Global Advanced At-home Biomarker Testing Market By Product Type (Metabolic Biomarkers, Genetic Biomarkers, Cancer Biomarkers, and Hormonal Biomarkers), By Technology (Immunoassays (ELISA), Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), and Lateral Flow Assays (LFA)), By Application (Diabetes & Metabolic Disorders, Cardiovascular Diseases, Cancer, and Autoimmune Diseases), By Sample Type (Blood, Urine, Saliva, and Buccal Swab), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170318

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

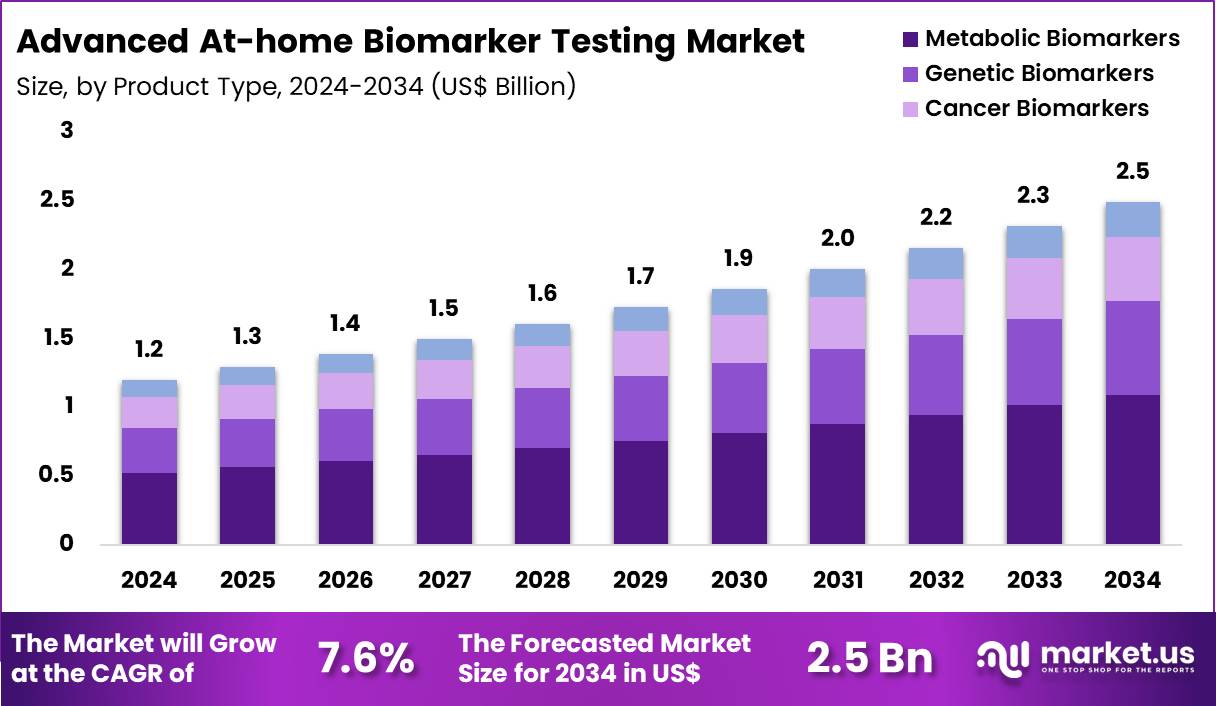

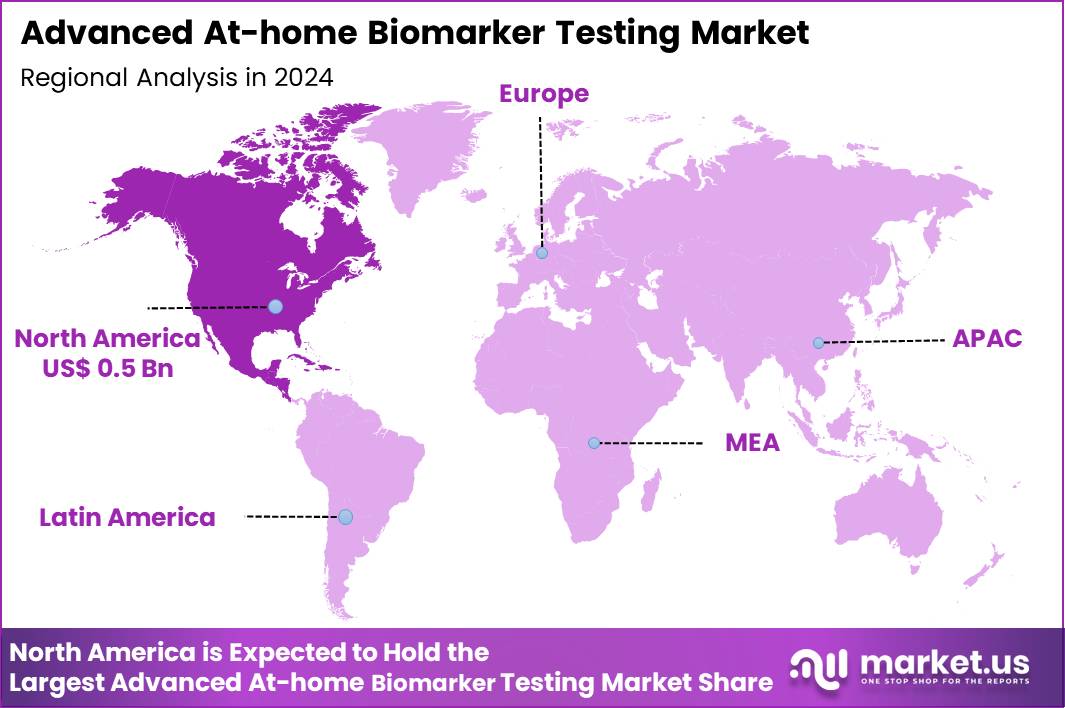

The Global Advanced At-home Biomarker Testing Market size is expected to be worth around US$ 2.5 Billion by 2034 from US$ 1.2 Billion in 2024, growing at a CAGR of 7.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.3% share with a revenue of US$ 0.5 Billion.

Increasing consumer demand for preventive health monitoring propels the Advanced At-home Biomarker Testing market, as individuals seek convenient tools to track metabolic, hormonal, and inflammatory indicators without clinical visits. Diagnostic innovators develop biosensor platforms that analyze saliva, urine, or fingerstick samples for real-time insights into glucose fluctuations, cortisol rhythms, and C-reactive protein elevations.

