Global Adaptive Security Market Size, Share Report By Component (Adaptive Security Solutions, Service), By Deployment Mode (On-Premise, Cloud-Based), By Application (Network Security, Application Security, End Point Security, Cloud Security, Others), By Industry Vertical (BFSI, IT and Telecom, Retail and E-commerce, Manufacturing, Healthcare, Energy and Utilities, Government and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153654

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

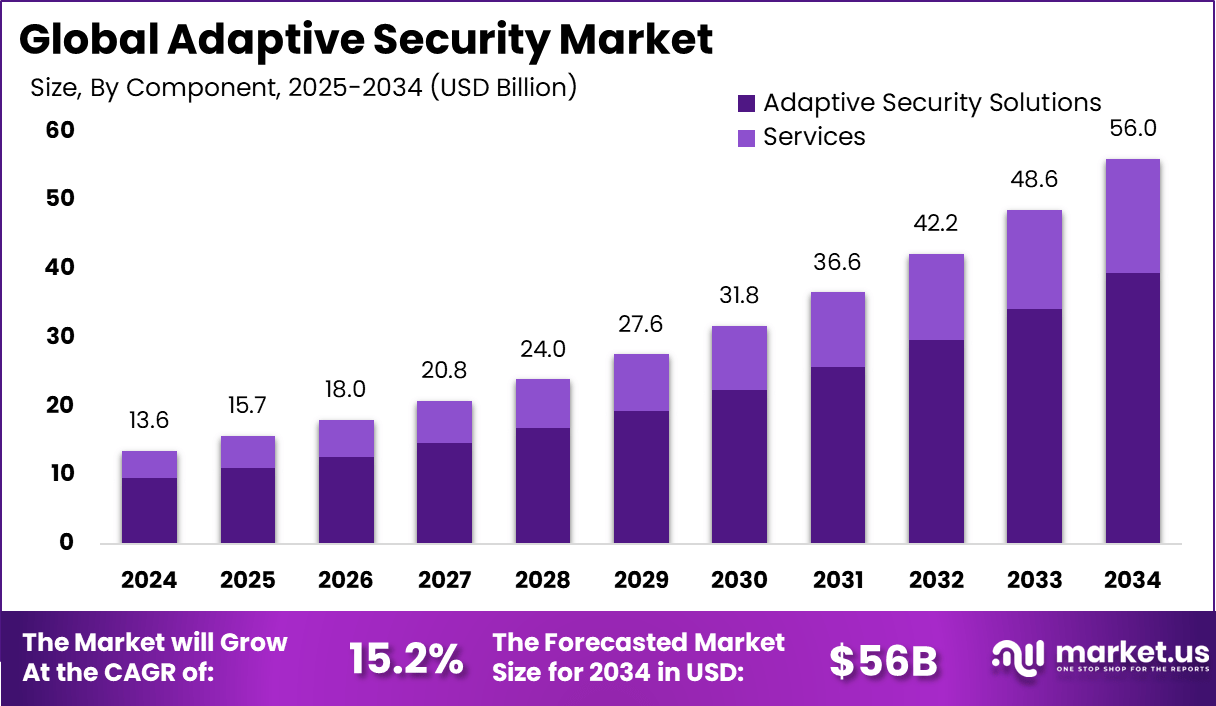

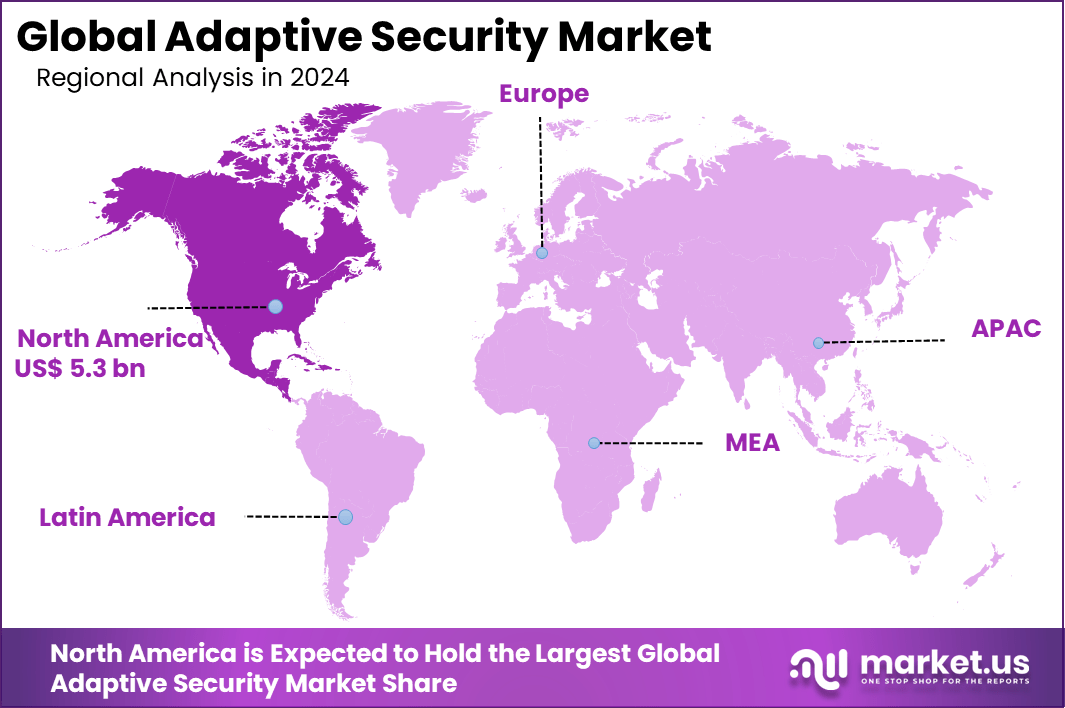

The Global Adaptive Security Market size is expected to be worth around USD 56 billion by 2034, from USD 13.6 Billion in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39%, share, holding USD 5.3 Billion in revenue.

Adaptive security is rapidly shifting the cybersecurity industry, as organizations recognize the value of systems that can continuously monitor behavior, analyze current threats, and respond in real time. Unlike static security models, adaptive security automatically adjusts defences as new threats emerge. This means companies stay one step ahead in the battle against evolving cyber risks, instead of merely reacting when an attack occurs.

The market is becoming recognized for its capacity to transform IT security postures through smart automation and deep analysis of data streams, driving a transition toward proactive protection. The most powerful driver in the adaptive security market is the rise in cyber threats. Attacks are growing both in number and sophistication, pushing businesses and public agencies to seek flexible solutions.

Today, advanced persistent threats and complex exploits can bypass traditional defences, prompting a need for adaptable, always-on protection. Expanding digital operations, increased use of cloud computing and IoT, along with high-profile data breaches, are pressing organizations to upgrade their cybersecurity frameworks urgently. The growing digitalization of every industry further amplifies demand, as more sectors shift core processes online.

Key Takeaway

- North America led the market in 2024. It held over 39% share. Revenue reached USD 5.3 billion.

- The United States alone generated USD 4.25 billion. Its growth rate is 13.6% CAGR.

- The global market will grow at a 15.2% CAGR from 2025 to 2034. Cyber threats and AI-based attacks are key drivers.

- Adaptive security solutions made up 70.4% of the market. These are used for real-time protection and risk detection.

- On-premise deployment held 60.2% share. It is preferred for better data control and internal compliance.

- Network security was the top application with 38.7% share. Cloud adoption has made networks more vulnerable.

