Company Overview

Archer Daniels Midland Statistics: Archer-Daniels-Midland Company (ADM) is a leading global enterprise in human and animal nutrition and a key player in the agricultural supply chain. The company plays an essential role in supporting global food security by connecting agricultural producers with markets worldwide through a well-integrated network of sourcing, processing, and distribution capabilities. ADM offers one of the most comprehensive portfolios of natural ingredients and nutrition solutions across the food, beverage, and feed industries, serving as a bridge between local supply and global demand.

The company operates through 3 major business segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition. The Ag Services and Oilseeds segment oversees the origination, procurement, transportation, and storage of agricultural commodities and oilseeds, including sunflower seed, soybeans, canola, rapeseed, cottonseed, and flaxseed. This segment also handles oilseed crushing and refining, producing vegetable oils and protein meals for food, feed, and industrial applications.

The Carbohydrate Solutions segment focuses on the wet and dry milling of corn and wheat, converting these grains into a variety of high-value products used across the food, beverage, and industrial sectors. Its offerings include sweeteners, corn and wheat starches, glucose, syrups, dextrose, and flour. These ingredients serve as foundational components for baked goods, beverages, confectionery, and bio-based products, reflecting ADM’s strategic focus on both nutrition and sustainable materials.

Moreover

The Nutrition segment serves diverse end markets, including food, beverages, dietary supplements, livestock feed, aquaculture, and pet nutrition. It specializes in the development, manufacturing, and distribution of a wide range of natural and functional ingredients, including plant-based proteins, soluble fibers, emulsifiers, polyols, hydrocolloids, probiotics, enzymes, botanical extracts, and flavor systems. This segment emphasizes innovation through nature-derived solutions that enhance taste, texture, and nutritional value for both human and animal consumption.

ADM’s product portfolio spans natural colors and flavors, nutritional and health ingredients, corn sweeteners, biofuels, vegetable oils, flour, and animal feed. Supported by one of the most extensive global networks of grain elevators, processing facilities, and transportation systems, the company efficiently procures, cleans, stores, and distributes agricultural commodities such as oilseeds, barley, corn, wheat, milo, and oats, transforming them into essential products that nourish people and support industries worldwide.

| Region | Description | Innovation Centers | Processing Plants | Procurement Centers |

|---|---|---|---|---|

| Asia-Pacific | Focused on ensuring a secure and efficient supply of products to meet growing regional demand for food, feed, and nutrition solutions. | 8 | 25 | 59 |

| South America | Works closely with growers and partners to provide soybean meal, edible oils, and food and beverage ingredients across regional markets. | 5 | 39 | 69 |

| EMEA (Europe, Middle East & Africa) | Covers the full agricultural value chain, from sourcing raw materials to delivering finished food, feed, and industrial products. | 20 | 81 | 114 |

| North America | ADM’s founding region since 1902, now serving as the core of global operations and innovation with extensive production and supply capabilities. | 29 | 182 | 278 |

History of Archer Daniels Midland

- 1902: Daniels Linseed Co. was founded in Minneapolis, marking the beginning of what would later evolve into Archer-Daniels-Midland Company (ADM).

- 1903: George A. Archer joined the company, forming a partnership that would shape its direction and future growth.

- 1923: The firm officially changed its name to Archer-Daniels-Midland Company, symbolizing its new corporate identity and expansion vision.

- 1924: ADM became publicly listed on the New York Stock Exchange, gaining access to capital for large-scale operations and acquisitions.

- 1927: The company established a new grain division, further integrating itself into the agricultural supply chain.

- 1929: ADM began crushing soybeans and acquired the flour milling business of Commander Larabee, diversifying its processing capabilities.

- 1963: Construction of the company’s first export terminal in the Gulf of Mexico expanded ADM’s global trade capacity.

- 1967: ADM entered the barge freight business, enhancing its inland transportation and logistics network.

- 1969: The company relocated its headquarters to Decatur, Illinois, positioning itself closer to America’s agricultural heartland.

- 1974: ADM acquired its first soybean processing facilities in South America and Europe, establishing a global production footprint.

- 1979: The creation of ADM Trucking strengthened the company’s logistics and transportation efficiency.

- 1986: ADM formed Golden Peanut Company, marking its entry into the peanut processing industry.