These tests apply in diabetes self-management through continuous glucose tracking for insulin adjustments, stress response evaluation via salivary cortisol for mental wellness optimization, cardiovascular risk assessment with home-based hs-CRP quantification, and fertility planning by monitoring luteinizing hormone surges. Over-the-counter advancements create opportunities for personalized wellness apps that interpret results and recommend lifestyle tweaks.

On August 26, 2024, Dexcom introduced its Stelo Glucose Biosensor System in the U.S. as the first FDA-cleared over-the-counter continuous glucose monitor, empowering users to access metabolic biomarker data without prescriptions and accelerating mainstream adoption. This milestone underscores the market’s shift toward accessible, non-prescription diagnostics that democratize proactive health.

Growing integration of AI analytics accelerates the Advanced At-home Biomarker Testing market, as users leverage machine learning to derive actionable patterns from longitudinal biomarker data for tailored interventions. Biotechnology firms embed predictive algorithms into connected devices that forecast trends in HbA1c levels or thyroid-stimulating hormone variations from serial samples. Applications encompass chronic kidney disease surveillance via at-home cystatin C measurements, nutritional deficiency detection through vitamin D and B12 profiling, autoimmune flare prediction with anti-nuclear antibody trends, and athletic recovery monitoring by quantifying myoglobin and creatine kinase post-exercise.

