Global Wireless Telecom Infrastructure Market Size, Share, Statistics Analysis Report By Infrastructure Type (Base Stations, Antennas, Transceivers, Backhaul Equipment, Other Infrastructure Types), By Technology (4G/LTE, 5G, Other Technologies), By End-User (Telecom Operators, Enterprises, Government and Public Sector, Other End-Users), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 30670

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

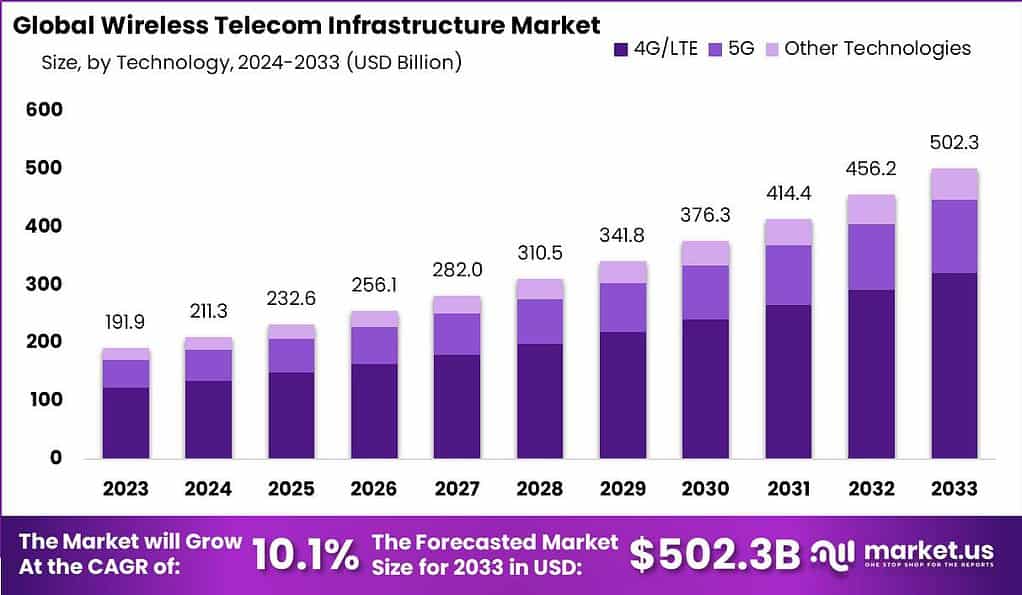

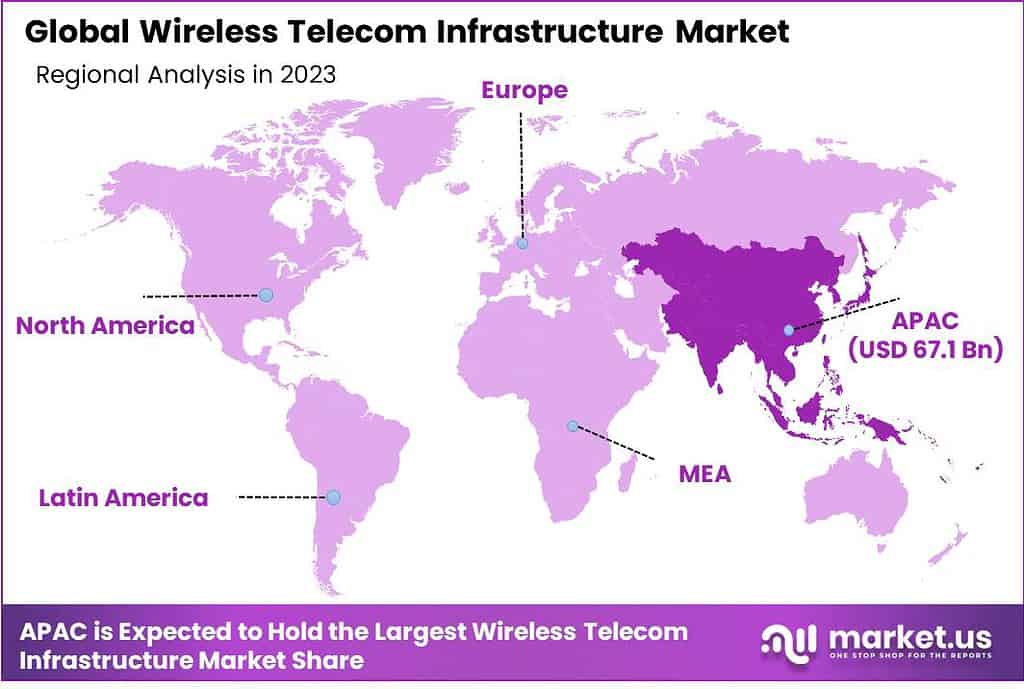

The Global Wireless Telecom Infrastructure Market size is expected to be worth around USD 502.3 Billion by 2033, from USD 191.9 Billion in 2023, growing at a CAGR of 10.1% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 35% share, holding USD 67.1 Billion revenue.

Wireless telecom infrastructure encompasses the array of network systems and equipment that enable wireless communication and data transfer without the need for physical connections like cables. This infrastructure includes various elements such as telecom towers, which support antennas and communication devices essential for wide network coverage, especially crucial in rural and remote areas.

The wireless telecom infrastructure market is driven by several key factors. The increasing demand for mobile and broadband services, the push for expanded coverage in both urban and rural areas, and the ongoing upgrades from older technologies to advanced networks like 5G all contribute to the growth of this market.

Additionally, the need for robust and reliable communication networks has been underscored by the expanding IoT (Internet of Things) landscape, which requires widespread and efficient wireless connectivity to function optimally. The primary drivers of the wireless telecom infrastructure market include the surging demand for higher data speeds and greater network coverage.

This demand is largely fueled by the increasing consumption of digital content and the proliferation of connected devices. Advancements in technology, such as the rollout of 5G networks, are also significant catalysts, enhancing the capabilities of wireless networks to support new applications and services that require high bandwidth and low latency.

The market demand within the wireless telecom sector is robust, driven by the need for continuous connectivity and increased data transmission capabilities. Opportunities in this market are abundant, particularly in the development of infrastructure that supports the latest technologies like 5G and beyond.

