Global Wrist Wearable Devices Market Size, Share, Industry Analysis Report By Product Type (Smartwatches, Fitness Trackers, Others), By Display Type (LED, LCD, Others), By Application (Consumer Electronics, Healthcare, Enterprise & Industrial Applications, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161430

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

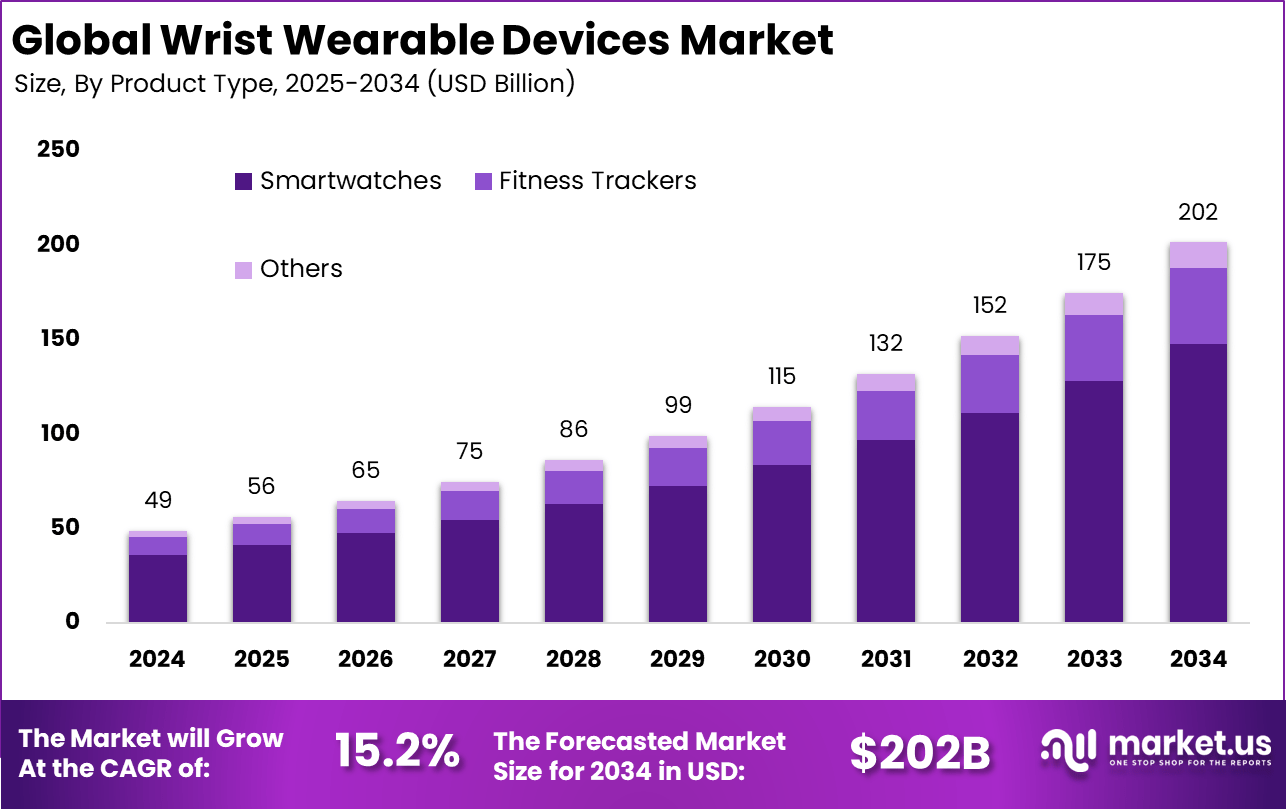

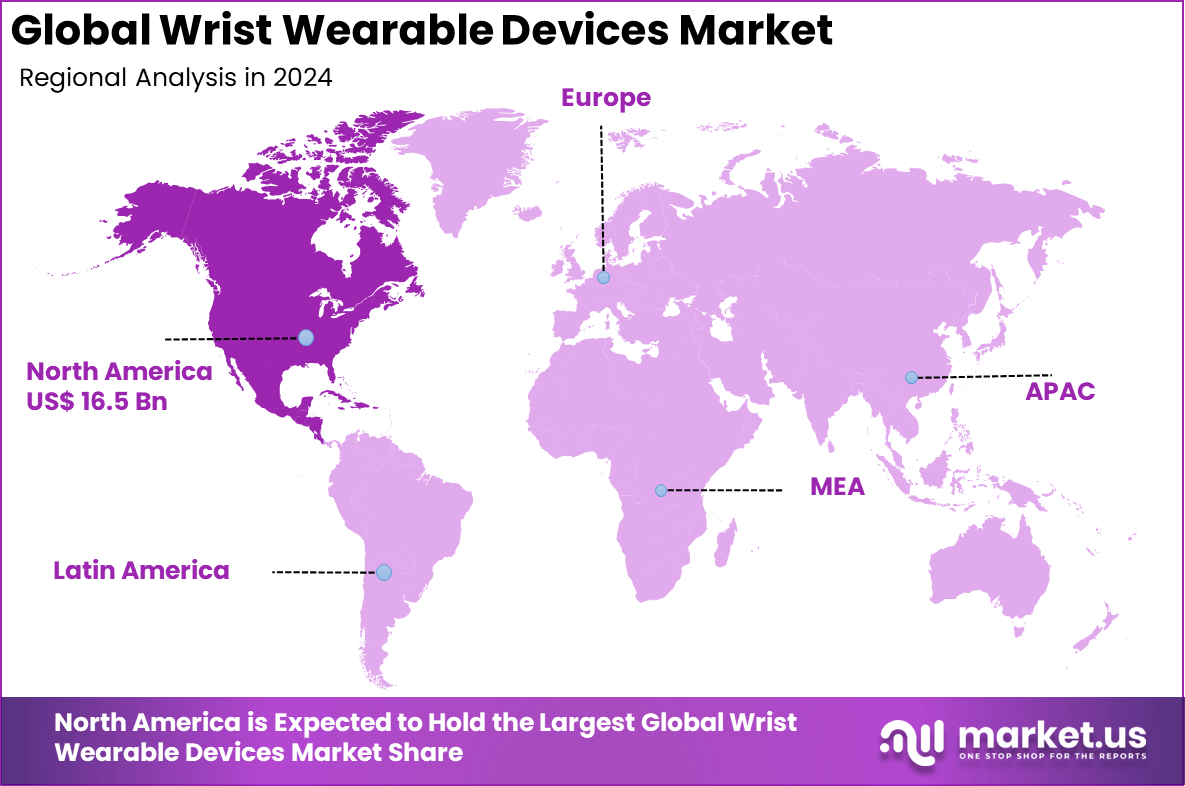

The Global Wrist Wearable Devices Market size is expected to be worth around USD 202 billion by 2034, from USD 49 billion in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33.7% share, holding USD 16.5 billion in revenue.

The wrist wearable devices market includes products such as smartwatches, fitness bands, health monitoring bands, and hybrid wearables designed for everyday use, wellness tracking, and productivity. Adoption has expanded from basic step counters to multifunctional devices that integrate sensors, displays, connectivity, and companion apps. The market serves both consumer and enterprise users, with applications in personal health, workplace safety, payments, and communication.

Top driving factors include technological advancements such as enhanced sensors, improved battery life, and AI-powered health analytics. These improvements make wrist wearables more accurate, user-friendly, and multifunctional. The integration of features like ECG, sleep analysis, and GPS tracking offers users valuable personalized insights, encouraging greater daily use.

According to coolest-gadgets.com, Global wearable device shipments rose by 8.8% in Q1 2024, with total shipments projected to hit 442.7 million units in 2023, up 6.3% year over year. The smartwatch segment generated USD 45 billion in revenue in 2023, with Apple accounting for 20.2% of global wearable shipments in Q3 2023.

Digital fitness and well-being wearables are expected to earn USD 68 billion in 2023, while the medical wearables market is projected to reach USD 89.3 million by 2026. In the U.S., over 100 million devices are expected to be online by 2026, and nearly one in three adults use wearables, with over 80% willing to share health data with doctors, though fewer than 25% of people with or at risk of cardiovascular disease currently use them.

For instance, In May 2025, Huawei introduced the Watch 5 with multi-sensing technology and a Tap Finger Touch Sensor. It tracks heart rate, blood oxygen, and stress in real time, while the tap feature lets users access functions directly from the watch face for a smoother experience. Demand analysis shows that wrist-worn wearables are favored due to their convenience and continuous health tracking capabilities.

