Quick Navigation

Overview

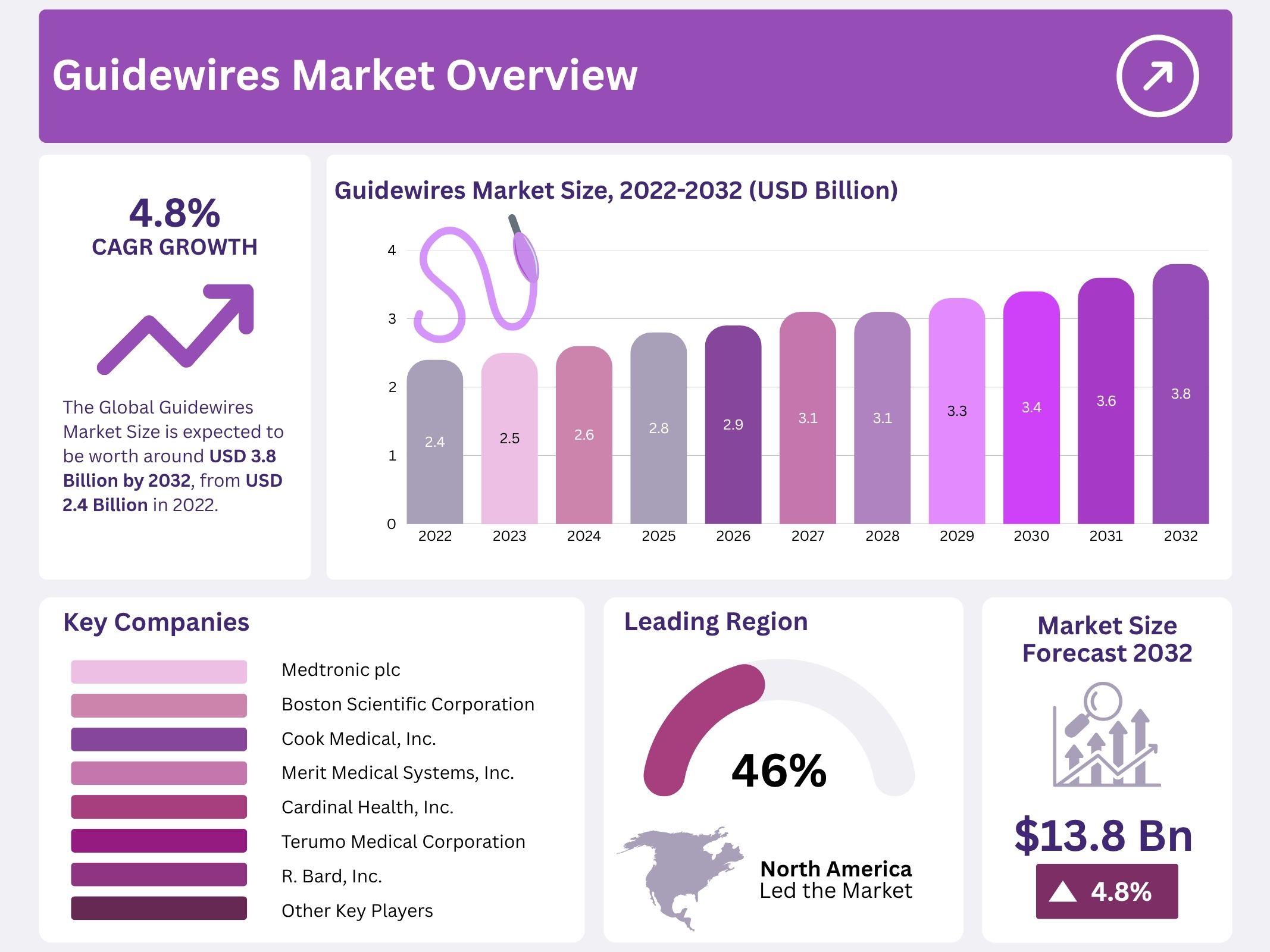

The Global Guidewires Market is projected to reach USD 3.8 billion by 2032, rising from USD 2.4 billion in 2023, at a CAGR of 4.8%. Growth is supported by the increasing burden of cardiovascular and neurovascular diseases. Cardiovascular diseases remain the leading cause of death worldwide, with 19.8 million deaths reported in 2022. The rising use of percutaneous coronary intervention (PCI), neurovascular stroke treatments, and peripheral interventions continues to sustain guidewire demand.

