Global Advanced Ceramics Market By Material Type (Titanate, Alumina, Ferrite, Zirconate, Other Material Types), By Application (Monolithic Ceramics, Ceramic Coatings Ceramic Filters, Others), By End-use Industry (Electrical & Electronics, Transportation, Medical, Defence & Security, Environmental, Chemical, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 32209

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

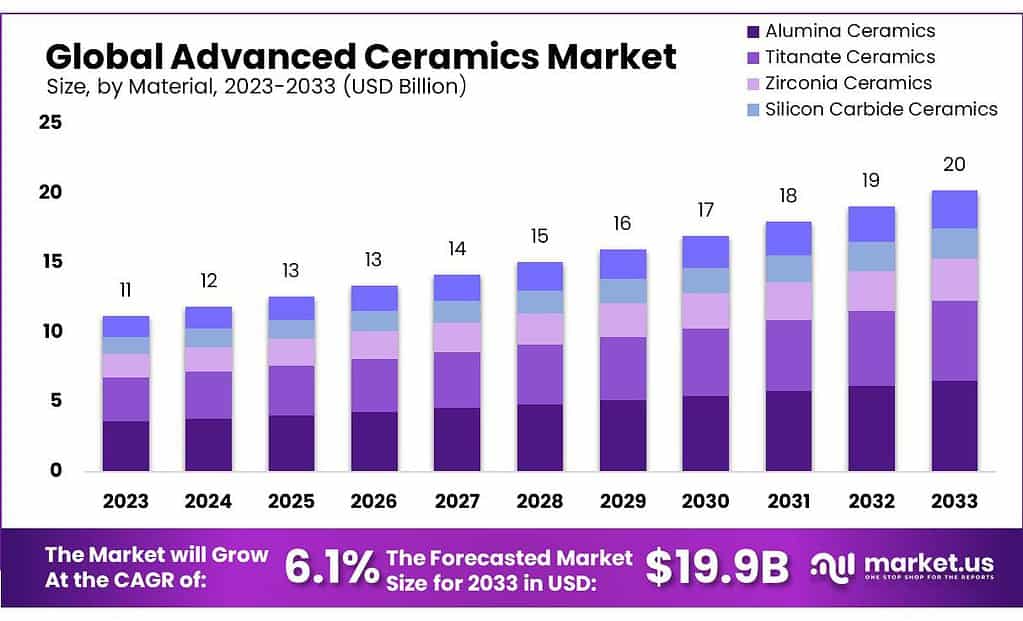

The global Advanced Ceramics Market size is expected to be worth around USD 19.9 billion by 2033, from USD 11.2 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

Market growth is expected to be boosted by the increasing use of advanced ceramics in different applications and the rise in the medical and telecom sectors.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth: The Advanced Ceramics Market is projected to expand significantly, with an estimated worth of USD 19.9 billion by 2033, showcasing a CAGR of 6.1% from 2023’s USD 11.2 billion.

- Material Trends: Alumina Dominance: Alumina held the largest revenue share in 2023 (over 32.2%) and is expected to persist due to its suitability for extreme applications like mechanical seals and ballistic armor. Titanate Growth: Titanate is poised for rapid growth, particularly in wireless communication technologies, attributed to its use in antennas and resonators.

- Application Insights: Monolithic Ceramics Lead: Accounting for over 74.4% in 2023, monolithic ceramics are ideal for high-temperature resistance and find extensive use in electronic devices and vehicles. Ceramic Matrix Composites (CMCs): Anticipated to experience the fastest growth rate (5.3%), CMCs offer enhanced properties like strength and thermal shock resistance, utilized notably in the aerospace and automotive sectors.

