Company Overview

Siemens Healthineers Statistics: Siemens Healthineers AG is a leading global provider of healthcare technologies, solutions, and services, operating across four primary segments: Diagnostics, Imaging, Varian, and Advanced Therapies. The company maintains a strong footprint in key growth markets and has direct representation in over 70 countries. Its major production and R&D facilities are strategically located in Germany, the United States, China, India, Great Britain, and Slovakia.

Through its comprehensive system expertise, Siemens Healthineers designs, produces, and distributes a wide portfolio of advanced diagnostic and therapeutic solutions for healthcare providers in more than 180 nations. The company also delivers clinical consulting, training, and service programs that span the entire care continuum from disease prevention and early detection to diagnosis, treatment, and post-care management.

As of September 30, 2024, Siemens Healthineers employed approximately 72,000 people worldwide, up from about 71,000 in the previous year, underscoring its continued expansion and commitment to driving innovation and excellence in global healthcare delivery. As of September 30, 2024, Siemens Healthineers held approximately 25,000 technical intellectual property rights, including around 16,000 granted patents, slightly exceeding the total recorded in fiscal year 2023. The company’s R&D workforce surpassed 13,000 employees by the end of fiscal 2024, operating through a network of research and development centers across the globe, primarily in Germany, China, the United States, and India.

Financial Analysis By Siemens Healthineers Statistics

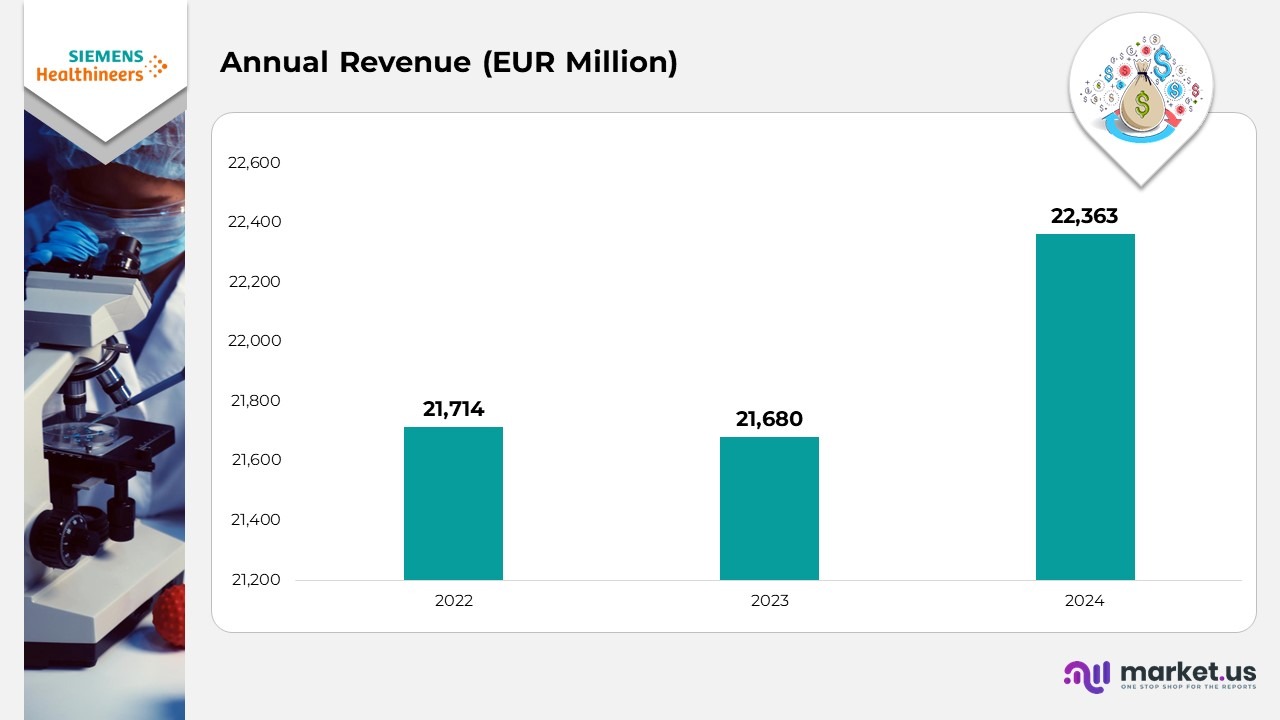

- In 2024, revenue increased by 4.7% compared to the previous year. Excluding revenue from the rapid COVID-19 antigen test business, which concluded in the fourth quarter of fiscal year 2023, comparable revenue growth reached 5.2%.

