Company Overview

Hormel Foods Statistics: Hormel Foods Corporation is a leading food processing and manufacturing company that develops, produces, and distributes a wide range of meat, nut, and food products for retail, foodservice, and commercial customers across the United States and global markets.

The company operates through 3 core segments: Retail, Foodservice, and International. The Retail segment focuses on processing, marketing, and selling food products primarily within the U.S. retail market and includes results from the company’s joint venture, MegaMex Foods, LLC. The Foodservice segment caters to restaurants, convenience stores, and commercial customers in the U.S., providing a variety of processed and ready-to-serve food products. The International segment manages Hormel’s global operations, encompassing processing, marketing, and sales of company products outside the United States, along with international joint ventures, equity investments, and royalty agreements.

Hormel Foods’ portfolio features category-leading brands ranked No. 1 or No. 2 in over 40 product categories. Its products are available in more than 75 countries, with a strong presence in markets such as the United States, China, Japan, Australia, South Korea, the Philippines, Brazil, Canada, and Panama.

History of Hormel Foods Corporation

1800’s

- 1891: George A. Hormel founded Geo. A. Hormel & Co. in Austin, Minnesota, marking the beginning of a legacy in food production.

- 1898: The company’s military support tradition began when three employees enlisted in the Spanish-American War, with George Hormel guaranteeing their jobs and benefits upon return.

1900’s

- 1901: The first sales branch was established in Minneapolis, strengthening Hormel’s regional distribution network.

- 1911: The company ran its first national advertisement in Ladies’ Home Journal, introducing Hormel products to a wider audience.

- 1926: A. Hormel & Co. developed the world’s first canned ham, transforming the meat industry through innovation in preservation.

- 1927–1928: George Hormel retired from daily management at 67, appointing his son Jay C. Hormel as acting president. The company went public in 1928.

- 1935–1941: Under Jay’s leadership, Hormel launched its most iconic products, including Dinty Moore beef stew, Hormel chilli, and SPAM brand.

- 1938: Hormel introduced guaranteed annual wages and an employee profit-sharing plan, pioneering fair labor practices in the food sector.

- 1941–1944: During World War II, Hormel shipped up to 15 million cans of SPAM weekly to support U.S. troops overseas.

- 1941–1942: The Hormel Foundation was established in 1941, followed by the establishment of The Hormel Institute in 1942, which focuses on research and community development.

- 1946: Jay C. Hormel launched the Hormel Girls, a women’s drum and bugle corps created to promote company products and morale.

- 1947: Tim Corey became the first company president outside the Hormel family, ushering in a new leadership era.

1950’s

- 1955: Under Bob Gray and Tommy Thompson, Hormel emphasized quality-focused innovation and market-driven product strategies.

- 1959–1963: Popular products such as Little Sizzlers pork sausage and Cure 81 hams were launched, while the company celebrated production of its 1 billionth can of SPAM.

- 1969: Led by Jim Holton, Hormel expanded its international presence and built 10 new domestic plants, including a flagship facility in Austin, Minnesota.

- 1973: Hormel became the first meatpacking company to feature nutritional labels on its meat products.

- 1976: Annual sales surpassed 1 billion dollars, driven by the success of core brands.

- 1979: Dick Knowlton took leadership and guided the company through a period of strong competition and innovation.

- 1982: A new 1,089,000 square-foot facility opened in Austin, representing a USD 100 million investment — the largest in company history.

- 1990: Hormel began trading on the New York Stock Exchange and announced its seventh two-for-one stock split.

- 1993: The company officially changed its name to Hormel Foods Corporation, reflecting its expanded market presence and product diversity.

2000’s

- 2000–2013: Under Jeff Ettinger, Hormel completed more than 10 acquisitions, including Skippy peanut butter, CytoSport (Muscle Milk), and Applegate Farms, while establishing the MegaMex Foods joint venture.

- 2011: Hormel introduced SPAMMY, a fortified turkey spread created to combat childhood malnutrition; over 25 million servings have been distributed.

- 2012: The SPAM brand celebrated its 75th anniversary with the introduction of Sir Can-A-Lot, the company’s first campaign mascot.

- 2014: Hormel collaborated with the Cancer Nutrition Consortium to develop Hormel Vital Cuisine, a product line tailored to cancer patients’ nutritional needs.

- 2015–2025: Under Jim Snee’s leadership, Hormel embarked on a decade of transformation, focusing on innovation, sustainability, and modernization.

- 2016: The company celebrated its 125th anniversary and inaugurated the new SPAM Museum in Austin, while CEO Jeff Ettinger was named among the World’s Best CEOs by Barron’s.

- 2017: Hormel expanded into South America through the acquisition of Cidade do Sol in Brazil, strengthening its global reach.

- 2020: The Inspired Pathways scholarship program was launched for employees’ children, alongside major facility expansions in Nevada and Nebraska to meet growing demand.

