Global AI Consulting Market Size, Share Analysis Report By Service Type (Strategy Consulting, Management Consulting, Operations Consulting, Financial Advisory Consulting, Human Resource Consulting, IT Consulting, Others), By Enterprise Size (Small and Mid-sized, Large Enterprise), By End User (Healthcare, Finance and Banking, Retail and E-commerce, Manufacturing, Telecommunications, Energy and Utilities, Automotive, Logistics and Transportation, Education, Real Estate, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147179

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

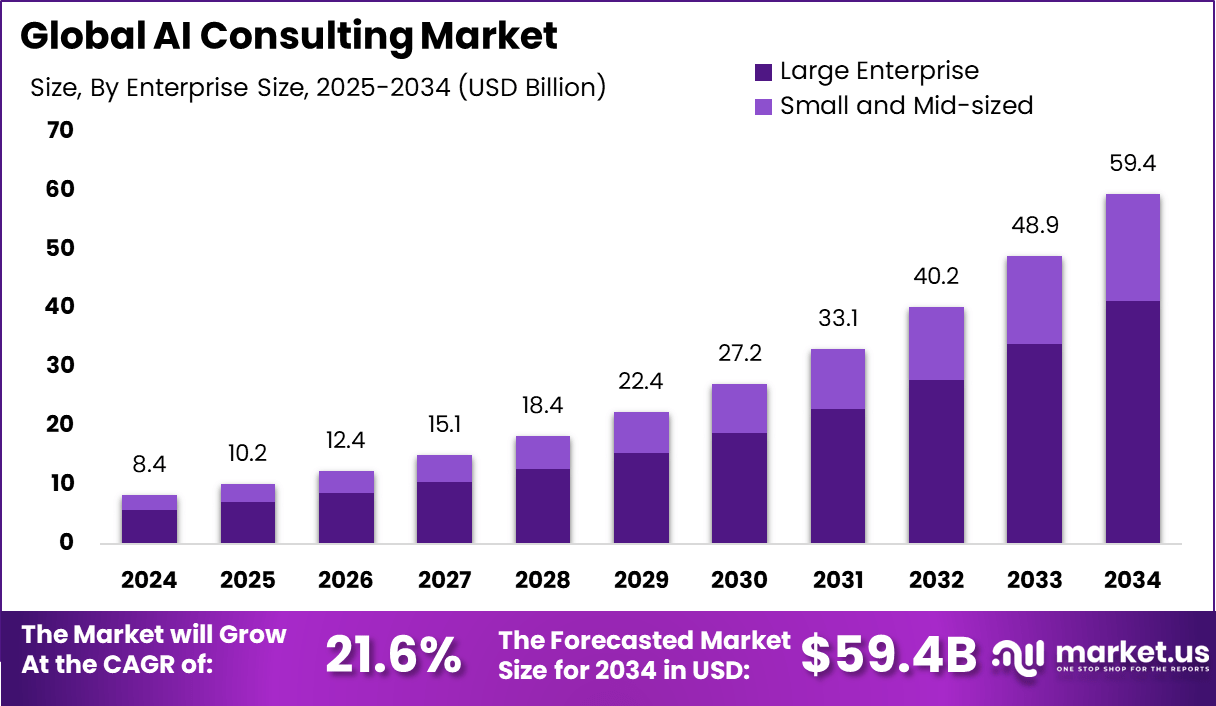

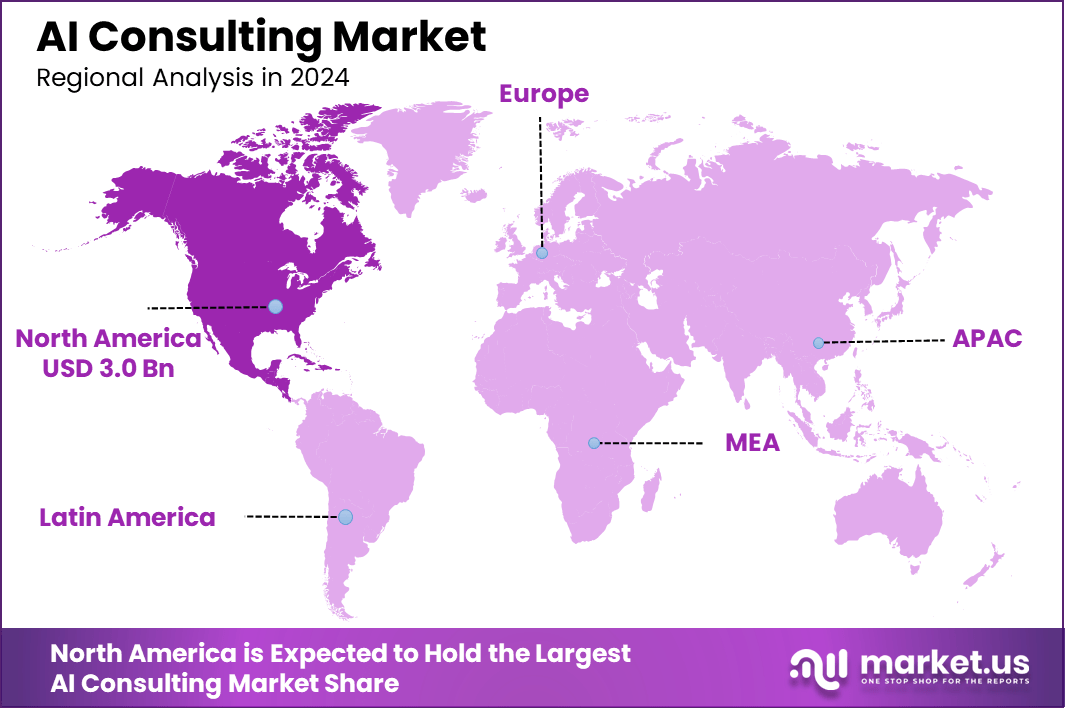

The Global AI Consulting Market size is expected to be worth around USD 59.4 Billion By 2034, from USD 8.4 billion in 2024, growing at a CAGR of 21.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.84% share, holding USD 3.0 Billion revenue.

AI consulting refers to the service provided by experts who help organizations implement and optimize artificial intelligence technologies. These services encompass a range of activities including the development of AI strategies, integration of AI technologies, and training organizational teams on AI adoption. The objective is to enhance operational efficiency, decision-making, and innovation across various business functions through tailored AI solutions.

The demand for AI consulting is primarily fueled by the need to improve operational efficiencies and the growing realization of AI’s potential in driving innovation and competitiveness. Industries such as BFSI, healthcare, and retail are particularly keen on leveraging AI for tasks ranging from fraud detection and risk assessment to customer service automation and personalized shopping experiences.

