Global AI in Auto Insurance Market Size, Share, Statistics Analysis Report By Component ((Solutions [Claims Automation, Underwriting, Fraud Detection and Prevention, Risk Assessment, Customer Support (Chatbots, Virtual Assistants)], Services), By Deployment (On-Premises, Cloud), By End-User (Insurance Providers, Brokers and Agents, InsurTech Companies), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 120248

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Statistics

- Key Takeaways

- US AI in Auto Insurance Market Size

- Regional Analysis

- By Component

- By Deployment

- By End-User

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

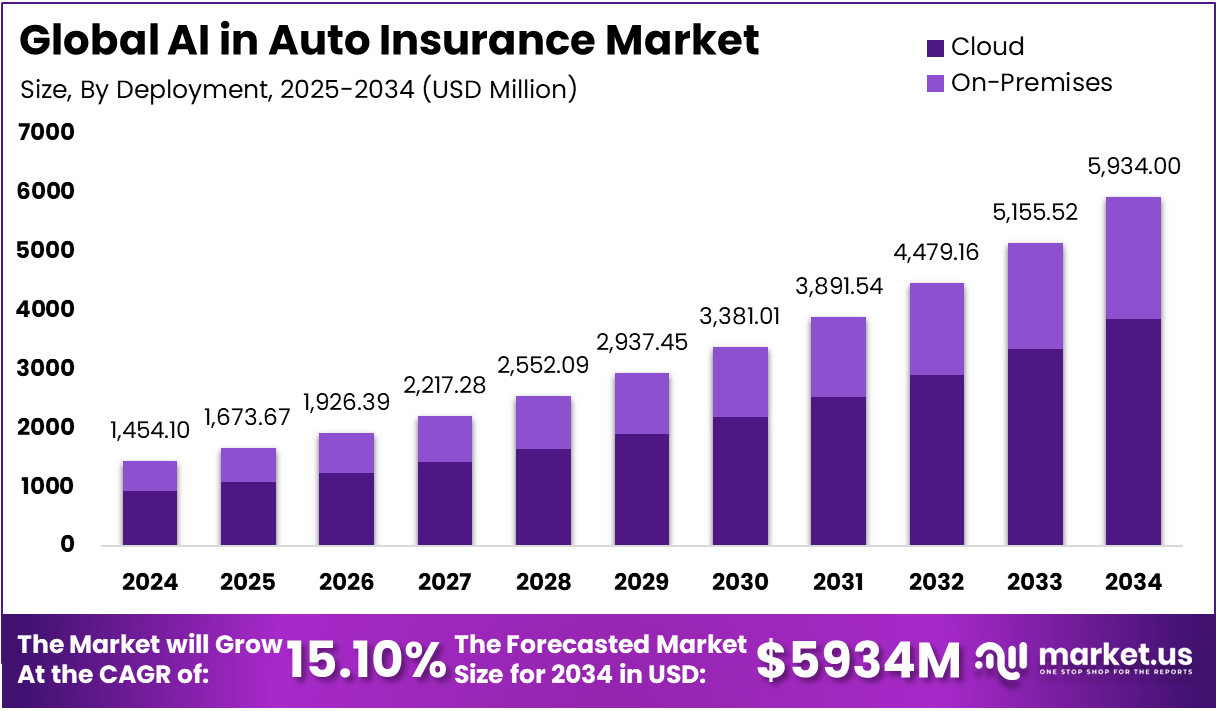

The Global AI in Auto Insurance Market size is expected to be worth around USD 5934.0 Million By 2034, from USD 1,454.1 Million in 2024, growing at a CAGR of 15.10% during the forecast period from 2025 to 2034.