- 1994: The company made a strategic investment in Wilmar International, expanding its influence across Asian agricultural markets.

- 1997: ADM acquired Glencore’s Brazilian operations and entered the edible beans business, expanding its product portfolio.

2000’s

- 2009: The company launched ADM Cares, a corporate giving initiative, and constructed its first wholly owned food elements facility in China.

- 2014: ADM acquired WILD Flavors and moved its global headquarters to Chicago, strengthening its leadership in flavor and ingredient innovation.

- 2015: The company acquired Eatem Foods, expanding its specialty food ingredient offerings.

- 2016: ADM acquired a majority stake in Biopolis and introduced ADM Medsofts, enhancing its biotechnology and agri-services portfolio.

- 2017: The company acquired Crosswind Industries, Inc. and Chamtor, expanding into pet nutrition and wheat processing.

- 2018: ADM acquired Rodelle, Protexin, and Algar Agro assets, increasing its capabilities in natural ingredients and animal nutrition.

- 2019: The company acquired Neovia, joined the Paradigm for Parity coalition, and purchased Florida Chemical Company to strengthen its citrus ingredients portfolio.

- 2020: ADM acquired Yerbalatina Phytoactives, a Brazilian manufacturer of plant-based extracts and natural ingredients, reinforcing its focus on sustainable nutrition solutions.

(Source: Company Website)

Archer Daniels Midland Statistics By Employee Analysis

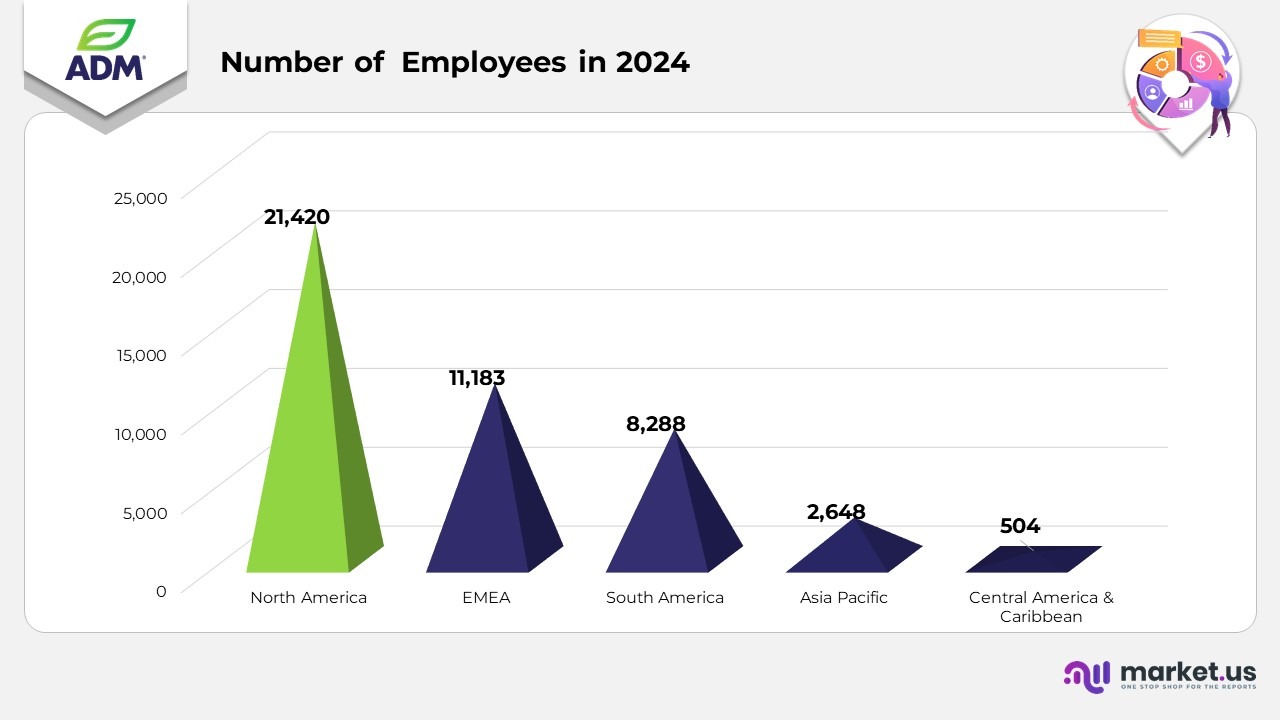

- In North America, Archer-Daniels-Midland (ADM) employed 21,420 individuals, including 10,034 salaried, 11,171 hourly, and 215 part-time employees in 2024. This region represented ADM’s largest workforce hub, driven by extensive grain processing, oilseed crushing, ethanol production, and logistics operations across the United States and Canada.

