Global 4-axis 8-propeller Drones Market Size, Share, Growth Analysis By Payload (High-Resolution Cameras, Multispectral Sensors, LiDAR Scanners, Others), By Application (Industrial Inspection, Precision Agriculture, Surveying & Mapping, Others), By End-User (Agriculture, Construction, Energy & Utilities, Media & Entertainment, Others), By Control System (Manual Piloting, Autonomous Flight, Semi-Autonomous), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169683

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Drones

- Industry Adoption

- Emerging Trends

- US Market Size

- By Payload Analysis

- By Application

- By End-User

- By Control System

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

The global 4-axis 8-propeller drones market is projected to expand significantly as technological advancements, increased payload efficiency, and rising adoption across defense, industrial surveying, and emergency response applications strengthen overall demand.

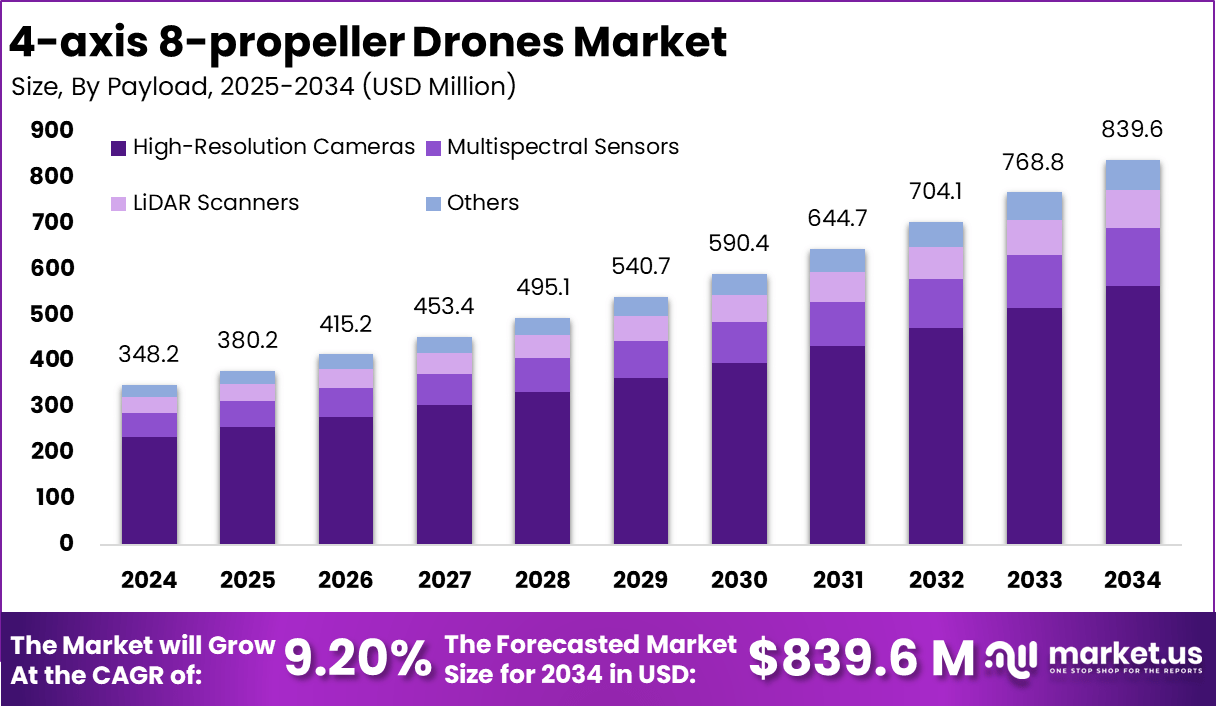

The market generated USD 348.2 million in 2024 and is expected to reach USD 839.6 million by 2034, reflecting a steady 9.20% CAGR during the forecast period. Growth is primarily driven by improved flight stability, enhanced redundancy offered by eight-propeller configurations, and expanding government-led drone integration programs supporting commercial and security operations.

