Acne Medicine Market By Product Type (Prescription Medicines, Hormonal Treatments, Oral Antibiotics, and Oral Contraceptive Tablets), By Formulation (Topical Medication, Antibiotics, and Oral Medication), By Distribution Channel (Retail Store, Pharmacy & Drug Store), By Acne Type (Non-inflammatory Acne and Inflammatory Acne), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152516

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

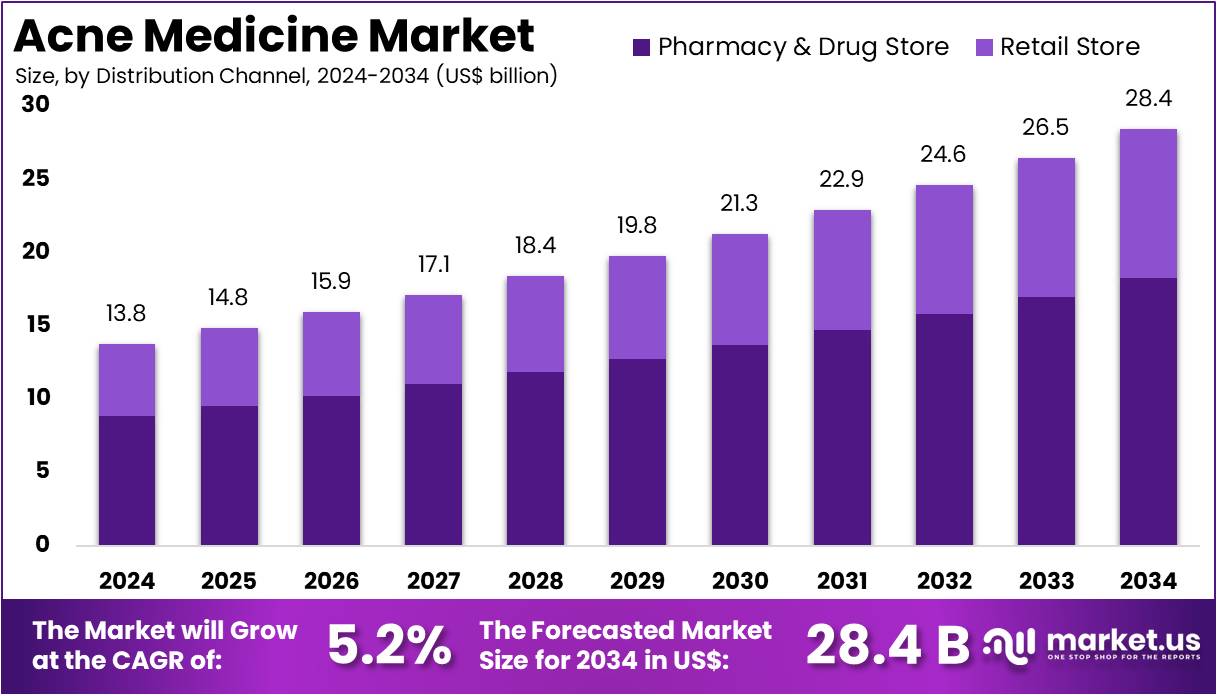

The Acne Medicine Market Size is expected to be worth around US$ 28.4 billion by 2034 from US$ 13.8 billion in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034.

Rising awareness about skin health and increasing demand for effective acne treatments are driving the growth of the acne medicine market. Acne vulgaris, affecting millions of individuals, particularly adolescents and young adults, has prompted the development of numerous therapeutic options ranging from topical treatments to oral medications. The market sees strong demand for products that target the underlying causes of acne, such as excessive sebum production, clogged pores, and bacterial infection.

Advances in dermatological treatments, including the development of combination therapies and personalized medicine, have expanded treatment options for patients with varying severities of acne. Recent trends show a shift toward using multi-ingredient formulations that combine antimicrobial agents, retinoids, and benzoyl peroxide for more comprehensive treatment approaches.

In October 2023, Bausch Health Companies revealed that CABTREO (clindamycin phosphate, benzoyl peroxide, and adapalene) Topical Gel obtained approval from the US FDA for the treatment of acne vulgaris in individuals aged 12 and older. This approval marks the first fixed-dose, triple-combination therapy for acne to be approved by the FDA, broadening treatment choices for patients and increasing market opportunities.