- The year-over-year growth was primarily driven by very strong performance in the Varian segment, along with solid growth in the Imaging and Advanced Therapies segments.

- In nominal terms, total revenue rose by 3.1% to €22,363 million. Currency translation negatively impacted revenue growth by approximately 2 percentage points.

- The equipment book-to-bill ratio for fiscal year 2024 stood at 1.11, reflecting a strong outcome, though slightly below the exceptional prior-year level of 1.16.

(Source: Siemens Healthineers Annual Report)

Siemens Healthineers Statistics By Segmental Analysis

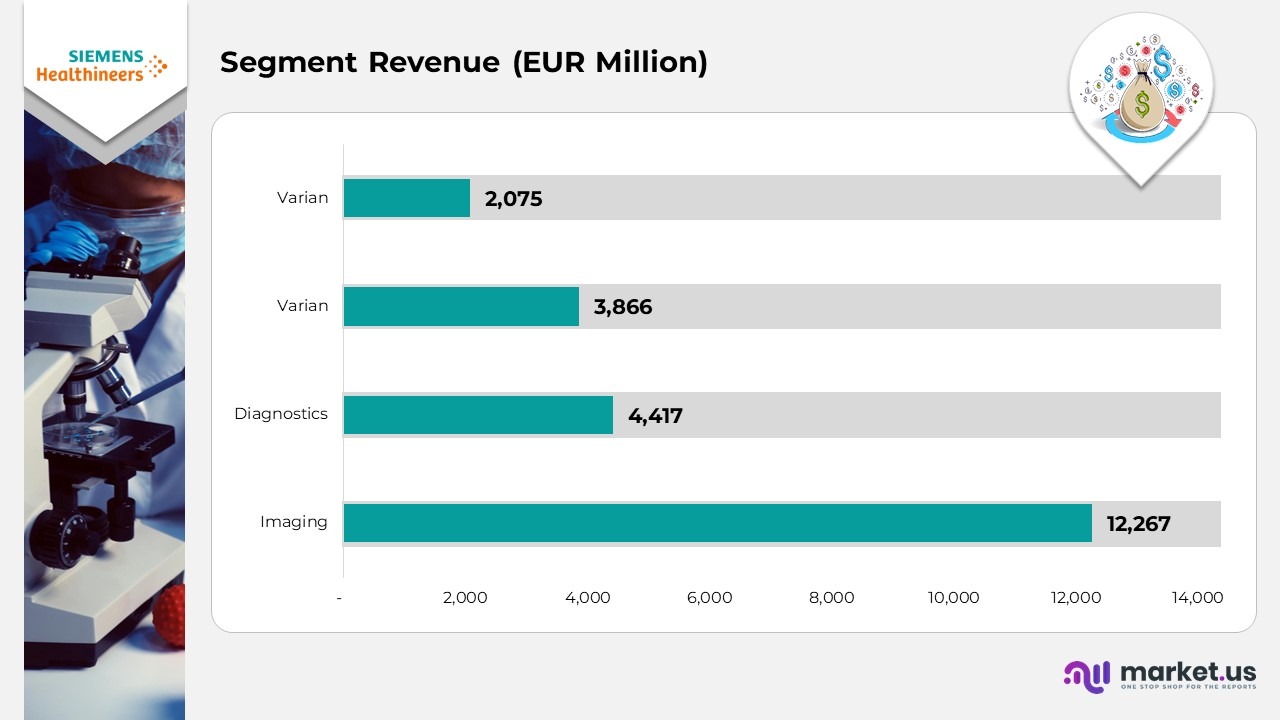

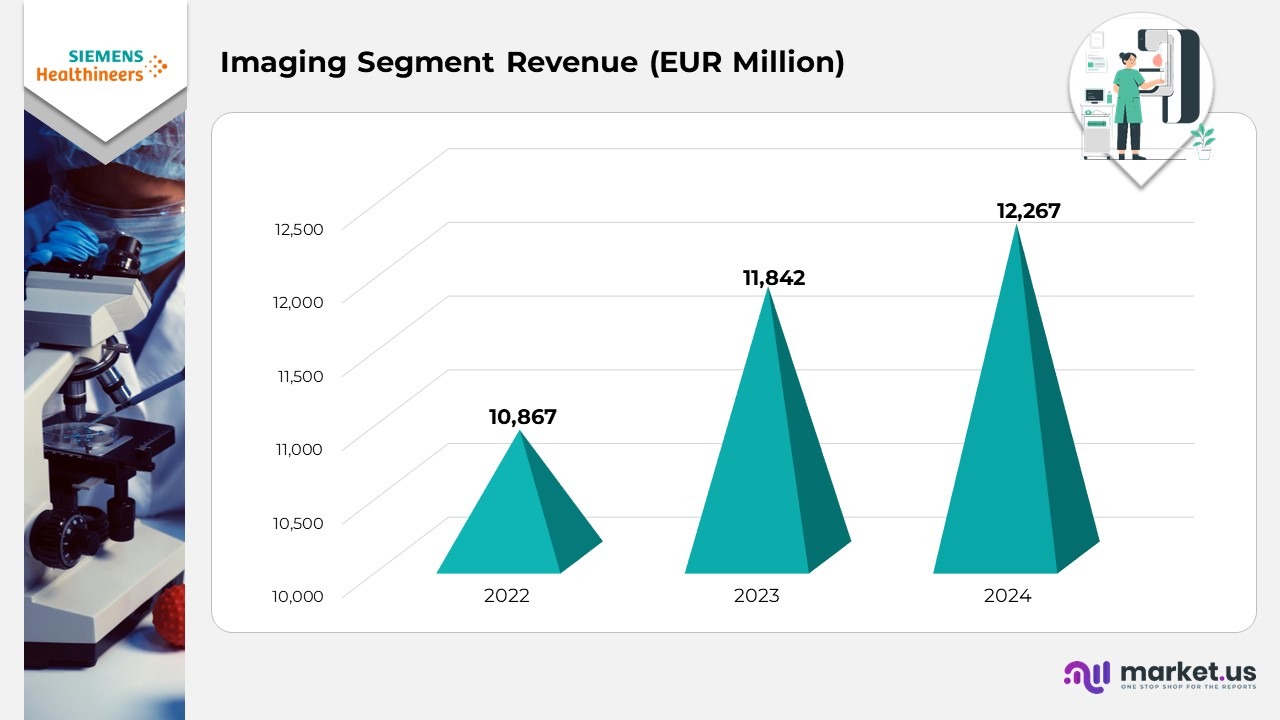

- In 2024, Siemens Healthineers’ Imaging segment recorded revenue of €12,267 million, supported by solid global demand for advanced imaging technologies such as magnetic resonance, computed tomography, and ultrasound systems across major healthcare markets.