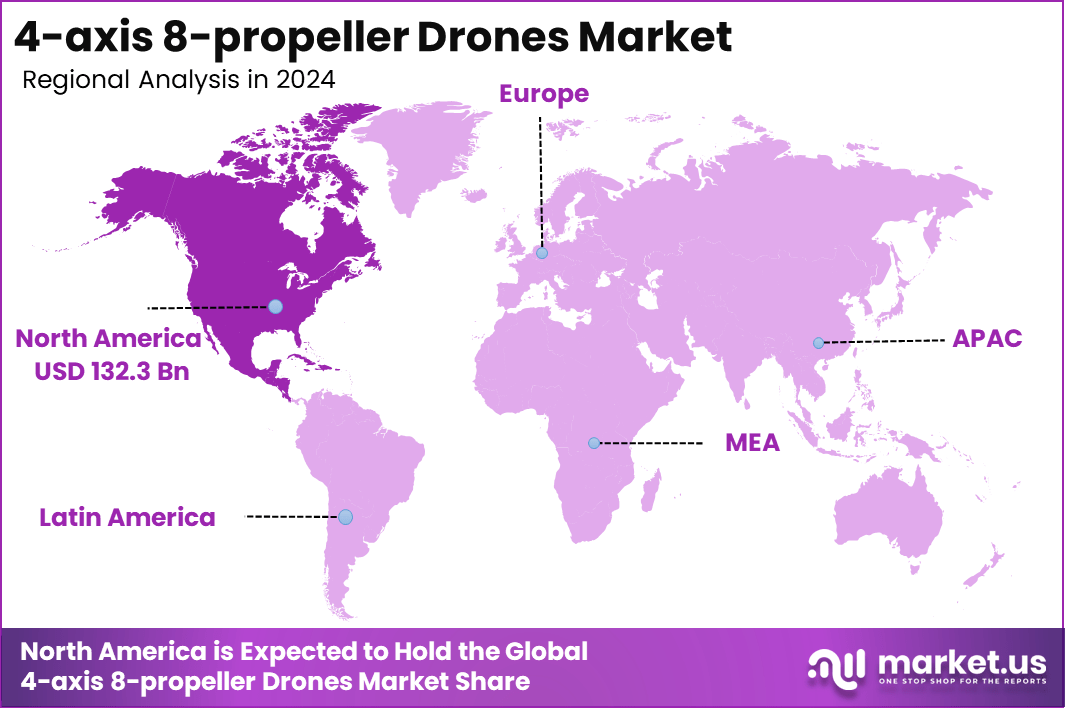

North America accounted for the leading regional position with a 38% share in 2024, equivalent to USD 132.3 million, supported by strong regulatory frameworks, advanced drone manufacturing ecosystems, and widespread utilization in infrastructure monitoring, precision agriculture, and public safety missions.