The major reasons for this increased demand include the necessity to improve operational efficiencies, reduce costs, and enhance customer engagement through personalized services. The integration of AI enables businesses to automate complex processes and derive insights from large data sets, driving the need for expert consulting services in AI implementation.

The market trends in AI consulting indicate a growing emphasis on cognitive AI technologies, such as machine learning and natural language processing, to automate customer interactions and improve data analysis. This trend is particularly prevalent in customer service and healthcare sectors. Organizations adopt these technologies primarily to streamline operations, enhance decision-making accuracy, and offer differentiated customer experiences.

According to ColorWhistle, 84% of business leaders recognize the enhancement of forecasting accuracy through AI technologies. Additionally, over 50% of large enterprises have adopted AI consulting services, reflecting a growing integration of AI in business operations. It is estimated that nearly 45% of tasks currently handled by consultants could be automated with existing AI technologies.

This trend is echoed in customer service industries, where 50% of companies have implemented AI solutions into their business models. MIT Sloan’s research further supports this adoption, with 75% of top executives believing that AI is a pivotal factor for organizational growth and a competitive edge in their respective markets. This consensus highlights the transformative impact of AI on business efficiency and strategic development.

Key Takeaways

- The Global AI Consulting Market is expected to grow significantly from USD 8.4 billion in 2024 to approximately USD 59.4 billion by 2034, registering a CAGR of 21.6% during the forecast period from 2025 to 2034.

- In 2024, North America dominated the global AI consulting market with more than 36.84% market share, generating USD 3.0 billion in revenue. This leadership is supported by advanced AI adoption and innovation initiatives across various sectors in the region.

