Global AI Avatar Market Size, Share Analysis Report By Platform (AI Video Generation Platforms, Interactive Digital Human Platforms, Stylized Avatar & Social Media Tools, 3D & Metaverse Avatars), By Degree of Customization (Preset Avatars, Partially Customizable Avatars, Fully Customizable Avatars), By Type (Interactive Avatars, Noninteractive Avatars), By Application (Virtual Agents & Assistants, Virtual Characters, Virtual Influencers, Virtual Companions), By End User (Enterprise (Media & Entertainment, Education, Healthcare & Life Sciences, Retail & E-commerce, IT & Telecom, BFSI, Automotive, Others), Individual Users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152281

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

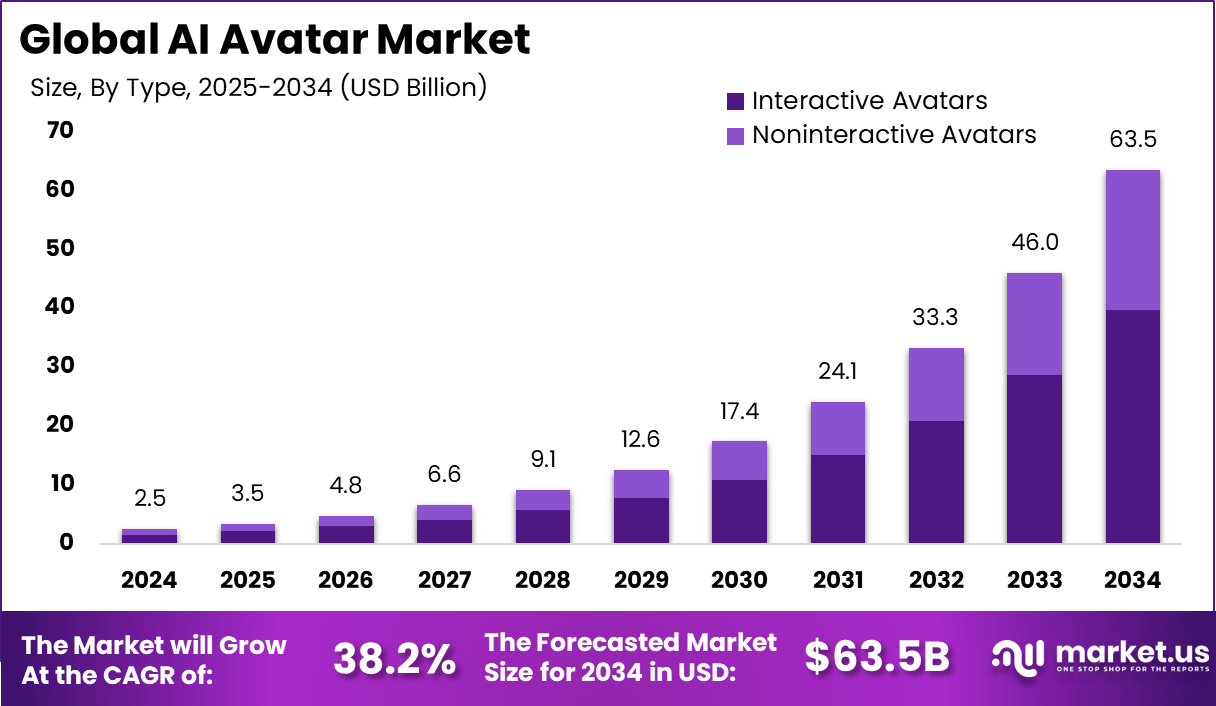

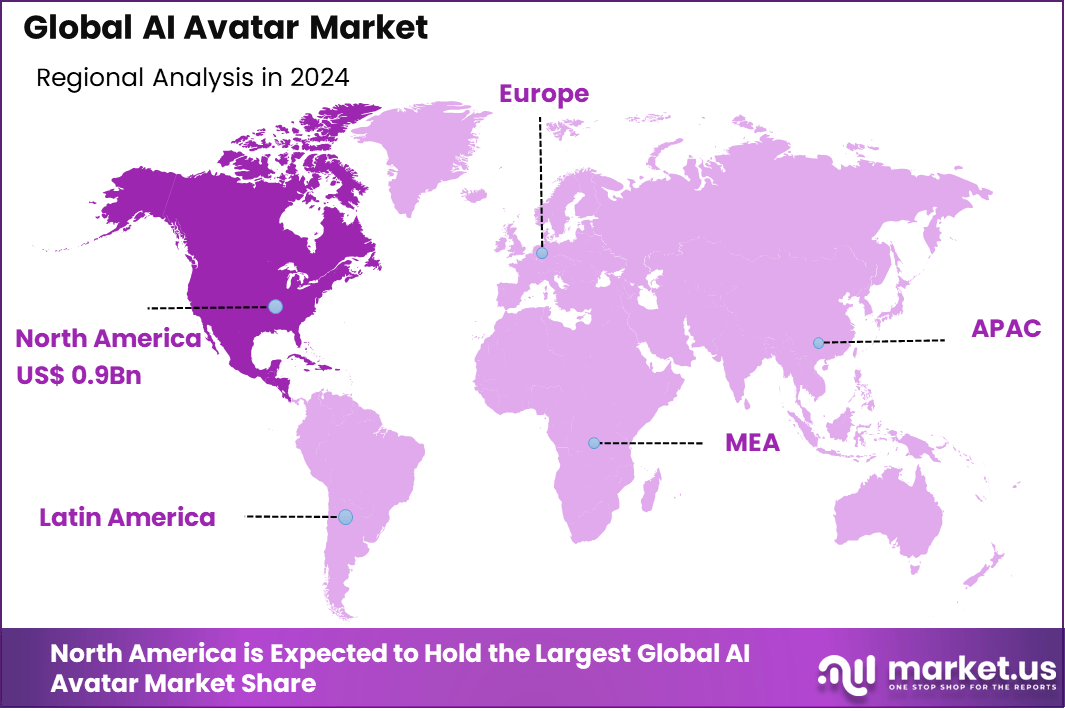

The Global AI Avatar Market size is expected to be worth around USD 63.5 Billion By 2034, from USD 2.5 billion in 2024, growing at a CAGR of 38.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.2% share, holding USD 0.9 Billion revenue.

The AI Avatar market refers to digital human-like agents powered by artificial intelligence that simulate interactive communication with users. These avatars are used in customer service, virtual events, marketing, education, and healthcare to deliver personalized, scalable, and lifelike digital experiences. The combination of generative AI, real-time animation, and natural language understanding has positioned AI avatars as a transformative solution for businesses seeking enhanced engagement and efficiency.

The primary force driving adoption is the consumer desire for hyper‑personalized digital engagement. Businesses employ AI avatars to simulate human‑like conversations, gather user preferences, and deliver interactive brand experiences that align with modern expectations. Advances in core AI technologies – such as generative models and computer vision – are lowering barriers for creating realistic avatars, further incentivizing adoption.