- 2020: A new health center was established in partnership with Premise Health to enhance team member wellness and healthcare access.

- 2021: Hormel acquired Planters and Corn Nuts, significantly expanding its footprint in the snacking industry.

- 2025: John Ghingo was appointed president, becoming the 11th individual to lead the company in its nearly 135-year history, marking the beginning of a new chapter for Hormel Foods.

(Source: Company Website)

Hormel Foods Employee Analysis Statistics

- As of October 27, 2024, the company employed approximately 20,000 active personnel.

- Over 90 per cent of the total workforce was based in the United States.

- Approximately 20 per cent of employees were covered under collective bargaining agreements.

- Contracts at 2 company facilities, representing nearly 300 employees, are scheduled to expire in the upcoming fiscal year.

(Source: Hormel Foods Corporation Annual Report)

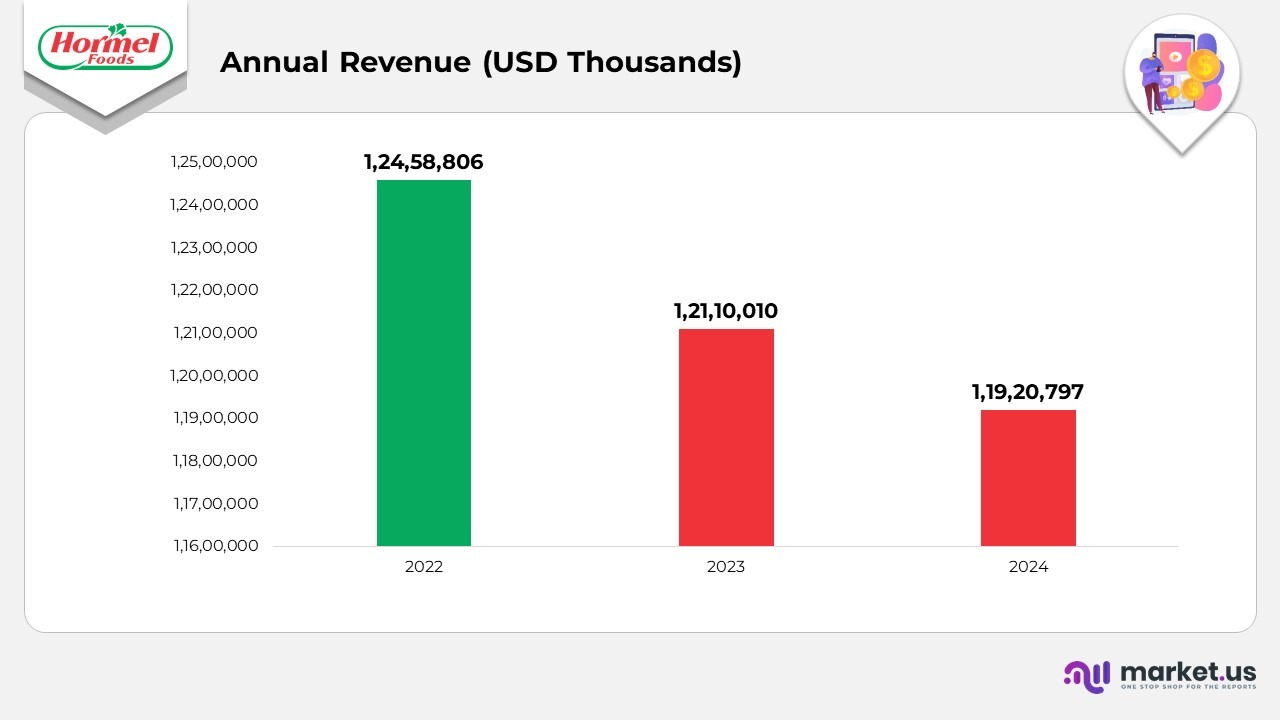

Financial Analysis

- In 2022, Hormel Foods recorded annual revenue of USD 12,458,806 thousand, reflecting strong post-pandemic market demand and stable retail performance.

- In 2023, revenue declined slightly to USD 12,110,010 thousand, representing an 8% YoY decrease, primarily due to inflationary pressures and cost adjustments within key segments.

- In 2024, revenue further moderated to USD 11,920,797 thousand, marking a 6% YoY decline compared to 2023, driven by softer consumer demand and cautious international spending.

- Overall, the company experienced a cumulative 3% revenue contraction from 2022 to 2024, reflecting a strategic transition period emphasizing operational efficiency and product portfolio optimization.