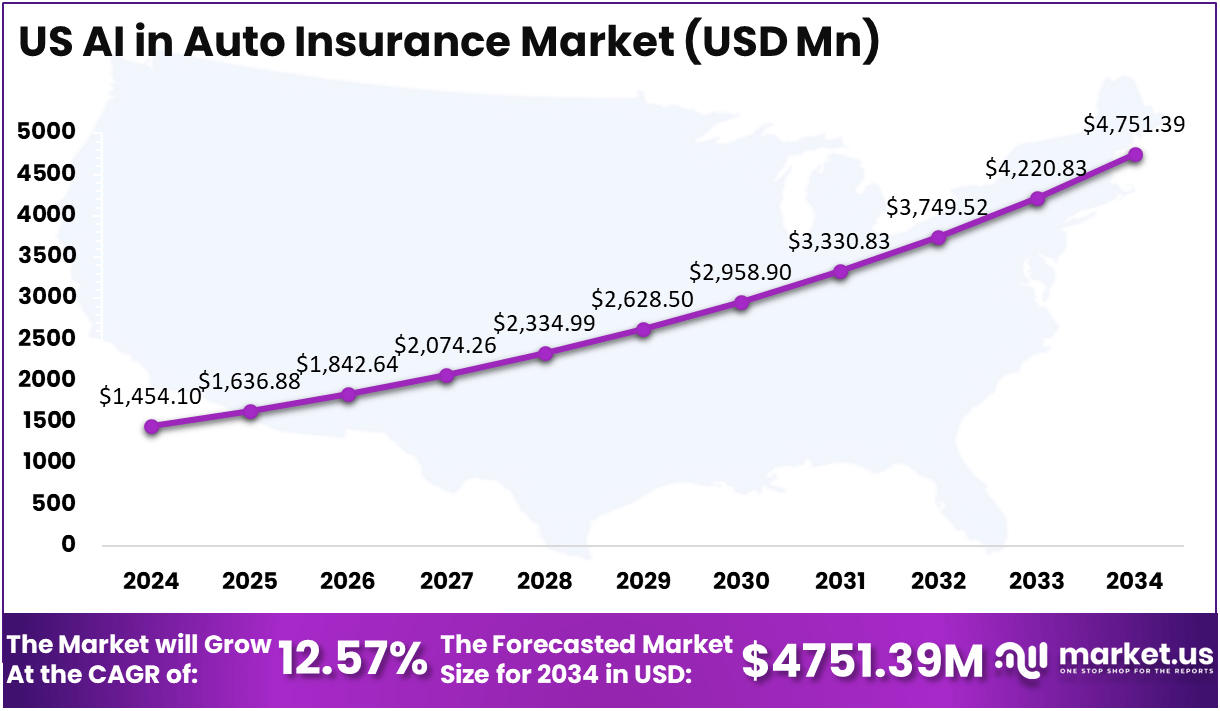

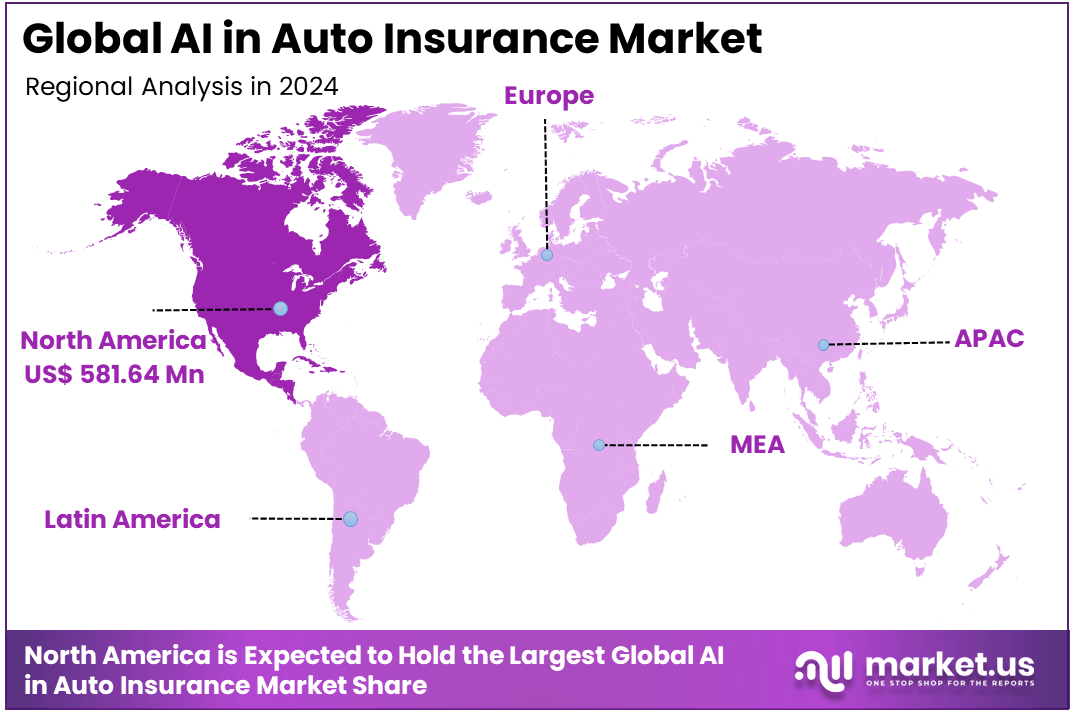

In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 581.64 Million in revenue. Further, In North America, The United States Dominates the market size by USD 539.7 Million holding the strong position steadily with a CAGR of 12.57%.

AI in auto insurance refers to the use of artificial intelligence technologies to enhance and streamline various processes within the auto insurance industry. These technologies include machine learning, predictive analytics, natural language processing, and computer vision, which are utilized to assess risks, detect fraud, automate claims processing, and improve customer experiences.

AI-driven systems analyze vast amounts of data, such as driver behavior, vehicle telematics, and historical claim records, to make accurate predictions and recommendations. This not only helps insurers reduce operational costs but also ensures personalized and efficient service for policyholders.

The adoption of AI in auto insurance is primarily driven by the increasing availability of telematics data and advanced analytics. Telematics devices installed in vehicles collect real-time information on driver behavior, speed, and location, enabling insurers to offer usage-based insurance (UBI) models.

This allows for personalized premiums based on individual driving habits, making insurance more affordable and fair. Additionally, the growing frequency of fraudulent claims in the insurance sector has made fraud detection a critical use case for AI. Machine learning algorithms can identify suspicious patterns and flag potential fraud in real-time, significantly reducing financial losses for insurers.