- The EMEA region employed 11,183 people, consisting of 5,985 salaried, 4,658 hourly, and 540 part-time workers. EMEA maintained a higher proportion of salaried professionals, reflecting ADM’s strong focus on commodity trading, food ingredient innovation, and research centers in Europe.

- In South America, ADM’s workforce totaled 8,288, comprising 2,904 salaried, 4,511 hourly, and 873 part-time employees. The region had the highest share of part-time workers, largely due to the seasonal nature of crop processing and flexible employment models across Brazil and Argentina.

- The Asia Pacific workforce reached 2,648 employees, with 1,817 salaried, 805 hourly, and 26 part-time positions. This region maintained a high ratio of salaried employees, highlighting ADM’s growing investment in nutrition, plant-based proteins, and food innovation centers across China, India, and Singapore.

- In Central America and the Caribbean, ADM employed 504 people: 238 salaried, 260 hourly, and 6 part-time. Although it had the smallest regional workforce, it supported key port operations and trading offices that facilitated commodity exports and regional distribution.

- Overall, Archer-Daniels-Midland employed 44,043 individuals globally, including 20,978 salaried, 21,405 hourly, and 1,660 part-time employees. North America and EMEA together accounted for over 74% of ADM’s global workforce, underscoring its strong presence in developed agricultural markets and its strategic expansion into emerging regions.

(Source: Archer-Daniels-Midland Company Annual Report)