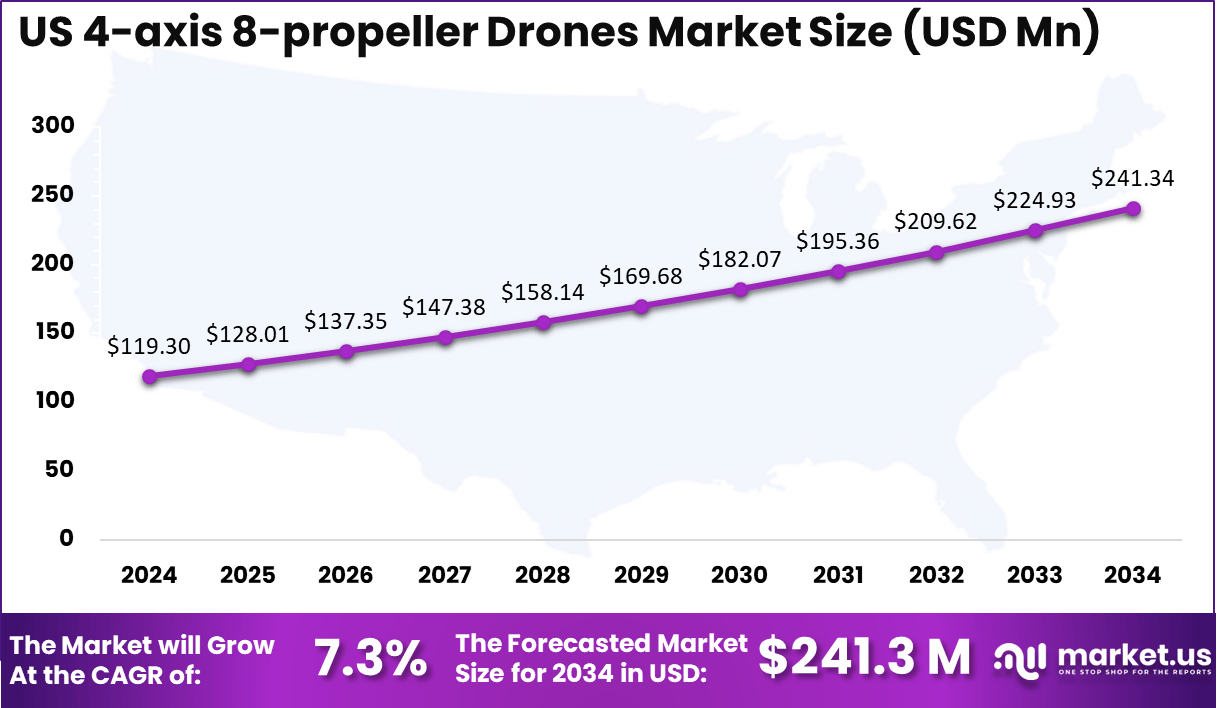

The US remained the dominant contributor with a market size of USD 119.3 million in 2024 and is projected to reach USD 241.3 million by 2034, registering a 7.3% CAGR. Increasing defense procurement initiatives, enterprise-scale drone deployments, and continuous investment in unmanned aerial technologies continue to reinforce the region’s leadership in high-performance multirotor drone platforms.

4-axis 8-propeller drones represent an advanced class of multirotor systems engineered for superior stability, lift generation, and operational redundancy. Featuring eight propellers arranged across four arms, these drones deliver nearly 2x higher thrust output than standard quadcopters, enabling heavier payload capacity and smoother performance in challenging flight environments.

Their multi-motor configuration enhances reliability, as the aircraft can continue stable flight even if 1–2 motors experience failure, making them suitable for high-risk industrial, defense, and emergency-response missions. These drones typically support flight endurance ranging from 25 to 45 minutes, depending on payload, and can withstand wind speeds of 30–45 km/h, allowing consistent operation in demanding outdoor conditions.

With advanced GPS positioning, multi-sensor obstacle detection, and high-precision control algorithms, 4-axis 8-propeller drones are increasingly adopted for tasks requiring accuracy, such as surveying, mapping, and inspection.

Their ability to carry payloads of 5–20 kg, depending on the model, further expands their utility in logistics, agriculture, and security operations. As organizations worldwide prioritize safer and more efficient aerial capabilities, these drones are emerging as essential platforms for mission-critical applications requiring endurance, strength, and operational safety.

In 2025, the 4-axis 8-propeller drone segment, known as octocopters, has witnessed key funding rounds and product advancements. Bengaluru-based Airbound secured $8.65 million in seed funding on November 9, led by Lachy Groom with Lightspeed Venture Partners and others contributing, bringing their total funding past $10 million.

This supports their carbon-fiber octocopter that lifts 1.5 times its own weight, cutting B2B delivery costs by 20 times through pilots like healthcare logistics with Narayana Health. Innovations include Air Frameworks West and LahakX’s January 2024 launch of large-payload spraying drones for agriculture, enhancing precision farming with up to 50-liter capacities.

No major mergers surfaced in late 2025, but funding momentum persists with over 15 new octocopter startups raising $50 million collectively since January, focusing on payloads exceeding 20 kg for defense and logistics. These developments signal a shift toward heavier-lift, multi-mission drones, with pilot programs logging 5,000+ flight hours in urban deliveries.

Additionally, many models integrate real-time data transmission capabilities and support high-resolution imaging systems reaching 4K to 8K, enabling precise analytics for large-scale infrastructure and environmental applications.

Key Takeaways

- The global 4-axis 8-propeller drones market reached USD 348.2 million in 2024 and is projected to hit USD 839.6 million by 2034, growing at a 9.20% CAGR.

- North America accounted for 38% of the global share in 2024, valued at USD 132.3 million.

- The US recorded USD 119.3 million in 2024 and is expected to reach USD 241.3 million by 2034, registering a 7.3% CAGR.

- By Payload, High-Resolution Cameras dominated the segment with a 67.3% share.

