Global Zero UI Technologies Market Size, Share, Industry Analysis Report By Component (Hardware (Sensors, Cameras, Microphones, Specialized Modules, Edge Chips), Software (Voice Platforms, Gesture SDKs , Gaze Analytics, Intent Engines, Middleware), Services (Integration, Customization, UX Design, Managed Services)), By Deployment (Cloudbased, Edge/Ondevice, Hybrid), By Technology (Voice/Speech Recognition, Gesture & Motion Recognition, Touch & Haptic Surfaces, Computer Vision & Gaze Tracking, BrainComputer Interfaces (BCI), Others), By Application (Smart Home & Consumer Electronics, Automotive, AR/VR/Gaming, Healthcare & Assistive Tech, Retail & Kiosks, Industrial & Enterprise, Public Spaces & Hospitality), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162901

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Generative AI

- Consumer Adoption

- Impact on Experience and Efficiency

- User Behavior and Pain Points

- Investment and Business Benefit

- US Market Size

- Emerging Trends

- Growth Factors

- By Component

- By Deployment

- By Technology

- By Application

- Key Market Segment

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

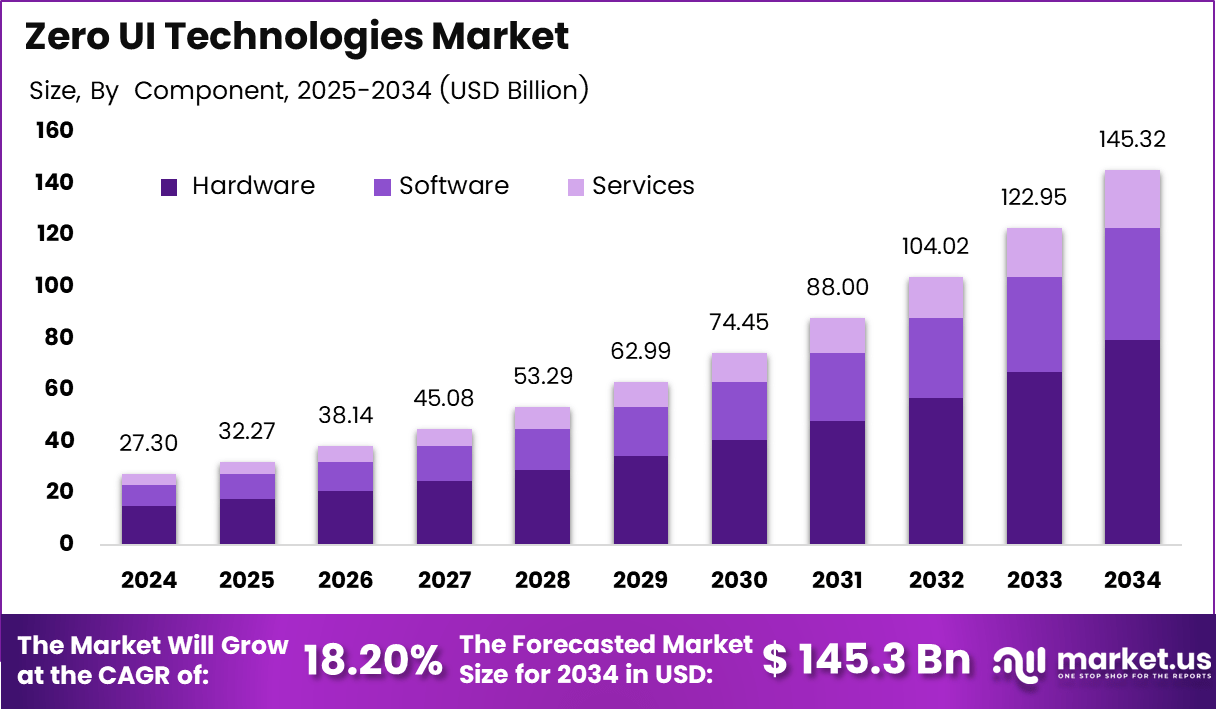

The Global Zero UI Technologies Market was valued at USD 27.3 billion in 2024 and is projected to reach USD 145.3 billion by 2034, expanding at a CAGR of 18.2%. The market growth is driven by the rising adoption of intuitive, touchless, and multimodal user interfaces integrating voice, gesture, and gaze-based interactions.

