Global 6G-Enabled Industrial Microservices Market Size, Share, Industry Analysis Report By Component (Platforms & Framework, Services, Hardware Infrastructure), By Deployment Model (On-Premise, Cloud-Based, Hybrid / Edge-Cloud Integration), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Application (Smart Manufacturing & Industrial Automation, Predictive Maintenance, Supply Chain & Logistics Optimization, Robotics & Autonomous Systems, Industrial IoT & Edge Intelligence, Digital Twin & Simulation, Cybersecurity & Risk Management, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Oct. 2025

- Report ID: 160368

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- Performance statistics compared to 5G

- Investment and Regulatory Environment

- Market-Enabling Technologies

- US Market Size

- By Component

- By Deployment Model

- By Enterprise Size

- By Application

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

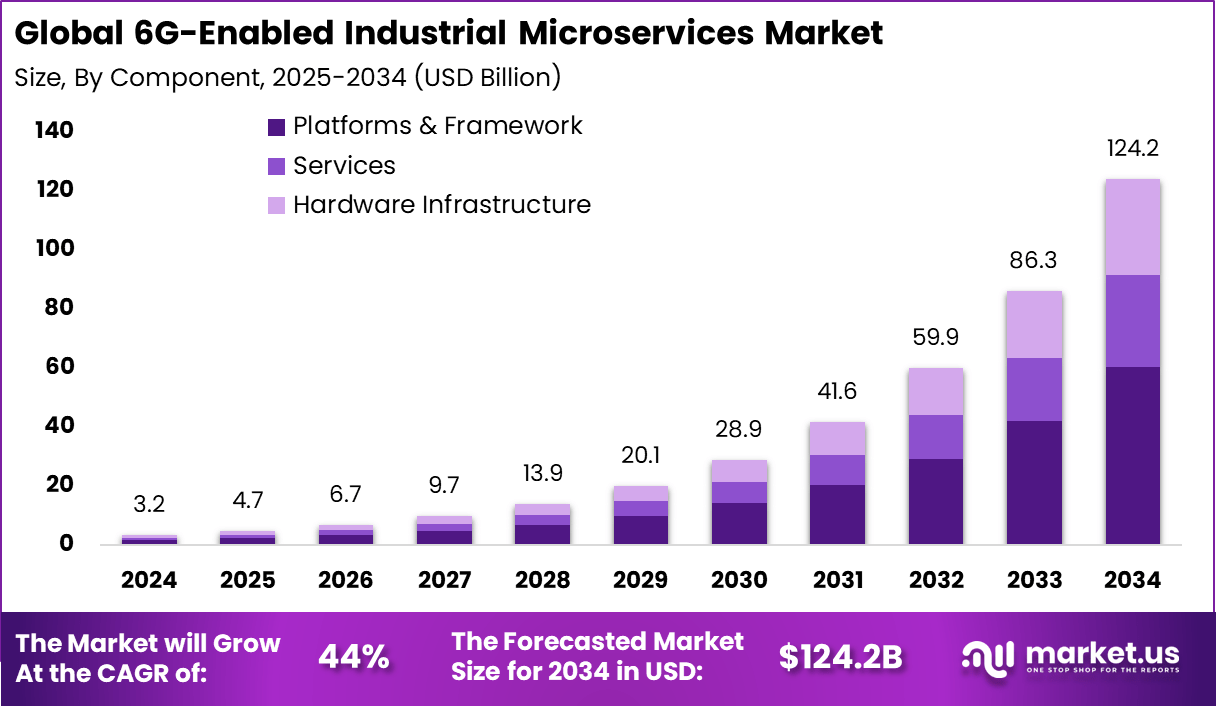

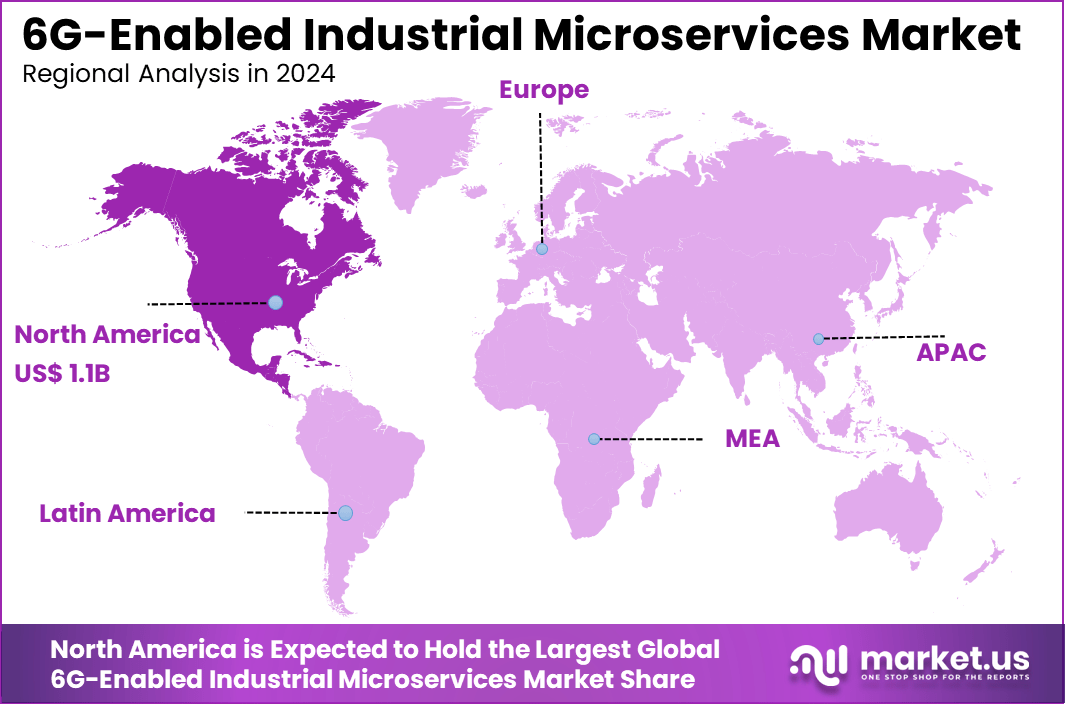

The Global 6G-Enabled Industrial Microservices Market generated USD 3.2 billion in 2024 and is predicted to register growth from USD 4.7 billion in 2025 to about USD 124.2 billion by 2034, recording a CAGR of 44% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 35.5% share, holding USD 1.1 Billion revenue.

The 6G-enabled industrial microservices market involves the combination of microservice architectures with the latest 6G wireless networks in industrial settings. Microservices allow large industrial applications to be broken down into smaller, independent modules that can be deployed and updated separately. The expected capabilities of 6G networks include extremely low latency of less than 1 millisecond, terabit-per-second speeds, and built-in AI-driven networking.

The top driving factors for this market include the growth of edge computing, the increasing penetration of AI and machine learning, and the rise of smart factories across both established and emerging economies. The need for ultra-reliable, low-latency communications has become critical as industries deploy more connected sensors and devices.

Adoption is accelerating due to smart manufacturing programs and government support in regions such as North America and Asia-Pacific, where advanced R&D efforts are enabling early trials. Industrial users are increasingly focused on real-time automation, predictive maintenance, and remote operations. Nearly 50% of enterprises in these early-adopter regions now view 6G as a strategic priority owing to its ability to instantly process large-scale IoT data.

Governments have become pivotal investors, especially in North America and Asia-Pacific. In India, for instance, national programs have set targets to secure over 10% of global 6G patents by 2030, driving indigenous innovation and reducing technology imports. Federal and regional authorities are accelerating 6G rollout by offering major financial incentives and simplified regulations, while U.S. manufacturing sectors benefit from steady capital inflows for research and infrastructure upgrades.

Key Insight Summary

- Platforms & frameworks lead with 48.6%, serving as the backbone for integrating industrial microservices.

