Company Overview

The Hershey Company Statistics: The Company is a confectionery leader known for creating moments of delight through its chocolates, mints, sweets, and snacks. One of North America’s most recognized chocolate producers, a leading U.S. snack manufacturer, and a global leader in both chocolate and non-chocolate confectionery. The company markets, distributes, and sells products under more than 90 brand names across approximately 70 countries worldwide.

Hershey operates through 3 core business segments: North America Confectionery, North America Salty Snacks, and International.

The company’s products are available in more than 85 countries, including the United States, Brazil, Canada, India, Japan, South Korea, Mexico, the Philippines, Singapore, and the United Arab Emirates. Hershey’s brand portfolio features some of the world’s most iconic names, including Hershey’s, Reese’s, Kit Kat, Hershey’s Kisses, Twizzlers, Jolly Rancher, and Ice Breakers, representing its enduring commitment to quality, taste, and innovation in the confectionery and snack industries.

History of The Hershey Company

1800’s

- 1894: Milton Hershey integrates the Lancaster Caramel Company and establishes the Hershey Chocolate Company as a subsidiary, laying the foundation for future global growth.

1900’s

- 1900: Launch of Hershey’s Milk Chocolate Bars and sale of the Lancaster Caramel Company to focus exclusively on chocolate manufacturing.

- 1907: Production of Hershey’s Chocolate Kisses begins, becoming one of the brand’s most iconic products.

- 1909: Catherine Hershey and Milton sign the Deed of Trust, founding the Hershey Industrial School, later known as the Milton Hershey School.

- 1918: Milton Hershey transfers his company’s assets to the Milton Hershey School Trust Fund to support education for disadvantaged children.

- 1921: Introduction of the mechanical kiss-wrapping machine with the trademarked Plume design.

- 1925: Launch of Mr Goodbar, expanding Hershey’s chocolate product line.

- 1927: Hershey is listed on the New York Stock Exchange (NYSE), marking its emergence as a public company.

- 1930–1945: The Great Works Project leads to the construction of Hershey’s key landmarks, including Hersheypark, the Hersheypark Theatre, and the Hersheypark Hotel; during World War II, the company produces the Ration D Bar for U.S. troops.

- 1939: Launch of Hershey’s Miniatures, initially used by sales teams as sample bars.

- 1963: Acquisition of H.B. Reese Candy Company, adding the famous Reese’s brand to Hershey’s product portfolio.

- 1971: Hershey’s Tropical Bar is sent to the moon with the Apollo 15 astronauts.

- 1973: Opening of Hershey’s Chocolate World, the first retail experience center.

- 1975: National distribution of York Peppermint Patties begins.

- 1977: Acquisition of Y&S Licorice, comprising the Twizzlers line of foodstuffs.

- 1979: Hershey achieves $1 billion in annual sales for the first time.

- 1988: National re-launch of the 5th Avenue candy bar.

- 1996: Acquisition of LEAF, Inc., adding 40 brands such as Whoppers, Jolly Rancher, Milk Duds, PayDay, Heath, Rainblo, and Good & Plenty.

2000’s

- 2000: Hershey becomes a founding member of the World Cocoa Foundation, supporting sustainable cocoa farming in West Africa.

- 2003: Introduction of sugar-free forms of Reese’s Peanut Butter Cups and Hershey’s chocolate candy.

- 2007: Celebration of the 100th anniversary of Hershey’s Kisses.

- 2008: Hershey reaches $5 billion in annual sales, highlighting steady business expansion.

- 2012: Hershey was named to The Civic 50 as one of America’s most community-minded companies.

- 2012: Inclusion in the Dow Jones Sustainability World Index for its strong environmental and social performance.

- 2012–2016: International expansion into China, India, Brazil, Canada, and Mexico strengthens Hershey’s global footprint.

- 2014: Introduction of a new corporate logo, symbolizing modernization and brand evolution.

- 2016: Launch of Hershey’s Simply 5 Syrup and Reese’s Pieces Peanut Butter Cups; Hershey’s Chocolate World welcomes its 100 millionth visitor.