The Zero UI technologies market refers to systems and platforms that enable human-technology interaction without the reliance on traditional graphical user interfaces such as screens, buttons or menus. These technologies use voice, gesture, contextual sensing, ambient computing, artificial intelligence, and other modalities to enable natural and often invisible interaction. The concept of Zero UI is gaining traction as organisations and consumers seek more intuitive, embedded and seamless experiences.

Top driving factors for Zero UI adoption include user demand for convenience and hands-free control, especially in connected devices like smart speakers and wearables. Voice user interfaces lead this market segment, supported heavily by AI-powered natural language processing that makes voice commands accurate and context-aware. Gesture recognition and motion tracking add another layer of natural interaction, making it easier for users to perform tasks without physical touch.

Demand for Zero UI technologies is strongest in environments where hands-free or ambient interaction provides clear value. Smart home and IoT systems, automotive cockpit interfaces, retail and store environments, healthcare monitoring and wearable devices are key areas. For example, smart home devices increasingly support voice and gesture controls instead of touch screens.

Key Takeaways

- The Hardware segment dominated with 54.6%, driven by the rising use of sensors, cameras, and microphones that enable intuitive, touch-free user interactions.

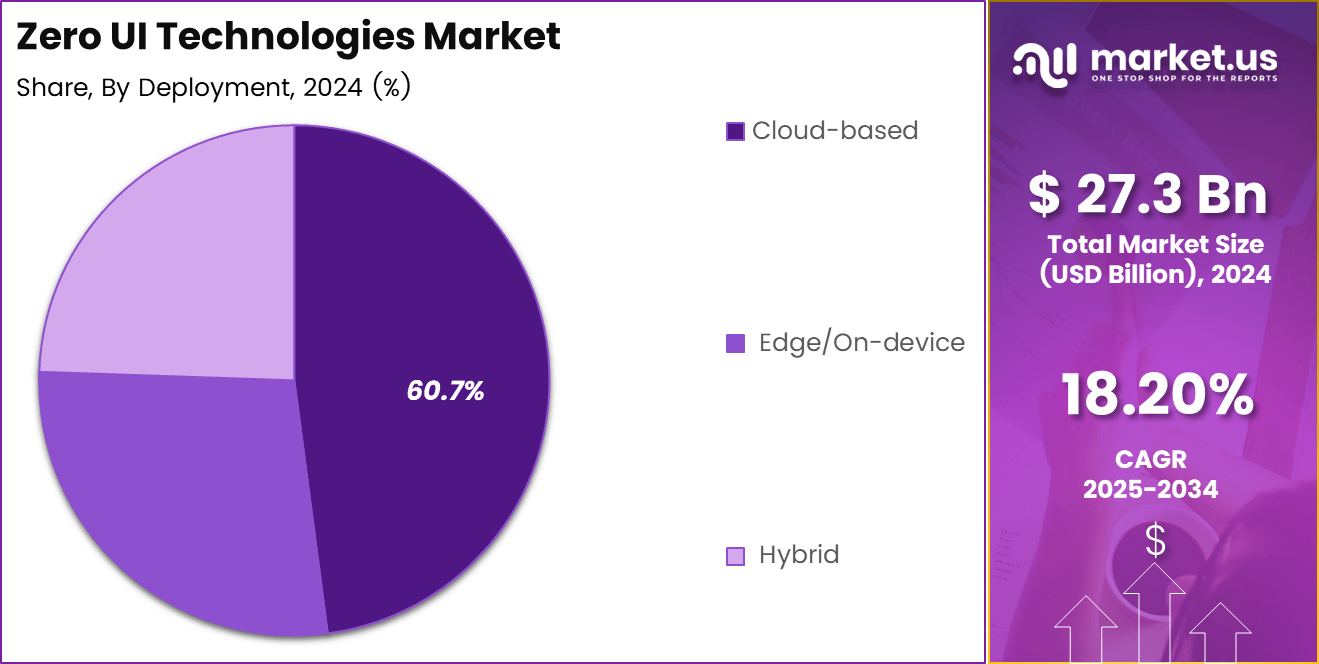

- Cloud-based deployment held 60.7%, reflecting growing reliance on cloud infrastructure for processing natural interactions and managing real-time data.