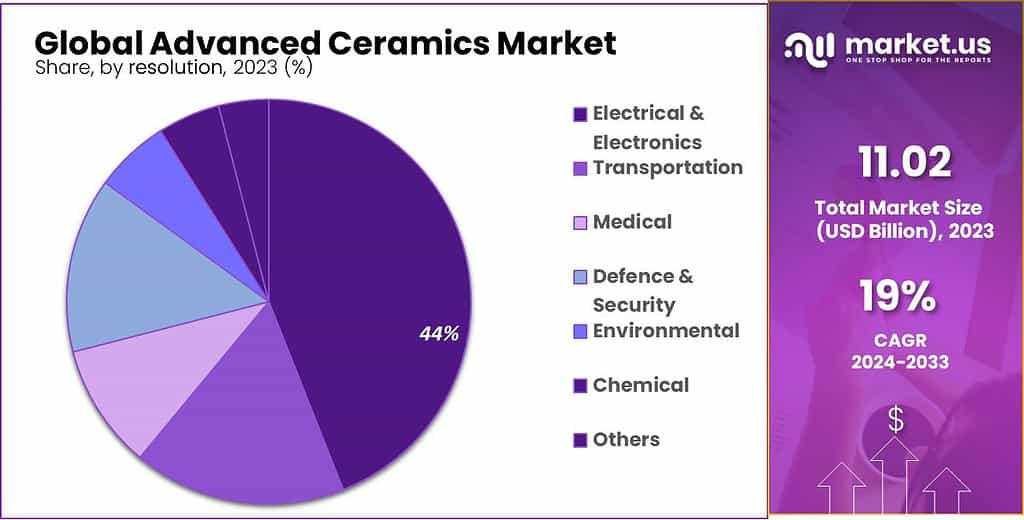

- End-Use Industry Dynamics: Electronics Dominance: Electronic devices contributed 44.1% to the total revenue in 2023 and are expected to maintain growth, driven by increased investments in electronics. Bio Ceramics Surge: Expected to witness the fastest growth, particularly in the medical field for applications like dental implants and replacement parts for surgeries.

- Market Drivers and Restraints: Rising Demand in Medical and Electronics: Advanced ceramics’ increased use in medical devices and electronics is a major growth driver. Brittle Nature Challenge: The inherent brittleness of these materials presents a challenge, especially in high-pressure or impact-prone environments.

- Opportunities and Challenges: Nanotechnology Adoption: Advanced ceramics find applications in nanotechnology, offering strength and lightness, particularly in the aerospace and automotive industries. Production Cost Challenges: High production costs pose a challenge to the wider adoption of advanced ceramics, necessitating cost-effective production methods.

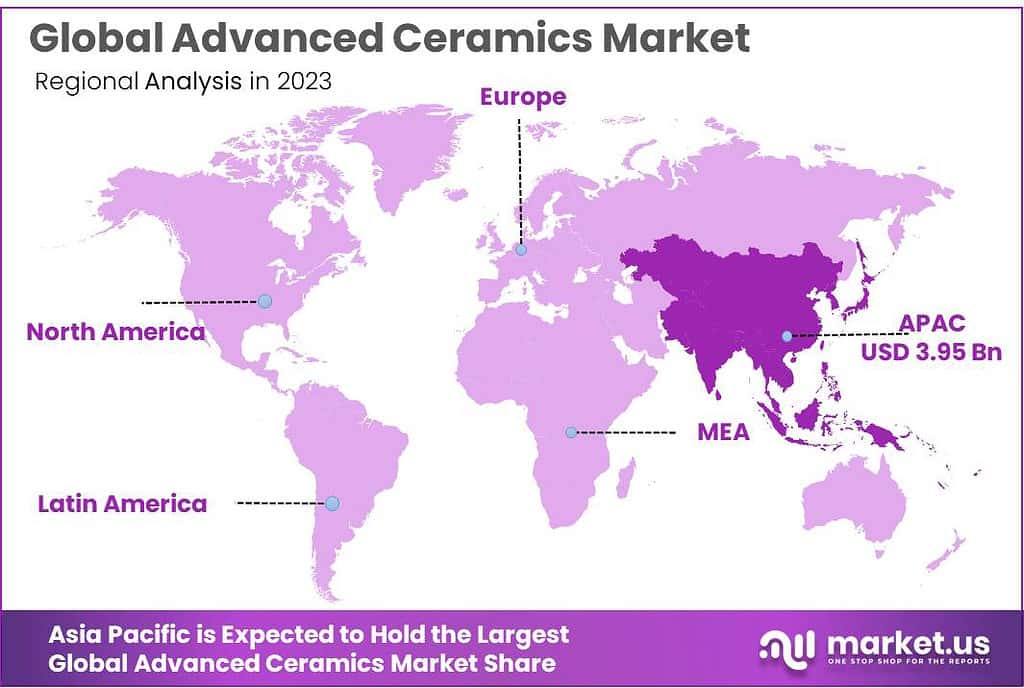

- Regional Analysis: Asia Pacific Dominance: The Asia Pacific held the largest revenue share in 2023 (35.9%) and is expected to grow further, driven by investments in EVs and medical equipment. North America’s Significant Share: North America accounted for a large revenue share, with growth stimulated by flourishing electronics, medical, and EV industries.

Material Type Analysis

In 2023, Alumina accounted for the largest revenue share at over 32.2%. This trend is expected to continue in the future. Advanced ceramics made from alumina are suitable for extreme applications, which require characteristics like thermal stability and wear resistance. These include mechanical seals, ballistic armor, and semiconductor parts.

The fastest expected growth rate for titanate over the forecast period is slated to be 1. This product is used in antennas and resonators. Today’s world has made titanium-based materials essential components of the dielectric resonators used in microwave communication systems. Segment growth will be driven by increasing investments in wireless communication, particularly after the COVID-19 pandemic.