- 2017: Michele Buck becomes Hershey’s first female CEO, introducing the Innovative Snacking Powerhouse strategy that leads to acquisitions of Amplify Snack Brands and Pirate Brands.

- 2019: Hershey was named to the Dow Jones Sustainability World Index for the seventh consecutive year and ranks #35 on DiversityInc’s Top 50 Companies for Diversity.

- 2020: Hershey achieves 1:1 gender pay impartiality for salaried employees in the U.S. and ranks #21 on DiversityInc’s Top 50 list.

Later 2020

- 2021: Acquisitions of Dot’s Pretzels, Pretzels Inc., and Lily’s Sweets strengthen Hershey’s salty and better-for-you portfolio; recognized as the World’s #1 Top Female-Friendly Company by Forbes.

- 2021: Hershey achieves 1:1 POC pay equity and is recognized in The Civic 50 for the ninth consecutive year.

- 2022: Ranked #6 on DiversityInc’s Top 50 Companies for Diversity.

- 2023: Hershey acquires two Weaver Popcorn Manufacturing facilities, earns Great Place to Work certification, and ranks #3 on DiversityInc’s Top 50 list.

- 2024: Launches Shaq-A-Licious XL Gummies with Shaquille O’Neal; acquires Sour Strips; expands its $355 million Bowling Green facility; signs a long-term cocoa sustainability agreement with cooperatives.

- 2024: Named among the World’s Most Ethical Companies by Ethisphere and recognized in The Civic 50 as Consumer Staples Leader.

- 2025: Kirk Tanner becomes CEO; opens the fully integrated digital Reese’s Chocolate Processing Facility; announces a feature film, HERSHEY, in partnership with Dandelion Media, set to premiere in 2026.

(Source: Company Website)

Hershey Company Employee Analysis

- As of December 31, 2024, the company employed approximately 18,540 full-time and 1,490 part-time employees across its global operations.

- A total of 6,525 employees, representing about 33% of the global workforce, were covered under collective bargaining agreements.

- In 2025, the company is scheduled to negotiate new agreements for employees at 7 facilities, all located outside the United States.

- These upcoming negotiations will involve approximately 69% of the total employees currently under collective bargaining agreements.

(Source: The Hershey Company Annual Report)