Their lightweight form factor and ease of use promote consistent wear, leading to more reliable data collection. The rising prevalence of lifestyle diseases like diabetes and cardiovascular conditions increased the need for remote health monitoring. According to global health data, 1 in 4 adults suffer from such chronic ailments, increasing the necessity for these devices.

Key Takeaway

- 73.4% share was captured by the smartwatches segment in 2024, confirming its strong leadership within wrist wearables.

- 63.9% share belonged to the LED display segment, showing consumer preference for high visibility and energy-efficient screens.

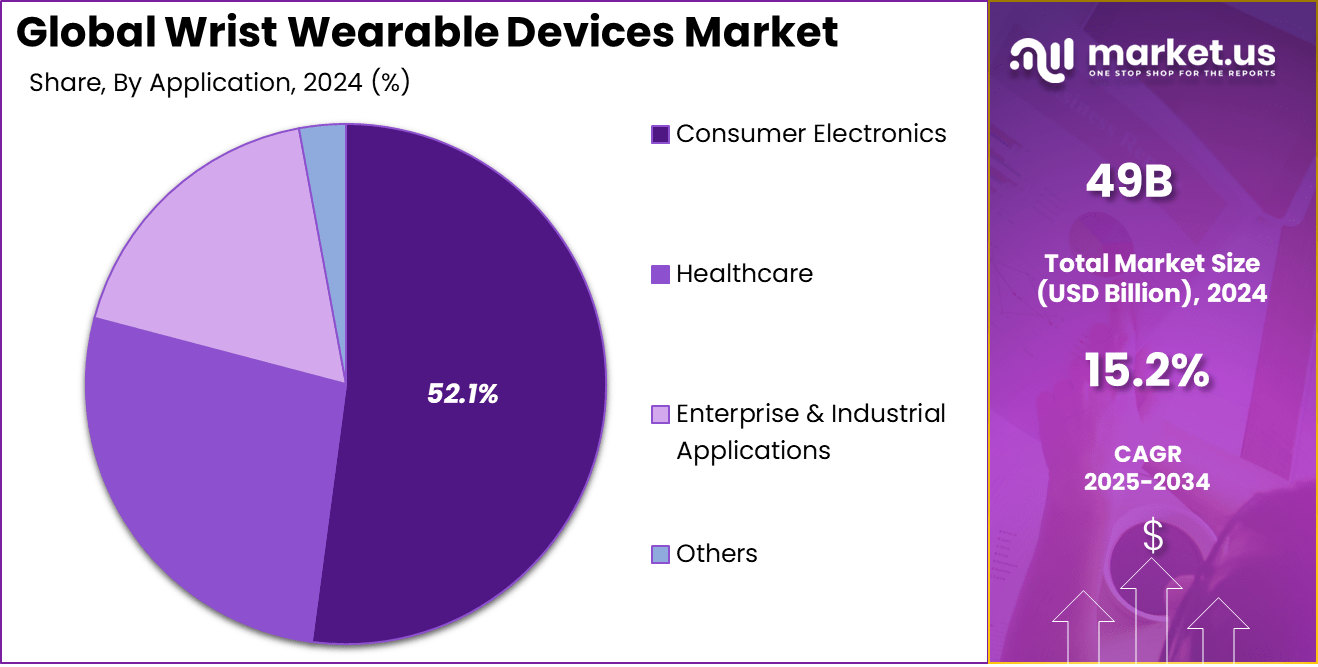

- 52.1% share was taken by consumer electronics applications, highlighting wearables as mainstream lifestyle gadgets.

- The U.S. market recorded strong expansion momentum, supported by double-digit CAGR trends.

- 33.7% share was held by North America, positioning the region as the global leader in adoption and usage of wrist wearable devices.

Analysts’ Viewpoint

Investment opportunities in the wrist wearable sector are promising due to rapid innovation and expanding consumer base. The market is ripe for new entrants focusing on niche applications like specialized medical monitoring or fashion-oriented devices. Subscription services for premium health analytics and personalized coaching offer recurring revenue streams.

Investors also see opportunities in emerging markets where rising income levels and smartphone penetration are fueling demand. Continuous R&D into next-gen sensors and battery technologies presents further paths for growth. From a business perspective, wrist wearables improve productivity by enabling health monitoring that reduces sick days and supports employee wellness programs.