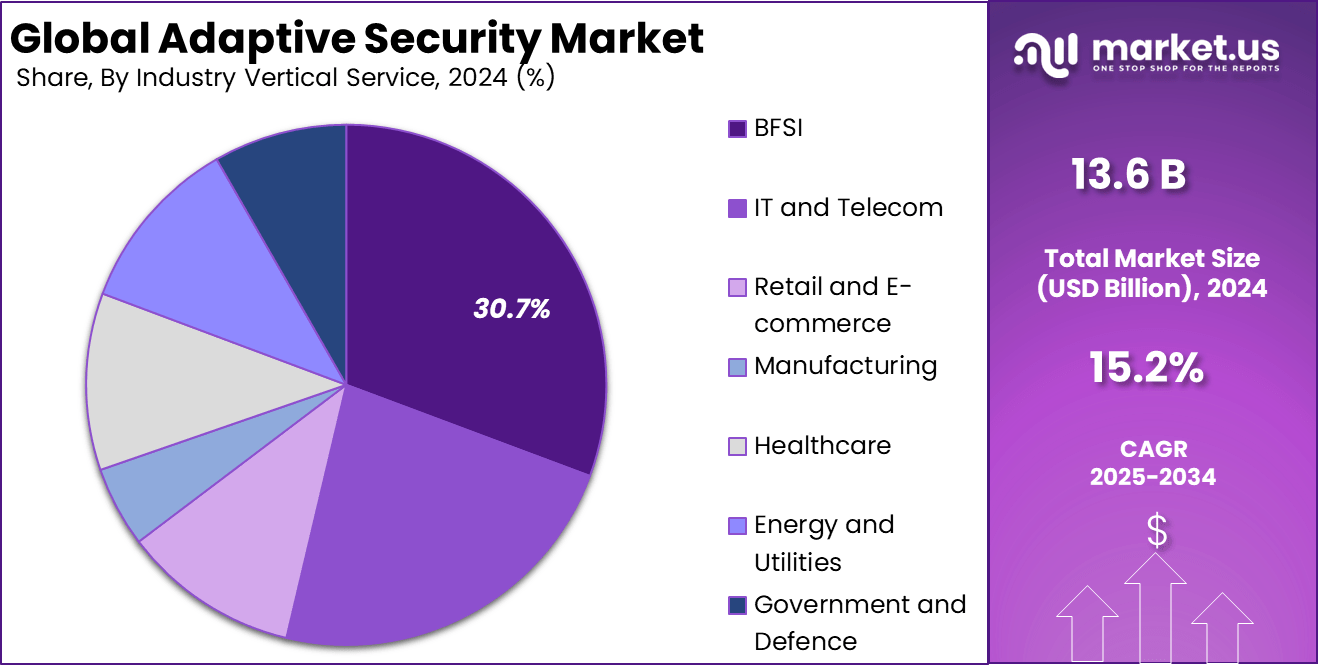

- The BFSI sector led by vertical, capturing 30.7% share. High risks of data breaches drive strong investment.

Analysts’ Viewpoint

Investment in adaptive security is rapidly growing because the underlying benefits now extend far beyond mere risk reduction. As cyberattack trends get more complex, investors see strong potential for adaptive security solutions to address challenges in new domains such as IoT, healthcare, and critical infrastructure. The increase in remote work, diverse digital platforms, and distributed business models offers unique areas for innovation.

The business advantages of deploying adaptive security are clear. Companies achieve reduced incident response times and minimize the impact of data breaches. Productivity increases as cyber risks are automatically identified and remediated, allowing employees to focus on core tasks. The risk of regulatory fines is diminished, as proactive compliance monitoring ensures that legal and industry requirements are continuously met.

Regulation is playing an increasingly important role in boosting adaptive security market growth. Laws such as GDPR and similar privacy rules across the globe are requiring firms to adopt dynamic, responsive defences to meet compliance. This regulatory pressure is giving rise to more investment in automated, continuously-monitored systems that can rapidly generate compliance evidence.