Additionally, growing interest in non-pharmaceutical options, such as laser therapy and light-based treatments, offers alternative routes to managing acne, further contributing to market diversity. With ongoing research into new molecules and treatment combinations, the acne medicine market is poised for continuous innovation, providing better solutions for patients seeking effective and long-lasting results.

Key Takeaways

- In 2024, the market for acne medicine generated a revenue of US$ 13.8 billion, with a CAGR of 5.2%, and is expected to reach US$ 28.4 billion by the year 2034.

- The product type segment is divided into prescription medicines, hormonal treatments, oral antibiotics, and oral contraceptive tablets, with prescription medicines taking the lead in 2023 with a market share of 40.0%.

- Considering formulation, the market is divided into topical medication, antibiotics, and oral medication. Among these, topical medication held a significant share of 45.3%.

- Furthermore, concerning the distribution channel segment, the market is segregated into retail store, pharmacy & drug store. The pharmacy & drug store sector stands out as the dominant player, holding the largest revenue share of 64.3% in the acne medicine market.

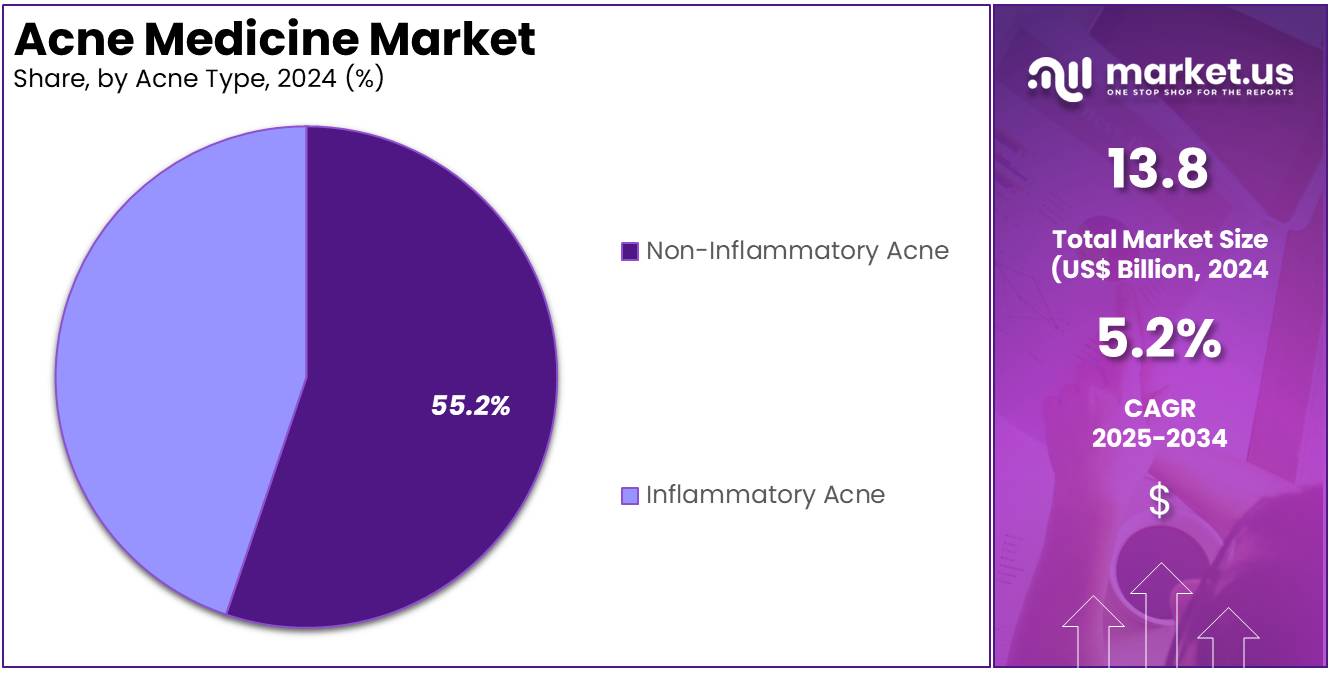

- The acne type segment is segregated into non-inflammatory acne and inflammatory acne, with the non-inflammatory acne segment leading the market, holding a revenue share of 55.2%.