They enhance communication through instant notifications and promote safety in high-risk professions via sensors that detect fatigue or hazardous conditions. For consumer brands, these devices offer deeper customer insights and improved engagement through personalized offers. The devices also create opportunities for businesses to innovate in health and fitness, tapping into growing consumer health awareness.

Role of Generative AI

Generative AI is playing a transformative role in wrist wearable devices, shifting their core purpose from merely tracking data to providing personalized health and fitness guidance. Around 45% of wearable device manufacturers are now embedding generative AI algorithms that analyze user behavior and physiological data to deliver tailored fitness plans and real-time health alerts.

This technology helps wearables offer deeper insights such as predictive health risks and customized wellness recommendations, making them far more valuable for users focused on holistic health management. The adoption of generative AI is also enhancing conversational features like virtual assistants, improving user interaction by making devices more intuitive and responsive to individual needs.

This integration of generative AI is boosting user engagement significantly. Studies show that wearables equipped with AI-powered personalization see a 35% higher daily active use rate compared to traditional devices. The resulting data-driven insights enable users to proactively manage their health with notifications on heart rate variability, sleep quality, and exercise recovery.

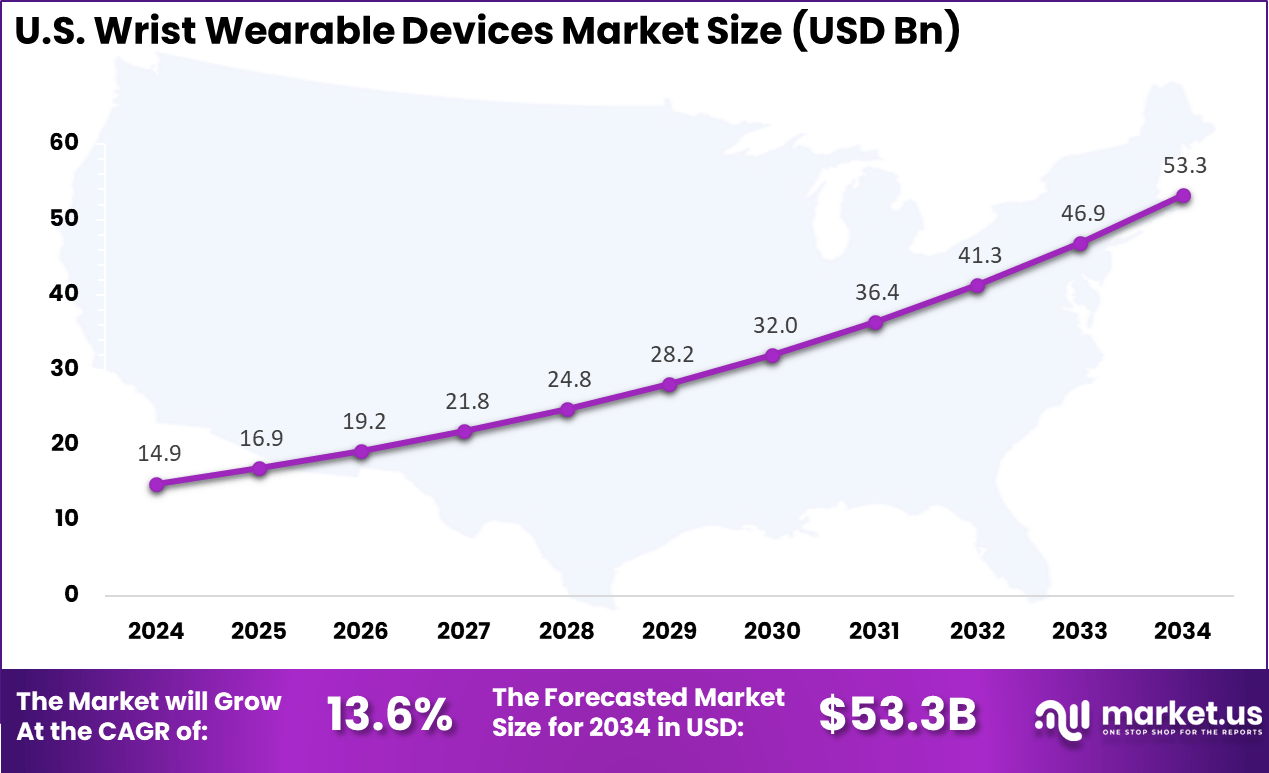

U.S. Market Size

The market for Wrist Wearable Devices within the U.S. is growing tremendously and is currently valued at USD 14.9 billion, the market has a projected CAGR of 13.6%. The market is growing tremendously due to increasing health consciousness, rising demand for fitness tracking, and the integration of advanced technologies like AI and machine learning.