Rural connectivity remains a significant area for growth, as these regions often lack the infrastructure needed for high-speed internet access, presenting a valuable opportunity for market players to expand their reach and impact.

Technological advancements are continuously shaping the wireless telecom infrastructure sector. Innovations such as small cell technology, distributed antenna systems (DAS), and the integration of AI for network optimization are key developments. These technologies help in increasing the capacity and efficiency of wireless networks, particularly in densely populated areas.

In 2022, the U.S. wireless and mobile industry allocated $11.9 billion towards enhancing capacity and coverage in the nation’s wireless networks, as reported by the Wireless Infrastructure Association. By the close of 2022, the industry boasted 142,100 cellular towers, 209,500 macrocell sites (excluding small cells), 678,700 macrocell sectors (excluding small cells), along with 452,200 outdoor small cell nodes and 747,400 indoor small cell nodes actively supporting network operations.

American Tower Corporation (AMT) is the leading player in terms of market capitalization, with a value of $102.2 billion as of February 16, 2024. The company has witnessed a 5% increase in its share price in 2023 and secured $5.2 billion in funding in 2022. American Tower Corporation is known for its extensive portfolio of cellular towers, which contribute to the expansion and enhancement of wireless networks across the country.

Crown Castle International Corp. (CCI) holds the second-largest market capitalization, standing at $60.7 billion. However, the company experienced a 3% decline in its share price in 2023. Crown Castle International Corp. secured $4.7 billion in funding in 2022. The company specializes in the deployment and operation of shared communications infrastructure, including towers and small cell networks.

SBA Communications Corporation (SBAC) holds a market capitalization of $30.4 billion. The company faced an 8% decrease in its share price in 2023 and secured $3.1 billion in funding in 2022. SBA Communications Corporation focuses on the development and leasing of wireless infrastructure, including towers and rooftops, catering to the needs of wireless carriers.

Equinix, Inc. (EQIX), with a market capitalization of $39.5 billion, witnessed a 2% increase in its share price in 2023. The company secured $2.8 billion in funding in 2022. Equinix specializes in providing data center and interconnection solutions, facilitating the connectivity and exchange of data between various networks and providers.

