Company Overview

Texas Instruments Statistics: Texas Instruments Incorporated is a global semiconductor company that designs and manufactures semiconductors sold to electronics designers and manufacturers worldwide. The company operates through 2 primary business segments: Analog and Embedded Processing. The Analog segment comprises two key product lines, Power and Signal Chain, that enable efficient power management and precise signal conversion.

The Embedded Processing segment provides digital components that function as the “brains” of various electronic systems, optimized for performance, power efficiency, and cost across applications. These products range from low-cost microcontrollers used in consumer devices, such as electric toothbrushes, to advanced, application-specific systems that support motor control and industrial automation.

Texas Instruments maintains design, manufacturing, and sales operations across more than 30 countries through 15 manufacturing sites, serving a diverse customer base of over 100,000 clients across the United States, Japan, China, Europe, the Middle East, and Africa. Approximately 60% of the company’s revenue is generated from customers headquartered outside the United States, with around 20% attributed to end customers based in China. As of December 31, 2024, the company employed approximately 34,000 people globally, with about 90% involved in research and development, sales, or manufacturing functions, underscoring its commitment to innovation and operational excellence.

Texas Instruments Strength Statistics

- Texas Instruments employs approximately 31,000 people worldwide, distributed as follows:

- 13,000 in America

- 16,000 in Asia-Pacific

- 2,000 in Europe

- The company operates 15 manufacturing facilities worldwide, producing over 10billion semiconductor chips annually.

- Its portfolio includes approximately 80,000 products, serving over 100,000 customers across various industries.

- In 2021, about 62% of the company’s total revenue came from the industrial and automotive markets, highlighting their strong alignment with Texas Instruments’ core product applications.

(Source: Company Website)

