Global Agricultural Machinery Maintenance Services Market Size, Share, And Industry Analysis Report By Service Type (Preventive Maintenance Services, Emergency Maintenance Services, Condition-Based Maintenance Services), By Ownership (Individual Farmers, Corporate Farms), By Operational Size (Small-Scale Operations, Medium-Sized Farms, Large Sized Farms), By Application (Crops, Livestock), By Equipment Type (Tractors and Power Units, Harvester, Planting and Seeding Equipment, Irrigation Systems), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174586

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

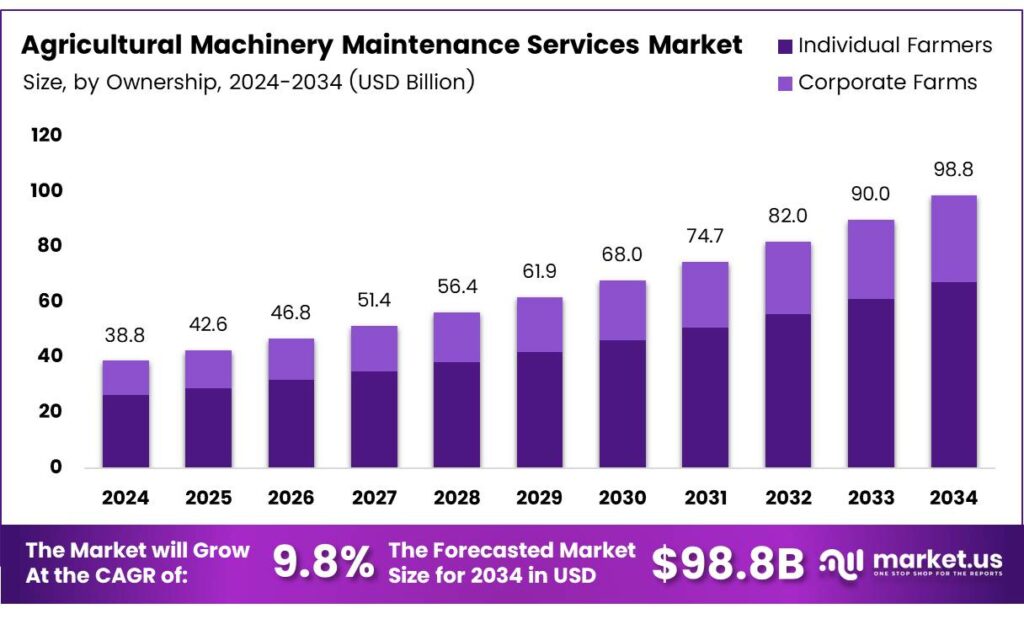

The Global Agricultural Machinery Maintenance Services Market size is expected to be worth around USD 98.8 billion by 2034, from USD 38.8 billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034.

The Agricultural Machinery Maintenance Services Market refers to organized maintenance, repair, and performance-optimization services for smart farm machinery used across crop and livestock operations. It includes preventive, corrective, and predictive maintenance designed to reduce downtime and enhance operational efficiency. As farms modernize, this service ecosystem becomes essential for sustaining productivity and lowering lifecycle costs.

The market supports tractors, harvesters, irrigation systems, tillage tools, and spraying equipment, enabling farmers to maintain consistent output. Service providers offer lubrication, mechanical checks, diagnostics, and digital monitoring to extend asset life. As mechanization increases globally, farmers increasingly depend on structured maintenance to protect expensive machinery investments and ensure seamless seasonal operations.

- A tractor weighing 7300 kg with 155 CV, 6 cylinders, and four-wheel drive requires lifecycle inventory assessments for its maintenance and manufacturing demands. The study models tractors within the 100–199 CV category, representing 70% of France’s annual sales. Lifecycle inventories consider 7200-hour and 12000-hour operational lifetimes.

The Agricultural Machinery Maintenance Services Market is expanding as farms transition toward equipment-centric operations requiring predictable service cycles. Increasing dependence on high-powered tractors and precision machinery encourages farmers to adopt long-term maintenance contracts. This trend aligns with rising operational efficiencies demanded across global agriculture markets.

Key Takeaways

- The Global Agricultural Machinery Maintenance Services Market is projected to reach USD 98.8 billion by 2034, growing from USD 38.8 billion in 2024, at a CAGR of 9.8% during 2025–2034.

- Corrective Maintenance Services lead with a 38.9% market share in 2025.