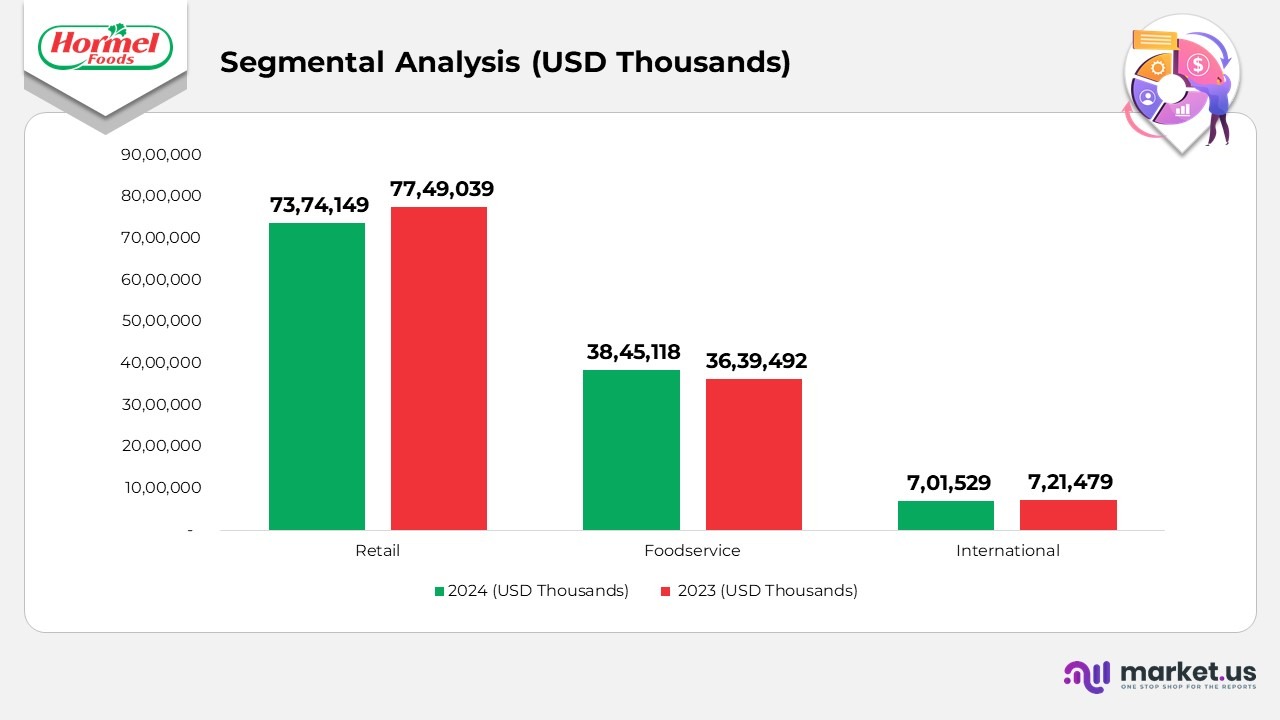

Hormel Foods Segmental Analysis Statistics

- The Retail segment generated USD 7,374,149 thousand in 2024, down 8% from USD 7,749,039 thousand in 2023, primarily due to pricing adjustments and the normalization of post-pandemic consumer spending.

- The Foodservice segment achieved USD 3,845,118 thousand in 2024, marking a 6% YoY growth from USD 3,639,492 thousand, supported by strong demand in quick-service and commercial food channels.

- The International segment posted USD 701,529 thousand, a 8% decline from USD 721,479 thousand in 2023, primarily due to currency headwinds and market softness in Asia.

- In terms of profitability, total segment profit for 2024 reached USD 1,251,144 thousand, an increase of 8% from USD 1,228,606 thousand in 2023, driven by operational efficiencies and cost optimization initiatives.

- The Retail segment profit was USD 562,768 thousand, a 6% decline from USD 577,690 thousand, reflecting margin pressure from competitive pricing.

- Foodservice profit rose modestly to USD 596,292 thousand in 2024, up 6% from USD 565,682 thousand, supported by volume gains in high-margin categories.

- International profit increased significantly to USD 92,084 thousand, representing a 7% rise from USD 55,234 thousand, reflecting stronger joint venture contributions and improved export performance.

- Net unallocated expenses totaled USD 215,304 thousand, remaining nearly flat compared to USD 214,482 thousand in 2023.

- Noncontrolling interest recorded a negative USD 407 thousand versus USD 653 thousand in the previous year, reflecting reduced minority share adjustments.

- Earnings before income taxes increased to USD 1,035,434 thousand in 2024, up 2% from USD 1,013,472 thousand in 2023, demonstrating the company’s resilience despite revenue moderation and inflationary pressures.