The rising prevalence of diabetes and hypertension further strengthens the need for catheter-based therapies. In 2022, about 830 million adults were living with diabetes, a figure that has quadrupled since 1990. Hypertension now affects 1.4 billion people worldwide in 2024. Both conditions are major risk factors for coronary artery disease, peripheral arterial disease, and stroke, which drive higher procedure volumes. In parallel, the aging global population increases cases of atherosclerotic disease, valvular disorders, and arrhythmias, reinforcing steady adoption of minimally invasive vascular treatments.

Trauma, Service Capacity, and Policy Drivers

Trauma and injury care represent an additional growth factor. Road traffic crashes cause 1.19 million deaths annually, alongside millions of non-fatal injuries. Endovascular repair and bleeding control techniques depend on guidewires for safe access and navigation. Healthcare system capacity also supports growth. National audits, such as the UK National Audit of PCI, show high and sustained activity across hospital networks. Similarly, OECD data confirm stable PCI rates across member countries, indicating structured service delivery and consistent device usage in catheterization labs.

Stroke Care, Technology, and Future Prospects

The expansion of mechanical thrombectomy and guideline-driven stroke care has increased neurovascular procedures worldwide. Wider hospital adoption is translating into higher demand for specialized guidewires. Technology cycles further strengthen the sector. FDA 510(k) clearances highlight steady innovation, with improvements in steerability, torque response, coatings, and sensor-based navigation. These advances enhance procedure efficiency and reduce radiation exposure. Supported by demographic shifts, clinical guidelines, and ongoing innovation, the global guidewires market is expected to show strong, steady growth throughout the forecast period.

Key Takeaways

- The global guidewires market was valued at approximately USD 2.4 billion in 2023, reflecting strong adoption across multiple healthcare applications.

- The industry is projected to expand at a compound annual growth rate (CAGR) of 4.8% between 2022 and 2032, driven by technological advancements.

- Guidewire technology is predominantly utilized in gastrointestinal, cardiovascular, and interventional radiology procedures, highlighting its importance in minimally invasive medical interventions.

- The surgical segment accounted for 53.2% of the market share in 2022, demonstrating its significant contribution to overall guidewire demand.

- Stainless steel material held the highest revenue share in 2022, attributed to its strength, flexibility, and broad suitability in guidewire applications.

- Coated guidewires represented 56.4% of global revenue share in 2022, largely due to enhanced performance, better maneuverability, and patient safety outcomes.

- The cardiology application segment is anticipated to witness significant growth during the forecast period, driven by rising cardiovascular disease prevalence globally.

- Hospitals and specialty clinics are expected to dominate end-user demand, as these facilities increasingly adopt advanced guidewires for improved treatment outcomes.

- North America accounted for a 46% revenue share in 2022, supported by high healthcare expenditure and strong presence of leading manufacturers.

- Asia-Pacific is projected to record the fastest growth, with an 8.4% CAGR, fueled by expanding healthcare infrastructure and growing medical procedure volumes.

- Key players such as Boston Scientific Corporation and Medtronic plc held major market shares, consolidating their positions through innovation and strategic partnerships.

Regional Analysis

North America accounted for the largest revenue share of 46% in the global guidewires market. This dominance is linked to the high prevalence of cardiovascular diseases and the rising number of coronary and peripheral interventions. The preference for advanced treatment methods, together with greater access to healthcare infrastructure, has reinforced regional growth. In addition, strong clinical adoption of guidewires across interventional cardiology has contributed to market expansion. The increasing demand for minimally invasive procedures is expected to sustain North America’s leading market position.

