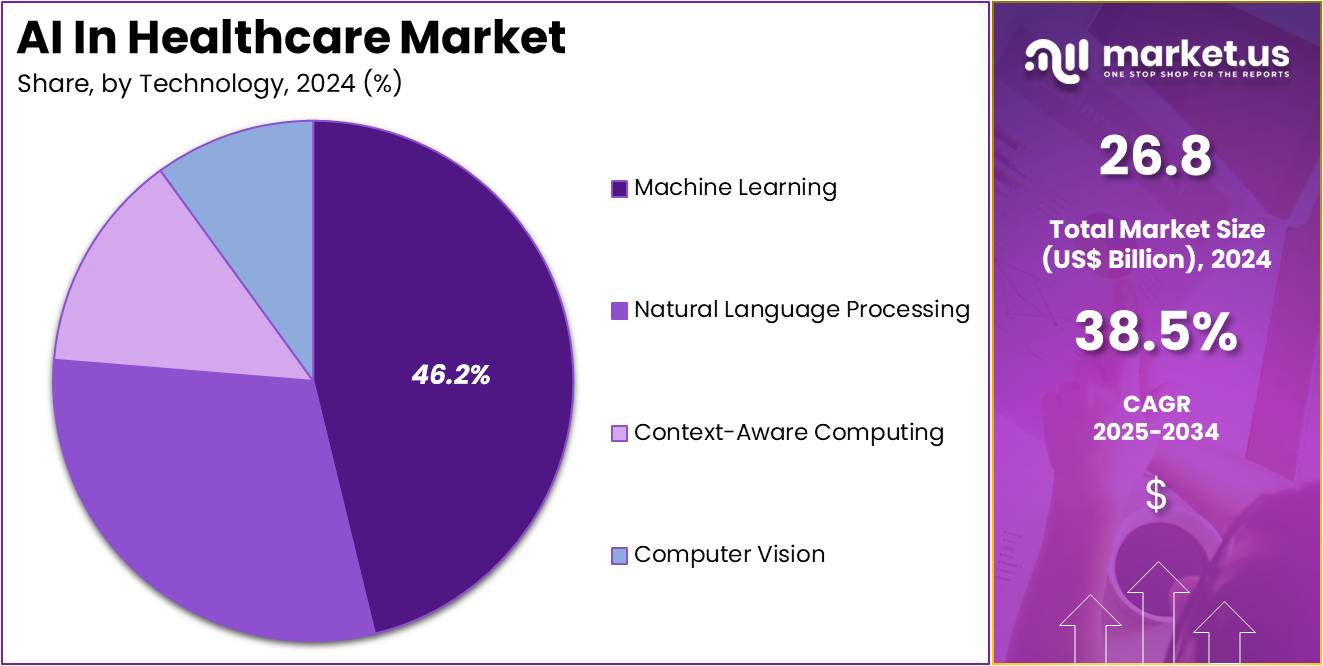

- Considering technology, the market is divided into machine learning, natural language processing, context-aware computing, and computer vision. Among these, machine learning held a significant share of 46.2%.

- Furthermore, concerning the application segment, the robot-assisted surgery sector stands out as the dominant player, holding the largest revenue share of 25.4% in the AI in healthcare market.

- The end-user segment is segregated into healthcare companies, healthcare providers, patients, healthcare payers, and others, with the healthcare companies segment leading the market, holding a revenue share of 50.5%.