- Individual Farmers dominate the segment with a 67.1% share in 2025.

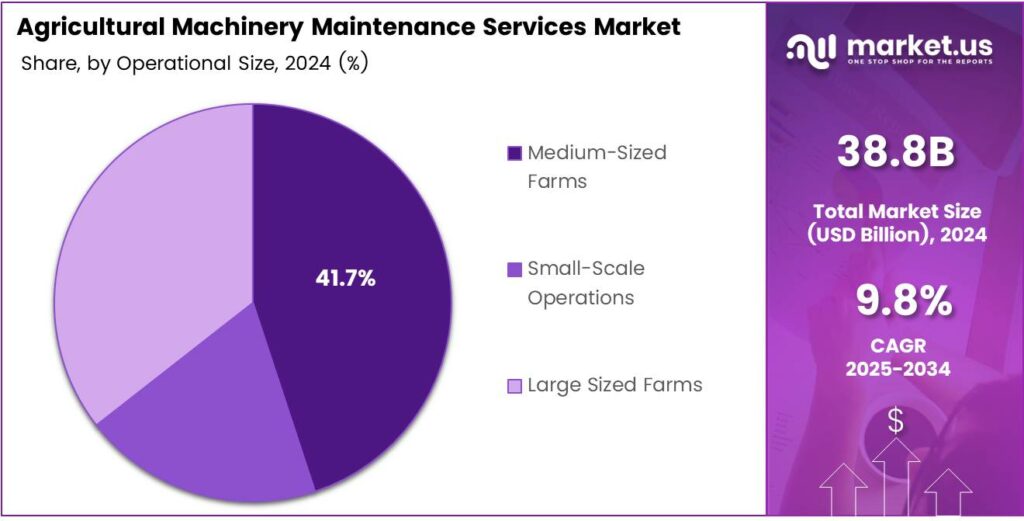

- Medium-Sized Farms hold the highest share at 41.7% in 2025.

- Crops account for the largest share at 89.2% in 2025.

- Tractors and Power Units dominate with 37.5% share in 2025.

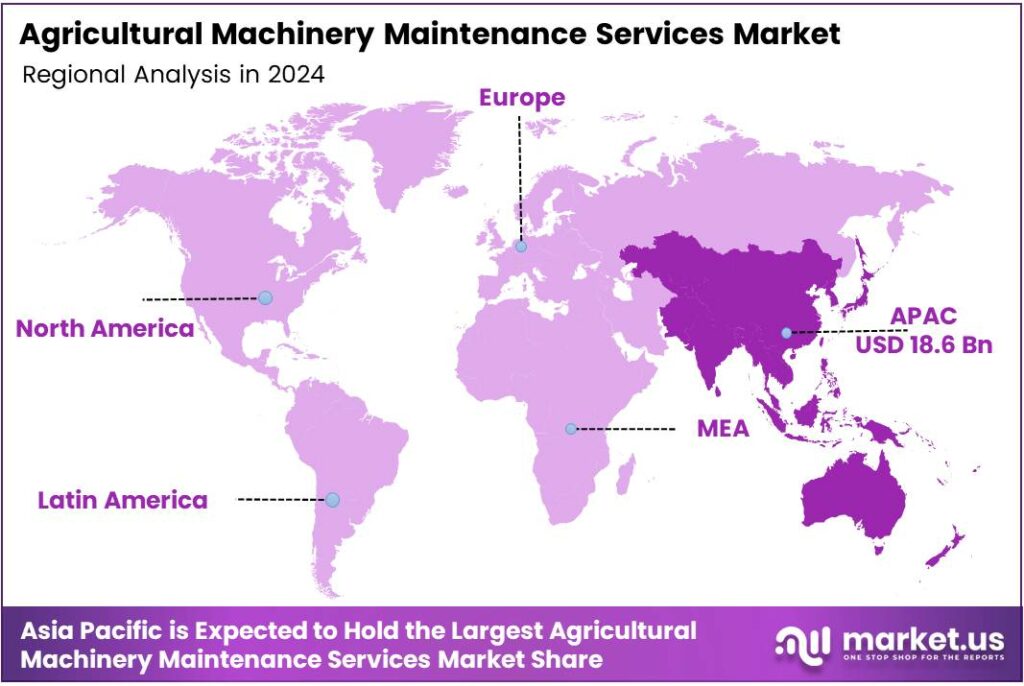

- Asia Pacific leads the market with a 48.1% share valued at USD 18.6 billion in 2025.

