Global AI Game Generator Market Size, Share Analaysis Report By Component (Software/Platform and Services), By Deployment Mode (Cloud-based and On-premises), By Technology (Machine Learning, Natural Language Processing (NLP), Generative Adversarial Networks (GANs), Transformer Models, Computer Vision, and Procedural Content Generation (PCG)), By End-User (Independent Game Developers, Large Game Studios, Educational & Training Simulation Developers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154204

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

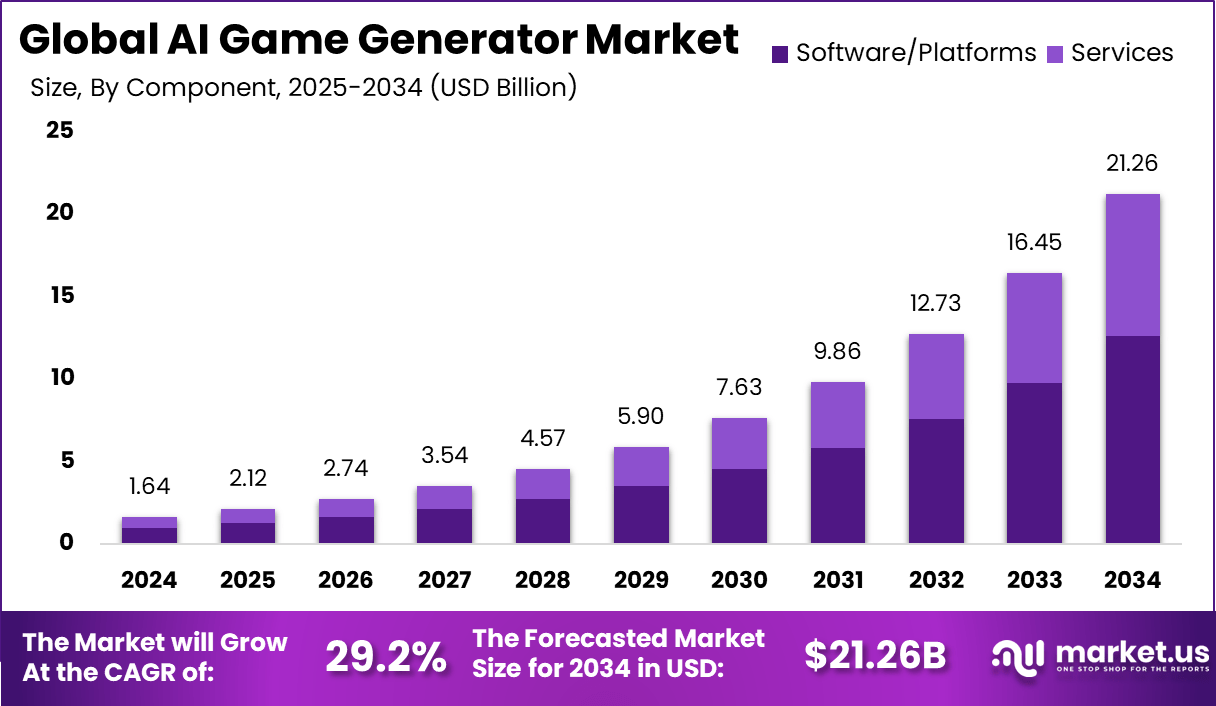

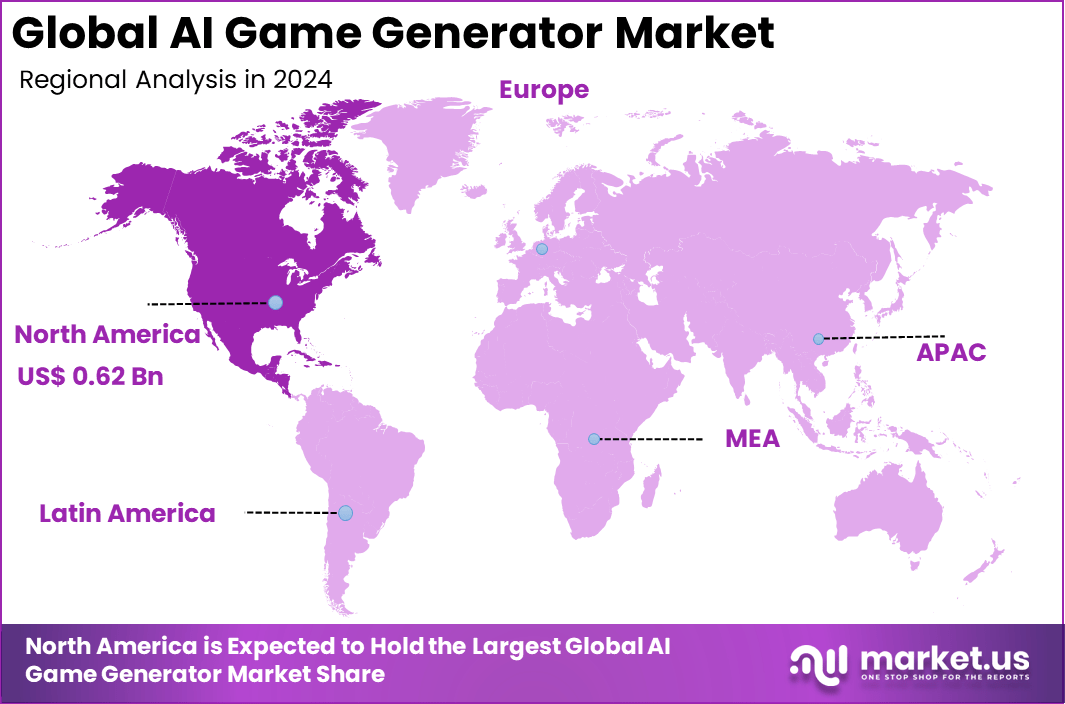

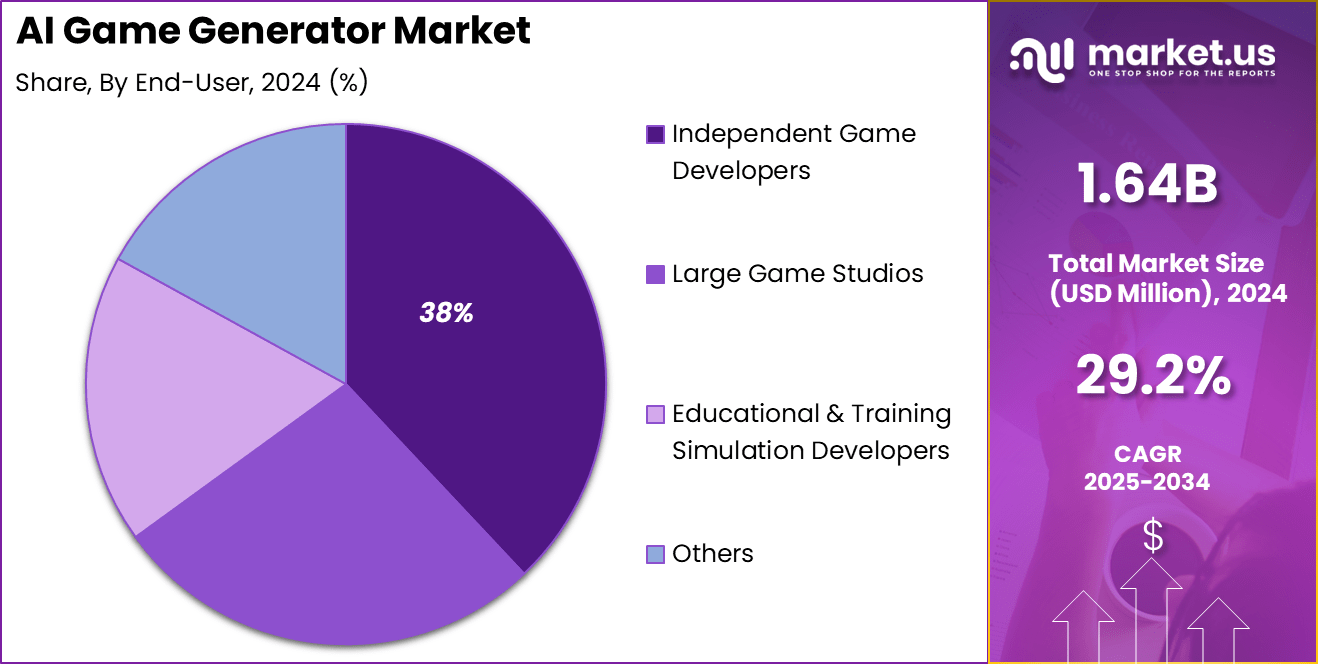

The Global AI Game Generator Market size is expected to be worth around USD 21.26 billion by 2034, from USD 1.64 billion in 2024, growing at a CAGR of 29.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 0.62 billion in revenue.