Digital Realty Trust, Inc. (DLR) holds a market capitalization of $38.9 billion. The company experienced a 5% decline in its share price in 2023 and secured $3.5 billion in funding in 2022. Digital Realty Trust focuses on providing data center solutions and colocation services, supporting the storage and processing needs of wireless networks and cloud providers.

Verizon Communications Inc. (VZ) is a prominent wireless telecom operator with a market capitalization of $352.4 billion. The company witnessed a 3% increase in its share price in 2023 and secured $10.5 billion in funding in 2022. Verizon Communications Inc. plays a vital role in the wireless infrastructure market as a wireless service provider, investing heavily in expanding and upgrading its network infrastructure to support the growing demand for wireless connectivity.

Key Takeaways

- The Wireless Telecom Infrastructure Market is projected to witness significant growth, with an estimated worth of USD 502.3 billion by 2033, showing a robust CAGR of 10.1% during the forecast period.

- Base stations emerged as the dominant infrastructure type in 2023, capturing over 40% market share. They play a crucial role in facilitating wireless communication networks, especially with the increasing demand for wireless services and the deployment of advanced technologies like 5G.

- In 2023, the 4G/LTE segment held over 64% market share, underscoring its widespread adoption and maturity. This technology offers high-speed data transmission, improved network capacity, and wide coverage, making it the preferred choice for consumers and businesses.

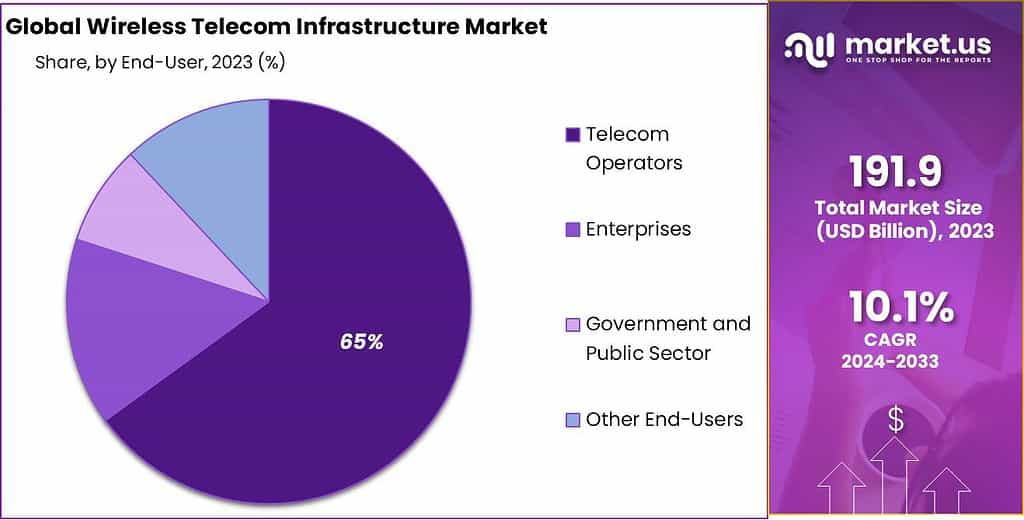

- Telecom operators held a dominant position in the market, capturing more than 65% market share in 2023. They drive demand for wireless infrastructure by serving millions of subscribers, investing in network expansion, and adopting new technologies like 5G to enhance communication services.

- Asia-Pacific led the market in 2023, accounting for over 35% market share. Factors such as rapid adoption of mobile technology, economic growth, and the deployment of 5G networks contribute to the region’s dominance.

Infrastructure Type Analysis

In 2023, the Base Stations segment held a dominant market position in the wireless telecom infrastructure market, capturing more than a 40% share. This segment’s leading position can be attributed to several key factors that highlight its crucial role in enabling wireless communication networks.

Base stations are fundamental components of wireless networks as they serve as the primary interface between mobile devices and the network infrastructure. These stations facilitate the transmission and reception of wireless signals, allowing for seamless connectivity and communication. The increasing demand for wireless services, coupled with the growing number of mobile devices, has propelled the need for robust and efficient base stations.

Moreover, the deployment of advanced wireless technologies such as 5G has further boosted the significance of base stations. 5G networks require a dense network of base stations to provide high-speed data transmission, low latency, and enhanced network capacity. As a result, telecom operators and infrastructure providers are investing heavily in upgrading their base station infrastructure to support the rollout of 5G networks.

