Global AI in Computer Aided Synthesis Planning Market Size, Share, Growth Analysis By Offering (Software/Platforms, Services [Consulting & Integration, Support & Maintenance, Custom Model Development]), By Technology (Machine Learning (ML)/Deep Learning (DL), Natural Language Processing (NLP), Others), By Application (Drug Discovery & Medicinal Chemistry, Materials Science, Agrochemicals, Academic Research, Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Contract Research Organizations (CROs)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162196

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI

- Analysts’ Viewpoint

- AI Industry Adoption

- Emerging trends

- US Market Size

- Investment and Business Benefit

- By Offering

- By Technology

- By Application

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

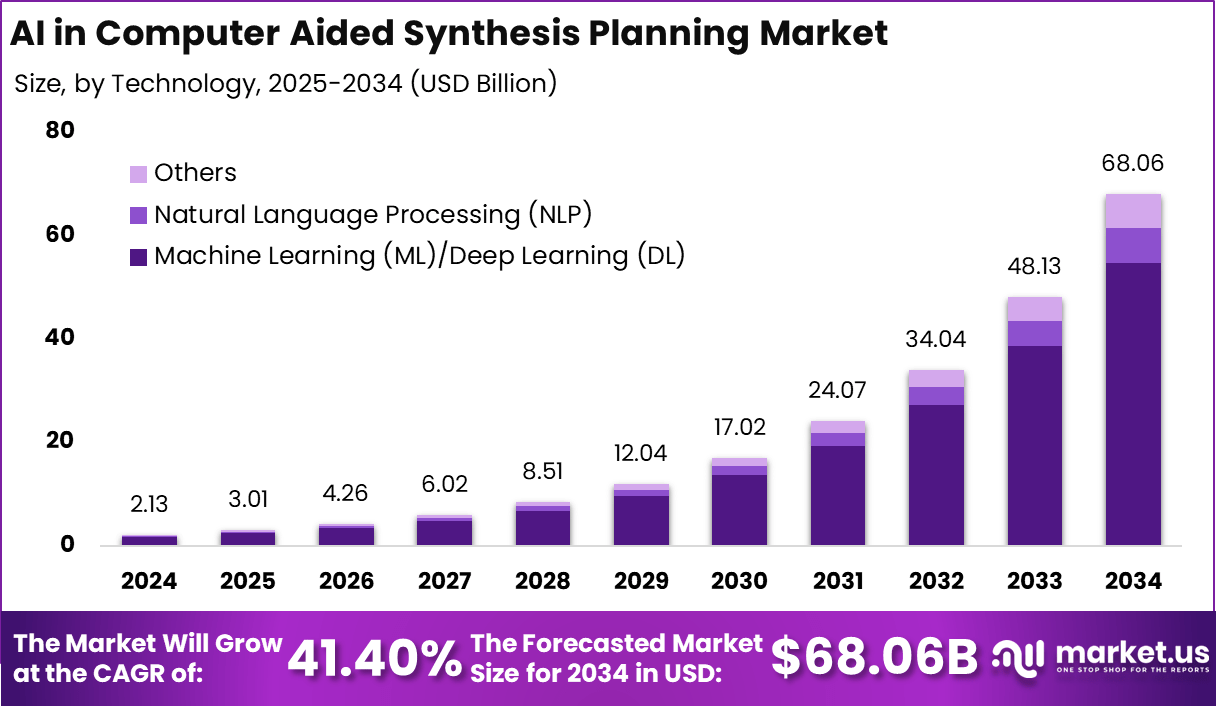

The Global AI in Computer-Aided Synthesis Planning (CASP) Market was valued at USD 2.13 billion in 2024 and is projected to reach approximately USD 68.06 billion by 2034, growing at an impressive CAGR of 41.4% during the forecast period. This surge reflects the rapid integration of artificial intelligence in chemical synthesis, where AI-driven algorithms are transforming how chemists design, predict, and optimize synthetic routes for complex molecules. By combining machine learning, deep neural networks, and predictive analytics, AI-enabled CASP tools are reducing experimental timelines, minimizing costs, and enhancing accuracy in drug discovery and materials development.

