Global Yellow Phosphorus Market Size, Share, And Business Benefits By Sales Channel (Direct Sales, Indirect Sales), By End Use (Phosphoric Acid, Phosphorus Trichloride, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162760

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

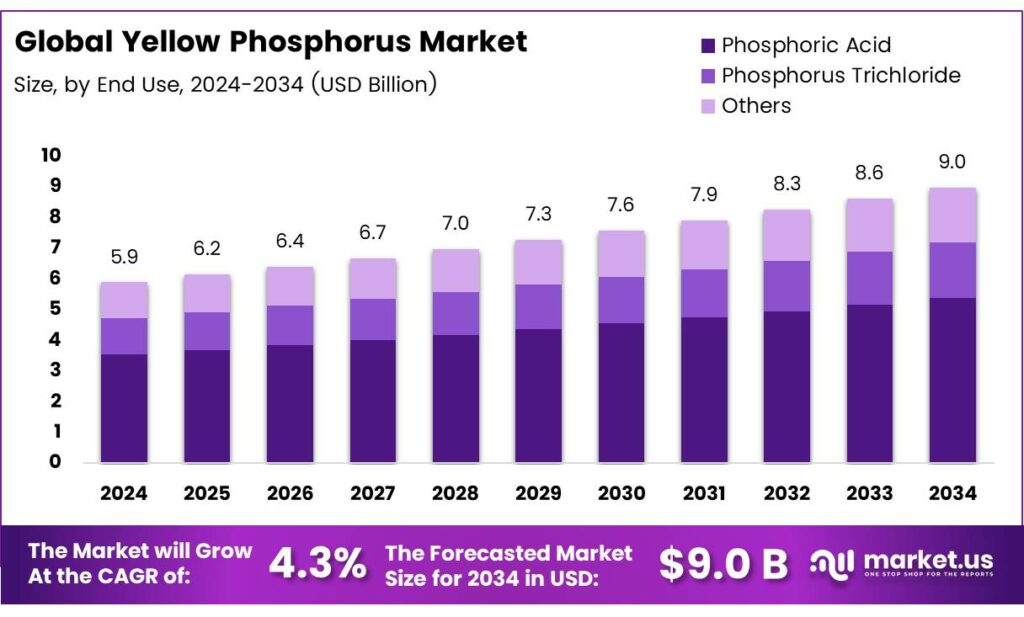

The Global Yellow Phosphorus Market size is expected to be worth around USD 9.0 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

Yellow phosphorus slag (YPS), a byproduct of yellow phosphorus production, generates 8–12 tons per ton of phosphorus, containing harmful components like phosphorus and fluorine, posing significant environmental pollution risks. Its accumulation challenges the phosphorus industry, but YPS holds potential for high-value applications due to its silicon, calcium, and rare earth metals (REMs) content.

These elements can be extracted to create valuable products, while YPS itself serves as an effective material for environmental remediation, including wastewater treatment, soil remediation, and carbon capture. The physical and chemical properties of YPS enable diverse recovery methods for waste heat, silicon, calcium, and REMs, which are evaluated for efficiency and feasibility. Despite its promise, further research is needed to optimize recovery and remediation techniques for sustainable waste management.

Yellow phosphorus, also called white phosphorus, is a highly reactive and toxic allotrope of phosphorus, with the chemical formula P4 and CAS Number 12185-10-3. It appears as a white to yellow, soft, waxy solid that emits acrid fumes in the air and can spontaneously combust. To prevent ignition, it is typically stored or shipped in water. Synonyms include molecular phosphorus, tetraatomic phosphorus, and phosphorus tetramer. Unlike the less toxic red and black phosphorus, yellow phosphorus is highly hazardous.

Militarily, yellow phosphorus is used in ammunition and incendiary devices due to its flammability. Industrially, it produces phosphoric acid, fertilizers, food additives, and cleaning compounds. Historically, it was used in pesticides and fireworks, though this is now rare. Red phosphorus, safer than yellow, is used in pyrotechnics, fertilizers, and methamphetamine production. Phosphorus compounds like P2O5 and PCl3 are key doping agents in semiconductor manufacturing.