Additionally, the rise of emerging applications and services such as IoT (Internet of Things), smart cities, and autonomous vehicles heavily rely on base stations for seamless connectivity. These applications require a reliable and extensive network coverage, which can be achieved through the deployment of strategically located base stations.

Furthermore, the increasing demand for mobile data and video streaming services has driven the need for higher-capacity base stations. With the exponential growth of data consumption, base stations need to support the ever-increasing data traffic and provide a consistent user experience.

Technology Analysis

In 2023, the 4G/LTE segment held a dominant market position in the wireless telecom infrastructure market, capturing more than a 64% share. This segment’s leading position can be attributed to several factors that underline the widespread adoption and maturity of 4G/LTE technology.

4G/LTE (Fourth Generation/Long-Term Evolution) technology has been a significant driver of the wireless telecom infrastructure market due to its ability to provide high-speed data transmission, improved network capacity, and lower latency compared to previous generations of wireless technology. The large-scale deployment of 4G/LTE networks worldwide has enabled faster and more reliable wireless connectivity, meeting the growing demand for mobile data and supporting a wide range of applications and services.

One of the key factors contributing to the dominance of the 4G/LTE segment is the extensive network coverage it offers. 4G/LTE networks have achieved wide coverage in various regions globally, providing reliable connectivity in urban, suburban, and rural areas. This widespread availability of 4G/LTE networks has made it the go-to technology for consumers and businesses, driving the demand for 4G/LTE infrastructure.

Additionally, the maturity of 4G/LTE technology and the availability of a wide range of compatible devices have played a crucial role in its market dominance. The majority of smartphones, tablets, and other mobile devices in the market are 4G/LTE-enabled, making it the most widely supported wireless technology. This compatibility has further fueled the demand for 4G/LTE infrastructure to ensure seamless connectivity and optimal performance for users.

Furthermore, while the deployment of 5G networks has gained momentum, the transition to 5G is a gradual process that takes time and substantial investments. As 5G technology continues to evolve and expand, telecom operators and infrastructure providers are still heavily reliant on 4G/LTE infrastructure to cater to the existing user base and provide reliable coverage. This reliance on 4G/LTE networks has contributed to the continued dominance of the 4G/LTE segment in the wireless telecom infrastructure market.

End-User Analysis

In 2023, the Telecom Operators segment held a dominant market position in the wireless telecom infrastructure market, capturing more than a 65% share. This segment’s leading position can be attributed to several key factors that highlight the significant role of telecom operators in driving the demand for wireless infrastructure.

Telecom operators are the primary providers of wireless communication services, offering voice, data, and other value-added services to consumers and businesses. They invest heavily in building and expanding their network infrastructure to meet the increasing demand for wireless connectivity, both in terms of coverage and capacity.

One of the reasons for the Telecom Operators segment’s dominance is the large customer base that telecom operators serve. With millions of subscribers relying on their services, telecom operators require robust and extensive network infrastructure to ensure reliable and uninterrupted communication. This drives the need for continuous investment in wireless telecom infrastructure, including towers, base stations, and backhaul equipment, to cater to the growing number of subscribers and their data consumption.

Moreover, telecom operators play a crucial role in driving technological advancements in the wireless industry. They are at the forefront of adopting and deploying new wireless technologies such as 5G, which require significant infrastructure upgrades. Telecom operators invest in upgrading their networks to support the latest technologies, enabling faster and more efficient wireless communication for their customers.

Additionally, telecom operators often have exclusive partnerships and agreements with equipment vendors and infrastructure providers. These partnerships give them access to the latest and most advanced wireless infrastructure solutions, allowing them to stay ahead in terms of network capabilities and service offerings. This further strengthens their position in the market.

Key Market Segments

Infrastructure Type

- Base Stations

- Antennas

- Transceivers

- Backhaul Equipment

- Other Infrastructure Types

Technology

- 4G/LTE

- 5G

- Other Technologies

End-User

- Telecom Operators

- Enterprises

- Government and Public Sector

- Other End-Users

Driver

One of the key drivers in the wireless telecom infrastructure market is the increasing demand for high-speed and reliable wireless connectivity. With the proliferation of smartphones, tablets, IoT devices, and other connected devices, consumers and businesses have an insatiable appetite for data-intensive applications and services.