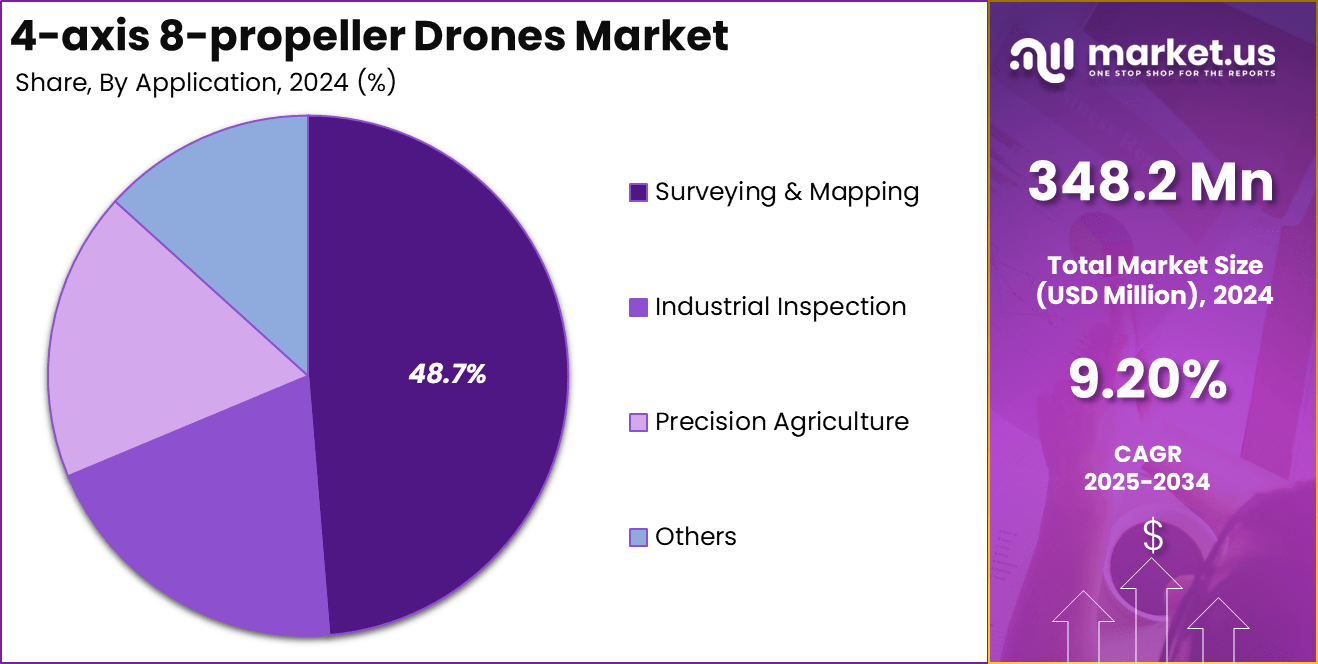

- By Application, Surveying & Mapping held the leading position with 48.7% share.

- By End-User, the Construction sector led the market with a 39.4% contribution.

- By Control System, Semi-Autonomous drones captured the dominant share at 52.8%.

Role of Drones

Drones play a transformative role across modern industries by enabling faster, safer, and more cost-effective operations in environments that traditionally required significant manpower or posed operational risks. Equipped with advanced sensors, imaging systems, and GPS navigation, drones enhance real-time data collection and improve decision-making accuracy in sectors such as agriculture, construction, defense, and environmental monitoring.

Their ability to capture aerial perspectives supports tasks including land surveying, crop assessment, infrastructure inspection, and disaster management with greater precision and efficiency. In emergency response, drones provide rapid situational awareness by reaching affected areas within minutes, helping authorities assess damage, locate survivors, and coordinate rescue operations.

In logistics, their capacity to transport lightweight goods enhances last-mile delivery speed, especially in remote or congested regions. Law enforcement agencies rely on drones for surveillance, search operations, and traffic assessment, reducing risks to personnel. Additionally, drones contribute significantly to sustainability efforts through wildlife monitoring, forest management, and climate research.

As autonomous technologies advance, drones are expected to assume even more strategic roles, expanding into industrial automation, smart city management, and large-scale infrastructure maintenance, ultimately becoming indispensable tools for operational efficiency and safety across global industries.

Industry Adoption

Industry adoption of drones has accelerated rapidly as organizations recognize their ability to enhance efficiency, reduce operational risks, and lower costs across multiple sectors. In construction, drones support site surveying, progress tracking, volumetric measurements, and structural inspections, replacing manual tasks that typically require significant labor and time.