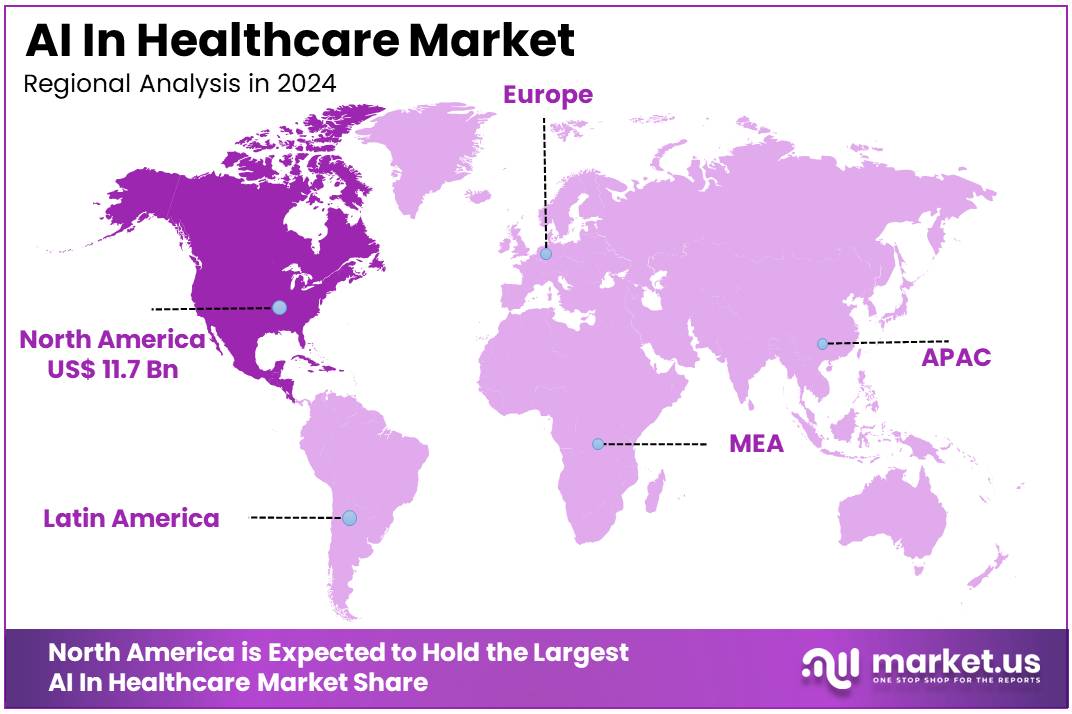

- North America led the market by securing a market share of 43.5% in 2023.

Product Type Analysis

Hardware is expected to dominate the AI in healthcare market, comprising 45.3% of the market share. The growth of this segment is driven by the increasing demand for advanced medical devices that incorporate AI technology, such as diagnostic imaging tools, robotic surgery systems, and wearable health trackers. These devices require sophisticated hardware capable of processing vast amounts of real-time data, which is essential for providing accurate diagnostic results, personalized treatments, and efficient medical procedures.

The integration of AI-powered hardware has revolutionized how healthcare providers approach surgery, diagnostics, and patient care management. The demand for such hardware is projected to rise as healthcare providers increasingly adopt AI for real-time decision-making, predictive analytics, and personalized medicine. Furthermore, advancements in AI hardware, including more powerful processors and sensor technologies, are expected to drive innovation and fuel market growth.

Technology Analysis

Machine learning (ML) is projected to be the dominant technology in the AI in healthcare market, accounting for 46.2% of the share. ML’s ability to process large volumes of healthcare data, recognize patterns, and provide predictive insights is at the core of many AI applications in healthcare. ML is widely used in diagnostics, drug discovery, predictive analytics, and patient monitoring systems, where it provides the capability to detect early signs of diseases, personalize treatment plans, and improve patient outcomes.

As healthcare systems continue to focus on improving efficiency, reducing costs, and enhancing care quality, ML’s role in automating tasks, personalizing medicine, and improving decision-making will continue to grow. The increasing volume of healthcare data and the advancements in ML algorithms are expected to drive further adoption of this technology across various medical applications, ensuring its sustained dominance in the market.

Application Analysis

Robot-assisted surgery is expected to be the leading application in the AI in healthcare market, with 25.4% of the market share. The increasing adoption of minimally invasive surgery, which offers smaller incisions, reduced recovery times, and lower risk of complications, is a key factor in the growth of this segment. Robot-assisted surgery systems, powered by AI, provide enhanced precision, flexibility, and control, leading to better surgical outcomes.

The integration of AI into surgical robots allows for real-time adjustments and decision support, improving the accuracy and efficiency of surgeries. As the technology behind robotic surgery continues to advance, enabling greater surgical capabilities and expanding its use in various specialties, the demand for robot-assisted surgery is expected to increase. This will continue to drive growth in the application of AI in healthcare, particularly in hospitals and surgical centers that focus on improving patient outcomes.

End-User Analysis

Healthcare companies are projected to be the largest end-users in the AI in healthcare market, comprising 50.5% of the share. These companies, which include pharmaceutical firms, medical device manufacturers, and biotechnology companies, are increasingly leveraging AI technologies to optimize their operations, enhance research and development, and improve patient care. AI plays a significant role in drug discovery, clinical trials, patient monitoring, and personalized medicine.

The increasing need for efficient healthcare delivery, coupled with the ability of AI to analyze complex data and generate insights, is driving the adoption of AI solutions by healthcare companies. As more pharmaceutical and biotechnology firms invest in AI to accelerate drug development, optimize manufacturing processes, and enhance clinical trials, the market share for healthcare companies as end-users is expected to continue to grow. The focus on data-driven decision-making, personalized treatments, and innovation in drug discovery will further fuel the demand for AI technologies among healthcare companies.