- Voice/Speech Recognition technology led with 65.3%, supported by its widespread integration into smart devices, automotive systems, and virtual assistants.

- The Smart Home & Consumer Electronics segment accounted for 45.1%, highlighting strong adoption in AI-powered home automation and connected devices.

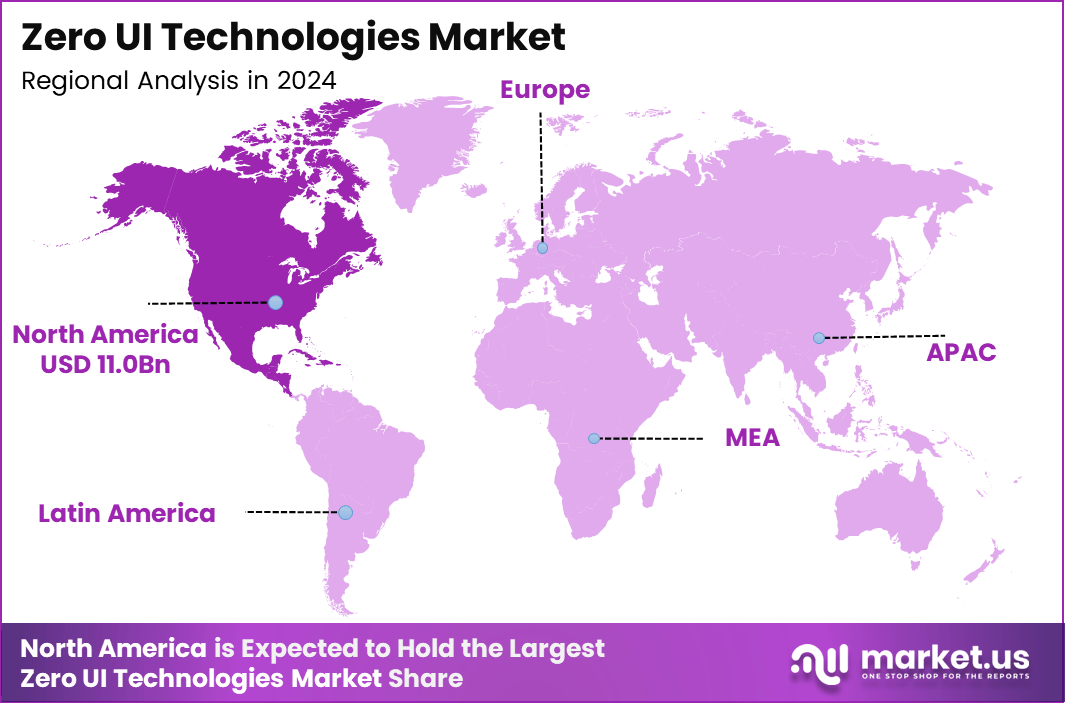

- North America captured 40.4% of the global market, driven by early adoption of AI-driven interfaces and advanced connected ecosystems.

