Global Window and Door Frame Market Size, Share and Future Trends Analysis Report By Type (Door Frame, Window Frame), By Material (Metal, Wood, Glass, Composite, uPVC, Others), By Application (Residential, Commercial), By Distribution Channel (Distributor, Specialized Store, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148404

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

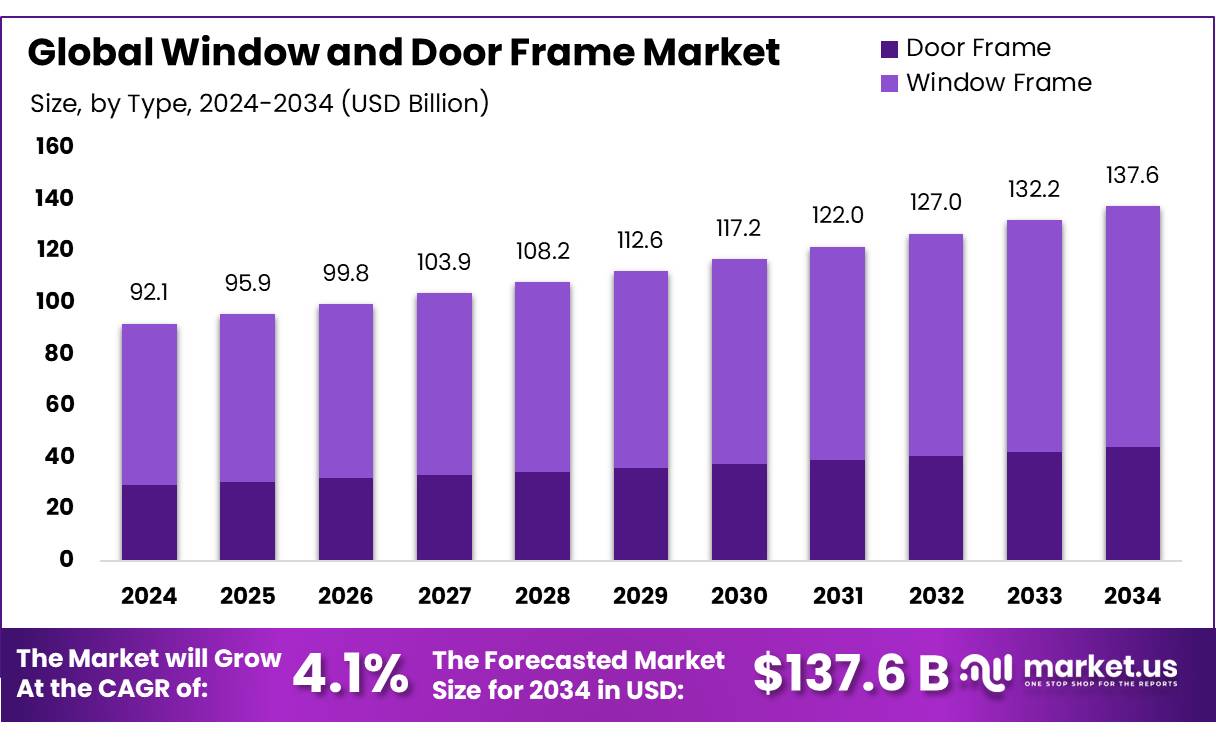

The Global Window and Door Frame Market size is expected to be worth around USD 137.6 Billion by 2034, from USD 92.1 Billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

The global window and door frame concentrates market is experiencing steady growth, driven by robust demand in the building and construction sector, increasing urbanization, and a focus on energy-efficient and sustainable building solutions. Window and door frame concentrates, essential for manufacturing durable and aesthetically appealing frames, are integral to residential, commercial, and industrial construction. The market is shaped by evolving architectural trends, technological advancements, and stringent regulatory frameworks promoting energy efficiency and environmental sustainability.

According to the United Nations, global urban population growth, projected to reach 68% by 2050, is fueling construction activities, particularly in emerging economies, thereby boosting demand for high-quality window and door frames.

Technological advancements are reshaping the industry landscape. The integration of smart technologies into window and door systems, such as automated locking mechanisms and energy-efficient glazing, is becoming increasingly prevalent. Additionally, the adoption of prefabricated and modular construction methods is streamlining installation processes and reducing on-site labor requirements.

Key Takeaways

- Window and Door Frame Market size is expected to be worth around USD 137.6 Billion by 2034, from USD 92.1 Billion in 2024, growing at a CAGR of 4.1%.

- Window Frames held a dominant market position, capturing more than a 67.9% share.

- uPVC held a dominant market position, capturing more than a 32.1% share.