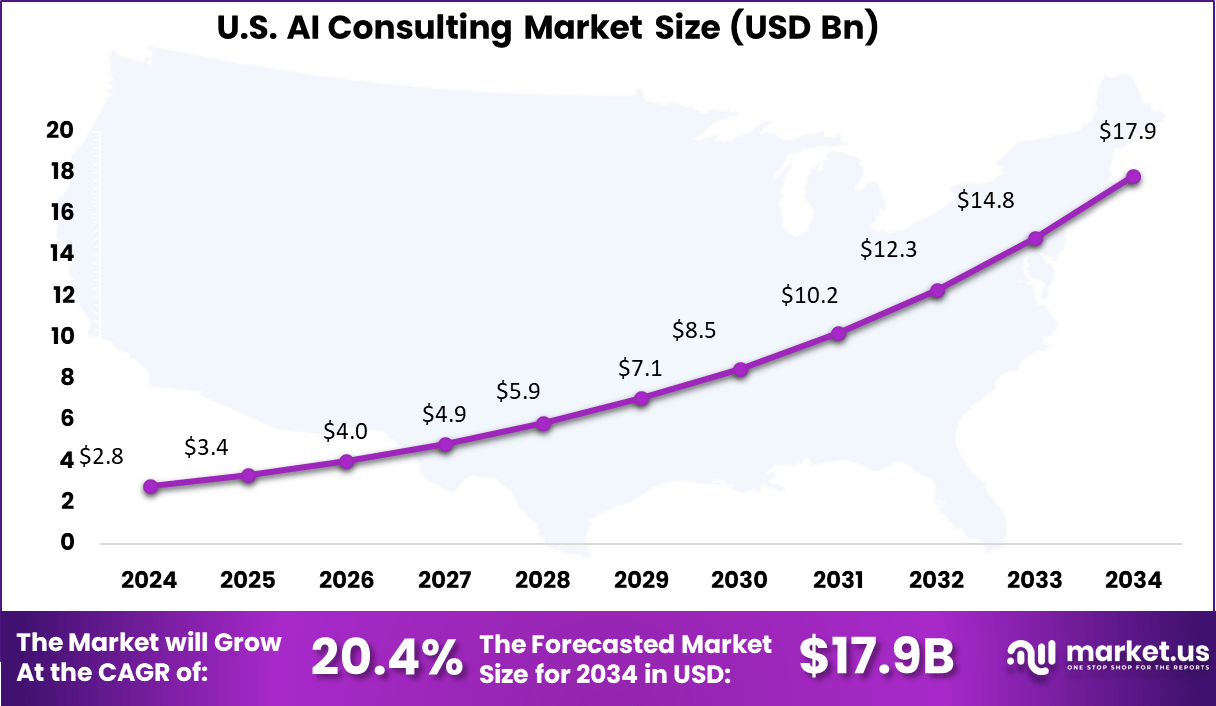

- The US AI Consulting Market is valued at USD 2.8 billion in 2024 and is projected to reach approximately USD 17.9 billion by 2034, growing at a CAGR of 20.4% from 2025 to 2034, highlighting the country’s substantial contribution to AI consulting services demand.