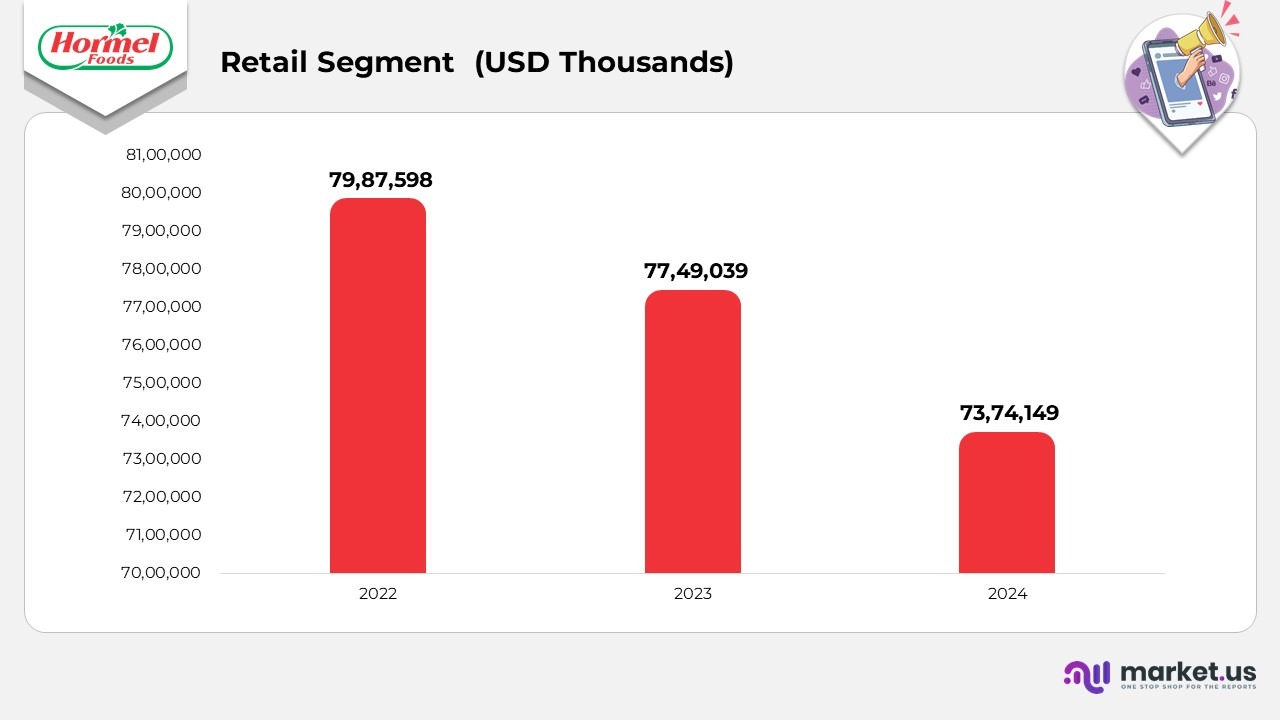

Retail Hormel Foods Statistics

- The retail segment recorded a total volume of 2,915,141 lbs in fiscal 2024, marking a 4.6% decline from 3,055,393 lbs in 2023, primarily attributed to easing consumer demand in certain packaged food categories.

- Net sales reached USD 7,374,149 thousand in 2024, representing a 4.8% decrease from USD 7,749,039 thousand in 2023, influenced by reduced shipment volumes and normalization in product pricing across key retail brands.

- Segment profit for 2024 totalled USD 562,768 thousand, a 2.6% decrease from USD 577,690 thousand in the prior year, primarily due to elevated production costs and increased marketing expenditures.

- Adjusted segment profit declined to USD 562,768 thousand in 2024 from USD 606,073 thousand in 2023, reflecting a 7.1% contraction amid inflationary cost pressures and a shift in consumer behavior toward budget-friendly options.

- Overall, the retail business faced moderate headwinds in 2024, maintaining steady profitability through disciplined cost management, brand resilience, and operational efficiency despite volume softness.