For instance, in April 2023, Spheroid Universe introduced AI-powered avatars designed to operate within the real world through augmented reality (AR) technology. These avatars are specifically developed to support business applications, enabling enterprises to deploy them for activities such as sales presentations, advertising campaigns, and customer engagement.

According to market.us, The global digital avatar market is projected to witness remarkable growth over the coming years. It is anticipated to reach a value of USD 745.1 Billion by 2033, rising from USD 416.7 Billion in 2023, driven by a robust compound annual growth rate of 46.2% during the forecast period from 2024 to 2033.

Organizations are adopting AI avatars primarily to enhance scalability, efficiency and brand consistency. Automated avatars reduce the need for live agents in high‑volume interactions. They offer brand‑aligned experiences without fatigue and can operate continuously. Moreover, the ability to capture rich interaction data supports strategic decision‑making.

Demand is strongest among industries requiring constant, personalized customer engagement – such as retail, finance, healthcare, and education. Digital avatar deployment for virtual customer support, tutoring, and health guidance is being favored for 24/7 availability and consistent quality. The consumer appetite for realistic avatar agents in gaming and entertainment continues to grow, driving B2C demand, supported by widespread smartphone penetration and social media adoption.

Key Insight Summary

- In 2024, the global AI avatar market was valued at USD 2.5 billion and is projected to reach USD 63.5 billion by 2034, growing at a CAGR of 38.2%. The market is showing strong long-term growth.

- North America led with over 39.2% share, contributing about USD 0.9 billion.