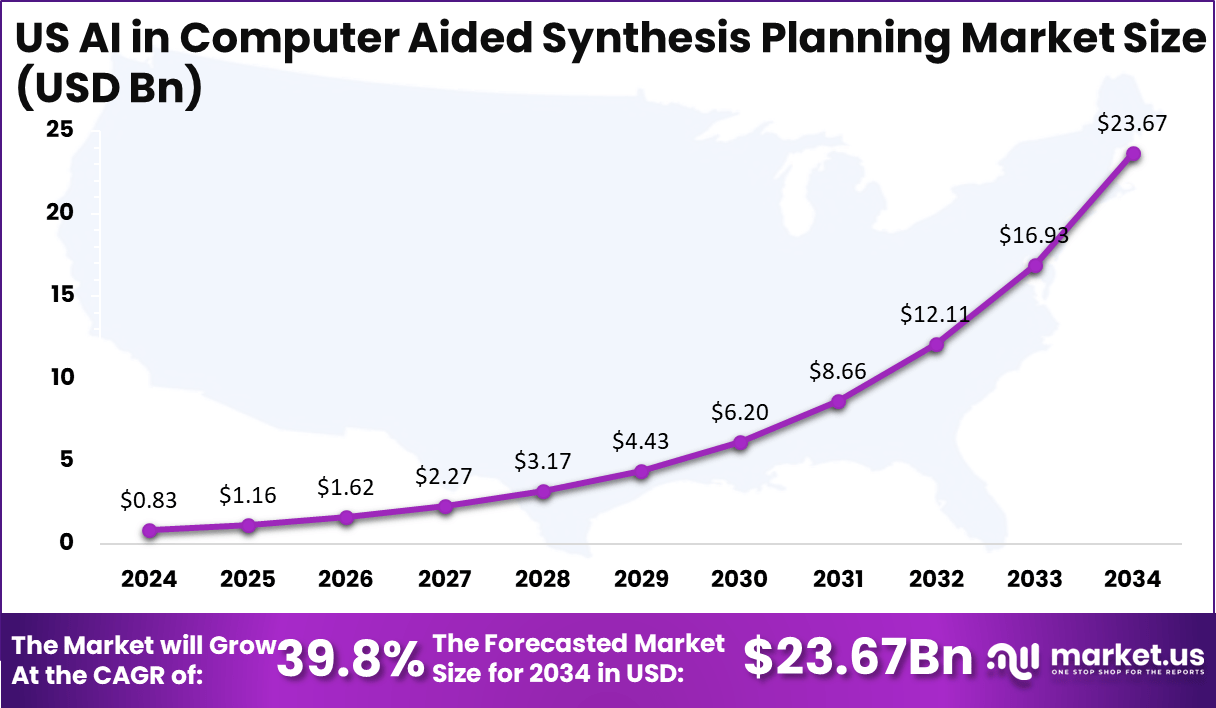

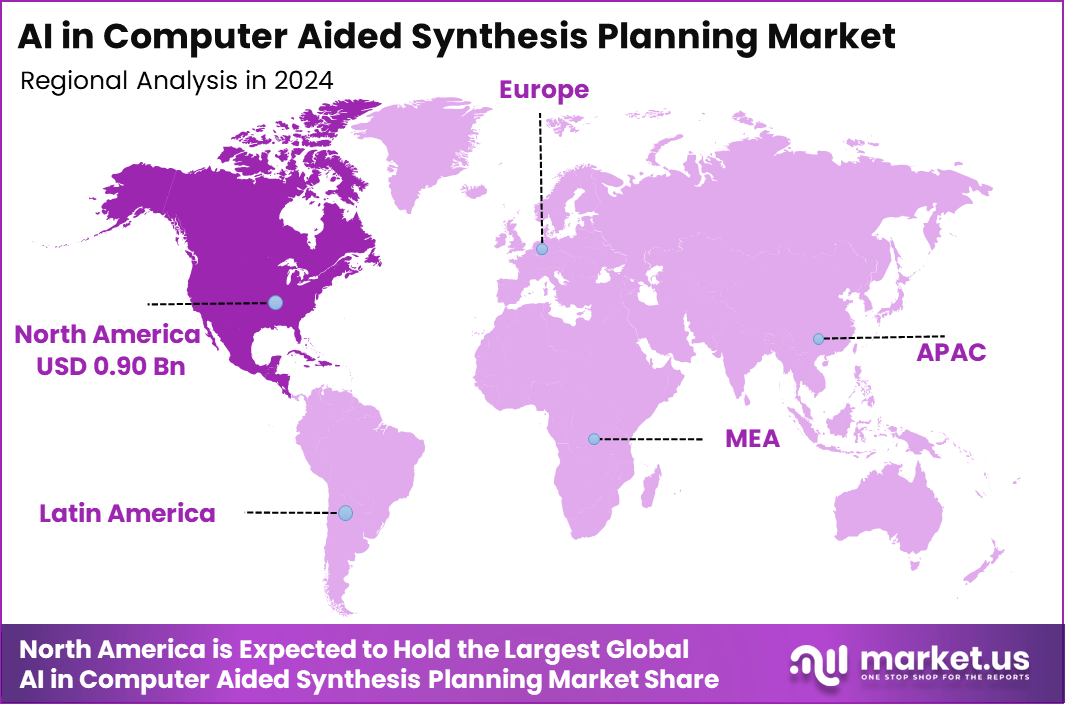

North America holds a dominant position in the market, accounting for 42.6% of the global share with a valuation of USD 0.90 billion in 2024. The United States, contributing USD 0.83 billion, is anticipated to expand at a strong CAGR of 39.8%, driven by the growing adoption of AI-assisted synthesis tools across the pharmaceutical, biotechnology, and academic research sectors. The region’s strong digital infrastructure, active R&D ecosystem, and collaborations between technology companies and research institutes continue to accelerate innovation. The market’s robust trajectory underscores AI’s pivotal role in revolutionizing synthesis planning, enabling faster, smarter, and more sustainable chemical innovation.