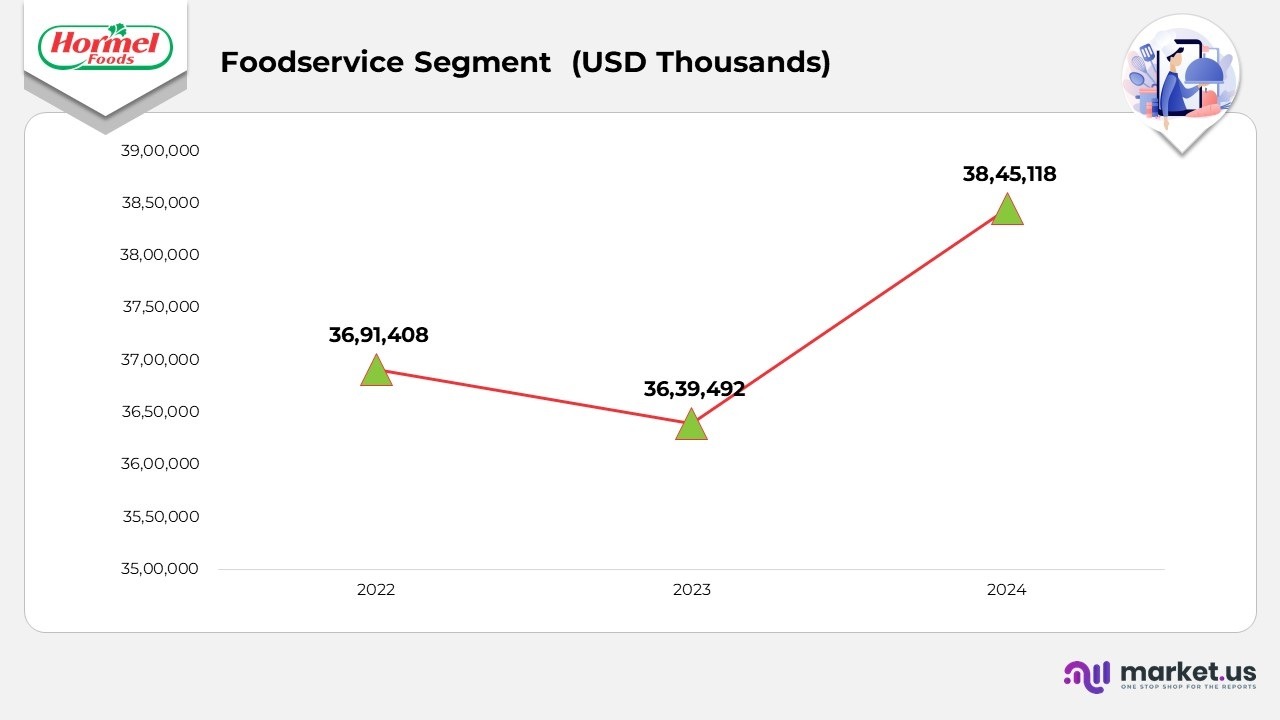

Hormel Foods Foodservice Statistics

- The foodservice segment achieved a total volume of 1,061,730 lbs in fiscal 2024, marking a 4% increase from 1,026,772 lbs in 2023, driven by increased demand for premium prepared proteins and snack-oriented offerings.

- Net sales amounted to USD 3,845,118 thousand in 2024, up 6% year-over-year from USD 3,639,492 thousand in 2023, supported by strong performance across premium meats, turkey, bacon, and pizza topping categories.

- Segment profit reached USD 596,292 thousand in 2024, representing a marginal 0.1% improvement from USD 595,682 thousand in 2023, as expanded sales of branded and international protein products helped offset higher operating costs.

- Growth momentum was fueled by the success of Heritage Premium Meats, Hormel Fire Braised meats, Jennie-O turkey, Planters snack nuts, and Cafe H protein lines, reflecting the rising consumer inclination toward convenient and protein-rich menu options.

- However, profitability faced slight pressure from lower margins in Heritage Premium Meats, poultry, and pizza topping categories, coupled with increased selling and administrative expenses.

- Overall, the foodservice division demonstrated resilient performance in 2024, supported by innovative product development, expanding protein portfolios, and sustained growth within the food-away-from-home segment.