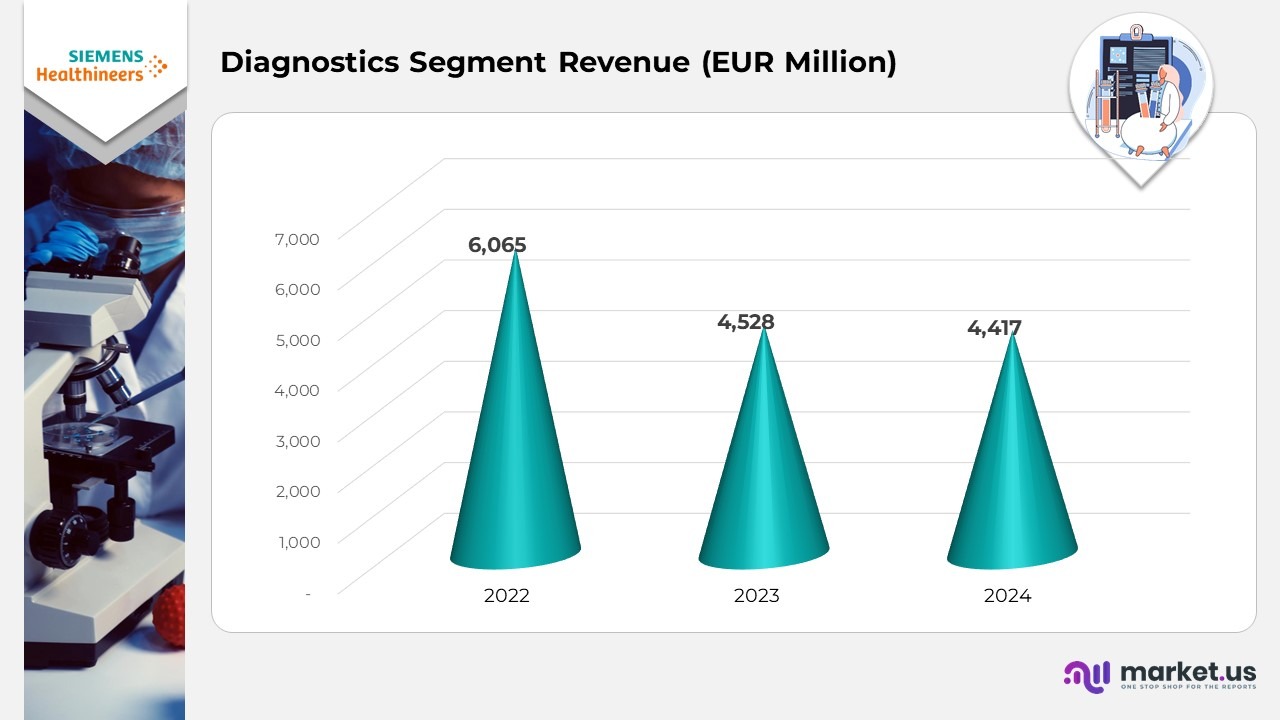

- The Diagnostics segment generated €4,417 million in 2024, driven by steady sales of in-vitro diagnostic systems, laboratory automation platforms, and recurring reagent contracts that ensured stable performance across diverse clinical settings.

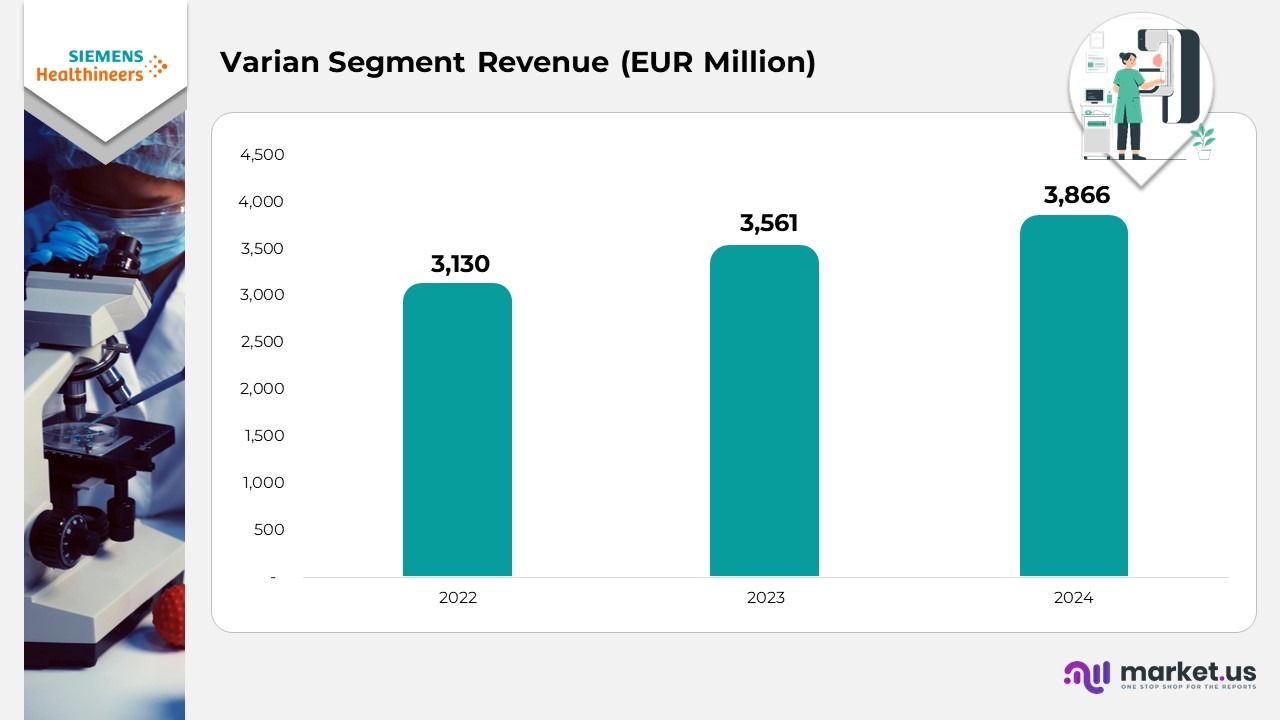

- Siemens Healthineers’ Varian segment achieved €3,866 million in 2024, reflecting strong momentum in oncology care solutions, including precision radiotherapy systems and digital oncology management tools.