Artificial Intelligence (AI) in Computer-Aided Synthesis Planning (CASP) represents a transformative advancement in chemical research, enabling scientists to design and optimize molecular synthesis pathways with unprecedented speed and accuracy.

Traditionally, chemical synthesis relied heavily on manual expertise and trial-and-error experimentation, but AI-driven CASP systems are reshaping this landscape through predictive modeling, data-driven retrosynthesis, and automated route optimization. By analyzing vast chemical reaction databases and applying deep learning algorithms, AI systems can suggest efficient synthetic pathways, anticipate potential side reactions, and identify cost-effective and sustainable routes for compound development.

This technology is becoming particularly vital in pharmaceuticals, materials science, and agrochemicals, where faster discovery cycles and lower R&D costs are critical. Companies and research institutions are leveraging AI-based CASP to accelerate drug discovery, streamline chemical design, and enhance reproducibility in laboratory processes. The integration of AI also facilitates digital collaboration between chemists and computational platforms, reducing time-to-market for new compounds.

Moreover, the growing availability of open-source reaction data and advancements in cloud computing are making AI-CASP tools more accessible and scalable. As industries continue to prioritize innovation and sustainability, AI-powered synthesis planning is emerging as a cornerstone of next-generation chemical research and intelligent molecular design.

Market expansion is reinforced by the rise of cloud-based AI SaaS solutions, enabling global collaboration in computational chemistry and synthesis design. Companies are increasingly adopting explainable AI (XAI) techniques to meet regulatory demands and ensure transparency in automated synthesis recommendations.

Moreover, acquisitions and partnerships in 2025 have centered around integrating AI-enabled synthesis planning with SaaS drug discovery tools, allowing for reduced research costs and faster molecule design. North America remains the leading region for CASP adoption due to high pharmaceutical R&D expenditure, while Asia-Pacific is the fastest-growing region owing to increased collaborations between contract research organizations (CROs) and AI startups.

Overall, the AI in the CASP market is witnessing a transition from experimental pilot tools to industrial-scale automated systems, with over 30% of new drug leads in 2025 being discovered using AI-assisted chemistry workflows. With consistent venture funding, public grants, and strategic partnerships fueling technological convergence between AI, cloud, and robotics, the sector is expected to maintain double-digit growth and dominate computational drug synthesis innovation through the next decade.

On the financial front, AI companies captured 51% of all global venture capital funding in 2025, surpassing USD 200 billion cumulatively, with the U.S. accounting for nearly 85% of total AI investments. This boost reflects investor optimism towards AI’s role in computational chemistry and CASP. Additionally, the retrosynthesis AI tools market saw key players like IBM and Merck advancing “explainable retrosynthesis” approaches to meet strict regulatory compliance and data transparency requirements.

Key Takeaways

- The global AI in Computer-Aided Synthesis Planning (CASP) market was valued at USD 2.13 billion in 2024 and is projected to reach USD 68.06 billion by 2034, registering a strong CAGR of 41.4%.

- North America accounted for the largest share at 42.6%, with a market size of USD 0.90 billion in 2024, driven by advanced R&D infrastructure and early AI adoption in chemical synthesis.

- The United States dominated the regional market with a value of USD 0.83 billion in 2024, expected to surge to USD 23.67 billion by 2034 at a CAGR of 39.8%, supported by strong pharmaceutical and biotechnology research initiatives.

- By offering, the software/platforms segment held the majority share of 65.8%, fueled by rising demand for AI-driven synthesis modeling, predictive tools, and automated retrosynthesis solutions.

- By technology, machine learning (ML) and deep learning (DL) dominated with an 80.3% share, enhancing molecular design accuracy and enabling faster optimization of synthetic routes.

- By application, drug discovery and medicinal chemistry accounted for 75.2% of the market, as pharmaceutical researchers increasingly use AI to accelerate compound development and candidate validation.

