Global Yoga Accessories Market Size, Share, Industry Analysis Report By Yoga Mats (Eco-friendly Mats, Non-toxic Mats, Thickness Options), By Yoga Apparel (Yoga Pants, Yoga Tops, Yoga Accessories) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166151

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

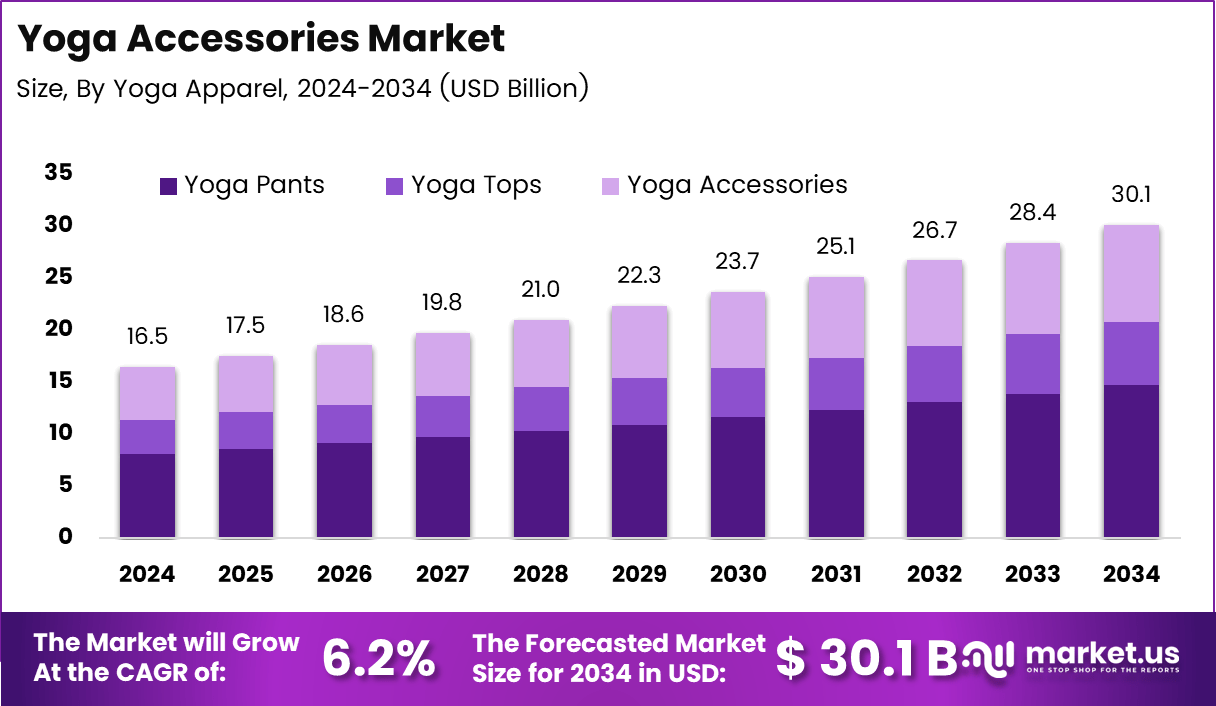

