Quick Navigation

Overview

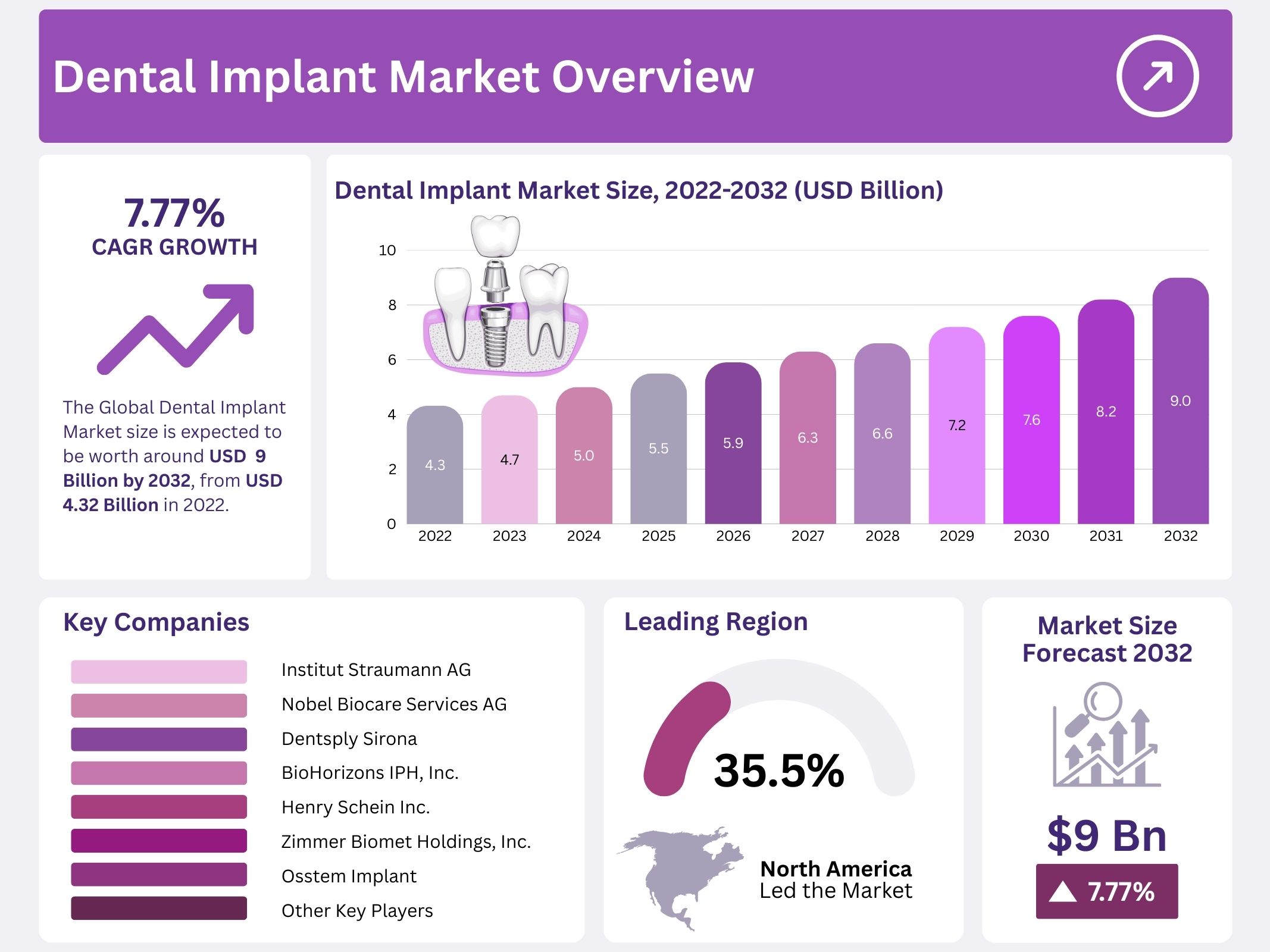

The Global Dental Implants Market is witnessing significant expansion and is projected to reach approximately USD 9 billion by 2032, from USD 4.7 billion in 2023. The market is expected to grow at a compound annual growth rate (CAGR) of 7.77% between 2024 and 2033. Growth is strongly influenced by rising dental disorders, increasing cosmetic dentistry demand, and technological innovations that are transforming restorative dental solutions worldwide.