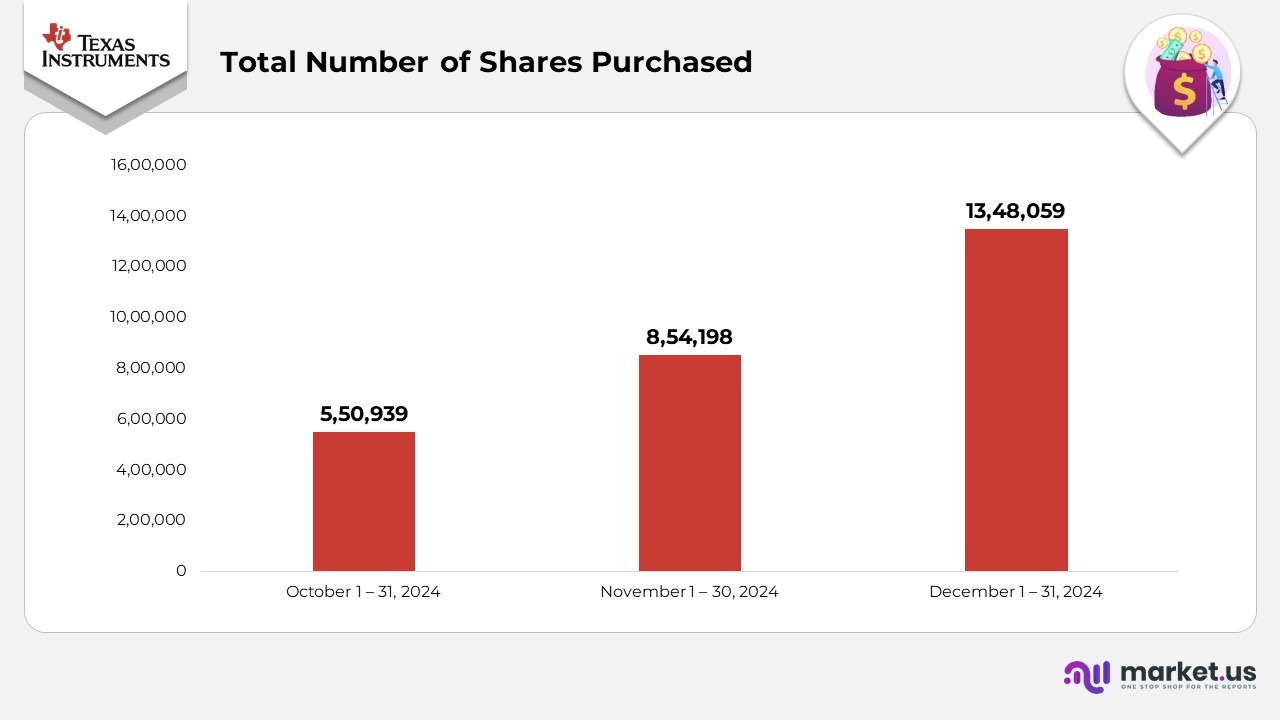

Shareholder Analysis By Texas Instruments Statistics

- During October 2024, the company repurchased 550,939 shares at an average price of $202.26 per share.

- In November 2024, total repurchases increased to 854,198 shares, with an average price of $203.84 per share.

- December 2024 recorded the highest buyback volume, with 1,348,059 shares repurchased at an average price of $191.23 per share.

- The total number of shares repurchased across the quarter was 2,753,196, indicating a consistent capital return to shareholders.

(Source: Texas Instruments Annual Report)

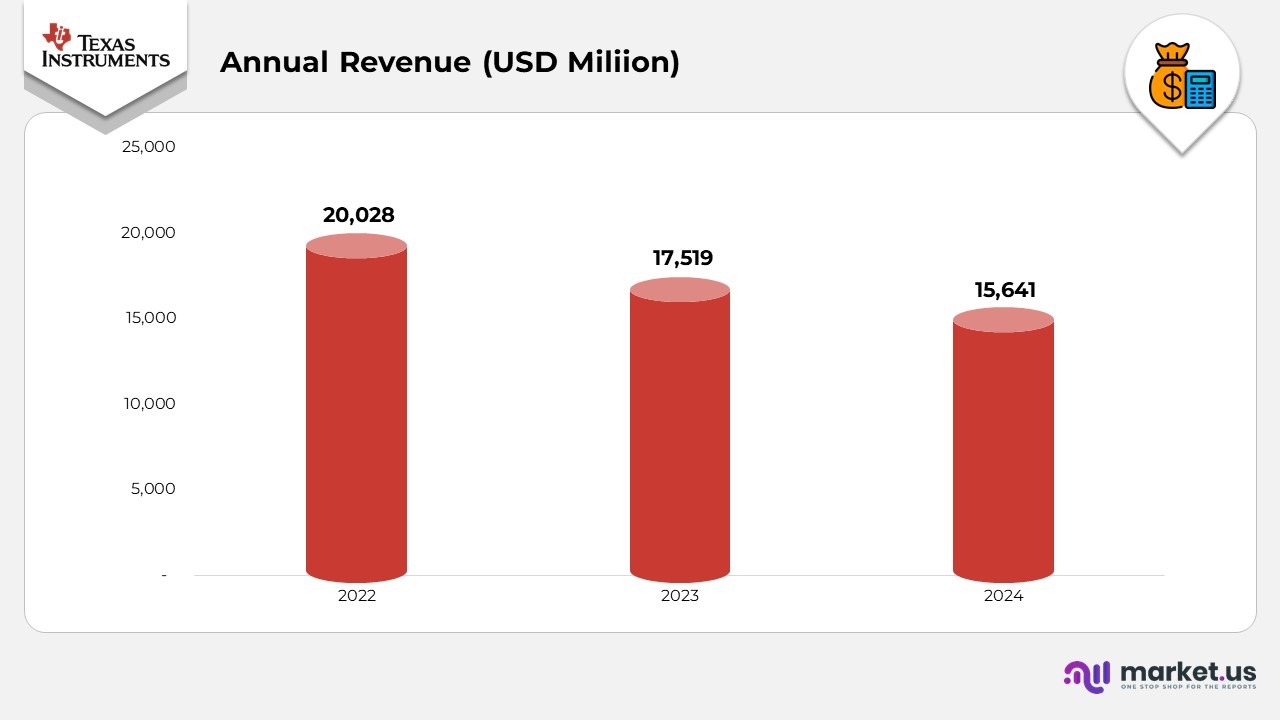

Financial Analysis By Texas Instruments Statistics

- In 2022, Texas Instruments achieved $ 20.028 billion in annual revenue, supported by strong demand from the industrial automation, automotive electronics, and power management sectors, marking a high-growth phase in semiconductor applications.