The AI Game Generator market is currently experiencing robust transformation driven by a convergence of advanced machine learning techniques and rising demand for richer gaming experiences. This segment has benefited from continuous innovation in generative AI models, enabling the creation of lifelike characters, environments, and even procedural narratives that would have been prohibitively time‑consuming using traditional methods.

Top driving factors can be attributed to player demand for immersive and realistic visuals alongside the need to reduce time‑to‑market. Developers are prompted to adopt AI tools to accelerate workflows and to maintain competitive differentiation in a saturated gaming market. The pressure to deliver high‑quality content quickly without large budgets has made AI generators an essential technology enabler.

Demand analysis reveals that growth is powered by increasing penetration of VR, AR, and cloud‑gaming platforms where personalization and dynamic content are table stakes. Procedural content generation is gaining traction due to its scalability and ability to support diverse gaming worlds on smaller teams. As cloud‑based deployment continues to dominate, it further enhances accessibility of these tools.

The increasing adoption of technologies such as deep learning, generative adversarial networks, and procedural generation frameworks reflects a shift toward smarter asset creation. These technologies enable not only automation of standard assets but also dynamic, context‑aware generation that adapts to player actions and preferences.

Market Size and Growth

Report Features Description Market Value (2024) USD 1.64 Bn Forecast Revenue (2034) USD 21.26 Bn CAGR(2025-2034) 29.2% Leading Segment Cloud-Based : 74% Largest Market North America [38% Market Share] Largest Country U.S. [USD 0.58 Billion Market Revenue], CAGR: 27.3% Key Takeaways

- The Global AI Game Generator Market is projected to reach USD 21.26 billion in 2034 from USD 1.64 billion in 2024, growing at a compound annual growth rate (CAGR) of 29.2%.

- By Component, the Software/Platforms segment dominates the market with a 71% share, primarily due to the rising adoption of AI-based tools for generating game assets (2D/3D), narrative scripts, code logic, and procedural levels.

- By Deployment Mode, Cloud-Based solutions hold a leading 74% share. The preference for cloud deployment is attributed to its scalability, ease of access, and support for real-time collaboration.

- By Technology, Machine Learning leads with a 22% market share, playing a critical role in enabling adaptive gameplay, dynamic content creation, and behavior modeling.

- By End-User, Independent Game Developers are the largest contributor, accounting for 38% of the market. The accessibility of AI tools, combined with their cost-efficiency and ability to reduce development cycles.

- North America holds the largest regional share (38%), with the U.S. contributing USD 0.58 billion and growing at 27.3% CAGR.