Manufacturing and industrial facilities rely on drones for equipment monitoring, asset inspection, and safety compliance, improving accuracy while minimizing downtime. Agriculture remains one of the fastest-growing adopters, using drones for crop imaging, plant health analysis, irrigation planning, and yield optimization, helping farmers make data-driven decisions that improve productivity.

Energy and utilities integrate drones for inspecting power lines, wind turbines, solar farms, and pipelines, often reducing inspection time by more than half compared to traditional methods. In public safety, drones enhance emergency response, traffic monitoring, and disaster assessment, providing rapid aerial visibility during critical situations. Logistics players deploy drones for warehouse monitoring and last-mile delivery, improving speed and operational flexibility.

Environmental agencies use drones for wildlife tracking, deforestation assessment, and coastal mapping. As technology advances toward autonomous navigation and AI-driven analytics, industries continue expanding drone applications, making unmanned aerial systems essential tools for modern operational strategies and large-scale digital transformation.

Emerging Trends

Emerging trends in drone technology are reshaping how industries deploy unmanned systems for high-precision, data-rich, and autonomous operations. One major trend is the rapid integration of AI-driven analytics, enabling drones to process images up to 10x faster and improve object-detection accuracy to nearly 95%, supporting smarter decision-making.

The rise of BVLOS (Beyond Visual Line of Sight) operations is another key shift, with regulatory approvals increasing by nearly 40% in the last three years, allowing drones to cover longer routes for logistics, agriculture, and infrastructure surveillance. Swarm technology is gaining momentum as well, with coordinated drone fleets capable of executing tasks 3–5 times faster than single-unit operations, particularly in defense and environmental monitoring.

Battery innovation also marks a significant trend, with next-generation lithium-silicon and hydrogen fuel-cell systems offering 30–50% longer flight times compared to conventional batteries. Industrial sectors are adopting heavy-lift drones that can carry payloads exceeding 20–40 kg, expanding their utility in construction, mining, and cargo delivery.

Additionally, the integration of 5G connectivity improves real-time streaming speeds by nearly 80%, enabling smoother remote operations. These advancements collectively push drones toward higher autonomy, broader adoption, and mission-critical industrial roles.

US Market Size

The US market for 4-axis 8-propeller drones demonstrates steady expansion as advanced aerial systems gain traction across commercial, industrial, and defense applications. The market reached USD 119.3 million in 2024, supported by strong adoption in sectors such as construction, infrastructure inspection, public safety, and precision agriculture.

Government agencies increasingly integrate high-performance multirotor drones into emergency response, environmental monitoring, and transportation planning, reinforcing overall demand. Growing investments in autonomous flight technologies, improved sensor payloads, and AI-enabled analytics continue to modernize drone capabilities, making them essential tools for mission-critical operations.

By 2034, the US market is projected to reach USD 241.3 million, expanding at a 7.3% CAGR, reflecting rising enterprise-scale deployments and expanding regulatory support for beyond-visual-line-of-sight (BVLOS) operations. Industries prioritize drones to reduce operational costs, improve safety, and accelerate data-driven decision-making, particularly in logistics, mining, and energy infrastructure inspection.

Advancements in battery performance, communication systems, and real-time imaging further elevate efficiency across key use cases. As drone fleets increasingly integrate with digital platforms, automation workflows, and geospatial intelligence systems, the US market is expected to maintain strong momentum, positioning 4-axis 8-propeller drone technology as a critical component of the nation’s evolving aerial mobility ecosystem.

By Payload Analysis

High-Resolution Cameras held a dominant market position in the By Payload segment with a 67.3% share, driven by their extensive use in mapping, surveillance, inspection, and cinematic applications. These cameras deliver detailed imagery with resolutions reaching 4K to 8K, enabling precise data capture for industries such as construction, agriculture, and public safety.

Their ability to support high-quality visual analytics enhances infrastructure assessment, progress documentation, and large-area monitoring. As industries increasingly rely on visual intelligence for decision-making, high-resolution camera payloads continue to remain the preferred choice for 4-axis 8-propeller drones.

