Global Hydrogen Fuel Cells Market By Type (Low-Temperature Fuel Cell, Medium, and High-Temperature Fuel Cell), By Technology (Polymer Exchange Membrane Fuel Cell (PEMFC), Phosphoric Acid Fuel Cell (PAFC), Solid Oxide Fuel Cells (SOFC), Direct Methanol Fuel Cells (DMFC), Molten Carbonate Fuel Cells (MCFC), Alkaline Fuel Cell (AFC)), By Capacity (Up to 50 KW, 50 to 100 KW, 100 to 150 KW, 150 to 200 KW, Above 200 KW), By Application (Portable, Stationary, Fuel Cell Vehicles), By End-use (Residential, Commercial, Industrial, Marine, Automotive, Military And Defense, Warehouse Logistics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 14878

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

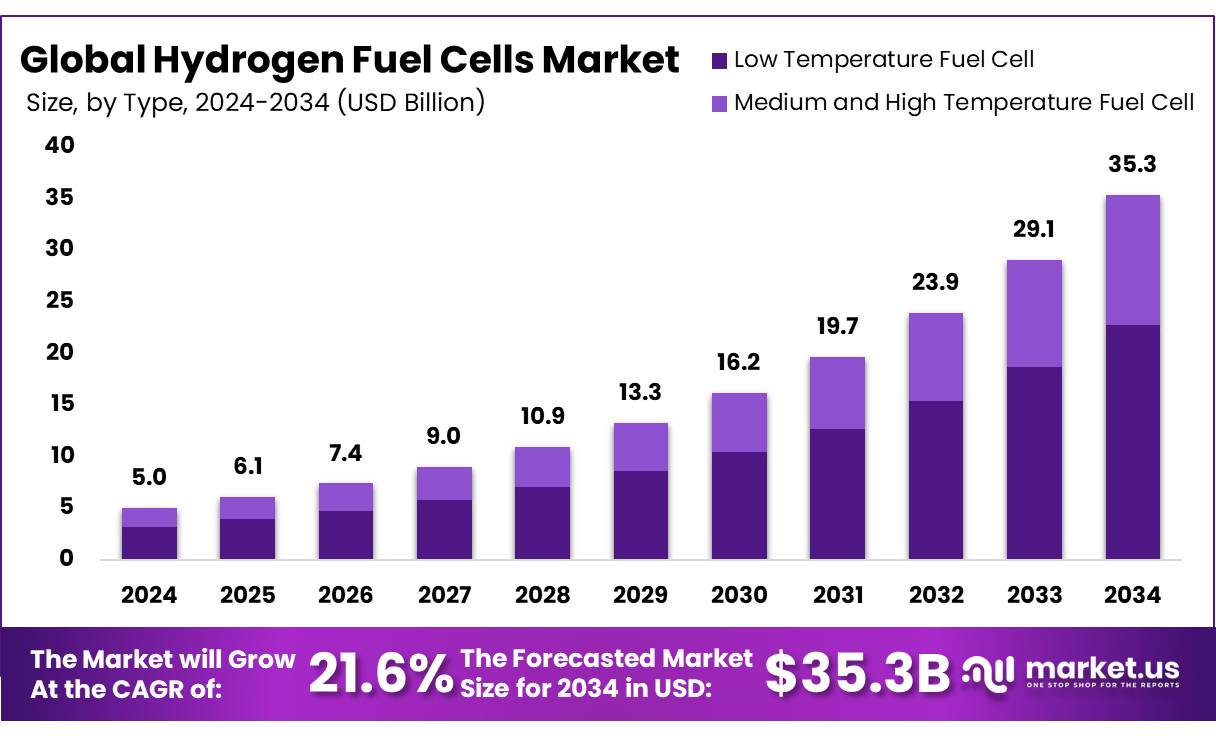

The Global Hydrogen Fuel Cells Market size is expected to be worth around USD 35.3 Billion by 2034, from USD 5.0 Billion in 2024, growing at a CAGR of 21.6% during the forecast period from 2025 to 2034.