Financial Analysis

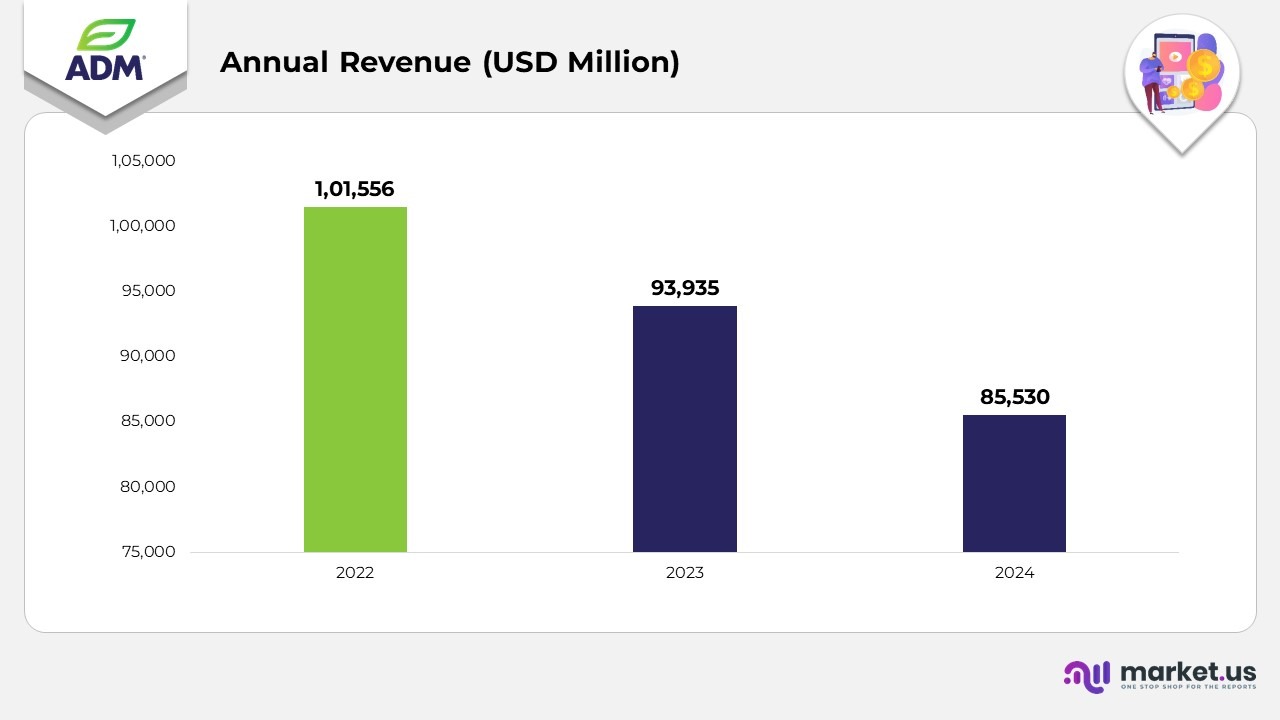

- In 2022, Archer-Daniels-Midland (ADM) generated USD 101,556 million in revenue, supported by strong global demand and high market prices for soybeans, corn, wheat, and edible oils. Favorable trading conditions and export volumes contributed to growth.

- In 2023, revenue fell to USD 93,935 million as commodity prices eased from previous highs. Despite lower prices, stable demand in oilseeds and carbohydrate solutions helped sustain overall performance.

- In 2024, revenue declined further to USD 85,530 million, down USD 8.4 billion or -8.9% from 2023. The drop resulted mainly from lower prices across soybeans, corn, meal, oils, wheat, and alcohol, partially offset by higher sales volumes of these products and flavors.

- From 2022 to 2024, ADM’s total revenue decreased by USD 16.0 billion, reflecting normalization in global commodity markets after a period of record-high pricing.

Geographical Revenue

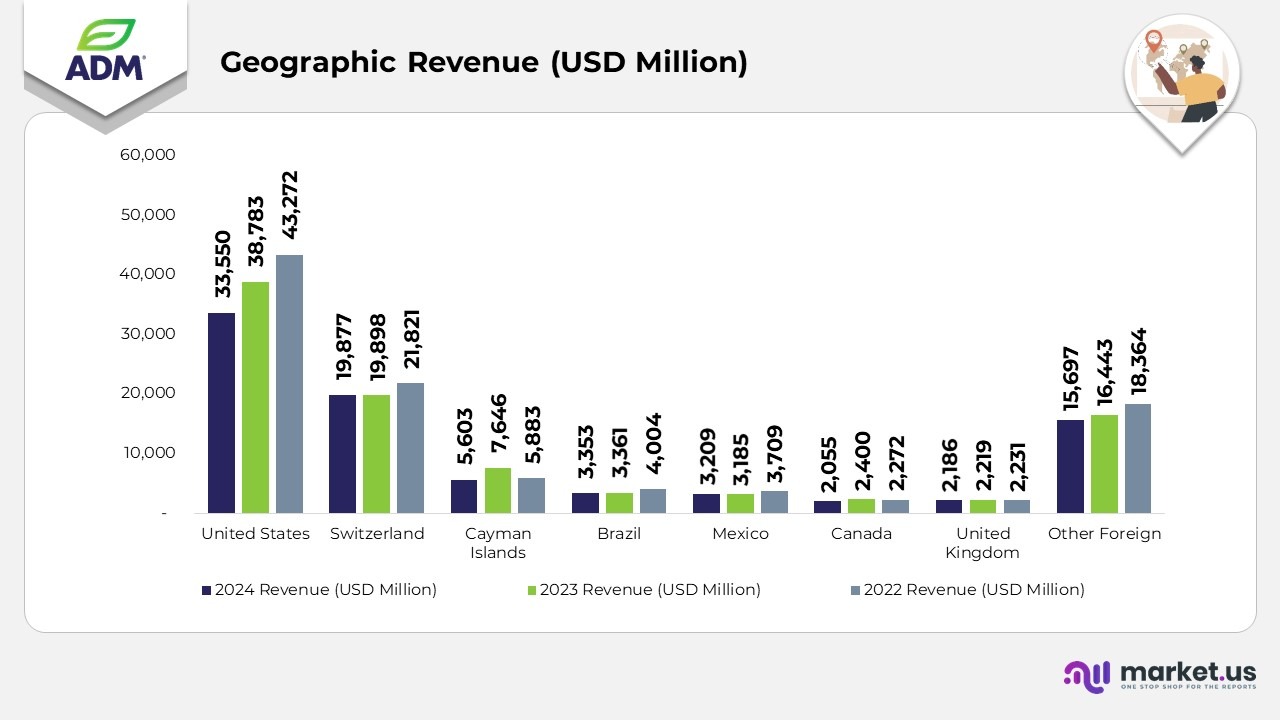

- In 2024, Archer-Daniels-Midland (ADM) reported total revenue of USD 33,550 million from the United States, a decline from USD 38,783 million in 2023 and USD 43,272 million in 2022, reflecting lower commodity prices and reduced trading activity.