Financial Analysis

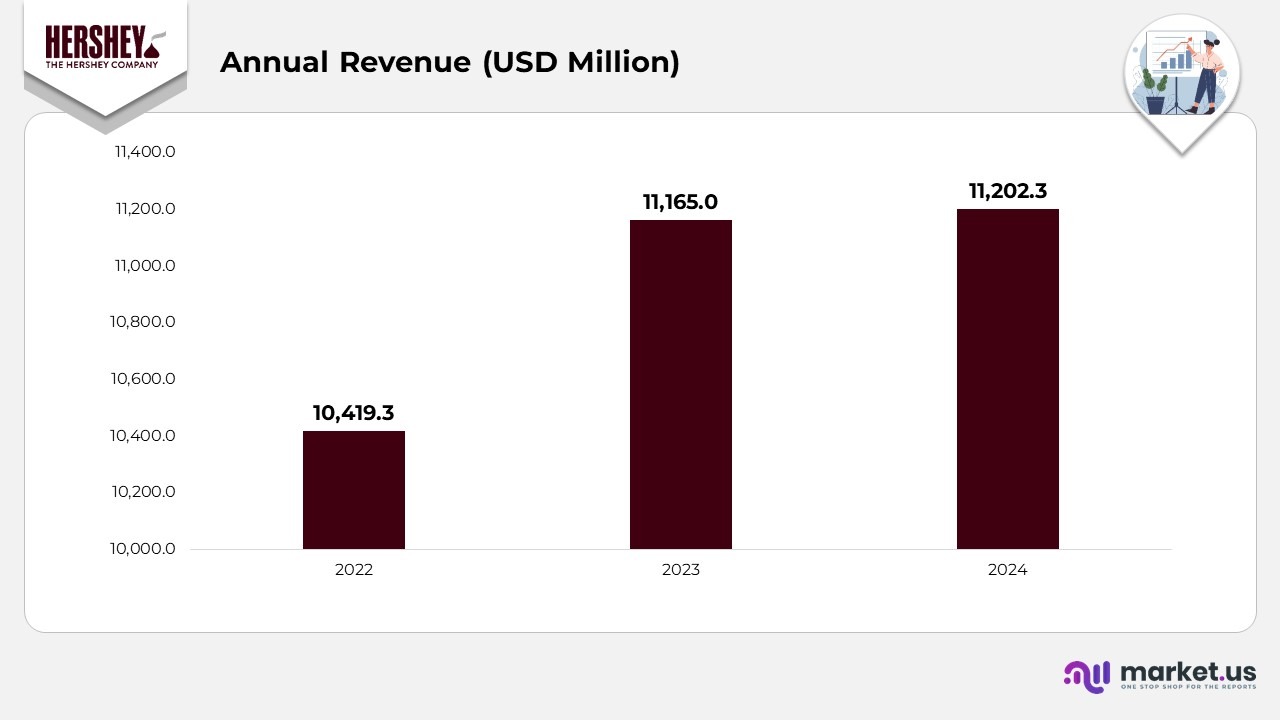

- In 2024, net sales totalled 11,202.3 million, an increase of 37.3 million, or 0.3%, compared to 2023. This growth was primarily driven by a 3% favourable price realisation, supported by higher list prices in the North American Confectionery and International

- The increase was partially offset by a 2% decline in sales volume, attributed to lower performance in the Confectionery and International divisions. However, the North American salty snacks segment saw a positive volume rise.

- Foreign currency exchange had a minimal negative impact, slightly dampening overall growth for 2024.

- In 2023, net sales reached 11,165.0 million, marking a 745.7 million increase or 7.2% compared to 2022. This strong performance was primarily fueled by an 3% favorable price realization across all segments, reflecting strategic price adjustments.

- A 2% positive effect from foreign currency exchange further supported the increase. In comparison, a 1.3% decline in volume due to softer consumer demand for everyday confectionery products in the U.S. moderated the gains.