Hydrogen fuel cells generate electricity by combining hydrogen and oxygen through an electrochemical reaction, producing only electricity, water, and a small amount of heat. This clean energy technology offers a sustainable alternative to traditional combustion engines and power sources, emitting no carbon dioxide or pollutants.

Hydrogen fuel cells are used across various applications, including powering electric vehicles such as cars, buses, and trucks, as well as providing stationary power for buildings, industrial facilities, and emergency backup systems. They are also utilized in portable devices, benefiting from their quiet operation and high efficiency.

Globally, the hydrogen fuel cell market is rapidly expanding, fueled by increasing environmental regulations, government incentives, and investments in hydrogen infrastructure, especially in regions like North America, Europe, and Asia-Pacific. As technology advances and costs decrease, hydrogen fuel cells are becoming a key component in the shift toward cleaner, more sustainable energy solutions worldwide.

Key Takeaways

- The global hydrogen fuel cells market was valued at USD 5.0 billion in 2024.

- The global hydrogen fuel cells market is projected to grow at a CAGR of 21.6% and is estimated to reach USD 35.3 billion by 2034.

- Among types, low-temperature fuel cells accounted for the largest market share of 67.4%.

- Among technology, Polymer Exchange Membrane Fuel Cell (PEMFC) accounted for the majority of the market share at 33.1%.

- By capacity, Above 200 KW accounted for the largest market share of 33.1%.

- By application, stationary accounted for the majority of the market share at 53.1%.