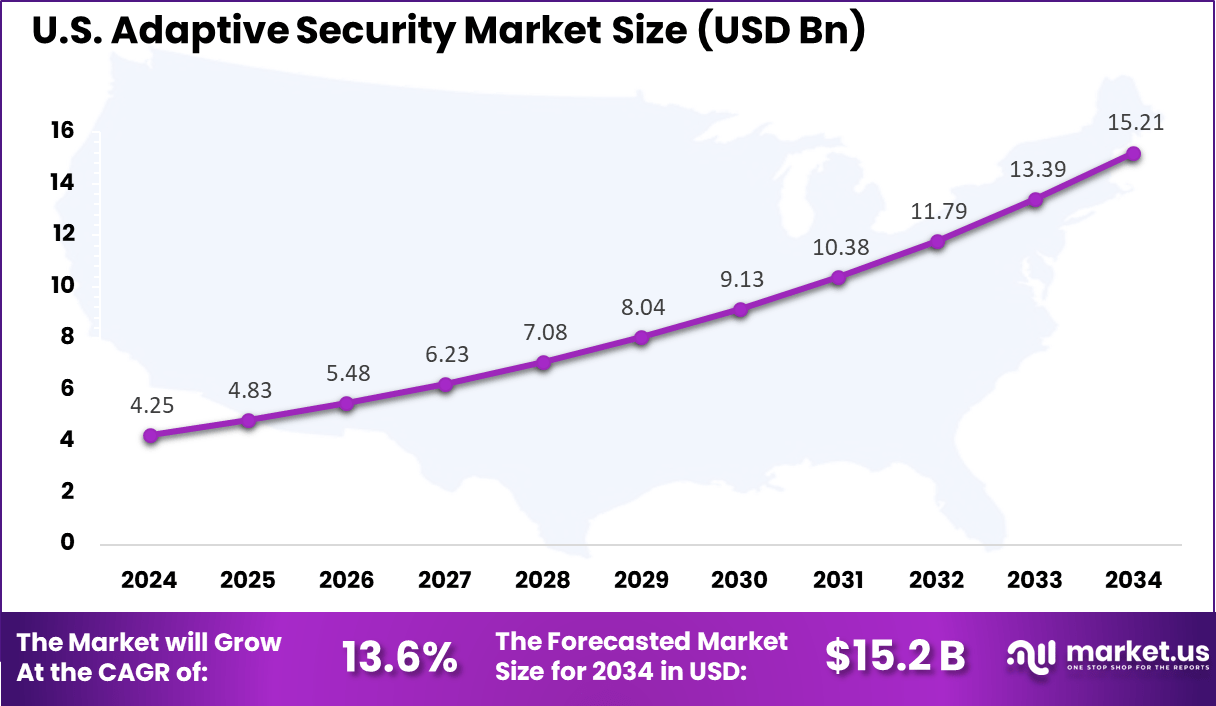

U.S. Market Size

The U.S. Adaptive Security Market was valued at USD 4.25 Billion in 2024 and is anticipated to reach approximately USD 15.2 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 13.6% during the forecast period from 2025 to 2034.

For instance, In April 2025, the U.S. Department of Homeland Security allocated USD 3.0 billion to the Cybersecurity and Infrastructure Security Agency (CISA) to enhance federal systems. This funding supports the Continuous Diagnostics and Mitigation (CDM) program, aiming to improve the security of government networks. It also covers research and development initiatives to advance cybersecurity technologies and boost resilience against evolving threats.

In 2024, North America held a dominant market position in the global Adaptive Security Market, capturing more than a 39% share, holding USD 5.3 Billion in revenue. This leadership is largely due to the strong technological base, early adoption of high-security practices, and increasing sophistication of cyber threats.

The early adoption of adaptive security measures by organizations in North America is driving them to meet increasingly demanding regulatory standards and adapt to changing cyber threats. This region is now considered to be at an advanced stage in the adaptive security space in the presence of major technology vendors such as Palo Alto Networks and Cisco Systems, with a strong focus on cybersecurity.

Component Type Analysis

In 2024, The Adaptive Security Solutions segment held a dominant market position, capturing a 70.4% share of the Global Adaptive Security Market.

The growth of the Adaptive Security Solutions segment is further fueled by the integration of advanced technologies like artificial intelligence, machine learning, and automation. With these technologies, organizations can detect and prevent potential threats with proactive measures rather than relying on reactive security measures.

Moreover, the rise of cloud computing and IoT devices has broadened the scope of attacks, necessitating more adaptable and scalable security measures. This has led to a surge in demand for comprehensive adaptive security solutions, cementing their market leadership.

For instance, In April 2025, AT&T partnered with Palo Alto Networks to launch AT&T Dynamic Defense, a next-generation cybersecurity solution aimed at strengthening enterprise protection. This offering enhances security through deep network integration, AI-driven operations, and improved defense across cloud and SaaS environments, helping businesses stay resilient against evolving cyber threats.

Deployment Analysis

In 2024, the On-Premises segment held a dominant market position, capturing a 60.2% share of the Global Adaptive Security Market.