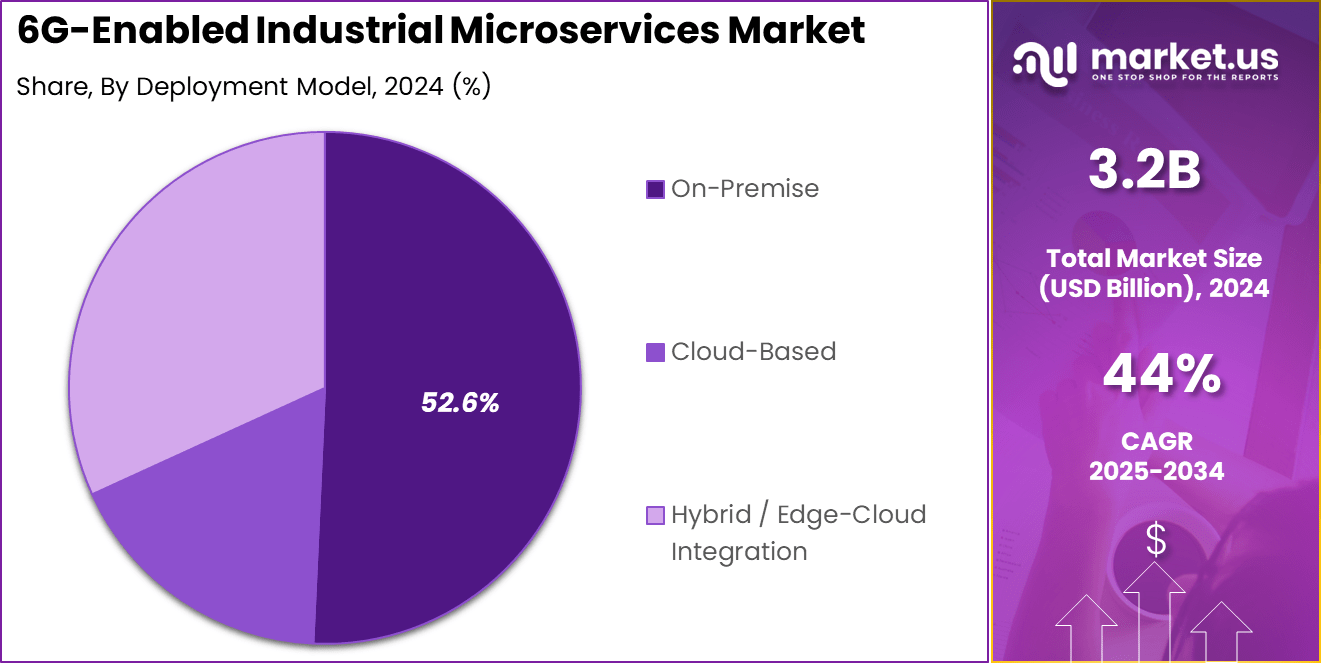

- On-premise deployment holds 52.6%, reflecting enterprises’ preference for secure, localized control of critical operations.

- Large enterprises dominate with 70.5%, leveraging 6G microservices for complex and large-scale industrial systems.

- Smart manufacturing & industrial automation applications account for 32.6%, driven by Industry 4.0 transformation.

- North America contributes 35.5%, supported by strong R&D investment and early adoption of advanced network technologies.