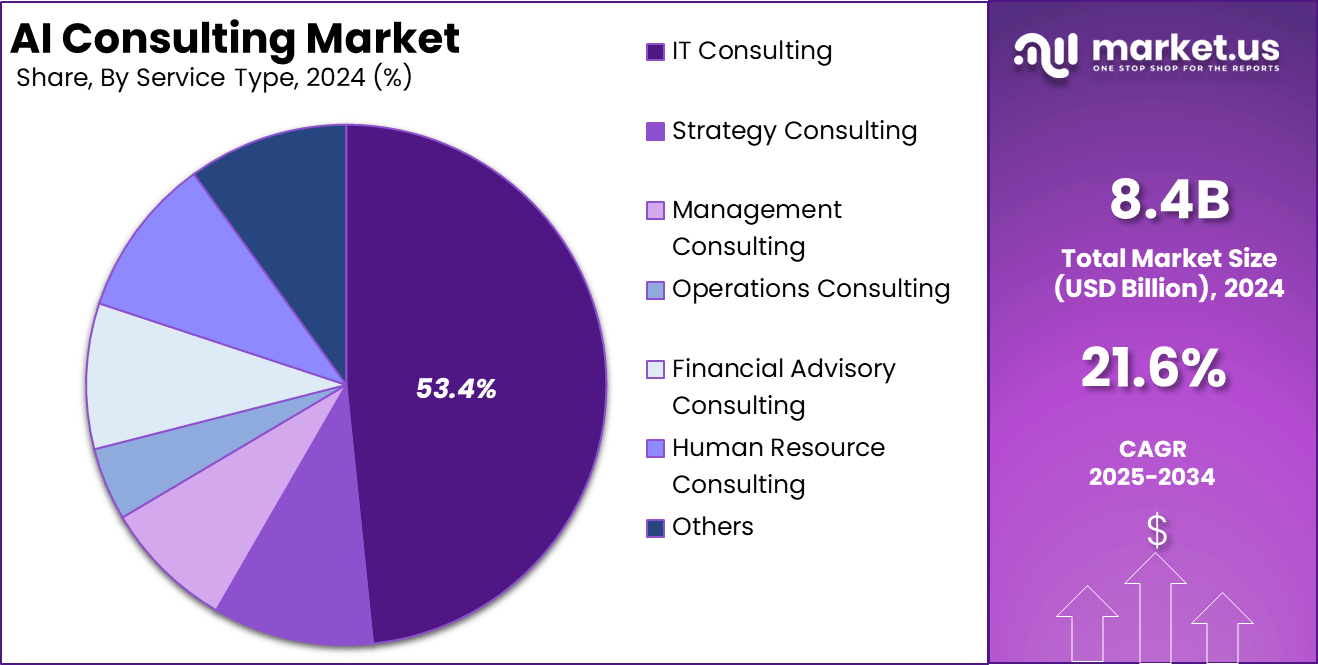

- The IT Consulting segment held the largest share in 2024, accounting for more than 53.4% of the AI consulting market. This leadership is driven by the rising demand for AI strategy development, digital transformation consulting, and system integration services.

- In 2024, the Large Enterprise segment captured over 69.4% share in the AI consulting market, reflecting the high demand for scalable and complex AI solutions among large corporations with significant digital transformation budgets.

- The Finance and Banking segment led the AI consulting market by end-user industry in 2024, holding more than 28.6% share. This growth is attributed to the sector’s increasing focus on AI-driven risk management, fraud detection, automation, and customer analytics solutions.

Analysts’ Viewpoint

The AI consulting market presents numerous investment opportunities, particularly in sectors where AI can significantly enhance efficiency and innovation. Healthcare, finance, and retail are notable areas where investments in AI consulting can yield substantial returns due to the high demand for personalization and operational efficiency.

The adoption of AI consulting offers various business benefits, including improved efficiency, reduced operational costs, and enhanced competitive advantage. Companies utilizing AI consulting can expect to see a significant transformation in how they operate, making them more agile and responsive to market changes.

The regulatory landscape for AI consulting is evolving, with more emphasis on data protection, privacy, and ethical considerations. Compliance with regulations such as GDPR in Europe and similar standards in other regions is becoming crucial for businesses adopting AI technologies.

The top impacting factors in the AI consulting market include technological innovation, regulatory changes, and the shift towards data-driven business models. Additionally, the economic landscape and sector-specific dynamics also play significant roles in shaping the market.

US Market Growth

The US AI Consulting Market is valued at approximately USD 2.8 Billion in 2024 and is predicted to increase from USD 3.4 Billion in 2025 to approximately USD 17.9 Billion by 2034, projected at a CAGR of 20.4% from 2025 to 2034.

In 2024, North America held a dominant market position in the AI consulting industry, capturing more than a 36.84% share and generating revenue of USD 3.0 Billion. This leadership can be attributed to several factors. Primarily, the region benefits from a highly developed technological infrastructure and a concentration of leading AI firms, including global giants such as IBM, Google, and Microsoft, which drive innovation and market growth.

Furthermore, significant investments in AI research and development by both public and private sectors support the swift adoption of AI technologies across industries. North America’s advanced regulatory and policy framework also plays a crucial role in fostering a conducive environment for AI development and adoption.