The rising prevalence of periodontal diseases, dental caries, and tooth loss is a major market driver. Both elderly and younger populations are increasingly undergoing tooth replacement procedures. Poor oral hygiene, lifestyle factors, and growing sugar consumption contribute to the rise in dental problems. This, in turn, is creating strong demand for dental implants as a preferred solution compared to traditional dentures and bridges.

The global aging population further accelerates market growth. Older adults are more prone to edentulism and require restorative dental procedures. The World Health Organization estimates that nearly 2 billion people will be aged 60 years or older by 2050. This demographic shift is expected to significantly expand the patient base for implantology, making it a key factor in long-term market expansion.

Technological advancements in dental implant design and materials are also boosting adoption. Developments such as computer-aided design and manufacturing (CAD/CAM), 3D printing, mini implants, and biocompatible materials like titanium and zirconia have improved treatment outcomes. These innovations enhance precision, durability, and success rates, thereby encouraging both patients and practitioners to adopt modern implant solutions.

Rising disposable income and growing healthcare expenditure are driving adoption across both developed and emerging markets. Countries such as India, China, and Brazil are seeing increased demand due to expanding access to advanced dental care. In addition, favorable reimbursement policies in North America and Europe are supporting wider acceptance, while medical tourism in countries such as Mexico, Hungary, Turkey, and Thailand provides affordable treatment options, further boosting global demand.

The integration of digital dentistry is reshaping the industry. Tools such as intraoral scanners, cone-beam computed tomography (CBCT), and guided implant surgery improve treatment efficiency and accuracy. Alongside this, the expansion of dental clinics, professional training programs, and rising patient awareness of preventive dental care are enhancing accessibility. Together, these factors are expected to sustain strong growth momentum in the dental implants market over the coming decade.

Key Takeaways

- The global dental implants market is witnessing steady expansion, recording a notable growth rate of 7.77%, supported by increasing oral health awareness worldwide.

- Titanium-based dental implants dominated the market in 2022, accounting for approximately 92% of the share, due to their strength, biocompatibility, and long-term reliability.

- Dental clinics emerged as the leading end-users in 2022, largely because of widespread adoption of implants and reliance on advanced digital dental technologies.

- North America secured the largest market share in 2022 at 35.5%, attributed to its aging population and growing awareness of oral health.

- Market growth has been restrained by high treatment costs, limited insurance coverage, and the complexity of implant procedures, impacting patient adoption rates.

- Rising prevalence of oral health issues globally is driving demand, with dental implants increasingly preferred for their durability and functional restoration benefits.

- North America’s strong position in 2022 was reinforced by demographic trends such as an expanding elderly population and increased focus on dental care.

- Asia Pacific is projected to witness the fastest growth, supported by economic stability, improved healthcare infrastructure, and an aging population needing advanced dental treatments.

- Technological advancements, including dental scanners, CAD/CAM, CBCT, and 3D printing, are revolutionizing implant procedures, enhancing precision, and improving overall treatment outcomes.

- Dental implant materials now range widely, spanning titanium, zirconium, polymers, ceramics, and biomaterials, providing greater flexibility and innovation in treatment approaches.

- The widespread adoption of digital technologies within dental clinics is reinforcing their market dominance, creating efficiencies in diagnosis, customization, and implant placement procedures.

- Key industry players shaping the market include Institut Straumann AG, Nobel Biocare Services AG, and Dentsply Sirona, recognized for innovation and strong global presence.

Regional Analysis

North America held a leading share of the global dental implant market in 2022, representing over 35.5% of the total revenue. The region benefits from a large geriatric population with high incidences of dental problems. Growing awareness regarding preventive and therapeutic oral treatments further drives market expansion. According to the American Academy of Implant Dentistry, nearly 3 million people in the United States have dental implants. This number reflects advanced healthcare infrastructure, high disposable incomes, and strong demand for aesthetic dental solutions.

The dominance of North America is also supported by higher spending capacity and access to advanced treatments. Developed economies allocate greater resources toward oral healthcare, which strengthens adoption rates of implants. Rising emphasis on cosmetic dentistry has also created stronger demand. The focus on oral aesthetics is especially notable among aging populations. Increased awareness campaigns by dental associations have further accelerated treatment adoption. As a result, North America continues to maintain its competitive edge in the global market.

Asia Pacific is projected to record the fastest growth during the forecast period. Rapid economic development, combined with rising disposable incomes, supports this expansion. Densely populated nations with aging populations present a growing need for dental care solutions. The region has also become a preferred destination for medical tourism, offering low-cost and quality dental treatments. These advantages attract both local and international patients. As healthcare systems strengthen, the adoption of advanced procedures is expected to rise, making Asia Pacific a key growth engine in the global market.