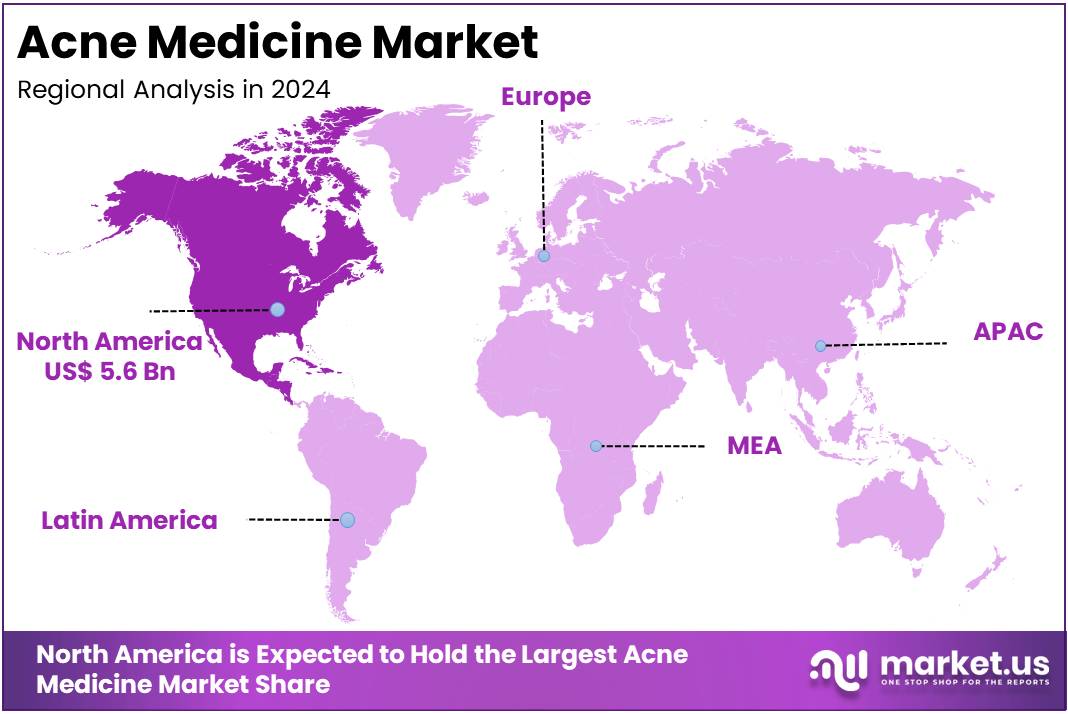

- North America led the market by securing a market share of 40.9% in 2023.

Product Type Analysis

Prescription medicines hold the largest share of 40.0% in the acne medicine market. This growth is driven by the increasing preference for targeted, effective treatments for moderate to severe acne. Patients are becoming more informed about the effectiveness of prescription-based therapies, and this awareness is fueling the demand. Additionally, the rise of dermatology consultations and the development of new prescription therapies are contributing factors.

The approval of combination treatments, such as fixed-dose therapies, is expected to drive growth in this segment. As more personalized treatments for acne are developed, this segment is likely to see sustained expansion. Prescription medicines are also often considered more reliable and potent, which boosts their appeal. This segment’s growth is further supported by healthcare providers who often recommend these medications to patients for more severe cases of acne.

Formulation Analysis

Topical medication continues to dominate with a 45.3% share of the market. It is expected to maintain its strong position due to its ease of use and accessibility. Topical treatments such as gels, creams, and ointments are considered a first-line treatment for acne, particularly for non-inflammatory acne. As more over-the-counter topical products become available, this segment is likely to grow further, especially with the increasing consumer preference for non-prescription solutions.

Additionally, the focus on creating non-comedogenic and advanced formulations is expected to improve patient compliance and contribute to the continued growth of topical medication. Dermatologists are increasingly recommending topical treatments as part of a holistic acne treatment regimen, further driving this segment’s expansion. The rise in direct-to-consumer product offerings is also expected to fuel growth in this category. With consumers seeking more accessible and affordable options, topical medication is anticipated to remain a dominant choice in acne treatment.