Key Market Segments

By Product Type

- Hardware

- Processor

- MPU (Memory Protection Unit)

- GPU (Graphics Processing Unit)

- FPGA (Field-programmable Gate Array)

- ASIC (Application-specific Integrated Circuit)

- Memory

- Network

- Switch

- Interconnect

- Adapter

- Processor

- Software

- AI Platform

- Machine Learning Framework

- Application Program Interface (API)

- AI Solutions

- Cloud-based

- On-premise

- AI Platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others

By Technology

- Machine Learning

- Unsupervised

- Supervised

- Deep Learning

- Others

- Natural Language Processing

- Text Analytics

- Speech Analytics

- Smart Assistance

- OCR (Optical Character Recognition)

- Classification & Categorization

- Auto Coding

- Context-aware Computing

- Computer Vision

By Application

- Robot-assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Fraud Detection

- Cybersecurity

- Others

By End-Use

- Healthcare Companies

- Healthcare Providers

- Patients

- Healthcare Payers

- Others

Drivers

Growing Shortage of Healthcare Professionals is Driving the Market

The increasing global shortage of skilled healthcare professionals is a significant driver for the adoption of artificial intelligence in the healthcare sector. Hospitals and clinics worldwide face immense pressure to manage rising patient volumes with a limited and often overworked workforce, leading to burnout and operational inefficiencies. AI-powered tools can automate time-consuming administrative tasks, assist with diagnostics, and support clinical decision-making, thereby freeing up doctors, nurses, and other professionals to focus on direct patient care and more complex medical challenges.

According to a November 2024 report by the US Department of Health and Human Services’ Health Resources and Services Administration (HRSA), the US is projected to have a nationwide shortage of 207,980 registered nurses (RNs) and 302,440 licensed practical nurses (LPNs) by 2037. The OECD’s “Health at a Glance: Europe 2024” report, released in November 2024, stated that twenty EU countries reported a shortage of doctors in 2022 and 2023, and fifteen countries reported a shortage of nurses. These persistent shortages create a strong incentive for healthcare providers to invest in technologies that can augment human capabilities and optimize workflows, improving efficiency and relieving the burden on human staff.

Restraints

Regulatory and Ethical Hurdles are Restraining the Market

Significant restraints on the AI in healthcare market include complex and evolving regulatory frameworks, along with persistent ethical concerns surrounding data privacy, bias in algorithms, and accountability for AI-driven decisions. As AI systems become more integrated into clinical practice, governments and regulatory bodies are grappling with how to ensure these tools are safe, effective, and fair without stifling innovation. Developers must navigate a patchwork of regulations from different countries, which can be a slow and expensive process.

The US Food and Drug Administration (FDA) has been adapting its framework for AI-enabled medical devices, but this remains a complex pathway. As of August 7, 2024, the FDA had authorized 950 AI or machine learning-enabled medical devices, with a notable surge in approvals in 2023 and 2024. Despite this increase, the FDA’s approach remains cautious, particularly concerning generative AI.

For instance, as of October 2024, the FDA had not authorized any devices using generative AI or large language models for clinical use. A further challenge is building trust among medical professionals, who require transparency in how AI models arrive at a conclusion before they can fully rely on them for patient care.

Opportunities

Expansion of Generative AI into Clinical Workflows Creates Growth Opportunities

The rapid expansion of generative AI into clinical workflows presents a significant growth opportunity for the market. Generative AI models can create new data, summarize complex medical records, and automate documentation, fundamentally changing how healthcare professionals manage their time and access information. This technology holds the potential to drastically reduce the administrative burden, which is a major contributor to physician burnout. By automating tasks like charting, billing, and patient summaries, clinicians can spend more time on direct patient interaction.

For instance, in October 2024, Google Cloud expanded its Vertex AI platform for the Healthcare Data Engine. This expansion helps healthcare providers more efficiently query health records, consolidate insights from multiple sources, and participate in advanced data analytics, improving decision-making in patient care. This integration of advanced AI into data management and clinical decision support enhances efficiency.

Additionally, generative AI is being used in drug discovery to design new molecules and accelerate the research pipeline. As this technology matures and regulatory frameworks adapt, its application will broaden, creating new revenue streams and efficiency gains across the healthcare ecosystem.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly impact the AI in healthcare market through their influence on national investment, public funding for research, and the overall affordability of technology. During periods of strong economic growth, governments and healthcare providers increase their budgets for advanced technologies, which directly fuels the adoption of AI-powered solutions.