By Service Type Analysis

Corrective Maintenance Services dominate with 38.9% due to frequent equipment breakdowns and urgent repair needs.

In 2025, Corrective Maintenance Services held a dominant market position in the By Service Type Analysis segment of the Agricultural Machinery Maintenance Services Market, with a 38.9% share. This segment leads as farms often require fast repair actions to reduce downtime and restore operations quickly.

Preventive Maintenance Services continue expanding as farmers increasingly adopt scheduled servicing. This shift reduces unexpected failures and improves machine lifespan. Growing awareness, combined with digital monitoring tools, helps farmers plan periodic checks that cut long-term repair costs and enhance operational continuity across diverse agricultural environments.

Predictive Maintenance Services gain traction as connected sensors and analytics enable early issue detection. Farmers benefit from real-time insights that forecast component wear. This capability reduces unplanned interruptions, optimizes spare part usage, and strengthens equipment reliability across intensive field operations where timing and performance consistency remain crucial.

Emergency Maintenance Services remain essential for sudden machine failures during peak farming seasons. Farms depend on fast-response teams to fix critical breakdowns. As agricultural cycles are time-sensitive, this service helps prevent production delays and protects overall crop yield quality, especially during harvesting and planting activities.

By Ownership Analysis

Individual Farmers dominate with 67.1% due to widespread independent machinery ownership.

In 2025, Individual Farmers held a dominant market position in the By Ownership Analysis segment of the Agricultural Machinery Maintenance Services Market, with a 67.1% share. This leadership reflects their large population, direct machinery usage, and higher demand for routine service support to maintain consistent field productivity throughout seasonal operations.

Corporate Farms continue strengthening their service reliance as they operate larger fleets needing scheduled and technology-driven maintenance. These farms prefer structured contracts and modern diagnostic tools that reduce failures. Their expansion into high-value crops and large-acreage farming further encourages investments in systematic upkeep to sustain operational efficiency and reduce machine downtime.

By Operational Size Analysis

Medium-Sized Farms dominate with 41.7% due to balanced scale and consistent machinery utilization.

In 2025, Medium-Sized Farms held a dominant market position in the By Operational Size Analysis segment of the Agricultural Machinery Maintenance Services Market, with a 41.7% share. Their moderate fleet size demands frequent servicing, and structured maintenance routines help prevent costly failures during intensive seasonal workloads.

Small-Scale Operations increasingly seek cost-effective service solutions. These farms rely heavily on older machinery, making maintenance important for avoiding disruptions. Affordable repair packages and mobile technicians support their needs, helping them maintain productivity even with limited resources and varying crop cycles across rural regions.

Large Sized Farms depend on extensive, high-capacity machinery fleets. They prioritize advanced servicing methods such as predictive analytics and planned overhauls. Since downtime can cause significant financial losses, these farms seek long-term maintenance contracts that improve uptime, extend machine life, and safeguard large-scale production efficiency.

By Application Analysis

Crops dominate with 89.2% due to high machinery intensity in crop cultivation processes.

In 2025, Crops held a dominant market position in the By Application Analysis segment of the Agricultural Machinery Maintenance Services Market, with a high 89.2% share. Crop farming requires tractors, harvesters, and multiple tools, resulting in frequent servicing to maintain performance during soil preparation, planting, and harvesting.

Livestock farms depend on machinery for feed preparation, manure handling, and routine barn operations. Though their machinery usage is lower than that of crop farming, the need for reliable equipment remains vital. Regular maintenance ensures that feeding systems, loaders, and utility vehicles operate smoothly, supporting consistent animal care and farm productivity.

By Equipment Type Analysis

Tractors and Power Units dominate with 37.5% due to their central role in field operations.

In 2025, Tractors and Power Units held a dominant market position in the By Equipment Type Analysis segment of the Agricultural Machinery Maintenance Services Market, with a 37.5% share. These machines perform core field activities, making regular maintenance essential for preventing unexpected failures and ensuring stable farm operations.

Harvester maintenance demand grows as farms rely on combines for efficient harvesting. Timely servicing helps avoid crop losses and enhances grain quality. Because harvesting windows are short, farmers prioritize quick diagnostics, blade adjustments, and component checks to keep machines operating at peak performance.

Tillage and Soil Preparation Equipment require routine inspection due to continuous exposure to soil stress. Wear on discs, ploughs, and blades increases servicing needs. Farmers depend on maintenance services to sustain field readiness and preserve machine strength for demanding pre-planting operations across diverse soil types.