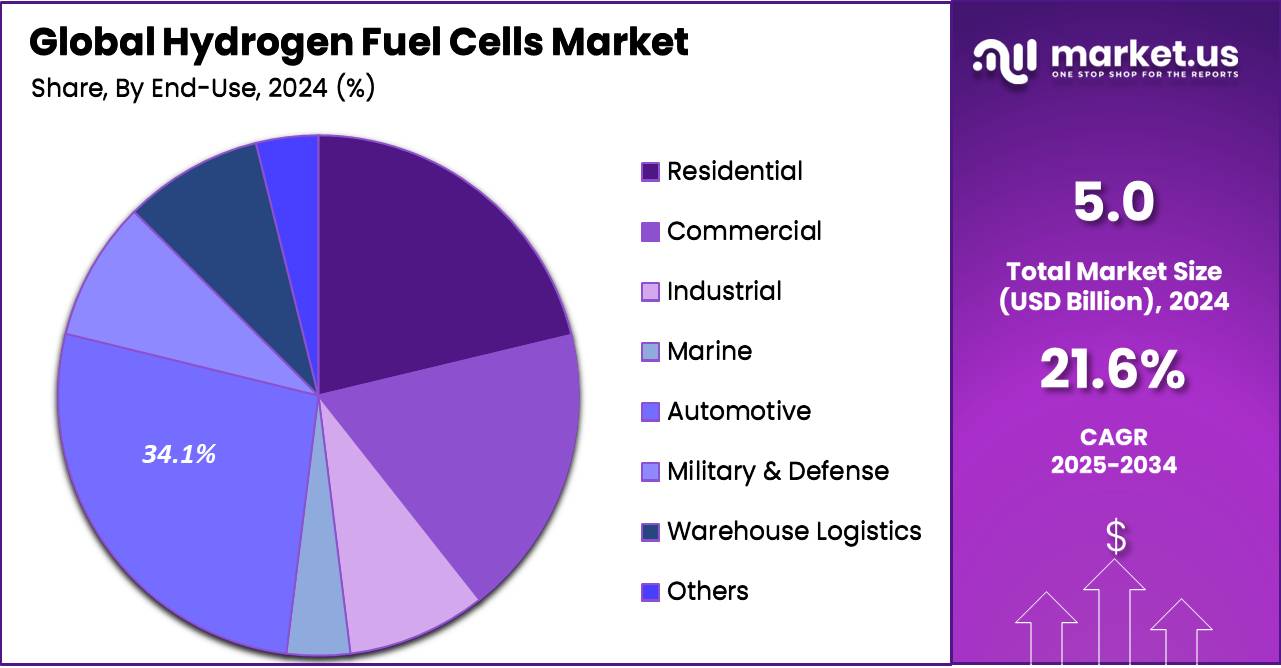

- Among end-use, automotive accounted for the largest market share of 34.1%

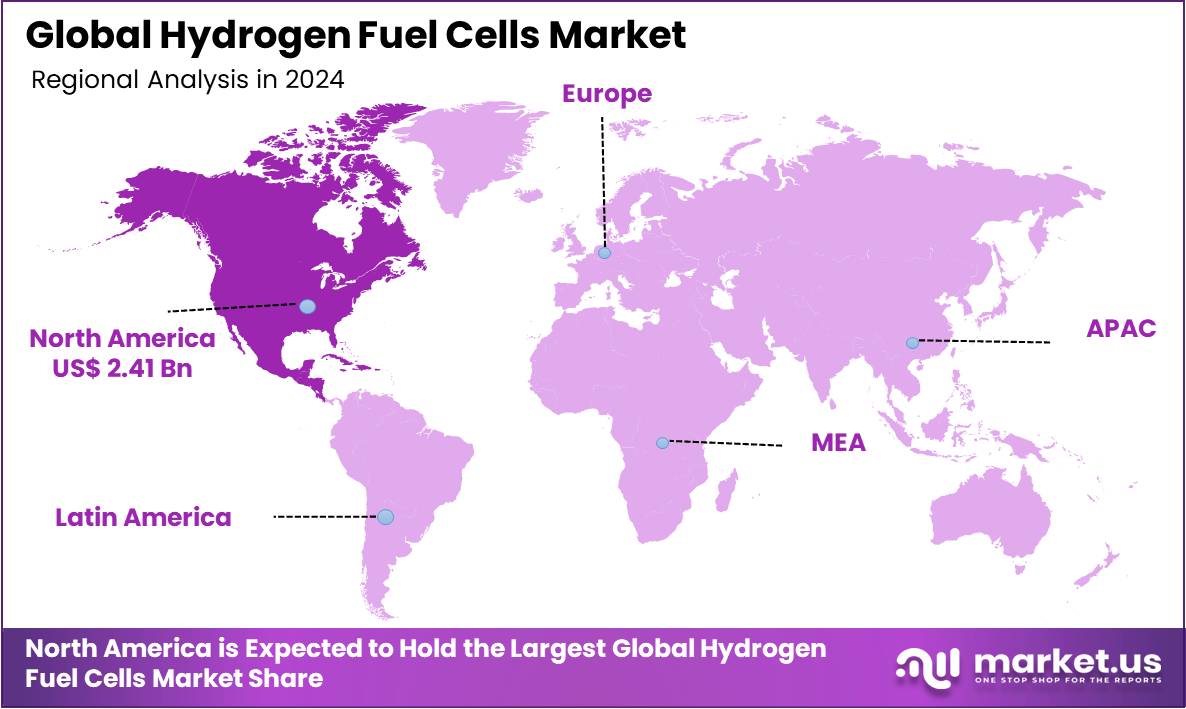

- North America is estimated as the largest market for Hydrogen Fuel Cells with a share of 48.2% of the market share.

Type Analysis

The Low-Temperature Fuel Cell Segment Held A Significant Revenue Share Of 67.4% in 2024.

The Hydrogen Fuel Cells market is segmented based on type into low-temperature fuel cells, and medium and high-temperature fuel cells. In 2024, the low-temperature fuel cell segment held a significant revenue share of 67.4%. Due to its widespread use in transportation and portable power applications. These fuel cells, such as Proton Exchange Membrane Fuel Cells (PEMFC), offer quick start-up times, and high power density, and operate efficiently at relatively low temperatures, making them ideal for electric vehicles and small-scale power generation. Additionally, their compact design and ability to deliver clean energy with zero emissions have driven strong demand in both consumer and industrial markets.

