Global Active Aerodynamic Market By Vehicle Type (Light Duty Vehicles, Heavy Commercial Vehicles), By Application (Grille Shutter, Spoiler, Air Dam, Side Skirts, Other Applications), By Mechanism, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 99574

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

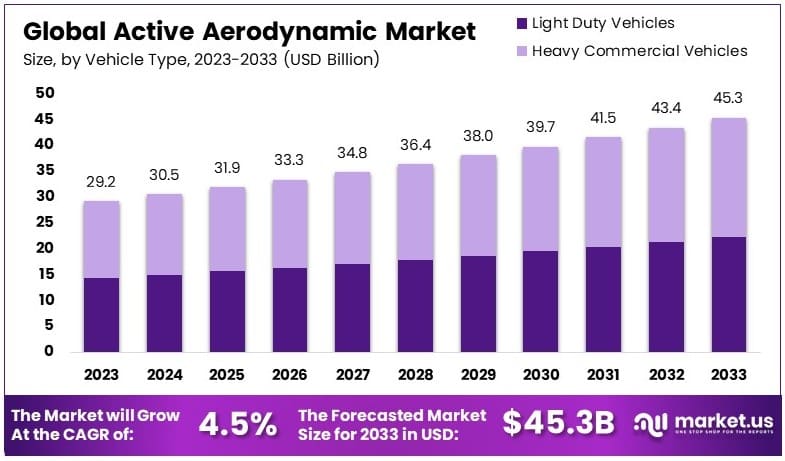

The Global Active Aerodynamic Market size is expected to be worth around USD 45.3 Billion by 2033, from USD 29.2 Billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

Active aerodynamic systems are technologies in vehicles that adjust airflow to optimize performance and fuel efficiency. These systems, like active grille shutters and rear spoilers, adapt automatically based on driving conditions. By reducing drag and improving stability, active aerodynamics enhance both energy efficiency and vehicle handling, especially at high speeds.

The active aerodynamic market includes companies developing adjustable systems to improve vehicle efficiency. Serving the automotive and transport industries, this market is driven by regulatory demands for reduced emissions and better fuel economy. As manufacturers prioritize eco-friendly solutions, the market grows with continuous advancements in aerodynamic technology.

Active grille shutters are a popular feature in this technology. These shutters open or close based on airflow needs, reducing drag by an average of 9% in specific driving conditions. This functionality optimizes engine cooling and improves the vehicle’s aerodynamic drag coefficient, highlighting the system’s efficiency benefits.

Government regulations strongly influence this market. The European Union’s CO₂ emission standards for passenger vehicles, with a target of 95 grams of CO₂ per kilometer, encourage manufacturers to adopt aerodynamic technologies. Meeting these stringent standards requires innovation in drag-reduction solutions, directly impacting demand for active aerodynamics.

The market sees increased competition as automotive brands seek to meet consumer and regulatory demands for efficiency. Active aerodynamic systems provide a competitive edge, enabling manufacturers to offer vehicles with improved performance and lower emissions. As eco-friendly and smart transport gains importance, this market is set for further growth and innovation.

Key Takeaways

- The Active Aerodynamic Market was valued at USD 29.2 Billion in 2023 and is projected to reach USD 45.3 Billion by 2033, with a CAGR of 4.5%.

- In 2023, Heavy Commercial Vehicles (HCV) lead with 51% in the vehicle type segment, driven by fuel efficiency needs.

- In 2023, Grille Shutters dominate the application segment with 40%, reflecting their role in aerodynamics.

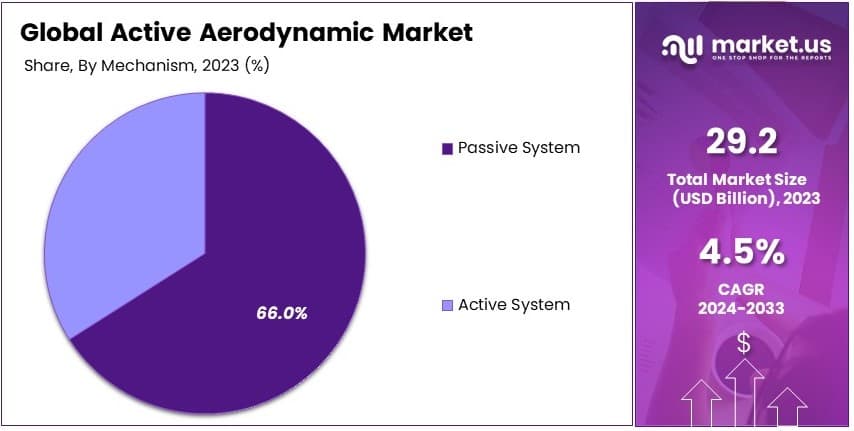

- In 2023, Passive System is the dominant mechanism with 66%, emphasizing low-maintenance solutions.