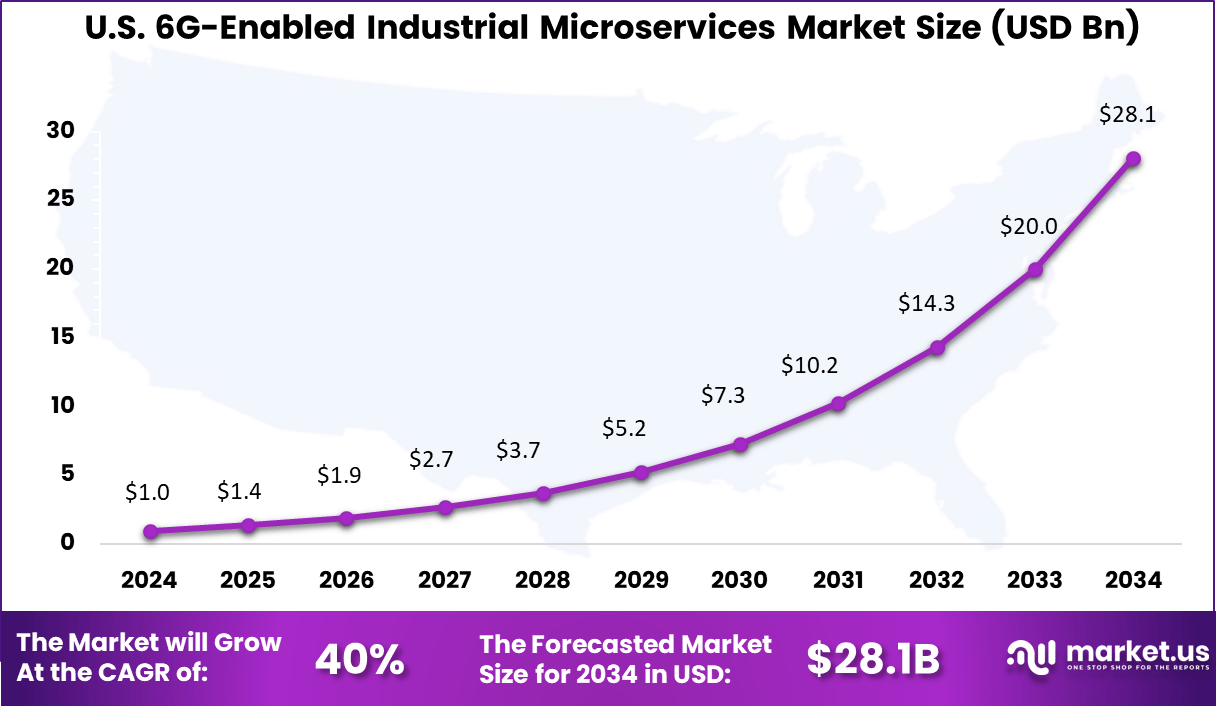

- The US market reached USD 0.97 billion and is expanding at a rapid CAGR of 40.0%, highlighting its leadership in next-generation industrial connectivity.

Analysts’ Viewpoint

Cloud-based solutions and hybrid edge-cloud setups are increasingly adopted, allowing firms to combine on-premises industrial control with the broad scalability of the cloud. This shift to cloud-native architectures, which represented the largest segment in recent results, is driven by demand for flexible, software-driven industrial platforms.

The hybrid approach in particular is seeing strong momentum due to its ability to deliver real-time, high-frequency control at the operational edge, while managing complex orchestrations and analytics in the cloud. Top technologies being adopted include AI-powered networking, quantum-resistant encryption, advanced service mesh frameworks, and digital twin simulation tools.

AI-integrated 6G platforms facilitate instant analysis of operational data, dynamically balance network resources, and anticipate failures before they occur. Digital twins, enabled by real-time data transmission, allow organizations to visualize, optimize, and monitor industrial assets virtually, marking a significant efficiency gain for manufacturing and logistics sectors.

Key reasons for adopting these 6G-enabled microservices within industry environments include substantial boosts in operational agility, security, and productivity. Companies cite the ability to react to market changes in real time, enable new business models like remote manufacturing, and sharply reduce downtime through data-driven maintenance strategies. As automation deepens, organizations also benefit from lower infrastructure costs and fewer disruptions due to adaptable, modular architectures.

Role of Generative AI

The role of generative AI in the landscape of 6G-enabled industrial microservices is moving beyond simple data analytics, contributing directly to network optimization, security, and automation strategies. In 2025, over 65% of large enterprises are relying on generative AI models to drive real-time automation and predictive maintenance throughout manufacturing and process industries.

These AI-powered microservices manage and analyze vast IIoT datasets, enabling failure prediction, autonomous decision-making, and resource allocation. By integrating generative AI natively into 6G infrastructure, industries are achieving improved operational efficiency while seeing significant reductions in downtime and manual intervention.

Generative AI is reshaping cybersecurity standards, enabling AI-driven threat detection and quantum-resistant encryption to become core defense mechanisms. These capabilities are no longer experimental add-ons but are now listed as strategic priorities in nearly 50% of industrial microservice deployments, reflecting a rapid shift toward proactive and autonomous cyber-resilience.

Performance statistics compared to 5G

Statistic 5G Network 6G Network (Projected) Data rate 20 Gbps (downlink) 1 Tbps or more Latency ~1 ms <1 microsecond (10–100 microseconds range) Device connectivity density 1 million devices/km² >10 million devices/km² Reliability 99.999% 99.9999% Positioning accuracy Meter-level (20 m) Centimeter-level Investment and Regulatory Environment

Investment opportunities are emerging rapidly as ecosystem maturity rises. Advanced manufacturing, logistics, and digitally driven enterprises are channeling substantial resources into 6G-ready infrastructure, with capital flowing into AI integration services, advanced cybersecurity, and orchestration technology providers.