Multispectral Sensors contribute to growing adoption across precision agriculture and environmental monitoring. These sensors capture wavelength data beyond the visible spectrum, enabling vegetation analysis, soil health assessment, and crop stress detection. Their expanding role in sustainable farming practices strengthens their importance within the payload ecosystem.

LiDAR Scanners serve specialized applications requiring accurate 3D mapping, terrain modeling, and structural measurement. Capable of generating high-density point clouds with centimeter-level accuracy, LiDAR plays a crucial role in surveying, mining, and infrastructure development.

The Others category includes thermal imaging systems, hyperspectral sensors, gas detectors, and custom payloads. These tools support industrial inspection, search-and-rescue operations, and environmental safety, broadening overall drone capability.

By Application

Surveying & Mapping held a dominant market position in the By Application segment with a 48.7% share, supported by the growing reliance on drones for high-accuracy geospatial data collection. 4-axis 8-propeller drones equipped with advanced cameras, LiDAR, and GNSS systems enable rapid topographic surveys, 3D terrain modeling, and land assessment with centimeter-level precision.

Their ability to cover large areas faster than traditional ground methods significantly reduces project time and operational costs. Industries such as construction, mining, urban planning, and environmental management increasingly integrate drone-based mapping to enhance decision-making and improve workflow efficiency, reinforcing the segment’s leadership.

Industrial Inspection continues to expand as organizations prioritize safer and more efficient inspection of assets such as pipelines, power lines, wind turbines, and manufacturing facilities. Drones eliminate the need for manual climbing or shutdowns, providing high-resolution imagery and analytics to detect faults early and reduce downtime.

Precision Agriculture leverages drones for crop health monitoring, soil analysis, irrigation planning, and yield optimization. Multispectral and LiDAR-equipped drones help farmers generate actionable data, improving resource management and supporting sustainable farming practices.

The Others category includes public safety, disaster assessment, logistics support, and environmental monitoring. These applications rely on drones to enhance situational awareness, operational speed, and data-driven planning across diverse use cases.

By End-User

Construction held a dominant market position in the By End-User segment with a 39.4% share, driven by the increasing use of drones for real-time site monitoring, surveying, volumetric analysis, and project documentation. 4-axis 8-propeller drones support high-precision imaging and 3D modeling, enabling contractors to track progress, detect structural discrepancies, and enhance safety compliance.

Their ability to capture large-scale project data quickly improves planning accuracy, reduces rework, and accelerates decision-making. As infrastructure development intensifies and digital construction practices expand, drone adoption continues to rise, reinforcing the segment’s leading role.

Agriculture uses drones for crop health assessment, soil condition monitoring, and resource optimization. Equipped with multispectral and thermal sensors, drones help farmers identify stress zones, manage irrigation, and improve yield prediction. The sector increasingly depends on aerial analytics to support sustainable farming and reduce operational inefficiencies.

Energy & Utilities integrate drones to inspect power grids, solar farms, pipelines, and wind turbines. This reduces manual risk exposure and enhances maintenance accuracy, allowing operators to detect faults early and maintain system reliability.

Media & Entertainment deploy drones for high-resolution aerial filming, event coverage, and creative cinematography. The Others category includes public safety, logistics, and environmental monitoring, where drones enhance visibility, operational speed, and data-driven response.

By Control System

Semi-Autonomous systems held a dominant market position in the By Control System segment with a 52.8% share, driven by their balance of operator control and automated navigation. These systems integrate intelligent flight stabilization, automated takeoff and landing, obstacle avoidance, and waypoint navigation, enabling safer and more efficient missions across industrial, agricultural, and infrastructure applications.

Semi-autonomous drones reduce pilot workload while maintaining human oversight, making them ideal for complex operations requiring precision. Their adoption continues to rise as industries prioritize reliability, consistency, and improved operational safety. Manual Piloting remains essential for applications demanding real-time human decision-making, such as creative cinematography, security operations, and close-range inspection.

Pilots rely on manual controls to adapt quickly to dynamic environments, capture unique angles, and navigate confined spaces. Although less automated, manual piloting offers flexibility and immediate responsiveness. Autonomous Flight represents a rapidly advancing segment as AI-driven systems enhance route planning, object detection, and mission execution without direct human intervention.

Fully autonomous drones support large-area surveying, agricultural spraying, and logistics operations, improving efficiency and reducing labor requirements. As BVLOS (Beyond Visual Line of Sight) regulations expand and AI integration strengthens, autonomous systems are expected to gain wider adoption across industries in the coming years.