Key Statistics

Operational Efficiency

- Cost Reduction: AI can reduce operational costs by up to 40%.

- Claims Processing Speed: AI systems can process claims up to 5 times faster than traditional methods.

- Customer Expectations: About 70% of customers expect claims to be resolved within one week.

Adoption Rates

- Underwriting: Approximately 18% of auto insurance companies are currently using AI tools for underwriting processes.

- Telematics Usage: Around 25% of insurers are utilizing telematics data to inform pricing strategies.

Fraud Detection

- Fraud Identification Accuracy: AI algorithms can identify fraudulent claims with an accuracy rate of about 90%, significantly mitigating losses.

- Financial Impact of Fraud: Insurance fraud costs the industry billions annually, making effective detection crucial.

Personalization and Pricing

- Telematics Benefits: Safe drivers can save up to 30% on premiums through personalized pricing models based on driving behavior.

- Customer Satisfaction Improvement: Insurers using AI for customer service report a 20-30% increase in customer satisfaction scores.

Customer Experience Enhancement

- Response Times: AI chatbots and virtual assistants can provide immediate responses, improving customer interaction.

- Policy Recommendations: AI systems analyze customer data to offer tailored policy recommendations, enhancing the overall user experience.

Future Trends

- Increased Investment: Insurers are expected to increase their investment in AI technologies, with forecasts suggesting that spending on AI in insurance could exceed $1 billion by 2025.