Europe is experiencing consistent growth in the guidewires market due to a rapid increase in surgical volumes. The region shows a strong emphasis on adopting minimally invasive techniques, particularly in cardiothoracic and vascular surgeries. Healthcare providers are shifting toward advanced interventional methods that improve patient outcomes and reduce recovery time. Favorable healthcare policies and rising awareness of innovative medical devices are further stimulating demand. As a result, Europe is anticipated to create promising opportunities for guidewire manufacturers and strengthen its presence in the global market.

Asia-Pacific is projected to record the highest compound annual growth rate (CAGR) of 8.4% during the forecast period. The rapid growth can be attributed to the entrance of novel market players and the implementation of aggressive marketing strategies. Cardiovascular disease prevalence and a rising geriatric population continue to drive demand for guidewires in this region. Increasing preference for minimally invasive surgery techniques that ensure faster results and greater accuracy supports this trend. Collectively, these factors are expected to boost regional adoption and accelerate overall market expansion.

Latin America and the Middle East & Africa are emerging regions with growing potential in the guidewires market. Expansion of healthcare facilities and infrastructure development are projected to fuel market growth. Rising awareness regarding advanced interventional treatments and the availability of improved healthcare services have contributed to increasing adoption rates. Although the market share remains smaller compared to developed regions, growing investments in healthcare technology and training programs are expected to create opportunities. These regions are likely to contribute steadily to the global market outlook.

Segmentation Analysis

The global guidewires market is segmented by product into surgical and diagnostic, each further divided into hydrophilic and hydrophobic types. The surgical segment accounted for the largest share of 53.2% in 2022. This growth was due to the rising adoption of minimally invasive surgical procedures for vascular disease treatment. Medical professionals and patients prefer these procedures for their effectiveness and reduced recovery time. In addition, favorable reimbursement policies across developed regions are further accelerating the adoption of surgical guidewires worldwide.

On the basis of material, the guidewires market is categorized into nitinol, stainless steel, and hybrid. Stainless steel dominated the market in 2022 due to superior performance outcomes in procedures. Its high torsional stability and resistance make it widely accepted among surgeons. These properties are projected to support continued demand in the future. However, nitinol is expected to grow at a higher CAGR because of a gradual shift in preference. Nitinol offers improved biocompatibility, flexibility, superelasticity, and steerability, which are essential in complex interventional procedures.

By coating type, the market is divided into coated and non-coated guidewires. The coated segment captured a 56.4% revenue share in 2022. This dominance is linked to its advantages, such as reduced friction, enhanced navigation through complex anatomical pathways, and improved tactile response. Coated guidewires also minimize infection risks and patient injuries, making them a preferred choice. Non-coated guidewires are witnessing declining adoption due to limited performance benefits and are anticipated to grow at a lower rate during the forecast period.

Based on application, the market is segmented into cardiology, neurology, vascular, urology, oncology, gastroenterology, and otolaryngology. The cardiology segment is expected to witness the highest growth during the forecast period. The increasing use of guidewires in cardiovascular procedures is attributed to the superior features of nitinol-based wires, including elasticity, steerability, and durability. These attributes support precise navigation in complex cardiovascular interventions, driving their adoption. The growing global burden of cardiovascular diseases is further strengthening market demand in the cardiology application area.

In terms of end-users, hospitals and specialty clinics accounted for the largest market share in 2022 and are projected to maintain dominance. The rising number of cardiovascular and gastrointestinal surgeries performed in hospitals is driving demand for guidewires. Additionally, the increasing preference of patients for outpatient procedures is creating opportunities for diagnostic centers. Ambulatory surgical centers, research laboratories, and academic institutes are also contributing significantly. Their growth is supported by increasing healthcare advancements and expanding medical infrastructure in emerging economies, thereby broadening market opportunities across different regions.