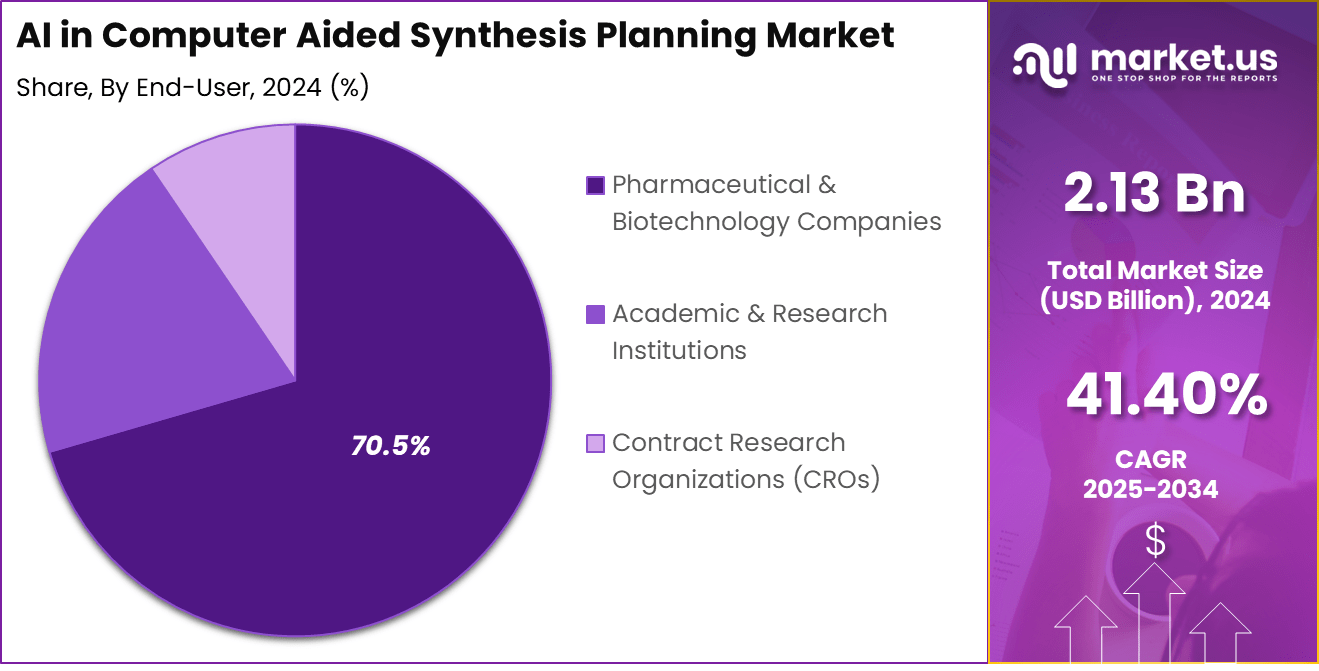

- By end-user, pharmaceutical and biotechnology companies represented 70.5% of total market share, leveraging AI-CASP to reduce R&D costs, shorten discovery timelines, and improve innovation efficiency.

Role of AI

Artificial intelligence (AI) plays a transformative role in computer-aided synthesis planning (CASP), reshaping how chemists design, predict, and execute chemical reactions. Traditionally, synthesis planning depended heavily on human intuition and manual experimentation.

AI now enables automated analysis of vast chemical reaction databases, allowing for accurate prediction of synthetic routes and optimization of molecular structures. Through machine learning and deep learning algorithms, AI identifies reaction patterns, predicts yields, and proposes efficient multi-step synthesis pathways, significantly reducing research time and experimental costs.

AI also enhances retrosynthetic analysis by suggesting alternative routes, identifying reagents, and minimizing environmental impact through greener chemistry approaches. In pharmaceutical R&D, AI-driven CASP accelerates drug discovery by rapidly generating viable synthesis plans for candidate molecules. These systems integrate seamlessly with laboratory automation platforms, enabling closed-loop experimentation where AI continuously learns and refines synthesis strategies from new data.

Beyond pharmaceuticals, industries such as materials science and agrochemicals are leveraging AI-CASP to design novel compounds with high precision. As computational power and chemical data accessibility improve, AI’s role is expected to expand further, making synthesis planning more intelligent, efficient, and sustainable—bridging the gap between computational chemistry and practical laboratory application.

Analysts’ Viewpoint

Analysts covering emerging technology markets view the growth trajectory for AI-enabled platforms — including domains such as Computer‑Aided Synthesis Planning (CASP) — with considerable optimism. They point to the convergence of advanced machine learning, large-reaction-database availability, and increasing demand for faster R&D workflows as key enablers for the sector.

Much like the broader commentary around AI investment, many analysts believe that the structural fundamentals (e.g., cost savings, productivity boosts, time-to-market reductions) support the high forecasted 40 %+ CAGRs in niche markets. Additionally, the relative immaturity of this particular use-case gives it further runway: early adopters in pharma, materials and agro-chemicals are still ramping up, leaving room for future scale.

That said, analysts remain cautiously aware of potential bottlenecks. Several call out the gap between AI promise and full-scale industrial deployment: issues such as reaction-data quality, interoperability with lab automation, and regulatory validation of AI-generated synthetic routes need continued maturation.

They warn of “capability-realisation” risk — where market value surges ahead of actual performance and integration outcomes. As such, their view is that while long-term upside is strong, stakeholders must monitor execution — vendors, adopters, and investors alike — to ensure that the large headline numbers (e.g., USD 68 billion by 2034) translate into realised value in the lab and marketplace.