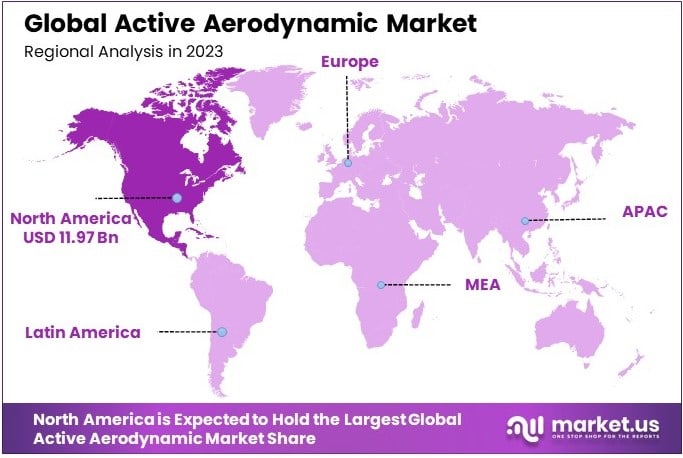

- In 2023, North America leads with 41.0%, supported by advancements in automotive aerodynamics.

Vehicle Type Analysis

Heavy Commercial Vehicles dominate with 51% due to their significant role in freight and transportation.

Heavy commercial vehicles hold a dominant position with a 51% market share, driven by the increasing demand for fuel efficiency and reduced carbon emissions in the freight and transportation sector. HCVs benefit greatly from advanced aerodynamic systems that reduce drag, thereby improving fuel economy and lowering operational costs.

Light duty vehicles also incorporate active aerodynamic systems but on a smaller scale compared to HCVs. These vehicles, typically used for personal or small business transport, are increasingly adopting such technologies to enhance performance and fuel efficiency, reflecting broader environmental and economic trends.

Application Analysis

Grille Shutters lead with 40% due to their effectiveness in enhancing vehicle aerodynamics and fuel efficiency.

The active aerodynamics market by application is diverse, including grille shutters, spoilers, air dams, side skirts, diffusers, wind deflectors, gap fairing, and other applications. Grille shutters are the dominant sub-segment, commanding a 40% market share. They are primarily valued for their ability to improve vehicle aerodynamics by altering air flow to the engine compartment, thus optimizing engine cooling and reducing drag.

Spoilers, which modify the air flow over the body of the vehicle to reduce lift and increase stability at high speeds, are also a key component of active aerodynamics. Air dams and side skirts work similarly by reducing the amount of air flowing underneath the vehicle and along the sides, thereby decreasing resistance and enhancing fuel efficiency.

Mechanism Analysis

Passive Systems dominate with 66% due to lower cost and simplicity.

Within the active aerodynamics market, mechanisms are categorized into passive and active systems. Passive systems hold a significant majority, with a 66% share of the market. Their dominance can be attributed to their simplicity, reliability, and lower cost compared to active systems.

Passive aerodynamic features are designed to improve vehicle performance without the need for mechanical control systems, making them easier to implement and maintain.

Active systems, although less prevalent, are gaining traction due to their ability to adapt to varying conditions and offer optimized performance. These systems use speed sensors and mechanical actuators to dynamically adjust aerodynamic components based on speed, wind conditions, and other environmental factors.

While more complex and expensive, active systems are poised for growth as technology advances and as the market for high-performance, energy-efficient vehicles expands.

Key Market Segments

By Vehicle Type

- Light Duty Vehicles

- Heavy Commercial Vehicles

By Application

- Grille Shutter

- Spoiler

- Air Dam

- Side Skirts

- Diffuser

- Wind Deflectors

- Gap Fairing

- Other Applications

By Mechanism

- Passive System

- Active System

Drivers

Rising Demand for Efficiency and Technological Advances Drive Market Growth

The Active Aerodynamic Market is driven by the increasing demand for fuel-efficient vehicles, advancements in automotive technologies, adoption in high-performance vehicles, and a strong focus on reducing carbon emissions.

As fuel prices rise and consumers prioritize cost-effective driving solutions, the demand for active aerodynamic systems, which optimize fuel efficiency, has grown significantly. This trend aligns with global efforts to reduce fossil fuel dependence and lower emissions.

Advancements in automotive technology, including integration with smart systems and enhanced materials, have also played a critical role in advancing the active aerodynamic sector. High-performance vehicles are increasingly adopting these systems, as they benefit from improved stability and speed, making active aerodynamics a preferred feature in sports and luxury cars.

Furthermore, the industry’s focus on reducing carbon emissions has led manufacturers to integrate aerodynamic solutions to enhance vehicle efficiency, contributing to the sector’s growth.

Restraints

High Costs and Regulatory Constraints Restrain Market Growth

The Active Aerodynamic Market faces restraints from the high costs associated with advanced aerodynamic systems, limited awareness, technical integration challenges, and regulatory constraints.