- Integration with Other Technologies: The combination of AI with other technologies such as blockchain and IoT is anticipated to further revolutionize the auto insurance landscape.

Technological advancements are driving the adoption of AI in auto insurance, with innovations such as computer vision and predictive analytics leading the way. For example, computer vision technology can analyze photos or videos of a damaged vehicle to provide instant repair estimates, significantly reducing the time required for claims processing.

Additionally, predictive analytics is helping insurers anticipate risks and customize policies based on customer data. Cloud computing and AI-as-a-service platforms are also making it easier for small and medium-sized insurers to access and deploy AI solutions, further democratizing the market. These advancements are transforming the auto insurance industry, making it more data-driven, efficient, and customer-centric.

The demand for AI in auto insurance is being fueled by consumers’ growing expectations for fast and efficient claim settlements. Traditional insurance processes, often laden with manual paperwork, are giving way to AI-driven systems that can assess damage using images, process claims within minutes, and even facilitate payments.

For instance, AI-powered chatbots and virtual assistants are revolutionizing customer service by providing instant responses to policy inquiries and claim statuses. The demand is particularly high in developed regions, where connected vehicles and IoT technologies are increasingly being integrated into the insurance ecosystem.

The AI in auto insurance market holds significant opportunities, especially in emerging economies where the penetration of digital technologies is accelerating. As insurers in these regions look to modernize their operations, AI offers solutions for automating underwriting, enhancing customer engagement, and optimizing risk management.

Furthermore, the rise of autonomous vehicles presents a promising opportunity for AI integration. These vehicles generate vast amounts of data, which AI can analyze to assess risks, determine liability in accidents, and create new insurance models tailored for autonomous driving.

Key Takeaways

Market Growth: The global AI in Auto Insurance Market was valued at USD b million in 2024 and is projected to reach USD 5,934.0 million by 2034, growing at a CAGR of 15.10% during the forecast period.

Market Breakdown:

- By Component: Solutions account for 76% of the market share in 2024, leading the market due to their extensive applications in risk assessment, claims automation, and customer service optimization.

- By Deployment: Cloud-based deployment holds a dominant share of 65% in 2024, driven by the flexibility, scalability, and cost-effectiveness that cloud solutions offer to insurance providers.