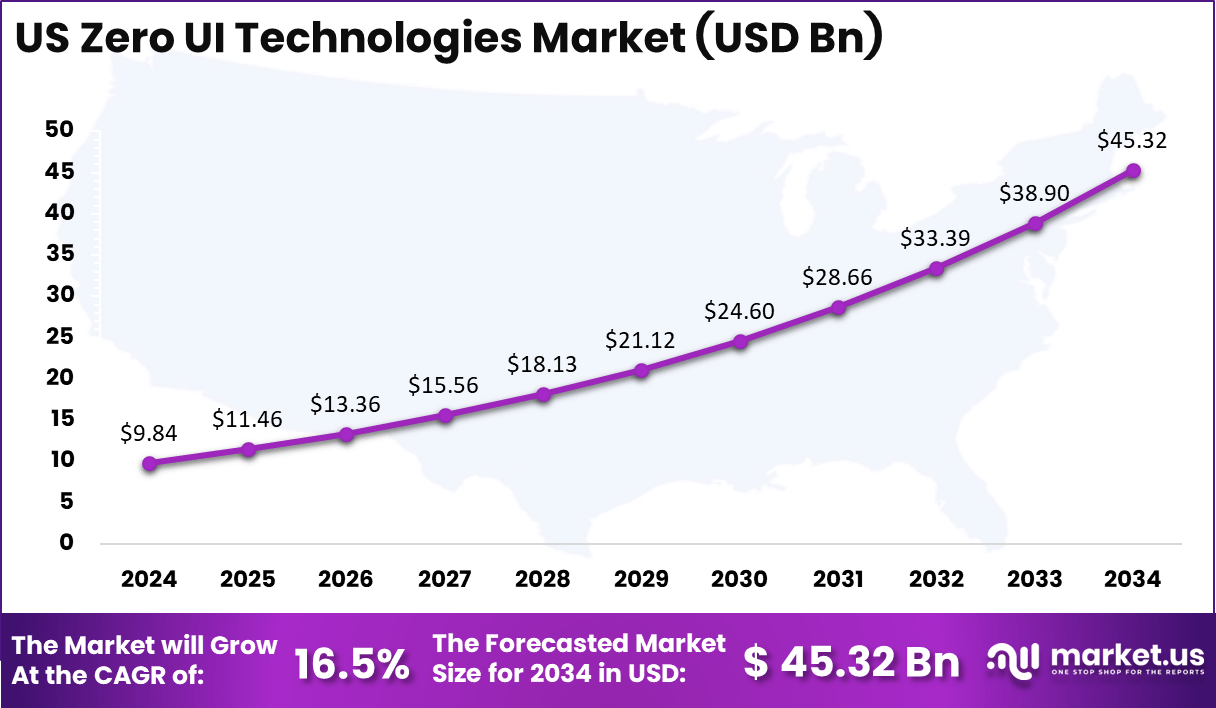

- The US market reached USD 9.84 Billion in 2024, expanding at a robust 16.5% CAGR, fueled by rapid innovation in voice-enabled devices and gesture-based control technologies.

Role of Generative AI

Generative AI plays a central role in shaping Zero UI technologies by enabling more natural and adaptive interactions. Around 80% of enterprises are expected to deploy generative AI applications by 2026, highlighting its rapid adoption and influence.

These AI models power voice assistants and gesture recognition systems that understand context through multiple input streams like voice, visuals, and sensor data. This multimodal capability allows Zero UI systems to respond in ways that feel intuitive and human-like, moving beyond mere text to comprehend and act on rich environmental cues.

These generative AI-driven interfaces also continually learn from user interactions, improving accuracy and personalization. For instance, AI tools can remember user preferences and previous interactions, making future engagements smoother and more relevant. This intelligent adaptation is a key reason behind the growing reliance on Zero UI systems, especially in consumer electronics and smart environments, where seamless, hands-free control is crucial.

Consumer Adoption

- Hands-free technology: A 2023 survey revealed that 62% of consumers planned to increase their use of hands-free technologies, such as voice commands, in the post-pandemic era.

- Voice search preference: In the U.S., 40% of users now prefer voice-based queries over typing, with this percentage continuing to rise each year as conversational interfaces become more natural and widely available.

- Zero-click search results: Research from Bain & Company shows that nearly 80% of consumers rely on zero-click search results for at least 40% of their queries, underscoring a growing demand for faster, frictionless access to information.

- Interest in touchless experiences: Findings from Capgemini indicate that 77% of customers expect non-touch interactions, while more than 62% believe this expectation will persist beyond the pandemic.

Impact on Experience and Efficiency

- Conversion rates: A 2025 survey of 500 respondents showed that using voice platforms drove an 18% increase in conversion rates compared to traditional screen-based marketing approaches.

- Time savings and productivity: Employees typically waste an average of 2.5 hours daily switching between applications. Zero UI implementations can address this inefficiency. For example, Domino’s Pizza adopted voice-enabled ordering, achieving a 95% accuracy improvement and 60% faster completion times.

- Improved engagement: Research on screenless capacitive sensing in tabletop gaming found that players engaged more and learned faster, with average turn durations reduced by 20% compared to traditional setups.