Conversely, economic downturns or periods of high inflation can lead to tighter budgets, which can slow down investment in new AI infrastructure and delay procurement of expensive AI software and hardware. The International Monetary Fund (IMF) indicated in its April 2025 “World Economic Outlook” that while global economic growth is stable, persistent geopolitical fragmentation and higher interest rates pose risks, which could indirectly impact healthcare spending and investment in technological innovation.

Geopolitical factors also play a crucial role, influencing global supply chains for the high-end chips and components required to run powerful AI systems, as well as cross-border data governance. Trade disputes or export controls on advanced technology can disrupt the availability of critical hardware, increasing development costs for AI companies.

Additionally, varying international data privacy regulations create a complex landscape for companies seeking to train AI models on diverse patient data from multiple countries. The transformative potential of AI in improving patient outcomes and reducing costs ensures that governments and private sectors will continue prioritizing investments in this market, fostering resilience even in the face of broader economic and political shifts.

Current US tariff policies can directly impact the AI in healthcare market by influencing the cost of imported hardware components and electronic parts essential for AI development and deployment. AI systems, particularly those used for large-scale data processing and imaging analysis, rely on powerful processors, graphics processing units (GPUs), and other electronic components, many of which are imported.

In April 2025, the US introduced broad new import tariffs, including a 10% baseline tariff on all imports, with higher rates on goods from specific trading partners. While pharmaceuticals were initially exempt, these tariffs can directly affect medical devices and electronic components. For instance, some reports from May 2025 indicated that certain medical device products are now subject to duties up to 25% or more, depending on the country of origin. These tariffs incrementally increase the cost of building and maintaining AI infrastructure for healthcare providers and technology developers in the US. This might translate to higher prices for AI solutions or potentially slow down the pace of innovation as companies absorb increased costs.

Conversely, these tariff policies can act as a powerful incentive for domestic production of essential electronic components and hardware, fostering a more resilient and secure national supply chain. This strategic shift towards localized manufacturing aims to reduce dependence on potentially volatile international sources and enhance national technological security, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Rise of Strategic Partnerships and Collaborations is a Recent Trend

A prominent recent trend in the AI in healthcare market is the rise of strategic partnerships and collaborations between technology giants, cloud service providers, and established healthcare companies. This trend leverages the distinct strengths of each partner: the technological expertise of tech firms and the clinical knowledge and access to data of healthcare organizations. These collaborations accelerate the development and deployment of AI solutions by providing access to massive datasets for model training and ensuring the solutions are clinically relevant and integrated into existing workflows.

In January 2024, Siemens and Amazon Web Services (AWS) teamed up to bring generative AI to software development. By integrating Amazon Bedrock with Siemens’ Mendix low-code platform, the collaboration allows professionals across various industries to easily build and enhance applications using advanced generative AI tools, which can be applied to healthcare.

These alliances are driving innovation, helping companies navigate the complexities of healthcare data, and accelerating the adoption of AI-powered solutions in a highly regulated environment. This trend is fostering an ecosystem where new technologies can be developed and integrated more rapidly than if companies were to act alone.

Regional Analysis

North America is leading the AI In Healthcare Market

North America dominated the market with the highest revenue share of 43.5% owing to substantial investments in digital health, increasing adoption of AI-powered solutions by healthcare providers, and supportive government initiatives.

The US digital health sector saw a 4% year-over-year increase in venture capital funding, reaching US$ 17.2 billion in 2024, with artificial intelligence solutions capturing 58% of this total funding, solidifying AI’s transformative role in healthcare. This investment is predominantly channeled into areas like TechBio, medical diagnostics, and health management solutions, aiming to advance personalized medicine and operational efficiency.

For instance, in September 2024, Medtronic collaborated with Siemens Healthineers to expand its spine surgery ecosystem with AI, robotics, and data integration. Furthermore, a March 2024 Microsoft-IDC study revealed that 79% of healthcare organizations are currently utilizing AI technology, with a reported return on investment (ROI) within 14 months, generating US$3.20 for every US$1 invested.

In Canada, the government announced a US$2.4 billion package in Budget 2024 to accelerate AI adoption, including US$2 billion to build and provide access to computing capabilities for researchers and startups. Canada Health Infoway also launched an AI Scribe Program in June 2025, inviting primary care clinicians to enroll, which aims to optimize digital healthcare with AI capabilities. These developments underscore a robust market expansion fueled by both private investment and strategic public sector support.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing government initiatives to integrate advanced technologies into healthcare systems, a rising focus on digital health solutions, and a growing demand for efficient patient care. Governments across the region are actively promoting the adoption of advanced technology.