Advanced aerodynamic solutions are costly to develop and implement, which can limit their adoption, especially in the mid-range vehicle segment. These high costs make active aerodynamics more accessible to luxury and premium segments, creating a barrier in broader market penetration.

Limited awareness among end-users about the benefits of active aerodynamics further restrains market growth, particularly in developing regions where automotive technology adoption is slower. Technical challenges in integrating aerodynamic systems into different vehicle models also present a barrier, as they require sophisticated engineering and compatibility adjustments.

Additionally, certain regions have regulatory constraints that limit the adoption of modified aerodynamics, affecting the global reach of active aerodynamic solutions.

Opportunity

Expansion into Electric Vehicles and Autonomous Tech Provides Opportunities

Growth opportunities in the Active Aerodynamic Market are driven by the expansion into electric and hybrid vehicles, integration with autonomous technologies, demand in emerging markets, and development of lightweight systems.

Electric and hybrid vehicles are a promising area for active aerodynamics, as these systems can optimize energy efficiency, aligning with the sustainability goals of electric vehicles. The integration with autonomous vehicle technologies also opens doors, as active aerodynamics can enhance stability and performance in self-driving cars, creating a safer and more efficient ride.

Emerging markets represent significant potential as they continue to expand their automotive sectors, providing new consumer bases for these advanced systems. Developing lightweight, compact aerodynamic solutions also presents an opportunity for companies to meet the increasing demand for efficient, adaptable systems.

Challenges

R&D Costs and Rapid Innovation Challenge Market Growth

The Active Aerodynamic Market faces challenges from high research and development (R&D) costs, rapid technological advancements, supply chain complexities, and the need to balance performance with design aesthetics.

The costs associated with R&D and production are substantial, requiring significant investment to produce systems that meet quality and performance standards. The rapid pace of innovation in automotive technology also shortens product lifecycles, forcing companies to keep up with new developments to remain competitive.

Supply chain and material sourcing issues, particularly for specialized components, add another layer of complexity, impacting production timelines and costs. Balancing high aerodynamic performance with aesthetic vehicle design is also challenging, as consumers expect both efficiency and appealing design.

Growth Factors

Expanding Automotive Industry and Sustainable Technologies Are Growth Factors

The growth of the Active Aerodynamic Market is supported by factors such as the expansion of the automotive industry, focus on sustainable vehicle technologies, growing investments in advanced manufacturing, and demand for enhanced performance and safety.

As the global automotive sector grows, demand for advanced aerodynamic solutions has increased, particularly with the push for environmentally friendly and fuel-efficient vehicles.

Investments in sustainable technologies are rising, as consumers and governments push for greener automotive solutions, making active aerodynamics a relevant choice for reducing emissions.

Growing investments in advanced vehicle manufacturing also contribute to the development of efficient aerodynamic systems. The demand for enhanced performance and safety, particularly in high-speed and luxury vehicles, further drives market growth by aligning with consumer priorities for reliable and efficient transport.

Emerging Trends

Demand for Smart and Lightweight Aerodynamics Is Latest Trending Factor

Trending factors in the Active Aerodynamic Market include the rise of electric vehicles, demand for smart aerodynamic systems, focus on lightweight components, and the use of artificial intelligence in optimization.

Electric vehicles have highlighted the need for aerodynamic efficiency, as range optimization is critical for EVs. This demand has spurred interest in smart and adaptive aerodynamic systems that adjust based on driving conditions, enhancing efficiency in real time.

The focus on lightweight vehicle components has grown as manufacturers aim to reduce overall weight, further improving fuel efficiency and performance.

Artificial intelligence (AI) is also increasingly used to optimize aerodynamic designs, allowing for data-driven solutions that enhance performance. These trends reflect the industry’s movement toward efficiency, intelligence, and adaptability, meeting modern consumer expectations for advanced and eco-friendly automotive solutions.

Regional Analysis

North America Dominates with 41.0% Market Share

North America leads the Active Aerodynamic Market with a 41.0% share, totaling USD 11.97 billion. This dominance is driven by strong automotive production, demand for fuel-efficient vehicles, and significant R&D investments in advanced vehicle technologies. The U.S. is the largest contributor, supported by innovation and extensive use of active aerodynamic systems in vehicles.

The region benefits from a mature automotive industry, stringent fuel economy regulations, and a focus on reducing emissions. Additionally, growing adoption of electric vehicles (EVs) and integration of active aerodynamics in commercial vehicles enhance market growth. Major automotive manufacturers and tech companies invest heavily in developing aerodynamic solutions to improve vehicle performance.

Regional Mentions:

- Europe: Europe sees steady growth, driven by stringent emission norms, increased adoption of EVs, and heavy investments in lightweight materials and active systems by automotive giants.