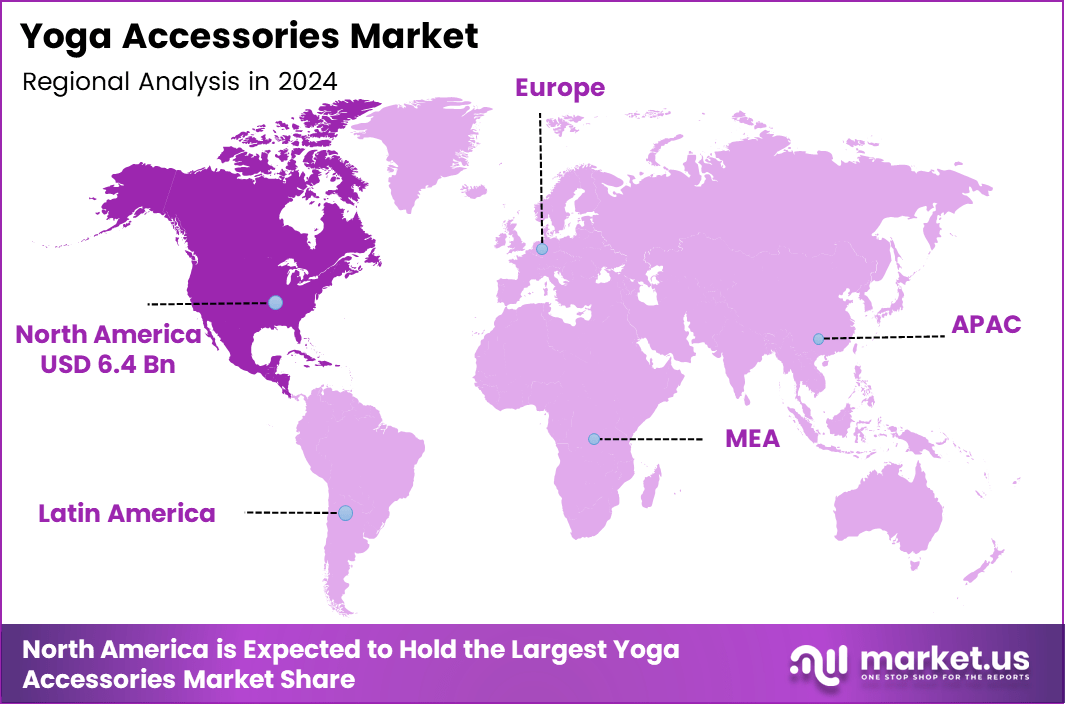

The Yoga Accessories Market size stands at USD 16.5 billion in 2024 and is projected to reach USD 30.1 billion by 2034, advancing at a CAGR of 6.2%. North America dominates the market with a share value of 38.9% valued at USD 6.4 billion in 2024, supported by high consumer spending on premium yoga products and a well-established fitness industry.