Distribution Channel Analysis

Pharmacy and drug stores dominate the acne medicine distribution channel with a 64.3% market share. This segment’s growth is expected to be driven by the trust consumers place in pharmacies for their healthcare needs. With professional advice available from pharmacists, consumers often prefer purchasing acne treatments from pharmacies for guidance on the most appropriate solutions. The availability of both prescription and over-the-counter acne treatments in these stores provides customers with a wide range of choices, boosting convenience. Moreover, pharmacies often stock a variety of specialized products, which are likely to increase the demand for acne treatments in this channel.

The growth of retail pharmacy chains and the expansion of drugstores offering skincare products further contribute to the segment’s expansion. The increasing focus on skincare, coupled with the emphasis on the clinical nature of the products sold in pharmacies, makes this segment attractive to consumers seeking reliable treatments. In addition, pharmacies offer the advantage of easy access to medications, including prescription drugs, which are likely to remain a preferred option for consumers seeking more effective treatment for severe acne cases. As demand for professional consultation and pharmaceutical-grade products increases, the pharmacy and drug store segment is anticipated to see sustained growth.

Acne Type Analysis

Non-inflammatory acne holds the largest share of 55.2% in the acne type segment. This dominance is expected to continue as non-inflammatory acne, which includes blackheads and whiteheads, is the most common form of acne. Non-inflammatory acne is easier to treat with over-the-counter products, which makes this segment attractive to a wide range of consumers. Adolescents and young adults are more likely to experience non-inflammatory acne, contributing to the sustained demand for treatments in this category.

The focus on early intervention and prevention of further outbreaks is projected to drive demand for products targeting non-inflammatory acne. Topical treatments and over-the-counter solutions, such as gels and creams, are likely to remain the go-to choices for consumers with non-inflammatory acne. As more effective and affordable treatments enter the market, the growth in this segment is expected to continue. The segment’s size and growth are further fueled by the increasing prevalence of acne among the younger population, particularly in regions where acne is considered a common cosmetic concern.

Key Market Segments

By Product Type

- Prescription Medicines

- Hormonal Treatments

- Oral Antibiotics

- Oral Contraceptive Tablets

By Formulation

- Topical Medication

- Antibiotics

- Oral Medication

By Distribution Channel

- Retail Store

- Pharmacy & Drug Store

By Acne Type

- Non-inflammatory Acne

- Inflammatory Acne

Drivers

Rising Prevalence of Acne is Driving the Market

The consistent and widespread prevalence of acne across diverse age groups is a significant driver propelling the expansion of the acne medicine market. Acne vulgaris, a chronic inflammatory skin condition, affects a substantial portion of the population, ranging from adolescents experiencing puberty to adults who face persistent or late-onset breakouts, thereby generating a constant and substantial demand for effective treatment options. This widespread occurrence necessitates a continuous supply of various therapeutic agents, including topical creams, gels, and oral medications.

Growing awareness about dermatological health and the notable aesthetic impact of skin conditions also increasingly motivates individuals to seek professional medical intervention and explore over-the-counter solutions for managing their acne. People increasingly prioritize clear skin, not just for aesthetic reasons but also for improved self-confidence and overall well-being, which translates into a greater willingness to invest in various treatment modalities.

According to the American Academy of Dermatology (AAD), acne stands as the most common skin condition in the United States, affecting up to 50 million Americans annually. The AAD further indicates that approximately 85% of individuals between the ages of 12 and 24 experience at least minor acne. Furthermore, adult acne continues to rise, impacting up to 15% of women. This high and sustained prevalence across diverse demographics ensures a consistently large patient pool requiring various forms of acne management, directly fueling the demand for innovative and accessible acne medications.

Restraints

Challenges in Patient Adherence to Treatment Regimens are Restraining the Market

Despite the extensive availability of various effective treatments, significant challenges in patient adherence to prescribed acne medicine regimens are notably restraining the market’s full potential. Effective acne treatment frequently demands consistent and prolonged application of topical medications or regular intake of oral medications, often extending over several months to achieve desired results.