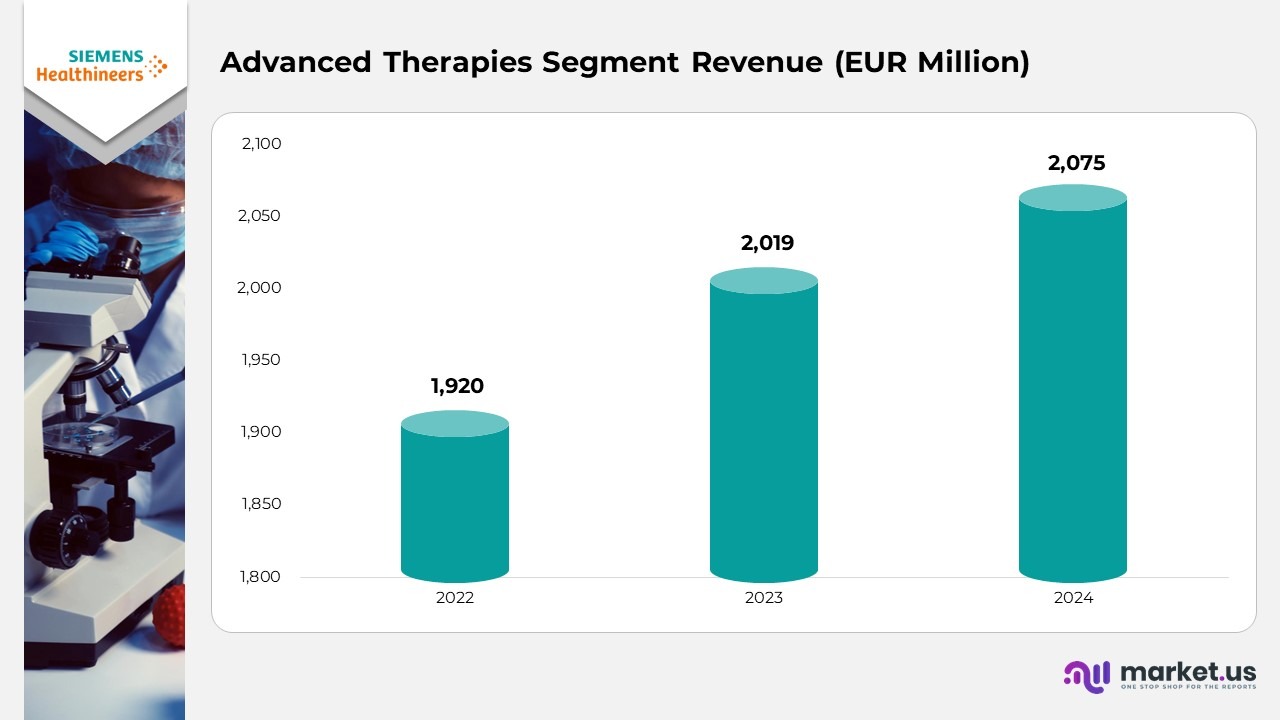

- The Advanced Therapies segment reported €2,075 million in 2024, benefiting from rising demand for image-guided, minimally invasive treatment solutions within cardiology, interventional radiology, and surgical applications.

Imaging By Siemens Healthineers Statistics

- Siemens’ Imaging segment delivers a comprehensive portfolio of imaging products, services, and digital solutions. Key offerings include systems for magnetic resonance imaging (MRI), X-ray, computed tomography (CT), molecular imaging, and ultrasound. All imaging and therapy systems are supported by unified software platforms, enabling seamless integration and performance optimization.

- The company provides a broad, scalable suite of software solutions to facilitate efficient image reading and structured diagnostic reporting across multiple modalities. Siemens also generates substantial recurring revenue from its customer services segment, covering spare parts and services driven by an extensive installed base and long-term service agreements that ensure a stable business foundation.

- In 2024, the adjusted revenue of the Imaging segment increased by 5.0%, with particularly strong growth contributions from Magnetic Resonance and Molecular Imaging product lines.

- Regionally, comparable revenue growth was very strong in the Americas and EMEA, while moderate in the Asia Pacific Japan region.

- In China, revenue declined by a high single-digit percentage, reflecting temporary delays in customer orders compared to exceptionally strong growth in the prior year. In nominal terms, adjusted revenue increased by 3.6% to €12,267 million.

Diagnostics By Siemens Healthineers Statistics

- Siemens’ Diagnostics segment encompasses a wide range of in-vitro diagnostic products and services, supporting healthcare providers in general laboratory, specialty laboratory, and point-of-care diagnostics.

- The portfolio serves diverse clinical settings, from centralized hospitals and reference laboratories to critical care, emergency departments, and physician offices. It spans multiple testing disciplines, including immunochemistry, hematology, hemostasis, urinalysis, diabetes care, and blood gas analysis.

