Global Workplace Transformation Market Size, Share and Analysis Report By Component (Solutions (Cloud-based, On-premises), Services (Consulting Services, Technology Integration Services, Managed Services)), By Organization Size (Large Enterprises, Small & Medium Businesses), By End-User Industry (IT & Telecommunications, BFSI, Healthcare, Retail & Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 172992

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Statistics

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Table

- By Component

- By Organization Size

- By End-User Industry

- By Region

- Regional Driver Comparison

- Emerging Trend Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

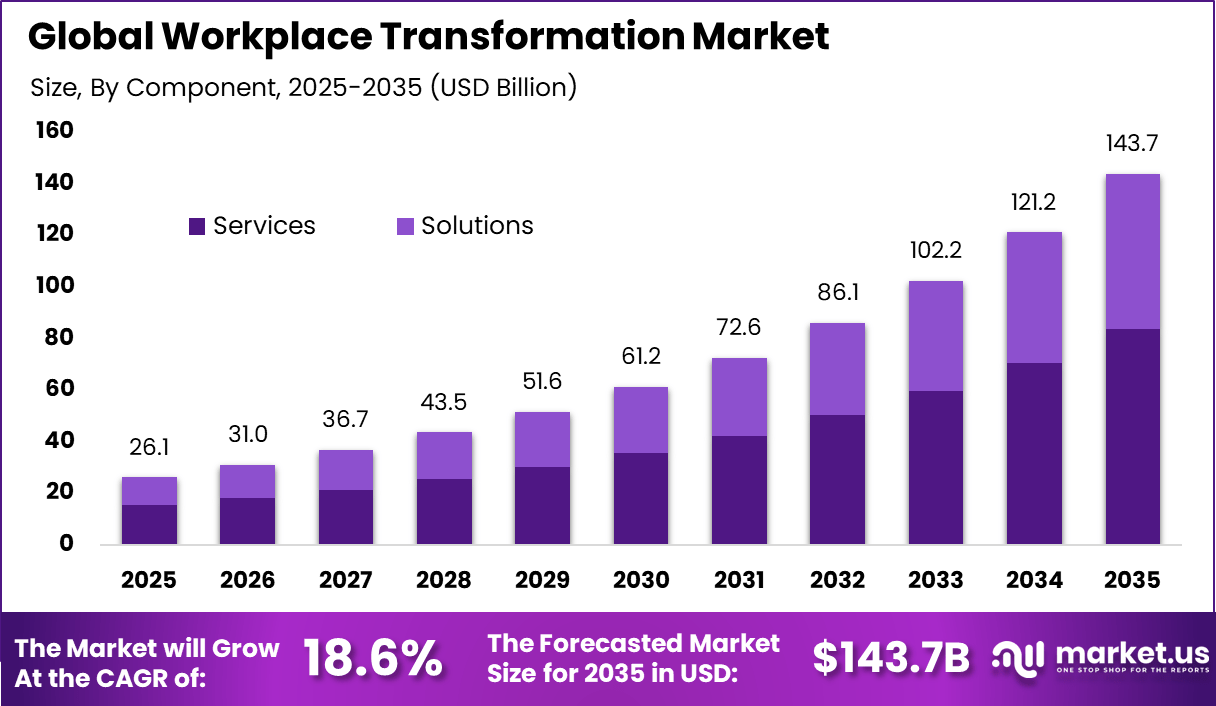

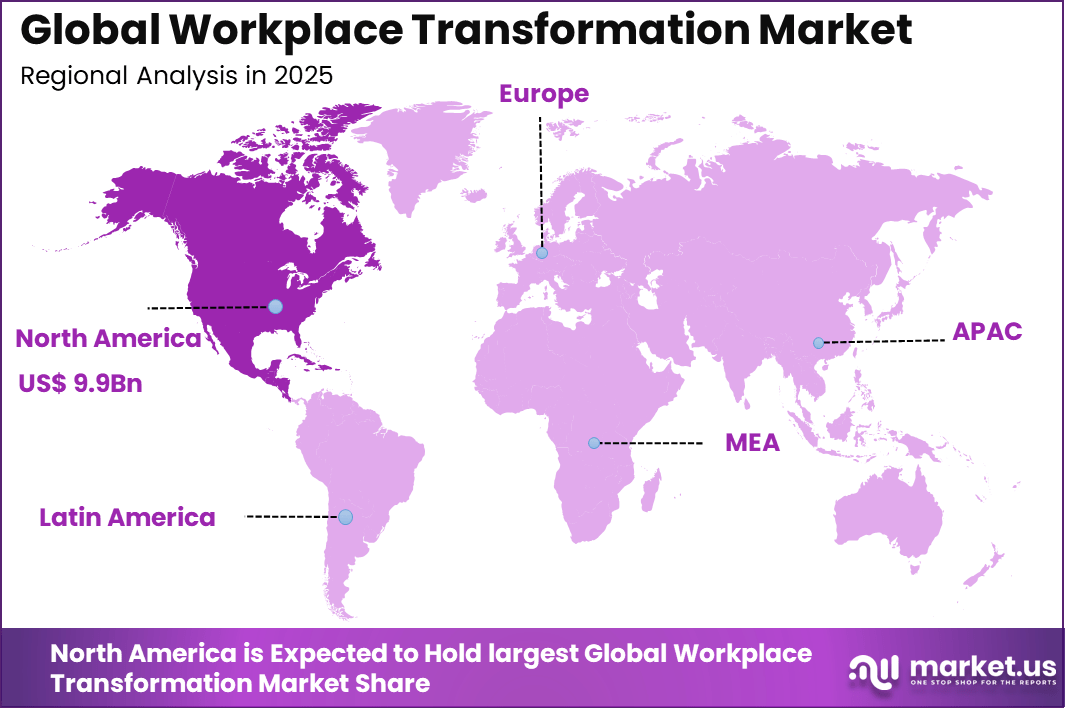

The Global Workplace Transformation Market size is expected to be worth around USD 143.7 Billion By 2035, from USD 26.1 billion in 2025, growing at a CAGR of 18.6% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 38.1% share, holding USD 9.9 Billion revenue.

The workplace transformation market refers to the suite of services, technologies, and strategies that enable organizations to redesign work environments and practices for improved performance. These solutions include digital collaboration tools, flexible workspace models, process automation technologies, and change management frameworks. Adoption of these solutions supports organizations in creating adaptable, resilient, and employee centric workplaces.

The market spans small enterprises to large global corporations aiming to modernize operations. Growth in this market has been influenced by shifts in how and where work is performed. Organizations have increasingly embraced remote and hybrid work arrangements, prompting investment in digital infrastructure and workplace redesign. Employee expectations for flexibility, wellbeing, and inclusive work cultures have further driven demand.

Top Market Takeaways

- Services dominate the market with a 58.3% share, as organizations rely on consulting, integration, and managed services to modernize workflows, infrastructure, and employee experience.