- Reduction of screen fatigue: With average global screen time approaching 7 hours per day, zero UI technologies are helping reduce screen fatigue and cognitive overload by shifting interactions away from visual interfaces.

User Behavior and Pain Points

- Frustration with traditional interfaces: App complexity continues to be a major barrier to retention. Studies show that 67% of customers abandon applications they find confusing, while 73% delete apps within the first week of download, highlighting the importance of intuitive design.

- Increased efficiency concerns: Workflow inefficiencies are significant in workplace environments. Employees spend an average of 2.5 hours per day switching between applications, reducing productivity and increasing operational friction.

- Voice search preference: User interaction patterns are shifting toward voice-enabled technologies. In the United States, 40% of users already prefer conducting queries through voice rather than typing, reflecting a growing comfort with conversational interfaces.

- Conversational search: The nature of search behavior is evolving. Approximately 53% of voice searches are for “fun questions” rather than direct needs, suggesting that users view conversational search as both functional and exploratory, reinforcing engagement with voice-first platforms.

Investment and Business Benefit

Investment opportunities are significant in the development of sophisticated hardware sensors, AI and machine learning models, and edge computing infrastructure that supports Zero UI. Investors are focused on funding startups and enterprises building advanced speech recognition, gesture control systems, and AI software that anticipates user needs in real time.

The increasing venture capital interest is driven by Zero UI’s potential to disrupt traditional UI markets and expand into novel application areas such as brain-computer interfaces, gesture-controlled smart devices, and fully autonomous ambient systems. Strategic investment in privacy and security frameworks is also essential to address growing concerns and facilitate wider deployment.

Business benefits of Zero UI include enhanced operational efficiency, improved customer experience, and better accessibility. Enterprises deploying Zero UI see increased app usage and stronger collaboration because interactions feel more natural and less burdensome. Zero UI reduces “app fatigue” where users struggle with multiple complex interfaces, by offering seamless, conversational engagement.

Moreover, businesses benefit from higher productivity as workers complete tasks faster with less mental strain. Zero UI also fosters trust by integrating low-friction security methods, like biometric and behavioral authentication, while minimizing interruptions inherent to traditional interfaces.

US Market Size

The US Zero UI Technologies Market was valued at USD 9.84 billion in 2024 and is projected to reach USD 45.32 billion by 2034, expanding at a 16.5% CAGR. This growth is driven by rising adoption of voice, gesture, and AI-based touchless systems across smart homes, automotive, and healthcare applications.

The Zero UI Technologies Market represents a rapidly evolving domain centered on touchless human–machine interaction, enabling seamless control through voice, gesture, gaze, and motion recognition. Fueled by advancements in AI, IoT, and edge computing, these systems are redefining digital engagement across smart homes, automotive, healthcare, and industrial automation globally.

North America accounted for the Zero UI Technologies Market share in 2024, valued at USD 11.0 billion, supported by major players in AI, automotive, and smart device manufacturing. The US contributes over 38% of the total market, emphasizing rapid integration across smart home and enterprise applications.

Europe follows with approximately 27% share, driven by regulatory support for AI ethics and innovation in gesture and gaze technology. The Asia-Pacific region is expected to exhibit the fastest growth at 21.5% CAGR, led by China, Japan, and South Korea, due to heavy investments in robotics and consumer electronics.

MEA and Latin America, though smaller markets, show increasing adoption in retail and hospitality interfaces. Collectively, regional diversification and technological adoption underscore the transition toward ambient, userless digital environments across industrial, healthcare, and consumer sectors.

Emerging Trends

A major trend in Zero UI is the shift towards invisible, ambient user interfaces that eliminate screens and buttons altogether. By 2028, it is estimated that 70% of customer journeys will occur through AI-driven conversational interfaces. This means voice commands, gesture controls, and sensor-based interactions will dominate how users engage with technology.

Alongside this, edge computing is gaining momentum, allowing Zero UI devices to process data locally, which reduces latency and enhances real-time user experiences. Another emerging trend is the expansion of Zero UI across diverse industries such as automotive, healthcare, and smart homes.