- The segment’s product lineup also features laboratory workflow solutions and informatics systems that enhance operational efficiency and integrate seamlessly with Siemens’ diagnostic platforms. Profitability in this division primarily stems from long-term customer contracts, which combine initial instrument placements with recurring reagent sales, ensuring a resilient and predictable revenue stream.

- In 2024, Siemens reported a comparable revenue decline of 0.6% in the Diagnostics segment. However, excluding the rapid COVID-19 antigen test business (which no longer generated revenue in 2024 compared to €121 million in the prior year), the adjusted comparable revenue increased by 2.1%.

- Geographically, strong comparable growth was recorded in the EMEA region and slight growth in China, both unaffected by the discontinuation of antigen test sales. Comparable revenue remained flat in the Americas, while the Asia Pacific Japan region experienced a sharp decline relative to the prior year due to reduced antigen test sales. Excluding those tests, revenue in the region was slightly below the previous year’s level.

- On a nominal basis, the adjusted revenue decreased by 2.5% to €4,417 million, reflecting the overall normalization of post-pandemic testing demand and a gradual return to steady-state diagnostic operations.

Varian By Siemens Healthineers Statistics

- Varian’s segment delivers an extensive range of advanced cancer care technologies and services designed to support oncology departments across hospitals and clinics worldwide. The portfolio addresses patient needs at every stage of treatment, featuring integrated equipment for high-precision, image-guided radiotherapy and digital tools for treatment planning, healthcare management, and patient engagement.

- With a substantial installed base, Siemens generates strong recurring revenue from services and spare parts, complemented by tailored operational support for cancer centers. This includes leveraging best practices, clinical expertise, and digital platforms to help care providers implement personalized and optimized treatment approaches. The segment’s forward-looking innovations, such as cryoablation, microwave, and embolization technologies, are employed by interventional radiologists to combat cancer and related diseases. Its oncology technologies also extend to CT, MRI, and molecular imaging systems specifically optimized for radiotherapy applications.

- In 2024, Varian’s adjusted revenue increased by 9.5%, marking robust performance across most regions. Comparable revenue growth was sharp in the Asia Pacific Japan region, significant in the Americas, and strong in the EMEA region.

- In China, revenue declined by a lowdouble-digit percentage, mainly due to delayed customer orders following a strong prior-year performance. Overall, in 2024, adjusted revenue reached €3,866 million, representing a nominal increase of 8.6% over the previous year.

Advanced Therapies By Siemens Healthineers Statistics

- Siemens’ Advanced Therapies segment offers a comprehensive portfolio of integrated services, products, and solutions that support the treatment of diseases across multiple clinical disciplines. The portfolio is centered on image-guided, minimally invasive procedures used in interventional radiology, cardiology, and surgery, enhancing precision and patient outcomes.

- Key products within this segment include mobile C-arms and angiography systems, which are essential for advanced interventional and surgical applications. In the area of endovascular robotics, Siemens focuses exclusively on developing solutions for neurovascular interventions, further strengthening its innovation leadership in precision therapies.

- The adjusted revenue for the Advanced Therapies segment increased by 1% on a comparable basis, reflecting robust demand across major geographies.

- Regionally, very strong comparable revenue growth was recorded in the Americas,EMEA, and Asia Pacific Japan However, in China, comparable revenue declined sharply due to delayed customer orders following a particularly strong prior-year performance.

- In nominal terms, adjusted revenue rose by 2.7% to €2,075 million, demonstrating the segment’s continued strength despite regional headwinds.

(Source: Siemens Healthineers Annual Report)