Emerging economies in Asia-Pacific are pushing investments as R&D incentives increase, while North American adoption is buoyed by reliable connectivity frameworks and government partnerships. The regulatory environment is evolving to support fast deployment and innovation.

North America benefits from streamlined permitting and financial incentives that help expedite 6G rollouts, while Asia-Pacific sees strong support for R&D and transitions from previous wireless standards. Policymakers worldwide are acting to ensure spectrum availability and secure network operation, with a growing focus on underpinning data privacy, ethical AI use, and industrial cybersecurity.

Market-Enabling Technologies

- Massive MIMO and Beamforming: Advanced antenna systems are critical for handling the surge in connected devices. These technologies improve capacity and spectral efficiency, ensuring high-performance connectivity in dense network environments.

- Integrated Satellite-Terrestrial Networks (ISTNs): By combining satellite and terrestrial infrastructures, ISTNs extend coverage to remote and underserved regions, while also enhancing reliability and spectrum utilization.

- Intelligent Orchestration: Next-generation orchestration platforms enable the deployment and dynamic migration of nano-services across distributed computing resources. This ensures seamless operations, optimized resource allocation, and resilience in large-scale networks.

US Market Size

In the US, the market reached 0.97 billion with forward-looking advances in AI-powered network management and terahertz communications. A CAGR of 40.0% highlights the region’s agility in adopting cutting-edge solutions for industrial automation and smart manufacturing, positioning North America as a primary hub for industrial innovation.

In 2024, North America held 35.5% of the market, driven by its strong industrial automation base and robust cloud infrastructure for deploying advanced connectivity solutions. The region’s leadership is supported by investments in R&D, digital twin technologies, and government policies streamlining industrial digitalization.

By Component

In 2024, Platforms and frameworks accounted for 48.6% of the 6G-enabled industrial microservices market. These solutions serve as the foundation for service mesh, orchestration, and API management, making it easier to deploy, manage, and scale modular applications across industrial facilities.

The rise of cloud-native and service-based models is fueling widespread adoption, allowing organizations to optimize resources and improve reliability in high-speed industrial environments. Advanced 6G platforms are built to harness ultra-low latency and high throughput capabilities, enabling real-time automation and control within smart factories.

The integration of AI-driven orchestration and edge computing features further boosts operational efficiency, supporting large-scale industrial deployments that demand robust data security and instant decision-making.

By Deployment Model

In 2024, On-premise deployment led with 52.6% share, as many industries still prefer complete control and local data processing for their mission-critical automation systems. Security is a top priority, and on-premise models offer direct oversight while meeting latency and reliability needs in environments with sensitive equipment and proprietary data.

This deployment type enables industries to leverage the high-speed and near-zero latency of 6G networks to manage complex, distributed microservices directly within their own infrastructure. On-premise deployments now incorporate advanced management tools and AI-powered monitoring, ensuring smooth operations for robotics, process automation, and production analytics at scale.

By Enterprise Size

In 2024, Large enterprises made up 70.5% of market adoption, using their significant resources to implement fully integrated 6G-enabled microservices architectures. These organizations process sizable amounts of real-time data for predictive maintenance, digital twins, and seamless automation across extensive production networks.

Large enterprises offer the environment for advanced use cases like autonomous robotics, remote asset management, and dynamic resource allocation with AI. Their investments are accelerating innovation, driving the overall market forward, while small and medium businesses (SMEs) see increasing opportunities as costs drop and edge-cloud tools evolve.

By Application

In 2024, Smart manufacturing and industrial automation commanded 32.6% of application share, transforming production with real-time control and ultra-reliable communication enabled by 6G networks. Applications include predictive maintenance, precision robotics, and digital twins, creating an optimized factory ecosystem responsive to changing demands.

The adoption of these microservices is supported by the capability of 6G to interconnect vast numbers of IoT sensors and devices in factories, enabling seamless workflow automation. Zero-latency operations make it possible to deploy self-optimizing systems, robotic process automation, and high-speed production lines across industries.

Emerging Trends

Emerging trends in this sector revolve around hybrid edge-cloud architectures and rapid uptake of industrial automation. About 50% of the current market value in 2024 is attributed to platforms and frameworks that utilize 6G’s terabit-level speeds and sub-millisecond latency to support digital twins, multi-robot orchestration, and real-time control systems.