For instance, in December 2024, the government of Andhra Pradesh, India, introduced the AI-powered Janani Mitra app for pregnant women across the state. This innovative application offers personalized delivery parameters, nutrition guidance, and overall health monitoring, directly enhancing the well-being of expectant mothers through technology.

In China, the National Health Commission is likely to continue supporting the integration of AI in various healthcare applications to address its vast population’s needs. Japan’s Ministry of Health, Labour and Welfare is anticipated to further develop guidelines and initiatives for AI integration in healthcare, fostering innovation while ensuring patient safety.

Companies are also expanding their AI-driven healthcare solutions in the region; for example, in September 2024, Huawei launched its Medical Technology Digitalization 2.0 Solution to facilitate precision healthcare with artificial intelligence. This collective push from governments and industry players, combined with the increasing digital literacy and rising healthcare demands in the region, ensures that the deployment of artificial intelligence in healthcare will accelerate significantly across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the AI in healthcare market use several strategies to expand their presence. These include developing advanced therapies and research tools that serve medical needs. Companies also invest in automation and high-throughput technologies. This helps to scale their solutions and improve treatment accuracy. Partnerships with biotech firms, research institutes, and hospitals are common. These collaborations speed up innovation and help integrate AI solutions into clinical care. Players also focus on expanding infrastructure and distribution networks to ensure timely service delivery.

Microsoft Corporation is a leading player in the AI in healthcare market. The company is based in Redmond, Washington. It develops software, services, and hardware tailored for the healthcare sector. Microsoft offers AI-powered platforms such as Azure AI and Microsoft Cloud for Healthcare. These solutions support hospitals and clinics in making better decisions and streamlining their operations. Microsoft’s AI tools assist in clinical decision-making, predictive analysis, and delivering personalized treatments. The company also works closely with medical institutions to refine these tools.

Through continuous innovation and strong partnerships, Microsoft maintains a solid role in the healthcare AI space. The company’s focus is on integrating AI into daily healthcare workflows. By doing so, it helps improve patient outcomes and reduce costs. Microsoft’s initiatives are backed by a strong technological foundation and global reach. Its strategic investments in healthcare-specific AI continue to grow. As a result, Microsoft remains a major contributor to AI-driven transformation in the healthcare industry.

Top Key Players in the AI In Healthcare Market

- Siemens Healthineers

- Nvidia

- Intel

- Innovaccer

- IBM

- HelloCareAI

- Enlitic

Recent Developments

- In April 2025, HelloCareAI raised $47 million in funding to expand its AI-powered virtual healthcare platform designed for smart hospitals. This funding aims to enhance patient care through the integration of AI-assisted nursing, remote health monitoring, and more efficient hospital workflow management systems.

- In February 2025, Innovaccer unveiled “Agents of Care,” a suite of AI-driven tools designed to alleviate burnout among medical staff. By automating routine administrative tasks, these tools improve efficiency and allow healthcare providers to dedicate more time to direct patient care.

Report Scope

Report Features Description Market Value (2024) US$ 26.8 billion Forecast Revenue (2034) US$ 696.0 billion CAGR (2025-2034) 38.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hardware (Processor (MPU (Memory Protection Unit), GPU (Graphics Processing Unit), FPGA (Field-programmable Gate Array), and ASIC (Application-specific Integrated Circuit)), Memory, and Network (Switch, Interconnect, and Adapter)), Software (AI Platform (Machine Learning Framework and Application Program Interface (API)) and AI Solutions (Cloud-based and On-premise)), and Services (Deployment & Integration, Support & Maintenance, and Others)), By Technology (Machine Learning (Unsupervised, Supervised, Deep Learning, and Others), Natural Language Processing (Text Analytics, Speech Analytics, Smart Assistance, OCR (Optical Character Recognition), Classification & Categorization, and Auto Coding), Context-aware Computing, and Computer Vision), By Application (Robot-assisted Surgery, Virtual Assistants, Administrative Workflow Assistants, Fraud Detection, Cybersecurity, and Others), By End-user (Healthcare Companies, Healthcare Providers, Patients, Healthcare Payers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, Nvidia, Intel, Innovaccer, IBM, HelloCareAI , Google, Enlitic. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens Healthineers

- Nvidia

- Intel

- Innovaccer

- IBM

- HelloCareAI

- Enlitic