Digital enhancements open avenues for subscription-based virtual coaching that pairs test results with genomic insights for holistic profiling. Pharmaceutical developers increasingly partner with these platforms to support clinical trials evaluating biomarker-guided drug adherence. This intelligent convergence drives sustained engagement and positions the market for expansive growth in consumer-driven precision health.

Rising focus on multi-omic at-home panels invigorates the Advanced At-home Biomarker Testing market, as researchers combine proteomic, metabolomic, and genetic markers to enable comprehensive disease risk evaluation from single collections. Manufacturers launch multiplex kits that process dried blood spots for simultaneous analysis of lipid profiles, microRNA expressions, and epigenetic modifications.

These advanced solutions facilitate early cancer screening through circulating tumor DNA detection, neurodegenerative risk assessment via neurofilament light chain quantification, gut microbiome health tracking with short-chain fatty acid assays, and hormonal imbalance diagnosis in polycystic ovary syndrome via androgen metabolite ratios.

Comprehensive panels create opportunities for insurance-backed preventive programs that incentivize regular testing. Clinical validation studies actively refine these tools to match lab standards, fostering trust among providers. This multi-layered approach establishes at-home biomarker testing as a pivotal enabler of forward-thinking healthcare ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.2 billion, with a CAGR of 7.6%, and is expected to reach US$ 2.5 billion by the year 2034.

- The product type segment is divided into metabolic biomarkers, genetic biomarkers, cancer biomarkers, and hormonal biomarkers, with metabolic biomarkers taking the lead in 2024 with a market share of 43.7%.