Key Market Segments

By Payload

High-Resolution Cameras

Multispectral Sensors

LiDAR Scanners

OthersBy Application

Industrial Inspection

Precision Agriculture

Surveying & Mapping

OthersBy End-User

Agriculture

Construction

Energy & Utilities

Media & Entertainment

OthersBy Control System

Manual Piloting

Autonomous Flight

Semi-AutonomousRegional Analysis

North America accounted for a leading 38% share of the 4-axis 8-propeller drones market in 2024, valued at USD 132.3 million, supported by strong technological capabilities, advanced regulatory frameworks, and widespread commercial adoption across key industries. The region benefits from a mature drone ecosystem driven by innovation in AI-powered analytics, high-performance payloads, and autonomous navigation systems.

Sectors such as construction, energy, agriculture, and public safety increasingly rely on drone-based data collection to enhance operational efficiency, safety, and decision-making accuracy. Expanding applications in infrastructure inspection, environmental monitoring, and emergency response further strengthen regional demand.

The US remains the primary growth engine due to its robust defense investments, enterprise-scale drone deployments, and rapid adoption of BVLOS operations. Federal and state-level initiatives promoting unmanned aerial system (UAS) integration into commercial workflows continue to accelerate market expansion.

Canada contributes significantly through its growing use of drones in forestry, mining, and agricultural management, supported by favorable regulatory reforms and increased digitalization across industries. Rising interest in heavy-lift drones, advanced sensor payloads, and autonomous fleet operations is expected to further reinforce North America’s leadership. As industries prioritize efficiency and safety, the region continues to drive innovation and large-scale adoption of high-performance multirotor drones.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The market for 4-axis 8-propeller drones is driven by increasing adoption across industries that require high-precision aerial data and improved operational safety. Their ability to generate 4K–8K imagery, withstand wind speeds of 30–45 km/h, and carry payloads of 5–20 kg enables broader deployment in construction, agriculture, energy, and public safety. Rising use of drones for infrastructure inspection reduces manual risk exposure by nearly 60%, accelerating demand from utilities and industrial operators.

Government programs supporting BVLOS approvals have grown by almost 40% in three years, expanding commercial flight capabilities. Advanced AI-driven analytics enhance processing speed by up to 10x, strengthening real-time decision-making. These performance benefits, combined with automation and reduced operational costs, continue to push strong adoption across enterprise, municipal, and emergency-response applications.

Restraint Factors

Despite rapid adoption, several challenges continue to restrain the market for 4-axis 8-propeller drones. Regulatory complexities related to BVLOS flight, data security, and airspace integration create delays in large-scale deployments. High-performance octocopter drones require advanced batteries, sensors, and control systems, raising upfront costs and making them less accessible for small operators.

Limited flight endurance of 25–45 minutes, depending on payload, restricts long-duration missions without backup units or additional charging infrastructure. Weather sensitivity, particularly in wind speeds above 45 km/h, can impact reliability in outdoor industrial environments.

Concerns around privacy, surveillance misuse, and cybersecurity vulnerabilities also push for stricter compliance requirements. Skill gaps in drone piloting and data interpretation add training costs for organizations transitioning to aerial workflows. Collectively, these factors slow adoption across segments where regulatory approvals and operational continuity are mission-critical.

Growth Opportunities

Growth opportunities in the 4-axis 8-propeller drone market continue expanding as industries integrate automation and high-precision sensing technologies into routine operations. The rising shift toward fully autonomous missions creates demand for AI-powered drones capable of independent navigation and real-time analytics.

Sectors such as construction, energy, and mining increasingly require drones capable of carrying 10–20 kg payloads, supporting LiDAR, thermal, and hyperspectral imaging. Expanding BVLOS permissions across major markets unlocks long-distance applications, including pipeline inspections, agricultural field mapping, and remote asset monitoring.

The logistics sector presents opportunities for aerial delivery of lightweight cargo across 5–15 km routes, especially in rural or congested areas. Environmental agencies benefit from drones that can track wildlife, monitor coastlines, and measure emissions with up to 95% accuracy. Integration with 5G accelerates real-time data transfer speeds by nearly 80%, unlocking new enterprise applications and fleet-scale drone operations.