The Asia-Pacific region is experiencing the fastest growth in adoption due to large smartphone user bases and rapid development of local language voice assistants. Additionally, AI-powered personalization and context awareness are becoming standard features that drive more meaningful and engaging user experiences in emerging Zero UI solutions.

Growth Factors

The growth of Zero UI technologies is propelled by increasing demand for touchless and hands-free interfaces driven by convenience and hygiene concerns. About 43% of the global Zero UI market share was reported to be led by North America in 2024, where advanced voice-assistant ecosystems and heavy investments in AI are common.

Consumers and enterprises alike seek seamless digital interactions without needing to navigate complex screens or physical controls. Technological advances in AI, IoT sensors, and real-time data processing further boost Zero UI adoption.

These innovations enable devices to better understand user context and automate routine tasks, which enhances user satisfaction and operational efficiency. The rising integration of Zero UI technology into smart speakers, wearables, and connected vehicles also fuels market expansion as these products become essential parts of daily life.

By Component

In 2024, Hardware leads the Zero UI technologies market with a share of 54.6%, driven by growing demand for sensory and input devices that enable seamless interaction without touch. Cameras, microphones, motion sensors, and haptic units form the foundation of gesture, voice, and vision-based interfaces.

Advancements in chip design and embedded AI are improving the responsiveness of these systems, making natural interaction possible across consumer and enterprise devices. The rising integration of hardware into wearables, home assistants, and automotive control systems is accelerating adoption.

Manufacturers are focusing on compact sensor arrays and multimodal input systems that can interpret human intent more intuitively. As reliance on physical controls declines, the hardware layer remains key for ensuring precision, responsiveness, and energy efficiency in Zero UI experiences.

By Deployment

In 2024, Cloud-based deployment dominates with 60.7%, reflecting the growing use of AI models hosted remotely to process vast real-time sensory data. Cloud infrastructure supports the scalability and speed required for interpreting speech, gesture, and facial cues across devices. Its flexibility allows continuous system updates and remote model training, ensuring accuracy improvement without local hardware limitations.

Businesses favor cloud-based Zero UI solutions for easy integration with IoT systems, virtual assistants, and AR applications. The configuration also enables faster cross-device synchronization, particularly in smart home environments. As 5G and edge computing advance, cloud-based interaction systems are expected to deliver near-instant responses, reinforcing user trust and efficiency.

By Technology

In 2024, Voice and speech recognition hold the largest share at 65.3%. The natural appeal of voice as a hands-free interface has made it central to Zero UI adoption. Smart speakers, connected vehicles, and customer service bots now rely heavily on accurate speech processing to create frictionless user experiences.

Advances in neural speech synthesis and natural language understanding have greatly improved recognition accuracy even in noisy environments. Continuous learning models are fine-tuning responses based on tone, context, and sentiment, making voice technologies more adaptive.

Integration with multilingual and accent-sensitive systems broadens their usability across regions. As voice becomes the universal interface layer, it anchors the transition to more intuitive computing environments where spoken language drives interaction.

By Application

In 2024, Smart home and consumer electronics represent 45.1% of global demand. The rapid growth of IoT ecosystems and connected appliances has made touchless control a standard expectation. Devices such as televisions, lighting systems, and home assistants are increasingly powered by voice, gesture, or motion controls designed for seamless living experiences.

The convenience and accessibility offered by Zero UI make it an attractive option for broader household adoption. Consumer electronics brands are embedding AI-driven interfaces into everyday products, reshaping how people interact with entertainment and automation systems.

Gesture recognition for display control and facial recognition for personalized access are gaining momentum. This segment’s expansion is fueled by lifestyle shifts toward convenience, efficiency, and personalization within connected home networks.