Planting and Seeding Equipment need precise calibration and part replacements. These machines influence crop uniformity, making upkeep crucial. Maintenance ensures accurate seed placement, stable seedbed formation, and smoother functioning during planting seasons, helping farmers achieve consistent yields and efficient fieldwork execution.

Key Market Segments

By Service Type

- Preventive Maintenance Services

- Corrective Maintenance Services

- Predictive Maintenance Services

- Emergency Maintenance Services

- Condition-Based Maintenance Services

By Ownership

- Individual Farmers

- Corporate Farms

By Operational Size

- Small-Scale Operations

- Medium-Sized Farms

- Large-Sized Farms

By Application

- Crops

- Livestock

By Equipment Type

- Tractors and Power Units

- Harvester

- Tillage and Soil Preparation Equipment

- Planting and Seeding Equipment

- Irrigation Systems

- Spraying and Application Equipment

Emerging Trends

Digital Service Platforms and Predictive Maintenance Shape Market Trends

One of the key trending factors in the agricultural machinery maintenance services market is the use of digital tools for service management. Mobile apps and online platforms are helping farmers book services, track maintenance schedules, and access technical support easily.

- One of the strongest indicators of this shift comes from John Deere, which confirmed that more than 500,000 machines are connected through its Operations Center worldwide as of 2024, allowing farmers to monitor performance and schedule maintenance before a breakdown occurs.

Predictive maintenance is also gaining attention. Using machine data to identify potential failures before breakdowns helps reduce repair costs and machine downtime. This trend supports more efficient farm operations. Remote diagnostics and on-site service vans are becoming more common, improving service reach in rural areas.

Drivers

Rising Mechanization in Agriculture Drives Maintenance Service Demand

The growing use of tractors, harvesters, and advanced farm equipment is a major driver for the agricultural machinery maintenance services market. Farmers are increasingly relying on machines to improve productivity and reduce labor dependency. Regular servicing has become essential to keep equipment running efficiently during peak farming seasons.

- Higher machine utilization leads to faster wear and tear of components such as engines, hydraulics, and transmission systems. This naturally increases the need for timely maintenance and repair services. The European Commission’s Digital Agriculture initiative continues to support telematics adoption across agriculture, investing €185 million under rural modernization programs to boost sensor-based management of machinery.

Rising farm sizes and commercial farming practices are pushing farmers to invest more in professional maintenance services rather than handling repairs on their own. Government support for farm mechanization in many regions further adds to the installed base of machinery.

Restraints

High Service Costs and Skill Gaps Restrain Market Expansion

One of the key restraints in the agricultural machinery maintenance services market is the high cost of professional repair and servicing. For small and marginal farmers, regular maintenance expenses can feel burdensome, especially during periods of low farm income. This often leads to delayed servicing, which impacts service market growth.

- The U.S. Department of Agriculture (USDA) has repeatedly highlighted how digital agriculture is rising quickly, noting that farms using connected equipment and data systems reported a 47% increase in operational efficiency under USDA’s precision agriculture updates.

Inconsistent service availability and long repair turnaround times also reduce farmer confidence in third-party maintenance providers. In some cases, farmers prefer temporary fixes instead of full servicing to save money. These cost pressures and workforce challenges together slow down the wider adoption of organized maintenance services.

Growth Factors

Expansion of Precision Farming Creates New Growth Opportunities

The increasing adoption of precision farming and smart agricultural equipment creates strong growth opportunities for maintenance service providers. Advanced machines with sensors, GPS, and digital controls require specialized servicing and regular calibration. This opens space for value-added maintenance solutions.

- The U.S. Department of Agriculture also highlights rising use of advanced tractors and harvesters. USDA’s Farm Production Expenditures report shows that American farmers spent USD 16.3 billion on machinery and maintenance, making it one of the largest expenditure categories in the sector.

The rise of equipment leasing and rental models increases the need for frequent inspections and servicing. Partnerships with equipment manufacturers and dealers can further strengthen service networks. As farming becomes more technology-driven, demand for professional and reliable maintenance services is expected to rise steadily.

Regional Analysis

Asia Pacific Dominates the Agricultural Machinery Maintenance Services Market with a Market Share of 48.1%, Valued at USD 18.6 Billion

In 2025, the Asia Pacific led the Agricultural Machinery Maintenance Services Market, supported by rapid mechanization, expanding farm sizes, and rising adoption of service-based maintenance models. With a dominant share of 48.1% and a market valuation of USD 18.6 billion, the region benefits from government-backed farm modernization programs and increasing use of tractors, harvesters, and precision equipment.