Key Takeaways

- The Global Yellow Phosphorus Market is expected to reach USD 9.0 billion by 2034 from USD 5.9 billion in 2024, with a 4.3% CAGR.

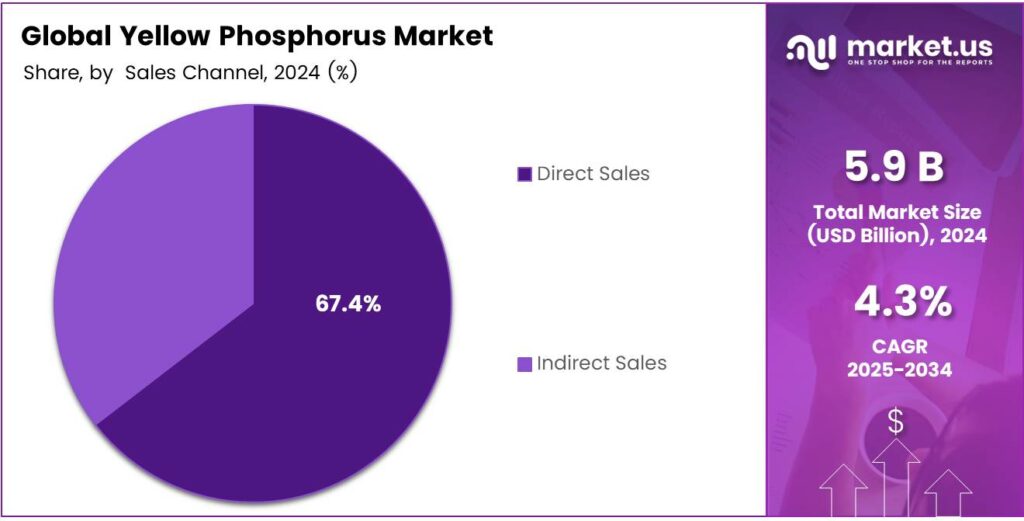

- Direct Sales dominated in 2024, holding a 67.4% share in the sales channel segment due to direct manufacturer-end-user transactions.

- Phosphoric Acid led the end-use segment in 2024 with a 58.3% share, driven by its use in fertilizers, food-grade applications, and detergents.