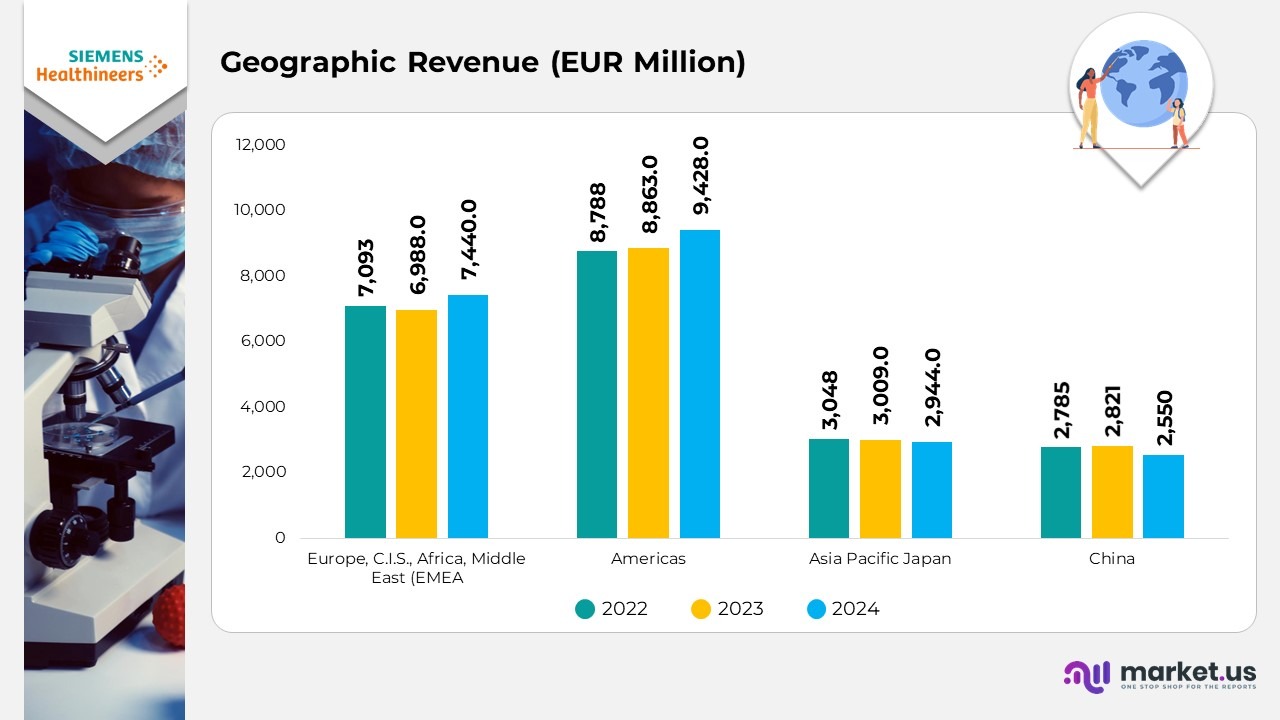

Siemens Healthineers Statistics By Geographical Analysis

- In 2024, Siemens Healthineers’ EMEA region generated €7,440 million in revenue, compared with €6,988 million in 2023 and €7,093 million in 2022. Revenue declined slightly by 0.2% on a comparable basis due to the discontinuation of the rapid COVID-19 antigen test business, which lowered Diagnostics revenue. Conversely, Varian showed sharp growth, Imaging reported significant growth, and Advanced Therapies achieved very strong growth. In Germany, revenue dropped by 26.1% on a comparable basis, with moderate growth in Imaging, moderate gains in Varian, and slightly negative results in Advanced Therapies.

- The Americas region recorded revenue of €9,428 million in 2024, up from €8,863 million in 2023 and €8,788 million in 2022. Comparable revenue decreased by 0.6%, primarily due to the end of the antigen test business in Diagnostics. Despite this, Varian achieved sharp growth, Imaging reported very strong growth, and Advanced Therapies posted slight growth. In the United States, revenue fell by 2.5% on a comparable basis, driven by lower Diagnostics revenue, while Varian and Imaging segments maintained solid expansion.

Moreover

- In the Asia Pacific Japan region, Siemens Healthineers achieved €2,944 million in 2024, compared to €3,009 million in 2023 and €3,048 million in 2022. Comparable revenue increased by 4.7%, supported by significant growth in Imaging and very strong growth in Varian and Advanced Therapies, respectively. The Diagnostics segment, however, experienced a clear revenue decline due to the discontinuation of the antigen test business.

- The China region recorded €2,550 million in revenue in 2024, compared with €2,821 million in 2023 and €2,785 million in 2022. Revenue rose by 7.1%, led by sharp growth in Advanced Therapies and significant and very strong growth in Varian and Imaging, respectively. Meanwhile, the Diagnostics segment faced a decline in revenue due to lockdowns and reduced testing at the start of the fiscal year, though performance improved later as restrictions eased and routine testing volumes recovered.

(Source: Siemens Healthineers Annual Report)

Research and Development Expenditure

- In fiscal year 2024, Siemens Healthineers recorded R&D expenses of €1,918 million, compared with €1,866 million in 2023, reflecting continued investment in innovation and technology advancement across its business segments.

- The company’s R&D intensity, defined as the ratio of R&D expenses to total revenue, stood at 9% in both 2024 and 2023, underscoring a consistent commitment to research-driven growth.