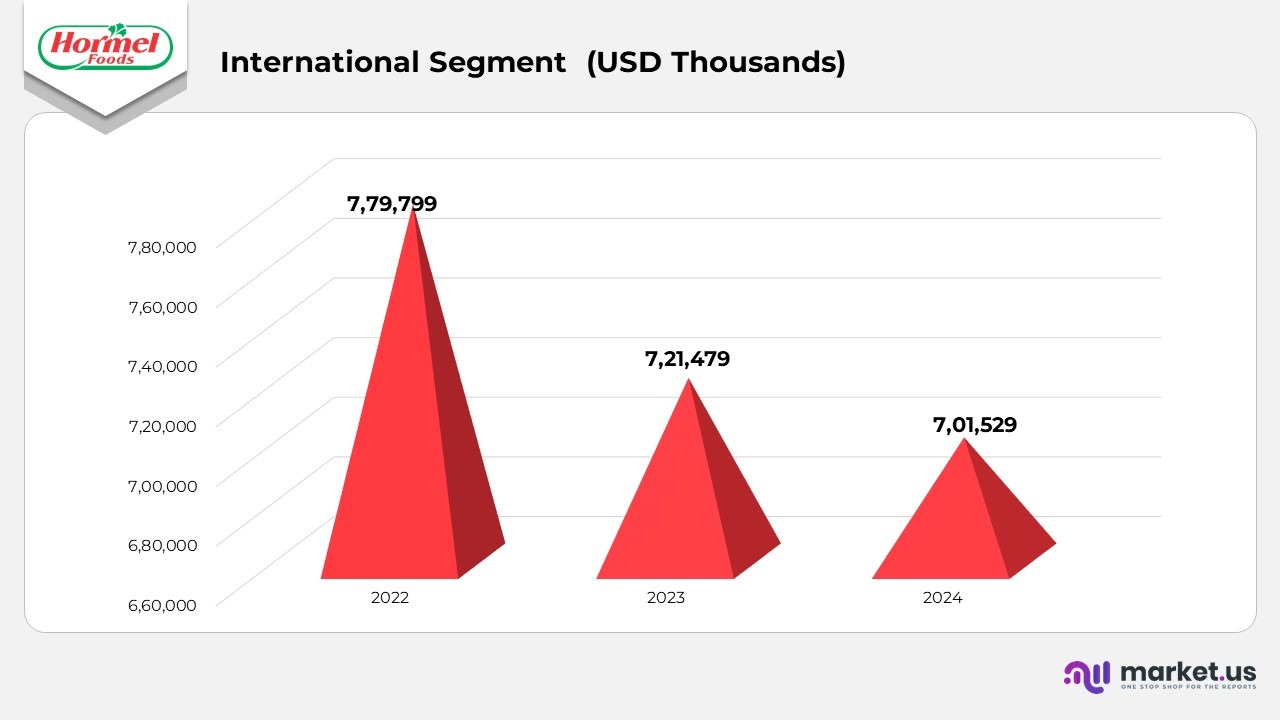

International

- The international segment posted a total volume of 311,419 lbs in fiscal 2024, a 5% reduction from 329,573 lbs in 2023, largely reflecting lower turkey export activity and shifting trade dynamics.

- Net sales totalled USD 701,529 thousand in 2024, a 2.8% decline from USD 721,479 thousand in 2023, primarily due to currency headwinds and reduced export volumes, despite a stronger performance in Asian markets.

- Segment profit rose sharply to USD 92,084 thousand in 2024, up 7% from USD 55,234 thousand in 2023, driven by the strength of branded exports and enhanced profitability from international joint ventures.

- Growth was primarily fueled by expanding demand in China and sustained momentum in branded exports of SPAM luncheon meat and Skippy peanut butter, reinforcing Hormel’s global brand leadership.

- Although overall shipment volumes moderated, profitability improved due to an optimized product portfolio, strategic pricing, and operational efficiencies across international operations.

- In summary, the international division achieved notable profit growth in 2024, underscoring the effectiveness of Hormel’s global expansion initiatives and strong positioning in key export markets.

(Source: Hormel Foods Corporation Annual Report)

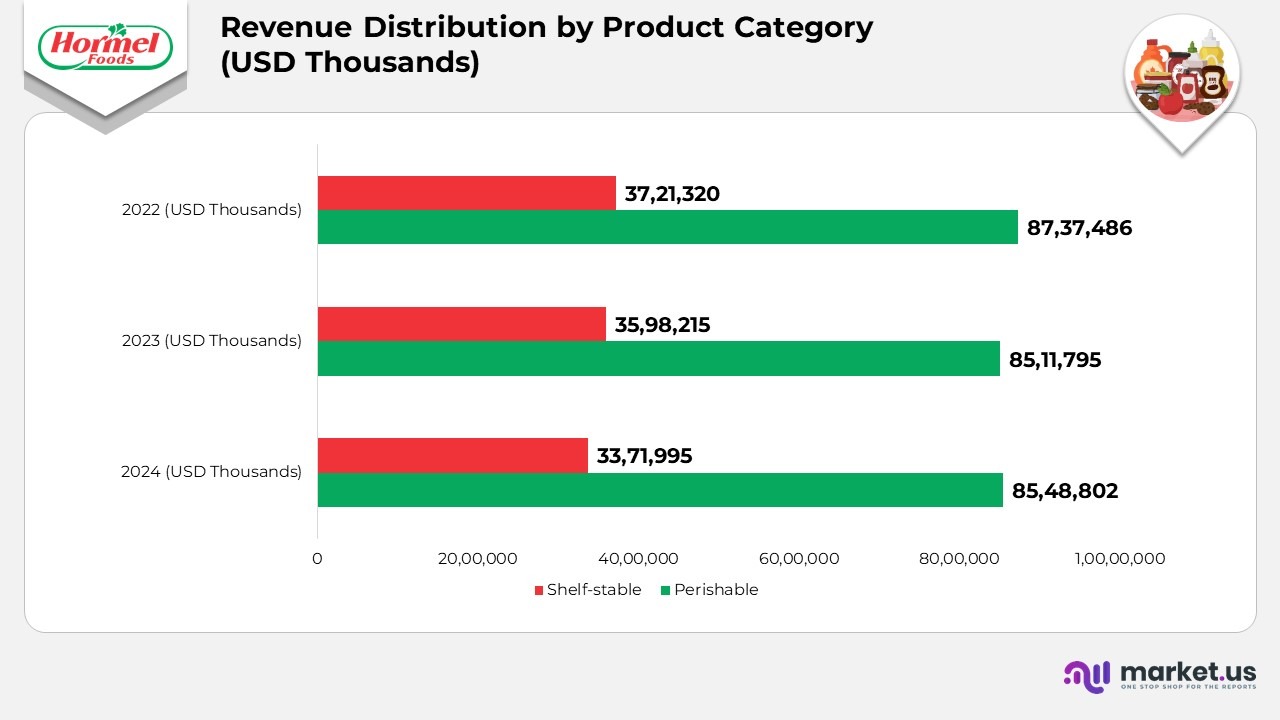

Revenue Distribution by Product Category

- The company’s total net sales for fiscal 2024 amounted to USD 11,920,797 thousand, reflecting contributions from both perishable and shelf-stable product categories.

