Global Food-Grade Phosphate Market Size, Share and Future Trends Analysis Report By Source (Sodium Phosphate, Ammonium Phosphate, Calcium Phosphate, Potassium Phosphate, Others), By Product, Bakery Products, Dairy, Beverages and Meat, Seafood Processing, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148656

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

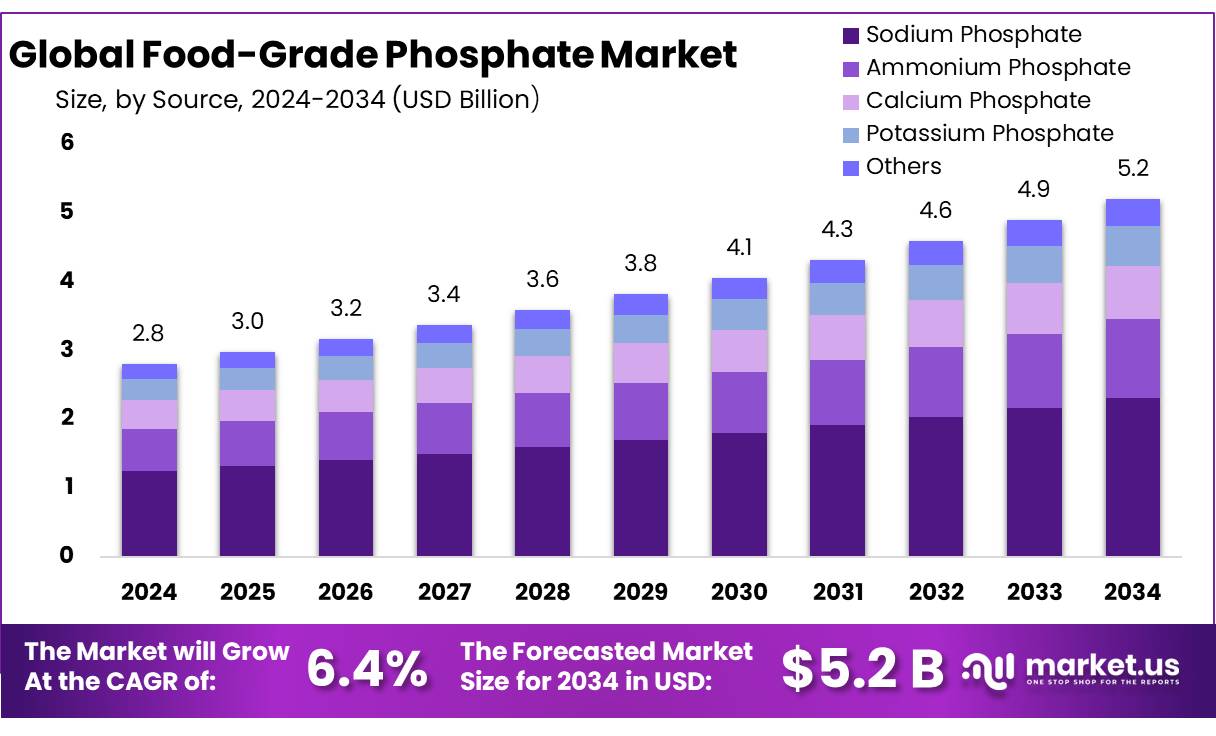

The Global Food-Grade Phosphate Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 2.8 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Food-grade phosphate concentrates play a critical role in the food processing industry, serving primarily as emulsifiers, stabilizers, and leavening agents across a wide range of food products. These phosphates ensure improved texture, moisture retention, and extended shelf life, which are essential qualities for modern food production. Their applications span bakery products, processed meats, dairy, beverages, and convenience foods, making them indispensable ingredients in meeting consumer demand for quality and safety.

The food-grade phosphate concentrates is shaped by rising urbanization, increasing disposable incomes, and a growing preference for processed and convenience foods worldwide. According to the Food and Agriculture Organization (FAO), global processed food consumption is expected to grow at a steady pace, driven by changing consumer lifestyles and urban populations reaching 56.2% of the world’s total population in 2024. This trend directly supports the demand for additives like phosphate concentrates, which enhance product consistency and shelf stability.

Moreover, regulatory bodies such as the U.S. Food and Drug Administration (FDA) have established stringent guidelines for food additives, ensuring safety and quality in food-grade phosphate use. The FDA’s Code of Federal Regulations (CFR) Title 21 specifies permissible levels for phosphate additives, reinforcing industry adherence to quality standards.