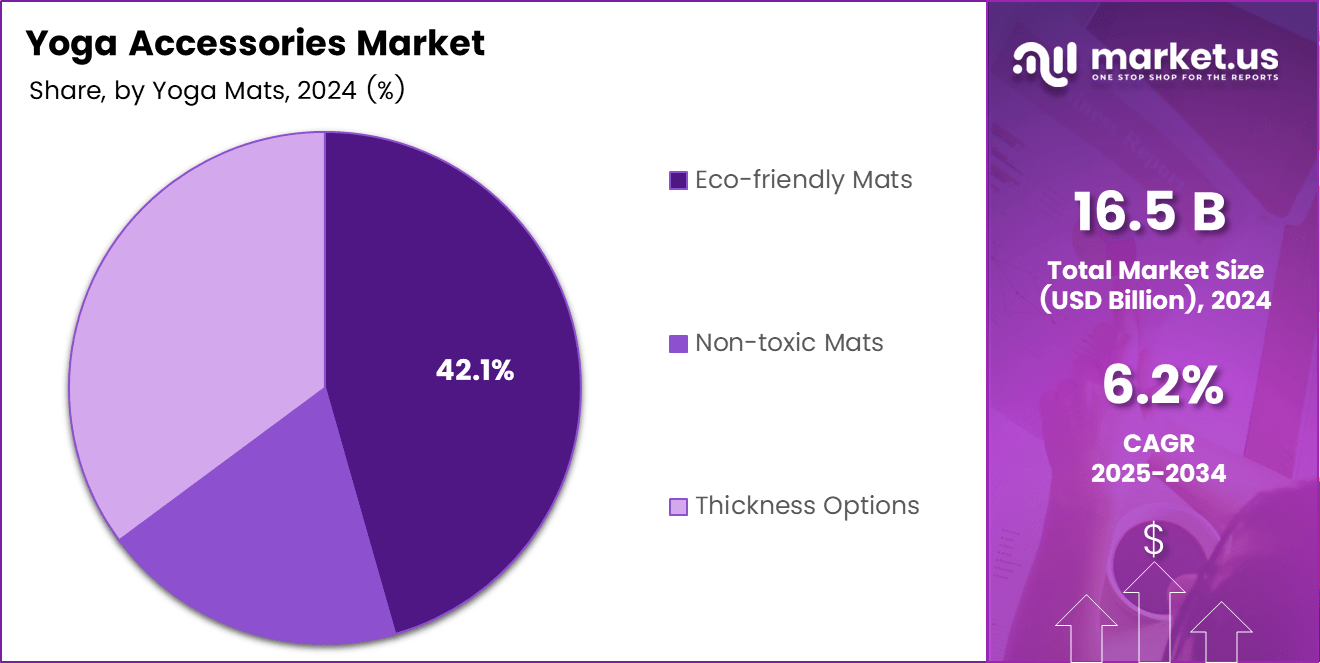

Europe follows as another major region, while APAC is emerging rapidly due to increasing urban fitness trends and expanding e-commerce penetration. Segment-wise, eco-friendly mats lead the yoga mats category with a 42.1% share, reflecting growing awareness around sustainable materials. In the apparel segment, yoga pants remain the largest contributor throughout the forecast period, supported by rising adoption of athleisure and performance wear. The market outlook remains positive as manufacturers innovate with sustainable materials, improved grip technologies, and fashion-forward yoga apparel lines, while digital fitness platforms continue to attract global users into yoga routines.

The yoga accessories market continues to expand as yoga becomes increasingly embedded in mainstream wellness, fitness, and lifestyle routines across the world. Rising interest in mindful living, stress management, and at-home fitness has strengthened demand for a wide range of accessories, including mats, apparel, and supporting gear. North America remains the most influential region due to strong consumer awareness, high adoption of premium wellness products, and a well-developed retail and e-commerce ecosystem.

Europe also shows strong participation, while Asia-Pacific is emerging as a fast-growing region as yoga culture spreads in urban centers and digital platforms make classes more accessible. Product preferences are shifting toward sustainable materials, non-toxic formulations, and yoga mats offering varied thickness levels to support comfort and stability.

Yoga apparel continues to evolve with performance-driven fabrics, everyday athleisure trends, and growing demand for versatile, comfortable wear. With increasing global focus on health, wellness, and sustainability, the market is expected to maintain steady growth supported by innovation, lifestyle changes, and deeper integration of yoga into daily routines worldwide.

Key Takeaways

- Yoga pants lead the apparel segment with a 49.1% share in 2024.

- Eco-friendly mats dominate the yoga mats category with a 42.8% share.

- North America remains the largest market with a 38.9% Share, valued at USD 6.4 billion in 2024.

- The yoga accessories market is projected to reach USD 30.1 billion by 2034.

- The market is expected to grow steadily at a CAGR of 6.2% from 2025 to 2034.

Analyst’s Viewpoint

The yoga accessories market continues to gain strong momentum as wellness habits shift from occasional routines to long-term lifestyle choices. Consumers increasingly prioritise products that combine comfort, sustainability, and performance, pushing brands to innovate across materials and design.

The rise of eco-friendly mats and high-performance apparel indicates that sustainability and functionality are no longer optional—they have become core purchasing drivers. At the same time, e-commerce growth and social-media-led fitness culture are expanding the reach of yoga accessories, especially among younger buyers who value convenience and aesthetic appeal.

While premium pricing remains a barrier in emerging markets, the long-term outlook stays positive as manufacturers introduce budget-friendly lines without compromising quality. The growing preference for home workouts and hybrid wellness routines also contributes to consistent demand. Overall, the market shows steady expansion, supported by product innovation, lifestyle transformation, and the increasing integration of yoga into everyday wellbeing.