Hershey Company Segmental Analysis

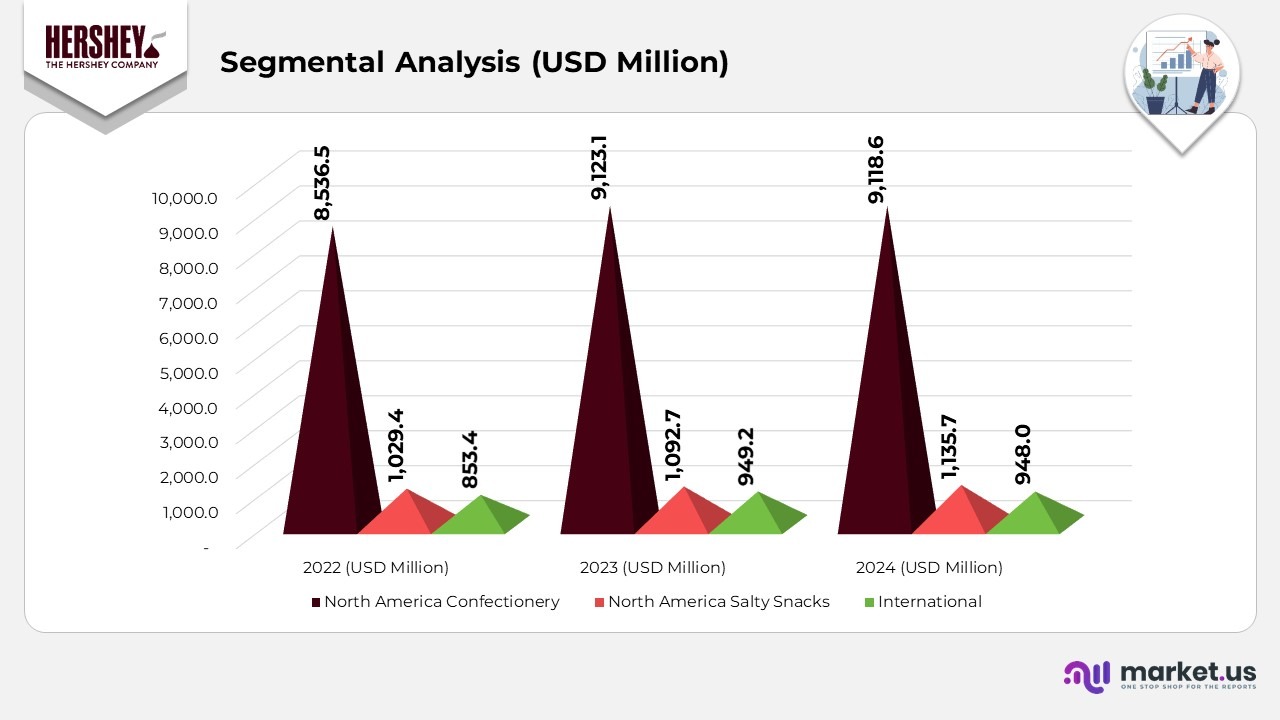

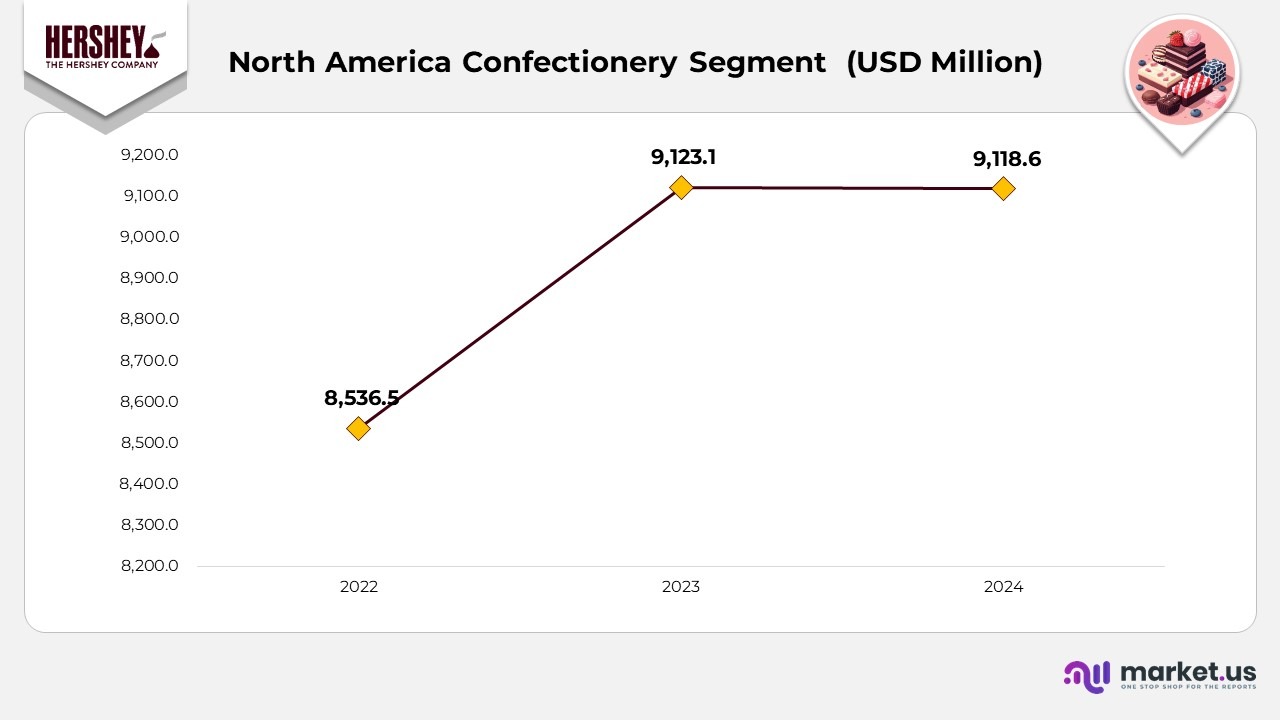

- In 2024, the North America Confectionery segment achieved USD 9,118.6 million in net sales, maintaining a near-flat performance compared to USD 9,123.1 million in 2023, while showing significant growth from USD 8,536.5 million in 2022. The steady year-over-year results demonstrate strong brand resilience despite moderate fluctuations in volume.