This dominance is primarily driven by the desire of organizations to maintain direct control over their security infrastructures, particularly in areas with strict regulatory requirements such as finance, healthcare, and government. Businesses can benefit from on-premises solutions that promote greater data independence, enabling them to adhere more closely to their local counterparts’ data protection laws and internal policies.

For instance, In January 2025, Oracle introduced a suite of tools designed to expedite compliance with the U.S. Department of Defense’s Cybersecurity Maturity Model Certification (CMMC) for defense contractors utilizing Oracle Cloud Infrastructure (OCI). The objective of these tools is to simplify the process of obtaining CMMC Levels 1, 2, and 3, which will be mandatory for contractors starting October 15, 2024.

This initiative centers on the OCI Core Landing Zone, an Infrastructure-as-Code (IaC) template that is based on Terraform and allows for the deployment of preconfigured cloud services that comply with CMMC requirements in a one-click process. By using this approach, it becomes simpler to map security controls and speed up the creation of compliance-oriented cloud architectures.

Application Analysis

In 2024, the Network Security segment held a dominant market position, capturing a 38.7% share of the Global Adaptive Security Market.

This segment is growing due to the increasing prevalence and sophistication of cyber threats, the Network Security industry continues to hold a dominant position in the adaptive security market. To maintain the security of sensitive data and ensure efficient operations, organizations in different industries are increasingly relying on network infrastructure protection.

The growing importance of network security is fueled by the increasing use of cloud computing, IoT devices, and remote work environments, all of which expand the attack range and demand robust security measures. The integration of advanced technologies like artificial intelligence (AI) and machine learning into network protection solutions has further enhanced the segment’s ability to detect and counter threats in real-time.

For instance, In April 2025, Darktrace announced its participation as a launch partner in the public preview of Microsoft’s Azure Virtual Network Terminal Access Point (TAP). The collaboration allows Darktrace’s Cyber AI platform to utilize granular packet data in hybrid environments, which enhances threat detection and response capabilities.

Through this integration, continuous streaming of virtual machine network traffic without impacting VM bandwidth can be streamed without interruption, simplifying the defense against Cyber AI that analyzes both encrypted and decrypted packets to identify unusual activity in real-time, providing proactive protection for Azure environments.

Industry Vertical Analysis

In 2024, the BFSI segment held a dominant market position, capturing a 30.7% share of the Global Adaptive Security Market.

This segment is growing due to rising frequency of cyberattacks targeting financial institutions, the growing popularity of online banking services, and the strict regulatory requirements for implementing effective cybersecurity measures.

To ensure compliance with regulations like the General Data Protection Regulation (GDPR) and the Cybersecurity Regulation of the New York Department of Financial Services, financial institutions are heavily investing in adaptive security measures to shield against data breaches, fraud, and unauthorized access.

For instance, In March 2025, the Institute for Development and Research in Banking Technology (IDRBT), in collaboration with Quick Heal Technologies Limited, launched IBCART 3.0 (Indian Bank Center for Analysis of Risks and Threats). This upgraded platform aims to enhance cybersecurity within the banking sector by offering broader reach, advanced security controls, and contextual threat intelligence.

IBCART 3.0 provides curated threat intelligence specifically for the banking and financial services sector, classified with risk scores to aid in proactive risk mitigation. The collaboration with Seqrite Labs of Quick Heal focuses on integrating emerging tools in artificial intelligence and machine learning to strengthen financial institutions’ defenses against cyber threats.

Key Market Segments

By Component

- Adaptive Security Solutions

- Service

- Professional Service

- Managed Services

By Deployment Mode

- On-Premise

- Cloud-Based

By Application

- Network Security

- Application Security

- End Point Security

- Cloud Security

- Others

By Industry Vertical

- BFSI

- IT and Telecom

- Retail and E-commerce

- Manufacturing

- Healthcare

- Energy and Utilities

- Government and Defense

- Others

Emerging Trend

Integration of AI and Machine Learning in Adaptive Security

A standout trend in adaptive security is the increasing reliance on artificial intelligence and machine learning to enhance protection strategies. As cyber attackers develop more sophisticated methods, adaptive security solutions are blending AI technologies to identify, analyze, and neutralize threats in real-time.