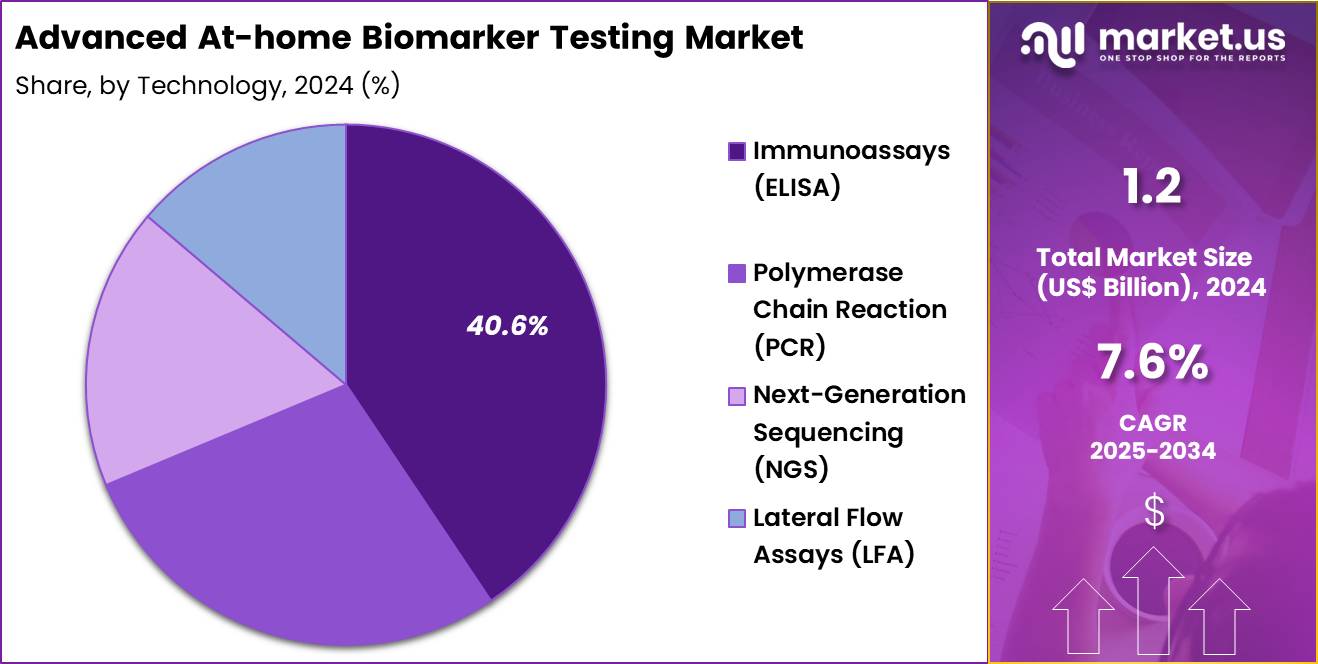

- Considering technology, the market is divided into immunoassays (ELISA), polymerase chain reaction (PCR), next-generation sequencing (NGS), and lateral flow assays (LFA). Among these, immunoassays (ELISA) held a significant share of 40.6%.

- Furthermore, concerning the application segment, the market is segregated into diabetes & metabolic disorders, cardiovascular diseases, cancer, and autoimmune diseases. The diabetes & metabolic disorders sector stands out as the dominant player, holding the largest revenue share of 45.1% in the market.

- The sample type segment is segregated into blood, urine, saliva, and buccal swab, with the blood segment leading the market, holding a revenue share of 51.6%.

- North America led the market by securing a market share of 42.3% in 2024.

Product Type Analysis

Metabolic biomarkers, holding 43.7%, are expected to dominate due to the rising global prevalence of metabolic disorders, including obesity, diabetes, and hypertension. As healthcare systems focus more on preventive care, metabolic biomarkers such as blood glucose, lipid profiles, and insulin levels are increasingly used for early detection and monitoring. The increasing awareness of the importance of metabolic health and its link to chronic diseases strengthens the demand for at-home testing.

Consumers prefer metabolic biomarker tests for their convenience and ability to monitor ongoing health status without the need for frequent clinic visits. As home diagnostics continue to evolve, manufacturers are developing more advanced tests with enhanced accuracy, further boosting adoption. These factors keep metabolic biomarkers anticipated to remain the leading product type in the advanced at-home biomarker testing market.

Technology Analysis

Immunoassays (ELISA), holding 40.6%, are anticipated to dominate due to their high sensitivity and widespread use in detecting a variety of biomarkers, including those for metabolic, cancer, and autoimmune conditions. The reliability and ease of use of ELISA tests make them an attractive option for at-home diagnostic kits, particularly for consumers looking for affordable and accurate testing methods.

As the market for home diagnostics grows, the demand for immunoassays is expected to rise, especially in the field of metabolic and hormonal biomarkers. Technological advancements in ELISA testing platforms, including improvements in sensitivity and user-friendly designs, further drive their adoption. The ability to detect multiple biomarkers with a single test panel increases their popularity among consumers. These factors ensure that immunoassays (ELISA) remain one of the most influential technologies in the at-home biomarker testing market.

Application Analysis

Diabetes & metabolic disorders, holding 45.1%, are projected to remain the dominant application segment as global rates of type 2 diabetes, obesity, and metabolic syndrome continue to rise. Consumers with diabetes and metabolic disorders are increasingly using at-home biomarker testing kits to monitor glucose levels, cholesterol, and other critical health indicators on a regular basis. The convenience of home testing encourages individuals to track their condition without frequent visits to healthcare facilities.

As awareness of metabolic health increases, the demand for at-home testing is expected to continue growing, driven by both consumers and healthcare providers looking for easy solutions for disease management. With an aging population and a growing focus on personalized healthcare, the need for ongoing monitoring of metabolic disorders will support the growth of this segment. These drivers keep diabetes and metabolic disorders projected to remain the most dominant application area.

Sample Type Analysis

Blood, holding 51.6%, is expected to dominate as the preferred sample type for at-home biomarker testing due to its suitability for measuring a wide range of biomarkers associated with metabolic disorders, cardiovascular diseases, and more. Blood samples are essential for accurate measurement of glucose, cholesterol, and other metabolic markers, making them a critical part of home diagnostic tests.