- In 2023, revenue declined to $17,519 million, reflecting a 5% year-over-year decrease caused by weaker consumer electronics demand, inventory adjustments, and lower capital spending by original equipment manufacturers (OEMs).

- The decline continued in 2024, as annual revenue dropped to $ 15.6 billion, a 10.7% decline from 2023, primarily due to the broader semiconductor market contraction and pricing pressure in analogue and embedded product lines.

- The 2-year cumulative decline of $4,387 million (21.9%) highlights the cyclical downturn of the global semiconductor industry amid macroeconomic instability and slower end-market recovery.

(Source: Texas Instruments Annual Report)

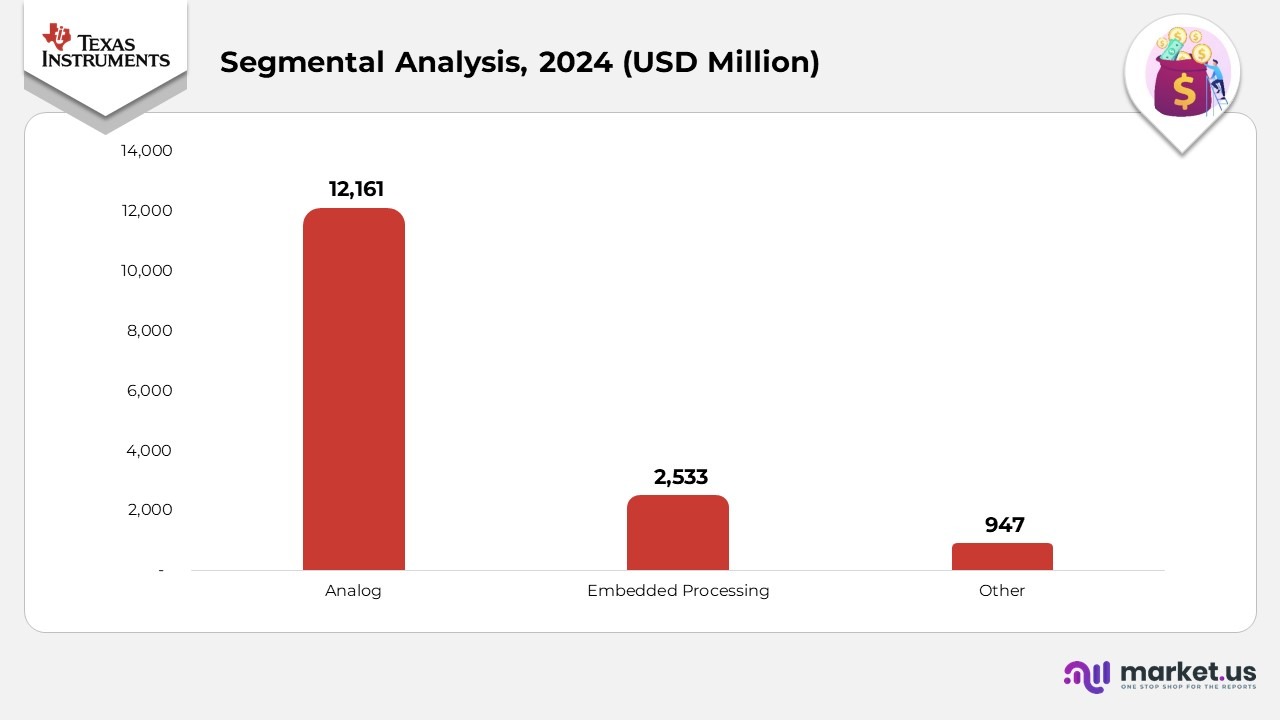

Texas Instruments Statistics With Segmental Analysis

Analog Segment

- Revenue for the Analogue segment declined from $15,359 million in 2022 to $13,040 million in 2023 and further to $12,161 million in 2024, indicating a steady slowdown in demand across industrial and communication markets.

