Global 5G in Aviation Market By Technology (Enhanced Mobile Broadband (eMBB), Ultra-Reliable Low Latency Communications (URLLC), Massive Machine Type Communications (mMTC)), By Communication Infrastructure (Small cell, Macro Cell), By Application (Communication, Navigation, Surveillance), By End-Use (Commercial Aviation, Military Aviation, General Aviation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 83163

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

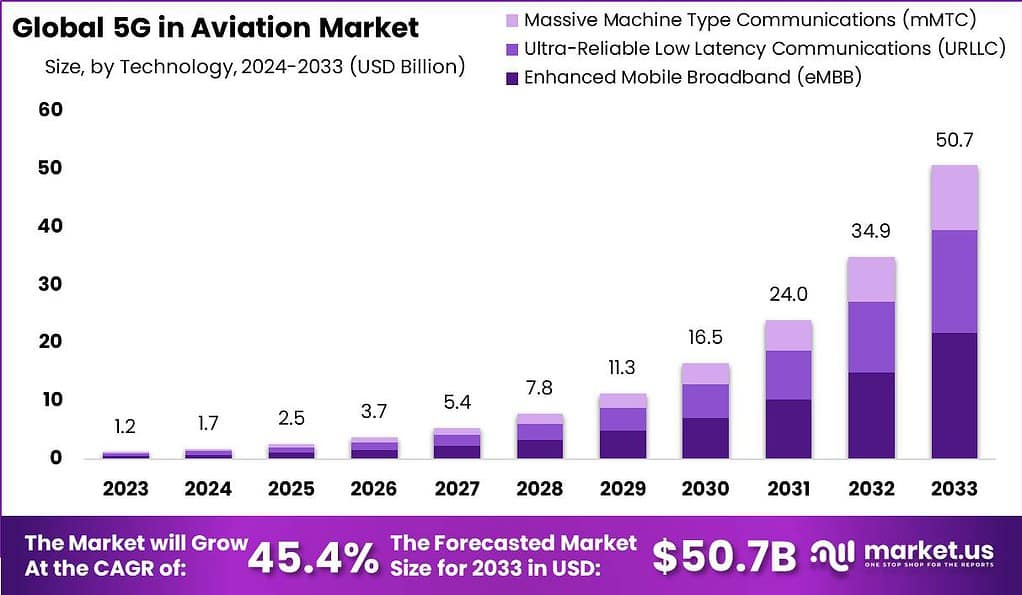

The Global 5G in Aviation Market size is expected to be worth around USD 50.7 Billion by 2033, from USD 1.2 Billion in 2023, growing at a CAGR of 45.4% during the forecast period from 2024 to 2033.

5G technology is set to revolutionize the aviation industry, offering new possibilities and enhancing various aspects of aviation operations. 5G in aviation refers to the application of fifth-generation wireless technology in the aviation sector, enabling faster and more reliable connectivity, improved safety, enhanced passenger experiences, and increased operational efficiency.

The 5G in aviation market represents the industry involved in providing 5G-enabled solutions and services to the aviation sector. It includes telecommunications providers, equipment manufacturers, aviation technology companies, and airlines. The market is driven by the increasing need for reliable connectivity, enhanced passenger experiences, and improved operational efficiency in the aviation industry. As 5G networks continue to expand and mature, the market is expected to witness significant growth and innovation.

Analyst Viewpoint

The need for improved safety and operational efficiency in aviation is a driving force behind the adoption of 5G. The low latency and high reliability of 5G networks enable real-time data transmission and analysis, facilitating predictive maintenance, remote monitoring, and condition-based maintenance for aircraft systems. This leads to enhanced safety measures, reduced downtime, and optimized operations.

Additionally, 5G connectivity supports unmanned aerial vehicles (UAVs) and autonomous systems, opening up opportunities for advanced applications in surveillance, cargo transportation, and beyond. The potential for cost savings and revenue generation is a driving factor for the aviation industry to embrace 5G.

With efficient connectivity and improved operational processes, airlines can streamline their operations, reduce costs, and increase productivity. This includes enhanced passenger management, targeted advertising, and personalized services, which can generate additional revenue streams for airlines.