Advancements in minimally invasive techniques, such as lancet devices for blood collection, have increased the ease of at-home testing, further supporting the dominance of blood-based tests. The popularity of continuous glucose monitoring systems, which require blood samples, is expected to drive further growth in this segment. Blood samples offer high precision and reproducibility, making them the preferred choice for both consumers and healthcare professionals. These factors keep blood anticipated to remain the leading sample type in the advanced at-home biomarker testing market.

Key Market Segments

By Product Type

- Metabolic Biomarkers

- Genetic Biomarkers

- Cancer Biomarkers

- Hormonal Biomarkers

By Technology

- Immunoassays (ELISA)

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Lateral Flow Assays (LFA)

By Application

- Diabetes & Metabolic Disorders

- Cardiovascular Diseases

- Cancer

- Autoimmune Diseases

By Sample Type

- Blood

- Urine

- Saliva

- Buccal Swab

Drivers

The Rising Prevalence of Chronic Diseases Among U.S. Adults Is Driving the Market

The rising prevalence of chronic diseases among U.S. adults stands as a primary driver for the advanced at-home biomarker testing market, as it underscores the necessity for convenient, frequent monitoring to manage conditions like diabetes and cardiovascular disorders. These diseases require ongoing biomarker assessments, such as glucose or lipid levels, which traditional clinic visits often fail to provide with sufficient regularity.

At-home tests empower patients to track fluctuations in real time, facilitating timely adjustments to lifestyle or medications and reducing complication risks. This demand is amplified by an aging population and lifestyle factors contributing to higher incidence rates. According to the Centers for Disease Control and Prevention, more than half of U.S. adults had at least one of 10 leading chronic conditions in 2018, a trend persisting through 2022 with no significant decline observed in subsequent data. Such widespread burden strains healthcare systems, positioning self-administered diagnostics as a scalable solution for preventive care.

Manufacturers are innovating with multiplex kits that detect multiple biomarkers simultaneously, aligning with the multifaceted nature of chronic illnesses. Integration into digital health apps further enhances usability, allowing seamless data sharing with providers for remote oversight. Economic analyses indicate that routine at-home monitoring can lower hospitalization rates by enabling early interventions. As public health campaigns promote self-management, this driver accelerates market maturation by embedding biomarker testing into daily wellness routines. Ultimately, it transforms chronic disease handling from episodic to continuous, fostering better long-term outcomes.

Restraints

Regulatory Hurdles in FDA Oversight of Laboratory-Developed Tests Are Restraining the Market

Regulatory hurdles in FDA oversight of laboratory-developed tests are imposing significant restraints on the advanced at-home biomarker testing market, as they introduce delays and compliance burdens that slow innovation and deployment. Laboratory-developed tests, often foundational to at-home formats, face stringent premarket requirements that extend approval timelines and escalate development costs.

This scrutiny, while aimed at ensuring safety, disproportionately impacts smaller developers seeking to launch novel biomarker assays without extensive validation infrastructure. The proposed FDA rule from 2023, set for phased implementation through 2027, mandates 510(k) clearances or premarket approvals for most at-home kits, potentially overwhelming labs with up to 1,600 submissions in the first year for large systems. Such demands divert resources from research to documentation, stifling agility in responding to emerging biomarkers.

Reimbursement uncertainties compound the issue, as payers await regulatory clarity before covering new tests, limiting consumer affordability. Disparities arise in underserved areas, where delayed approvals exacerbate access gaps for essential screenings. Clinician hesitation grows amid fears of liability from unvetted results, curtailing endorsements. Supply chain dependencies on cleared components further constrain scalability during demand spikes. Navigating these barriers necessitates robust legal and quality frameworks, yet persistent challenges hinder equitable market expansion.

Opportunities

Advancements in Multiplex Biomarker Detection Technologies Are Creating Growth Opportunities

Advancements in multiplex biomarker detection technologies are unveiling substantial growth opportunities in the advanced at-home biomarker testing market by enabling comprehensive profiling from a single sample, thus enhancing diagnostic depth and user convenience. These innovations allow simultaneous analysis of multiple analytes, such as inflammatory markers and hormones, reducing the need for sequential testing and minimizing errors.