Growth is accelerating in SMEs as barriers around cost and complexity begin to recede, with AI-powered analytics providing actionable real-time insights and optimizing logistics and supply chains. In regions like Asia-Pacific, the trend is heightened by rapid urbanization and the convergence of smart factory technologies – with government-driven industrial digitalization contributing to the fastest growth rates globally.

Growth Factors

Key growth factors include the adoption of industrial automation and the expanding use of IIoT devices, which are pushing demand for 6G’s ultra-reliable, low-latency capabilities. The industry is seeing over 35% of value creation in North America, where robust infrastructure and strong government-industry partnerships foster technology rollouts.

Advanced sensing, high-precision positioning, and edge computing are also fueling new applications in sectors such as healthcare and finance, where secure and high-speed data transmission are critical for operational excellence. The widespread adoption of digital twins, adaptive robotics, and context-aware systems is driving industrial performance to new heights.

Key Market Segments

By Component

- Platforms & Framework

- Services

- Hardware Infrastructure

By Deployment Model

- On-Premise

- Cloud-Based

- Hybrid / Edge-Cloud Integration

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Smart Manufacturing & Industrial Automation

- Predictive Maintenance

- Supply Chain & Logistics Optimization

- Robotics & Autonomous Systems

- Industrial IoT & Edge Intelligence

- Digital Twin & Simulation

- Cybersecurity & Risk Management

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Integration of AI, Edge Computing, and 6G Connectivity

The convergence of AI, edge computing, and ultra-high-speed 6G connectivity is a powerful driver for 6G-enabled industrial microservices. This integration allows industries to adopt agile microservices architectures that support real-time automation and distributed intelligence.

The ability to analyze vast amounts of data generated by Industrial IoT devices in real time helps optimize operations and improve predictive maintenance. This real-time data processing, enabled by ultra-low latency and terabit-level speeds of 6G, enhances operational efficiency and responsiveness, which is critical for smart factories and Industry 4.0 environments.

In addition, AI-driven security features like quantum-resistant encryption and real-time threat detection strengthen industrial networks against cyber threats. The combined effect of these technologies enables new industrial applications such as autonomous robotics, digital twins, and AI-driven decision-making. These advancements make 6G-enabled microservices crucial for industries aiming to enhance productivity, reduce downtime, and maintain competitive edge in digital transformation.

Restraint

High Infrastructure and Deployment Costs

One major restraint for the 6G-enabled industrial microservices market is the high cost associated with deploying 6G infrastructure. The technology demands significant investment for network rollout, especially in building ultra-fast, low-latency 6G networks that require next-generation antennas, base stations, and edge computing resources.

These upfront capital costs can be prohibitive, particularly for smaller industries and developing regions with limited financial resources. This financial barrier may slow down the adoption rate of 6G-enabled microservices as companies carefully evaluate return on investment.

High infrastructure costs also challenge comprehensive 6G network coverage, limiting market growth in regions that cannot afford such expenditure. Consequently, while technology advances rapidly, the economic feasibility remains a key challenge, holding back widespread deployment in the near term.

Opportunity

Growth in Industrial Automation and Smart Factories

The growth of industrial automation and smart factories presents a significant opportunity for 6G-enabled industrial microservices. With 6G providing ultra-reliable, low-latency communication, industries can deploy advanced automation systems that require real-time data exchange and precise control.

This technology supports interconnected networks of machines, sensors, and robots that improve productivity, reduce errors, and streamline resource management. 6G-based microservices accelerate the digital transformation of manufacturing, enabling real-time monitoring and instant adjustments in production processes.

It also facilitates complex use cases such as AI-driven predictive maintenance and digital twin simulations that allow manufacturers to optimize operations before issues arise. As smart factories expand, demand for reliable and fast 6G-enabled communication networks will grow, making this sector a lucrative area for market expansion.

Challenge

Managing Complex Heterogeneous Systems

A significant challenge in implementing 6G-enabled industrial microservices is managing the complexity of heterogeneous devices and systems in industrial environments. Industrial IoT networks comprise a wide range of sensors, machinery, edge devices, and cloud services that need to work seamlessly together.

Ensuring consistent quality of service (QoS), interoperability, and performance across these diverse components is difficult. Edge devices often have resource constraints in terms of storage and processing power, which complicates the deployment of advanced microservices.