Americans are increasingly adopting wearables to monitor their health, track physical activity, and manage chronic conditions. Additionally, the widespread use of smartphones and improved connectivity in wearables has boosted their appeal. The growing interest in personal wellness, coupled with innovations in design and functionality, is driving market growth.

For instance, in June 2025, the U.S. Health Secretary Robert F. Kennedy Jr. announced that the Department of Health and Human Services (HHS) would launch a nationwide campaign to encourage the adoption of wearable devices for health monitoring. This initiative aims to make wearable technology, such as smartwatches and fitness trackers, a staple in managing personal health metrics like heart rate and glucose levels.

In 2024, North America held a dominant market position in the Global Wrist Wearable Devices Market, capturing more than a 33.7% share, holding USD 16.5 billion in revenue. This dominance is due to high consumer demand for advanced health monitoring features, such as ECG, heart rate tracking, and fitness analytics.

The region benefits from strong technological adoption, a large base of health-conscious consumers, and continuous innovation from leading brands like Apple, Fitbit, and Garmin. Additionally, the growing trend of integrating wearables with IoT, healthcare systems, and mobile devices further strengthens the market’s growth in North America.

For instance, in May 2025, WHOOP, a prominent player in the wearable devices market, announced the launch of its new WHOOP 50MG, a next-generation fitness tracker, marking a significant move in North America’s dominance in the wrist wearable devices sector. The device is priced at $50 per month and focuses on advanced health and performance tracking, including metrics for sleep, recovery, and physical strain.

Product Type Analysis

In 2024, Smartwatches dominate the wrist wearable devices market with a substantial 73.4% share. Their popularity stems from their multifunctionality, combining features like fitness tracking, heart rate monitoring, notifications, and sometimes even ECG capabilities. Their appeal is further broadened by designs that cater to both casual users and fitness enthusiasts, providing personalized health data and convenient connectivity in one wearable.

Consumers increasingly value smartwatches for their role in health management and daily convenience. The rising awareness of health metrics such as sleep quality and oxygen levels has supported smartwatches’ growth, positioning them as essential personal health tools. This product type’s ability to sync seamlessly with mobile devices and offer real-time insights has cemented its place as the leading wrist wearable for broad consumer electronics use.

For Instance, in Feb July 2025, Sync launched a new wrist smartwatch capable of tracking 11 vital health metrics using AI-powered technology. This innovative device provides real-time monitoring of health indicators such as heart rate, blood oxygen levels, and stress, offering users personalized insights and proactive health recommendations.

Display Type Analysis

In 2024, LED displays account for a commanding 63.9% share in wrist wearable devices, favored for their bright visuals and energy efficiency. LED screens strike a balance between battery life and readability, which is crucial in devices worn all day. Their ability to provide clear, vivid display output enhances user experience in various lighting conditions, making it easier for users to interact with notifications, health stats, and other smartwatch functionalities.

LED display technology continues to evolve, allowing for more compact and customizable screens that fit well on smaller wearable devices. The clear, vibrant displays support features such as step counting, message alerts, and interactive controls, which are vital for consumer satisfaction. Such displays also contribute to the stylish appeal of wearable devices, further pushing LED as the standard display choice.

For instance, in September 2025, AUO launched its cutting-edge LED display technology for wrist wearable devices, featuring the Garmin fēnix 8 Pro MicroLED. This smartwatch incorporates over 400,000 ultra-miniature inorganic LEDs, providing exceptional brightness and color accuracy, even under direct sunlight.

Application Analysis

In 2024, The Consumer Electronics segment held a dominant market position, capturing a 52.1% share of the Global Wrist Wearable Devices Market. This dominance is due to the widespread adoption of wrist wearables as essential gadgets for daily life, offering functionalities like fitness tracking, notifications, and seamless integration with smartphones.