Driving factors for the food-grade phosphate concentrates market include the escalating demand for processed foods, particularly in emerging economies where food processing industries are rapidly expanding. For instance, the International Energy Agency (IEA) highlights that urban populations in Asia and Africa are expected to rise by more than 15% from 2023 to 2030, fostering increased consumption of packaged and processed food products.

Government initiatives aimed at improving food safety and nutrition also create growth opportunities for phosphate concentrates. The U.S. Department of Agriculture (USDA) has allocated funding toward advancing food additive research and safety evaluations, with an investment exceeding US$120 million in 2023 alone to support innovation in food ingredient technologies.

Key Takeaways

- Food-Grade Phosphate Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 2.8 Billion in 2024, growing at a CAGR of 6.4%

- Sodium Phosphate held a dominant market position, capturing more than a 44.3% share.

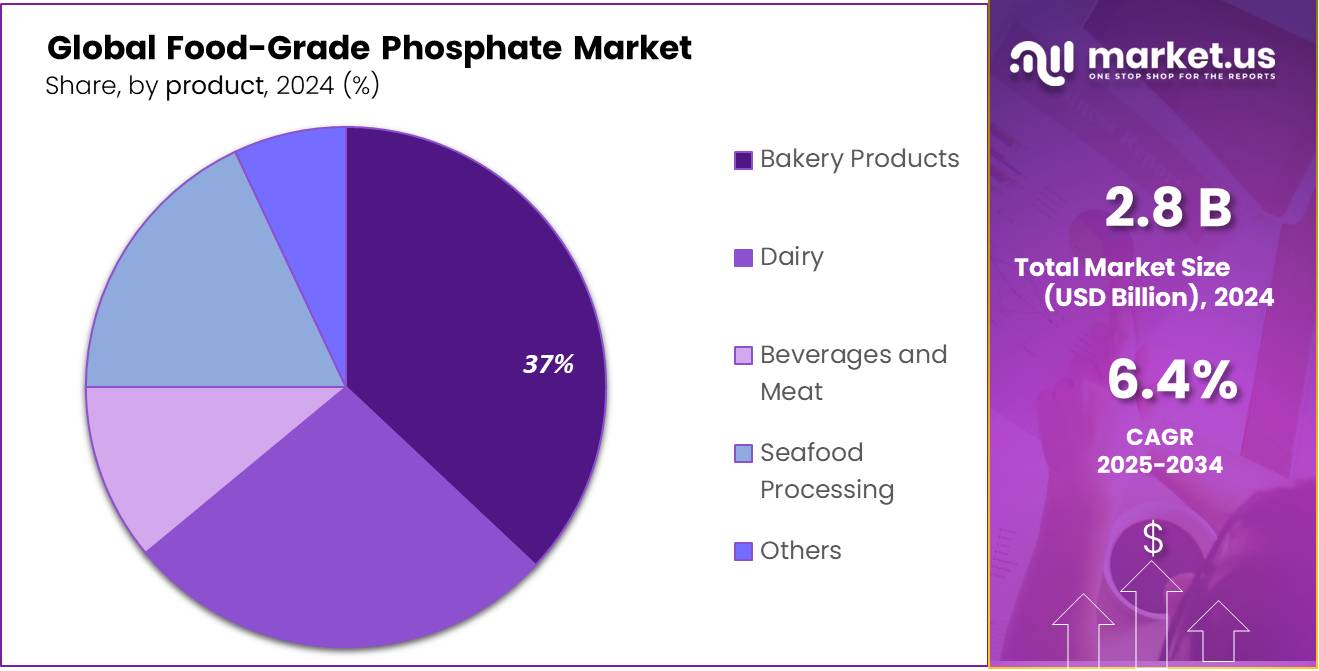

- Bakery Products held a dominant market position, capturing more than a 37.9% share.