- Cost of revenue increased slightly from $4,610 million in 2022 to $4,869 million in 2024, reflecting continued manufacturing investments despite lower sales volumes.

- Gross profit dropped from $10,749 million in 2022 to $7,292 million in 2024, showing margin pressure amid lower capacity utilization.

- R&D expenses rose consistently from $1,178 million (2022) to $1,411 million (2024), underscoring a sustained focus on analog innovation.

- Operating profit decreased sharply from $8,359 million in 2022 to $5,821 million in 2023 and further to $5,821 million in 2024, aligning with weaker overall revenue performance.

Embedded Processing Segment

- Revenue reached $3,261 million in 2022, rose to $3,368 million in 2023, but declined to $2,533 million in 2024, showing mixed performance as the company adjusted its embedded product portfolio.

- Cost of revenue increased from $1,223 million (2022) to $1,315 million (2024), partly due to input cost fluctuations.

- Gross profit fell from $2,038 million (2022) to $1,218 million (2024), indicating margin erosion tied to reduced end-market demand.

- R&D spending grew steadily from $413 million (2022) to $475 million (2024), highlighting ongoing development in digital control and microprocessor-based systems.

- Operating profit declined from $1,253 million in 2022 to $1,008 million in 2023 and further to $1,008 million in 2024, reflecting weaker pricing and lower order volumes.

Other Segment

- Revenue in the Other segment dropped from $1,408 million in 2022 to $1,111 million in 2023 and to $947 million in 2024, reflecting normalization in smaller product categories.

- Cost of revenue remained relatively stable, moving from $424 million (2022) to $363 million (2024).

- Gross profit decreased from $984 million (2022) to $584 million (2024), consistent with overall market contraction.

- R&D investment was $73 million in 2024, slightly lower than $89 million in 2023 and $180 million in 2022, indicating optimization of development spending.

- Operating profit decreased from $528 million in 2022 to $502 million in 2023, with no significant impact from restructuring in 2024.

(Source: Texas Instruments Annual Report)