By Application

Monolithic, which held the largest revenue share at over 74.4% in 2023, is expected to continue dominating the market for the next five years. It is ideal for use in electronic devices and vehicles because of its high-temperature resistance, durability, and reliability.

Ceramic matrix composites (CMCs), are expected to experience the fastest growth rate at 5.3% during the forecast period. These composites have a matrix and reinforcement material that are both ceramic. The combination of different materials gives them enhanced properties. CMCs are light, strong, and have excellent thermal shock properties.

Mitsubishi Chemical Corporation, an American chemical corporation, announced 2021 the creation of its CMC material. It is a mixture of carbon fiber and metal. It has high molding capabilities and low cost, but without sacrificing features like wear resistance, lightweight, and resistance to heat and rigidity. It is used in brake materials for industrial machine parts and mobility.

Note: Actual Numbers Might Vary In The Final Report

By End-use Industry

In 2023, electronic devices accounted for 44.1% of the total revenue. This trend is expected to continue in the future. It is used extensively in smartphones, TV sets, computers, as well as consumer appliances. The segment is expected to grow due to increased investments in electronics over the forecast period.

Reliance Industries, for example, announced in 2022 that it would invest up to US$ 221, million in Sanmina in the U.S. to establish a joint venture to increase its electronics production. This investment will create an Indian electronics manufacturing center that caters to the technology infrastructure needed for various industries, including aerospace, defense, healthcare, and medical systems.

Bio ceramics is expected to experience the fastest growth over the forecast period. This is due to the increasing importance of the medical industry in different countries. It is used in dental implants, and as replacement parts for knee and hip surgeries. Bioceramic is also being used in accessories. SWATCH launched the first-ever bio-ceramic watch in 2021 with its BIG BOLD series.

Маrkеt Ѕеgmеntѕ

By Material Type

- Titanate

- Alumina

- Ferrite

- Zirconate

- Other Material Types

By Application

- Monolithic Ceramics

- Ceramic Coatings Ceramic Filters

- Others

By End-use Industry

- Electrical & Electronics

- Transportation

- Medical

- Defence & Security

- Environmental

- Chemical

- Others

Drivers

Rising demand from medical & electronics sectors

Advanced ceramics are special materials used in lots of medical stuff like implants, sensors, and artificial joints for hips and knees. They’re also in things like pacemakers, heart pumps, and tools for giving medicine.

These ceramics are super helpful because they don’t get damaged easily by high heat or harsh chemicals. So, they’re perfect for medical devices that need to work well even in tough conditions. The medical field is getting bigger, and that means the need for these ceramics is growing worldwide.

Doctors like using advanced ceramics for replacing joints because these materials don’t usually cause a reaction in the body. In dentistry, these ceramics are great because they look natural. Dentists have been using them to make teeth look better for a long time. The companies that make these ceramics are making more types specifically for medical uses.

Restraints

Brittle nature of advanced ceramics

Advanced ceramics, like alumina, zirconia, and silicon carbide, are pretty fragile materials. They’re not great at handling pulling forces and can break easily, especially in certain situations. This brittleness can be a problem in places where things might get hit hard or have a lot of pressure or shaking.

Opportunity

Increasing use in nanotechnology

Advanced ceramics have become a big deal in nanotechnology, where really tiny stuff is a big deal. They’re using these ceramics that are smaller than 100 nanometers (super tiny!) in lots of cool ways.

They’re making things better in fields like aerospace and cars by mixing these tiny ceramic particles with plastics or metals. This mix makes materials stronger and lighter, which is great for building things that need to be tough but not heavy, like airplane parts or car components.

Challenges

High production cost of advanced ceramics

Making advanced ceramics can cost a lot more than regular materials. It’s because they need special equipment and really good raw materials.

This makes them pricier, which can be a problem in industries where keeping costs down is really important. Figuring out ways to make them cheaper and finding different materials to use is a big challenge in making advanced ceramics more affordable.

Geopolitical and Recession Impact Analysis

Impact of Geopolitics

- Global Material Access: Geopolitical tensions may impact the supply of raw materials crucial for advanced ceramics production. Disputes over resources or trade routes can disrupt the availability of materials, affecting the production and distribution of advanced ceramics globally.

- Collaborative Innovation: Geopolitical stability or instability can influence collaborations among nations or companies in advancing advanced ceramics technology. Positive geopolitical relations can encourage joint projects and knowledge sharing, while conflicts might hinder such collaborations, slowing down technological progress.

- Trade Regulations and Material Restrictions: Changes in trade policies or restrictions on materials essential for advanced ceramics manufacturing can affect their availability and pricing. Export limitations might disrupt the supply chain, impacting the market competitiveness of advanced ceramics. National

- Independence Strategies: Geopolitical factors often drive countries to seek independence in critical industries. Advanced ceramics might play a role in this strategy, with nations investing in domestic production, potentially reshaping the global market.