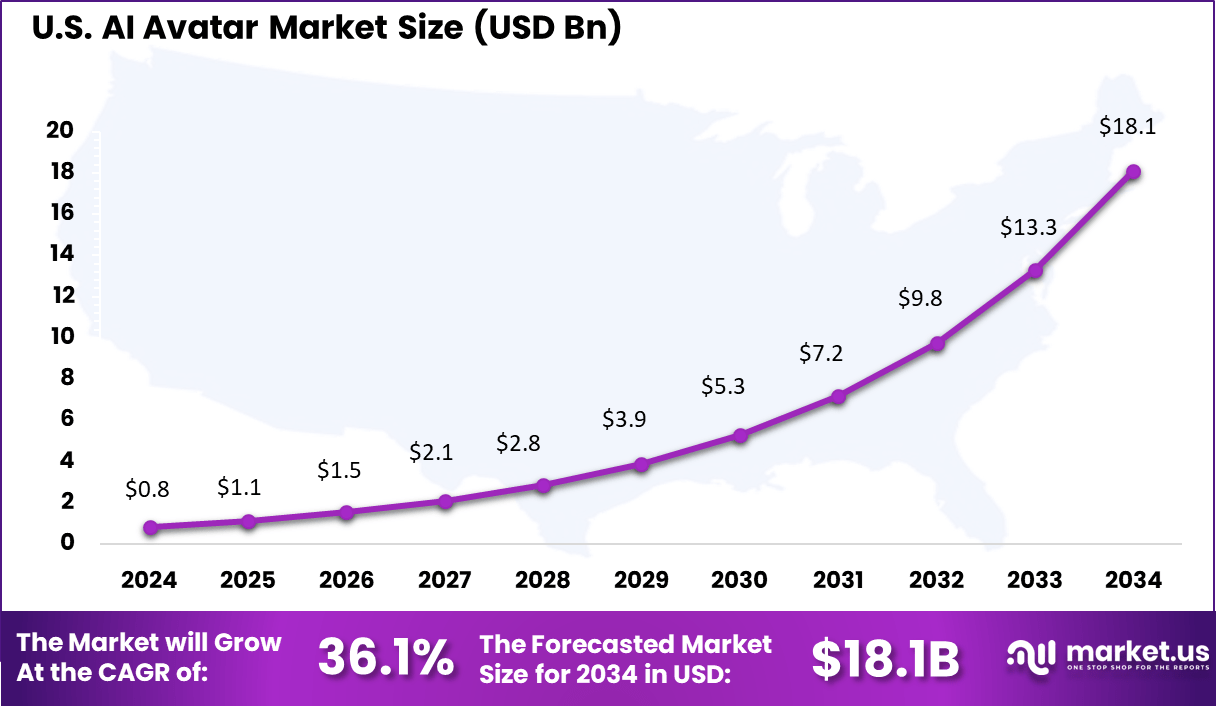

- The United States alone accounted for USD 0.83 billion and maintained a CAGR of 36.1%. The region remains the largest adopter.

- By platform, AI video generation platforms held 35.7% share in 2024. This reflects demand for automated, realistic video content.

- By degree of customization, preset avatars dominated at 40.0%. Businesses prefer quick and cost-effective options.

- By type, interactive avatars led the market with a commanding 62.6% share. Users are choosing more human-like, engaging solutions.

- By application, virtual agents and assistants accounted for 37.7%. Adoption is strong in customer service and personal help roles.