Investment & Business Benefits

Investment Benefits

- Rising global adoption of yoga and wellness routines creates long-term, stable demand for accessories, making the sector attractive for sustained returns.

- Expanding premium and eco-friendly product lines offer investors access to high-margin segments with strong brand loyalty.

- Growth of e-commerce and direct-to-consumer models improves scalability and reduces distribution costs, enhancing return on investment.

- Increasing interest in smart, tech-enabled accessories opens new investment pathways in innovation-driven subsegments.

- The market’s consistent CAGR and regional expansion provide opportunities for diversified portfolio gains across developed and emerging markets.

Business Benefits

- Companies can leverage strong consumer interest in sustainable and performance-driven products to build differentiated brand positioning.

- High repeat-purchase behavior for apparel, mats, and accessories supports steady revenue flow and customer lifetime value.

- Businesses can expand through online channels, allowing broader market reach, lower operating expenses, and data-driven customer engagement.

- Product categories such as yoga pants, eco-friendly mats, and accessories enable cross-selling and bundling strategies for higher sales.

- Strong wellness trends allow brands to collaborate with influencers, studios, and fitness platforms to boost visibility and strengthen market presence.

Yoga Mats Analysis

The yoga mats category consists of eco-friendly mats, non-toxic mats, and thickness-based options, each meeting different user needs within the growing wellness market. Eco-friendly mats dominate this category with 42.1%, driven by rising demand for biodegradable, natural rubber, cork, and jute materials that offer strong grip and sustainable benefits.

Non-toxic mats add significant value by eliminating PVC, phthalates, BPA, and other harsh chemicals, appealing to users who prioritize safe, hypoallergenic, and odor-free surfaces for indoor practice. These mats support individuals with sensitive skin, respiratory concerns, and long-duration home workouts.

Thickness-based mats address comfort and stability needs, offering variants suitable for beginners needing cushioning and advanced users seeking better balance and floor connection. The availability of multiple thickness levels helps users personalize their yoga experience according to joint support, practice intensity, and portability requirements. Together, these sub-segments enhance the overall demand for yoga mats, supporting broad adoption across global markets.

Yoga Apparel Analysis

The yoga apparel segment includes yoga pants, yoga tops, and supporting accessories, forming one of the strongest areas of growth within the yoga accessories market. Yoga pants lead this category with a 49.1% share, driven by the global shift toward athleisure, where stretchable, breathable, and moisture-wicking fabrics support both fitness routines and everyday comfort. These pants offer performance benefits such as flexibility, durability, and ergonomic fit, making them suitable for home workouts, studio sessions, and daily wear.

Yoga tops further strengthen the segment by providing lightweight, sweat-resistant, and mobility-enhancing options such as tanks, sports bras, and fitted shirts that improve upper-body comfort during practice.

Accessories like grip socks, headbands, and arm sleeves add functional value by improving balance and maintaining stability during poses. The growing influence of social media fitness trends, rising health awareness, and premium fabric innovation continues to expand the overall yoga apparel category, supporting steady global demand.

Key Market Segments

By Yoga Mats

- Eco-friendly Mats

- Non-toxic Mats

- Thickness Options

By Yoga Apparel

- Yoga Pants

- Yoga Tops

Yoga Accessories

Driver Analysis

Rising Health Awareness and Athleisure Growth

Growing interest in healthier lifestyles is pushing more people toward yoga and fitness routines, which directly increases the demand for yoga apparel. Consumers now look for clothing that supports flexibility, comfort, and better body movement during practice. For instance, the rising number of studio classes and home-workout users is creating steady demand for performance-oriented yoga pants and tops.

Another factor driving growth is the rapid expansion of athleisure into everyday wear. People now wear yoga pants, tops, and leggings outside the gym because of comfort and style. For instance, many office and travel outfits now incorporate yoga apparel due to their stretchable and breathable nature. This lifestyle shift strongly supports long-term market growth.