- The Perishable category generated USD 8,548,802 thousand in 2024, compared to USD 8,511,795 thousand in 2023 and USD 8,737,486 thousand in 2022, indicating steady demand across key refrigerated offerings.

- The Shelf-stable category recorded USD 3,371,995 thousand in 2024, down from USD 3,598,215 thousand in 2023 and USD 3,721,320 thousand in 2022, reflecting normalization in packaged and canned product sales.

- Perishable products include fresh meats, frozen foods, refrigerated meal solutions, bacon, hams, sausages, guacamole, and other items that require refrigeration to maintain their quality.

- Shelf-stable products comprise canned luncheon meats, nut butters, snack nuts, chili, microwaveable meals, stews, tortillas, salsas, tortilla chips, nutritional supplements, and other non-refrigerated food items.

(Source: Hormel Foods Corporation Annual Report)

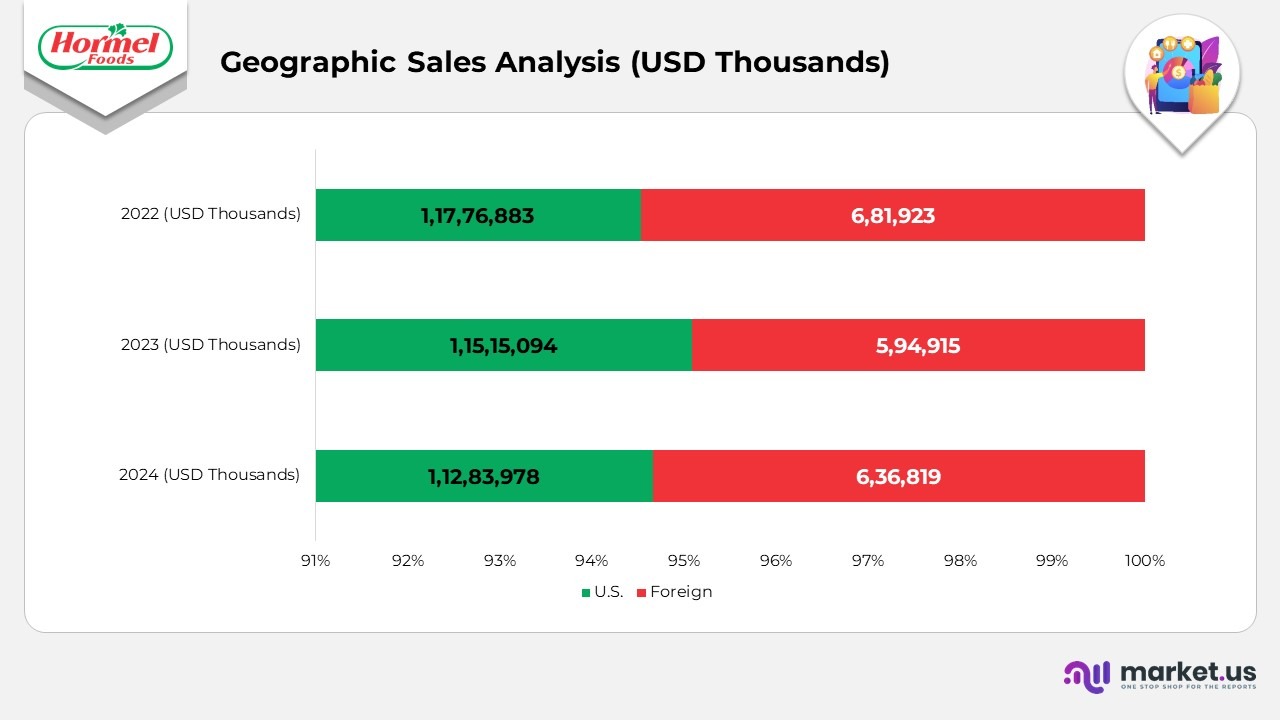

Geographic Sales Analysis

- The company’s S. operations generated USD 11,283,978 thousand in net sales during fiscal 2024, compared to USD 11,515,094 thousand in 2023 and USD 11,776,883 thousand in 2022, reflecting steady domestic performance with slight moderation.

- Foreign markets contributed USD 636,819 thousand in 2024, up from USD 594,915 thousand in 2023, but lower than the USD 681,923 thousand recorded in 2022, indicating a gradual stabilization in international demand and export activities.

- Hormel Foods maintained operations across all 50 U.S. states and multiple major international markets, underscoring its balanced domestic and global presence.