Moreover, securing these vast networks from evolving cyber threats while maintaining real-time performance is another complex task. Addressing these integration and management issues requires robust frameworks and continuous optimization to fully realize the potential of 6G-enabled industrial microservices.

Competitive Analysis

The 6G-Enabled Industrial Microservices Market is led by global telecom innovators such as Nokia Corporation, Ericsson AB, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., and ZTE Corporation. These companies are investing heavily in 6G infrastructure, ultra-low latency networking, and network slicing capabilities that enable autonomous microservices across smart factories.

Cloud and IT infrastructure providers including Microsoft Corporation, Amazon Web Services (AWS), Google Cloud, IBM Corporation, and Hewlett Packard Enterprise (HPE) are integrating microservices orchestration with edge computing and 6G-ready platforms. Their offerings support containerized applications, API-driven industrial workflows, and scalable machine data processing.

Industrial automation leaders such as Siemens AG, General Electric (GE Digital), Schneider Electric SE, and Rockwell Automation, Inc. focus on embedding 6G-powered microservices into control systems, robotics, and digital twin environments. Semiconductor and connectivity providers like Intel Corporation, Qualcomm Technologies, Inc., and Fujitsu Ltd. supply the processing and communication backbone for distributed industrial computing.

Top Key Players in the Market

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- NEC Corporation

- ZTE Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google Cloud (Alphabet Inc.)

- Siemens AG

- General Electric (GE Digital)

- Schneider Electric SE

- Rockwell Automation, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Fujitsu Ltd.

- Capgemini SE

- Other Major Players

Recent Developments

- In March 2025, NVIDIA announced collaborations with T-Mobile, MITRE, Cisco, ODC (Cerberus Capital Management), and Booz Allen Hamilton to co-develop AI-native wireless network hardware and software for 6G infrastructure. The initiative is based on the premise that next-generation wireless systems must be deeply integrated with AI from the ground up to support hundreds of billions of connected devices, including smartphones, sensors, autonomous vehicles, and industrial robots.

- In March 2025, South Korean researchers achieved a breakthrough in core wired 6G networking technology, enabling real-time remote collaboration, telemedicine surgeries, and ultra-low-latency conferencing. The Electronics and Telecommunications Research Institute (ETRI) developed key components designed to power hyper-immersive and high-precision services, laying the foundation for a fully interactive metaverse experience in the 6G era.

- In May 2025, Hewlett Packard Enterprise (HPE) extended its innovations in distributed networking with new data center switches aimed at meeting AI and high-performance computing demands, supporting next-gen 6G-enabled industrial microservices that require high throughput and low latency in complex industrial environments.

- In February 2025, Samsung Electronics released a comprehensive 6G white paper emphasizing AI-native communication and sustainable networks. They outlined their strategy to integrate AI across 6G network design, management, and operations, improving network quality and energy efficiency for industrial microservices. Samsung is steering the industry toward 6G commercialization by 2030 with early standardization focus starting in 2025.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 124.2 Bn CAGR(2025-2034) 44% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Platforms & Framework, Services, Hardware Infrastructure), By Deployment Model (On-Premise, Cloud-Based, Hybrid / Edge-Cloud Integration), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Application (Smart Manufacturing & Industrial Automation, Predictive Maintenance, Supply Chain & Logistics Optimization, Robotics & Autonomous Systems, Industrial IoT & Edge Intelligence, Digital Twin & Simulation, Cybersecurity & Risk Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nokia Corporation, Ericsson AB, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Cisco Systems, Inc., NEC Corporation, ZTE Corporation, IBM Corporation, Hewlett Packard Enterprise (HPE), Microsoft Corporation, Amazon Web Services (AWS), Google Cloud (Alphabet Inc.), Siemens AG, General Electric (GE Digital), Schneider Electric SE, Rockwell Automation, Inc., Intel Corporation, Qualcomm Technologies, Inc., Fujitsu Ltd., Capgemini SE, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  6G-Enabled Industrial Microservices MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

6G-Enabled Industrial Microservices MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- NEC Corporation

- ZTE Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google Cloud (Alphabet Inc.)

- Siemens AG

- General Electric (GE Digital)

- Schneider Electric SE

- Rockwell Automation, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Fujitsu Ltd.

- Capgemini SE

- Other Major Players