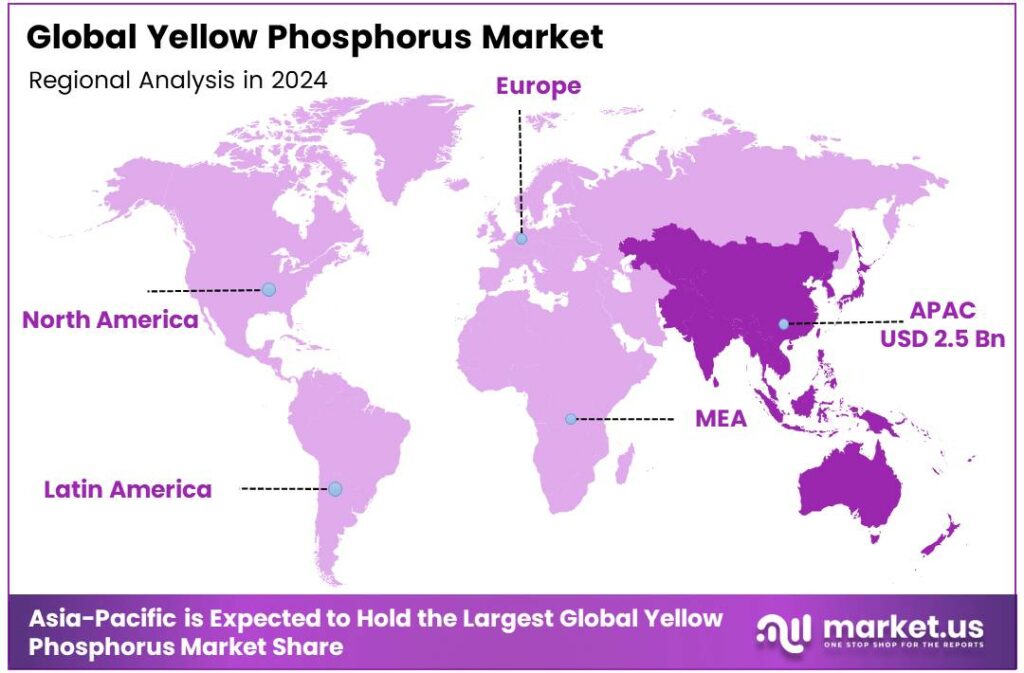

- Asia-Pacific held a 43.9% market share in 2024, valued at USD 2.5 billion, led by demand from China, India, and Japan.

By Sales Channel

Direct Sales dominates with 67.4% due to its streamlined supply chain and cost efficiency.

In 2024, Direct Sales held a dominant market position in the By Sales Channel Analysis segment of the Yellow Phosphorus Market, with a 67.4% share. This dominance stems from direct transactions between manufacturers and end-users, eliminating intermediaries.

It ensures better pricing, reliable supply, and stronger relationships, particularly for bulk buyers like chemical industries. The streamlined process enhances efficiency and trust. Indirect Sales, while less dominant, remains significant in the Yellow Phosphorus Market.

This channel involves distributors and traders, catering to smaller buyers or regions with limited direct access to manufacturers. It offers flexibility for diverse customer needs but faces challenges like higher costs and supply chain complexities, impacting its market share compared to direct sales.

By End Use

Phosphoric Acid dominates with 58.3% due to its extensive use in fertilizers and industrial applications.

In 2024, Phosphoric Acid held a dominant market position in the By End Use Analysis segment of the Yellow Phosphorus Market, with a 58.3% share. Its widespread use in fertilizer production drives demand, as agriculture relies heavily on phosphorus-based nutrients. Additionally, its role in food-grade applications and detergents further boosts its market prominence.

Phosphorus Trichloride is a key sub-segment in the Yellow Phosphorus Market. It is primarily used in producing pesticides, plasticizers, and flame retardants. Its demand is steady, driven by the chemical industry’s need for specialized compounds. However, its market share is smaller than phosphoric acid due to more niche applications.

Others in the Yellow Phosphorus Market include applications like flame retardants, rodenticides, and metal alloys. This sub-segment caters to diverse, smaller-scale industrial needs. While versatile, its market share remains limited compared to phosphoric acid and phosphorus trichloride, as these applications are less widespread and volume-driven.

Key Market Segments

By Sales Channel

- Direct Sales

- Indirect Sales

By End Use

- Phosphoric Acid

- Phosphorus Trichloride

- Others

Emerging Trends

Decarbonised and circular P₄ production is moving from pilots to policy

Yellow phosphorus (P₄) sits at the heart of flame retardants, agrochemicals, and electronics, but its route is power-hungry and carbon-intensive. That’s why the big shift underway is toward decarbonised furnaces and circular feedstocks. Technically, the case is clear: producing one tonne of yellow phosphorus typically needs about 14,500 kWh of electricity, so switching to low-carbon power and heat recovery has an immediate impact on costs and emissions.

The EU has formally listed phosphorus (white phosphorus, P₄) among Critical Raw Materials and is building supply-security rules under the Critical Raw Materials Act, raising the bar for cleaner, more resilient sourcing. Europe’s dependency is stark: industry notes the EU is 100% reliant on imports of P₄, largely from China, Vietnam, and Kazakhstan, so any efficiency or recycling step directly improves resilience.

Producers are testing lower-carbon electric-furnace operations, capturing off-gases and heat, and signing renewable-power contracts; policymakers are pushing recovery at wastewater plants; and downstream users are asking for verified, lower-footprint inputs. Together, these forces are steering P₄ away from purely energy-intensive origins toward cleaner power and urban-mined phosphorus, without compromising the purity levels specialty chemicals require.