Technology Analysis

The Polymer Exchange Membrane Fuel Cell Commands a Substantial 33.1% Market Share.

Based on technology, the market is further divided into Polymer Exchange Membrane Fuel Cells (PEMFC), Phosphoric Acid Fuel Cells (PAFC), Solid Oxide Fuel Cells (SOFC), Direct Methanol Fuel Cells (DMFC), Molten Carbonate Fuel Cells (MCFC), and Alkaline Fuel Cell (AFC). The predominance of the Polymer Exchange Membrane Fuel Cell (PEMFC), commanding a substantial 33.1% market share in 2024. Due to its high efficiency, low operating temperature, and quick start-up capabilities. PEMFCs are particularly favored in the transportation sector, especially for fuel cell electric vehicles, because they provide reliable power output and compact design. Their ability to operate efficiently under varying loads and produce zero emissions makes them a preferred choice for both automotive and portable power applications, driving strong demand globally.

Capacity Analysis

The Above 200 KW Held A Dominant Position With A 33.1% Share In 2024.

Among capacity, the hydrogen fuel cell market is classified into Up to 50 KW,50 to 100 KW,100 to 150 KW,150 to 200 KW, and Above 200 KW. In 2024, Above 200 KW held a dominant position with a 33.1% share. Due to its suitability for large-scale applications such as power plants, industrial facilities, and commercial buildings. These high-capacity fuel cells are favored for their ability to provide stable and efficient power over extended periods, supporting the growing demand for clean, reliable energy in sectors requiring substantial electricity loads. Additionally, increasing investments in hydrogen infrastructure and government initiatives to promote large-scale clean energy solutions have further boosted the adoption of high-capacity hydrogen fuel cells.

Application Channel Analysis

The Stationary Segment Emerging As The application, Holding 53.1% Of The Total Market Share

By application, the market is categorized into portable, stationary, and fuel-cell vehicles. With the Stationary segment emerging as the application, holding 53.1% of the total market share in 2024. This strong position is due to the increasing demand for reliable, clean power in commercial buildings, industrial facilities, and backup power systems. Stationary fuel cells offer advantages such as high efficiency, scalability, and uninterrupted power supply, making them ideal for critical infrastructure and off-grid applications. Additionally, growing investments in renewable energy integration and government incentives for reducing carbon emissions have accelerated the adoption of stationary fuel cells worldwide.

End-Use Analysis

The Automotive Lead The Market, Accounting For A Dominant 34.1% Share In 2024.

In terms of users, the hydrogen fuel cells market comprises residential, commercial, industrial, marine, automotive, military & defense, warehouse logistics, and others. In 2024, automotive led the market, accounting for a dominant 34.1% share. This growth is driven by the rising adoption of fuel cell electric vehicles (FCEVs) as a clean alternative to traditional combustion engines, supported by increasing government regulations on emissions and incentives for green transportation. Additionally, advances in hydrogen fueling infrastructure and improvements in fuel cell technology have made hydrogen-powered vehicles more practical and appealing to consumers, fueling strong market demand in this sector.

Key Market Segments

By Type

- Low-Temperature Fuel Cell

- Medium and High Temperature Fuel Cell

By Technology

- Polymer Exchange Membrane Fuel Cell (PEMFC)

- Phosphoric Acid Fuel Cell (PAFC)

- Solid Oxide Fuel Cells (SOFC)

- Direct Methanol Fuel Cells (DMFC)

- Molten Carbonate Fuel Cells (MCFC)

- Alkaline Fuel Cell (AFC)

By Capacity

- Up to 50 KW

- 50 to 100 KW

- 100 to 150 KW

- 150 to 200 KW

- Above 200 KW

By Application

- Portable

- Stationary

- Primary

- Back-up

- Combined Heat & Power (CHP)