Restraint Analysis

Higher Price of Premium Products

Premium yoga apparel often uses advanced fabrics, moisture-control technology, and durable stitching, which increases production cost. This makes many products more expensive than regular activewear, limiting adoption among price-sensitive groups. For instance, consumers in developing regions may avoid high-priced leggings or tops even if interested in yoga.

Additionally, manufacturers face rising raw material costs and fluctuating textile prices, which further increase retail costs. For instance, brands that rely on imported performance fabrics struggle to offer budget-friendly options. This pricing challenge slows down penetration in mass-market categories.

Opportunity

Analysis, Customisation and Smart Fabric Innovation

There is a strong opportunity for brands offering personalised fits, custom colours, and yoga apparel tailored to different body types. Consumers are increasingly looking for clothing that feels made for them. For instance, custom-fit leggings and size-inclusive tops attract buyers who value comfort and style equally.

Smart textiles also open new growth areas, such as moisture-sensing, posture-tracking, or temperature-adaptive fabrics. For instance, tops that help users maintain posture during sessions can appeal to beginners and professionals. These innovations can create premium demand and help brands differentiate themselves.

Challenge Analysis

Counterfeit Products and Quality Concerns

The market faces a major challenge due to counterfeit yoga apparel sold at very low prices. These products often look similar to branded items but lack durability and safety. For instance, low-cost leggings that tear easily or cause skin irritation damage consumer trust.

This affects brand reputation and reduces confidence in online shopping, where fake products are widely sold. For instance, many buyers hesitate to purchase yoga pants from unfamiliar sellers due to fear of receiving poor-quality copies. Brands must address this challenge to protect customer loyalty.

Emerging Trends

Emerging trends in the Yoga Accessories Market highlight a strong shift toward sustainable materials, smart packaging formats, and digital-first purchasing behavior. Companies are increasingly adopting bioplastic, recyclable paperboard, and lightweight metal alternatives to reduce environmental impact and appeal to eco-conscious buyers.

Another key trend is the move toward flexible packaging formats such as pouches, sachets, and compact containers that improve convenience, reduce storage space, and lower transportation costs. Functional packaging is also emerging, with features such as resealable closures, tamper-evident seals, and portion-controlled formats gaining traction across commercial and institutional users. In distribution, the rapid growth of online channels is reshaping buying patterns, supported by better product visibility, subscription models, and doorstep delivery preferences.

At the same time, offline stores continue introducing smarter shelving, curated assortments, and premium sustainable options. Together, these trends reflect a market moving toward efficiency, reduced waste, and higher value through convenience-driven and environmentally aligned solutions.

Regional Analysis

North America accounts for 38.9% of the yoga accessories market in 2024, reaching USD 6.4 billion and standing as the leading regional contributor. The region’s strong performance is driven by high awareness of fitness routines, increasing adoption of yoga for stress management, and strong purchasing power for premium accessories. Consumers in the US and Canada consistently invest in eco-friendly mats, performance apparel, and advanced accessories, supporting steady product demand across all segments. The presence of established wellness brands, well-structured retail channels, and the rapid growth of e-commerce also strengthen the regional market.

For instance, a surge in home-based yoga sessions and digital fitness platforms has boosted sales of mats, apparel, and supportive tools. Corporate wellness programs and community yoga events further enhance participation levels across all age groups. Together, these factors position North America as the dominant region, contributing significantly to overall market expansion and long-term growth momentum.

Regional Mentions:

- Europe

Europe shows steady growth due to expanding wellness programs, increasing yoga studio presence, and rising preference for sustainable mats and apparel across major countries. - APAC

APAC continues to grow rapidly, supported by rising urbanization, increasing health consciousness, and a large young population adopting yoga as part of daily fitness routines. - Latin America

Latin America is developing its yoga market gradually as more consumers adopt wellness practices and local brands expand their product offerings. - MEA

MEA shows emerging potential, driven by growing interest in fitness, increasing availability of affordable yoga accessories, and the expansion of modern retail channels.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

SWOT Analysis

Strengths

- Strong demand driven by rising health awareness and increasing global adoption of yoga.