AI Industry Adoption

The adoption of AI within the Computer-Aided Synthesis Planning (CASP) domain is gaining strong momentum across pharmaceutical, chemical, and materials research settings. Advanced machine learning (ML) and deep learning (DL) models are increasingly used to predict reaction outcomes, design synthetic routes, and optimize process conditions — significantly reducing time-to-experiment and resource expenditure.

For example, one study shows AI accurately predicts reaction outcomes and controls selectivity, simplifying synthesis planning for organic compounds.

Chemical companies, particularly in North America and Europe, are integrating AI-powered retrosynthesis platforms like Molecule. one to streamline workflow, boost throughput, and enhance collaboration between computational and lab teams.Beyond core R&D automation, AI adoption is being driven by its ability to handle unstructured literature, reaction-data extraction, and rapid ideation of novel molecules. A recent agent framework uses large-language-model (LLM) architectures to mine chemical literature and recommend reaction conditions, showcasing how human-expert workflows are being augmented by AI.

Emerging trends

The integration of generative AI and deep learning models into CASP systems is accelerating. These models are now capable of proposing multistep synthetic routes, predicting reaction conditions and durations, and ranking pathways by feasibility—thereby moving from human-led retrosynthesis to semi-autonomous route design.

A growing emphasis on sustainable and green chemistry is driving CASP uptake. AI tools are increasingly employed to identify less-toxic reagents, reduce step counts, optimize yields, and minimise waste, aligning with regulatory and environmental mandates across the chemical and pharmaceutical sectors.

Automation and lab-digital convergence is becoming more prevalent: AI-CASP platforms are being integrated with robotics, microfluidics, and automated experimentation to translate in-silico synthetic plans into real-world, scalable workflows.

There’s a shift toward open-source reaction-databases, collaboration, and cloud access, enabling smaller firms and academic labs to leverage CASP tools that were previously the domain of large pharmaceutical companies. This democratisation increases adoption across end-users.

Finally, the chemical industry and regulatory bodies are gradually recognising AI-CASP as a strategic capability—not just in discovery but across manufacturing and materials development—opening new use-cases in specialty chemicals, agrochemicals, and advanced materials.

US Market Size

The U.S. market for AI in CASP was estimated at USD 0.83 billion in 2024, positioning it as a leading national segment within the broader field of AI-enabled synthesis planning. With a projected growth to USD 23.67 billion by 2034, the market is anticipated to expand at a robust CAGR of 39.8%. This sharp growth reflects deepening investment by U.S. pharmaceutical, biotechnology and materials science firms in AI-driven retrosynthesis and route-optimization platforms. The U.S. benefit comes from its high-maturity R&D ecosystem, strong computational chemistry capabilities, and rich data-asset base for machine learning.

A key driver is the marked shift from manual, intuition-based synthesis planning towards AI-augmented workflows that reduce experimental cycle time, cut costs and improve innovation throughput. U.S. companies are increasingly deploying ML/DL tools, cloud-based platforms and digital-lab integrations to scale synthetic chemistry efforts. At the same time, regulatory and sustainability imperatives add pressure for more efficient, greener synthetic pathways, further fuelling demand.

While the forecast growth is impressive, market participants must manage challenges such as data-quality, model interpretability, and cross-discipline integration between cheminformatics and laboratory practice. Overall, the U.S. market is set to remain a foundational growth driver for AI-CASP globally—anchored in innovation, capital and ecosystem strength.

Investment and Business Benefit

Investment Rationale

- Deploying AI-CASP solutions presents a compelling investment case for companies in pharmaceuticals, materials and chemicals, as the technology helps reduce time-to-market, lowers R&D costs and increases throughput of novel compounds.

- From a strategic vantage, firms investing early in AI-CASP build internal capabilities and data-assets that can serve as long-term competitive advantages, differentiating them from rivals in innovation speed and operational efficiency.

- Investors view companies with AI-enabled synthesis planning as operating with higher scalability and lower cost risk, which improves their appeal in funding rounds, mergers and acquisitions, and partner ecosystems focused on next-generation molecule design.

- Because the CASP market is forecast to expand at ~41.4% CAGR globally, participating in this growth via either solution vendors or adopters presents attractive upside potential for stakeholders supporting this ecosystem.

Business Benefits

- On the business side, AI-CASP platforms enable organizations to identify optimal synthetic routes, reduce the number of experimental steps, decrease reagent consumption, and lower failure rates in lab trials—translating into tangible cost savings and higher success rates in compound development.

- Enhanced data-driven synthesis planning improves decision-making, enabling chemists to explore a broader chemical space faster, reducing bottlenecks between computational design and laboratory execution, and accelerating time-to-hit or time-to-lead in drug discovery.

- For companies, the ability to incorporate sustainability metrics (fewer steps, greener reagents) through AI likewise supports regulatory and ESG goals, strengthens reputation, and may open new markets or partnerships based on sustainable innovation.

- Collectively, these benefits make AI-CASP a value-driver—not only in operations but in the strategic agenda for businesses seeking to scale molecular innovation, manage risk, and leverage digital transformation as a core component of R&D excellence.