This surge in data consumption necessitates robust wireless infrastructure to provide seamless connectivity and support the growing demand for high-bandwidth services such as video streaming, online gaming, and cloud computing. As a result, telecom operators and infrastructure providers are compelled to invest in expanding and upgrading their wireless networks to meet this escalating demand and offer an enhanced user experience.

Restraint

A significant restraint in the wireless telecom infrastructure market is the high cost associated with deploying and maintaining network infrastructure. Building and maintaining a comprehensive network of towers, base stations, and backhaul equipment requires substantial financial investments. Additionally, the continuous need for upgrades and technology advancements further adds to the expenses. These high costs pose a challenge for both telecom operators and infrastructure providers, especially smaller players with limited financial resources.

Moreover, the return on investment for infrastructure deployments is typically spread over an extended period due to the long-term nature of contracts and agreements with telecom operators. This financial burden can hinder the pace of infrastructure development, particularly in regions with budget constraints or limited access to funding.

Opportunity

One significant opportunity in the wireless telecom infrastructure market lies in the emergence of new applications and technologies, such as the Internet of Things (IoT) and smart cities. The proliferation of IoT devices and the need for seamless connectivity between them present a vast opportunity for infrastructure providers. IoT applications require a robust and reliable network infrastructure to support the massive influx of data and enable real-time communication between devices.

Additionally, the development of smart cities, which rely on interconnected devices and sensors for efficient resource management and improved quality of life, further drives the demand for advanced wireless infrastructure. This presents a compelling opportunity for infrastructure providers to offer tailored solutions and expand their market presence by catering to the specific requirements of IoT and smart city deployments.

Challenge

One of the significant challenges in the wireless telecom infrastructure market is the deployment of 5G networks. While 5G offers tremendous potential for faster speeds, lower latency, and increased network capacity, its implementation comes with various challenges. 5G requires a denser network of small cells and base stations due to its higher frequency bands, which poses challenges in terms of infrastructure deployment and site acquisition.

Additionally, the cost of upgrading existing infrastructure to support 5G can be substantial. Furthermore, the regulatory environment and spectrum availability vary across regions, leading to inconsistencies and delays in 5G deployment. Overcoming these challenges and ensuring a smooth and widespread rollout of 5G networks is crucial for infrastructure providers and telecom operators to fully leverage the potential of this transformative technology.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the wireless telecom infrastructure market, capturing more than a 35% share. This regional leadership can be attributed to several key factors that highlight the dynamic growth and potential of the Asia-Pacific market.

One of the primary reasons for Asia-Pacific’s leading position is its vast population and the rapid adoption of mobile technology in the region. With a significant portion of the world’s population residing in countries like China and India, there is a substantial customer base for telecom operators and infrastructure providers to cater to. This large population, combined with increasing smartphone penetration and growing internet usage, has created a strong demand for wireless connectivity and infrastructure in the Asia-Pacific region.

Moreover, the Asia-Pacific region has witnessed significant economic growth and increasing urbanization over the years. This has led to a surge in demand for advanced communication services, including high-speed internet and mobile data. Telecom operators in the region have been investing heavily in expanding and upgrading their network infrastructure to meet the rising demand and provide reliable connectivity to urban centers as well as rural areas.

Furthermore, Asia-Pacific is emerging as a key market for the deployment of 5G networks. Several countries in the region, including China, South Korea, and Japan, have been at the forefront of 5G advancements and have made substantial investments in 5G infrastructure.

The rollout of 5G networks in Asia-Pacific has been driven by factors such as government initiatives, strong industry partnerships, and the need to support emerging technologies like IoT and smart cities. This focus on 5G deployment has further fueled the demand for wireless telecom infrastructure in the region.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the Wireless Telecom Infrastructure Market witnessed dynamic developments from key players such as ZTE, Crown Castle, Ericsson, Mobilitie, TowerCo, Nokia, AT&T Towers, Samsung, SBA Communications, American Tower Corporation, Vertical Bridge, and other significant industry participants. ZTE, a prominent global telecommunications equipment manufacturer, continued to make strides in providing cutting-edge infrastructure solutions, particularly in the realm of 5G technology. Their innovative offerings contributed to the advancement of wireless networks worldwide, positioning them as a key player in the market.