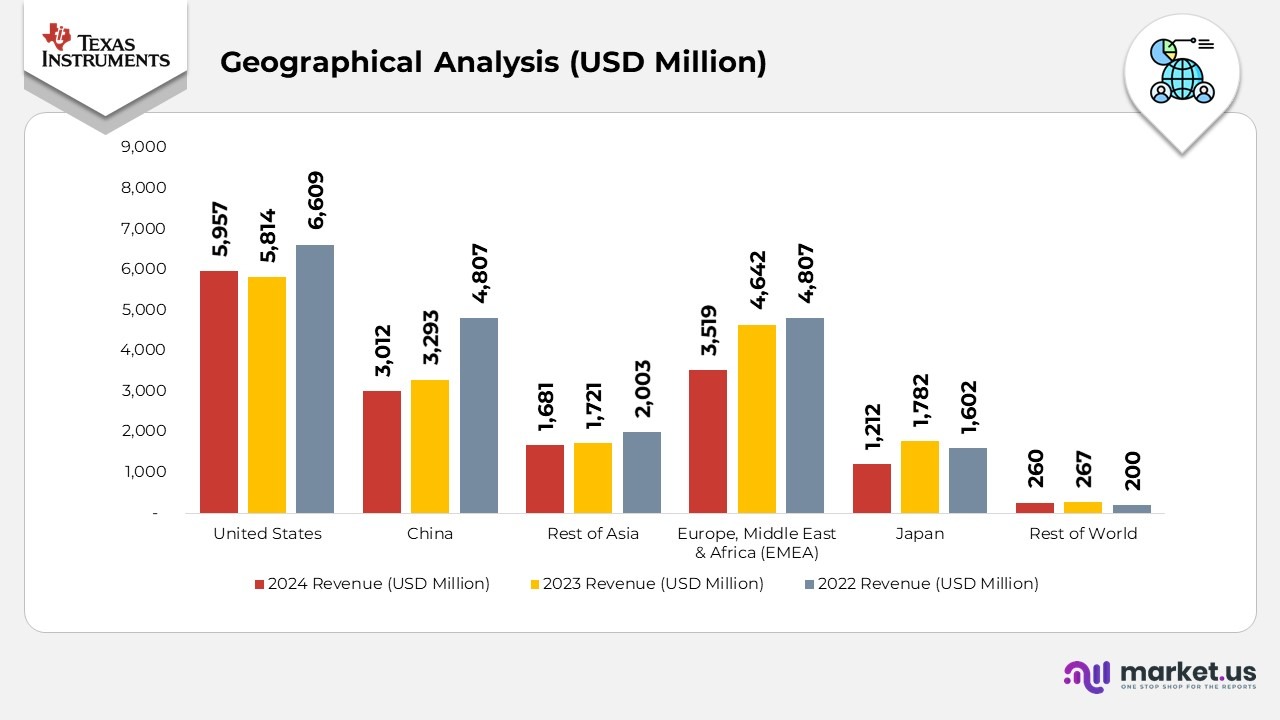

Texas Instruments Statistics By Geographical Revenue Analysis

- The United States accounted for $5,957 million (38% of total revenue), showing moderate growth from $5,814 million in 2023 and $6,609 million in 2022, driven by strong demand in the industrial and automotive sectors.

- China contributed $3,012 million (19%), down from $3,293 million in 2023 and $4,807 million in 2022, due to softening electronics production and ongoing trade-related headwinds.

- The Rest of Asia generated $1,681 million (11%), remaining stable relative to $1,721 million in 2023 and $2,003 million in 2022, reflecting consistent demand from regional OEMs and device manufacturers.

- The Europe, Middle East, and Africa (EMEA) region generated $3,519 million (22%), down from $4,642 million in 2023 and $4,807 million in 2022. Within this, Germany alone represented 11% of the total 2024 revenue, underscoring its position as a major European market for Texas Instruments.

- Japan contributed $1,212 million (8%), a decrease from $1,782 million in 2023 and $1,602 million in 2022, primarily due to fluctuations in demand for the automotive and electronics segments.

- The Rest of the World segment contributed $260 million (2%), showing stability compared to $267 million in 2023 and $200 million in 2022.

(Source: Texas Instruments Annual Report)