By Offering

The software and platforms segment dominates the AI in Computer-Aided Synthesis Planning (CASP) market, accounting for approximately 65.8% of the total share in 2024. This dominance is driven by the increasing deployment of AI-based synthesis planning tools that enable retrosynthetic analysis, reaction prediction, and route optimization.

These software solutions leverage machine learning and deep learning models to analyze large chemical databases, predict optimal reaction pathways, and enhance the accuracy of synthetic design. Platforms offering AI-driven retrosynthesis are becoming the backbone of modern R&D operations in pharmaceuticals, materials science, and chemical industries. The scalability of these software solutions, combined with their ability to integrate with laboratory information systems and digital lab environments, continues to strengthen their adoption among enterprises seeking efficiency and innovation.

The services segment, which contributes around 34.2% of the market, plays a crucial role in enabling the effective implementation and operation of AI-CASP platforms. It includes consulting and integration services to help organizations adopt and customize AI tools, support and maintenance services for ongoing platform optimization, and custom model development tailored to specific research needs.

These services ensure seamless system functionality, model validation, and regulatory compliance. Together, the software and services components form a comprehensive ecosystem that drives AI-enabled chemical innovation while supporting long-term digital transformation in synthesis planning.

By Technology

In the “By Technology” segmentation of the AI in Computer-Aided Synthesis Planning (CASP) market, the Machine Learning (ML) / Deep Learning (DL) category dominates with a share of approximately 80.3%. These technologies form the core of modern synthesis-planning platforms, applying neural networks and advanced algorithms to analyze vast reaction databases, predict optimal synthetic routes, and anticipate reaction outcomes. Their ability to learn from historical data, infer chemical transformations, and optimize multistep workflows has made them indispensable for drug discovery, materials science, and chemical synthesis.

While ML/DL holds the lion’s share, other technologies such as Natural Language Processing (NLP) and Others (for instance, rule-based systems, graph-theory approaches, and combinatorial algorithms) play supporting yet significant roles.

NLP is increasingly used for extracting insights from unstructured chemical literature and patents, enabling models to access broader reaction knowledge and enhance synthesis suggestions. The “Others” category includes legacy methods and emerging hybrid approaches that combine symbolic chemistry rules with AI-driven predictions, enabling transparency and interpretability in some high-stakes synthesis use-cases.

Together, this technological layering illustrates a market where ML/DL drives the primary value, while complementary technologies such as NLP and rule-based systems enhance coverage, data ingestion, and collaborative capabilities—enabling more comprehensive, intelligent, and efficient synthesis-planning ecosystems.

By Application

The Drug Discovery & Medicinal Chemistry application segment leads the market, accounting for approximately 75.2% of the total share in 2024. This dominance is driven by pharmaceutical and biotechnology firms’ increasing reliance on AI-powered retrosynthesis tools to accelerate candidate identification, streamline route optimization, and reduce time and cost in preclinical development. With pressure to bring novel molecules to market faster and more efficiently, the integration of CASP platforms into medicinal chemistry workflows has become a strategic necessity rather than optional.

Beyond drug discovery, other applications are gaining traction—Materials Science, Agrochemicals, Academic Research, and Others (such as specialty chemicals or petrochemicals) represent growing segments. In Materials Science, AI-CASP is applied to design novel materials, polymers, and functional compounds. Agrochemical firms are leveraging synthesis-planning tools to develop sustainable agro-inputs with optimized synthetic routes.

Academic research institutions are using these platforms to explore theoretical chemistry, teach synthesis planning, and innovate foundational methods. The “Others” category encapsulates adjacent chemical innovation spaces that are adopting AI-driven CASP solutions. While smaller today compared to drug discovery, these applications represent significant expansion opportunities as the technology matures and penetrates new industrial verticals.

By End-User

The segment of Pharmaceutical & Biotechnology Companies holds the lion’s share with approximately 70.5% of the market, underscoring their leading role in adopting AI-powered CASP solutions. These organisations are heavily invested in drug discovery workflows and synthetic chemistry, and thus they prioritise advanced tools that can optimise synthetic routes, reduce development timelines, and lower costs. Because of the high stakes of novel molecule discovery and the regulatory/regimen pressures in the pharmaceutical sector, AI-CASP deployments are seen as strategic enablers to maintain competitiveness and innovation velocity.

In parallel, Academic & Research Institutions and Contract Research Organisations (CROs) form the remainder of the market. Academic labs utilise CASP platforms for exploratory chemistry, teaching, and proof-of-concept research, often paving the way for broader commercial uptake.

CROs, on the other hand, leverage these tools to provide synthesis planning as a service for their pharmaceutical clients—helping streamline outsourced R&D, scale capabilities, and bring greater efficiency to external development partnerships. While their current market shares are smaller compared to pharma/biotech companies, these end-users represent important growth opportunities as AI-CASP solutions become more accessible, collaborative, and integrated into broader research ecosystems.