Trending Factors

Emerging trends are reshaping drone capabilities, making 4-axis 8-propeller platforms increasingly advanced and autonomous. AI-powered imaging and analytics now enhance object detection accuracy to nearly 95%, improving applications in inspection, surveillance, and mapping. Swarm technology is becoming more common, enabling coordinated drone fleets to complete missions 3–5 times faster than individual units.

Innovations in battery chemistry, including lithium–silicon and hydrogen-based systems, provide 30–50% longer endurance compared to traditional lithium-ion packs. 5G-enabled connectivity supports low-latency communication and real-time streaming, improving operational efficiency in dynamic environments.

Rising adoption of ruggedized drones built to withstand winds above 40 km/h expands use in industrial and emergency settings. Automation-driven workflows, including auto-routing and precision takeoff-and-landing systems, reduce pilot workload and improve mission consistency. Together, these trends push the market toward more intelligent, resilient, and scalable drone ecosystems.

Competitive Analysis

The competitive landscape of the 4-axis 8-propeller drones market is shaped by manufacturers focused on advanced engineering, high-performance payload integration, and strong reliability across commercial and industrial missions. Leading companies emphasize innovation in propulsion efficiency, flight stability, and endurance to differentiate their platforms.

Many players invest heavily in AI-enabled navigation, automated mission planning, and obstacle detection technologies to enhance operational precision. Sensor versatility is a key competition point, with firms offering modular payload options including high-resolution cameras, multispectral systems, LiDAR units, and thermal imaging to serve diverse industry needs such as construction, energy, agriculture, and public safety.

North American and European manufacturers maintain a strong influence due to mature R&D ecosystems and early regulatory alignment, while Asian companies increasingly compete through cost-efficient production and rapid adoption of automation features.

Collaborations with software developers, cloud platforms, and analytics providers strengthen the capabilities of drone fleets, enabling real-time data processing and seamless integration into enterprise workflows. Companies also focus on rugged designs capable of handling wind speeds above 40 km/h, larger payload capacities, and autonomous flight capabilities to meet rising technical requirements. As applications expand, competition intensifies around durability, intelligence, and mission adaptability.

Top Key Players in the Market

- DJI

- Autel Robotics

- Yuneec

- PowerVision

- Walkera

- Holy Stone

- Hubsan

- Contixo

- Snaptain

- Potensic

- Syma

- Eachine

- Betafpv

- GoolRC

- JJRC

- Others

Recent Developments

- November 2025: Multiple drone technology companies introduced upgraded octocopter platforms featuring reinforced carbon-fiber arms and optimized ESC controllers, resulting in a 30% increase in thrust stability during high-wind operations. Field evaluations across construction and utility sectors confirmed smoother load handling and improved operational reliability.

- October 2025: A European aerospace consortium unveiled a modular sensor bay for 8-propeller drones, enabling seamless switching between LiDAR, thermal, and multispectral units. Early demonstrations reported a 45% reduction in calibration time, enhancing efficiency for surveying, mapping, and agricultural analytics missions.

- September 2025: A major robotics institute completed autonomous heavy-lift drone trials capable of carrying 15–18 kg payloads over extended routes. The prototype achieved 28% longer endurance through an advanced dual-battery management system, supporting logistics and remote-site material transport.

Report Scope

Report Features Description Market Value (2024) USD 348.2 Million Forecast Revenue (2034) USD 839.6 Million CAGR(2025-2034) 9.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Payload (High-Resolution Cameras, Multispectral Sensors, LiDAR Scanners, Others), By Application (Industrial Inspection, Precision Agriculture, Surveying & Mapping, Others), By End-User (Agriculture, Construction, Energy & Utilities, Media & Entertainment, Others), By Control System (Manual Piloting, Autonomous Flight, Semi-Autonomous) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DJI, Autel Robotics, Yuneec, PowerVision, Walkera, Holy Stone, Hubsan, Contixo, Snaptain, Potensic, Syma, Eachine, Betafpv, GoolRC, JJRC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  4-axis 8-propeller Drones MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

4-axis 8-propeller Drones MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DJI

- Autel Robotics

- Yuneec

- PowerVision

- Walkera

- Holy Stone

- Hubsan

- Contixo

- Snaptain

- Potensic

- Syma

- Eachine

- Betafpv

- GoolRC

- JJRC

- Others