From an opportunities perspective, the integration of 5G in aviation presents numerous growth prospects. One of the key opportunities lies in the development of innovative in-flight services and applications. With high-speed connectivity, airlines can offer passengers a wide range of services, including live streaming, virtual reality experiences, and in-flight shopping. These opportunities can enhance the passenger experience and create new revenue streams for airlines.

Key Takeaways

- Market Size Projection: The global 5G in Aviation market is projected to grow significantly, with a forecasted worth of around USD 50.7 Billion by 2033, representing a staggering Compound Annual Growth Rate (CAGR) of 45.4% during the forecast period from 2024 to 2033.

- Technology Trends: Enhanced Mobile Broadband (eMBB) emerges as the leading technology segment, capturing over 43% of the market share in 2023. eMBB facilitates high-speed data transfer and increased bandwidth, enhancing connectivity and communication within the aviation ecosystem.

- Infrastructure Dominance: Small Cells dominate the communication infrastructure segment, holding over 60% of the market share in 2023. These compact yet powerful cells are essential for providing the necessary coverage and capacity required in high-demand aviation environments like airports.

- Application Significance: Communication stands out as the dominant application segment, accounting for over 40% of the market share in 2023. The pivotal role of advanced communication systems in ensuring safety, efficiency, and reliability in aviation operations drives the growth of this segment.

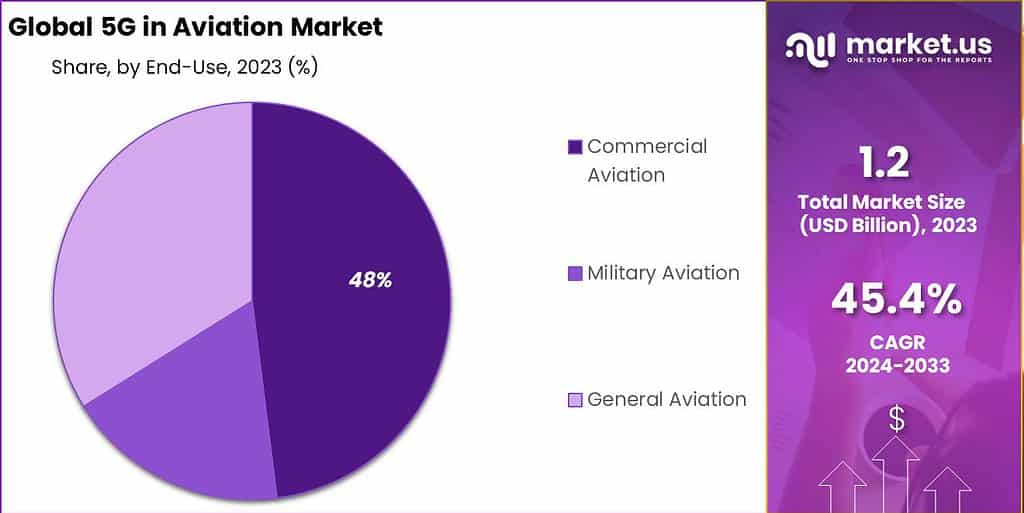

- End-Use Insights: Commercial Aviation emerges as the dominant end-use segment, capturing a significant market share of over 48% in 2023. The integration of 5G technology within commercial aviation leads to advancements in in-flight connectivity, operational efficiency, and passenger experiences, contributing to the segment’s growth.