- Switzerland contributed USD 19,877 million in 2024, nearly stable compared with USD 19,898 million in 2023, but slightly below USD 21,821 million in 2022, reflecting moderate fluctuations in global trade.

- The Cayman Islands generated USD 5,603 million in 2024, down from USD 7,646 million in 2023, indicating a reduction in export-related revenue compared to the prior year’s elevated levels.

- In Brazil, revenue totalled USD 3,353 million in 2024, up from USD 3,361 million in 2023 and USD 4,004 million in 2022, demonstrating steady performance despite challenging commodity market conditions.

- Mexico recorded USD 3,209 million in 2024, up slightly from USD 3,185 million in 2023 but below USD 3,709 million in 2022, supported by consistent demand for food and feed ingredients.

- Canada contributed USD 2,055 million in 2024, a decline from USD 2,400 million in 2023 and USD 2,272 million in 2022, impacted by softening grain export volumes.

- The United Kingdom posted USD 2,186 million in 2024, relatively stable compared to USD 2,219 million in 2023 and USD 2,231 million in 2022, with strong activity in nutrition and ingredient solutions offsetting modest declines in agricultural trade.

- Other foreign markets collectively generated USD 15,697 million in 2024, compared to USD 16,443 million in 2023 and USD 18,364 million in 2022, reflecting broader global market corrections and lower commodity price realizations across international operations.

(Source: Archer-Daniels-Midland Company Annual Report)