- The North America Salty Snacks segment reported net sales of USD 1,135.7 million in 2024, an increase from USD 1,092.7 million in 2023 and USD 1,029.4 million in 2022. This consistent growth reflects increasing consumer demand for premium, convenient snack options and successful product diversification efforts.

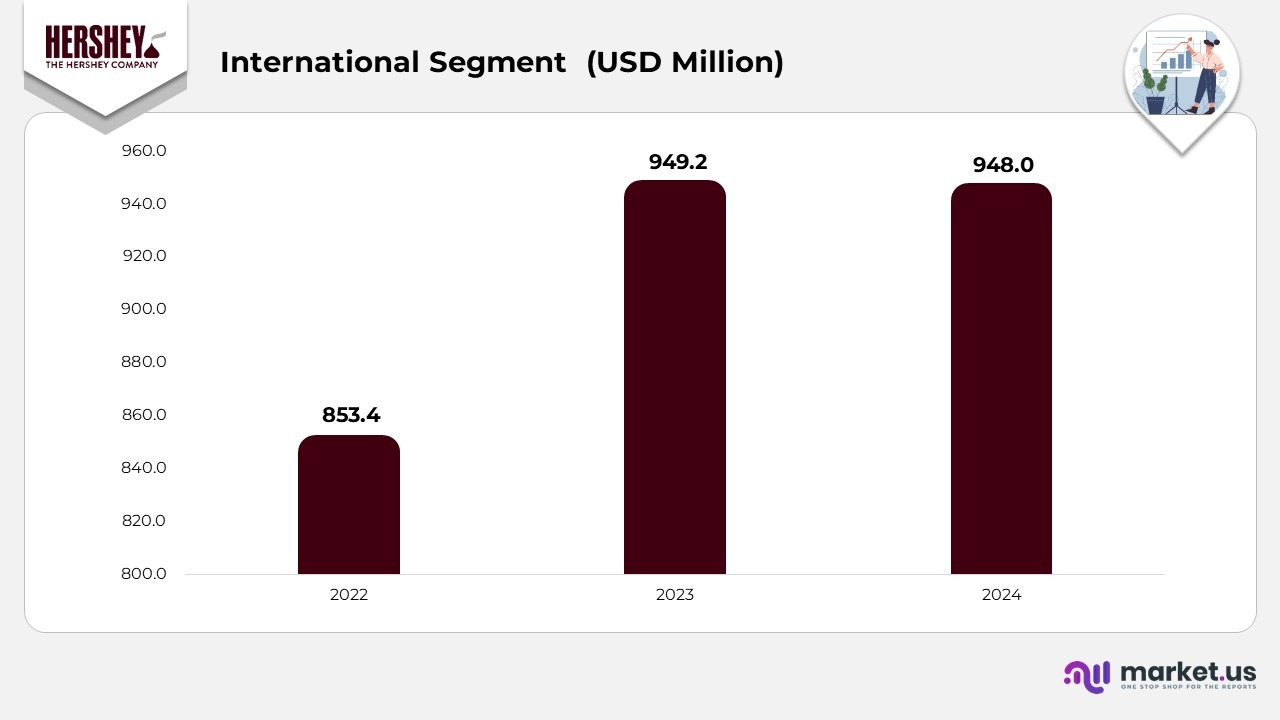

- The International segment generated USD 948.0 million in 2024, marginally lower than USD 949.2 million in 2023, but higher than USD 853.4 million in 2022. The performance highlights stable global operations with gradual expansion across markets such as India, Brazil, and Mexico.