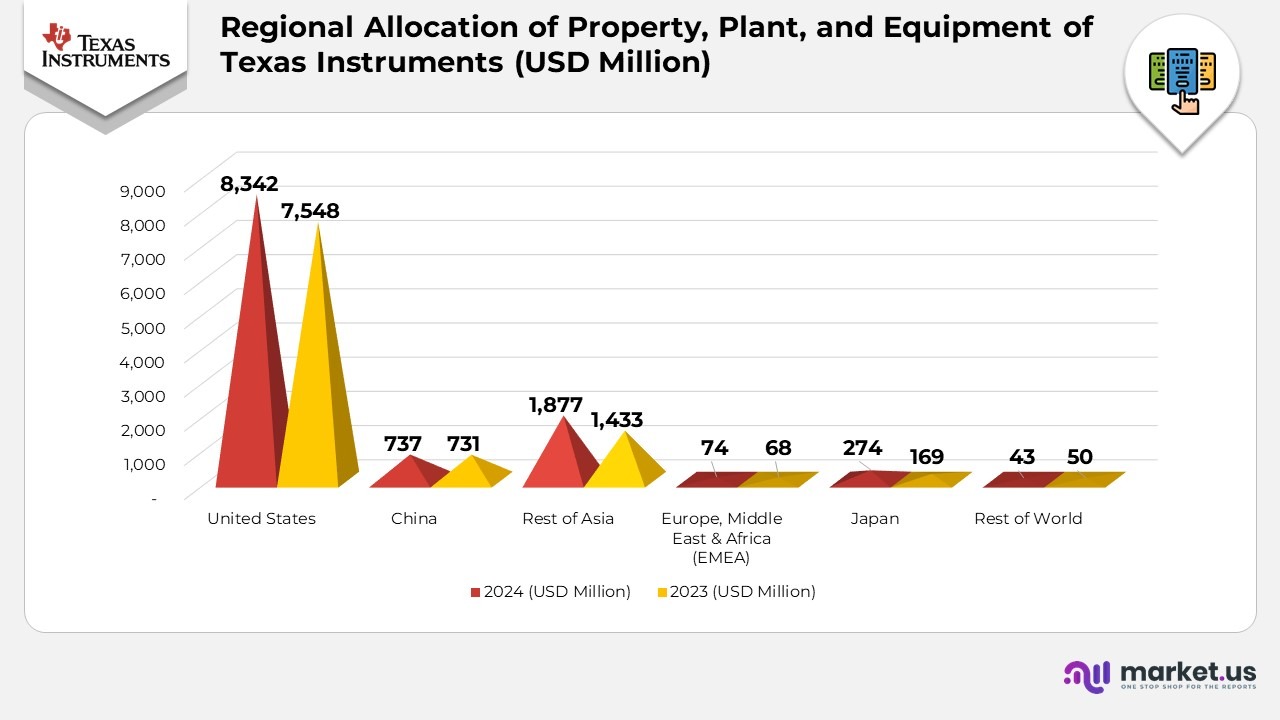

Regional Allocation of Property, Plant, and Equipment Statistics of Texas Instruments

- In 2024, Texas Instruments reported total property, plant, and equipment valued at $11,347 million, up from $9,999 million in 2023, underscoring the company’s ongoing expansion of its global manufacturing footprint.

- The United States remained the primary base of operations, with asset value increasing to $8,342 million from $7,548 million, reflecting significant investments in advanced fabrication facilities and capacity enhancement projects.

- In China, property, plant, and equipment (PP&E) stood at $737 million, compared to $731 million in the prior year, indicating steady operational infrastructure in the region.

- The Rest of Asia experienced notable growth, with PP&E rising to $1,877 million from $1,433 million, driven by the expansion of assembly, packaging, and testing capabilities in key semiconductor hubs.

- The Europe, Middle East, and Africa (EMEA) region saw a modest increase in assets, reaching $74 million in 2024 from $68 million in 2023, reflecting incremental facility improvements.

- Japan recorded a substantial increase in property and equipment value to $274 million, up from $169 million, highlighting focused investments in R&D and regional production capacity.

- The Rest of the World contributed $43 million in 2024 compared to $50 million in 2023, indicating stable asset allocation outside major markets.

(Source: Texas Instruments Annual Report)