Key Market Segment

By Component

- Hardware

- Sensors

- Cameras

- Microphones

- Specialized Modules

- Edge Chips

- Software

- Voice Platforms

- Gesture SDKs

- Gaze Analytics

- Intent Engines

- Middleware

- Services

- Integration

- Customization

- UX Design

- Managed Services

By Deployment

- Cloudbased

- Edge/Ondevice

- Hybrid

By Technology

- Voice/Speech Recognition

- Gesture & Motion Recognition

- Touch & Haptic Surfaces

- Computer Vision & Gaze Tracking

- BrainComputer Interfaces (BCI)

- Others

By Application

- Smart Home & Consumer Electronics

- Automotive

- AR/VR/Gaming

- Healthcare & Assistive Tech

- Retail & Kiosks

- Industrial & Enterprise

- Public Spaces & Hospitality

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for Seamless Interaction

The primary driver for Zero UI Technologies is the rising demand for seamless and intuitive user interaction without relying on traditional screens or buttons. Users increasingly prefer natural modes of communication like voice commands, gestures, and ambient sensing, which make technology feel more integrated and effortless in daily life.

This shift is fueled by advancements in AI, voice recognition, and sensor integration that enable accurate, real-time responses. Such natural user interfaces improve convenience and enrich user experiences, driving adoption across consumer electronics, smart homes, and automotive interfaces

Restraint Analysis

Privacy and Security Concerns

A significant restraint on Zero UI adoption is the heightened privacy and security risks associated with its always-listening and sensor-reliant systems. Constant data collection through microphones, cameras, and ambient sensors raises concerns about unauthorized access, data misuse, and surveillance.

These issues make users hesitant to fully embrace Zero UI technologies, especially in the absence of standardized global regulations governing data protection. Companies must address these privacy challenges transparently and implement robust security protocols to build user trust and enable broader market growth.

Opportunity Analysis

Expansion of Ambient Computing

Ambient computing presents a major opportunity for Zero UI Technologies to become an invisible but intelligent part of everyday environments. This technology allows devices to automatically detect user context and preferences and respond proactively without explicit commands.

Voice assistants like Alexa, Siri, and Google Assistant exemplify this approach by controlling multiple smart devices and performing tasks seamlessly. As smart homes, wearables, and IoT applications grow, Zero UI’s integration with ambient computing promises to unlock fresh business opportunities through personalized, frictionless user interactions.

Challenge Analysis

Ensuring Accuracy and Reliability

A key challenge in developing Zero UI is achieving accurate and reliable recognition of voice, gestures, and contextual cues across diverse environments. Variations in accent, language, background noise, and user behavior complicate the task of interpreting commands correctly.

Misinterpretations or latency can frustrate users, hampering adoption. Additionally, many Zero UI applications demand high processing power, which can impact device battery life and performance. Overcoming these technical hurdles requires continuous AI refinement, sensor calibration, and optimization to deliver smooth and dependable user experiences.

SWOT Analysis

Strengths

- Rapid integration of AI, ML, and NLP technologies enabling more natural, intuitive, and multimodal user experiences.

- Strong backing from global tech leaders and venture investors driving 25.4% year-over-year funding growth.

- High adoption across smart homes, automotive, and healthcare sectors, creating sustained market demand.

- Hardware advancements in edge chips, sensors, and cameras enhancing real-time response accuracy and energy efficiency.

Weaknesses

- High implementation and integration costs limit adoption among small and mid-sized enterprises.

- Complexity in system calibration and interoperability across devices and operating platforms.

- Dependence on continuous AI model training and large data volumes for optimal accuracy.

- Limited standardization in gesture and gaze-based interfaces affecting user consistency.

Opportunities

- Rising deployment of generative AI and cloud-edge fusion to power adaptive, context-aware interactions.

- Expansion into AR/VR, industrial automation, and touchless healthcare diagnostics creates multi-sector growth avenues.

- Increasing government and corporate investment in AI-driven smart infrastructure and connected ecosystems.

- Potential for data monetization and predictive analytics through Zero UI-based consumer behavior insights.

Threats

- Privacy and data security risks associated with biometric and voice data collection.

- Stringent regulatory compliance under GDPR and evolving U.S. data protection laws.

- Rapid technological evolution is increasing R&D pressure on companies to maintain an innovation pace.

- Market competition from established AI voice platforms and gesture analytics firms is intensifying pricing challenges.

Key Player Analysis

The Zero UI Technologies Market is led by major technology innovators such as Amazon (Alexa Voice Service), Google (Assistant & Nest), Apple Inc. (Siri & HomeKit), Microsoft Corporation (Cortana & HoloLens), and Meta Platforms Inc. (Oculus & AR/VR). These companies are shaping the next generation of interface-free interaction through voice, gesture, and spatial computing technologies.