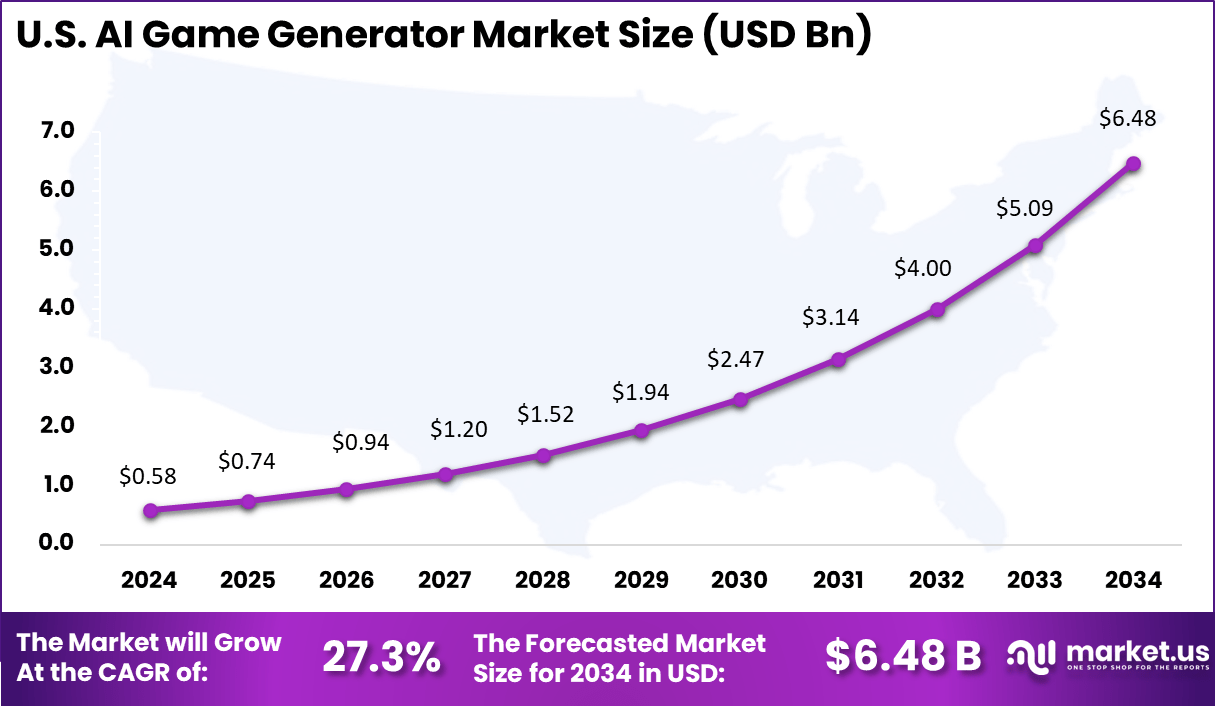

Current Valuation of U.S. Market

As of 2024, the U.S. AI game generator market is valued at approximately USD 0.58 billion, and is expected to grow to USD 6.48 billion by 2034, registering a CAGR of around 27.3%. The United States held a leading position in the AI game generator market due to its advanced digital infrastructure, well-established gaming ecosystem, and early adoption of AI-based development tools.

The country benefits from a high concentration of game development studios, AI research institutions, and cloud computing providers, which together form a strong innovation cluster. The synergy between Silicon Valley’s AI leadership and the presence of major gaming hubs in California, Washington, and Texas has significantly supported early experimentation and deployment of AI in game design and asset generation.

The U.S. market is also driven by high consumer demand for immersive, personalized gaming experiences. This demand has encouraged developers to adopt AI generators to speed up asset creation and enhance storytelling capabilities. Furthermore, the availability of venture capital and government initiatives supporting responsible AI development have reduced entry barriers for startups, allowing them to bring AI tools to mid-sized and indie developers.

Indie developers in the U.S. are increasingly leveraging platforms like Scenario and Promethean AI to automate the creation of game assets and environments, significantly reducing development time and cost. Major studios such as Ubisoft and Electronic Arts have also adopted AI solutions. Ubisoft, for example, uses its proprietary Ghostwriter tool to generate dialogue for non-playable characters (NPCs).

Additionally, companies like NVIDIA are pioneering AI-driven NPC behavior, as demonstrated in titles like Mecha BREAK and Retail Mage. According to a 2024 survey by a16z Games, 73% of U.S. game studios are already using AI, with 40% reporting productivity gains over 20% and 25% experiencing cost savings above 20%.

In 2024, North America held a dominant market position, capturing more than a 38% share and generating around USD 0.62 billion in revenue within the global AI game generator market. This leadership can be attributed to the region’s highly mature gaming industry, strong presence of AI innovation hubs, and advanced digital infrastructure.

The U.S., in particular, hosts a dense network of tech companies, gaming studios, and academic institutions that actively contribute to the development and rapid deployment of generative AI tools. This ecosystem provides developers with faster access to cutting-edge solutions, cloud platforms, and funding channels essential for scaling AI-generated content in games.

By Component Analysis

In 2024, the Software/Platforms segment dominated the AI Game Generator Market, accounting for 71% of the total share. This leadership is primarily driven by the widespread adoption of AI-powered platforms that allow game developers to automate asset creation, storyline development, level generation, and character behavior. These tools reduce development time and cost while enabling creators to focus on gameplay mechanics and user engagement.

The accessibility of these platforms has made it easier for developers to integrate advanced AI functionalities without deep programming knowledge. Whether for 2D, 3D, or VR environments, software-based AI generators are empowering both professionals and hobbyists to innovate faster and with greater creative freedom.

By Deployment Mode Analysis

In 2024, Cloud-based deployment captured 74% of the market share in 2024, emerging as the preferred model for AI game generation. The appeal lies in its scalability, low hardware dependency, and ability to support collaborative workflows across geographically dispersed teams. Game developers use cloud platforms to access powerful AI engines, run large training datasets, and generate real-time updates during game development cycles.