However, patients commonly struggle with adherence due to a multitude of factors, including a perceived lack of immediate visible results, complex or inconvenient application schedules, and bothersome side effects such as skin irritation, excessive dryness, redness, or increased sun sensitivity, particularly with retinoids and benzoyl peroxide. These adverse effects can lead to discomfort, prompting patients to discontinue treatment prematurely or use their medications inconsistently, thereby reducing overall treatment efficacy and ultimately diminishing the perceived value of the product.

While specific government data on acne medication adherence is often aggregated within broader pharmaceutical usage patterns, the Centers for Disease Control and Prevention (CDC) consistently highlights patient adherence as a critical factor in managing chronic diseases, a principle equally applicable to persistent conditions like acne. The inconsistent use of prescribed medications directly impacts sales volumes and the overall growth trajectory of the market.

Furthermore, the absence of quick, visible improvements can be disheartening for patients, especially adolescents, further contributing to treatment discontinuation. Addressing adherence challenges requires developing more tolerable formulations, simplifying regimens, and enhancing patient education to ensure better treatment outcomes and sustained market growth.

Opportunities

Growth of Tele-dermatology and Digital Health Platforms is Creating Growth Opportunities

The rapid and sustained growth of tele-dermatology services and broader digital health platforms is creating significant growth opportunities within the acne medicine market. Tele-dermatology allows patients to consult with dermatologists remotely, effectively overcoming geographical barriers and substantially reducing long wait times for in-person appointments. This significantly increased accessibility to professional medical advice facilitates earlier diagnosis and the timely prescription of acne medications, thereby broadening the patient base that can receive appropriate and consistent treatment.

Many individuals, especially younger demographics, find virtual consultations more convenient, less time-consuming, and often less intimidating than traditional in-person visits, encouraging them to proactively seek help for their skin concerns. The sheer convenience of obtaining prescriptions, managing follow-up care, and receiving ongoing guidance without physically visiting a clinic encourages greater compliance and sustained engagement with long-term treatment plans.

The Centers for Medicare & Medicaid Services (CMS) reported significant utilization of telehealth services by Medicare beneficiaries, with millions of beneficiaries accessing care remotely, reflecting a broader shift in healthcare delivery that includes dermatology. For example, a National Center for Health Statistics (NCHS) Data Brief from February 2024, analyzing 2021 and 2022 data, indicated that 37% of US adults used telehealth appointments in 2021, a figure that continued to show strong adoption.

While specific teledermatology figures from government sources are often embedded within broader telehealth statistics, the pervasive nature of skin conditions like acne makes them a significant component of these virtual visits. This burgeoning trend in virtual care directly supports the accessibility and broader distribution of acne medications, as more patients can connect with specialists who can accurately diagnose their condition and prescribe appropriate therapies, substantially expanding the market’s reach and utilization.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the acne medicine market, shaping both its challenges and its trajectory. Economic conditions, such as persistent inflation and fluctuations in disposable income, directly impact consumer spending on both over-the-counter acne treatments and the affordability of prescription medications. During periods of high inflation, the cost of raw materials for pharmaceutical production, manufacturing, and distribution can increase, potentially leading to higher product prices for consumers.

For instance, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for all urban consumers, U.S. city average, increased 3.1% over the 12 months ended January 2024, indicating pervasive inflationary pressures affecting various consumer goods, including health and personal care products. However, in times of economic uncertainty, consumers might prioritize essential healthcare, potentially shifting demand towards more affordable generic acne treatments, which can still maintain market activity.

Simultaneously, geopolitical tensions, including international trade disputes or regional conflicts, can disrupt global supply chains for active pharmaceutical ingredients (APIs) and finished drug products, potentially leading to manufacturing delays, product shortages, or increased costs. Despite these challenges, such global events can also compel pharmaceutical companies to diversify their manufacturing bases and supply chains, fostering more resilient production networks that ultimately ensure a more stable supply of crucial ingredients for acne medications in the market.

Current US tariffs have both direct and indirect impacts on the acne medicine market. Tariffs on imported pharmaceutical ingredients, especially active pharmaceutical ingredients (APIs) and certain finished drug products, increase costs for drug manufacturers operating in or importing into the US. These higher input costs may force pharmaceutical companies to either absorb the additional expenses, which could hurt their profit margins, or pass these costs on to consumers through higher prices for acne medications. This price increase can make acne treatments less accessible, particularly for those who rely on more affordable options.