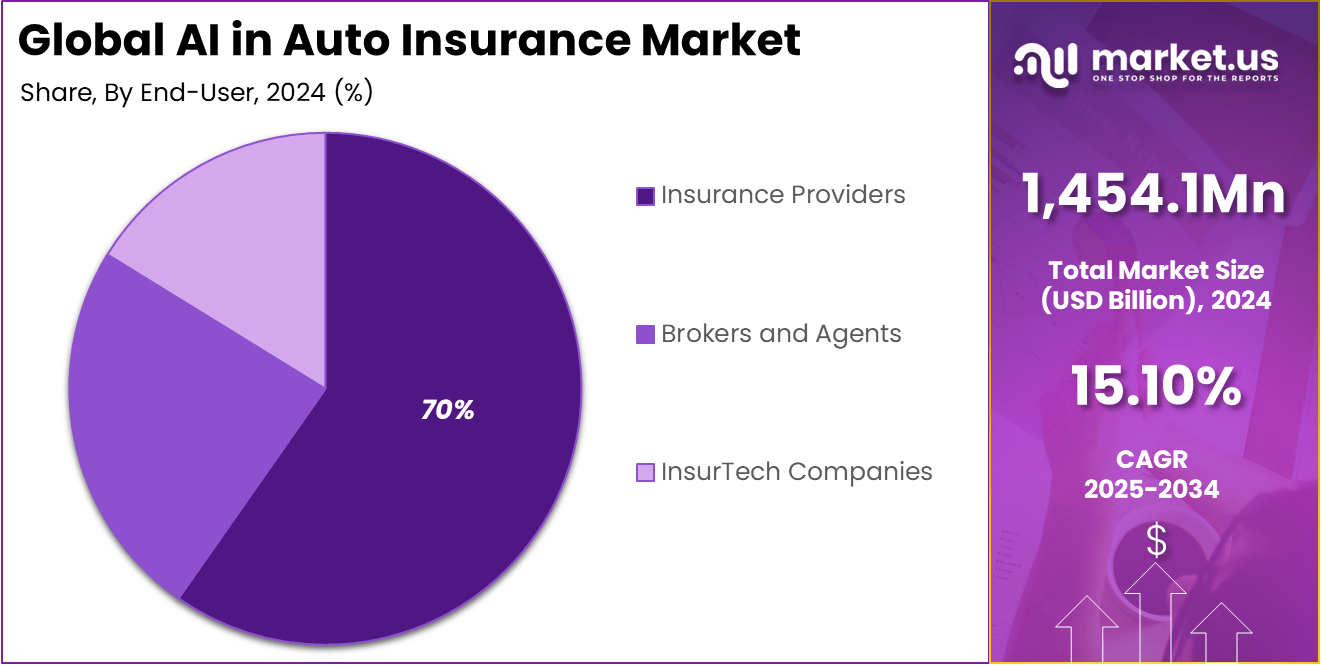

- By End-User: Insurance providers dominate the market with a 70% share, as they are the primary adopters of AI technologies to improve operational efficiency and customer engagement.

Geographical Insights:

- North America: The region holds a significant 40% share of the global AI in the auto insurance market in 2024, driven by strong adoption rates in the U.S. and Canada, coupled with advancements in AI technology.

- United States: The U.S. market is valued at USD 539.7 million in 2024, with a CAGR of 12.57%, reflecting steady growth due to the increased implementation of AI for underwriting, claims processing, and fraud detection.

US AI in Auto Insurance Market Size

A significant portion of this share is driven by the United States, which alone dominates the market with a size of USD 539.7 million and continues to hold a strong position with a steady CAGR of 12.57%. The U.S. is home to some of the largest global insurance companies.

Which have been quick to integrate AI-driven solutions such as predictive analytics, automated claims processing, and personalized customer service to enhance operational efficiency. The availability of large-scale data, along with robust technological infrastructure, further accelerates the adoption of AI technologies in the region.

The U.S. market’s dominance is also attributed to the increasing pressure on insurance companies to innovate and remain competitive. By leveraging AI, insurers can enhance their risk management strategies, improve customer experience, and reduce operational costs, which are key drivers of the market’s strong growth.

The steady adoption of AI tools, including machine learning algorithms and natural language processing for better decision-making, is helping U.S. insurers improve their efficiency and offer more personalized services to their clients. This consistent growth trend in the U.S. makes it a key leader in the global AI in the auto insurance market.

Regional Analysis

In 2024, North America held a dominant market position in the AI auto insurance market, capturing more than a 40% share, equating to USD 581.64 million in revenue. This leadership is primarily attributed to the significant adoption of AI technologies among major insurance providers in the region, especially in the United States.

The U.S. is home to some of the largest global insurance companies, which have been quick to integrate AI-driven solutions such as predictive analytics, automated claims processing, and personalized customer service to enhance operational efficiency.

The high level of technological infrastructure and data availability in North America further accelerates the implementation of AI solutions, allowing insurers to leverage machine learning algorithms for risk assessment and fraud detection. Another key factor contributing to North America’s dominance is the strong investment in AI research and development by both private insurers and tech companies.

This has led to the creation of advanced AI tools tailored to the needs of the insurance industry. Moreover, the region benefits from a highly competitive market where insurers are under pressure to innovate and differentiate their services. AI helps companies stay ahead by providing improved customer experiences, faster claims handling, and better pricing models.