Key Market Segments

By Offering

- Software/Platforms

- Services

- Consulting & Integration

- Support & Maintenance

- Custom Model Development

By Technology

- Machine Learning (ML)/Deep Learning (DL)

- Natural Language Processing (NLP)

- Others

By Application

- Drug Discovery & Medicinal Chemistry

- Materials Science

- Agrochemicals

- Academic Research

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Contract Research Organizations (CROs)

Regional Analysis

In 2024, North America accounted for 42.6% of the global AI-CASP market, with a size of USD 0.90 billion. The United States alone contributed USD 0.83 billion to this figure. Looking ahead, the U.S. market is projected to grow substantially, reaching USD 23.67 billion by 2034 with a robust compound annual growth rate (CAGR) of 39.8%.

Several factors contribute to this regional leadership. The U.S. combines a mature R&D ecosystem—especially in pharmaceuticals and biotech—with a deep pool of computational chemistry, AI talent, and infrastructure. Academic and industrial partnerships, along with substantial investment in next-gen molecular design tools, bolster the adoption of AI-enabled CASP platforms. The presence of large pharma/biotech companies and increasing digital transformation in chemical & materials sciences further reinforces growth.

At the same time, North America’s dominance provides a “first-mover” advantage but also indicates an opportunity for other regions to catch up. The U.S. trajectory suggests that as AI-CASP becomes further integrated, vendors and service providers will increasingly target U.S. customers with advanced software platforms, custom model development, and AI workflows tailored to synthesis planning. In summary, the U.S. and North America region will continue to act as a key growth engine for the global AI-CASP market, anchored by innovation, investment, and ecosystem depth.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The AI in Computer-Aided Synthesis Planning (CASP) market is driven by the growing need for faster, cost-effective, and precise molecule design in drug discovery and chemical research. AI technologies such as machine learning and deep learning are revolutionizing synthesis route prediction by automating retrosynthetic analysis and improving reaction yield forecasting.

The increasing demand for digital transformation across the pharmaceutical and biotechnology industries is further accelerating the adoption of AI-driven synthesis tools. The integration of AI with lab automation, cloud computing, and predictive modeling also enhances productivity, enabling scientists to explore complex chemical spaces with reduced human intervention.

Another key growth driver is the rising focus on sustainable and green chemistry. AI-powered synthesis planning helps optimize reaction steps, minimize waste, and select eco-friendly reagents, aligning with global sustainability initiatives. Continuous advancements in data accessibility, reaction databases, and computational chemistry are also fueling market expansion. Strategic collaborations between AI startups, research institutions, and chemical manufacturers are boosting innovation and scalability, creating a strong foundation for widespread adoption.

Restraint Factors

Despite rapid progress, the AI in CASP market faces several challenges that restrain growth. High implementation costs, limited access to quality reaction data, and the need for skilled AI chemists remain major barriers to adoption. Many research organizations and SMEs struggle with integrating AI-CASP tools into legacy systems due to data incompatibility and infrastructure limitations. Additionally, the reliability of AI-generated synthesis routes often depends on the availability and diversity of historical reaction datasets, which can introduce prediction biases.

Regulatory uncertainty also poses a limitation, as many countries lack defined standards for AI-assisted synthesis in drug development or materials research. Data privacy, intellectual property protection, and the interpretability of AI models further add complexity to deployment. These challenges slow down adoption among conservative industry players who require validated, reproducible, and regulatory-compliant solutions before large-scale implementation.

Growth Opportunities

Significant growth opportunities exist as AI-CASP technologies move beyond drug discovery into materials science, agrochemicals, and academic research. The increasing availability of cloud-based and open-source CASP platforms is lowering entry barriers for smaller firms and institutions. Demand for customized AI models tailored to specific reaction types or compound classes presents lucrative business opportunities for software developers and service providers. Additionally, the integration of generative AI and reinforcement learning in synthesis planning is expected to open new frontiers in autonomous chemistry.

Government funding and industry collaborations focused on sustainable innovation and digital chemistry are creating a favorable ecosystem for market expansion. The combination of AI with robotics and automated synthesis labs is expected to further enhance accuracy and efficiency, enabling closed-loop experimentation. As the pharmaceutical and materials sectors continue to embrace digital R&D transformation, the commercial potential for AI-driven synthesis planning solutions will expand rapidly across both established and emerging markets.

Challenging Factors

The primary challenge in the AI-CASP market lies in ensuring accuracy, interpretability, and scalability of AI models. While AI algorithms can predict reaction pathways effectively, understanding the chemical logic behind these recommendations remains complex, limiting user confidence in critical applications such as drug discovery. Moreover, the need for large, standardized, and high-quality reaction datasets is crucial to training robust models, yet data fragmentation across institutions hinders this goal.