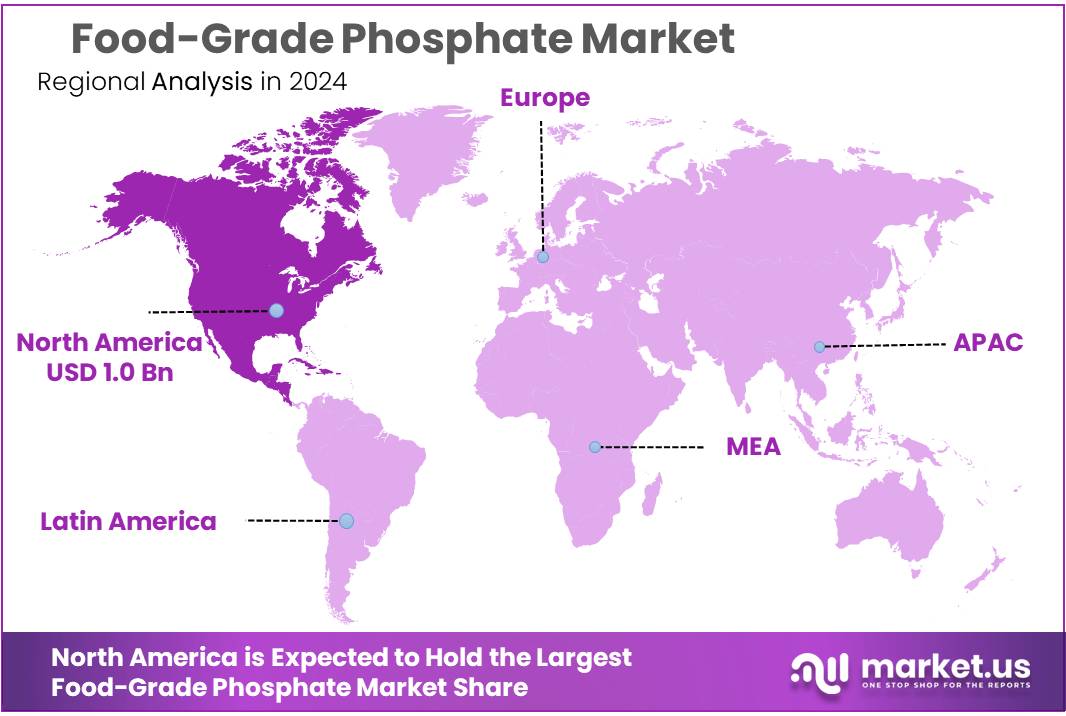

- North America emerged as the dominant region in the global food-grade phosphate market, capturing approximately 38.5% of the market share, valued at around USD 1 billion.

By Source

Sodium Phosphate Leads Food-Grade Phosphate Market with Over 44.3% Share in 2024

In 2024, Sodium Phosphate held a dominant market position, capturing more than a 44.3% share in the food-grade phosphate segment. This strong presence is largely due to its versatility in various food applications, including as a preservative, emulsifier, and texturizer. Sodium Phosphate’s ability to improve food texture and shelf life has made it a preferred choice among manufacturers.

Additionally, the compound’s cost-effectiveness and ease of availability contribute to its continued dominance. Industry players have steadily increased production capacity to meet rising demand in processed foods, dairy products, and meat processing. As of 2025, Sodium Phosphate remains a key ingredient in food formulations, supported by growing consumer preference for convenience foods and regulatory acceptance across major markets. This steady trend highlights the ingredient’s crucial role in maintaining food quality and safety.

By Product

Bakery Products Lead Food-Grade Phosphate Market with Over 37.9% Share in 2024

In 2024, Bakery Products held a dominant market position, capturing more than a 37.9% share in the food-grade phosphate product segment. The widespread use of food-grade phosphate in bakery items is driven by its ability to improve dough stability, enhance texture, and extend shelf life. Manufacturers increasingly rely on these additives to maintain product freshness and improve baking performance. The growing demand for packaged and ready-to-eat baked goods has further fueled this trend.

By 2025, bakery products continue to be the largest application area for food-grade phosphates, supported by changing consumer lifestyles and a preference for convenient, high-quality baked foods. This steady growth underscores the importance of phosphates in ensuring consistent product quality in the bakery industry.

Key Market Segments

By Source

- Sodium Phosphate

- Ammonium Phosphate

- Calcium Phosphate

- Potassium Phosphate

- Others

By Product

- Bakery Products

- Dairy

- Beverages and Meat

- Seafood Processing

- Others

Drivers

Rising Demand for Processed Foods Fuels Growth of Food-Grade Phosphate Market

One of the most significant driving factors for the food-grade phosphate market is the growing global demand for processed and convenience foods. As lifestyles become busier, consumers increasingly prefer ready-to-eat and packaged food options that save time without compromising on taste or quality. Food-grade phosphates play a vital role in this sector by improving the texture, moisture retention, and shelf life of processed products, making them indispensable ingredients for manufacturers.