As consumers increasingly seek multifunctional devices for both convenience and health management, smartwatches and fitness trackers have become integral to the consumer electronics ecosystem, driving consistent demand in the market.

For Instance, in October 2025, TAG Heuer introduced the Connected Calibre E5, a luxury smartwatch that transitions from Google’s Wear OS to a proprietary operating system for improved integration with iPhones. This move enhances the watch’s performance and connectivity, offering advanced health and fitness tracking features, including heart rate monitoring and specialized workout modes.

Key Market Segments

By Product Type

- Smartwatches

- Fitness Trackers

- Others

By Display Type

- LED

- LCD

- Others

By Application

- Consumer Electronics

- Healthcare

- Enterprise & Industrial Applications

- Others

Drivers

Increasing Health Consciousness

As consumers become more health-conscious, the demand for wrist wearable devices like fitness trackers and smartwatches has surged. These devices offer valuable features such as heart rate monitoring, sleep tracking, and activity logging, helping users manage and improve their health. The growing awareness of the importance of regular health monitoring and preventive care is driving adoption, positioning wrist wearables as essential tools for individuals looking to track and enhance their physical well-being.

For instance, in June 2025, Health Secretary Robert F. Kennedy Jr. proposed the development of a wearable device aimed at enhancing public health monitoring. This initiative reflects the growing trend of increasing health consciousness, where wearable technology plays a pivotal role in tracking vital health metrics such as heart rate, sleep patterns, and activity levels. Restraint

Restraint

Data Privacy Concerns

Data privacy concerns stand as a major restraint in wrist wearable device adoption. Users are increasingly cautious about sharing personal health information gathered by these devices because of fears related to data breaches and misuse. This caution affects consumer trust and slows the willingness to buy and use wrist wearables that collect sensitive biometric data.

Manufacturers face the dual challenge of securing device data and complying with stringent privacy regulations, which adds complexity and cost to product development. Failure to assure users about strong data protection can hinder market growth, especially in regions with strict data privacy laws. Hence, privacy concerns remain a critical restraint affecting market expansion.

Opportunities

Integration with AI and Machine Learning

The integration of AI and machine learning in wrist wearable devices presents a significant opportunity to enhance their functionality. By leveraging AI to analyze health data, these devices can offer predictive health insights and personalized recommendations, helping users make informed decisions about their wellness.

This technology allows wearables to evolve from simple trackers to sophisticated health assistants, creating a more valuable and engaging experience that attracts a broader audience looking for advanced, data-driven health solutions.

For instance, in July 2025, Sync unveiled its latest wrist smartwatch, designed to track 11 vital health metrics using AI-powered technology. This innovative device offers real-time monitoring of key health indicators such as heart rate, blood oxygen levels, and stress levels, providing users with personalized health insights.

Challenges

Competition and Market Saturation

The wrist wearable market is becoming highly competitive, with many brands offering similar features such as fitness tracking, heart rate monitoring, and GPS functionality. As the market saturates, differentiation becomes a key challenge for companies aiming to stand out.

Brands need to innovate continuously, providing unique features or superior user experiences to capture consumer attention. Price sensitivity, combined with high competition, requires manufacturers to balance quality, cost, and innovation to maintain a competitive advantage.

For instance, in June 2025, a report from IDC revealed that Huawei secured the top position in the global wrist-worn device market during Q1, surpassing other key competitors in terms of shipments. This achievement highlights the intense competition and market saturation in the wearable tech industry, as brands fight for consumer attention through innovative features and competitive pricing.

Latest Trends

Emerging trends in wrist wearable devices highlight a strong shift toward multi-functional health monitoring combined with stylish, durable designs. About 40% of new devices launched in 2025 focus on advanced sensors for ECG, blood oxygen levels, and stress monitoring, making health tracking more comprehensive and accurate.

Alongside this, the rise of smart rings and no-display health monitors is growing by 25%, catering to users wanting subtle, non-intrusive devices that blend seamlessly into daily life. These trends showcase a consumer preference for wearables that provide high-end health functionality without compromising style or convenience.

Another key trend is enhanced connectivity and ecosystem integration. Over 50% of wrist wearables in 2025 support seamless syncing with smartphones, smart home devices, and fitness platforms, expanding their utility beyond the wrist. This interconnectivity allows users to have unified control and insights across multiple devices and environments, boosting convenience and user satisfaction.