Another challenge involves bridging the gap between computational predictions and practical laboratory execution. Integrating AI-generated routes into real-world experiments requires advanced lab automation, human oversight, and regulatory validation. The lack of interdisciplinary collaboration between chemists, data scientists, and AI engineers often slows progress. Finally, competitive pressures and the rapid pace of AI innovation require continuous model refinement and technological updates, which can strain budgets and resources for organizations attempting to stay ahead in this evolving market.

Competitive Analysis

The competitive landscape of the AI in Computer-Aided Synthesis Planning (CASP) market is defined by a mix of technology innovators, pharmaceutical giants, and specialized startups driving advancements in digital chemistry. DeepMatter Group Plc is a prominent player with its flagship platform, DigitalGlassware, which focuses on digitizing laboratory workflows and capturing real-time reaction data to enhance reproducibility in chemical synthesis.

Merck KGaA stands out as one of the leading multinational corporations integrating AI across its research divisions, leveraging AI-driven retrosynthesis and catalyst design to accelerate molecule discovery. Similarly, IKTOS, a France-based company, specializes in de novo drug design and retrosynthesis through generative AI models, offering both SaaS solutions and collaborative R&D services to global pharmaceutical clients.

Major pharmaceutical firms such as Hoffmann-La Roche, Novartis, and AbbVie are investing heavily in AI-enabled synthesis platforms to optimize drug discovery pipelines, often partnering with AI startups for faster and more predictive compound design. On the technology front, IBM and Microsoft are contributing through infrastructure and cloud-based AI platforms that support large-scale chemical data processing and computational modeling.

Schrödinger Inc. continues to dominate the computational chemistry space with advanced molecular simulation and modeling tools that align closely with AI-CASP applications. Emerging innovators such as Synple Chem and Chemify are focusing on autonomous synthesis and AI-assisted molecular assembly, representing the next generation of CASP startups.

Overall, the market reflects a balance between scale and specialization—where large corporations bring resources and infrastructure, while niche AI firms drive agility, innovation, and domain expertise—creating a dynamic and collaborative ecosystem for digital chemistry advancement.

Top Key Players in the Market

- DeepMatter Group Plc

- Merck KGaA

- PostEra

- IKTOS

- Wiley-VCH GmbH

- The Open Science Project

- Medici Technologies, LLC

- IBM Corporation

- Microsoft Corporation

- Hoffmann-La Roche Limited

- Novartis AG

- AbbVie Inc.

- Schrödinger Inc.

- Synple Chem

- Chemify

- Others

Major Developments

- February 2025: IKTOS Partners with Novartis to Enhance AI-Based Drug Design

IKTOS entered a strategic collaboration with Novartis AG to apply its deep-learning generative models for accelerating drug discovery through AI-driven retrosynthesis and molecular optimization. The partnership focuses on leveraging IKTOS’s proprietary AI algorithms to design synthetically feasible compounds, aiming to shorten the preclinical development timeline and enhance pipeline efficiency.

- January 2025: Schrödinger Introduces Automated Synthesis Planning Module

Schrödinger Inc. launched an automated synthesis planning module within its computational platform, integrating machine learning and cheminformatics for real-time reaction prediction. The tool assists chemists in evaluating multiple synthetic pathways and identifying the most cost-efficient and sustainable options for molecule synthesis.

- March 2025: DeepMatter Group Plc Expands Digital Chemistry Data Platform

DeepMatter Group Plc enhanced its DigitalGlassware platform by incorporating AI-assisted predictive analytics for synthesis route optimization. The upgraded system enables chemists to analyze reaction conditions, optimize yield predictions, and access cloud-based collaboration features, supporting data-driven decision-making in laboratory environments.

Report Scope

Report Features Description Market Value (2024) USD 2.13 Billion Forecast Revenue (2034) USD 68.06 Billion CAGR(2025-2034) 41.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Offering (Software/Platforms, Services [Consulting & Integration, Support & Maintenance, Custom Model Development]), By Technology (Machine Learning (ML)/Deep Learning (DL), Natural Language Processing (NLP), Others), By Application (Drug Discovery & Medicinal Chemistry, Materials Science, Agrochemicals, Academic Research, Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Contract Research Organizations (CROs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DeepMatter Group Plc, Merck KGaA, PostEra, IKTOS, Wiley-VCH GmbH, The Open Science Project, Medici Technologies, LLC, IBM Corporation, Microsoft Corporation, Hoffmann-La Roche Limited, Novartis AG, AbbVie Inc., Schrödinger Inc., Synple Chem, Chemify, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  AI in Computer Aided Synthesis Planning MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Computer Aided Synthesis Planning MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DeepMatter Group Plc

- Merck KGaA

- PostEra

- IKTOS

- Wiley-VCH GmbH

- The Open Science Project

- Medici Technologies, LLC

- IBM Corporation

- Microsoft Corporation

- Hoffmann-La Roche Limited

- Novartis AG

- AbbVie Inc.

- Schrödinger Inc.

- Synple Chem

- Chemify

- Others