According to the Food and Agriculture Organization (FAO), global consumption of processed foods has steadily increased, with urban populations reaching 56.2% in 2024, up from 55% in 2020. This shift toward urban living correlates with greater reliance on packaged and processed food due to convenience and accessibility. Emerging economies in Asia, Africa, and Latin America are particularly experiencing rapid growth in processed food demand as their middle classes expand and disposable incomes rise. The United Nations Department of Economic and Social Affairs projects that by 2030, more than 60% of the global population will reside in urban areas, further supporting the expansion of processed food consumption.

Governments worldwide have recognized the importance of food safety and quality in this trend. For example, the U.S. Food and Drug Administration (FDA) maintains strict regulations on the use of food-grade phosphates, ensuring that these additives meet safety standards while supporting industry innovation. Additionally, programs by the U.S. Department of Agriculture (USDA) have invested over US$120 million in 2023 to improve food ingredient technologies, including safer and more effective food additives.

Restraints

Health Concerns Over Phosphate Intake Limit Growth in Food-Grade Phosphate Market

A major restraining factor for the food-grade phosphate market is the growing health concerns related to excessive phosphate intake. While phosphates are important additives in many food products, there is increasing awareness about the potential negative effects of high phosphate consumption on human health, particularly kidney function and cardiovascular risk. This has led to cautious consumer behavior and tighter regulatory scrutiny, which can slow down market growth.

The World Health Organization (WHO) recommends limiting phosphate additives in processed foods to ensure safe consumption levels. Studies indicate that excessive phosphate intake is linked to elevated risks of chronic kidney disease and heart problems, especially among vulnerable groups such as the elderly and individuals with pre-existing health conditions. According to the National Kidney Foundation, an estimated 37 million adults in the United States suffer from chronic kidney disease, making phosphate intake regulation a public health priority.

This growing health awareness has prompted regulatory agencies worldwide to tighten limits on phosphate additives. For instance, the European Food Safety Authority (EFSA) has updated its guidance on acceptable daily intake (ADI) levels for phosphate additives, encouraging food manufacturers to reduce phosphate usage wherever possible. Similarly, the U.S. Food and Drug Administration (FDA) continues to monitor phosphate additive use to ensure compliance with safety standards and protect consumers.

Governments and health organizations are also investing in public education campaigns about dietary phosphorus. The U.S. Department of Health and Human Services has included phosphate intake guidelines as part of its broader nutrition awareness programs, aiming to help consumers make informed food choices.

Opportunity

Government Support for Plant-Based Food Innovations

A significant growth opportunity for the food-grade phosphate market lies in the increasing government support for plant-based food innovations. As consumer preferences shift towards plant-based diets, governments worldwide are recognizing the importance of supporting this transition through research funding, policy initiatives, and infrastructure development.

For instance, the Danish government has developed an action plan to promote plant-based foods, aiming to increase the share of plant-based products in the food sector. The University of Copenhagen projects that the protein-rich plant-based food sector in Denmark can expect growth of between 4% and 11% annually . Such initiatives not only support the growth of plant-based food markets but also create opportunities for ingredients like food-grade phosphates, which are essential in the formulation of plant-based products.

Similarly, the European Union has been investing in research and development to enhance the quality and sustainability of plant-based foods. These investments are aimed at improving the texture, taste, and nutritional profile of plant-based products, areas where food-grade phosphates play a crucial role.

Trends

Sustainable Sourcing and Clean Label Trends in Food-Grade Phosphates

A significant trend shaping the food-grade phosphate market is the growing emphasis on sustainable sourcing and clean label formulations. As consumers become more health-conscious and environmentally aware, there is an increasing demand for food products that are transparent in their ingredient lists and ethically produced. This shift is prompting food manufacturers to seek out phosphate additives that align with these values, leading to innovations in both product offerings and sourcing practices.

According to the Food and Agriculture Organization (FAO), sustainable food production practices are essential to meet the nutritional needs of a growing global population while minimizing environmental impact. The FAO emphasizes the importance of reducing food waste and promoting the use of natural and responsibly sourced ingredients in food processing. This aligns with the increasing consumer preference for clean label products, which are perceived as healthier and more trustworthy.