Hershey Company North America Confectionery Statistics

- The North America Confectionery segment manages Hershey’s core chocolate and non-chocolate confectionery operations in Canada and the United States.

- This includes gum, protein bars, spreads, refreshment products, snack bites, mixes, and pantry and food service items. The segment also oversees Hershey’s retail stores in Hershey (Pennsylvania), Niagara Falls (Ontario), Las Vegas, New York, and Singapore, along with global licensing of company trademarks.

- The segment accounted for 4%, 81.7%, and 81.9% of total net sales in 2024, 2023, and 2022, respectively. Net sales totalled USD 9,118.6 million in 2024, down slightly from USD 9,123.1 million in 2023, representing a decline of USD 4.5 million.

- The minor decrease was driven by a 4% drop in volume, primarily due to weaker performance in everyday U.S. confectionery brands. However, this was partially offset by a 4% favorable price realization from portfolio-wide price adjustments and a modest contribution from the 2024 acquisition of Sour Strips. Foreign currency movements had no material impact on the results.

Moreover

- Licensing and owned retail operations, including Hershey’s Chocolate World stores, reported a 5% increase in net sales during 2024 compared to 2023, reflecting improved retail traffic and strong brand engagement.

- Segment income reached USD 2,945.7 million in 2024, down from USD 3,117.0 million in 2023, a decrease of USD 171.3 million (5.5%). The decline resulted from higher commodity and supply chain costs, as well as an unfavourable product mix, partially offset by lower advertising expenses and favourable pricing.

- In 2023, net sales increased to USD 9,123.1 million from USD 8,536.5 million in 2022, a rise of USD 586.6 million (6.9%), primarily due to a 9% favourable price realization resulting from portfolio-wide price hikes. This gain was slightly offset by a 9% decline in volume and an unfavourable 0.2% foreign exchange impact.

- Licensing and owned retail experienced a 12.1% sales increase in 2023 compared to 2022, driven by strong visitor growth at retail locations.

- Segment income increased to USD 3,117.0 million in 2023 from USD 2,811.1 million in 2022, a rise of USD 305.9 million (10.9%), primarily driven by pricing gains and supply chain efficiencies, partially offset by rising labour and production costs.

North America Salty Hershey Company Statistics

- The North America Salty Snacks segment manages Hershey’s snack and grocery portfolio, focusing on products such as ready-to-eat pretzels, popcorn, and other salty snacks. This division accounted for 1%, 9.8%, and 9.9% of total net sales in 2024, 2023, and 2022, respectively, underscoring its consistent contribution to the company’s growth.