Initiatives such as the U.S. National AI Research and Development Strategic Plan encourage the implementation of AI across various sectors, including healthcare, finance, and automotive, which are key areas of focus for AI consulting services. Additionally, the region’s commitment to addressing ethical and privacy concerns related to AI further strengthens its market position by ensuring trust and compliance in AI implementations.

Service Type Analysis

In 2024, the IT Consulting segment held a dominant market position in the AI consulting industry, capturing more than a 53.4% share. This prominence is largely due to the critical role that IT infrastructure plays in the adoption and integration of AI technologies across businesses.

IT consulting services are essential for organizations aiming to harness AI capabilities, ensuring that the underlying technological frameworks are robust, scalable, and secure. IT Consulting leads the AI consulting segments because it directly addresses the core needs of businesses undergoing digital transformation. As companies seek to leverage AI for competitive advantage, they require expert guidance to navigate the complexities of integrating AI with existing IT systems.

This includes everything from data management and cloud services to cybersecurity and compliance, which are pivotal for effectively deploying AI solutions. Moreover, the rapid evolution of AI technologies necessitates continual updates and adaptations in IT strategies, further driving demand for specialized IT consulting services.

The sector’s growth is also fueled by the increasing need for AI-driven cybersecurity solutions and cloud-based AI services. As businesses expand their digital footprints, the demand for secure, AI-enhanced systems grows, making IT consulting not just relevant but essential. This service type not only leads in market share but also sets the foundation for the successful implementation of AI across other business functions, underscoring its pivotal role in the AI consulting market.

Enterprise Size Analysis

In 2024, the Large Enterprise segment held a dominant market position in the AI consulting industry, capturing more than a 69.4% share. This leadership is primarily attributed to the extensive resources and capabilities that large enterprises possess, which enable them to invest significantly in AI technologies and consulting services.

Large enterprises often have complex, multifaceted operations that can greatly benefit from the efficiencies and insights provided by AI, making them prime candidates for substantial investments in AI consulting. The leading position of the Large Enterprise segment is further reinforced by their ability to scale AI implementations across various departments and global operations.

These enterprises are typically at the forefront of adopting advanced AI-driven solutions such as machine learning, natural language processing, and robotics, which are integral to enhancing operational efficiencies, customer interactions, and innovation strategies. Additionally, large enterprises are more likely to have the infrastructure to support the integration of AI and the data capacities necessary for AI systems to function optimally.

Moreover, large enterprises are often subject to more stringent regulatory requirements, which necessitate robust AI solutions that can ensure compliance while optimizing performance. The ability to deploy AI to navigate complex regulatory landscapes efficiently makes AI consulting services particularly valuable for these organizations, thereby driving the segment’s dominance in the market.

End User Analysis

In 2024, the Finance and Banking segment held a dominant market position in the AI consulting industry, capturing more than a 28.6% share. This sector’s leadership in AI consulting utilization is driven by the critical need for automation, risk management, and enhanced customer service within the industry.

Financial institutions are increasingly relying on AI to streamline operations, improve risk assessment capabilities, and deliver personalized customer experiences, all of which require sophisticated AI integration. The prominence of the Finance and Banking segment also stems from its requirement to comply with strict regulatory and security standards, which can be efficiently managed through AI-driven solutions.

AI technologies such as machine learning and predictive analytics are integral in detecting fraud, managing financial risks, and ensuring compliance. These capabilities not only help in safeguarding against financial crimes but also in adapting to changing regulations more swiftly.

Additionally, the competitive nature of the finance and banking industry necessitates continual innovation and improvement in customer service, investment strategies, and operational efficiency. AI consulting plays a pivotal role in enabling these institutions to leverage the latest technologies to maintain competitive advantages, manage vast amounts of data, and make informed decisions quickly.

Key Market Segments

By Service Type

- IT Consulting

- Strategy Consulting

- Management Consulting

- Operations Consulting

- Financial Advisory Consulting

- Human Resource Consulting

- Others

By Enterprise Size

- Small and Mid-sized

- Large Enterprise

By End User

- Healthcare

- Finance and Banking

- Retail and E-commerce

- Manufacturing

- Telecommunications

- Energy and Utilities

- Automotive

- Logistics and Transportation

- Education

- Real Estate

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Automation and Efficiency

One of the foremost drivers of the AI consulting market is the escalating demand for automation across various industries. Organizations are striving to enhance operational efficiency, reduce costs, and improve productivity, which is significantly driving the adoption of AI technologies.

