Global 3D Camera Market By Technology (Time-of-Flight (ToF) Cameras, Stereo Vision Cameras, Structured Light Cameras), By Application (Professional Camera, Smartphone and Tablets, Computer, and Others Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 66263

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

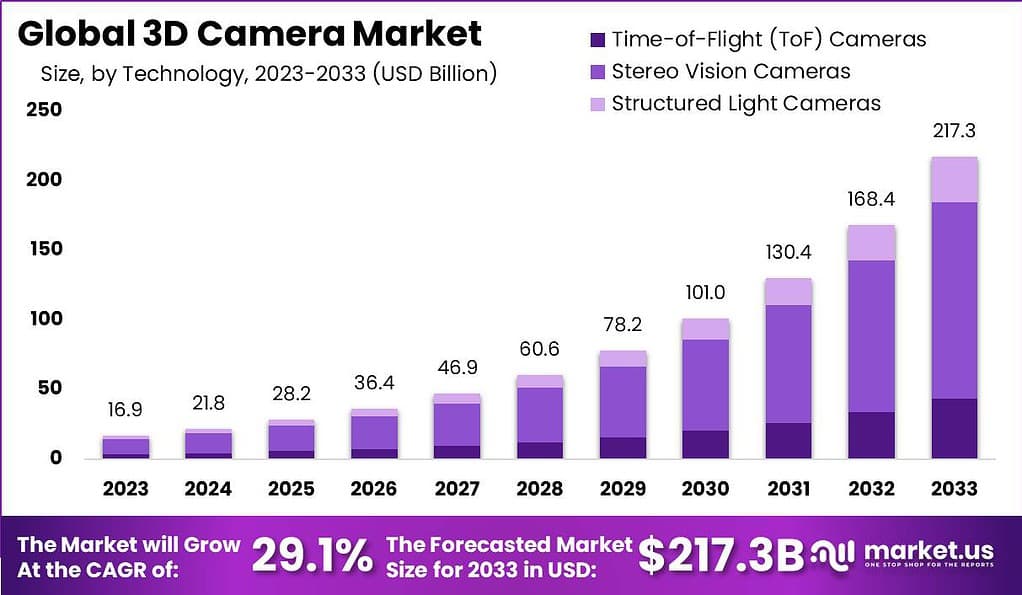

The global 3D Camera Market is projected to have a moderate-paced CAGR of 29.1% during the forecast period 2024-2033. The current valuation of the market is USD 16.9 Billion in 2023. The demand for 3D camera is anticipated to reach a high of USD 217.3 Billion by the year 2033.

A 3D camera is a tool designed to capture and document images or videos in three dimensions, enabling depth perception and a more immersive visual experience. This device employs multiple lenses or sensors to acquire depth information, resulting in a stereoscopic effect.

The global 3D camera market has seen substantial growth in recent years thanks to falling component prices and rising demand from industries like media and entertainment, smartphone manufacturing, robotics, and automotive. Major applications for 3D cameras include 3D modeling and design, augmented/virtual reality experiences, post-production VFX, autonomous navigation, facial recognition, and advanced inspection & quality control.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth and Projections: The 3D Camera market is expected to grow by 29.1% over the timeframe from 2024 until 2033. The market’s value for 2023 stood at USD 16.9 billion and is projected to be USD 217.3 billion in 2033.

- 3D Camera Functionality: 3D cameras are designed to capture images and videos in three dimensions, providing depth perception for a more immersive visual experience.

- Market Growth Drivers: The demand from consumers for improved image quality in smartphones tablets, smartphones, and digital cameras is an important driving driver.

- Key Market Segments: In 2023, Stereo Vision Cameras held a dominant market position, capturing over 64.9% of the market share.

- Applications of 3D Cameras: Major applications include 3D modeling and design, augmented/virtual reality experiences, post-production VFX, and facial recognition.

- Regional Dynamics: Asia Pacific emerged as the dominant player, capturing over 38.2% of the market share, driven by a robust manufacturing ecosystem and the adoption of 3D imaging technologies.

- Key Market Players: Major players in the 3D camera market include Sony Corporation, Fujifilm Holdings Corporation, Panasonic Corporation, Canon Inc., Nikon Corporation, GoPro, Inc., and Samsung Electronics Co., Ltd.