Additionally, cloud infrastructure enables seamless integration with game engines, asset libraries, and development tools. This flexibility allows developers to iterate quickly, deploy updates more efficiently, and reduce infrastructure overhead, which is critical for both indie creators and large studios.

According to Unity’s 2024 developer report, over 65% of AI tool users prefer cloud-based solutions for ease of integration into their existing workflows. Conversely, On-Premise deployment, though more limited in adoption, remains relevant for studios with stringent data privacy, security, or performance requirements. AAA studios using proprietary AI tools may opt for on-premise deployment to maintain full control over development pipelines.

By Technology Analysis

In 2024, Machine Learning represented 22% of the technology segment in 2024, standing out as a core enabler of automated and adaptive game development processes. ML models are used to learn from user behavior, generate new levels dynamically, and optimize in-game experiences based on player interaction.

These systems are also trained to produce realistic environments, character dialogues, and decision trees that evolve over time. Game developers increasingly rely on ML for creating personalized gameplay scenarios and enhancing replayability. As data from game usage accumulates, machine learning continues to power smarter and more immersive AI-driven content generation tools within the ecosystem.

By End-User Analysis

In 2024, Independent Game Developers emerged as the largest end-user segment, holding a 38% share in 2024. These developers benefit the most from AI game generation platforms, as they often face resource constraints yet seek to deliver high-quality, innovative games. AI tools allow them to automate routine tasks, reduce dependency on large teams, and experiment with new ideas rapidly.

The democratization of game development through AI is particularly valuable for indie creators looking to compete in a saturated market. Platforms that offer low-code or no-code interfaces have further boosted adoption among individuals and small studios seeking creative control with minimal technical burden.

Driving Factor

Increasing demand for automated game development tools to reduce time and cost

One of the primary drivers of the AI Game Generator Market is the ability of AI tools to significantly reduce game development time and associated costs. Traditional game development is often resource-intensive, requiring large teams of designers, artists, writers, and developers to spend months or even years building content.

AI-powered tools such as procedural level designers, narrative generators, and asset creation platforms automate many of these tasks, allowing developers to focus more on creativity and innovation rather than manual production. For example, Ubisoft uses its AI tool “Ghostwriter” to generate in-game dialogue, reducing the time writers spend on repetitive non-player character (NPC) conversations.

Similarly, Promethean AI helps artists create 3D environments by suggesting and placing objects based on context, cutting down design time by up to 80%. A study by Modl.ai, a company offering AI-powered game testing and behavior modeling, found that AI can reduce testing cycles by 30–50%. These efficiencies translate to lower development costs, enabling indie developers to produce high-quality games with smaller teams and budgets.

Restraining Factor

Concerns over content quality, coherence, and originality of AI-generated outputs

A key restraint in the AI Game Generator market is the concern over the quality, coherence, and originality of AI-generated content. While AI tools can rapidly produce game assets, narratives, and levels, the outputs often lack the depth, emotional nuance, and contextual awareness that human designers bring.

For example, AI-generated dialogue using models like GPT or similar large language models can become repetitive, inconsistent with character personalities, or contextually inappropriate over long gameplay sessions. This can break player immersion and compromise storytelling integrity. In procedural level design, some indie developers have reported that AI-generated maps or worlds may appear random or disjointed, requiring manual correction or curation.

Games like AI Dungeon, which rely heavily on GPT-powered storytelling, have faced criticism for generating incoherent or illogical plotlines, especially during extended gameplay. According to a 2023 survey by Game Developer Magazine, 42% of developers using AI tools cited “lack of narrative consistency” as a major drawback.

Moreover, originality is another issue, as AI models are trained on existing datasets, potentially leading to derivative or overly familiar content. These limitations hinder the ability of studios to fully rely on AI without extensive human oversight, thus affecting adoption and overall trust in AI-generated game development processes.

Growth Opportunity

Expansion into education, training simulations, and AR/VR gaming

The integration of AI game generators into education, training simulations, and AR/VR gaming presents a significant growth opportunity for the market. AI-generated content enables rapid development of interactive, scenario-based learning environments that are customizable, immersive, and cost-effective. In education, platforms like Minecraft Education Edition and Classcraft already use gamified environments to teach coding, critical thinking, and collaboration.