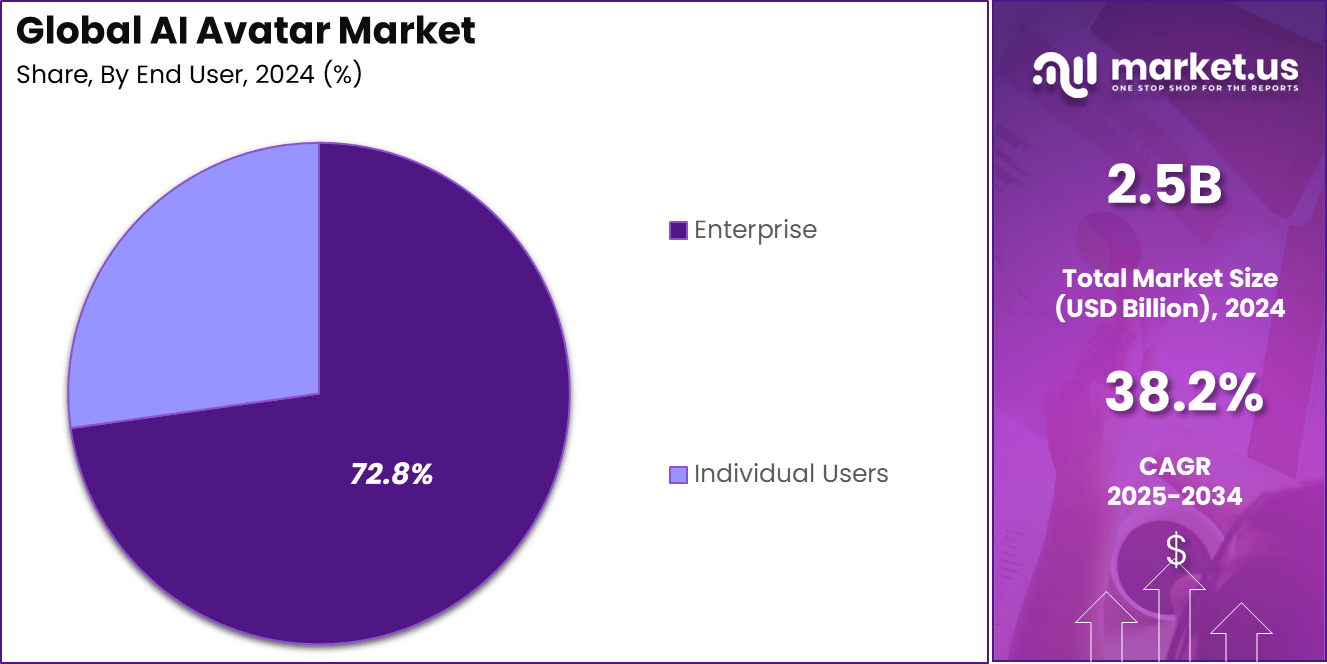

- Among end users, the enterprise segment held the largest share at 72.8%. Organizations are investing in digital workforce solutions.

- The market growth is driven by the need for scalable, efficient, and personalized virtual interaction globally.

US Market Size

The U.S. AI Avatar Market was valued at USD 0.8 Billion in 2024 and is anticipated to reach approximately USD 18.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 36.1% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 39.2% share and generating around USD 0.9 billion in revenue within the AI Avatar market. This leadership was strongly influenced by rapid technological integration across entertainment, education, and enterprise sectors.

The region has seen a sharp increase in the adoption of AI avatars in video production, customer engagement, and digital learning tools, primarily due to the presence of highly digitized infrastructure and a strong ecosystem of AI developers, cloud providers, and creative platforms.

Major tech players have also invested in AI-based avatar generation tools that cater to content creators, educators, and businesses alike, supporting faster commercialization. Furthermore, the growing consumer demand for hyper-personalized digital experiences has accelerated the use of interactive AI avatars in virtual communication, healthcare, and retail applications.

The rise of metaverse platforms and virtual influencers has also fueled the uptake of 3D avatars that mimic human gestures, speech, and emotions in real time. Government funding and institutional investments into AI and digital identity verification technologies have reinforced the market’s growth in sectors such as banking, healthcare, and defense.

By Platform Analysis

In 2024, AI Video Generation Platforms segment held a dominant market position, capturing more than a 35.7 % share and maintaining its leading stance. Growth in this segment is attributed to a surge in demand for automated video content across marketing, education, and entertainment sectors.

Adoption of these platforms is being driven by significant improvements in generative AI, which enable realistic voiceovers, dynamic scene transitions, and data‑driven personalization. The result is a solution that delivers professional‑quality video at a fraction of traditional production costs, making it highly appealing to organizations seeking swift, scalable content creation.

The leadership of AI Video Generation Platforms is reinforced by its ability to serve a wide range of use cases and by integration with existing digital ecosystems. In regions like Asia‑Pacific, substantial user bases and growing internet penetration have further propelled adoption rates.

Moreover, the platforms’ capacity to support multi‑language dubbing and tailored messaging bolsters their attractiveness for global campaigns. As a result, businesses deploying these tools report measurable gains in engagement and time‑to‑market, reinforcing the segment’s dominance in the AI Avatar landscape.

By Degree of Customization

In 2024, Preset Avatars segment held a dominant market position, capturing more than a 40.0 % share. This leadership reflects the appeal of ready-to-use avatar options that require minimal setup. Enterprises and individual users alike valued the simplicity and immediacy offered by these avatars.