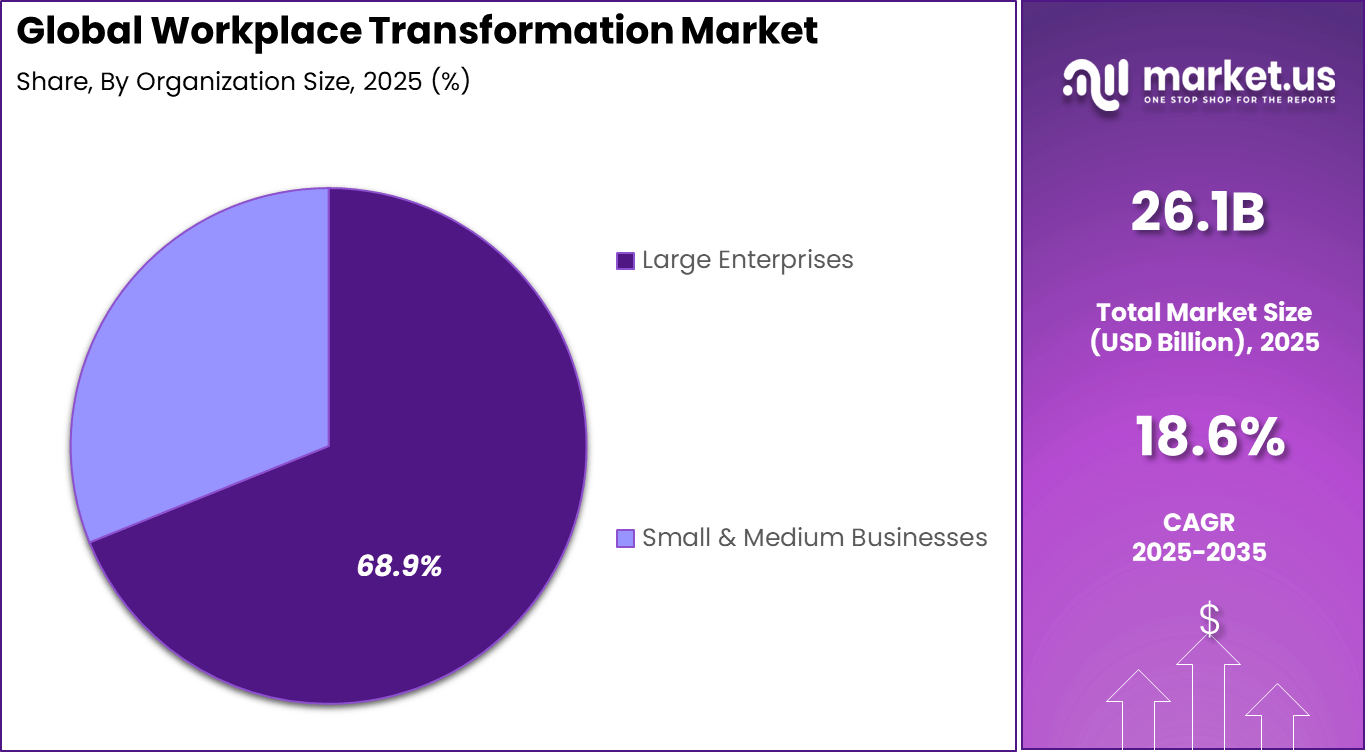

- Large enterprises lead adoption with 68.9%, driven by large-scale digital transformation programs, hybrid work models, and workforce productivity initiatives.

- IT & Telecommunications is the top end-user industry at 41.7%, reflecting early adoption of cloud workplaces, collaboration platforms, and automation tools.

- North America holds 38.1% of the global market, supported by strong enterprise IT spending and mature digital workplace ecosystems.