North America shows steady growth driven by high mechanization rates, advanced digital agriculture, and strong adoption of precision maintenance technologies. The region benefits from widespread use of telematics-based diagnostics and subscription-driven maintenance packages. Increasing labor shortages and rising demand for automation in farming further stimulate market expansion across the U.S. and Canada.

Europe’s market performance is influenced by strict equipment regulations, aging tractor fleets, and a strong push toward sustainable, efficient machinery usage. EU farm modernization funds and cross-border agricultural technology initiatives support continuous maintenance adoption. High awareness of predictive maintenance and digital diagnostics enhances service demand across Germany, France, Spain, and Italy.

The U.S. market benefits from advanced farm consolidation, high usage of precision agriculture, and strong emphasis on maximizing machinery uptime. Increasing adoption of predictive analytics, sensor-based monitoring, and dealer-backed service agreements drives industry growth. Continuous investments in high-horsepower equipment and automation strengthen the need for robust maintenance services nationwide.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, John Deere continues to set the tone for agricultural machinery maintenance services by keeping uptime as the center of its customer promise. Its advantage comes from deep dealer coverage and a mature service ecosystem that links parts availability, trained technicians, and field support into one workflow. This makes it easier for large farms and contractors to plan maintenance windows, reduce unplanned stoppages, and protect seasonal productivity.

AGCO Corporation, the maintenance story in 2025 is shaped by a practical, fleet-focused approach across mixed-brand farm operations. The company’s strength lies in supporting diverse equipment needs, where service packages, warranty-linked maintenance, and strong dealer execution can influence repeat purchasing. AGCO is competing on reliability plus service responsiveness, especially where harvest and planting schedules leave little room for downtime.

Kubota Corporation, the service opportunity is closely tied to compact and mid-range equipment users who demand fast turnaround and predictable costs. The company benefits from a broad installed base, which naturally feeds recurring demand for preventive servicing, parts replacement, and workshop-led maintenance. Kubota’s maintenance positioning is often associated with practical serviceability and strong support for utility-focused farm tasks.

LAAS Group remains highly relevant in service-led differentiation for high-performance harvesting and forage systems. Specialized technician capability and precise parts support during peak operating periods. In markets where harvest timing is critical, CLAAS’s maintenance execution can directly influence customer retention and premium equipment preference.

Top Key Players in the Market

- John Deere

- AGCO Corporation

- Kubota Corporation

- CLAAS Group

- Mahindra and Mahindra

- Escorts Kubota Limited

- SDF Group

- JCB

- Yanmar Holdings

- Stara

Recent Developments

- In 2024, Deere introduced Operations Center PRO Service to help owners (and independent techs, with permission) diagnose, repair, and reprogram equipment, including access to machine-specific health insights, maintenance plans, and software updates aimed at reducing downtime and speeding service decisions.

- In 2024, AGCO launched FarmerCore as a next-gen support model designed to improve the ownership experience with an on-farm mindset, smarter network coverage, and digital engagement, directly influencing how maintenance and service are delivered via dealers.

Report Scope

Report Features Description Market Value (2024) USD 38.8 Billion Forecast Revenue (2034) USD 98.8 Billion CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Preventive Maintenance Services, Corrective Maintenance Services, Predictive Maintenance Services, Emergency Maintenance Services, Condition-Based Maintenance Services), By Ownership (Individual Farmers, Corporate Farms), By Operational Size (Small-Scale Operations, Medium-Sized Farms, Large Sized Farms), By Application (Crops, Livestock), By Equipment Type (Tractors and Power Units, Harvester, Tillage and Soil Preparation Equipment, Planting and Seeding Equipment, Irrigation Systems, Spraying and Application Equipment) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape John Deere, AGCO Corporation, Kubota Corporation, CLAAS Group, Mahindra and Mahindra, Escorts Kubota Limited, SDF Group, JCB, Yanmar Holdings, Stara Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Agricultural Machinery Maintenance Services MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Agricultural Machinery Maintenance Services MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- John Deere

- AGCO Corporation

- Kubota Corporation

- CLAAS Group

- Mahindra and Mahindra

- Escorts Kubota Limited

- SDF Group

- JCB

- Yanmar Holdings

- Stara