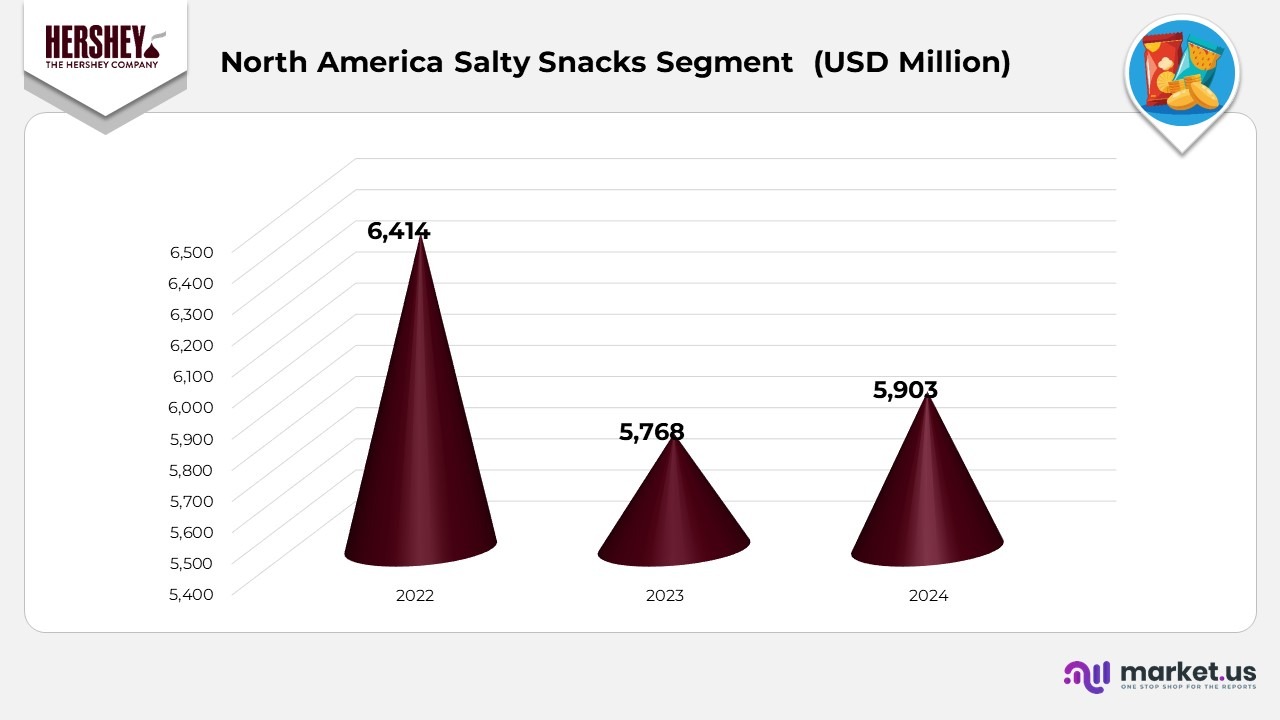

- Net sales reached USD 1,135.7 million in 2024, rising from USD 1,092.7 million in 2023, reflecting an increase of USD 43.0 million (3.9%). The growth was primarily driven by a 5% increase in sales volume, led by the strong performance of Dot’s Homestyle. However, this was partly offset by a 1% unfavorable price realization due to price adjustments affecting SkinnyPop and Dot’s products.

- Segment income for 2024 climbed to USD 199.4 million from USD 158.3 million in 2023, a gain of USD 41.1 million (26.0%). The improvement was attributed to higher sales volumes, reduced supply chain expenses, and lower commodity costs. These benefits were partially offset by increased advertising and marketing investments, as well as a modest negative impact from pricing adjustments.

- In 2023, net sales totalled USD 1,092.7 million, up from USD 1,029.4 million in 2022, representing a USD 63.3 million (6.1%) increase. The growth reflected a 4% favorable price realization from strategic price hikes across key brands, particularly SkinnyPop and Dot’s Homestyle Pretzels, coupled with a 0.7% volume increase primarily from Dot’s snacks.

- Segment income in 2023 was USD 158.3 million, a slight decrease from USD 159.9 million in 2022, representing a decline of USD 1.6 million (1.0%). This marginal drop was largely due to higher advertising and consumer marketing expenses, as well as costs associated with the voluntary recall of certain Paqui products. Favorable price adjustments and a positive product mix helped mitigate the impact.

Hershey Company International Statistics

- The International segment encompasses Hershey’s operations in Mexico, India, Brazil, and Malaysia, as well as exports to Latin America, Europe, Asia, the Middle East, and Africa.

- Net sales in 2024 were USD 948.0 million, compared to USD 949.2 million in 2023, a decrease of USD 1.2 million (0.1%). The decline was due to a 1% unfavorable foreign exchange impact and a 1% volume drop, partly offset by a 2% price realization gain.

- Sales in Mexico, Brazil, and Latin America dropped 5.7%, while Europe, MEA, and World Travel Retail increased by 13.1%, reflecting higher travel retail demand.

- Segment income in 2024 was USD 111.5 million, down from USD 148.3 million in 2023, representing a decline of USD 36.8 million (24.8%), primarily due to higher input costs and currency impacts.

- In 2023, net sales reached USD 949.2 million, up from USD 853.4 million in 2022, representing an increase of USD 95.8 million (11.2%). This growth was driven by 4.7% price gains, 3.4% currency benefits, and 3.1% volume growth.

- Sales growth in 2023 was led by World Travel Retail (+15.6%), Mexico (+14.3%), and Brazil & Latin America (+13.0%).