- Fuel Cell Vehicles

- Light Duty Vehicles

- Medium Duty Vehicles

- Heavy-Duty Vehicles

By End-Use

- Residential

- Commercial

- Industrial

- Marine

- Automotive

- Military & Defense

- Warehouse Logistics

- Others

Drivers

Increasing Demand For Clean And Sustainable Energy Solutions

The rising demand for clean and sustainable energy solutions is a key driver behind the rapid growth of the global hydrogen fuel cell market. With growing global concerns over climate change, air pollution, and fossil fuel dependency, hydrogen fuel cells are emerging as a vital component in the transition to low-carbon energy systems. These fuel cells offer zero-emission power generation, by emitting only water vapor as a byproduct, making them highly attractive for governments and industries focused on reducing greenhouse gas emissions and improving air quality. As governments across various nations implement stricter environmental policies and clean energy targets, hydrogen technologies are receiving increased attention and investment.

- The International Renewable Energy Agency (IRENA) estimates that by 2050, clean hydrogen could meet 12% of energy consumption, 1 and could abate seven gigatons of CO2 emissions annually.

- The International Renewable Energy Agency (IRENA) estimates hydrogen could supply up to 12% of final energy demand by 2050 and contribute 10% of the emissions mitigation required for the 1.5°C climate scenario, with transport being a key sector for this growth.

Hydrogen fuel cells also align with market needs for high efficiency and energy reliability. Their ability to convert hydrogen into electricity more efficiently than traditional combustion engines makes them ideal for diverse applications from transportation and residential power to industrial backup systems. The automotive sector, in particular, is leveraging hydrogen fuel cell technology for long-range, quick-refueling vehicles, complementing battery-electric solutions.

Hydrogen energy and fuel cell systems are being developed and deployed in a range of stationary power, portable power, and transportation applications around the world Using hydrogen and fuel cell technologies to provide an environmental and economic pathway to clean, reliable power was a key feature of world economic recovery and energy infrastructure plans.

- In the U.S., the Government in June 2021 launched the Hydrogen Energy Earthshot initiative, aiming to reduce the cost of clean hydrogen to $1 per kilogram in one decade.

Furthermore, governments around the world are recognizing the critical role of clean energy in achieving climate goals, and are increasingly supporting the adoption of hydrogen fuel cells. The scalability and versatility of hydrogen fuel cells make them ideal for integration into both centralized grids and off-grid energy systems, enhancing their appeal across various sectors. To accelerate this transition, governments are offering incentives to manufacturers, fostering public-private partnerships, and investing in technological innovation. These efforts are creating a favorable environment for the hydrogen fuel cell market, positioning it for substantial growth as clean energy becomes a global priority.

- The U.S. Department of Energy’s Office of Fossil Energy and Carbon Management (FECM) awarded $34 million to 12 projects under its Small-Scale Solid Oxide Fuel Cell Systems and Hybrid Electrolyzer Technology Development FOA. These projects focus on advancing solid oxide fuel cells (SOFCs), solid oxide electrolyzer cells (SOECs), and modular fuel cell systems, including applications at data centers.

- The Australian Minister for Energy and Emissions Reductions created the Advancing Hydrogen Fund, offering A$300 million (~US$207 million) to finance hydrogen projects in Australia.

Restraints

High Initial Investment Cost

The high initial installation cost of hydrogen fuel cells is a significant barrier to their widespread adoption. This is primarily due to the expensive materials used in fuel cell stacks, such as platinum-based catalysts, which are critical for efficient operation but add substantial cost. Additionally, hydrogen fuel cell systems require advanced components such as compressors, humidifiers, and power electronics, all of which increase the overall system complexity and price.

Another major factor is the underdeveloped hydrogen infrastructure establishing refueling stations and safe, high-pressure hydrogen storage systems demands considerable upfront investment. Moreover, hydrogen fuel cells are not yet manufactured at the same scale as traditional engines or battery systems, which limits cost reductions through economies of scale. Together, these challenges make the total cost of ownership relatively high, especially in comparison to battery-electric and internal combustion technologies, slowing the commercial rollout of hydrogen-powered solutions.