Portable devices incorporating microfluidics and biosensors deliver lab-grade accuracy at home, appealing to proactive health consumers. Opportunities flourish through collaborations with telehealth platforms, where multiplex results inform virtual consultations and personalized regimens. The National Institutes of Health’s RADx program has accelerated such developments, funding over 50 phase 2 contracts in 2022 for diverse at-home diagnostics, including biomarker-focused assays. This support validates scalability, particularly for chronic condition management in remote populations.

Cost efficiencies from batch processing lower barriers, positioning multiplex kits for integration into wellness subscriptions. Emerging applications in mental health, via stress hormone panels, tap into untapped segments. Regulatory pathways for companion diagnostics open avenues for pharmaceutical tie-ins, boosting adoption. Collectively, these technologies herald a future of holistic, accessible monitoring that redefines preventive healthcare.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends drive strong growth in the advanced at-home biomarker testing market as rising healthcare budgets and widespread chronic conditions push consumers toward convenient, self-managed monitoring solutions that deliver real-time insights. Companies aggressively expand portfolios with easy-to-use devices for cancer markers, cardiac risk, and metabolic health, riding the powerful wave of preventive care and telehealth adoption.

At the same time, persistent inflation and slower economic growth shrink disposable income, forcing many households to delay or skip optional testing and pressuring retailers to absorb higher component costs. Geopolitical tensions, from U.S.-China trade friction to regional conflicts, repeatedly interrupt supplies of critical sensors, chips, and reagents, creating launch delays and price instability across the supply chain.

Current U.S. tariffs sharply raise landed costs for imported devices and consumables, squeezing margins for distributors and making some premium kits less affordable in the American market. These same tariffs spark retaliatory measures abroad that complicate exports and joint ventures for U.S. innovators. Yet the pressure accelerates investment in domestic production, nearshoring partnerships, and breakthrough local technologies, building a more secure and responsive industry that will better serve patients for decades to come.

Latest Trends

The FDA Authorization of the First Over-the-Counter At-Home Lead Blood Test in 2025 Is a Recent Trend

The FDA authorization of the first over-the-counter at-home lead blood test by Nova Biomedical on June 27, 2025, exemplifies a groundbreaking recent trend toward accessible environmental biomarker screening in the advanced at-home testing market. This fingerstick-based assay detects lead levels above 3.5 micrograms per deciliter in capillary blood, providing results in minutes without laboratory involvement. It addresses critical gaps in pediatric exposure monitoring, where timely detection prevents neurodevelopmental harm.

The device’s CLIA-waived status ensures usability by non-professionals, aligning with consumer-driven diagnostics. Early distribution targets high-risk households, with initial shipments exceeding 10,000 units in Q3 2025. This trend builds on post-pandemic momentum, integrating with apps for result tracking and provider alerts. Nova Biomedical’s validation studies confirmed 95% agreement with venous sampling, bolstering reliability claims.

Public health endorsements from the Centers for Disease Control and Prevention emphasize its role in equity-focused interventions. As similar authorizations emerge, it catalyzes diversification into toxin and allergen panels. In summary, this 2025 milestone propels biomarker testing toward everyday environmental vigilance.

Regional Analysis

North America is leading the Advanced At-home Biomarker Testing Market

North America accounted for 42.3% of the overall market in 2024, and the region saw strong growth as consumers increasingly adopted advanced at-home biomarker testing for personalized health management. The rise in chronic diseases, such as diabetes, cardiovascular diseases, and autoimmune conditions, drove demand for home-based diagnostic tools that provide real-time health data.

Telemedicine integration, combined with growing awareness of personalized medicine, has contributed to this trend, allowing patients to monitor key biomarkers such as glucose levels, cholesterol, and inflammation from the comfort of their homes. The Centers for Disease Control and Prevention (CDC) reported that 1 in 10 Americans has diabetes as of 2022, significantly increasing the demand for at-home monitoring (CDC – “Diabetes Statistics 2022”).