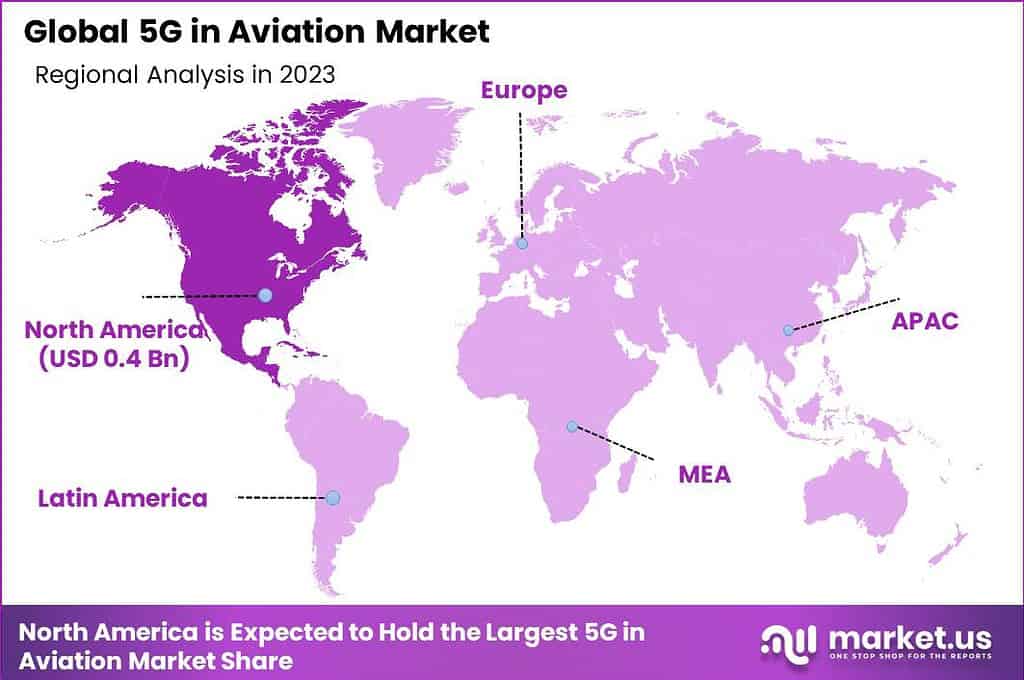

- Regional Dynamics: North America secures a dominant market position, capturing over 30% of the market share in 2023. Factors such as a mature aviation industry, robust telecommunications infrastructure, and stringent safety standards contribute to North America’s early and widespread adoption of 5G in aviation.

Communication Infrastructure Analysis

In 2023, the Small Cell segment held a dominant market position, capturing more than a 60% share in the 5G in Aviation market.

Small Cells are instrumental in providing the necessary coverage and capacity required for the dense, high-demand environments typical of airports and aviation ecosystems. These compact, yet powerful, cells facilitate the deployment of 5G networks in areas where larger Macro Cells cannot efficiently deliver services due to their size and power requirements.

Small Cells offer a cost-effective solution for enhancing network performance, supporting the high data rates and low latency required for modern aviation operations. They enable airlines, airports, and service providers to offer passengers high-speed, reliable connectivity for in-flight entertainment, real-time communication, and operational efficiency. Furthermore, the scalability of Small Cells allows for a more flexible and adaptive network infrastructure, capable of meeting the dynamic demands of the aviation industry.

The increasing demand for enhanced passenger experiences, coupled with the need for improved operational efficiency, has driven the adoption of Small Cells in the aviation sector. As airlines and airports continue to invest in digital transformation initiatives, the reliance on robust, high-speed wireless communication infrastructures is paramount. This trend is reflected in the significant market share occupied by the Small Cell segment, underscoring its essential role in the deployment of 5G networks within the aviation industry.

Technology Analysis

As of 2023, the Enhanced Mobile Broadband (eMBB) segment emerged as the frontrunner in the 5G aviation market, securing a prominent market position with a share of over 43%.

eMBB offers enhanced data transfer speeds and increased bandwidth, enabling seamless connectivity and faster communication within the aviation ecosystem. The higher data rates provided by eMBB enable efficient transmission of large volumes of data, such as high-definition video streaming and real-time monitoring of critical aviation systems. This capability proves instrumental in improving in-flight entertainment experiences for passengers and facilitating smooth operational processes for airlines.

Additionally, the eMBB technology empowers pilots and air traffic controllers with real-time access to crucial data, such as weather updates, flight plans, and aircraft diagnostics, ensuring enhanced safety and efficiency in aviation operations. The utilization of eMBB also opens up opportunities for innovative applications, such as virtual reality (VR) and augmented reality (AR) for training purposes, which further contribute to the segment’s growth.

Furthermore, the widespread adoption of eMBB in the aviation industry can be attributed to its robust network coverage and compatibility with existing infrastructure. The seamless integration of 5G networks with existing 4G LTE infrastructure facilitates a smooth transition to the new technology, minimizing disruptions and infrastructure costs for airlines and aviation service providers.