- Asia Pacific: Asia Pacific experiences rapid growth, fueled by expanding automotive production, rising demand for fuel-efficient vehicles, and government incentives for green technologies, especially in China, Japan, and South Korea.

- Middle East & Africa: The region shows moderate growth, supported by growing investments in automotive manufacturing and increasing demand for fuel-efficient commercial vehicles.

- Latin America: Latin America shows potential, driven by increasing production of passenger and commercial vehicles and a growing focus on energy efficiency in key markets like Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The active aerodynamic market is expanding rapidly, driven by the need for improved vehicle fuel efficiency and reduced emissions. The top four players in this sector are Magna International Inc., Valeo, Rochling SE & Co. KG, and Plastic Omnium. These companies maintain strong positions through innovation, advanced materials, and strategic collaborations.

Magna International Inc. is a leader in active aerodynamic systems, offering advanced grille shutters, active spoilers, and air deflectors. Its focus on enhancing fuel efficiency and vehicle performance strengthens its market position globally.

Valeo specializes in active grille shutters and automated systems that improve vehicle aerodynamics. The brand emphasizes lightweight materials and smart technology, enhancing vehicle performance and reducing emissions. Valeo’s global reach and strong partnerships support its growth.

Rochling SE & Co. KG offers innovative solutions like active diffusers and side skirts that adapt to driving conditions. It targets both passenger and commercial vehicles, focusing on reducing drag and improving energy efficiency. Rochling’s emphasis on sustainable materials supports its market competitiveness.

Plastic Omnium provides a wide range of active aerodynamic components, including spoilers and air dams. It focuses on smart integration and compatibility with electric vehicles, enhancing its market presence. The brand’s strong R&D and collaboration with automakers drive its growth.

These companies drive growth through technological innovation, strategic partnerships, and expanding product applications, making them leaders in the active aerodynamic market.

Top Key Players in the Market

- Magna International Inc

- Rochling SE & Co. KG

- Plastic Omnium

- SMP Automotive

- Valeo

- SRG Global

- Polytec Holding AG

- Plasman

- INOAC Corporation

- Rehau Group

- SDN BHD

- HBPO

- Spoiler Factory

- Airflow Deflector

- BMW AG

- Audi AG

- Ford Motor Company

- Daimler Truck Holding AG

- Volkswagen

- Renault Group

- PSA Group

- General Motors

- Other Key Player

Recent Developments

- Lotus: On September 2024, Lotus unveiled the Eletre Carbon, a luxury electric hyper-SUV with carbon fiber detailing, and introduced the Chapman Bespoke customization service in North America, allowing extensive personalization options for customers.

- Hyundai and Kia: On January 2024, Hyundai and Kia introduced the “Active Air Skirt” technology, which deploys at speeds above 80 km/h to reduce aerodynamic drag, improving efficiency and stability in electric vehicles. Tests on the Genesis GV60 showed a 2.8% drag reduction, equating to an approximate 6 km range increase.

- Formula 1: On June 2024, the FIA announced the implementation of active aerodynamics for Formula 1 cars starting in the 2026 season. This includes movable elements on the front and rear wings to optimize performance and energy efficiency, adapting aerodynamics dynamically for straights and corners.

- Dodge: On August 2024, Dodge revealed the Active Aero Airfoil System for its upcoming electric muscle car, the Charger Daytona. The system adjusts the rear wing angle according to driving conditions to optimize aerodynamics, aiming to enhance performance and efficiency in Dodge’s electric vehicle lineup.

Report Scope

Report Features Description Market Value (2023) USD 29.2 Billion Forecast Revenue (2033) USD 45.3 Billion CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Light Duty Vehicles, Heavy Commercial Vehicles), By Application (Grille Shutter, Spoiler, Air Dam, Side Skirts, Diffuser, Wind Deflectors, Gap Fairing, Other Applications), By Mechanism (Passive System, Active System) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Magna International Inc, Rochling SE & Co. KG, Plastic Omnium, SMP Automotive, Valeo, SRG Global, Polytec Holding AG, Plasman, INOAC Corporation, Rehau Group, SDN BHD, HBPO, Spoiler Factory, Airflow Deflector, BMW AG, Audi AG, Ford Motor Company, Daimler Truck Holding AG, Volkswagen, Renault Group, PSA Group, General Motors, Other Key Player Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Magna International Inc

- Rochling SE & Co. KG

- Plastic Omnium

- SMP Automotive

- Valeo

- SRG Global

- Polytec Holding AG

- Plasman

- INOAC Corporation

- Rehau Group

- SDN BHD

- HBPO

- Spoiler Factory

- Airflow Deflector

- BMW AG

- Audi AG

- Ford Motor Company

- Daimler Truck Holding AG

- Volkswagen

- Renault Group

- PSA Group

- General Motors

- Other Key Player