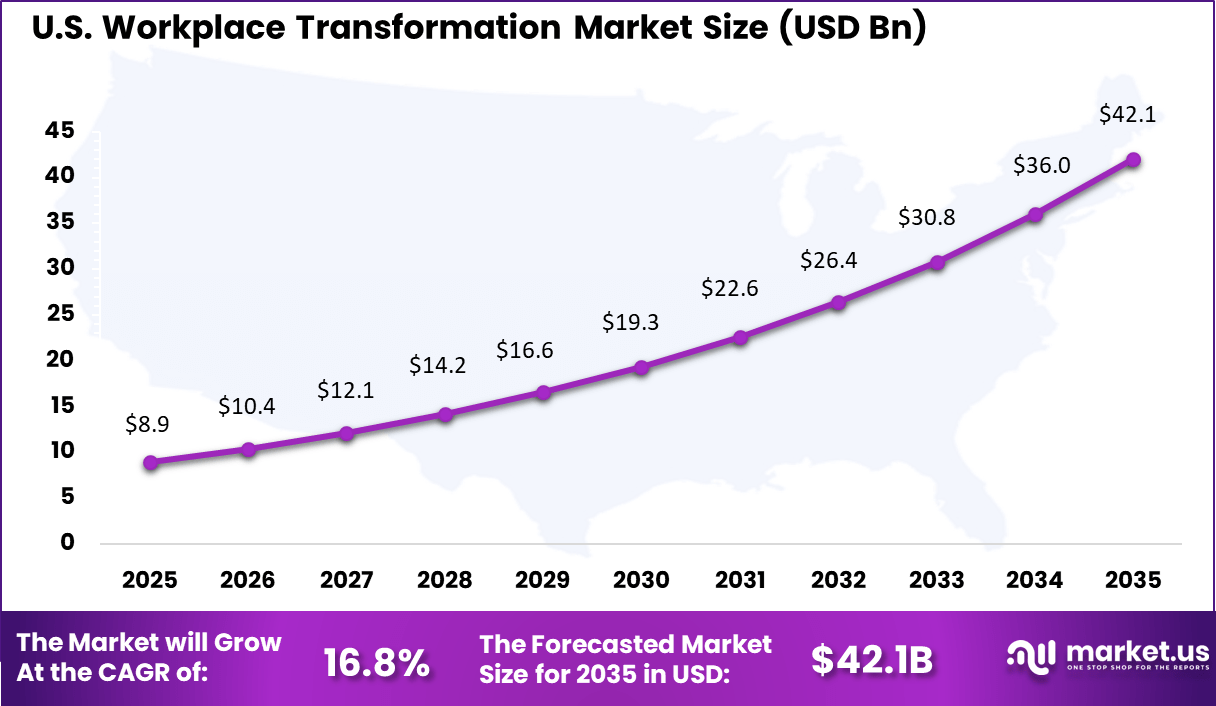

- The U.S. market reached USD 8.96 billion, expanding at a 16.83% CAGR, driven by hybrid work adoption, AI-enabled collaboration tools, and continuous workplace digitization.

Key Statistics

- More than 80% of organizations have a formal workplace transformation strategy in place.

- 84% of companies now offer flexible or hybrid work models.

- 91% of enterprises rely on cloud-based collaboration platforms for daily operations.

- About 22% of roles are expected to be created or displaced by 2030, increasing demand for new skills.

- 81% of employees require AI-related upskilling to stay relevant.

- 78% of jobs are already being enhanced by technology, with AI supporting task execution and decision-making.

- AI and big data, cybersecurity, and overall digital literacy lead skill demand.

- 55% of organizations cite technology selection as a major challenge, alongside data security concerns.

- Nearly 70% of workplace transformation initiatives fail to fully achieve their objectives.

- Only 19% of HR leaders feel prepared to address future talent shortages.

- Around 91% of organizations now rely on cloud-based collaboration platforms, reflecting the central role of digital infrastructure in modern workplaces.

- About 13% of employees report using generative AI for more than 30% of their daily tasks, significantly higher than the 4% usage level perceived by senior executives, indicating a visibility gap at leadership levels.

- Organizations that have effectively embedded AI tools report productivity improvements of up to 37%, driven by faster task execution, better information access, and reduced manual effort.

- Despite progress, more than 33% of enterprises still perform up to half of their workplace processes manually, highlighting substantial potential for further automation and efficiency gains.

Drivers Impact Analysis

Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Hybrid Work Adoption Long term shift toward flexible and remote work models across enterprises. ~4.8% North America, Europe Short to Mid Term Digital Collaboration Demand Rising dependence on cloud based collaboration and communication platforms. ~3.9% Global Short Term Workforce Productivity Focus Growing emphasis on efficiency, automation, and performance monitoring tools. ~3.2% North America, Asia Pacific Mid Term Employee Experience Improvement Organizations prioritize engagement, retention, and digital workplace satisfaction. ~2.7% North America, Europe Mid to Long Term Enterprise IT Modernization Migration from legacy systems toward modern digital workplace environments. ~2.1% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Cybersecurity Exposure Expansion of digital workplace platforms increases attack surfaces and security vulnerabilities. ~2.4% Global Short Term Change Management Failure Employee resistance and low adoption slow the transition to new digital work models. ~1.9% Global Short to Mid Term Data Privacy Compliance Failure to meet data protection regulations creates legal and operational risks. ~1.5% North America, Europe Mid Term IT Skill Shortage Limited availability of skilled professionals delays digital transformation initiatives. ~1.2% Asia Pacific, Emerging Markets Long Term Restraint Impact Table