This shift from static defense systems to more dynamic tools allows organizations to catch new and evolving cyberattacks before they become damaging. AI helps adaptive security continuously monitor activities on networks, learn from new threat patterns, and automate responses to suspicious behavior. What sets this trend apart is its ability to bring predictive insights to cybersecurity teams.

Instead of only reacting to known threats, adaptive security powered by AI can uncover hidden risks through behavioral analytics and anomaly detection. It analyzes everyday user actions, recognizes what is normal, and flags anything out of the ordinary. This makes defense not only faster but also smarter, giving security a proactive edge as risks continue to change and multiply in today’s rapidly digitalizing world.

Key Driver

Rising Frequency and Sophistication of Cyberattacks

One of the main drivers pushing the adoption of adaptive security is the growing number and complexity of cyber threats facing organizations today. As the digital landscape expands, attackers invent new tactics, making traditional security tools less effective at stopping breaches.

Organizations now turn to adaptive security solutions to stay one step ahead, as these systems automatically adjust their defense strategies and protect sensitive data across networks, cloud platforms, and connected devices. Companies are increasingly aware that simple firewalls or signature-based antivirus software are no longer enough.

In 2025, the Cyber Security Breaches Survey by the UK’s Department for Science, Innovation and Technology revealed that 43% of businesses and 30% of charities experienced cyberattacks in the past year, impacting around 612,000 businesses. The threat was especially severe for larger entities, with 67% of medium-sized and 74% of large businesses reporting security breaches.

The need to meet strict industry regulations and customer expectations also adds pressure. Adaptive security offers a way to comply with emerging policies while providing advanced protection, making it the answer to the evolving cyber risk environment. This shift is not just about technology but about ensuring organizational resilience and building trust with clients and stakeholders.

Major Restraint

High Implementation and Operational Costs

Even as adaptive security brings numerous benefits, the cost involved in setting up and maintaining advanced solutions is a significant limitation for many organizations. Implementing intelligent, real-time monitoring and response systems often means investing in new tools and hiring highly skilled cybersecurity professionals.

For small and mid-sized enterprises, these financial and resource barriers can be overwhelming, since the expense often extends beyond the initial deployment to include ongoing updates and maintenance. This restraint makes it harder for organizations with limited budgets to adopt state-of-the-art adaptive security, leaving gaps in their defenses.

Budget limits can also slow down upgrades to keep up with the rapidly changing nature of threats. These considerations force many organizations to prioritize other areas or settle for less robust security, which ironically can leave them more exposed to cyber risks in the long term.

Bright Opportunity

Expansion of Cloud and IoT-Driven Adaptive Security

A striking opportunity in the adaptive security landscape arises from the rapid expansion of cloud computing and the Internet of Things. As more organizations move operations and data to the cloud and add smart devices from multiple sources, the possible points of cyber intrusion multiply.

Adaptive security solutions provide a unique chance for businesses to safeguard these new, hybrid digital environments with flexible, scalable protections that evolve as usage patterns and threats change. With so many devices and virtual systems communicating at once, organizations need security that can adapt moment by moment. This opens the door for advanced solutions that not only protect earlier but also bring better insights into performance and vulnerabilities.

Those who invest in cloud-ready and IoT-compatible adaptive security can gain a competitive edge, offering safer customer experiences and more efficient business operations. The transformation of digital infrastructure is an ongoing journey, making this opportunity a promising one for both established players and newcomers in the cybersecurity space.

Ongoing Challenge

Shortage of Skilled Cybersecurity Professionals

Despite the promise of adaptive security, one tough challenge stands in the way: a global shortage of trained cybersecurity professionals equipped to design, deploy, and maintain adaptive systems. As cyber threats become more difficult to detect and manage, the need for specialized expertise grows.

For instance, In January 2025, the World Economic Forum’s Global Cybersecurity Outlook reported a global shortage of 3.4 million skilled cybersecurity professionals. This talent gap coincides with a 45% global rise in ransomware attacks between 2020 and 2023. Critical sectors such as healthcare, finance, and energy were most affected, leading to disruptions and financial losses surpassing USD 1.2 trillion in 2024.