Opportunity

Rise Hydrogen Fuel-Cell Vehicle.

The rise of hydrogen fuel-cell vehicles (HFCVs) is creating significant growth opportunities for the global hydrogen fuel-cell market. These vehicles, which use hydrogen to generate electricity through a fuel cell rather than relying on large batteries, offer a compelling solution for zero-emission transportation. HFCVs combine the advantages of electric propulsion—such as high efficiency and quiet operation with long driving ranges and quick refueling times, making them especially attractive for sectors like commercial transportation, logistics, and public transit.

- According to a NITI Aayog report, India could cumulatively reduce 3.6 gigatonnes of CO₂ emissions by 2050 by embracing green hydrogen.

Governments and automakers worldwide are investing heavily in hydrogen infrastructure and R&D, with many major vehicle manufacturers launching or piloting hydrogen-powered models. The versatility of hydrogen fuel cells allows their integration across a broad range of vehicle platforms, including passenger cars, heavy-duty trucks, buses, trains, and even maritime and aviation applications. As global efforts to reduce air pollution and carbon emissions intensify, hydrogen fuel-cell technology is emerging as a critical enabler of cleaner urban mobility and sustainable transport systems.

- The IEA highlights that to meet climate goals, hydrogen must expand into new sectors, including heavy industry and long-distance transport, such as fuel-cell vehicles.

Furthermore, the deployment of hydrogen-powered material handling equipment (MHE) and logistics vehicles at ports, airports, and warehouses is gaining momentum, reflecting broader industrial adoption. With governments offering incentives and funding to accelerate fuel cell vehicle adoption, manufacturers are better positioned to overcome production cost barriers and infrastructure challenges. The rising demand for low-emission alternatives, coupled with hydrogen’s high energy density and long-range capabilities, is pushing the market forward. Supported by continuous technological advancements and favorable policy measures, hydrogen fuel-cell vehicles are expected to play a critical role in the clean energy transition, unlocking sustained growth opportunities for the global hydrogen fuel cell market.

- The European Union has set ambitious targets for hydrogen, aiming for 40 GW of renewable hydrogen electrolyzer capacity by 2030 and supporting the deployment of hydrogen-powered buses, trucks, and trains as part of its Green Deal and Fit for 55 packages.

- For instance, EERE’s Hydrogen and Fuel Cell Technologies Office announced approximately US$64 million of funding for 18 H2@Scale projects, including manufacturing technologies for electrolyzers, development of carbon fiber for hydrogen storage tanks on board trucks, components, and fuel cell systems for medium- and heavy-duty trucks, hydrogen use in steelmaking, training and workforce development in the hydrogen and fuel cell industry, and large-scale demonstrations of hydrogen and fuel cells in port and data center applications.

Trends

Portable Hydrogen Fuel Cells

The growing demand for longer-lasting, efficient, and rapidly rechargeable power sources in portable electronic devices (PEDs) is emerging as a trend in the future growth of the global hydrogen fuel cells market, particularly through the development of portable hydrogen fuel cells. As conventional batteries struggle to meet the high power demands and extended operating times required by modern and next-generation PEDs, especially in critical sectors such as military, emergency services, and remote operations hydrogen fuel cells are gaining traction as a viable alternative.

Portable hydrogen fuel cells offer several advantages over traditional battery systems, including instant recharging via fuel cartridge replacement, greater energy density (3000–9000 Wh/kg), longer operational lifetimes, and independence from grid electricity. These features make them especially attractive for users requiring mobility, reliability, and autonomy.

Furthermore, the rise of microelectromechanical systems (MEMS) technology has enabled the miniaturization of complex fuel cell architectures, making it increasingly feasible to integrate hydrogen fuel cells into compact and lightweight devices. This trend is expected to significantly impact the global hydrogen fuel cell market by expanding its applications beyond automotive and stationary power into the consumer electronics and defense sectors. As innovation continues to reduce costs and improve performance, portable hydrogen fuel cells are poised to play a central role in accelerating market growth and diversifying the fuel cell industry’s reach.