In addition, the regulatory environment in North America is relatively conducive to the growth of AI in auto insurance. The U.S. and Canada have put frameworks in place that encourage innovation while maintaining customer privacy and data security standards. This has allowed insurance providers to adopt AI technologies without significant regulatory barriers, further fueling market growth in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

By Component

In 2024, the Solutions segment held a dominant market position in the AI in auto insurance market, capturing more than a 76% share. This leadership is driven by the widespread adoption of AI-powered solutions that offer significant improvements in efficiency, accuracy, and cost-effectiveness for insurance providers.

Solutions such as claims automation, underwriting, fraud detection and prevention, risk assessment, and customer support are increasingly being leveraged to streamline operations and enhance the overall customer experience. As insurance companies look for ways to reduce manual intervention, lower operational costs, and improve decision-making processes, AI solutions are becoming indispensable.

One of the primary drivers behind the dominance of the Solutions segment is the ability of AI to automate complex and time-consuming tasks. Claims automation has proven to be one of the most impactful applications, allowing insurers to quickly and accurately process claims without human involvement.

Additionally, underwriting powered by AI enables insurers to analyze vast amounts of data to assess risk more accurately, while fraud detection and prevention solutions help identify suspicious activities with greater precision. These benefits significantly reduce operational costs and improve profitability, making AI solutions a critical investment for auto insurers.

By Deployment

In 2024, the Cloud segment held a dominant market position in the AI in auto insurance market, capturing more than a 65% share. This strong performance can be attributed to the numerous benefits that cloud-based solutions offer to insurance providers. Cloud deployment enables insurers to scale their AI operations without the need for extensive infrastructure investment.

By storing vast amounts of data in the cloud, insurance companies can access real-time insights and analytics, enhancing decision-making processes and operational efficiency. The flexibility, scalability, and cost-effectiveness provided by cloud solutions are key factors driving their widespread adoption.

Cloud technology also supports seamless integration of AI tools across different systems within an insurance company. For example, AI-powered claims automation, fraud detection, and underwriting can be easily integrated into a company’s existing cloud infrastructure, improving the overall workflow and reducing delays.

Additionally, cloud-based platforms offer greater accessibility, allowing employees and managers to access critical data from anywhere, at any time, which is essential for businesses that operate across multiple locations or have remote workforces. This level of convenience and efficiency makes cloud deployment the preferred choice for many insurance providers.

By End-User

In 2024, the Insurance Providers segment held a dominant market position in the AI in auto insurance market, capturing more than a 70% share. This dominance is primarily driven by the substantial adoption of AI technologies among traditional insurance companies looking to enhance operational efficiency, improve risk assessment, and offer more personalized services to customers.

Insurance providers are leveraging AI-driven solutions like claims automation, underwriting, fraud detection, and customer support systems to streamline processes and reduce costs. These solutions help insurers process claims faster, assess risks more accurately, and improve customer satisfaction, all of which are crucial for maintaining competitiveness in a fast-evolving market.

The demand for AI in insurance providers is also fueled by the increasing pressure to reduce operational inefficiencies and improve profitability. With AI-powered tools, insurers can analyze large amounts of data in real time to make more informed decisions, such as accurately predicting risk and detecting fraud before it happens.

This has made AI an indispensable part of the core operations of insurance companies. Additionally, with growing consumer expectations for faster and more seamless service, insurance providers are increasingly turning to AI to provide real-time customer support, utilizing technologies like chatbots and virtual assistants.

Key Market Segments

By Component

- Solutions

- Claims Automation

- Underwriting

- Fraud Detection and Prevention

- Risk Assessment

- Customer Support (Chatbots, Virtual Assistants)

- Services

By Deployment

- On-Premises

- Cloud

By End-User

- Insurance Providers

- Brokers and Agents

- InsurTech Companies

Driving Factors

Increasing Demand for Operational Efficiency

One of the major driving factors propelling the growth of AI in the auto insurance market is the increasing demand for operational efficiency. Insurance providers are under constant pressure to optimize their operations, reduce costs, and enhance customer experience.