Growth Factors

The growth of wrist wearable devices is primarily fueled by rising health consciousness and technological innovation. Around 60% of consumers in key markets report buying wrist wearables to better track fitness and vital health parameters, showing an increasing demand for personal wellness management tools.

Advances in sensor technology, improved battery life, and AI-driven algorithms are making these devices more accurate, reliable, and capable of offering actionable health insights. This helps push adoption among a wider demographic, including older adults and those managing chronic conditions. Affordable pricing and expanding availability in emerging markets are also contributing to growth.

Nearly 30% annual increase in shipments is recorded in regions like Asia-Pacific, where rising income levels and smartphone penetration make wrist wearables accessible to new consumer segments. Brands are broadening their portfolios to include budget-friendly options with essential health features, helping bridge the gap between technology and mass-market adoption. This sustained demand and technological progress will continue to drive expansion in the wrist wearable segment.

Key Players Analysis

The Wrist Wearable Devices Market is led by major consumer electronics brands such as Apple Inc., Samsung Electronics Co., Ltd., Fitbit (Google), and Huawei Device Co., Ltd. These companies dominate the smartwatch and fitness tracker segments through advanced health monitoring, seamless smartphone integration, and strong ecosystem compatibility.

Fast-growing players like Xiaomi Corporation, Garmin Ltd., Amazfit (Huami Corporation), Zepp Health, and Mobvoi focus on affordability, sports performance tracking, and long battery life. Their wearables are popular among fitness enthusiasts and value-conscious consumers, offering capabilities such as oxygen saturation monitoring, coaching features, and multi-sport modes across diverse price tiers.

Traditional and performance-focused brands including Casio Computer Co., Ltd., TAG Heuer S.A., Timex Group USA, Inc., Suunto, Polar Electro, and Coros cater to premium, outdoor, and professional athletic segments. These companies emphasize durability, GPS accuracy, luxury design, and specialized training analytics. A range of other market participants continue to expand the ecosystem with niche innovations across wellness, productivity, and connected lifestyle applications.

Top Key Players in the Market

- Apple Inc.

- Casio Computer Co., Ltd.

- Samsung Electronics Co., Ltd.

- Fitbit (Google)

- Garmin Ltd.

- Huawei Device Co., Ltd.

- Xiaomi Corporation

- Mobvoi Information Technology Company

- Zepp Health

- TAG Heuer S.A.

- Timex Group USA, Inc.

- Amazfit (Huami Corporation)

- Suunto

- Polar Electro

- Coros

- Others

Recent Developments

- In September 2024, Apple introduced the Apple Watch Series 10, featuring advanced health monitoring capabilities such as sleep apnea detection and faster charging. The new model also offers a more compact design for enhanced comfort during overnight wear, continuing Apple’s focus on integrating health and wellness features into everyday life.

- In July 2024, Samsung unveiled the Galaxy Watch Ultra during its Galaxy Unpacked event, showcasing cutting-edge features like advanced AI-powered health monitoring and fitness tracking. The new smartwatch includes a larger, more durable display, enhanced sleep tracking, and personalized fitness coaching.

Report Scope

Report Features Description Market Value (2024) USD 49 Bn Forecast Revenue (2034) USD 202 Bn CAGR(2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Smartwatches, Fitness Trackers, Others), By Display Type (LED, LCD, Others), By Application (Consumer Electronics, Healthcare, Enterprise & Industrial Applications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Casio Computer Co., Ltd., Samsung Electronics Co., Ltd., Fitbit (Google), Garmin Ltd., Huawei Device Co., Ltd., Xiaomi Corporation, Mobvoi Information Technology Company, Zepp Health, TAG Heuer S.A., Timex Group USA, Inc., Amazfit (Huami Corporation), Suunto, Polar Electro, Coros, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wrist Wearable Devices MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Wrist Wearable Devices MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Casio Computer Co., Ltd.

- Samsung Electronics Co., Ltd.

- Fitbit (Google)

- Garmin Ltd.

- Huawei Device Co., Ltd.

- Xiaomi Corporation

- Mobvoi Information Technology Company

- Zepp Health

- TAG Heuer S.A.

- Timex Group USA, Inc.

- Amazfit (Huami Corporation)

- Suunto

- Polar Electro

- Coros

- Others