Geopolitical Impact Analysis

The global hydrogen fuel cell market is increasingly shaped by geopolitical factors, as countries shift towards securing independent energy and leading in clean technology. With growing concerns over climate change and energy security, major economies like the EU, the U.S., China, and Japan are investing heavily in hydrogen as a strategic alternative to fossil fuels. This shift is influenced by shifting alliances, trade policies, and resource control, especially the access to rare earth metals and clean hydrogen production technologies.

Additionally, global instability such as the Russia-Ukraine war has accelerated Europe’s push toward hydrogen energy to reduce its dependence on Russian gas. At the same time, China’s dominance in green hydrogen infrastructure and electrolyzer production gives it significant strategic leverage in the global energy landscape.

Recently, new tariffs imposed by former President Trump on Chinese goods, including energy-related materials, have created setbacks for both U.S. and Chinese manufacturers. In response, China introduced retaliatory tariffs on energy imports from the U.S., further escalating trade tensions. These geopolitical developments are not only shaping national policies and international partnerships but are also influencing market investments, disrupting supply chains, and affecting the transfer of hydrogen-related technologies. As a result, they play a critical role in determining the pace and direction of hydrogen fuel cell adoption around the world.

Regional Analysis

North America Held the Largest Share of the Global Hydrogen Fuel Cells Market

In 2024, North America dominated the global Hydrogen Fuel Cells market, accounting for 48.2% of the total market share, Driven by increasing demand for clean and sustainable energy solutions, and supportive Government policies, incentives, and a commitment to achieving net-zero emissions goals have further accelerated the adoption of clean energy technologies. Especially countries such as the U.S. and Canada have implemented various federal and state-level programs to encourage the transition towards hydrogen fuel cell vehicles.

- According to the U.S. Department of Energy, there are currently around 17,000 hydrogen-powered vehicles on U.S. roads, all located in California, while electric vehicles (EVs) are in the millions—highlighting hydrogen’s early adoption stage but also its strong growth potential as infrastructure and policy support continue to expand.

Another important factor significantly contributing the North America’s hydrogen fuel cells market growth is the increased demand for hydrogen as a clean fuel source for industries like transportation, heavy manufacturing, and agriculture. As sectors such as shipping, aviation, and freight seek alternatives to fossil fuels, hydrogen fuel cell technology offers a viable way to produce electricity from hydrogen. Additionally, the North American hub of the various global energy industries, along with a region’s robust infrastructure for renewable energy generation and storage, supports the boosting of hydrogen fuel cells. The U.S. has also committed to creating a national hydrogen strategy, with a focus on scaling up hydrogen production and storage capacity. Moreover, Canada’s hydrogen and clean energy initiatives, including investments in carbon capture and storage (CCS), further enhance the growth potential for the hydrogen fuel cell market.

Furthermore, as the demand for green hydrogen and hydrogen fuels continues to rise globally, North America’s technological leadership, policy support, and abundant renewable energy resources position it to maintain its leadership role in the hydrogen fuel cells market. The region is expected to play a critical role in the global transition to a sustainable energy future by helping to decarbonize industrial sectors while continuing to innovate and scale up hydrogen fuel cell technologies to meet growing global demand.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In The Hydrogen Fuel Cells Market Maintain Their Dominate Position By Technological Advancements And Adoption Of Zero-Emission Transit Solutions.

Ballard Power Systems Global leader in PEM fuel cell technology, focusing on heavy-duty vehicles (trucks, buses, trains, marine) and backup power. Supplies fuel cell modules for ferries, buses, and mining vehicles, with large-scale commercial deployments focusing on PEM fuel cell products for heavy-duty vehicles (trucks, buses, trains, marine) and backup power.