- Segment income in 2023 increased to USD 148.3 million from USD 107.9 million in 2022, a rise of USD 40.4 million (37.4%), driven by pricing and currency benefits despite higher supply chain costs.

- Between 2022 and 2024, the International segment showed resilience, maintaining stable revenues despite a challenging currency environment and fluctuating demand across regions.

(Source: The Hershey Company Annual Report)

The Hershey Company Patents Portfolio

| Patent / Publication Title | Patent / Publication Number | Filing Date | Date of Patent / Publication |

|---|---|---|---|

| Hygienic pallet and methods of use and manufacture | 12043444 | August 16, 2023 | July 23, 2024 |

| Shelf-stable fried confectionery food products and approaches of creation the same | 20240138422 | March 31, 2022 | May 2, 2024 |

| A load stabilizer for stabilizing lots transported by a ground vehicle | 11945361 | January 21, 2021 | April 2, 2024 |

| System and method for conveying confection molds | 11758919 | April 27, 2022 | September 19, 2023 |

| Hygienic pallet and methods of use and manufacture | 11760536 | October 8, 2021 | September 19, 2023 |

| Formulations and methods of preparing products with a meat-like texture with plant-based protein sources | 11737476 | January 17, 2019 | August 29, 2023 |

| Reduced sugar chocolate and the method of making the same | 20220232849 | April 22, 2020 | July 28, 2022 |

| Shipping and display container and method of making the same | 11396398 | April 6, 2021 | July 26, 2022 |

| Shelf-stable cake truffle | 20220192207 | April 15, 2020 | June 23, 2022 |

| Stackable corrugated shipping and display container and method of making same | 11299313 | November 5, 2019 | April 12, 2022 |

| Filling composition for a confectionary product | 20220095642 | January 21, 2020 | March 31, 2022 |

| Confection | D960486 | March 29, 2021 | August 16, 2022 |

| Confection | D977220 | September 28, 2021 | February 7, 2023 |

| Confection | D977221 | September 28, 2021 | February 7, 2023 |

| Confection | D977222 | September 29, 2021 | February 7, 2023 |

| Corrugated package for storage and transport | D989620 | June 11, 2020 | June 20, 2023 |

| Confectionary mold | D1002297 | April 27, 2021 | October 24, 2023 |

| Pallet | D1012416 | October 8, 2021 | January 23, 2024 |

| Confection | D1088397 | June 21, 2024 | August 19, 2025 |

(Source: Justia Patents)

Recent Developments

- In August 2025, Hershey entered a creative collaboration with Shaquille O’Neal, featuring glowing visuals, dynamic sound effects, and immersive candy-themed graphics, creating a one-of-a-kind sensory experience that celebrates the brand’s playful energy.

- In July 2025, Hershey joined forces with OREO to launch an innovative collaboration featuring two new co-branded treats. This fusion of Hershey’s signature chocolate and OREO’s iconic flavour offered fans a dual delight that redefined indulgent snacking experiences.

- In April 2025, Hershey announced an acquisition agreement with LesserEvil, a fast-growing manufacturer of organic and better-for-you snacks. This move strategically broadens Hershey’s reach in the health-conscious snacking market, complementing its established confectionery brands, such as Hershey’s, Reese’s, and Jolly Rancher, alongside salty snack labels like Dot’s Homestyle Pretzels, SkinnyPop, and Pirate’s Booty.

- In March 2025, Hershey collaborated with Jasmine Roth to introduce a fresh, family-friendly Easter campaign designed to inspire fun traditions and encourage creative celebrations through themed treats and engaging activities.

- In March 2025, Hershey also teamed up with 7-Eleven, Inc. to debut the Shaq-A-Licious XL Sour Pineapple Slurpee, inspired by Shaquille O’Neal’s Sour Pineapple gummy flavor. Available across Speedway, 7-Eleven, and Stripes stores nationwide, this limited-time release brought the candy’s bold flavor to life in a refreshing beverage experience.

(Source: The Hershey Company Press Releases)