AI technologies, such as claims automation, underwriting, and fraud detection, are playing a pivotal role in achieving these objectives. For instance, AI can streamline the claims process, enabling faster, more accurate assessments of claims without manual intervention.

This not only improves customer satisfaction but also reduces operational costs, as insurers can handle more claims with fewer resources. AI-driven predictive analytics helps insurers assess risks more accurately, providing a more personalized pricing model and ensuring better risk management.

Restraining Factors

Data Privacy Concerns

A significant restraining factor for the adoption of AI in the auto insurance market is concerns surrounding data privacy. Insurance companies rely heavily on vast amounts of personal and sensitive data to power AI systems, such as driving behavior, claim histories, and other personal information. However, the collection and use of this data raise serious concerns about privacy and data security.

Consumers and regulatory bodies are increasingly wary about how this data is stored, accessed, and used. Stringent data protection regulations, such as GDPR in Europe and various data privacy laws in North America, impose strict guidelines on how insurers must handle personal data. Failure to comply with these regulations can result in hefty fines, legal issues, and damage to a company’s reputation.

Furthermore, insurers must ensure their AI algorithms do not perpetuate biases, such as unfair pricing models based on sensitive demographic information. These concerns can slow down the adoption of AI technologies, especially for smaller insurers who may lack the resources to ensure full compliance with these complex data privacy laws.

Growth Opportunities

Expansion of InsurTech Startups

The rapid growth of InsurTech startups presents a significant growth opportunity for AI in the auto insurance market. These tech-driven companies are focused on revolutionizing the insurance industry by using technology, such as AI, to deliver more efficient, personalized, and accessible insurance products.

By leveraging AI, InsurTech firms can develop innovative solutions for claims automation, pricing optimization, and risk assessment, which are disrupting traditional insurance models. These startups often have fewer legacy systems to update, enabling them to implement AI solutions faster and more efficiently than established insurance providers.

The rise of telematics—devices that track driving behavior—also presents an opportunity for InsurTech companies to offer personalized insurance products based on individual driving habits. This is a compelling option for consumers who prefer to pay premiums that reflect their actual risk profiles, rather than a one-size-fits-all pricing model.

Challenging Factors

Integration with Legacy Systems

One of the major challenges in adopting AI in the auto insurance market is the integration with legacy systems. Many established insurance providers rely on outdated, complex systems that are not designed to work with modern AI tools. These legacy systems often lack the flexibility to process large volumes of data or integrate seamlessly with advanced AI solutions.

As a result, integrating AI into existing operations can be costly, time-consuming, and technically challenging. Insurance companies must not only invest in new technologies but also in the process of upgrading or replacing legacy systems, which can lead to significant upfront costs.

Additionally, the transition period can disrupt normal operations, causing temporary inefficiencies and slowdowns in service delivery. Smaller insurers, in particular, may struggle with these technological challenges due to limited resources. Furthermore, integrating AI while ensuring that it complements existing workflows and adheres to regulatory standards requires careful planning and execution.

Growth Factors

Rising Adoption of AI for Cost Efficiency

A major growth factor driving the AI in auto insurance market is the increasing adoption of AI solutions aimed at improving cost efficiency. As insurers look for ways to reduce operational costs and streamline their operations, AI technologies such as automated claims processing, fraud detection, and risk assessment are emerging as essential tools.

According to market reports, AI implementation can reduce claims processing time by up to 60%, leading to substantial savings for insurance providers. AI-driven tools also help insurance companies improve underwriting accuracy, which reduces the risk of financial losses. With AI’s ability to handle vast amounts of data in real-time, insurers can make more accurate decisions, minimize risks, and deliver faster services, thereby driving overall market growth.

Emerging Trends

Integration of Telematics and IoT

An emerging trend in the AI in auto insurance market is the integration of telematics and Internet of Things (IoT) technologies. By using data from connected devices, such as telematics-enabled car systems, insurers can monitor real-time driver behavior. This information allows insurers to offer pay-as-you-drive insurance policies that adjust premiums based on individual driving patterns.