AI-driven solutions such as robotic process automation (RPA) and machine learning algorithms are pivotal in streamlining operations, minimizing human error, and increasing scalability. AI consultants are crucial in identifying automation opportunities, implementing these technologies, and ensuring seamless integration with existing systems.

This drive towards automation is supported by the substantial availability of data from diverse sources like IoT devices, social media, and customer interactions, further enhancing the demand for AI consulting to make data-driven decisions and foster industry innovation.

Restraint

High Implementation Costs

A significant restraint in the AI consulting market is the high cost associated with the implementation of AI technologies. These costs include not only the initial investment in technology but also expenses related to integration, customization, and ongoing maintenance.

For small and medium-sized enterprises in particular, these costs can be prohibitive, deterring them from adopting AI solutions despite the long-term benefits such as improved efficiency and reduced labor costs. This financial burden remains a substantial barrier, impacting the overall growth and adoption rates in the AI consulting sector.

Opportunity

Growing Demand for AI-Powered Personalization

The AI consulting market is witnessing a significant opportunity in the form of AI-powered personalization. This trend is particularly prevalent in sectors like e-commerce, marketing, and customer service, where AI can analyze customer behavior, preferences, and interactions to deliver customized experiences and targeted recommendations.

This capability not only enhances customer engagement and loyalty but also drives revenue growth. AI consultants play a vital role in helping organizations implement these personalized solutions, thereby creating a considerable market opportunity as businesses seek to leverage AI for a competitive advantage.

Challenge

Data Privacy and Ethical Concerns

A major challenge facing the AI consulting market is addressing data privacy and ethical concerns. As AI systems heavily rely on vast amounts of data, concerns over how this data is collected, stored, and used are growing. Ensuring compliance with data protection regulations like GDPR and addressing the ethical implications of AI decision-making are critical.

These issues can complicate the deployment of AI technologies, requiring AI consultants to guide organizations on balancing innovation with responsible AI practices. This challenge is further exacerbated by regulatory uncertainties, making it difficult for businesses to commit to AI solutions that may face future compliance issues.

Growth Factors

The AI Consulting market is experiencing rapid growth driven by several key factors. Increasing demand for automation across various industries is one significant driver. Organizations are leveraging AI to enhance operational efficiency, reduce costs, and optimize workflows, which in turn boosts productivity and scalability.

This trend is supported by the integration of AI in areas like robotic process automation (RPA) and machine learning algorithms, which help in streamlining operations and enhancing decision-making processes. Another major growth factor is the rising need for AI-driven insights.

Businesses across different sectors recognize the value of utilizing AI to analyze vast datasets and generate actionable insights, which are crucial for informed decision-making and improving overall operational efficiency. This need is particularly pressing as the volume of data generated by organizations continues to grow, necessitating sophisticated analytical capabilities that AI consulting can provide.

Emerging Trends

Emerging trends in AI consulting highlight the growing integration of AI across diverse business functions. There is a notable shift towards cognitive AI applications, such as natural language processing, computer vision, and machine learning, which are increasingly being adopted to automate customer interactions and enhance user experiences and decision-making in sectors like healthcare and customer service.

Digital transformation initiatives also continue to propel the demand for AI consulting as businesses seek to integrate AI technologies to stay competitive and innovate. This includes adopting AI for strategic planning, enhancing customer engagement, and improving service delivery through intelligent automation and predictive models.

Business Benefits

The adoption of AI consulting brings multiple business benefits, primarily centering around enhanced efficiency and competitive differentiation. AI consulting helps companies automate complex processes, which reduces the need for manual intervention and minimizes errors. This automation extends across various domains from customer service (via chatbots and automated responses) to back-end operations like supply chain management and financial operations.

Furthermore, AI consulting enables personalized customer experiences by analyzing customer data to provide tailored services, recommendations, and support. This not only improves customer satisfaction but also helps in retaining customers and increasing sales. Moreover, AI-driven predictive analytics can help businesses anticipate market trends and customer needs, allowing them to make proactive strategic decisions.