By adding AI-driven narrative generation and adaptive learning paths, these platforms can offer highly personalized learning experiences at scale. In corporate and military training, AI-generated simulations are increasingly used to replicate real-world scenarios. For instance, Boeing and the U.S. Army have explored AI-powered virtual environments for pilot and combat training, reducing the cost and risk of live simulations.

The opportunity further expands with the rise of AR/VR technologies. AI tools can generate immersive 3D assets, interactive dialogues, and dynamic storylines in real time, enhancing user engagement in VR classrooms or simulation labs. Immersive technologies in training can improve learning retention by up to 75%, underscoring the potential of AI-generated game content in shaping next-gen educational and training experiences.

Latest Trends

Adoption of transformer-based models for generating realistic dialogue and storytelling

A major trend shaping the AI Game Generator market is the increasing adoption of transformer-based models for creating realistic, engaging dialogue and immersive storytelling. Transformer architectures such as OpenAI’s GPT, Google’s BERT, and Meta’s LLaMA excel at understanding context, semantics, and character tone, enabling them to generate coherent and emotionally resonant narratives.

These models are revolutionizing how in-game characters interact with players by enabling natural, branching conversations and dynamic story evolution. Examples include Inworld AI, which uses transformer-based models to create intelligent, reactive NPCs that can hold unscripted conversations with players.

The impact is significant, according to a 2024 report by Unity, nearly 60% of game developers experimenting with AI for dialogue creation prefer transformer-based solutions due to their scalability and narrative depth. As models continue to improve, especially in multi-turn dialogue and emotion tracking, transformer-based storytelling is poised to become a core element in next-generation interactive games, offering highly personalized and replayable experiences.

Key Market Segments

By Component

- Software/Platforms

- Game Asset Generators (2D/3D assets, sprites)

- Narrative & Dialogue Generators

- Code & Logic Generators

- Procedural Level Designers

- Services

- Integration & Customization Services

- Consulting Services

- Managed Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Generative Adversarial Networks (GANs)

- Transformer Models

- Computer Vision

- Procedural Content Generation (PCG)

By End-User

- Independent Game Developers

- Large Game Studios

- Educational & Training Simulation Developers

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The AI Game Generator market is moderately fragmented, with key players holding a combined market share of around 45–50% in 2024. Leading companies such as Scenario, Promethean AI, Inworld AI, Latitude, and Modl.ai dominate through innovation in asset generation, NPC interaction, and procedural design.

Larger firms like Ubisoft and NVIDIA leverage in-house AI tools like Ghostwriter and AI-powered character modeling for AAA game production. These players focus on expanding cloud capabilities, enhancing generative model accuracy, and forming strategic partnerships to maintain a competitive edge in this rapidly evolving market landscape.

Top Key Players in the AI Game Generator Market

- Unity Technologies

- OpenAI

- VEED.io

- GDevelop

- Scenario

- Promethean AI

- Ludo.ai

- Rosebud.ai

- Layer.ai

- Hotpot.ai

- Leonardo AI

- InWorld

- Charisma

- Meshy AI

- GANimator

- Other Key Players

Recent Developments

- October 2024: Sony Interactive Entertainment acquires Promethean AI, an animation-focused AI studio, to strengthen its in-house design capabilities.

- September 2024: Electronic Arts (EA) acquires AI analytics firm Modl.ai, enhancing its automated testing and player behavior analysis tools.

- March 2025: Roblox launches a new Mesh Generator API, powered by its 1.8‑billion‑parameter model “CUBE 3D”, to enable creators to auto-generate 3D objects on the platform.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platform and Services), by Deployment Mode (Cloud-based and On-premises), By Technology (Machine Learning, Natural Language Processing (NLP), Generative Adversarial Networks (GANs), Transformer Models, Computer Vision, and Procedural Content Generation (PCG)), By End-User (Independent Game Developers, Large Game Studios, Educational & Training Simulation Developers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unity Technologies, OpenAI, VEED.io, GDevelop, Scenario, Promethean AI, Ludo.ai, Rosebud.ai, Layer.ai, Hotpot.ai, Leonardo AI, InWorld, Charisma, Meshy AI, GANimator, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Unity Technologies

- OpenAI

- VEED.io

- GDevelop

- Scenario

- Promethean AI

- Ludo.ai

- Rosebud.ai

- Layer.ai

- Hotpot.ai

- Leonardo AI

- InWorld

- Charisma

- Meshy AI

- GANimator

- Other Key Players