As of 2023, the market for connected cars was valued at over USD 70 billion and is expected to continue growing rapidly. By incorporating AI with telematics, insurers can also improve fraud detection, leveraging data-driven insights to identify suspicious activities more efficiently.

Business Benefits

Improved Customer Experience and Personalization

AI’s ability to enhance customer experience and offer personalized services is another key benefit driving its adoption in auto insurance. By utilizing AI chatbots, virtual assistants, and automated claims processes, insurers can provide quicker and more effective customer service.

AI-driven algorithms analyze customer data to offer tailored insurance plans that reflect individual risk profiles. This personalized approach not only boosts customer satisfaction but also increases customer retention rates. AI technologies enable insurers to respond to customer inquiries 24/7, ensuring a high level of service availability.

Key Players Analysis

Progressive Corporation, one of the largest auto insurers in the U.S., has been at the forefront of integrating AI and technology into its operations. The company has focused on using AI for pricing optimization, claims automation, and customer service enhancement through AI-driven chatbots. Progressive has partnered with technology firms to enhance its AI capabilities, making it easier to integrate telematics data into its policies.

GEICO, another major player in the U.S. auto insurance industry, has heavily invested in AI-powered customer service, offering automated chatbots and virtual assistants to streamline claim processes and answer customer queries. One of GEICO’s recent innovations is the “GEICO Mobile App”, which uses AI to allow users to manage their policies, report accidents, and even get quotes without speaking to a representative.

Ping An Insurance, a leading Chinese insurer has been embracing AI and big data analytics to revolutionize the insurance industry in China and abroad. The company has launched several AI-driven services, including smart claims processing and personalized underwriting. In 2024, Ping An introduced its AI-powered claim assistant, which uses facial recognition and AI algorithms to process claims faster and more accurately.

Top Key Players in the Market

- Progressive Corporation

- GEICO

- Ping An Insurance Company of China Ltd

- Microsoft Corporation

- CCC Information Services Inc.

- Claim Genius

- Nauto Inc.

- Shift Technology

- Traceable

- SAS Institute Inc.

- Insurify Inc.

- Amazon Web Services (AWS)

- Google LLC

- Other Key Players

Recent Developments

- In 2024: Progressive Corporation launched an advanced AI-driven claims processing system that uses machine learning algorithms to automate the entire claims workflow, reducing processing times by up to 50%.

- In 2024: Ping An Insurance Company of China Ltd. expanded its use of AI-powered telematics to offer real-time dynamic pricing for auto insurance. By using data from connected cars, the insurer’s AI system adjusts policy rates based on individual driving behavior.

Report Scope

Report Features Description Market Value (2024) USD 1,454.1 Mn Forecast Revenue (2034) USD 5934.0 Mn CAGR (2025-2034) 15.10% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component ((Solutions [Claims Automation, Underwriting, Fraud Detection and Prevention, Risk Assessment, Customer Support (Chatbots, Virtual Assistants)], Services), By Deployment (On-Premises, Cloud), By End-User (Insurance Providers, Brokers and Agents, InsurTech Companies) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Progressive Corporation, GEICO, Ping An Insurance Company of China Ltd, Microsoft Corporation, CCC Information Services Inc., Claim Genius, Nauto Inc., Shift Technology, Tracable, SAS Institute Inc., Insurify Inc., Amazon Web Services (AWS), Google LLC, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Auto Insurance MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Auto Insurance MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Progressive Corporation

- GEICO

- Ping An Insurance Company of China Ltd

- Microsoft Corporation

- CCC Information Services Inc.

- Claim Genius

- Nauto Inc.

- Shift Technology

- Traceable

- SAS Institute Inc.

- Insurify Inc.

- Amazon Web Services (AWS)

- Google LLC

- Other Key Players