(Source: Hormel Foods Corporation Annual Report)

Hormel Foods Corporation Patents Portfolio

| Patent / Publication Title | Patent / Publication Number | Type | Filing Date | Publication / Grant Date |

|---|---|---|---|---|

| Microwaveable Packaged Food Product | 20210403222 | Application | September 14, 2021 | December 30, 2021 |

| Method of Producing Bacteria-Reduced Ground, Raw, Fresh, Meat Products | 10874113 | Grant | February 8, 2016 | December 29, 2020 |

| Composition Containing Non-Polar Compounds | 10335385 | Grant | April 15, 2014 | July 2, 2019 |

| Pork Belly Processing for Pre-Cooked Bacon | 8968808 | Grant | May 4, 2009 | March 3, 2015 |

| Adjustable Thermal Forming Die Assembly | 8919729 | Grant | May 12, 2011 | December 30, 2014 |

| Peanut Spread | 8906441 | Grant | September 14, 2012 | December 9, 2014 |

| Product Cutter | 8869668 | Grant | November 18, 2011 | October 28, 2014 |

| Metering Product Delivery Pump System | 8800813 | Grant | November 15, 2011 | August 12, 2014 |

| Compositions Containing Non-Polar Compounds | 8741373 | Grant | June 20, 2011 | June 3, 2014 |

| Apparatus and Method Using Electromagnetic Radiation for Stunning Animals to Be Slaughtered | 8568207 | Grant | March 15, 2013 | October 29, 2013 |

| Method for Reducing Microbial Contamination for Poultry | 8545922 | Grant | April 9, 2007 | October 1, 2013 |

| Method of Making Bacon Pieces | 8337934 | Grant | January 26, 2005 | December 25, 2012 |

| Package Vision Evaluation System | 8223200 | Grant | June 9, 2009 | July 17, 2012 |

| Modular Conveyor Belt | 8113340 | Grant | November 5, 2009 | February 14, 2012 |

| Use of High-Pressure Processing to Aid in Hair or Feather Removal from Animal Carcasses/Hides | 8062104 | Grant | September 29, 2009 | November 22, 2011 |

| Apparatus for Removing a Stockinette | 7934442 | Grant | May 12, 2005 | May 3, 2011 |

| Method and Apparatus for Material Handling for a Food Product Using High-Pressure Pasteurization | 7722912 | Grant | May 16, 2005 | May 25, 2010 |

| Turkey Loader | 6564751 | Grant | May 31, 2001 | May 20, 2003 |

| Bottle | D466022 | Grant | April 24, 2001 | November 26, 2002 |

| Jar | D476576 | Grant | April 24, 2001 | July 1, 2003 |

(Source: Justia Patents)

Recent Developments

- In October 2025, Hormel Foods partnered with Forward Consumer to finalize an agreement by year-end, under which the Justin’s branded business, known for its leading nut butters and USDA-certified organic chocolate delicacies, will transition into a standalone company. Ownership will be divided, with 51% held by Forward and 49% retained by Hormel Foods, reinforcing its strategy of fostering independent brand innovation.

- In October 2025, the company collaborated with Black Label Bacon and Frank’s RedHot to introduce a co-branded offering that combines crispy texture, savoury depth, and signature heat, creating a flavour experience designed to appeal to both fan bases.

- In September 2025, Hormel Foods launched a playful marketing campaign, Pepperoni Insurance, in celebration of National Pepperoni Pizza Day. The initiative allowed customers to claim a free pack of Hormel pepperoni, ensuring every pizza was “properly protected” while supplies lasted.

- In August 2025, the La Victoria brand unveiled a new range of topping sauces designed to elevate everyday meals with bold, Mexican-inspired flavour fusions. The lineup reflects Hormel’s continued focus on authentic taste innovation and premium culinary experiences.

Moreover

- In May 2025, Justin’s expanded its organic chocolate treat portfolio with the introduction of mindful candy bars catering to diverse snacking moments. Available in 1.4-ounce single-serve bars, priced between USD 2.49 and USD 2.79, and 4.2-ounce multi-serve pouches featuring six mini bars, priced between USD 6.79 and USD 7.49, the launch underscores Justin’s commitment to cleaner indulgence.

- In April 2025, Hormel’s SPAM brand partnered with Disney’s live-action film adaptation of Lilo & Stitch, launching a nationwide campaign starting May 5. The collaboration celebrated the shared cultural heritage of Hawai‘i and the enduring global appeal of both the SPAM brand and the beloved character Stitch.

- In April 2025, Applegate introduced two new frozen chicken items—Applegate Naturals Lightly Breaded Chicken Tenders and Applegate Naturals Lightly Breaded Popcorn Chicken. Made from whole cuts of white meat, humanely raised without antibiotics, these gluten-free products deliver a crisp, flavorful, and minimally processed snacking experience.

- In February 2025, Applegate Farms, LLC launched Applegate Naturals Breakfast Sandwiches, a ready-to-heat-and-eat offering designed for on-the-go convenience, further expanding its footprint in the better-for-you frozen breakfast segment.

(Source: Hormel Foods Corporation Press Releases)