Application Analysis

In 2023, the Communication segment held a dominant market position in the 5G in Aviation market, capturing more than a 40% share. This prominence is largely due to the pivotal role that advanced communication systems play in ensuring the safety, efficiency, and reliability of aviation operations. The deployment of 5G technology within this segment has revolutionized how information is exchanged between aircraft, control towers, and ground services, facilitating real-time data transmission with minimal latency.

Moreover, the Communication segment’s growth is driven by the increasing demand for seamless, uninterrupted connectivity by passengers and the aviation industry’s push towards digital transformation. The ability of 5G networks to handle large volumes of data at high speeds is crucial for meeting these demands, ensuring that the Communication segment remains at the forefront of the 5G in Aviation market.

As the aviation sector continues to evolve, the importance of robust and efficient communication systems becomes ever more critical. The integration of 5G technology in this domain not only supports current operational needs but also paves the way for future innovations, such as unmanned aerial vehicles (UAVs) and advanced air mobility (AAM) solutions. Consequently, the Communication segment’s significant market share reflects its essential role in shaping the future of aviation, highlighting its potential for continued growth and innovation.

End-Use Analysis

In 2023, the Commercial Aviation segment emerged as the dominant player in the 5G aviation market, capturing a significant market share of over 48%.

This substantial market share underscores the critical role that 5G technology plays in modernizing and enhancing commercial airline operations and passenger experiences. The integration of 5G within commercial aviation has led to significant advancements in in-flight connectivity, enabling airlines to offer passengers high-speed internet access, live television, and on-demand video streaming services. Such amenities have become a competitive differentiator in the airline industry, significantly improving customer satisfaction and loyalty.

Furthermore, 5G technology facilitates more efficient airline operations, from improved ground-to-air communication to more accurate real-time data sharing between aircraft and control towers, which enhances flight safety and operational efficiency.

The ability to transmit large volumes of data at high speeds is critical for real-time weather updates, flight tracking, and for supporting the Internet of Things (IoT) applications in aviation, such as smart baggage handling and predictive maintenance of aircraft. This reduces delays and maintenance costs, contributing to the segment’s growth.

The dominance of the Commercial Aviation segment is also a reflection of the ongoing recovery and expansion of the global travel industry, which has been driving demand for more connected and efficient air travel solutions. As airlines continue to invest in digital transformation to meet the evolving expectations of travelers and to streamline operations, the role of 5G technology in commercial aviation is expected to grow even further.

Key Market Segments

By Communication Infrastructure

- Small Cell

- Macro Cell

By Technology

- Enhanced Mobile Broadband (eMBB)

- Ultra-Reliable Low Latency Communications (URLLC)

- Massive Machine Type Communications (mMTC)

By Application

- Communication

- Navigation

- Surveillance

By End-Use

- Commercial Aviation

- Military Aviation

- General Aviation

Driver

Enhanced Passenger Connectivity

The demand for enhanced passenger connectivity serves as a significant driver for the adoption of 5G technology in the aviation industry. With the increasing reliance on smartphones, tablets, and other connected devices, passengers expect seamless and high-speed internet access during their flights. 5G technology offers the potential to deliver faster data speeds, lower latency, and more reliable connectivity, thereby meeting the growing demands of modern air travelers.

Airlines and aviation stakeholders recognize the importance of providing robust in-flight connectivity to improve the passenger experience, increase customer satisfaction, and maintain a competitive edge in the market. As a result, the drive to enhance passenger connectivity acts as a key catalyst for the deployment of 5G networks within the aviation sector.

Restraint

High Infrastructure Costs

One of the primary restraints hindering the widespread adoption of 5G technology in aviation is the high infrastructure costs associated with upgrading and deploying new communication networks. Implementing 5G infrastructure, including small cells, antennas, and network equipment, requires substantial investment from airlines, airports, and service providers.

Additionally, the installation and maintenance of 5G infrastructure in airports and aircraft can be complex and resource-intensive, further adding to the overall costs. These high upfront expenses pose a significant barrier for many aviation stakeholders, especially smaller airlines and general aviation operators, limiting their ability to invest in 5G technology. As a result, the cost of infrastructure remains a critical restraint in the adoption of 5G in the aviation industry.