Impact of Recession

- Research Funding Reduction: Economic downturns can lead to decreased funding for R&D in the advanced ceramics sector. Both public and private sectors might cut investments in research projects, slowing down innovation.

- Infrastructure Investment Slowdown: Recessions may impact investments in advanced ceramics production infrastructure. Governments and private entities might delay or reduce infrastructure projects, affecting market growth.

- Fluctuating Demand: Economic downturns can cause demand fluctuations for advanced ceramics, particularly in industries like manufacturing and construction. Changes in industrial activities and consumer spending can influence market demand.

- Supply Chain Disruptions: Recessions can disrupt global supply chains for advanced ceramics, affecting the availability of crucial components. Sourcing challenges might lead to project delays, impacting market growth.

Regional Analysis

The Asia Pacific held the largest revenue share at 35.9% in 2023, and it is expected to continue its lead in the future. The market is expected to grow due to increased investments in EVs and medical equipment. Seven factories were built at the Medical Devices Park, Telangana in India in 2021 by seven companies.

In 2021, North America accounted for a large revenue share. Market growth is expected to be stimulated by the flourishing electronics, medical and EV industries. Market growth will be further boosted by the demand for high-quality semiconductors capable of ultra-high frequency signal transmission, which ensures better connectivity.

Note: Actual Numbers Might Vary In The Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Markets are characterized by established players which increases competition. Many market players at different stages of the value chain observe this integration. Companies are also taking strategic steps to increase their market share and stay ahead of the competition, such as acquisitions and new product development.

Fralock Holdings, LLC purchased Ceramic Tech Incorporated in May 2021. This company is involved in pre-fired pressing, pressing, sintering, creating specialized formulations, grinding for global OEMs, and sintering.

The acquisition also included Strata met Advanced Materials which is a company that develops high-purity semiconductor-grade ceramic materials. The following are some of the most prominent players in global advanced ceramics markets:

Market Key Players

- The 3M Company.

- AGC Ceramics Co., Ltd.

- CeramTec GmbH

- CoorsTek Inc.

- Elan Technology

- KYOCERA Corporation

- Morgan Advanced Materials

- Murata Manufacturing Co., Ltd.

- Nishimura Advanced Ceramics Co., Ltd.

- Ortech Advanced Ceramics

- Other Key Players

Recent Development

In April 2022, Kyocera reached an agreement to acquire about 37 acres of land for a new smart factory at the Minami Shaaya Industrial Park in Ishayu City, Nagasaki Prefecture. Kyocera is designing this new factory for fine ceramic components production, set to start operating in 2026, in order to meet the growing demand in the electronics industry and advanced semiconductor technology.

In May 2022, Ceram Tec developed a new product under the name AlN HP. It is a highperformance substrate made of aluminum nitride. The newly launched AlN HP substrate

offers 40 percent more flexural strength than the previous generation of AlN substrates.In March 2022, Ceram Tec expanded its non-oxide ceramic portfolio by launching LKT 100 ceramic. The newly developed material offers high efficiency, excellent wear resistance, and high notch sensitivity.

Report Scope

Report Features Description Market Value (2023) USD 11.2 Billion Forecast Revenue (2033) USD 19.9 Billion CAGR (2023-2032) 6.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Titanate, Alumina, Ferrite, Zirconate, Other Material Types), By Application (Monolithic Ceramics, Ceramic Coatings Ceramic Filters, Others), By End-use Industry (Electrical & Electronics, Transportation, Medical, Defence & Security, Environmental, Chemical, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape The 3M Company, AGC Ceramics Co., Ltd., CeramTec GmbH, CoorsTek Inc., Elan Technology, KYOCERA Corporation, Morgan Advanced Materials, Murata Manufacturing Co., Ltd., Nishimura Advanced Ceramics Co., Ltd., Ortech Advanced Ceramics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are advanced ceramics market?Advanced ceramics are specialized materials known for their exceptional properties like high strength, hardness, heat resistance, and chemical stability. They are used in various industries for applications requiring superior performance compared to traditional materials.

Why are advanced ceramics preferred in certain industries?Their unique properties, including resistance to high temperatures and corrosion, make them ideal for applications where conventional materials might fail. For instance, in medical implants, their biocompatibility and durability are crucial.

How is the geopolitical landscape affecting the advanced ceramics market?Geopolitical tensions can impact the supply chain of raw materials necessary for advanced ceramics production. Disputes over resources or trade routes might disrupt the availability of materials, affecting global production and distribution.

-

-

- The 3M Company.

- AGC Ceramics Co., Ltd.

- CeramTec GmbH

- CoorsTek Inc.

- Elan Technology

- KYOCERA Corporation

- Morgan Advanced Materials

- Murata Manufacturing Co., Ltd.

- Nishimura Advanced Ceramics Co., Ltd.

- Ortech Advanced Ceramics

- Other Key Players