- Future Trends: Depth sensing for photography and LiDAR integration are prominent trends in the 3D camera market.

- Growth Opportunities: The healthcare sector offers significant growth opportunities for 3D cameras in medical imaging and surgical navigation.

- Challenges: Challenges in calibration and accuracy, data processing complexity, interoperability, and ethical considerations are factors that need to be addressed in the 3D camera market.

Technology Analysis

In 2023, the Stereo Vision Cameras segment held a dominant market position in the 3D Camera market, capturing more than a 64.9% share. This technology has gained prominence due to its ability to capture depth information by mimicking human vision using two distinct cameras placed slightly apart. Stereo Vision Cameras offer accurate depth perception, making them invaluable in applications such as autonomous vehicles, robotics, and augmented reality (AR). Their widespread adoption in automotive safety systems and navigation aids has driven their market share significantly.

Additionally, the availability of cost-effective and compact stereo vision camera solutions has further fueled their demand across various industries, contributing to their commanding position in the 3D Camera market. The Time-of-Flight (ToF) Cameras segment also witnessed substantial growth in 2023, accounting for a significant market share. ToF cameras use the principle of measuring the time it takes for light or laser pulses to travel to objects and back to the camera sensor, enabling precise depth mapping. This technology finds applications in gaming consoles, smartphones, and gesture recognition systems.

The adoption of ToF cameras in smartphones for facial recognition and enhanced photography capabilities has boosted their market presence. Furthermore, ToF cameras are increasingly utilized in industrial automation and surveillance, indicating their growing importance in the 3D Camera market.

Structured Light Cameras, while holding a comparatively smaller market share, continued to offer specialized solutions in 2023. These cameras project a known pattern of light onto objects and analyze the distortion of the pattern to calculate depth information. Structured Light Cameras are commonly employed in 3D scanning, quality control, and facial recognition applications. Their accuracy and precision make them a preferred choice in industries where meticulous measurements are essential. Although they cater to niche markets, Structured Light Cameras play a crucial role in specific industrial and research applications, maintaining their significance within the 3D Camera market.

Application Analysis

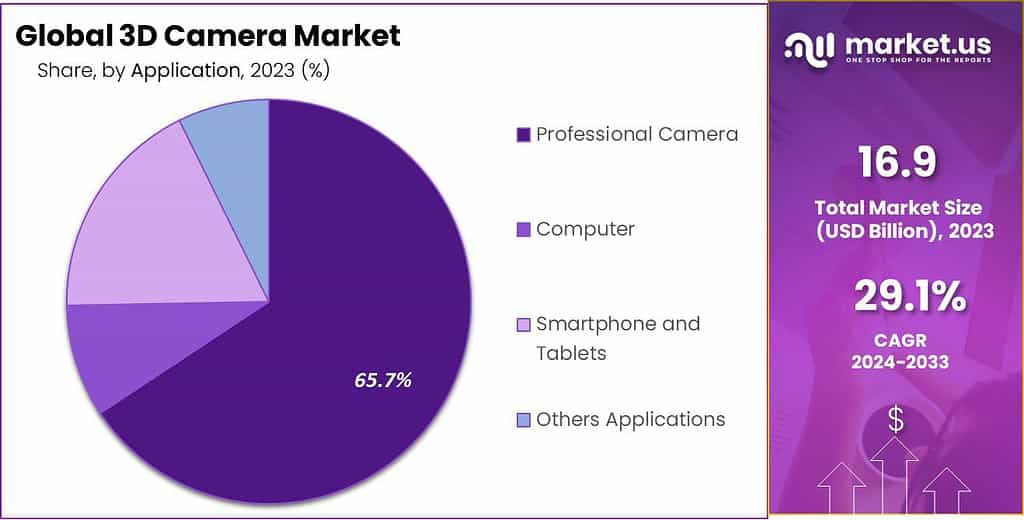

In 2023, the Professional Camera segment established its dominance in the 3D Camera market, capturing more than a commanding 65.7% share. These specialized 3D cameras are extensively employed in industries such as film production, healthcare, manufacturing, and engineering for applications that demand high precision and accuracy in 3D imaging.

Professional cameras equipped with 3D technology offer unparalleled depth perception and are pivotal in creating immersive cinematic experiences, capturing intricate medical scans, and aiding in 3D modeling and design tasks. Their robust performance and ability to deliver exceptional image quality have solidified their position as the leading application segment in the 3D Camera market.

Smartphones and Tablets emerged as another significant application segment, reflecting the increasing integration of 3D camera technology into consumer devices. By 2023, the devices made up for a substantial market share that was driven by the need for improved photography as well as Augmented Reality (AR) experience, as well as facial recognition on tablets and smartphones. The increasing use of 3D-enabled mobile phones has transformed the way people engage with tech, providing new possibilities for innovation and ease of use.

The Computer application segment also played a substantial role in the 3D Camera market, particularly in gaming and gesture recognition applications. 3D cameras integrated into computers enable immersive gaming experiences, motion tracking, and interactive interfaces. As gaming and virtual reality (VR) gain increasing popularity, the continued importance of incorporating 3D cameras into computer systems is anticipated.

The “Others” category encompasses various applications of 3D cameras, such as automotive safety systems, surveillance, and robotics, among others. While individually contributing to a smaller market share, these applications collectively offer unique opportunities for 3D camera technology. In the automotive sector, 3D cameras aid in advanced driver assistance systems (ADAS) and autonomous vehicles, enhancing road safety. In surveillance, they provide depth perception for more accurate monitoring, and in robotics, they enable precise object recognition and navigation.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- Consumer Demand for Enhanced Imaging: The increasing demand for high-quality 3D imaging in smartphones, tablets, and digital cameras is a major driving force. Consumers seek immersive experiences and innovative photography capabilities, spurring manufacturers to integrate 3D cameras into their devices.

- Growth of Augmented Reality (AR) and Virtual Reality (VR): The proliferation of Augmented Reality (AR) and Virtual Reality (VR) applications across diverse industries, including gaming, healthcare, and education, is driving the uptake of 3D cameras. These cameras play a crucial role in crafting lifelike and interactive virtual environments, ultimately elevating user experiences.

- Industrial Automation and Robotics: In industrial sectors, the need for automation, quality control, and precise object recognition is driving the demand for 3D cameras. They play a vital role in applications like robotic assembly lines, ensuring efficiency and accuracy.

- Advancements in Automotive Safety: Advanced Driver Assistance Systems (ADAS) and autonomous vehicles depend on 3D cameras for functions such as depth perception, object detection, and collision avoidance. The increasing focus on vehicle safety and advancements in self-driving technology is driving the widespread adoption of 3D cameras in the automotive industry.

Restraining Factors

- Cost and Complexity: The cost of 3D camera technology and the complexity of integrating it into devices can be a barrier to widespread adoption, especially in consumer products. Manufacturers must address cost-efficiency and usability challenges.

- Data Security and Privacy Concerns: 3D cameras capture detailed depth information, raising privacy and security concerns in certain applications, such as facial recognition. Addressing these concerns and complying with regulations is a challenge.

- Lack of Standards: The absence of standardized 3D imaging formats and technologies can hinder interoperability and limit the seamless integration of 3D cameras across different platforms and industries.

- Market Competition: Intense competition among 3D camera manufacturers and technology providers can lead to pricing pressures and a focus on differentiation. Companies must continuously innovate to stay ahead in this competitive landscape.

Growth Opportunities

- Healthcare Imaging: The healthcare sector offers significant growth opportunities for 3D cameras in medical imaging, surgical navigation, and patient monitoring. The ability to capture precise 3D anatomical data enhances diagnostics and treatment.

- Customized 3D Scanning Solutions: Tailoring 3D camera solutions for specific industries, such as manufacturing and architecture, presents opportunities for providers to meet specialized needs and gain a competitive edge.

- Miniaturization and Wearable Devices: Advancements in miniaturizing 3D camera technology open doors for wearable devices and applications like AR glasses, where compact and lightweight cameras are essential.

- AI Integration: Integrating artificial intelligence (AI) with 3D cameras for real-time object recognition and analysis enhances their capabilities. This integration can drive growth in applications like retail analytics and security.

Challenges

- Calibration and Accuracy: Ensuring the precise calibration and accuracy of 3D cameras in various environments and lighting conditions remains a challenge, especially in critical applications like medical imaging and robotics.

- Data Processing Complexity: Dealing with the vast amount of data generated by 3D cameras requires sophisticated processing capabilities. Managing and analyzing this data efficiently can be a challenge.

- Interoperability: Achieving seamless interoperability between different 3D camera brands and models is essential for industry-wide adoption. Overcoming compatibility issues and promoting standardization is a challenge.

- Ethical Considerations: Ethical concerns related to 3D imaging, such as privacy invasion and misuse of facial recognition, pose challenges that must be addressed through responsible technology development and regulations.

Key Market Trends

- Depth Sensing for Photography: The use of 3D cameras for depth sensing in smartphone photography, enabling features like portrait mode and 3D scanning, is a prominent trend. Consumers increasingly value these capabilities.

- LiDAR Integration: LiDAR technology is being integrated into 3D cameras for enhanced depth perception, particularly in autonomous vehicles and robotics. This trend contributes to improved safety and navigation.

- 3D Scanning and Printing: 3D cameras are driving the growth of 3D scanning and printing applications. Industries like manufacturing and architecture benefit from precise 3D models for prototyping and design.

- AR and VR in Education: The use of 3D cameras in AR and VR applications for educational purposes is a growing trend. These technologies offer immersive learning experiences in classrooms and training environments.

Key Market Segments

By Technology

- Time-of-Flight (ToF) Cameras

- Stereo Vision Cameras

- Structured Light Cameras

By Application

- Professional Camera

- Computer

- Smartphone and Tablets

- Others Applications

Regional Analysis

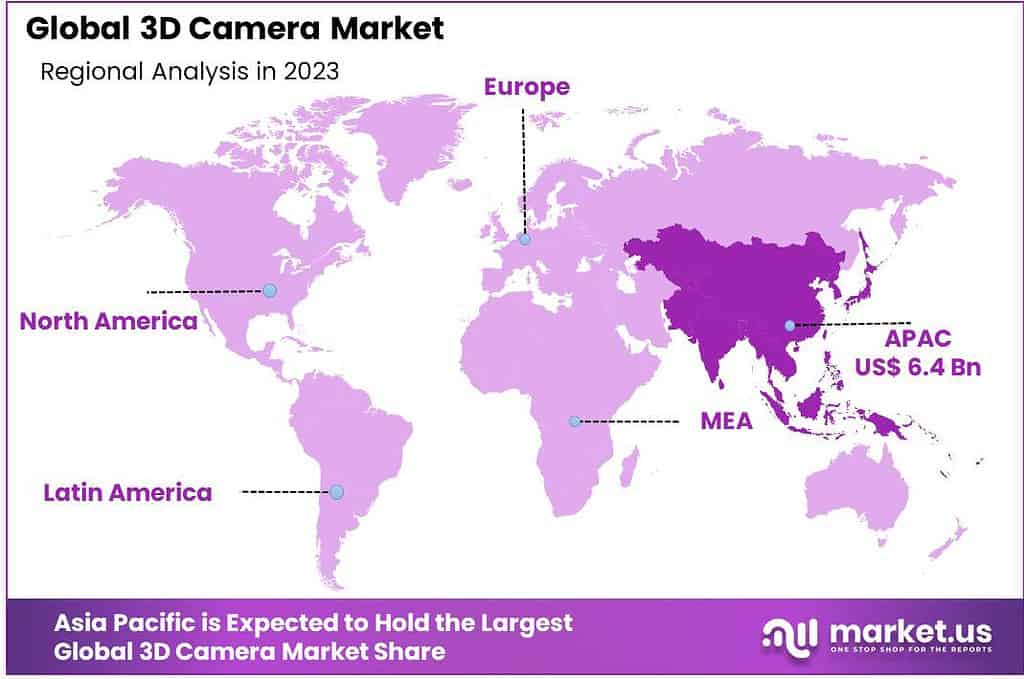

In 2023, the 3D Camera market exhibited distinctive regional dynamics, with Asia Pacific emerging as the dominant player, securing a commanding market position by capturing over 38.2% of the market share. Asia Pacific’s leading position in this domain can be ascribed to several factors, including the region’s robust manufacturing ecosystem, the burgeoning consumer electronics industry, and the rising adoption of 3D imaging technologies across various sectors.

The demand for 3D Camera in North America was valued at USD 6.4 billion in 2023 and is anticipated to grow significantly in the forecast period. Particularly, the thriving economies of Asia Pacific, such as China, Japan, and South Korea, have been pioneers in technological innovation, driving the demand for 3D cameras in diverse applications, spanning from smartphones to healthcare and the automotive sectors.

Concurrently, North America maintained a significant presence in the market. The region’s market stability was underpinned by its early adoption of 3D imaging solutions in industries like entertainment, healthcare, and aerospace. Furthermore, Europe secured a notable position, driven by the growing interest in 3D photography and imaging technologies across both consumer and industrial domains.

Latin America, Middle East, and Africa collectively contributed to the market, showcasing a gradual but promising adoption of 3D cameras, particularly in sectors like architecture and construction. These regional dynamics underscore the global landscape of the 3D Camera market, highlighting the varied levels of adoption and opportunities for industry players across different parts of the world.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The 3D camera market is characterized by the presence of several key players who are instrumental in driving innovation, technological advancements, and market growth.

Top Key Players

- Sony Corporation

- Fujifilm Holdings Corporation

- Panasonic Corporation

- Canon Inc.

- Nikon Corporation

- GoPro, Inc.

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Olympus Corporation

- Teledyne FLIR LLC

- Other Key Players

Recent Developments

- In January 2023, Orbbec unveiled its latest 3D camera, Gemini 2, during the CES 2023 convention in Las Vegas. This cutting-edge camera features ORBBEC’s next-generation depth engine chip, delivering a wide 100° field of view and incorporating a no-blind-zone technology in close range. This innovation enables depth measurement from 0 distance up to a range of 10 meters.

- Also in January 2023, MatterPort announced a strategic collaboration with John Deere. As part of this partnership, John Deere will leverage Matterport’s Pro2 and Pro3 cameras to capture spatially accurate, 4K resolution digital twins, contributing to the optimization of facility operations.

Report Scope

Report Features Description Market Value (2023) US$ 16.9 Bn Forecast Revenue (2033) US$ 217.3 Bn CAGR (2024-2033) 29.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Time-of-Flight (ToF) Cameras, Stereo Vision Cameras, Structured Light Cameras), By Application (Professional Camera, Smartphone and Tablets, Computer, and Others Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Sony Corporation, Fujifilm Holdings Corporation, Panasonic Corporation, Canon Inc., Nikon Corporation, GoPro Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co. Ltd., Intel Corporation, Olympus Corporation, Teledyne FLIR LLC, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a 3D camera, and how does it differ from traditional cameras?A 3D camera captures images or videos in three dimensions, providing depth perception. Unlike traditional cameras, 3D cameras use multiple lenses or sensors to create a stereoscopic effect for a more immersive visual experience.

How big is the 3D Camera Market?The global 3D Camera Market is projected to have a moderate-paced CAGR of 29.1% during the forecast period 2024-2033. The current valuation of the market is USD 16.9 Billion in 2023. The demand for 3D camera is anticipated to reach a high of USD 217.3 Billion by the year 2033.

What are the key drivers propelling the growth of the 3D camera market?The growth of the 3D camera market is driven by increased demand for enhanced photography, augmented reality (AR), virtual reality (VR), and applications in sectors like healthcare, gaming, and automotive.

How are 3D cameras used in the healthcare industry?3D cameras in healthcare assist in various applications such as surgical planning, telemedicine, and patient monitoring. They enable accurate 3D imaging for diagnostics and treatment.

What are the anticipated trends and future prospects for the 3D camera market?Anticipated trends include continued growth in AR and VR applications, increased integration in various industries, and ongoing advancements in technology, positioning 3D cameras as integral components in future innovations.

- Market Growth and Projections: The 3D Camera market is expected to grow by 29.1% over the timeframe from 2024 until 2033. The market’s value for 2023 stood at USD 16.9 billion and is projected to be USD 217.3 billion in 2033.

-

-

- Sony Corporation

- Fujifilm Holdings Corporation

- Panasonic Corporation

- Canon Inc.

- Nikon Corporation

- GoPro, Inc.

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Olympus Corporation

- Teledyne FLIR LLC

- Other Key Players