Segmental Analysis of Archer Daniels Midland Statistics

Ag Services and Oilseeds Segment in Archer Daniels Midland Statistics

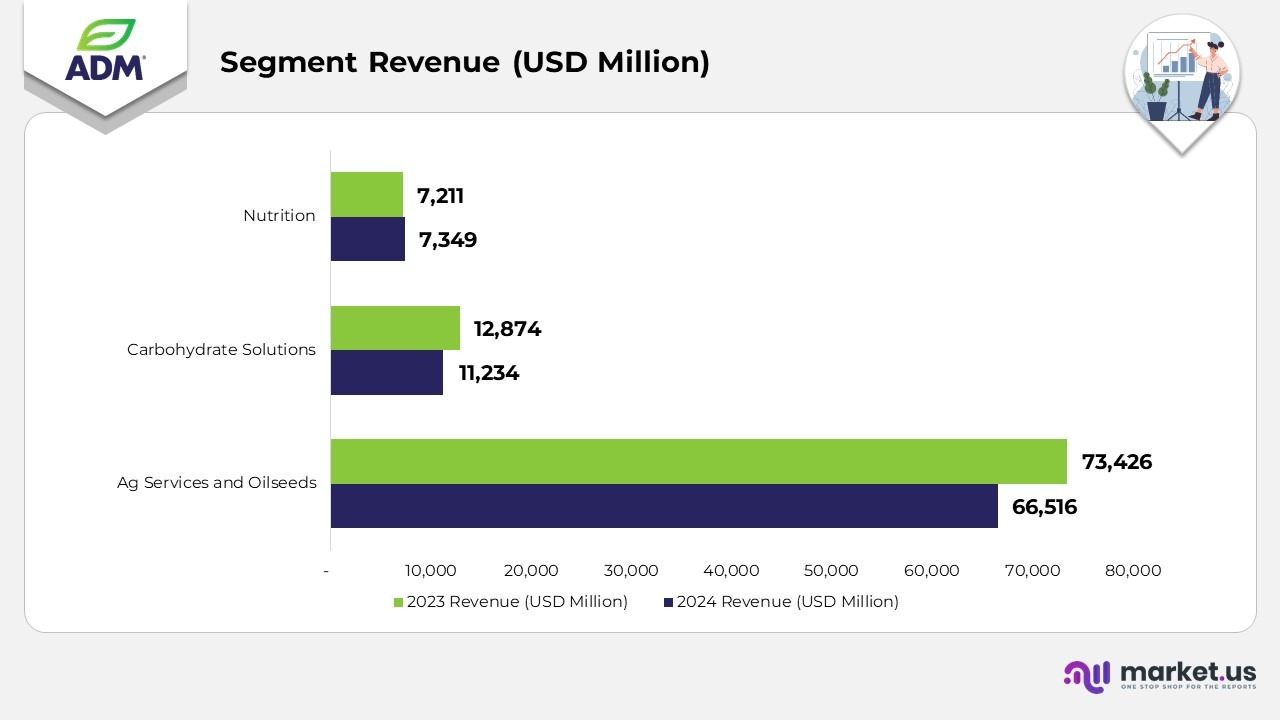

- In 2024, the Ag Services and Oilseeds segment generated USD 66,516 million, down from USD 73,426 million in 2023, reflecting softer global market prices and narrower trading margins.

- Ag Services contributed USD 44,083 million in 2024, down from USD 47,420 million in 2023, primarily due to lower grain volumes and decreased price realizations across export markets.

- The Crushing business reported USD 11,836 million in 2024, compared with USD 14,020 million in 2023. The decline stemmed from weaker oilseed processing margins, especially in soybeans and soft seeds.

- Refined Products and Other brought in USD 10,597 million in 2024, slightly below USD 11,986 million in 2023, affected by lower vegetable oil prices and reduced biodiesel demand in certain regions.

Carbohydrate Solutions Segment in Archer Daniels Midland Statistics

- Total revenue from Carbohydrate Solutions stood at USD 11,234 million in 2024, down from USD 12,874 million in 2023, influenced by declining global sweetener prices and softening starch demand.

- The Starches and Sweeteners division earned USD 8,587 million in 2024, down from USD 9,885 million in 2023, driven by lower corn prices and moderating beverage sector demand.

- Vantage Corn Processors contributed USD 2,647 million in 2024, slightly lower than USD 2,989 million in 2023, impacted by reduced ethanol margins and lower industrial alcohol sales.

Nutrition Segment in Archer Daniels Midland Statistics

- The Nutrition segment achieved USD 7,349 million in 2024, a modest increase from USD 7,211 million in 2023, supported by steady growth in specialty ingredients and health-focused product lines.

- Human Nutrition revenue reached USD 3,944 million in 2024, up from USD 3,634 million in 2023, driven by higher demand for plant-based proteins, probiotics, and flavor systems.

- Animal Nutrition contributed USD 3,405 million in 2024, compared to USD 3,577 million in 2023. The slight decline reflected lower feed additive pricing and mixed demand trends across livestock and aquaculture sectors.

(Source: Archer-Daniels-Midland Company Annual Report)

Recent Developments

- In August 2024, the company partnered with Farmers Business Network to enhance the Gradable technology platform, enabling farmers and grain buyers to derive greater value from crops produced through sustainable, regenerative practices.

- In March 2024, the company collaborated with Water.org, contributing USD 1 million to support global access to safe water and sanitation, improving the lives of millions worldwide.

- In January 2024, the company shipped its first verified and fully traceable soybean vessels from the U.S. to Europe. In anticipation of the EU deforestation regulations, ADM plans to expand traceability operations across North America during the 2024 growing season.

- In December 2023, the company signed an agreement to acquire Revela Foods, a leading provider of dairy flavour ingredients and solutions, thereby strengthening its speciality ingredients portfolio.

- In November 2023, the company expanded its global regenerative agriculture program to Brazil, focusing on soil health, biodiversity, and sustainable farming productivity.

- In October 2023, the company partnered with Solugen to scale plant-based specialty chemicals and bio-based molecular building blocks. Under the agreement, Solugen will build a 500,000 sq.ft. biomanufacturing facility next to ADM’s corn complex in Marshall, Minnesota, using ADM’s dextrose to produce lower-carbon organic acids.

- In September 2023, the company and the Syngenta Group signed a Memorandum of Understanding (MoU) to develop low-carbon oilseeds and next-generation crop varieties to support the growing biofuels market.

- In May 2023, the company partnered with Air Protein to advance the development of landless protein solutions, driving innovation in sustainable food production.

- In February 2023, the company opened a new manufacturing facility in Valencia, Spain, to meet rising global demand for postbiotics, probiotics, and wellness-related ingredients.

(Source: Archer-Daniels-Midland Company Press Releases)