They met essential needs such as virtual assistance, customer engagement, and digital events without the complexity or cost of bespoke development. As a result, uptake was rapid and widespread, solidifying the segment’s leading position within the AI Avatar market.

The prominence of Preset Avatars can be attributed to their reliable performance and ease of deployment. Organizations have increasingly prioritized solutions that integrate seamlessly into existing systems. Preset Avatars provide this through prebuilt personalities, voices, and interaction flows that can be utilized almost immediately.

By Type Analysis

In 2024, Interactive Avatars segment held a dominant market position, capturing more than a 62.6 % share and solidifying its status as the preferred avatar type. This segment achieved its lead through the integration of generative AI, real-time responsiveness, and emotionally aware interaction frameworks that offer immersive experiences.

Interactive avatars can mimic facial expressions, adapt to live conversation, and deliver nuanced emotional responses. These capabilities align well with use cases such as customer service, education, virtual events, and healthcare consultations, where real-time engagement and natural interaction enhance user satisfaction and effectiveness.

The segment’s dominance was further reinforced by advances in natural language processing and computer vision. Large-scale AI models now allow these avatars to understand context, remember user preferences, and respond in a human-like manner. Their integration with platforms such as VR/AR and spatial computing has also increased adoption, enabling deeply immersive experiences in both B2B and consumer-facing applications.

By Application Analysis

In 2024, Virtual Agents & Assistants segment held a dominant market position, capturing more than a 37.7 % share and reinforcing its central role in the AI Avatar landscape. This leadership stems from the segment’s ability to seamlessly integrate into existing customer-facing infrastructures – such as chatbots and voice-enabled systems – to deliver immediate, personalized support around the clock.

Virtual agents address common operational challenges by automating routine queries, facilitating transactions, and handling appointment scheduling. This efficiency leads to measurable gains in satisfaction and cost savings, making virtual agents the practical choice for organizations seeking both reliability and scale.

The segment’s prominence is further supported by advances in conversational AI and context-awareness, which allow virtual agents to maintain coherence across multi-turn interactions and adapt to evolving user needs. These capabilities significantly improve the quality of user experiences, performing far beyond static avatar models.

By End User Analysis

In 2024, Enterprise segment held a dominant market position, capturing more than a 72.8 % share and affirming its critical role in advancing AI Avatar deployment. This dominance is driven by widespread adoption across sectors such as media and entertainment, education, healthcare, retail, IT, banking, and automotive.

Enterprises have increasingly leveraged avatars to deliver scalable customer service, immersive learning modules, remote consultations, virtual showroom experiences, and secure telepresence. The diverse industrial integration reflects the segment’s flexibility and strategic importance in addressing complex organizational needs.

Enterprises benefit from the adaptability of AI Avatars to deliver consistent brand messaging, ensure regulatory compliance, and access advanced analytics. As these digital agents interact with large user bases, they generate deep insights on consumer behavior, operational bottlenecks, and service quality. These capabilities enable data-driven decision-making and continuous improvement.