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration High Implementation Cost Large upfront investments are required for digital tools, platforms, and supporting infrastructure. ~3.1% Emerging Markets Mid Term Integration Complexity Challenges in integrating new digital workplace solutions with legacy IT systems. ~2.6% Global Mid Term Cultural Readiness Gap Limited digital adoption mindset and resistance to change slow transformation. ~2.1% Emerging Markets Long Term ROI Measurement Challenges Difficulty in clearly measuring productivity improvements and return on investment. ~1.7% Global Long Term By Component

Services account for 58.3%, indicating that workplace transformation is largely driven by consulting and implementation support. Organizations rely on services to redesign workflows, digital tools, and employee experiences. These services include change management, process redesign, and technology integration. Expert guidance helps reduce disruption during transformation initiatives. Service-led approaches ensure smoother transitions.

The dominance of services is driven by the complexity of organizational change. Enterprises require tailored solutions rather than standard tools. Service providers help align technology with business objectives. Continuous support improves adoption outcomes. This sustains strong demand for service-based offerings.

By Organization Size

Large enterprises represent 68.9%, highlighting their leadership in workplace transformation adoption. These organizations manage complex workforces across multiple locations. Transformation initiatives help improve productivity and collaboration. Large enterprises invest heavily in digital workplace strategies. Scale increases the need for structured change.

Adoption among large enterprises is driven by operational efficiency goals. Organizations seek to modernize legacy systems and work models. Workplace transformation supports remote and hybrid work structures. Centralized governance is easier with enterprise-wide initiatives. This keeps large enterprises as the primary adopters.

By End-User Industry

IT and telecommunications account for 41.7%, making them the leading end-user industry. This sector experiences rapid technological change and workforce evolution. Workplace transformation helps manage distributed teams effectively. Digital collaboration tools are critical in this industry. Employee experience directly impacts performance.

Growth in this segment is driven by innovation cycles and competitive pressure. IT and telecom firms adopt new work models early. Transformation initiatives support agility and scalability. Digital-first cultures align well with transformation goals. This sustains strong industry demand.

By Region

The United States reached USD 8.96 Billion with a CAGR of 16.83%, reflecting robust market growth. Expansion is driven by enterprise modernization initiatives. Organizations focus on productivity and employee engagement. Technology-enabled workplaces gain priority. Market momentum remains strong.

North America accounts for 38.1%, supported by high enterprise digital maturity. Organizations in the region actively invest in modern workplace solutions. Remote and hybrid work adoption remains strong. Digital infrastructure supports large-scale transformation. The region continues to lead adoption.

Regional Driver Comparison

Region Primary Growth Driver Contribution to Growth (%) Adoption Maturity North America Hybrid work adoption and widespread use of cloud collaboration platforms. 38.1% Advanced Europe Digital workforce regulations and flexible work mandates across enterprises. 27% Advanced Asia Pacific Rapid enterprise digitization and growth of mobile and distributed workforces. 22% Developing Latin America Rising digital workplace adoption among small and medium sized enterprises. 8% Early Middle East and Africa Government led initiatives promoting digital workplaces and smart offices. 5% Early Emerging Trend Analysis

The Workplace Transformation market is evolving with the growing adoption of digital platforms that support collaboration and flexible work arrangements. Organizations are implementing technologies that allow employees to connect, share content, and coordinate tasks regardless of physical location. These tools help sustain productivity in hybrid and remote work environments.

The trend reflects a broader shift toward digital-first workplace models that are designed to support distributed teams. Another emerging trend is the use of analytics to measure employee engagement and workspace utilization.