Cummins focusing specializes in zero-emission solutions, including hydrogen fuel cells, engines, and PEM electrolyzers. Provides next-gen hydrogen engines and large-scale electrolyzer systems for commercial vehicles and green hydrogen projects. Recently company Launched next-gen hydrogen fuel cell technology for commercial vehicles and supplied a 100 MW PEM electrolyzer for BP’s Lingen green hydrogen project in Germany. INOCEL French company specializing in high-power hydrogen fuel cell systems for energy-intensive sectors (heavy industry, maritime, aviation). Mastery of the entire fuel cell value chain, with advanced R&D, gigafactory production, and focus on decarbonization and strategic partnerships.

The Major Players in The Industry

- FuelCell Energy, Inc.

- Ballard Power Systems.

- Cummins Inc.

- SFC Energy AG

- Bloom Energy

- Doosan Group

- Ceres Power Holdings plc

- Plug Power Inc.

- Toshiba Corporation

- AFC Energy

- Panasonic Holdings Corporation

- PowerCell Sweden AB

- Intelligent Energy Limited

- Pearl hydrogen

- Hyster-Yale Group, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Inocel

- Other Key Players

Recent Development

- In March 2023 – FuelCell Energy’s recent announcement of its solid oxide electrolyzer and fuel cell platform marks a significant advancement in clean energy technology. This modular and scalable system is designed to produce hydrogen with up to 100% electrical efficiency, leveraging excess heat from industrial or nuclear sources to lower costs.

- In November 2024 – Ballard Power Systems secured a major order from New Flyer for 200 hydrogen fuel cell engines, doubling a previous 2024 order and signaling the growing adoption of zero-emission transit solutions. The engines will power next-generation hydrogen buses across key U.S. states starting in 2025. This development strengthens Ballard’s market position amid its ongoing global restructuring efforts.

- In January 2025- Cummins Inc. launched the industry’s first turbocharger designed specifically for hydrogen internal combustion engines (H2 ICE) in heavy-duty on-highway vehicles, marking a major step in zero-emission transportation. The H2 ICE turbocharger, compliant with Euro VII standards, supports Cummins’ decarbonization strategy and has secured a supply contract with a major European OEM.

Report Scope

Report Features Description Market Value (2024) US$ 5.0 Bn Forecast Revenue (2034) US$ 35.3 Bn CAGR (2025-2034) 21.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Low-Temperature Fuel Cell, Medium, and High-Temperature Fuel Cell), By Technology (Polymer Exchange Membrane Fuel Cell (PEMFC), Phosphoric Acid Fuel Cell (PAFC), Solid Oxide Fuel Cells (SOFC), Direct Methanol Fuel Cells (DMFC), Molten Carbonate Fuel Cells (MCFC), Alkaline Fuel Cell (AFC)), By Capacity (Up to 50 KW, 50 to 100 KW, 100 to 150 KW, 150 to 200 KW, Above 200 KW), By Application (Portable, Stationary (Primary, Back-up, Combined Heat & Power (CHP)), Fuel Cell Vehicles (Light Duty Vehicles, Medium Duty Vehicles, Heavy Duty Vehicles), By End-use (Residential, Commercial, Industrial, Marine, Automotive, Military & Defense, Warehouse Logistics, Others), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape FuelCell Energy, Inc., Ballard Power Systems., Cummins Inc., SFC Energy AG, Bloom Energy, Doosan Group, Ceres Power Holdings plc, Plug Power Inc., Toshiba Corporation, AFC Energy, Panasonic Holdings Corporation, Power Cell Sweden AB, Intelligent Energy Limited, Pearl hydrogen, Hyster-Yale Group, Inc., Mitsubishi Heavy Industries, Ltd., Inocel, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrogen Fuel Cells MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Hydrogen Fuel Cells MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FuelCell Energy, Inc.

- Ballard Power Systems.

- Cummins Inc.

- SFC Energy AG

- Bloom Energy

- Doosan Group

- Ceres Power Holdings plc

- Plug Power Inc.

- Toshiba Corporation

- AFC Energy

- Panasonic Holdings Corporation

- PowerCell Sweden AB

- Intelligent Energy Limited

- Pearl hydrogen

- Hyster-Yale Group, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Inocel

- Other Key Players