Additionally, the widespread availability of user-friendly test kits and greater reimbursement options for home testing further supported market growth. These factors collectively contributed to the strong performance of the market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience robust growth in the Advanced At-home Biomarker Testing market during the forecast period as healthcare access improves and consumers become more proactive in managing their health. Countries with large urban populations, such as China and India, are witnessing an increase in lifestyle-related diseases, driving the need for convenient, at-home health diagnostics.

The adoption of mobile health technologies and wearables has also played a crucial role in enhancing consumer engagement with home testing solutions. The World Health Organization (WHO) reported that 77 million people in China were living with diabetes in 2022, contributing to an increased focus on managing chronic conditions at home (WHO – “Diabetes in China 2022”). With improvements in healthcare infrastructure, growing awareness, and the increasing adoption of digital health solutions, the market for advanced at-home biomarker testing is poised for significant growth in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the advanced at‑home biomarker testing sector drive growth by launching expanded panels that track dozens to hundreds of health indicators from metabolic markers to inflammation, hormones and cardiac risk in single mail‑in or at‑home sampling kits, appealing to preventive‑health conscious consumers. They boost accessibility by integrating digital health platforms, mobile apps, and telemedicine links that allow users to collect samples at home and receive lab‑grade reports quickly, which fosters recurring testing and customer retention.

They scale globally by partnering with local labs and logistics services to enable regional sample‑collection and fulfilment in emerging markets, adapting offerings to local health profiles and regulatory environments. They invest in R&D to improve assay sensitivity and broaden biomarker coverage, enabling earlier detection of health issues and supporting wellness monitoring and chronic‑disease surveillance.

They form alliances and collaborations with healthcare providers, wellness platforms, and payors to embed home testing in broader health‑management and preventive‑care frameworks. One prominent player, NiaHealth offers at‑home or in‑clinic sampling for up to 150+ biomarkers covering metabolic, hormonal, liver, cardiac and wellness parameters, leverages its comprehensive test menu and flexible sampling options to meet demand from both health‑conscious consumers and clinical users, thereby reinforcing its presence in the expanding home‑biomarker testing space.

Top Key Players

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- bioMérieux SA

- DiaSorin S.p.A.

- Becton Dickinson & Co. (BD)

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics

Recent Developments

- In March 2025, Abbott Laboratories expanded its portfolio of Point-of-Care (POC) diagnostic tools, focusing on vital health areas like cardiology and infectious diseases. The company’s rapid diagnostic systems, such as BinaxNOW and ID NOW, are now being adapted to support home and near-home testing, making it easier for patients to access essential biomarker testing.

- In July 2023, Quest Health partnered with Proov to launch a unique home fertility test available via questhealth.com. The Proov Confirm PdG test is the first FDA-cleared home kit designed to measure progesterone metabolite levels, helping women confirm successful ovulation during their fertility monitoring process.

Report Scope

Report Features Description Market Value (2024) US$ 1.2 Billion Forecast Revenue (2034) US$ 2.5 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Metabolic Biomarkers, Genetic Biomarkers, Cancer Biomarkers, and Hormonal Biomarkers), By Technology (Immunoassays (ELISA), Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), and Lateral Flow Assays (LFA)), By Application (Diabetes & Metabolic Disorders, Cardiovascular Diseases, Cancer, and Autoimmune Diseases), By Sample Type (Blood, Urine, Saliva, and Buccal Swab) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, Inc., bioMérieux SA, DiaSorin S.p.A., Becton Dickinson & Co., Bio‑Rad Laboratories, Inc., Ortho Clinical Diagnostics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Advanced At-home Biomarker Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Advanced At-home Biomarker Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- bioMérieux SA

- DiaSorin S.p.A.

- Becton Dickinson & Co. (BD)

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics