Global 3A Video Games Market Size, Share, Growth Analysis By Business Model (Premium/One-Time Purchase, Live-Service/Games-as-a-Service (GaaS), Subscription Services), By Genre (Action, Adventure, Role-Playing, Simulation, Strategy, Sports, Others), By Platform (PC, Console, Mobile), By Distribution Channel (Online Stores, Physical Retail, Digital Downloads), By End-User (Casual Gamers, Professional Gamers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163622

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Gamers Demand

- Analysts’ Viewpoint

- Emerging Trends

- US Market Size

- By Business Model

- By Genre

- By Platform

- By Distribution Channel

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

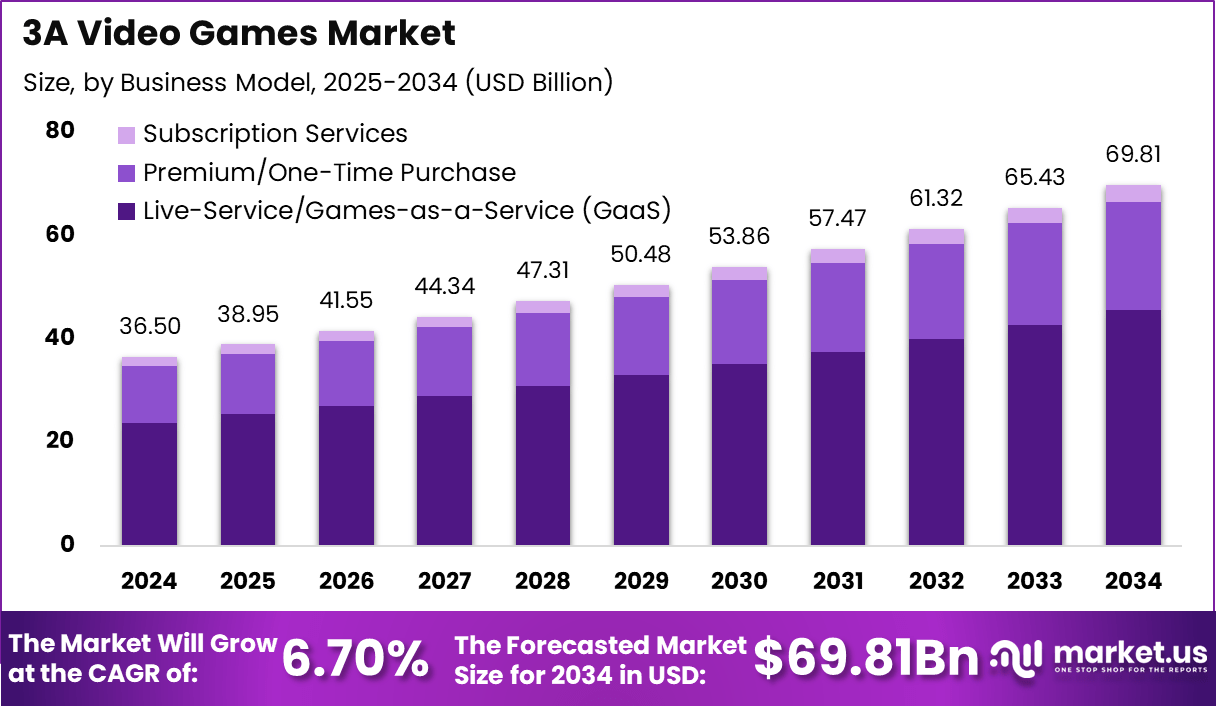

The global 3A video games market, valued at USD 36.5 billion in 2024, is projected to reach USD 69.81 billion by 2034, growing at a CAGR of 6.7%. This growth is driven by the rising demand for immersive gaming experiences, expanding eSports influence, and the integration of advanced graphics technologies such as ray tracing and real-time rendering. Studios are increasingly investing in large-scale productions with cinematic storytelling and realistic physics engines, enhancing player engagement across consoles, PCs, and cloud platforms.

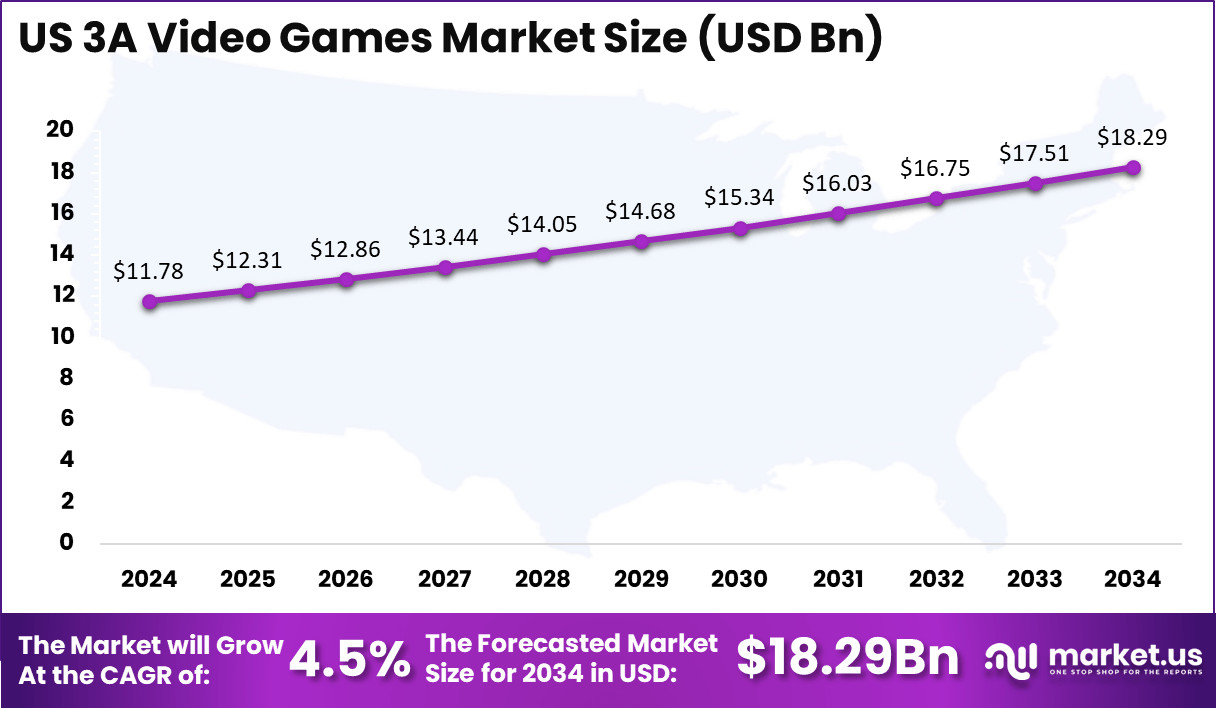

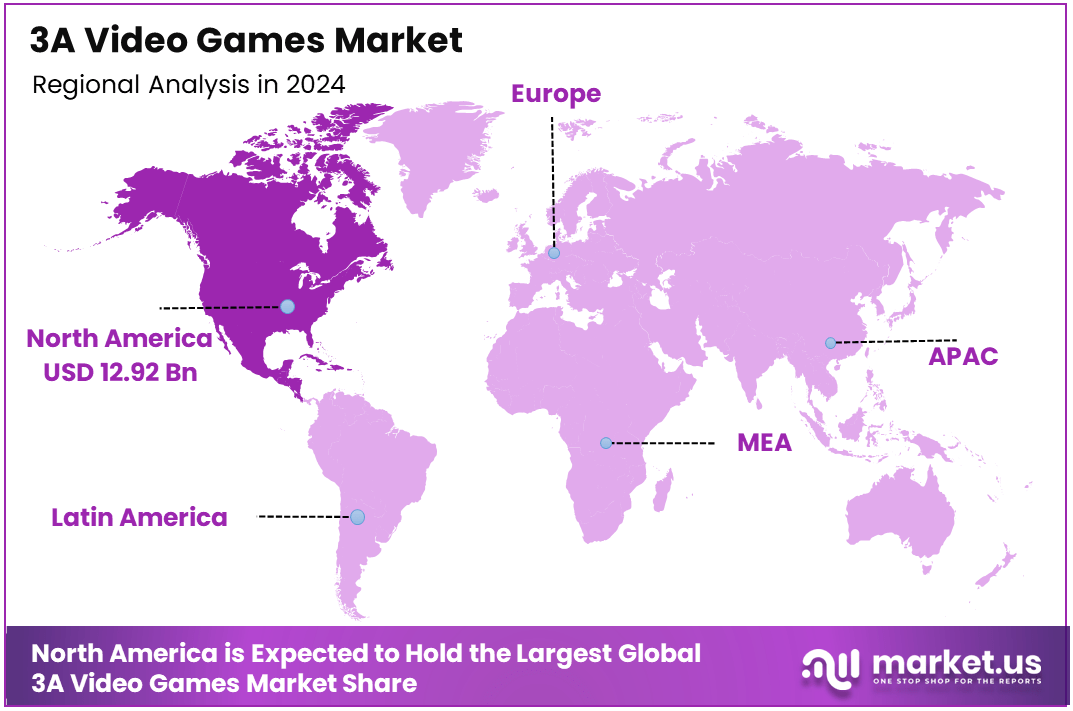

North America accounts for 35.4% of the market, valued at USD 12.92 billion in 2024, supported by strong consumer spending, widespread console ownership, and robust digital distribution infrastructure. The US, holding a dominant share with USD 11.78 billion in 2024, is anticipated to grow to USD 18.29 billion by 2034 at a CAGR of 4.5%, driven by increasing adoption of next-generation consoles, high-speed internet penetration, and strong game development ecosystems led by major studios such as Microsoft, Activision Blizzard, and Electronic Arts.

The 3A video games market is experiencing rapid expansion, fueled by growing demand for high-quality, immersive gaming experiences. These titles are known for their large budgets, sophisticated design, and cinematic storytelling, often rivaling blockbuster films in production value. The rise of powerful consoles, gaming PCs, and cloud-based streaming services has transformed how players access and experience games, while advancements in graphics engines and real-time rendering have enhanced realism and interactivity.

Developers are increasingly adopting artificial intelligence, motion capture, and virtual production technologies to create dynamic environments and complex character behaviors. Meanwhile, cross-platform accessibility and online multiplayer capabilities are driving player engagement and fostering global gaming communities.

The North American region continues to play a pivotal role in market growth, supported by strong gaming infrastructure, an active eSports culture, and leading developers such as Microsoft, Activision Blizzard, and Electronic Arts. Continuous innovation in storytelling, visual fidelity, and interactive gameplay positions 3A titles as the benchmark for the next generation of entertainment experiences.

Recently, the AAA video game industry has seen several notable developments involving big-name companies, large investments, and major new releases. In October 2025, Microsoft announced the acquisition of independent studio Kinetic Games for $150 million, boosting its portfolio ahead of the holiday season.

Electronic Arts (EA) launched its new AAA title “Titanfall Alpha” with pre-orders surpassing 700,000 units in the first 10 days, the fastest in company history. Sony invested $120 million in expanding PlayStation Studios, funding three new AAA game projects scheduled for release in 2026. Ubisoft reported Q3 2025 funding of $80 million, aimed at next-gen AI game design, while Activision Blizzard revealed a merger with Vicarious Visions, now operating with a combined development force of 2,500 employees.

Additionally, Capcom launched “Resident Evil Shadows,” which sold over 2 million units worldwide within its first month. These trends show how AAA gaming is fueled by large financial moves, strategic mergers, and blockbuster launches—reshaping the landscape for both studios and gamers.

The AAA video game market in 2025 continues to see huge business moves and industry changes. Recent deals include Electronic Arts acquiring BioWare Austin and Codemasters assets, with Krafton spending $93.7 million to buy Eleventh Hour Games for PC-focused titles, and investing $114.9 million to gain a minority stake in Neptune Co..

Rockstar Games and CD Projekt Red are set for major product launches, with GTA VI and Witcher IV both causing excitement and expected to surpass millions of sales in their first months of release. Meanwhile, publishers and venture capitalists are cautious about new investment, with most budgets now in the $15–20 million range for AA/AAA development, and seed funding typically between $1.5–3 million per project.

The AAA segment is forecasted to reach $200 billion in market revenue by 2033, with 8.5% annual growth. This expansion is fueled by increased investment and the global spread of cloud gaming, AI-powered graphics, and e-sports, all attracting attention from major studios like Ubisoft, Sony, and Microsoft.

Despite a tough funding climate, several publishers—including Sony and EA—have announced expanded AAA funding for new games in 2025, with budgets often topping $100 million per title. Overall, 2025’s AAA scene is shaped by blockbuster launches, high-value acquisitions, and technological leaps, while financial caution and shifting investment trends change how studios plan future games.

Key Takeaways

- The global 3A video games market is valued at USD 36.5 billion in 2024 and is expected to reach USD 69.81 billion by 2034, growing at a CAGR of 6.7%.

- North America accounts for 35.4% of the global market, driven by strong consumer demand and advanced gaming infrastructure.

- The US leads the region with a market value of USD 11.78 billion in 2024, projected to reach USD 18.29 billion by 2034 at a CAGR of 4.5%.

- By Business Model, Live-Service/Games-as-a-Service (GaaS) dominates with a 65.3% share, reflecting the shift toward continuous content updates and in-game purchases.

- By Genre, Action games hold the largest share at 45.1%, fueled by popular franchises offering immersive gameplay and cinematic experiences.

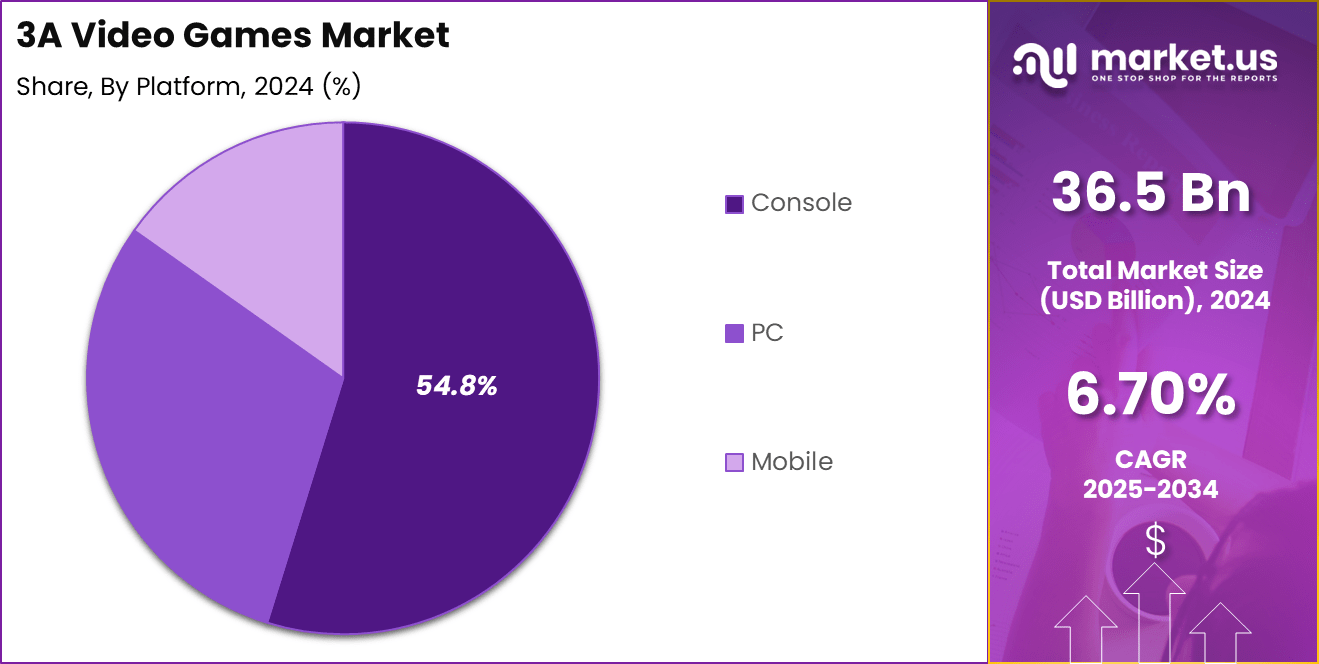

- By Platform, Consoles lead the market with a 54.8% share, supported by the widespread use of next-generation systems such as PlayStation 5 and Xbox Series X/S.

- By Distribution Channel, Digital Downloads account for 85.2% of total sales, underscoring the industry’s transition from physical to online distribution models.

- By End-User, Casual Gamers represent 80.4% of the market, driven by growing accessibility, mobile connectivity, and social gaming trends.

Gamers Demand

Gamer demand in the 3A video games market is steadily increasing, driven by the growing appetite for immersive, story-rich, and graphically advanced experiences. Players are seeking games that offer cinematic storytelling, open-world exploration, and multiplayer engagement with seamless cross-platform connectivity.

The demand is also being shaped by innovations in artificial intelligence, real-time rendering, and dynamic environments that make gameplay more personalized and lifelike. With the rise of next-generation consoles and high-performance PCs, gamers expect smooth frame rates, detailed textures, and realistic physics that enhance the overall experience.

Casual gamers form the largest segment of the player base, accounting for a majority of market participation due to the accessibility of online multiplayer and live-service formats. These players prefer games that are easy to learn yet engaging over extended periods, often supported by continuous updates and downloadable content. Meanwhile, the popularity of eSports and streaming platforms is influencing player expectations, as competitive gaming and social interactivity become major engagement drivers.

Subscription-based models, digital downloads, and cloud gaming have further simplified access, encouraging higher spending on premium titles and in-game content. Overall, gamer demand is evolving toward convenience, realism, and community-driven experiences that define the modern 3A gaming ecosystem.

Analysts’ Viewpoint

Analysts view the 3A video games market as moving toward steady, sustainable growth rather than rapid expansion. This shift reflects increasing production costs, extended development cycles, and heightened consumer expectations for realism and interactivity. The rise of live-service and Games-as-a-Service (GaaS) models is seen as a crucial growth driver, enabling continuous revenue through in-game purchases and seasonal content updates.

With action games dominating the genre landscape and digital downloads accounting for the vast majority of sales, developers are focusing heavily on delivering cinematic storytelling, premium graphics, and seamless online experiences. Analysts also note that console platforms remain the backbone of the 3A ecosystem, investing in next-generation hardware optimization and ecosystem integration essential for long-term success.

While North America, led by the US, continues to anchor market performance, its moderate CAGR suggests signs of maturity, prompting studios to explore opportunities in emerging regions and across multiple device platforms. Ultimately, analysts believe that future success in the 3A gaming space will depend on a studio’s ability to balance production scale with innovation, ensuring that every release delivers exceptional quality, deep narratives, and enduring franchise value in an increasingly competitive environment.

Emerging Trends

Emerging trends in the 3A video games market are reshaping how large-scale titles are developed, distributed, and monetised. One notable shift is the accelerating adoption of live-service and cross-platform formats, with approximately one-third of major AAA studios now focusing on live-service models to extend player engagement and lifetime value.

Advanced technologies such as generative AI, real-time rendering, and procedural content creation are enabling more dynamic game worlds and reducing development-cycle bottlenecks; this is helping studios deliver more immersive experiences within tighter timeframes.

Expanding digital distribution and the dominance of downloadable and streaming channels continue to gain ground, supporting the shift from physical media toward entirely online ecosystems. Additionally, emerging markets in Asia-Pacific and Latin America are attracting greater attention as growth regions, spurred by rising connectivity and disposable income—this presents opportunities for big-budget titles to tap new audiences.

Moreover, the competitive landscape is evolving: traditional barriers to entry are weakening, enabling smaller studios with advanced tools to challenge incumbent players—forcing AAA developers to innovate faster, differentiate through high production value, and consolidate franchise strength.

US Market Size

The 3A video games market in the US is demonstrating steady expansion, driven by technological innovation, evolving consumer preferences, and the strength of domestic game development studios. Valued at USD 11.78 billion in 2024, the market is projected to reach USD 18.29 billion by 2034, growing at a CAGR of 4.5%. This growth is supported by the increasing adoption of high-performance gaming consoles, cloud-based gaming services, and enhanced digital distribution models that allow instant access to large-scale titles.

The US continues to be a global hub for 3A game development, housing major studios such as Activision Blizzard, Electronic Arts, Microsoft Studios, and Take-Two Interactive, which consistently produce blockbuster franchises. Strong consumer spending on premium content, subscription services, and in-game microtransactions further boosts market value.

Moreover, advancements in AI-driven game design, virtual production, and real-time rendering are enabling developers to deliver immersive storytelling experiences and lifelike graphics. The integration of cross-platform compatibility and eSports engagement is also attracting a broader player base. With consistent investment in innovation and a mature gaming ecosystem, the US remains a cornerstone of the global 3A video games industry, setting quality and performance benchmarks for the international market.

By Business Model

Live-Service or Games-as-a-Service (GaaS) accounts for 65.3% of the 3A video games market, emerging as the dominant business model reshaping the industry’s revenue structure. This approach prioritizes long-term player engagement by continuously updating content, introducing new features, and integrating social and multiplayer elements. Unlike traditional premium or one-time purchase models, GaaS titles generate ongoing income through in-game transactions, seasonal passes, and cosmetic upgrades, ensuring a steady revenue flow for developers while extending the lifecycle of each game.

The growing popularity of online multiplayer ecosystems and digital connectivity has made this model central to 3A development strategies. Games such as Fortnite, Call of Duty: Warzone, and Destiny 2 exemplify the success of the GaaS model by maintaining large active communities through regular updates and live events.

This trend is further supported by integrating cloud gaming, cross-platform compatibility, and AI-driven personalization, which enhance accessibility and engagement. Subscription services also blend with GaaS frameworks, offering players bundled access to multiple live titles. As gamers increasingly value evolving, interactive experiences over static content, Live-Service models are expected to remain at the core of future 3A game monetization, ensuring both sustained profitability and stronger brand loyalty.

By Genre

Action holds the largest share of 45.1% in the 3A video games market, making it the most dominant genre due to its dynamic gameplay, high replay value, and broad audience appeal. This genre’s success is rooted in its ability to combine fast-paced mechanics, cinematic storytelling, and advanced visual effects, delivering immersive experiences that keep players engaged for extended periods. Popular franchises such as Call of Duty, Assassin’s Creed, and Grand Theft Auto continue to drive demand, supported by next-generation consoles that enable high-definition graphics, realistic physics, and seamless open-world environments.

Adventure and role-playing games are also gaining traction, fueled by strong narrative depth and expansive character customization that appeal to long-term engagement. Simulation and strategy games attract niche audiences seeking tactical gameplay and realism, while sports titles maintain steady growth through annual updates and eSports integration.

The “Others” category, including hybrid genres and indie collaborations, is evolving as developers experiment with new storytelling and multiplayer formats. Overall, the dominance of action titles reflects the market’s shift toward interactive entertainment that merges technical excellence with emotional immersion, setting new standards for 3A game development and reinforcing player expectations for realism, interactivity, and continuous innovation.

By Platform

Console platforms account for 54.8% of the 3A video games market, representing the dominant segment due to their superior processing power, optimized gaming environments, and exclusive high-budget titles. The success of next-generation consoles such as PlayStation 5, Xbox Series X/S, and Nintendo Switch has driven strong consumer adoption, offering immersive experiences through advanced graphics, real-time ray tracing, and enhanced frame rates. These platforms also provide seamless integration with cloud services, social features, and subscription models, enabling players to access extensive libraries of premium games.

PC gaming continues to hold a substantial share, supported by customizable hardware, competitive eSports ecosystems, and increasing accessibility through platforms such as Steam and Epic Games Store. The PC segment also benefits from modding communities and early adoption of emerging technologies like AI rendering and VR compatibility.

Mobile gaming, though rapidly expanding in other genres, plays a smaller role in the 3A segment due to hardware limitations, but cloud-based mobile streaming is beginning to bridge this gap. Overall, the console segment remains the foundation of 3A gaming, combining cutting-edge performance with exclusive titles and strong brand ecosystems that continue to define the global premium gaming experience.

By Distribution Channel

Digital downloads dominate the 3A video games market with an 85.2% share, highlighting the industry’s decisive shift toward online distribution and away from physical retail. The widespread adoption of high-speed internet, powerful digital storefronts, and integrated console ecosystems has made instant access to premium titles the standard for modern gamers. Platforms such as PlayStation Store, Xbox Live, Steam, and Epic Games Store have redefined how players purchase and update games, offering convenience, pre-load options, and regular discounts that enhance user engagement.

Online stores continue to serve as the primary gateway for both full-game purchases and in-game transactions, aligning with the rise of live-service and subscription-based models. Physical retail, once the backbone of game distribution, now caters primarily to collectors and limited-edition releases, accounting for a diminishing portion of total sales.

The increasing popularity of cloud gaming and cross-platform digital libraries further reinforces the preference for digital ownership. For developers and publishers, this transition has streamlined logistics, reduced manufacturing costs, and enabled direct consumer engagement through digital marketing and analytics. As a result, digital downloads have become the dominant and most profitable distribution model, shaping the future of 3A video game accessibility and monetization.

By End-User

Casual gamers represent 80.4% of the 3A video games market, making them the most influential end-user segment driving demand and revenue growth. This dominance is attributed to the accessibility of modern gaming platforms, simplified online distribution, and the increasing availability of cross-platform play that allows players to engage anytime and anywhere.

Casual gamers are drawn to titles with intuitive controls, engaging storylines, and social multiplayer modes, reflecting the market’s shift toward inclusivity and convenience. The growing popularity of live-service models, seasonal content updates, and digital community events further enhances player retention within this segment.

Professional gamers, while smaller in number, hold significant influence due to their role in competitive gaming and eSports ecosystems. This group drives visibility and marketing potential for 3A titles through streaming, tournaments, and sponsorships. Developers are increasingly designing competitive elements, ranking systems, and spectator features to attract and retain this audience.

However, the casual gamer segment remains the foundation of the market, supported by widespread broadband access, diverse gaming genres, and subscription-based models. Overall, the growing balance between casual accessibility and professional competitiveness is shaping the next evolution of 3A gaming experiences, expanding global participation and deepening long-term player engagement.

Key Market Segments

By Business Model

- Premium/One-Time Purchase

- Live-Service/Games-as-a-Service (GaaS)

- Subscription Services

By Genre

- Action

- Adventure

- Role-Playing

- Simulation

- Strategy

- Sports

- Others

By Platform

- PC

- Console

- Mobile

By Distribution Channel

- Online Stores

- Physical Retail

- Digital Downloads

By End-User

- Casual Gamers

- Professional Gamers

Regional Analysis

North America accounts for 35.4% of the global 3A video games market, solidifying its position as the largest regional contributor. The market size, valued at USD 12.92 billion in 2024, reflects the region’s strong gaming culture, advanced digital infrastructure, and high consumer expenditure on premium entertainment.

The United States leads regional growth, supported by established gaming giants such as Microsoft, Activision Blizzard, and Electronic Arts, which continue to produce top-grossing franchises and innovative live-service titles. Canada also plays a growing role, hosting major development studios and benefiting from favorable government incentives for interactive media production.

The region’s dominance is reinforced by widespread adoption of next-generation consoles, robust internet connectivity, and an expanding base of casual and professional gamers. Cloud gaming services, digital downloads, and subscription-based platforms have further enhanced accessibility, reducing reliance on physical retail.

The strong presence of eSports tournaments, gaming conventions, and streaming platforms such as Twitch and YouTube Gaming continues to elevate market engagement. Additionally, technological innovation in graphics, AI, and immersive gameplay experiences drives consumer retention and monetization. North America’s mature yet evolving gaming ecosystem positions it as a key driver of global 3A video game innovation and sustained revenue growth over the forecast period.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The primary driving forces behind the 3A video games market include the increasing demand for immersive and cinematic gaming experiences, supported by rapid technological advancements. High-definition graphics, real-time ray tracing, and AI-based rendering are transforming gameplay realism and player engagement.

The widespread adoption of next-generation consoles, powerful gaming PCs, and cloud-based streaming platforms has expanded accessibility and improved user experience. Additionally, the rise of live-service models and in-game monetization systems such as microtransactions and battle passes has strengthened long-term revenue streams for developers.

The growing influence of eSports, online multiplayer gaming, and social streaming platforms like Twitch and YouTube Gaming further boosts visibility and market penetration. Strong digital infrastructure in developed economies, coupled with an expanding global gamer population, continues to propel the 3A video games market into a high-growth trajectory with sustained engagement and recurring revenue generation.

Restraint Factors

The 3A video games market faces key restraints stemming from escalating development costs, lengthy production cycles, and rising consumer expectations. Creating high-budget titles requires massive investments in advanced graphics engines, talent, and marketing, making profitability challenging, especially for mid-sized studios.

The growing competition from indie and mid-tier developers offering innovative, cost-effective alternatives adds pricing pressure. Additionally, technical issues such as optimization challenges, large download sizes, and storage requirements hinder accessibility for casual players. Market saturation in developed economies like the US and Japan limits new user acquisition, while regulatory constraints related to data privacy and in-game purchases add compliance burdens.

Cybersecurity threats and the growing risk of data breaches within online multiplayer systems also pose operational challenges. Furthermore, the dependence on digital platforms increases vulnerability to server outages and subscription fatigue, restricting growth momentum in certain regions and consumer segments.

Growth Opportunities

Significant growth opportunities in the 3A video games market lie in expanding digital ecosystems, emerging regions, and evolving business models. The rise of cloud gaming services such as Xbox Cloud Gaming and NVIDIA GeForce Now is enabling access to premium titles across devices without hardware limitations.

Emerging markets in Asia-Pacific and Latin America present vast potential due to increasing internet penetration and affordable connectivity. Developers are also exploring cross-platform play and AI-driven adaptive gameplay to personalize user experiences and attract broader audiences. Subscription-based services and hybrid monetization models are opening new revenue channels while enhancing customer retention.

Furthermore, the integration of virtual and augmented reality is creating avenues for more immersive storytelling and interactive gameplay. As gaming converges with social entertainment and eSports, the 3A segment is poised to leverage digital innovation, expanding its global footprint and evolving into a core pillar of modern entertainment.

Challenging Factors

The 3A video games market faces several challenges that could hinder sustainable growth despite its strong momentum. One major challenge is the rising complexity of development pipelines, requiring multidisciplinary teams, extensive QA testing, and years of pre- and post-production effort. Delays in release schedules often impact profitability and investor confidence.

The competitive pressure to deliver visually superior games has also intensified, pushing smaller studios to the brink of financial strain. Another challenge is consumer fatigue from repetitive franchise models and aggressive monetization strategies, which can erode brand loyalty. The volatility of online reviews and social media reactions can quickly affect sales performance.

Furthermore, adapting to rapidly evolving technologies such as AI and cloud integration requires ongoing investment and skilled workforce training. Regional disparities in infrastructure and gaming regulations also complicate market expansion. Collectively, these challenges emphasize the need for innovation, efficiency, and adaptive business models in sustaining 3A market growth.

Competitive Analysis

These firms compete on several fronts, including intellectual property (IP) strength, production scale, global distribution reach, and live-service business models. For example, Epic Games is notable for its Unreal Engine technology and Fortnite ecosystem. Capcom is recognized for its enduring franchises such as Resident Evil and Monster Hunter. Tencent leverages its massive scale and investment capacity across global studios.

Nintendo and Sony (via PlayStation Studios) emphasise exclusive titles and hardware synergy. Meanwhile, Activision Blizzard leverages its blockbuster franchises and global publishing infrastructure following its integration within larger platform ecosystems.

Many of these companies are shifting towards service-based monetisation, cross-platform play, and recurring revenue streams to sustain market growth in the 3A segment. Competitive pressures are intensified by rising development costs, franchise fatigue, and the necessity of innovation; as a result, only those entities that can deliver premium production value, global franchise appeal, and live-service longevity are expected to maintain leadership in the evolving market.

Top Key Players in the Market

- Electronic Arts

- Take-Two Interactive

- Capcom

- Ubisoft

- Epic Games

- Bluehole

- Nexon

- Riot Games

- Tencent

- Niantic

- Neowiz Games

- Activision Blizzard

- Nintendo

- PlayStation Studios

- Sony Interactive Entertainment

- 2K Games

- Warner Bros. Games

- Xbox Game Studios

- Sega

- Bandai Namco

- Krafton

- Rockstar

- Blizzard Entertainment

- Others

Major Developments

- August 15, 2025: Tencent Holdings partnered with major financial institutions to create a new suite of gaming-related derivatives, offering investors exposure to esports performance and in-game asset trading.

- September 5, 2025: CME Group Inc. launched a new futures contract for NFTs linked to major gaming titles, providing a new trading platform for gaming-related digital assets.

Report Scope

Report Features Description Market Value (2024) USD 36.5 Billion Forecast Revenue (2034) USD 69.81 Billion CAGR(2025-2034) 6.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Business Model (Premium/One-Time Purchase, Live-Service/Games-as-a-Service (GaaS), Subscription Services), By Genre (Action, Adventure, Role-Playing, Simulation, Strategy, Sports, Others), By Platform (PC, Console, Mobile), By Distribution Channel (Online Stores, Physical Retail, Digital Downloads), By End-User (Casual Gamers, Professional Gamers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Electronic Arts, Take-Two Interactive, Capcom, Ubisoft, Epic Games, Bluehole, Nexon, Riot Games, Tencent, Niantic, Neowiz Games, Activision Blizzard, Nintendo, PlayStation Studios, Sony Interactive Entertainment, 2K Games, Warner Bros. Games, Xbox Game Studios, Sega, Bandai Namco, Krafton, Rockstar, Blizzard Entertainment, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Electronic Arts

- Take-Two Interactive

- Capcom

- Ubisoft

- Epic Games

- Bluehole

- Nexon

- Riot Games

- Tencent

- Niantic

- Neowiz Games

- Activision Blizzard

- Nintendo

- PlayStation Studios

- Sony Interactive Entertainment

- 2K Games

- Warner Bros. Games

- Xbox Game Studios

- Sega

- Bandai Namco

- Krafton

- Rockstar

- Blizzard Entertainment

- Others