Key Market Segments

By Platform

- AI Video Generation Platforms

- Interactive Digital Human Platforms

- Stylized Avatar & Social Media Tools

- 3D & Metaverse Avatars

By Degree of Customization

- Preset Avatars

- Partially Customizable Avatars

- Fully Customizable Avatars

By Type

- Interactive Avatars

- Noninteractive Avatars

By Application

- Virtual Agents & Assistants

- Virtual Characters

- Virtual Influencers

- Virtual Companions

By End User

- Enterprise

-

- Media & Entertainment

- Education

- Healthcare & Life Sciences

- Retail & E-commerce

- IT & Telecom

- BFSI

- Automotive

- Others

- Individual Users

-

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Market Dynamics

Category Analysis Emerging Trend A notable trend in the AI avatar domain is the integration of emotional intelligence into virtual companions. Recent advances in natural language processing and sentiment analysis are enabling avatars to detect user emotions and respond empathetically, effectively serving as digital wellbeing assistants in mental health and remote care settings. This trend is gaining momentum as users seek more humanized, relatable interactions in virtual environments and support platforms. Driver The primary driver fueling AI avatar adoption is the rising demand for hyper‑personalized digital interactions. Businesses are increasingly deploying avatars to deliver tailored experiences in customer service, education, and e‑commerce, where real‑time adaptability and contextual understanding enhance engagement and satisfaction. Restraint Trust issues, especially those related to the uncanny valley effect, remain a critical obstacle. When avatars are nearly – but not fully – humanlike, users may feel discomfort or mistrust, which can impair engagement. Additionally, concerns about privacy, deepfake misuse, and identity theft reduce confidence in deploying such avatars broadly, particularly in sensitive domains like healthcare and finance. Opportunity There is a clear opportunity in leveraging AI avatars as emotional wellness companions. As digital wellbeing becomes a priority, avatars that can offer empathetic dialogue and emotional support are increasingly valuable. Integrations with wearable devices, VR platforms, or mental health apps could elevate avatars into trusted daily companions, delivering scalable, personalized care. Challenge A significant challenge in this sector is ensuring scalability and performance under real‑world conditions. Deploying lifelike, emotionally sensitive avatars across many users simultaneously demands substantial computational and network resources. Issues such as latency, GPU requirements, and maintaining fluid interactions at scale represent ongoing obstacles. Key Player Analysis

Several key players are driving innovation in the AI Avatar market through advanced video synthesis, facial animation, and text-to-speech technologies. Companies such as Synthesia Limited, HeyGen, and D-ID AI Video have gained significant traction by offering AI video platforms that convert scripts into realistic avatars. These tools are widely used in enterprise training, marketing, and digital content creation.

Meanwhile, firms like GoAnimate, Inc., DeepBrain AI, Replika, and Powtoon.com, Inc. have carved niches by focusing on animated storytelling, emotional AI, and conversational agents. These companies support the growing need for interactive avatars across social media, therapy, and e-learning environments. Their tools often include customizable templates and emotion-driven responses, enhancing engagement in both business-to-consumer and business-to-business scenarios.

In addition, major tech players such as NVIDIA Corporation and Meta continue to influence the AI Avatar landscape by developing foundational technologies like real-time rendering, neural graphics, and immersive 3D engines. Startups like AKOOL, Soul Machines, UneeQ, Voki, and Prisma Labs are also expanding the market with novel avatar capabilities, including hyper-realistic facial movements and digital human interactions.

Top Key Players Covered

- Synthesia Limited

- HeyGen

- D-ID AI Video

- GoAnimate, Inc.

- NVIDIA Corporation

- Meta

- AKOOL

- Soul Machines

- UneeQ

- Replika

- Powtoon.com, Inc.

- DeepBrain AI

- Voki

- Prisma Labs

- Others

Recent Developments

- In March 2025, Microsoft partnered with D-ID to bring agentic AI avatars into Microsoft Teams and other enterprise applications. The integration is designed to improve internal and external communication by introducing lifelike, visually rich digital agents.

- In April 2025, Synthesia announced a strategic partnership with Shutterstock to strengthen its AI research by leveraging Shutterstock’s vast content library. This collaboration is intended to enhance the pre-training of Synthesia’s EXPRESS-2 model, which underpins its next generation of AI-powered avatars.

- In the same month, HeyGen and HubSpot extended their collaboration to further integrate AI-generated videos into HubSpot’s marketing and sales workflows. The enhanced integration allows businesses to create personalized, AI-driven videos automatically from existing contact data, eliminating the need for traditional filming or editing.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 63.5 Bn CAGR (2025-2034) 38.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (AI Video Generation Platforms, Interactive Digital Human Platforms, Stylized Avatar & Social Media Tools, 3D & Metaverse Avatars), By Degree of Customization (Preset Avatars, Partially Customizable Avatars, Fully Customizable Avatars), By Type (Interactive Avatars, Noninteractive Avatars), By Application (Virtual Agents & Assistants, Virtual Characters, Virtual Influencers, Virtual Companions), By End User (Enterprise (Media & Entertainment, Education, Healthcare & Life Sciences, Retail & E-commerce, IT & Telecom, BFSI, Automotive, Others), Individual Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Synthesia Limited, HeyGen, D-ID AI Video, GoAnimate, Inc., NVIDIA Corporation, Meta, AKOOL, Soul Machines, UneeQ, Replika, Powtoon.com, Inc., DeepBrain AI, Voki, Prisma Labs, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Synthesia Limited

- HeyGen

- D-ID AI Video

- GoAnimate, Inc.

- NVIDIA Corporation

- Meta

- AKOOL

- Soul Machines

- UneeQ

- Replika

- Powtoon.com, Inc.

- DeepBrain AI

- Voki

- Prisma Labs

- Others