Advancements in restorative dental implants continue to propel global market growth. Innovative technologies such as CAD/CAM-based dental restorations are expected to improve adoption rates. Increased accessibility to advanced dental procedures and better awareness among patients are also shaping positive demand trends. The growing influence of digital dentistry is likely to enhance treatment accuracy and efficiency. Rising interest in minimally invasive solutions is expected to further expand the market. Consequently, global adoption of restorative implants is forecast to strengthen across all regions in the coming years.

Segmentation Analysis

The dental implants market is segmented into endosteal, subperiosteal, and transosteal implants. Endosteal implants, placed directly into the jawbone, accounted for the largest share in 2022 due to their stability and effectiveness. Subperiosteal implants, positioned on top of the bone, are suited for patients with insufficient bone structure. Transosteal implants, though less common, serve patients with severe bone loss. Each type is selected based on patient condition and bone availability, shaping demand patterns in the overall dental implants market.

Tapered and parallel-walled designs dominate implant preferences. Tapered implants, with slanted walls, deliver high primary stability and stronger osseointegration. This design enhances long-term success rates and drives revenue growth in the segment. Their adoption is particularly strong in complex cases requiring durable solutions. Parallel-walled implants, with a consistent diameter, are used in simpler procedures, offering predictable outcomes and ease of application. While less advanced in stability than tapered variants, their clinical convenience sustains their demand across diverse treatment scenarios.

Titanium remains the leading material in dental implants, holding over 92% of the market in 2022. Its strength, biocompatibility, and non-allergic properties make it the industry standard. Titanium’s proven track record ensures continued dominance in implant procedures. However, zirconium implants are expected to show strong growth due to rising consumer demand for aesthetic alternatives. Their tooth-like color and effective functionality make them attractive to patients seeking natural-looking solutions. This shift highlights zirconium’s potential to gain significant market share during the forecast period.

End-users play a key role in market dynamics. Dental clinics held the largest share in 2022, driven by advanced equipment and specialized expertise. The integration of digital dentistry further strengthens their position. Hospitals, however, are projected to grow at the fastest rate. Increasing trauma cases, aging populations, and expanding multi-specialty facilities are fueling demand for implant procedures in hospitals. This trend indicates shifting preferences in service providers, with both clinics and hospitals contributing strongly to overall dental implant market expansion.

Key Players Analysis

The dental implant market shows a consolidated landscape, with Institute Straumann AG leading due to its wide premium product portfolio. The company has positioned itself strongly by offering high-quality implants at premium prices, making it a trusted choice for professionals and patients worldwide. Its broad portfolio and strong brand reputation further support its leadership. Straumann has also built a significant presence across Europe, North America, Asia Pacific, and South America, reinforcing its dominance and ensuring access to major revenue-generating markets.

Alongside Straumann, companies such as Danaher and Dentsply Sirona play important roles in shaping the market. These firms maintain strong positions with competitive pricing strategies and innovative product offerings. Their ability to serve diverse needs enhances global adoption and market penetration. Collectively, these leading players contribute to industry growth by setting high standards and driving innovation. Their extensive offerings and international presence ensure they remain central to market expansion and the evolving demands of dental professionals and patients.

Dental Implant Market Key Players are

- Institut Straumann AG

- Nobel Biocare Services AG

- Dentsply Sirona

- BioHorizons IPH Inc.

- Henry Schein Inc.

- Zimmer Biomet Holdings Inc.

- Osstem Implant

- Bicon LLC

- Other key players

Conclusion

The global dental implant market is on a steady growth path, driven by rising dental problems, cosmetic dentistry demand, and technological progress. Increasing awareness of oral health and better access to advanced care are shaping patient preferences. The aging population, rising disposable incomes, and medical tourism are also contributing to stronger adoption worldwide. While high treatment costs and limited insurance coverage remain challenges, innovations in materials and digital dentistry continue to improve outcomes and efficiency. With dental clinics and hospitals expanding their services, and leading companies driving innovation, the market is expected to maintain strong momentum and offer significant opportunities in the coming years.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Dental Syringes Market || Dental Compressors Market || Dental Consumables Market || Dental Anesthesia Market || Dental Tourism Market || Dental Orthodontic Wax Market || Dental Laboratories Market || Dental Imaging Market || Dental Practice Management Software Market || Dental 3D Printing Market || Dental Sterilization Market || Dental Impression Systems Market || Dental Fluoride Treatment Market || Dental Cement Market