- Additions to capitalized development expenses amounted to €151 million in 2024, down from €244 million in the previous year, representing a strategic focus on high-impact innovation projects.

- The ratio of capitalized development expenses to total R&D expenses was 8% in 2024, compared with 13% in 2023, indicating a more selective capitalization approach aligned with long-term portfolio priorities.

- The scheduled amortization of capitalized development expenses totaled €88 million in 2024, slightly lower than €94 million in 2023, reflecting the lifecycle progression of previously capitalized projects.

(Source: Siemens Healthineers Annual Report)

Siemens Healthineers ACUSON Ultrasound Systems and Associated Patent Portfolio

| Ultrasound System | Patent Numbers |

| ACUSON Sequoia | 6730035, 7221972, 7536644, 7817835, 7833163, 7904824, 8170318, 8241216, 8245577, 8292811, 8323198, 8636666, 8690781, 8961418, 9700285, 10193541, 10338203, 10430688, 10575825, 10682122, 10813626, 10945701, D924884 |

| ACUSON Juniper | 6730035, 7221972, 7536644, 7783095, 7904824, 7995820, 8073215, 8170303, 8170318, 8343053, 8396531, 8636666, 8771189, 9081097, 9157894, 9389203, 10278971, 10653396 |

| ACUSON Redwood | 6730035, 7221972, 7536644, 7783095, 7904824, 7995820, 8073215, 8170303, 8170318, 8343053, 8396531, 8636666, 8771189, 9081097, 9157894, 9389203, 10278671 |

| ACUSON SC2000 | 6551246, 7221972, 7764817, 7783095, 8073215, 8170303, 8170318, 8241216, 8343053, 8396531, 8494250, 8690781, 8696579, 8771189, 8922554, 9033883, 9196092, 9320496 |

| ACUSON S Family (S1000, S2000, S3000) | 6730035, 7221972, 7817835, 7904824, 8323198, 8636666, 8961418, 9081097, 9157894, 9389203, 9468421, 10278671, 10338203, 10675006 |

| ACUSON X Family (X150, X300, X500, X600, X700, NX3) | 8636666, 9157894, 9389203 |

| ACUSON Freestyle | 6780154, 7891230, 7984651, 8079263, 8166822, 8220334, 8312771, 8499635, 8600299, 8656783, 8695429, 9084574, 9116226, 9706976 |

| ACUSON AcuNav V and Volume ICE Catheters | 8449467, 8922554, 9261595, 10405830 |

| ACUSON Antares | 7904824, 8636666 |

| ACUSON P Family (P10, P300, P500) | 7342451, 7517317, 8009904, 9261595, 9420997 |

(Source: Siemens Healthineers Company Website)

Recent Developments

- In January 2025, Siemens Healthineers unveiled an advanced range of diagnostic imaging solutions at the Asian Oceanian Congress of Radiology (AOCR) 2025 held in Chennai. The showcase emphasized the company’s commitment to precision medicine by introducing next-generation innovations in MRI, CT, digital X-ray, and ultrasound, designed to enhance clinical decision-making and patient outcomes across the healthcare continuum.

- In July 2024, Siemens Healthineers strengthened its “Make in India” initiative by commencing local manufacturing of the Multix Impact E Digital Radiography X-ray System, reinforcing its dedication to domestic production and accessibility of high-quality imaging technology in India.

- In September 2022, the company expanded its product offerings in India through the introduction of the ARTIS icono, a multidisciplinary angiography system developed to deliver advanced interventional imaging capabilities for improved patient care.

- In April 2022, Siemens Healthineers increased its manufacturing capacity in India, aligning with the Indian Government’s “Make in India” and Production Linked Incentive (PLI) programs aimed at boosting local medical device manufacturing and attracting large-scale investments in the healthcare sector.

- In March 2023, the company launched the MAGNETOM Free. Star, a new-generation MRI scanner built on Siemens Healthineers’ High-V MRI platform, offering greater accessibility and cost efficiency for advanced diagnostic Imaging.

- In January 2022, Varian Medical Systems UK Limited and Varian Company, part of Siemens Healthineers, entered a 10-year strategic partnership with Oulu University Hospital in Finland to enhance the quality and integration of comprehensive cancer care for patients in Northern Finland.

- Also in 2022, Siemens Healthineers partnered with Cardea Bio Inc. to explore the development of real-time biosensor applications using Cardea’s Biosignal Processing Unit (BPU) platform, focusing on next-generation diagnostic solutions that integrate biosensing with digital healthcare innovation.

(Source: Siemens Healthineers Press Releases)