By Product

- Surgical

- Hydrophilic

- Hydrophobic

- Diagnostic

- Hydrophilic

- Hydrophobic

By Material

- Nitinol

- Stainless Steel

- Hybrid

By Coating

- Coated

- Non-Coated

By Application

- Cardiology

- Vascular

- Neurology

- Urology

- Gastroenterology

- Other Applications

By End-User

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers

- Research Laboratories & Academic Institutes

- Specialty Clinics

- Other End-Users

Key Players Analysis

The global guidewires market is led by two dominant players, Boston Scientific Corporation and Medtronic plc. These companies hold a major market share owing to their strong product portfolios, technological advancements, and established customer base. Their consistent focus on launching advanced products has strengthened their leadership position. Both companies are recognized for their global presence and extensive distribution networks, which have allowed them to capture significant demand across multiple healthcare markets. Their dominance acts as a benchmark for competitive strategies within the industry.

Apart from Boston Scientific and Medtronic, several prominent players contribute to the competitive landscape of the guidewires industry. Abbott, Cook Medical, Inc., and Merit Medical Systems, Inc. are notable participants with diverse product offerings and a strong focus on minimally invasive procedures. These companies have gained considerable traction by enhancing clinical outcomes and delivering innovative solutions. Their research and development efforts, along with collaborative partnerships, are contributing to greater adoption of advanced guidewire technologies worldwide.

The market also includes other established companies such as Cardinal Health, Inc., Terumo Medical Corporation, and B. Braun Melsungen AG. These players emphasize expanding their product portfolios and improving operational efficiencies. Their strategies often involve partnerships, mergers, and acquisitions to strengthen market penetration. In addition, companies like Teleflex Incorporated and Johnson & Johnson are reinforcing their market positions through investments in product innovation and targeted expansion in high-growth regions. This competitive environment drives constant innovation in the global guidewires sector.

In addition to the major corporations, several emerging players such as Boekel Scientific, ARCOX TMC GROUP, KARL STORZ & Co. KG, Stryker Corporation, and Olympus Corporation are contributing to the market’s diversity. Their focus is on offering cost-effective, innovative solutions to address unmet clinical needs. Although they hold smaller shares, their efforts in specialized applications and niche markets add to the competitive intensity. Collectively, both leading and emerging players are shaping the market through innovation, strategic collaborations, and customer-centric approaches that support the global growth trajectory of the guidewires industry.

Major Key Players

- Medtronic plc

- Boston Scientific Corporation

- Cook Medical, Inc.

- Merit Medical Systems, Inc.

- Cardinal Health, Inc.

- Terumo Medical Corporation

- R. Bard, Inc.

- Abbott

- Johnson & Johnson

- Braun Melsungen AG

- Teleflex Incorporated

- Boekel Scientific

- ARCOX TMC GROUP

- KARL STORZ & Co, KG

- Stryker Corporation

- Olympus Corporation

- Other Key Players

Conclusion

The global guidewires market is expected to grow steadily, supported by rising cases of cardiovascular, neurovascular, and peripheral diseases. Increasing preference for minimally invasive procedures, an aging population, and higher rates of diabetes and hypertension continue to drive demand. Guidewires play a vital role in interventional cardiology, neurology, and surgery, with advancements in coatings, materials, and design improving safety and efficiency. North America leads in adoption due to advanced healthcare systems, while Asia-Pacific shows the fastest growth with expanding infrastructure. Strong competition, continuous innovation, and strategic collaborations among key players are shaping the industry, ensuring sustained growth and wider applications in the years ahead.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Neurovascular Guidewires Market | Interventional Cardiology Devices Market | Interventional Cardiology and Peripheral Vascular Devices Market | AI In Cardiology Market | Neurovascular Devices Market | Neurovascular Catheters Market | Urology Devices Market | Gastroenterology Market | Venous Stents Market | Coronary Stents Market | Stents Market | Biliary Stents Market