Crown Castle, Ericsson, Nokia, and Samsung, renowned for their expertise in telecom infrastructure, played pivotal roles in driving the evolution of wireless networks, with a focus on deploying 5G infrastructure and enhancing network capabilities. Their collaborative efforts with telecom operators and industry stakeholders facilitated the expansion of 5G coverage and the delivery of high-speed, low-latency services to end-users.

Top Market Leaders

- ZTE

- Crown Castle

- Ericsson

- Mobilitie

- TowerCo

- Nokia

- AT&T Towers

- Samsung

- SBA Communications

- American Tower Corporation

- Vertical Bridge

- Other Key Players

Recent Developments

1. Mobilitie:

- January 2023: Announced a partnership with American Tower Corporation (ATC) to deploy and manage small cell infrastructure across the US.

- March 2023: Secured $200 million in funding to expand its 5G network infrastructure solutions.

- October 2023: Launched a new cloud-based platform for managing and optimizing network performance.

2. TowerCo:

- April 2023: Completed the acquisition of rival Crown Castle International for $19 billion, creating the world’s largest tower operator.

- July 2023: Signed a multi-year agreement with Verizon to deploy additional cell sites across the US.

- December 2023: Announced plans to invest $5 billion in expanding its fiber optic network infrastructure.

3. Nokia:

- February 2023: Unveiled a new generation of radio access network (RAN) equipment optimized for 5G deployments.

- June 2023: Secured a major contract with Deutsche Telekom to supply 5G equipment for its European networks.

- November 2023: Partnered with Microsoft to develop and deploy cloud-based solutions for edge computing in telecom networks.

Report Scope

Report Features Description Market Value (2023) US$ 191.9 Bn Forecast Revenue (2033) US$ 502.3 Bn CAGR (2024-2033) 10.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Infrastructure Type (Base Stations, Antennas, Transceivers, Backhaul Equipment, Other Infrastructure Types), By Technology (4G/LTE, 5G, Other Technologies), By End-User (Telecom Operators, Enterprises, Government and Public Sector, Other End-Users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ZTE, Crown Castle, Ericsson, Mobilitie, TowerCo, Nokia, AT&T Towers, Samsung, SBA Communications, American Tower Corporation, Vertical Bridge, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Wireless Telecom Infrastructure Market?The Wireless Telecom Infrastructure Market refers to the physical and virtual infrastructure that enables wireless communication. This includes cell towers, base stations, antennas, and other equipment necessary for wireless networks to function.

How big is Wireless Telecom Infrastructure Market?The Global Wireless Telecom Infrastructure Market size is expected to be worth around USD 502.3 Billion by 2033, from USD 191.9 Billion in 2023, growing at a CAGR of 10.1% during the forecast period from 2024 to 2033.

What are the Key Drivers of Growth in the Wireless Telecom Infrastructure Market?The growth of the Wireless Telecom Infrastructure Market can be attributed to several factors, including the increasing demand for high-speed internet and the proliferation of smartphones and other connected devices.

What are the Major Challenges Facing the Wireless Telecom Infrastructure Market?Some of the major challenges facing the Wireless Telecom Infrastructure Market include the high cost of deploying and maintaining wireless infrastructure, as well as regulatory hurdles and environmental concerns related to the installation of cell towers and other equipment.

What are the Opportunities for Growth in the Wireless Telecom Infrastructure Market?Despite the challenges, there are several opportunities for growth in the Wireless Telecom Infrastructure Market. For example, the deployment of 5G networks is expected to create new revenue streams for wireless infrastructure providers, while the increasing demand for wireless connectivity in emerging markets presents new growth opportunities.

What are the Key Players in the Wireless Telecom Infrastructure Market?Some of the key players in the Wireless Telecom Infrastructure Market include major telecommunications companies such as ZTE, Crown Castle, Ericsson, Mobilitie, TowerCo, Nokia, AT&T Towers, Samsung, SBA Communications, American Tower Corporation, Vertical Bridge, Other Key Players

Wireless Telecom Infrastructure MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Wireless Telecom Infrastructure MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ZTE

- Crown Castle

- Ericsson

- Mobilitie

- TowerCo

- Nokia

- AT&T Towers

- Samsung

- SBA Communications

- American Tower Corporation

- Vertical Bridge

- Other Key Players