In response to these consumer demands, food-grade phosphate producers are exploring alternative sourcing methods and developing phosphate additives that are free from synthetic chemicals and allergens. For instance, some companies are investing in the development of plant-based phosphates derived from natural sources, which not only cater to the clean label trend but also appeal to the growing vegan and vegetarian consumer base. These innovations are supported by government initiatives aimed at promoting sustainable agricultural practices and reducing the carbon footprint of food production.

Regional Analysis

North America Leads Food-Grade Phosphate Market with 38.5% Share in 2024

In 2024, North America emerged as the dominant region in the global food-grade phosphate market, capturing approximately 38.5% of the market share, valued at around USD 1 billion. This leadership position is attributed to the region’s robust food processing industry, high consumer demand for convenience foods, and stringent food safety regulations.

The United States, in particular, plays a pivotal role in this dominance, with major companies like Innophos and Nutrien Ltd. leading the production of specialty phosphates. Innophos operates nine manufacturing locations across North America, including facilities in New Jersey and Mexico, focusing on sustainable and high-quality phosphate products for the food and beverage sector. Nutrien Ltd., headquartered in Saskatoon, Saskatchewan, is a global leader in fertilizer production, with extensive operations in the United States, contributing significantly to the region’s phosphate supply.

The demand for food-grade phosphates in North America is driven by the increasing consumption of processed and convenience foods, which require additives to enhance texture, stability, and shelf life. Government initiatives and regulations, such as those from the U.S. Food and Drug Administration (FDA), ensure the safe use of phosphates in food products, further supporting market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aditya Birla Chemicals is a major player in the food-grade phosphate market, known for its robust manufacturing capabilities and commitment to quality. The company produces a wide range of phosphate products used in food processing, agriculture, and industrial applications. With a strong presence in Asia and expanding global reach, Aditya Birla focuses on sustainable production and innovation to meet evolving customer needs. Their emphasis on research and development helps maintain product consistency and compliance with international food safety standards.

TKI Hrashtnik is recognized for its phosphate mining and processing expertise, supplying high-quality phosphates used in various industries including food-grade applications. The company benefits from its strategically located mining operations and vertically integrated production processes. TKI Hrashtnik prioritizes environmental responsibility and product purity, which makes it a preferred supplier in food phosphate markets. Its long-standing experience and operational efficiency contribute to steady growth in regional and international markets.

Uniwar is a prominent chemical manufacturer specializing in phosphate compounds for food and industrial uses. The company offers customized phosphate formulations tailored to meet diverse client requirements, enhancing food texture, stability, and preservation. Uniwar’s production facilities adhere to stringent quality controls and international certifications, ensuring safe and reliable products. Its flexible supply chain and focus on customer service have helped Uniwar build strong partnerships in the global food processing industry.

Top Key Players in the Market

- Aditya Birla Chemicals

- TKI Hrashtnik

- Uniwar

- Haifa Group

- ATP Group

- ICL Innovation

- OCP S.A.

- Nutriscience Innovations

- Brewcraft

- Budeheim

- Prayon S.A.

- PhosAgro Group

- Ettlinger Corporation

- Nutrein Ltd.

- Innophos.

- FOSFA

Recent Developments

In 2024, ABCTL’s production capacity reached 110,000 tonnes per annum (TPA), with approximately 70% of its products exported worldwide, establishing it as the largest single-location producer in the Asia-Pacific region.

In 2024, Haifa Group announced a significant investment of approximately USD 350 million in infrastructure and facilities for the production of specialty fertilizers, including an ammonia production facility in Mishor Rotem, Israel.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Bn Forecast Revenue (2034) USD 5.2 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Sodium Phosphate, Ammonium Phosphate, Calcium Phosphate, Potassium Phosphate, Others), By Product, Bakery Products, Dairy, Beverages and Meat, Seafood Processing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aditya Birla Chemicals, TKI Hrashtnik, Uniwar, Haifa Group, ATP Group, ICL Innovation, OCP S.A., Nutriscience Innovations, Brewcraft, Budeheim, Prayon S.A., PhosAgro Group, Ettlinger Corporation, Nutrein Ltd., Innophos., FOSFA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food-Grade Phosphate MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Food-Grade Phosphate MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aditya Birla Chemicals

- TKI Hrashtnik

- Uniwar

- Haifa Group

- ATP Group

- ICL Innovation

- OCP S.A.

- Nutriscience Innovations

- Brewcraft

- Budeheim

- Prayon S.A.

- PhosAgro Group

- Ettlinger Corporation

- Nutrein Ltd.

- Innophos.

- FOSFA