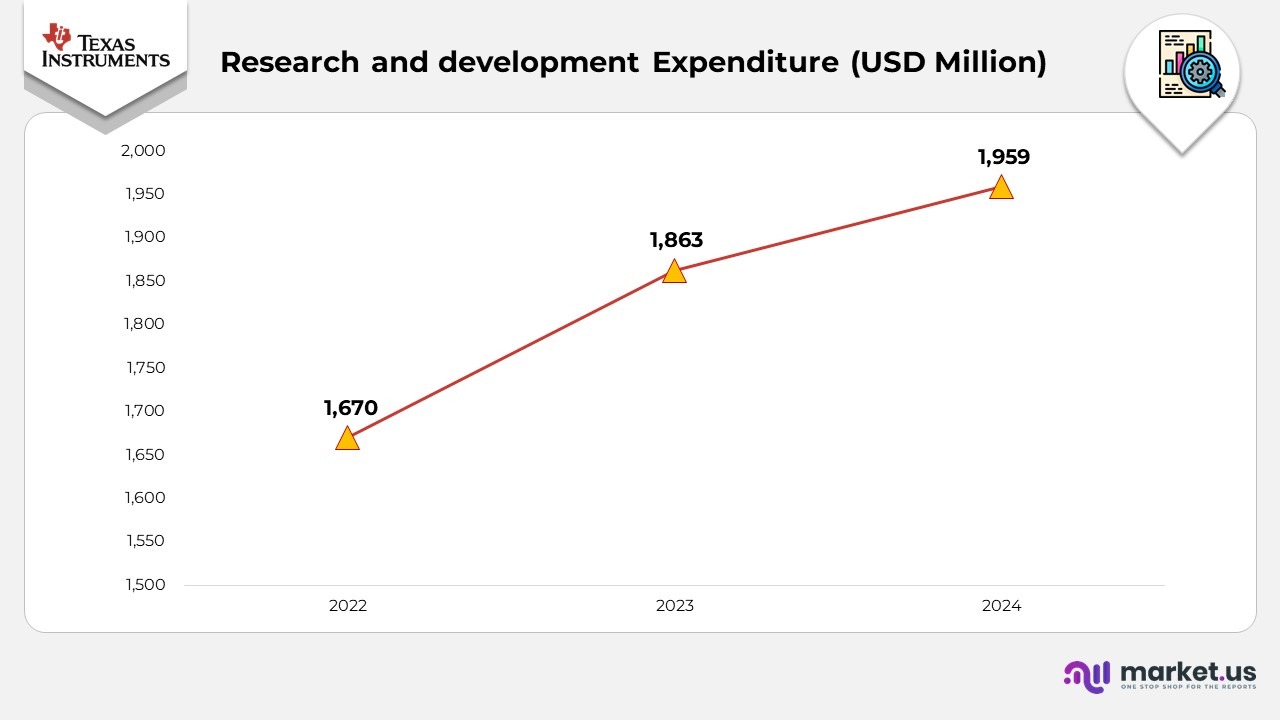

Research and Development Expenditure By Texas Instruments Statistics

- In 2022, Texas Instruments allocated $1,670 million toward research and development, emphasizing its focus on driving innovation and advancing semiconductor technologies.

- R&D spending increased to $1,863 million in 2023, representing an 11.6% year-over-year rise, aimed at enhancing analogue and embedded processing capabilities and expanding design infrastructure.

- In 2024, R&D investment increased further to $1,959 million, a 5.1% rise from the previous year, underscoring the continued commitment to developing advanced semiconductor processes and energy-efficient product solutions.

(Source: Texas Instruments Annual Report)

Texas Instruments Market Revenue Breakdown by Sector

- The industrial segment, which contributes 34% of TI’s revenue, encompasses applications in industrial automation, aerospace and defence, medical and healthcare, energy infrastructure, building automation, test and measurement, robotics, power delivery, and appliances, thereby supporting efficiency and reliability across multiple industrial domains.

- The automotive sector, which represents 35% of total revenue, encompasses technologies for infotainment and digital clusters, advanced driver assistance systems (ADAS), hybrid, electric, and powertrain systems, as well as body electronics, lighting, and passive safety systems, driving innovation toward smarter and safer mobility.

- The personal electronics market, which accounts for 20% of revenue, encompasses products such as mobile phones, PCs and notebooks, tablets, portable electronics, and connected peripherals. It also extends to printers, home theater systems, televisions, gaming devices, and non-medical wearables, enhancing performance and user experience in daily consumer electronics.

- The enterprise systems segment, which contributes 5% of TI’s revenue, focuses on data centres, enterprise computing, projectors, and industrial machinery, supporting advanced computing performance and optimised power management in large-scale environments.

- The communications equipment market, accounting for 4% of revenue, encompasses wireless infrastructure, wired networking, broadband fixed-line access, and datacom modules, facilitating faster connectivity and reliable data transmission across global communication networks.