- Wide product variety, including mats, apparel, props, and accessories that cater to all fitness levels.

- Growth supported by athleisure trends and premium fabric innovation.

- Expanding e-commerce presence, enabling easy access to brands worldwide.

Weaknesses

- The high cost of premium yoga accessories limits adoption in price-sensitive markets.

- Quality variation among brands leads to consumer confusion and mistrust.

- Limited product differentiation in low-end segments increases competition.

- Counterfeit products dilute brand value and affect customer loyalty.

Opportunities

- Rising interest in eco-friendly and sustainable materials creates strong product innovation potential.

- Growing online fitness culture boosts demand for mats, apparel, and props for home workouts.

- Personalised accessories and smart-connected products offer new revenue streams.

- Expansion into emerging markets with growing wellness communities.

Threats

- Intense competition from both global and low-cost regional players.

- Fluctuating raw material prices impact production and pricing stability.

- Market saturation in mature regions slows growth for premium brands.

- Increasing counterfeit presence reduces consumer confidence and harms brand reputation.

Competitive Landscape

The competitive landscape of the yoga accessories market is characterized by a mix of global brands, specialized wellness companies, and emerging regional players. Leading companies focus on high-quality materials, sustainable product lines, and strong branding to capture health-conscious consumers.

Many players invest in eco-friendly mats, premium performance apparel, and innovative accessories to strengthen their market position. Established brands maintain visibility through collaborations with fitness influencers, studio partnerships, and targeted digital marketing campaigns. At the same time, newer entrants compete by offering affordable, stylish, and niche-focused products to attract younger consumers.

Product innovation remains a major competitive factor. Companies are improving grip technology, moisture-wicking fabrics, and ergonomic designs to differentiate their offerings. Sustainability is also becoming a key battleground, with brands introducing biodegradable mats, recycled fabrics, and low-impact packaging.

The rise of e-commerce has further intensified competition as online marketplaces give smaller brands a wider reach. Overall, the market remains dynamic, with companies focusing on performance, comfort, sustainability, and strong customer engagement to stay competitive.

Major Companies in the Market

- Lululemon Athletica

- Manduka

- JadeYoga

- Barefoot Yoga

- Gaiam

- Yogabum

- Sequoia Brands Group

- Hugger Mugger Para Rubber

- Aurorae

- Khataland

Recent Developments

- October 2024: Alo Yoga revealed its Korean market entry by appointing global ambassador Jin of BTS, aligning its accessory range with a lifestyle-and-wellness message and supporting its upcoming flagship store launch in Seoul.

- October 2025

Lululemon Athletica announced a partnership with NFL and Fanatics to launch an apparel and accessories collection representing all 32 NFL teams. For the yoga accessories market, this reflects a strategic pivot where yoga-rooted brands use their accessory and apparel infrastructure to reach wider lifestyle and sports segments.

Report Scope

Report Features Description Market Value (2024) USD 16.5 Billion Forecast Revenue (2034) USD 30.1 Billion CAGR (2025-2034) 6.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Yoga Mats (Eco-friendly Mats, Non-toxic Mats, Thickness Options), By Yoga Apparel (Yoga Pants, Yoga Tops, Yoga Accessories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lululemon Athletica, Manduka, JadeYoga, Barefoot Yoga, Gaiam, Yogabum, Sequoia Brands Group, Hugger Mugger Para Rubber, Aurorae, Khataland Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lululemon Athletica

- Manduka

- JadeYoga

- Barefoot Yoga

- Gaiam

- Yogabum

- Sequoia Brands Group

- Hugger Mugger Para Rubber

- Aurorae

- Khataland