Drivers

Fertilizer and phosphoric-acid backbones keep P₄ demand resilient

Even though P₄ goes into many specialty chemistries, its demand tracks agriculture and phosphates because P₄-based intermediates feed crop-related chemistries and processing aids. On the upstream side, global phosphoric acid capacity is projected at 65.1 Mt (as P₂O₅) in 2025, with additions led by North Africa and incremental builds in India and Brazil, evidence that phosphate processing remains a multi-million-ton anchor market that stabilizes elemental-phosphorus value chains.

- On the downstream side, global pesticide use reached 3.70 Mt of active ingredients in 2022, up 4% year-over-year and roughly doubled since 1990, signaling a steady need for organophosphorus building blocks and processing auxiliaries where P₄ derivatives play essential roles.

Fertilizer and crop-protection cycles define the capacity, logistics, and contracting rhythm that P₄ producers plan around. Meanwhile, technology-adjacent pull from flame-retardant systems used in electronics and electrical infrastructure adds a layer of diversified demand, which policymakers recognize in strategic-materials frameworks.

Restraints

Safety and regulatory pressure raise costs across the P₄ chain

P₄’s processing steps generate hazardous gases (notably phosphine), demanding strict industrial hygiene and adding compliance costs that can cap output flexibility. Occupational limits are tight: the OSHA permissible exposure limit for phosphine is 0.3 ppm (8-hour TWA), with similar recommended limits from NIOSH and short-term ceilings that require continuous monitoring, gas scrubbing, and well-designed ventilation.

- These controls are non-negotiable and often capital-intensive for new units or debottlenecking projects. Alongside safety, cyclical demand on the fertilizer side can temporarily dampen derivative pull: in 2023, EU mineral-fertilizer use (N+P) was 9.3 Mt, down 3.7% year-on-year and over 20% below the 2017 peak, which tightens margins for upstream phosphorus chains and makes producers cautious on high-cost expansions.

Environmental permitting further slows timelines, as plants must evidence Best Available Techniques under EU BREF frameworks and comparable national rules elsewhere, embedding energy and emissions benchmarks into operating licences. That is prudent policy and good for worker safety and air quality, but it does restrain rapid P₄ supply responses, particularly in regions with expensive power or tight labour markets for EHS specialists.

Opportunity

Urban-mined phosphorus can meaningfully de-risk P₄ supply

A practical growth path is to build new P supply from cities via mandated phosphorus recovery from wastewater and channel it into P₄ value chains. Germany is the clearest signal market: new rules require phosphorus recovery from sewage sludge, with large plants hitting the 2029 deadline and smaller plants.

- The feedstock is not trivial. Germany alone processes about 1.8 million tonnes of sewage sludge annually, and experts estimate 50,000 t of phosphorus per year could be recovered, more than 40% of current domestic agricultural demand—creating a steady stream of secondary phosphorus for acid and, ultimately, P₄ routes that meet purity specs after refining.

For P₄ players, this is a chance to co-locate purification and reduction steps near recovery hubs, cut import exposure, and claim measurable Scope-3 benefits for downstream customers in electronics, batteries, and building safety. Because Europe has officially framed phosphorus as a strategic/critical raw material, projects that turn local waste into high-value P intermediates are more likely to unlock financing and permitting support under the Critical Raw Materials Act toolbox.

Regional Analysis

Asia-Pacific leads with a 43.9% share and a USD 2.5 Billion market value.

In 2024, Asia-Pacific dominated the Yellow Phosphorus market with a 43.9% share, accounting for approximately USD 2.5 billion. The region’s leadership is driven by strong industrial demand from China, India, and Japan, especially across fertilizers, flame retardants, and electronics manufacturing. China remains the largest producer and exporter, supported by abundant phosphate rock reserves and low production costs.

The nation’s Ministry of Industry and Information Technology has encouraged process modernization and emission reductions under its Green Mine initiative, further strengthening regional competitiveness. India, meanwhile, has expanded domestic production through chemical clusters in Gujarat and Odisha to support growing agrochemical and metallurgical industries.