Companies are deploying data tools that track how digital tools, physical spaces, and work patterns are used. Insights from this data help leaders reconfigure work processes, manage resources more efficiently, and enhance employee experience. This trend emphasizes evidence-based decision making as organizations adapt to changing workforce expectations.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Investment Focus Large Enterprises Very High ~44% End to end digital workplace platforms Mid Size Enterprises High ~29% Collaboration and workflow automation SMEs Moderate ~17% Cloud based productivity tools Public Sector Moderate ~10% Secure and compliant work environments Technology Enablement Analysis

Technology Enablement Role Impact on Growth (%) Adoption Status Cloud Computing Enables scalable and flexible remote work environments across enterprises. ~5.2% Mature Collaboration Platforms Supports real time teamwork, communication, and document sharing. ~4.3% Mature Artificial Intelligence Automates workflows, provides insights, and improves decision making. ~3.7% Growing Analytics and Monitoring Tracks workforce productivity, engagement, and performance metrics. ~3.1% Growing Virtual Desktops Provides secure remote access to enterprise systems and applications. ~2.3% Developing Key Market Segments

By Component

- Solutions

- Cloud-based

- On-premises

- Services

- Consulting Services

- Technology Integration Services

- Managed Services

By Organization Size

- Large Enterprises

- Small & Medium Businesses

By End-User Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Retail & Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Accenture, Deloitte, and IBM lead the workplace transformation market by delivering large scale consulting, digital strategy, and workforce modernization programs. Their services help enterprises redesign operating models, enable hybrid work, and improve employee experience. These firms focus on change management, cloud adoption, and data driven decision making. Rising demand for agile and resilient workplaces continues to reinforce their leadership.

Microsoft, Cisco, Hewlett Packard Enterprise, Citrix, VMware, and Google strengthen the market with collaboration platforms, secure digital workspaces, and cloud infrastructure. Their technologies support remote access, productivity, and workplace security. These providers emphasize scalability, integration, and user centric design. Growing hybrid work adoption supports wider deployment.

Adobe, Salesforce, ServiceNow, Atlassian, Slack, and Zoom expand the landscape with workflow automation, digital collaboration, and employee engagement tools. Their solutions improve communication, process efficiency, and customer alignment. These companies focus on ease of use and rapid deployment. Ongoing digitalization of work processes continues to drive steady growth in the workplace transformation market.

Top Key Players in the Market

- Accenture

- Deloitte

- IBM

- Microsoft

- Cisco

- HPE

- Citrix

- VMware

- Adobe

- Salesforce

- ServiceNow

- Atlassian

- Slack

- Zoom

- Others

Recent Developments

- In July 2025, a strategic partnership was formed between Infosys and the German energy company RWE to support digital workplace transformation. The collaboration focused on improving daily operations and strengthening internal efficiency across RWE’s workforce. Digital tools were adopted to simplify work processes and improve employee access to systems. This initiative aligned with RWE’s broader objective of building a more agile and efficient organization.

- In January 2024, Accenture reached an agreement to acquire Work & Co, a global digital product company. The acquisition was intended to strengthen Accenture’s digital product and experience transformation capabilities within Accenture Song. This move reflected Accenture’s focus on expanding its ability to deliver advanced digital solutions. The deal supported long term efforts to enhance client engagement through design led innovation.

Report Scope

Report Features Description Market Value (2025) USD 26.1 Bn Forecast Revenue (2035) USD 143.7 Bn CAGR(2026-2035) 18.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions (Cloud-based, On-premises), Services (Consulting Services, Technology Integration Services, Managed Services)), By Organization Size (Large Enterprises, Small & Medium Businesses), By End-User Industry (IT & Telecommunications, BFSI, Healthcare, Retail & Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture, Deloitte, IBM, Microsoft, Cisco, HPE, Citrix, VMware, Google, Adobe, Salesforce, ServiceNow, Atlassian, Slack, Zoom, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Workplace Transformation MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Workplace Transformation MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture

- Deloitte

- IBM

- Microsoft

- Cisco

- HPE

- Citrix

- VMware

- Adobe

- Salesforce

- ServiceNow

- Atlassian

- Slack

- Zoom

- Others