A June 2025 analysis by the Johns Hopkins Bloomberg School of Public Health highlighted the significant reliance of the US on global supply chains, noting that the value of US pharmaceutical imports more than doubled from US$73 billion in 2014 to over US$215 billion in 2024. This rise underscores the vulnerability of the US market to tariff policies. The analysis also pointed out that high tariffs on Chinese APIs—reaching up to 245%—were expected to considerably increase the cost of these critical ingredients, which are essential for producing generic drugs, including acne medications, in the US.

Indirectly, these tariffs could strain the relationships between manufacturers and distributors, and may even limit the availability of certain specialized or generic acne medications if the cost of importing becomes economically unviable. However, these tariff policies could also encourage pharmaceutical companies to invest in domestic manufacturing and innovation, thus promoting the development of US-based production facilities and research for acne treatments. This shift could lead to job creation and foster a more secure and independent supply chain for essential acne medications, ultimately strengthening the resilience and sustainability of the US acne medicine market.

Latest Trends

Advancements in Novel Targeted Therapies and Formulations is a Recent Trend

A prominent recent trend profoundly shaping the acne medicine market in 2024 and continuing strongly into 2025 is the acceleration of advancements in novel targeted therapies and innovative drug formulations. Pharmaceutical companies are increasingly focusing their research and development efforts on creating treatments that address specific molecular pathways involved in acne pathogenesis, leading to more effective, safer, and potentially better-tolerated options.

This includes the development of therapies that precisely target sebum production, inflammation, bacterial overgrowth, and follicular hyperkeratinization with greater specificity. There is also a notable emphasis on developing fixed-dose combination products and new drug delivery systems designed to improve patient adherence by simplifying regimens and minimizing common side effects. The U.S. Food and Medical Administration (FDA) plays a crucial role in approving these new treatments.

For instance, the FDA’s “Novel Drug Approvals for 2024” list (updated regularly by the agency) includes new therapies across various medical fields, and similar innovation is consistently seen in dermatological approvals. While specific acne approvals for 2024-2025 are detailed by pharmaceutical companies upon launch, the FDA’s rigorous approval process reflects the ongoing commitment to bringing new and improved medications to patients. This signals an ongoing drive within the pharmaceutical industry for more sophisticated, patient-friendly, and efficacious solutions for acne, aiming to overcome the limitations of older treatments and revitalize patient interest in therapeutic management.

Regional Analysis

North America is leading the Acne Medicine Market

The acne medicine market in North America experienced significant growth in 2024, driven by the persistent high prevalence of acne across adolescent and adult populations, coupled with continuous innovation and new product approvals. Acne remains the most common skin problem in the United States, affecting up to 50 million Americans, as highlighted by Bausch Health. This widespread condition creates a consistent and substantial demand for effective treatments.

A key driver for market expansion in 2024 was the introduction of novel formulations offering enhanced efficacy and convenience. For instance, Bausch Health Companies Inc. received U.S. Food and Drug Administration (FDA) approval for CABTREO (clindamycin phosphate, adapalene, and benzoyl peroxide) Topical Gel in October 2023, and it became commercially available in the U.S. in early 2024. This triple-combination topical treatment, the first and only fixed-dose product of its kind, simplifies dosing with a once-daily regimen, which is expected to improve patient adherence and outcomes.

Leading dermatology companies also reported robust performance. Galderma, a major player in dermatological solutions, reported that its overall net sales reached US$4,410 million for the full year 2024, with its Therapeutic Dermatology segment, which includes acne treatments, showing 6.1% year-on-year growth on a constant currency basis. While the U.S. market for Galderma’s therapeutic dermatology portfolio saw some impact from genericization, the introduction of new products like Nemluvio (though primarily for other indications, it reflects the company’s broader dermatology focus) and continued strong performance in other segments underscore the underlying strength and innovation within the North American dermatology market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market for acne medicine in Asia Pacific is expected to demonstrate substantial growth during the forecast period. This anticipated expansion will primarily stem from a rising awareness of dermatological conditions, increasing disposable incomes, and the growing influence of aesthetic trends, alongside improving access to specialized healthcare in many countries.