Opportunity

Integration of IoT in Aviation

The integration of the Internet of Things (IoT) presents a significant opportunity for the advancement of 5G technology in the aviation sector. IoT devices, sensors, and smart technologies have the potential to revolutionize various aspects of aviation operations, including aircraft maintenance, passenger services, and airport management. By leveraging 5G networks, aviation stakeholders can seamlessly connect and communicate with IoT devices in real-time, enabling proactive maintenance, enhanced security, and personalized passenger experiences.

Furthermore, the integration of IoT in aviation facilitates data-driven decision-making, allowing airlines and airports to optimize operations, improve efficiency, and reduce costs. As the aviation industry embraces IoT solutions, the demand for high-speed, low-latency connectivity provided by 5G technology is expected to increase, presenting a lucrative opportunity for market growth and innovation.

Challenge

Spectrum Allocation

A significant challenge facing the adoption of 5G technology in aviation is the allocation and management of spectrum resources. The aviation industry relies on designated radio frequency bands for communication, navigation, and surveillance purposes, which are regulated by international organizations such as the International Telecommunication Union (ITU).

As the demand for wireless connectivity continues to rise, there is a growing need for additional spectrum resources to support 5G networks in aviation. However, allocating spectrum for 5G while ensuring compatibility with existing aviation systems and minimizing interference poses a complex challenge for regulators and industry stakeholders.

Furthermore, the limited availability of suitable spectrum bands for 5G deployment in densely populated areas and near airports exacerbates the challenge of spectrum allocation. Addressing this challenge requires close collaboration between aviation regulators, telecommunications authorities, and industry partners to develop harmonized spectrum allocation strategies that balance the needs of aviation safety with the requirements of 5G connectivity.

Regional Analysis

In 2023, North America secured a dominant market position in the 5G aviation market, capturing a significant share of over 30%. The demand for 5G in Aviation in North America reached US$ 0.4 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

This regional dominance can be attributed to several key factors. Firstly, North America boasts a mature and technologically advanced aviation industry, with a high concentration of major airlines, airports, and aviation service providers. The region has been at the forefront of adopting innovative technologies, including 5G, to enhance operational efficiency, passenger experiences, and safety in aviation. As a result, North America has witnessed early and widespread adoption of 5G in the aviation sector, driving its dominant market position.

Moreover, the North American region has a robust telecommunications infrastructure, which acts as a solid foundation for the deployment of 5G networks. The presence of well-established cellular networks and a high level of network coverage facilitates the implementation and seamless integration of 5G technology in the aviation industry. This favorable infrastructure environment enables airlines and aviation stakeholders to leverage the benefits of 5G, such as enhanced connectivity, improved data transfer speeds, and low latency.

Furthermore, North America has a strong focus on aviation safety and regulatory frameworks. The region has stringent safety standards and regulations in place, which necessitate the implementation of advanced communication and navigation systems. 5G technology offers the potential to enhance safety measures and enable real-time data exchange, making it an attractive choice for the North American aviation industry.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the 5G in Aviation market include major telecommunications companies, aerospace manufacturers, and technology providers, each contributing to the advancement and adoption of 5G technology within the aviation industry.

Telecommunications giants such as Verizon Communications Inc., AT&T Inc., and T-Mobile US, Inc. are at the forefront of 5G deployment, offering high-speed connectivity solutions tailored to the unique needs of airlines, airports, and aviation stakeholders. Aerospace manufacturers like Airbus SE, The Boeing Company, and Bombardier Inc. play a crucial role in integrating 5G technology into aircraft systems and avionics.

Technology providers such as Nokia Corporation, Ericsson AB, and Huawei Technologies Co., Ltd. offer cutting-edge 5G solutions tailored to the specific requirements of aviation applications. These companies develop and deploy 5G infrastructure, software platforms, and IoT solutions designed to optimize air traffic management, enhance in-flight connectivity, and improve passenger experiences.

Companies like Honeywell International Inc., Thales Group, and Collins Aerospace provide a wide range of aviation solutions, including 5G-enabled cockpit displays, ground-based communication systems, and satellite connectivity services. By collaborating with industry partners and regulatory agencies, these players contribute to the development of standards, best practices, and certification processes necessary for the successful implementation of 5G in aviation.