Additionally, Japan and South Korea are focusing on high-purity phosphorus for semiconductors, aligning with the global chip-supply diversification push. Rising investments in energy-efficient furnace technology and wastewater recovery systems across the region underscore a sustainability shift.

The Asia-Pacific region’s dynamic manufacturing base, coupled with increasing export activity to Europe and North America, continues to make it the central hub for yellow phosphorus trade. With government-backed industrial reforms, technological innovation, the Asia-Pacific is expected to sustain its market dominance over the next decade, reflecting a steady transition toward cleaner and more efficient phosphorus production systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ka Phosphate LLC is a significant and specialized producer, deeply integrated into the yellow phosphorus supply chain. Its strategic focus on phosphate rock mining and processing provides a strong foundation for its market position. By controlling key upstream resources, the company ensures a consistent and cost-effective production pipeline. This vertical integration makes it a reliable and influential supplier, particularly in regions with high industrial demand, allowing it to maintain a competitive edge through operational efficiency and resource security.

Bayer AG is a global life science giant; its historical and potential involvement in the yellow phosphorus market is linked to its agricultural solutions division. Phosphorus is a critical precursor for certain specialty chemicals and pesticides. Bayer’s immense R&D capabilities and extensive global distribution network allow it to utilize yellow phosphorus for high-value downstream products. Its market power lies not in primary production but in advanced chemical synthesis and end-product formulation for the agricultural industry.

Yuntu Holdings acts as a pivotal player, likely functioning as a major investment and holding entity within the phosphorus chemical industry. Its strategy involves consolidating assets and fostering growth across the sector. By potentially controlling multiple production facilities or having significant stakes in them, Yuntu can influence market supply, pricing, and strategic direction. This financial and operational consolidation makes it a key market force.

Top Key Players in the Market

- Chengdu Wintrue Holding Co., Ltd.

- Ka phosphate LLC

- Hubei Xingfa Chemicals Group Co., Ltd.

- Bayer AG

- Duc Giang Chemicals Group

- Yuntu Holdings

- Jiangsu ChengXing Phosh-Chemical Co., Ltd.

- Yunphos Songming Co., Ltd.

- Viet Nam Apatite Phosphorus Joint Stock Company

Recent Developments

- In 2024, Kazphosphate LLP describes itself as a unique company in the territory of Kazakhstan. It operates a full cycle from mining and processing of phosphate rock to the final products, including yellow phosphorus and its derivatives. The digital transformation initiative suggests internal modernization, which may support operational efficiency, though not directly a yellow-phosphorus production update.

- In 2024, Bayer is clearly active in agribusiness, supply chain sustainability, and agricultural inputs, which by definition links to phosphate fertilisers and thereby the phosphorus feedstock chain (including yellow phosphorus). You may need to search Bayer’s investor presentations for yellow phosphorus or Phosphor (RAW) and check whether Bayer has announced deals for upstream phosphate feedstock, which indirectly covers yellow phosphorus.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Billion Forecast Revenue (2034) USD 9.0 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sales Channel (Direct Sales, Indirect Sales), By End Use (Phosphoric Acid, Phosphorus Trichloride, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Chengdu Wintrue Holding Co., Ltd., Ka phosphate LLC, Hubei Xingfa Chemicals Group Co., Ltd, Bayer AG, Duc Giang Chemicals Group, Yuntu Holdings, Jiangsu ChengXing Phosh-Chemical Co., Ltd, Yunphos Songming Co., Ltd., Viet Nam Apatite Phosphorus Joint Stock Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Yellow Phosphorus MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Yellow Phosphorus MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Chengdu Wintrue Holding Co., Ltd.

- Ka phosphate LLC

- Hubei Xingfa Chemicals Group Co., Ltd.

- Bayer AG

- Duc Giang Chemicals Group

- Yuntu Holdings

- Jiangsu ChengXing Phosh-Chemical Co., Ltd.

- Yunphos Songming Co., Ltd.

- Viet Nam Apatite Phosphorus Joint Stock Company