(Source: Texas Instruments Annual Report)

Patent of Texas Instruments

| Patent / Publication Title | Type | Filed | Publication / Grant Date | |

|---|---|---|---|---|

| High-Side Switch Circuit | Application | April 17, 2024 | October 23, 2025 | |

| Dynamic Temperature Calibration of Ultrasonic Transducers | Grant | December 26, 2018 | October 21, 2025 | |

| Channel Stop and Glowing Dopant Migration Control Implant | Grant | November 17, 2023 | October 21, 2025 | |

| Symmetric Air-Core Planar Converter with Partial EMI Shielding | Application | June 24, 2025 | October 16, 2025 | |

| TCP Power Optimization Protocol for Connected and Low Throughput Devices | Grant | January 2, 2024 | October 14, 2025 | |

| Switching Converter Ground Damping | Application | March 28, 2024 | October 2, 2025 | |

| Methods and Apparatus to Reduce Error in Operational Amplifiers | Grant | August 29, 2022 | September 23, 2025 | |

| Fin Field-Effect Transistor Semiconductor Device | Grant | December 8, 2021 | September 23, 2025 | |

| Calibration of Circuitry Parameters for Current Sensing | Grant | April 27, 2023 | September 23, 2025 | |

| Adaptive Burst Transfer for Direct Memory Access | Application | July 31, 2024 | September 18, 2025 | |

| Low Area and Power Multi-Bit Flip-Flop | Grant | January 29, 2024 | September 16, 2025 | |

| Transistor Shutdown Circuit | Application | May 24, 2024 | September 11, 2025 | |

| Enabling a Multi-Chip Daisy Chain Topology Using PCIe | Grant | August 1, 2023 | September 9, 2025 | |

| Streaming Engine with Variable Stream Template Format | Grant | March 4, 2024 | September 9, 2025 | |

| Conduction Mode Control | Application | April 19, 2024 | September 4, 2025 | |

| Plated Metal Layer in Power Packages | Grant | October 10, 2023 | September 2, 2025 | |

| Silicide-Block-Ring Body Arrangement for LDMOS and IGBT | Grant | June 24, 2021 | September 2, 2025 | |

| Switch Regulator | Application | February 28, 2024 | August 28, 2025 | |

| Bootstrap Circuit | Application | February 16, 2024 | August 21, 2025 | |

| Systems and Methods for Monitoring an Instruction Bus | Grant | January 25, 2024 | August 19, 2025 |

(Source: Justia Patents)

Recent Developments

- In November 2025, the company expanded its advanced assembly and test factory, TIEM2, in Malaysia, Melaka. This state-of-the-art facility integrates automation to bump, probe, assemble, and test billions of analog and embedded chips annually, serving markets such as vehicles, smartphones, and data centers.

- In May 2025, Texas Instruments collaborated with NVIDIA to enhance power distribution efficiency across AI infrastructure, thereby supporting high-performance and energy-optimised computing environments.

- In March 2025, the company introduced a new line of functionally isolated modulators, the first in the industry, designed to measure current and voltage with exceptional accuracy, enabling robotics to perform complex, precision tasks.

- In June 2025, the company invested $60 billion to expand semiconductor manufacturing in the United States, in coordination with the Trump administration. The new mega-sites in Texas and Utah are expected to support 60,000. jobs, strengthening domestic chip production for critical technologies.

- In March 2025, Texas Instruments unveiled the world’s smallest microcontroller (MCU), designed to optimize board space in medical wearables and personal electronics while maintaining high performance.

- In October 2024, the company expanded production of gallium nitride (GaN)-based power semiconductors at its Aizu, Japan, facility. Combined with its Dallas operations, TI now manufactures four times more GaN-based semiconductors, meeting the rising global demand for power efficiency.

- In August 2024, Texas Instruments signed an agreement for up to $1.6 billion in direct funding under the CHIPS and Science Act to support three 300mm wafer fabs under construction in Texas and Utah. The company also expects to receive $6–8 billion in Investment Tax Credits from the U.S. Treasury to bolster U.S. manufacturing.

- In June 2024, TI partnered with Delta Electronics to enhance electric vehicle onboard charging systems, furthering innovation in sustainable mobility and energy-efficient power technologies.

(Source: Texas Instruments Press Release)