The prevalence of acne remains significant across Asia, with studies in China, Korea, and Japan indicating that acne vulgaris is one of the most prevalent inflammatory skin diseases affecting young adults. As healthcare infrastructure continues to develop and access to dermatologists improves in emerging economies like India and China, more individuals will likely seek professional medical advice and prescription treatments for their skin concerns.

Governments and health organizations in the region are increasingly focusing on public health initiatives that include skin health, which should further drive demand. For instance, the International League of Dermatological Societies (ILDS) actively promotes skin health globally, with a strong presence and initiatives in Asia Pacific, as evidenced by their 2024 Member Initiatives Directory.

Pharmaceutical companies are strategically expanding their footprint in this dynamic region. Galderma, for example, reported strong growth in its Dermatological Skincare category, which includes brands like Cetaphil, in Asia Pacific markets, and saw notable market share gains in China for its neuromodulators, indicating a strong overall presence and investment in regional dermatology.

Bausch Health also plans regulatory submissions for its aesthetic devices, which can complement medical treatments, in Asia Pacific markets in 2024, signaling a broader commitment to the region’s skin health sector. These factors collectively indicate that the demand for and accessibility of these therapies will accelerate significantly across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the acne medicine market, key players adopt various strategies to enhance their growth. They focus on expanding product portfolios with advanced formulations such as topical creams, oral medications, and combination therapies to address different types of acne. Companies also invest heavily in R&D to develop innovative treatments targeting underlying causes like hormonal imbalances and bacterial infections.

Strategic partnerships and acquisitions allow these firms to expand their market reach and tap into new geographical regions. Additionally, some companies focus on direct-to-consumer marketing and digital platforms to increase brand visibility and engagement with customers. To cater to the growing demand for natural and organic solutions, many players are incorporating plant-based ingredients into their products. Competitive pricing and enhanced distribution networks also play a crucial role in their strategies.

One key player, Galderma, is a global leader in dermatology and specializes in both prescription and over-the-counter products. Known for its prominent brands such as Differin and Epiduo, the company has developed a strong market presence by focusing on innovative, science-backed treatments and expanding its global footprint. Galderma’s ongoing research into acne therapy and emphasis on consumer education further strengthens its position in the market.

Top Key Players in the Acne Medicine Market

- Teva Pharmaceutical Industries Ltd

- Sun Pharmaceutical Industries Limited

- Pfizer Inc

- Mayne Pharma Group Limited

- Johnson & Johnson

- Gentle Wellness Center

- Bausch Health Companies Inc

- Almirall Sa

Recent Developments

- In February 2024, the Gentle Wellness Center located in Fairfax, Virginia, unveiled the Morpheus8 therapy aimed at individuals with scar tissue resulting from dermatological conditions. This innovative procedure is intended to improve the texture and appearance of the skin, providing a fresh alternative for individuals dealing with scars due to various skin ailments.

- In April 2024, Bausch Health Companies Inc. introduced PrARAZLO (tazarotene lotion, 0.045%) as a treatment for acne vulgaris. This topical medication is now accessible through British Columbia’s BC PharmaCare program, offering patients an additional, effective option for managing acne in the area.

Report Scope

Report Features Description Market Value (2024) US$ 13.8 billion Forecast Revenue (2034) US$ 28.4 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Prescription Medicines, Hormonal Treatments, Oral Antibiotics, and Oral Contraceptive Tablets), By Formulation (Topical Medication, Antibiotics, and Oral Medication), By Distribution Channel (Retail Store, Pharmacy & Drug Store), By Acne Type (Non-inflammatory Acne and Inflammatory Acne) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teva Pharmaceutical Industries Ltd, Sun Pharmaceutical Industries Limited, Pfizer Inc, Mayne Pharma Group Limited, Johnson & Johnson, Gentle Wellness Center, Bausch Health Companies Inc, Almirall Sa. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teva Pharmaceutical Industries Ltd

- Sun Pharmaceutical Industries Limited

- Pfizer Inc

- Mayne Pharma Group Limited

- Johnson & Johnson

- Gentle Wellness Center

- Bausch Health Companies Inc

- Almirall Sa