Many organizations, especially those outside large urban centers or in emerging markets, struggle to fill open positions or provide adequate training to their teams. This skill gap risks delaying the adoption of adaptive security or causing inefficiencies in its use. Without staff who are confident working with AI-driven analytics or managing real-time incident response, even the best tools offer limited protection.

Closing this talent gap is now seen not just as a technical issue, but as a strategic imperative for businesses and public agencies alike. Investing in workforce development and making cybersecurity an attractive career path is essential for the future resilience of organizations everywhere.

Key Players Analysis

Cisco Systems Inc., Hewlett Packard Enterprise Company, FireEye Inc., and RSA Security LLC are leading the Adaptive Security Market with strong capabilities in real-time threat detection and response. Cisco’s AI-driven tools and HPE’s edge-to-cloud security models are widely adopted. FireEye and RSA focus on breach response, supporting high-risk industries with advanced mitigation strategies.

Rapid7 Inc., Cloudwick Technologies Inc., and Juniper Networks Inc. are gaining traction by offering behavioral analytics, endpoint protection, and network orchestration. These players address dynamic IT needs through scalable, real-time security solutions that align with zero-trust frameworks.

Trend Micro Incorporated, Oracle Corporation, WatchGuard Technologies Inc., and Illumio Inc. provide adaptive security tools for hybrid environments. Their innovations focus on segmentation, policy enforcement, and cloud infrastructure protection. Other emerging companies are also entering with modular and compliance-ready systems, supporting growing demand for agile and proactive cybersecurity.

Summary Table: Adaptive Security Alignment

Development Adaptive Security Relevance MIND: AI-driven data loss prevention Proactive response, ML-based adaptive controls NTT DATA: AI software-defined infrastructure Dynamic configuration, AI-driven system adaptation Palo Alto & Zero Networks: Micro-segmentation Automated/dynamic policy adjustment, adaptive isolation Cisco: AI reasoning models (open source) Community-driven evolution, AI-enhanced adaptive detection Fortinet: GenAI & AIOps in Security Fabric Autonomous detection/response, continuous adaptation to threats Top Key Players in the Market

- Cisco Systems Inc.

- Cloudwick Technologies Inc

- FireEye Inc.

- Hewlett Packard Enterprise Company

- Illumio Inc.

- Juniper Networks Inc.

- Oracle Corporation

- Rapid7 Inc

- RSA Security LLC

- Trend Micro Incorporated

- WatchGuard Technologies Inc.

- Others Players

Recent Developments

- June 2025: Cloudwick received the AWS Generative AI Competency, emphasizing its focus on secure and responsible AI-powered adaptive security, particularly within cloud platforms.

- April 2025: At RSA Conference, HPE launched new zero trust and adaptive security features for both hybrid and private cloud environments. The updates to HPE Aruba Networking Central include smarter access controls, improved observability, AI-driven policy enforcement, and automatic threat-adaptive responses tailored for complex regulatory needs.

- May 2024: Cisco rolled out critical security updates to its Adaptive Security Appliances (ASA) and Firepower Threat Defense products to address emerging threats and vulnerabilities – demonstrating their ongoing commitment to proactive defense.

Report Scope

Report Features Description Market Value (2024) USD 13.6 Bn Forecast Revenue (2034) USD 56 Bn CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Adaptive Security Solutions, Service), By Deployment Mode (On-Premise, Cloud-Based), By Application (Network Security, Application Security, End Point Security, Cloud Security, Others), By Industry Vertical (BFSI, IT and Telecom, Retail and Ecommerce, Manufacturing, Healthcare, Energy and Utilities, Government and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems Inc., Cloudwick Technologies Inc, FireEye Inc., Hewlett Packard Enterprise Company, Illumio Inc., Juniper Networks Inc., Oracle Corporation, Rapid7 Inc, RSA Security LLC, Trend Micro Incorporated, WatchGuard Technologies Inc., Others Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cisco Systems Inc.

- Cloudwick Technologies Inc

- FireEye Inc.

- Hewlett Packard Enterprise Company

- Illumio Inc.

- Juniper Networks Inc.

- Oracle Corporation

- Rapid7 Inc

- RSA Security LLC

- Trend Micro Incorporated

- WatchGuard Technologies Inc.

- Others Players