Key hardware and semiconductor leaders including Samsung Electronics, Intel Corporation, NVIDIA Corporation, and Qualcomm Incorporated play a crucial role in powering zero UI solutions through advanced processors, edge computing, and AI acceleration technologies. Their innovations enable real-time gesture recognition, neural processing, and contextual responsiveness, driving adoption across smart homes, automobiles, and industrial automation environments.

Additional contributors such as IBM Corporation, Baidu Inc., SenseTime Group, Nuance Communications, Leap Motion, Tobii AB, Neurable Inc., Emotiv Inc., Cogito Corporation, Affectiva, and Brain Products GmbH, along with other emerging players, are advancing emotion recognition, eye-tracking, and brain-computer interface technologies.

Top Key Players

- Amazon (Alexa Voice Service)

- Google (Assistant & Nest)

- Apple Inc. (Siri & HomeKit)

- Microsoft Corporation (Cortana & HoloLens)

- Meta Platforms Inc. (Oculus & AR/VR)

- Samsung Electronics

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- IBM Corporation

- Baidu Inc.

- SenseTime Group

- Nuance Communications

- Leap Motion

- Tobii AB

- Neurable Inc.

- Emotiv Inc.

- Cogito Corporation

- Affectiva

- Brain Products GmbH

- Others

Recent Developments

- February 2025, Amazon officially launched Alexa+, a generative AI-enhanced version of Alexa voice service. This new assistant offers more natural conversations, multi-turn interactions, and content creation capabilities, along with improved personalization and contextual awareness. Alexa+ was gradually rolled out with updated Echo devices and expanded device compatibility, reaffirming Amazon’s leadership in smart voice assistants.

- March 2025, Apple delayed the launch of its iPad-like smart home hub featuring a voice-controlled Siri interface and personalized, face-recognition-driven user experience to mid-2026. This device aims to serve as a centralized Apple Intelligence-powered home command center with voice commands and an interactive touchscreen for smart home management.

Report Scope

Report Features Description Market Value (2024) USD 27.3 Billion Forecast Revenue (2034) USD 145.3 Billion CAGR(2025-2034) 24.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Component (Hardware (Sensors, Cameras, Microphones, Specialized Modules, Edge Chips), Software (Voice Platforms, Gesture SDKs , Gaze Analytics, Intent Engines, Middleware), Services (Integration, Customization, UX Design, Managed Services)), By Deployment (Cloudbased, Edge/Ondevice, Hybrid), By Technology (Voice/Speech Recognition, Gesture & Motion Recognition, Touch & Haptic Surfaces, Computer Vision & Gaze Tracking, BrainComputer Interfaces (BCI), Others), By Application (Smart Home & Consumer Electronics, Automotive, AR/VR/Gaming, Healthcare & Assistive Tech, Retail & Kiosks, Industrial & Enterprise, Public Spaces & Hospitality) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon (Alexa Voice Service), Google (Assistant & Nest), Apple Inc. (Siri & HomeKit), Microsoft Corporation (Cortana & HoloLens), Meta Platforms Inc. (Oculus & AR/VR), Samsung Electronics, Intel Corporation, NVIDIA Corporation, Qualcomm Incorporated, IBM Corporation, Baidu Inc., SenseTime Group, Nuance Communications, Leap Motion, Tobii AB, Neurable Inc., Emotiv Inc., Cogito Corporation, Affectiva, Brain Products GmbH, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Zero UI Technologies MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Zero UI Technologies MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon (Alexa Voice Service)

- Google (Assistant & Nest)

- Apple Inc. (Siri & HomeKit)

- Microsoft Corporation (Cortana & HoloLens)

- Meta Platforms Inc. (Oculus & AR/VR)

- Samsung Electronics

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- IBM Corporation

- Baidu Inc.

- SenseTime Group

- Nuance Communications

- Leap Motion

- Tobii AB

- Neurable Inc.

- Emotiv Inc.

- Cogito Corporation

- Affectiva

- Brain Products GmbH

- Others