Top Market Leaders

- Qualcomm Technologies, Inc.

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Verizon Communications Inc.

- AT&T Inc.

- Honeywell International Inc.

- Gogo LLC

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- Thales Group

- Collins Aerospace (Raytheon Technologies Corporation)

Recent Developments

1. Qualcomm Technologies, Inc.:

- February 2023: Partnered with Thales to develop and deploy in-flight connectivity solutions using Qualcomm’s Snapdragon X35 5G modem.

- May 2023: Announced the Snapdragon Ride Platform for Connected Vehicles, which can be adapted for airborne applications, including real-time traffic management and situational awareness

2. Ericsson AB:

- January 2023: Signed a memorandum of understanding with Boeing to explore the use of 5G for cabin connectivity and aircraft maintenance solutions.

- April 2023: Collaborated with Verizon and American Airlines to conduct a 5G data transmission test on a commercial flight, demonstrating the feasibility of real-time in-flight data exchange.

- September 2023: Launched the “Ericsson Industry Connect” platform, which can be used to develop and deploy 5G-based solutions for various industries, including aviation.

3. Huawei Technologies Co., Ltd.:

- February 2023: Partnered with China Eastern Airlines to launch a 5G-connected aircraft testbed, focusing on exploring applications for inflight entertainment and passenger services.

- June 2023: Showcased its “5G Aviation Cloud” solution at an industry event, highlighting its potential for cloud-based applications and data management in the aviation sector.

- November 2023: Signed a cooperation agreement with the International Air Transport Association (IATA) to explore the use of 5G for improving air traffic management and airport operations.

Report Scope

Report Features Description Market Value (2023) US$ 1.2 Bn Forecast Revenue (2033) US$ 50.7 Bn CAGR (2024-2033) 45.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Enhanced Mobile Broadband (eMBB), Ultra-Reliable Low Latency Communications (URLLC), Massive Machine Type Communications (mMTC)), By Communication Infrastructure (Small cell, Macro Cell), By Application (Communication, Navigation, Surveillance), By End-Use (Commercial Aviation, Military Aviation, General Aviation) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Qualcomm Technologies Inc., Nokia Corporation, Ericsson AB, Huawei Technologies Co. Ltd., Verizon Communications Inc., AT&T Inc., Honeywell International Inc., Gogo LLC, Samsung Electronics Co. Ltd., Cisco Systems Inc., Thales Group, Collins Aerospace (Raytheon Technologies Corporation) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 5G in the context of the aviation industry?In the aviation industry, 5G refers to the use of fifth-generation cellular network technology to enhance connectivity and communication between aircraft, ground control systems, and various on-board systems.

How big is 5G in Aviation Industry?The Global 5G in Aviation Market size is expected to be worth around USD 50.7 Billion by 2033, from USD 1.2 Billion in 2023, growing at a CAGR of 45.4% during the forecast period from 2024 to 2033.

Who are the key players in 5G in Aviation Market?Qualcomm Technologies Inc., Nokia Corporation, Ericsson AB, Huawei Technologies Co. Ltd., Verizon Communications Inc., AT&T Inc., Honeywell International Inc., Gogo LLC, Samsung Electronics Co. Ltd., Cisco Systems Inc., Thales Group, Collins Aerospace (Raytheon Technologies Corporation) are the major companies operating in the 5G in Aviation Market.

What are the key benefits of implementing 5G in aviation?Implementing 5G in aviation offers several benefits, including faster and more reliable in-flight internet connectivity, improved communication between aircraft and ground control, enhanced safety through real-time data transmission, and support for emerging technologies like autonomous drones and urban air mobility.

What are some challenges to implementing 5G in the aviation industry?Challenges to implementing 5G in aviation include regulatory hurdles, spectrum allocation issues, infrastructure deployment costs, security concerns, and the need for interoperability between different communication systems and protocols.

Which is the fastest growing region in 5G in Aviation Market?In 2023, North America secured a dominant market position in the 5G aviation market, capturing a significant share of over 30%.

-

-

- Qualcomm Technologies, Inc.

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Verizon Communications Inc.

- AT&T Inc.

- Honeywell International Inc.

- Gogo LLC

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- Thales Group

- Collins Aerospace (Raytheon Technologies Corporation)