Key Player Analysis

The AI consulting market is experiencing rapid growth, driven by technological advancements and increasing demand for AI integration across industries. Among the leading firms in this sector, Accenture, IBM, and PwC have emerged as key players, each demonstrating significant activity in acquisitions, product development, and strategic partnerships.

Accenture has been proactive in expanding its AI capabilities through strategic acquisitions. The company has acquired several AI and analytics firms to enhance its service offerings, focusing on areas such as machine learning, data engineering, and cloud-based AI solutions. These acquisitions have enabled Accenture to provide more comprehensive AI consulting services to its clients.

IBM has focused on strengthening its AI portfolio through both acquisitions and product innovation. The company acquired Manta Software Inc. to bolster its data and AI governance capabilities. Additionally, IBM announced the acquisition of Software AG’s StreamSets and webMethods platforms for €2.13 billion ($2.33 billion), aiming to enhance its data integration and API management services.

PwC has made significant investments in AI, including a $1 billion commitment in the U.S. over three years. The firm has also formed partnerships with major technology providers like Microsoft and OpenAI to develop advanced AI tools and services. These initiatives are designed to enhance PwC’s consulting capabilities and offer clients innovative AI-driven solutions.

Top Key Players in the Market

- Bain and Company

- KPMG International

- PwC (PricewaterhouseCoopers)

- Capgemini SE

- Cognizant Technology Solutions

- Infosys Limited

- Tata Consultancy Services Limited

- Wipro Limited

- DXC Technology Company

- Genpact Limited

- Accenture Plc

- IBM Corporation

- Deloitte Touche Tohmatsu Limited

- Ernst and Young Global Limited

- Tech Mahindra Limited

- HCL Technologies Limited

- NTT DATA Corporation

- Avanade Inc.

- Others

Recent Developments

- December 2024: Bain enhanced leadership in its AI and digital practices. AI-enabled projects now drive 30% of Bain’s business, with expectations to reach 50% soon. Bain teams have created over 4,000 custom AI tools (“MyGPTs”) for internal and client use, showing deep AI integration.

- September 2024: BCG expanded its AI consulting capabilities by deepening collaborations with leading tech companies (AWS, Google, IBM, Microsoft, Salesforce, SAP, OpenAI, Anthropic, Palantir, etc.). This ecosystem supports clients with generative AI and end-to-end business transformation, leveraging BCG X for custom AI solutions.

- Q4 2024: Generative AI accounted for 5% of Capgemini’s bookings, showing rapid enterprise adoption. Capgemini is focusing on enterprise-scale AI, especially in data analytics and process automation, positioning itself as a leader in AI-driven consulting.

Report Scope

Report Features Description Market Value (2024) USD 8.4 Bn Forecast Revenue (2034) USD 59.4 Bn CAGR (2025-2034) 21.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Strategy Consulting, Management Consulting, Operations Consulting, Financial Advisory Consulting, Human Resource Consulting, IT Consulting, Others), By Enterprise Size (Small and Mid-sized, Large Enterprise), By End User (Healthcare, Finance and Banking, Retail and E-commerce, Manufacturing, Telecommunications, Energy and Utilities, Automotive, Logistics and Transportation, Education, Real Estate, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Boston Consulting Group, Bain and Company, KPMG International, PwC (PricewaterhouseCoopers), Capgemini SE, Cognizant Technology Solutions, Infosys Limited, Tata Consultancy Services Limited, Wipro Limited, DXC Technology Company, Genpact Limited, Accenture Plc, IBM Corporation, Deloitte Touche Tohmatsu Limited, Ernst and Young Global Limited, McKinsey and Company, Tech Mahindra Limited, HCL Technologies Limited, NTT DATA Corporation, Avanade Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bain and Company

- KPMG International

- PwC (PricewaterhouseCoopers)

- Capgemini SE

- Cognizant Technology Solutions

- Infosys Limited

- Tata Consultancy Services Limited

- Wipro Limited

- DXC Technology Company

- Genpact Limited

- Accenture Plc

- IBM Corporation

- Deloitte Touche Tohmatsu Limited

- Ernst and Young Global Limited

- Tech Mahindra Limited

- HCL Technologies Limited

- NTT DATA Corporation

- Avanade Inc.

- Others