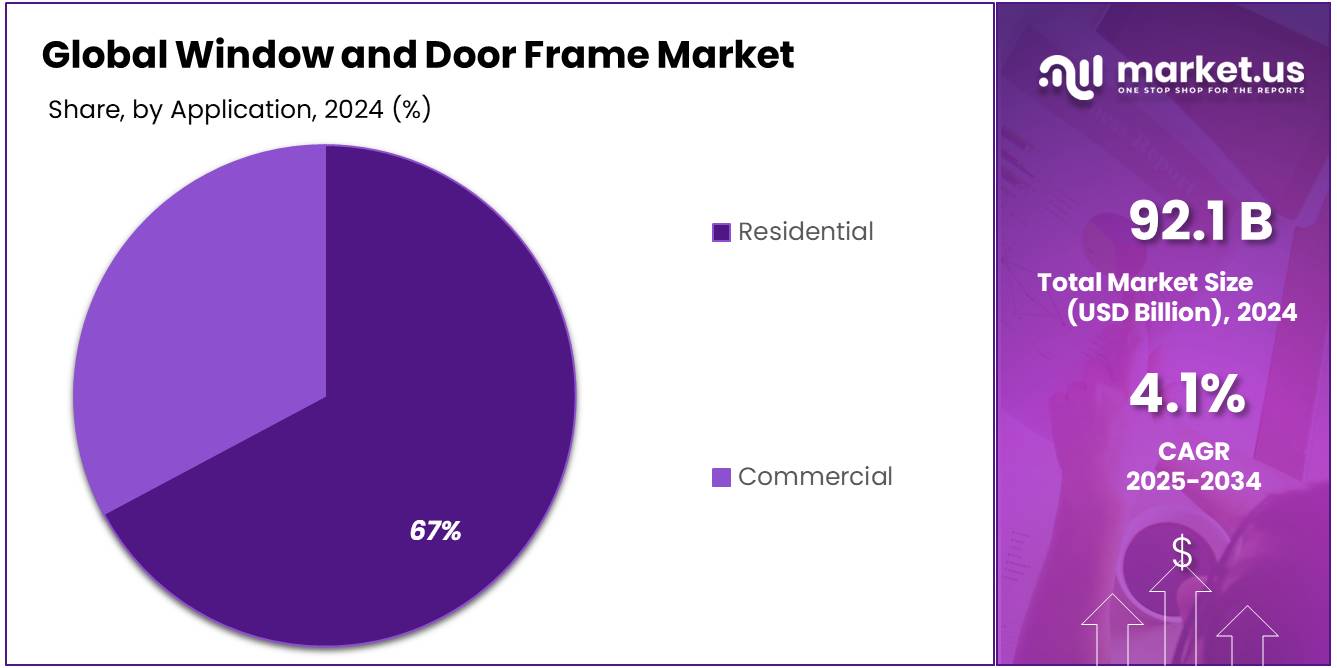

- Residential held a dominant market position, capturing more than a 67.6% share.

- Distributor held a dominant market position, capturing more than a 47.2% share.

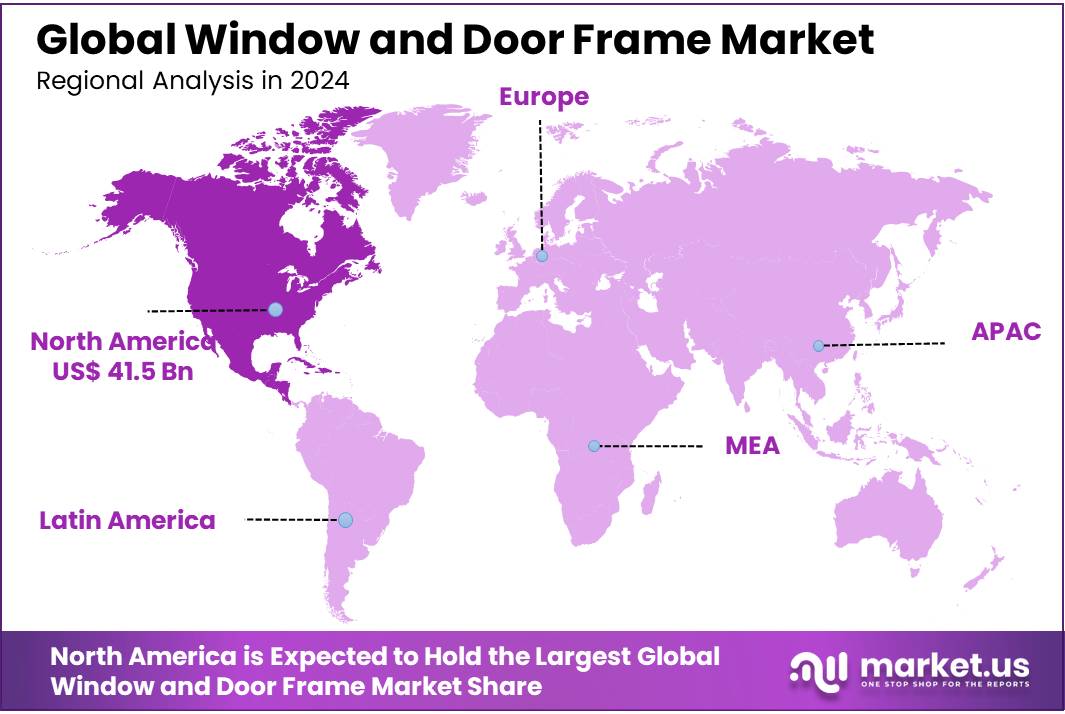

- North America dominated the global window and door frame market, capturing a substantial 45.10% share, equating to approximately USD 41.5 billion in market value.

Analysts Viewpoint

From an investment perspective, the Indian window and door frame sector presents a compelling opportunity, driven by rapid urbanization and a growing emphasis on energy-efficient construction. This growth is underpinned by government initiatives like the Pradhan Mantri Awas Yojana (PMAY) and the Smart Cities Mission, which are accelerating residential and commercial infrastructure development across the country.

Technological advancements are also influencing the market, with the integration of smart technologies into window and door systems becoming increasingly prevalent. Features such as automated locking mechanisms and energy-efficient glazing are enhancing the functionality and appeal of modern window and door frames. Moreover, the adoption of prefabricated and modular construction methods is streamlining installation processes and reducing on-site labor requirements.

However, investors should be cognizant of potential risks, including fluctuations in raw material prices and the need to comply with evolving regulatory standards. The Bureau of Indian Standards (BIS) plays a pivotal role in regulating and standardizing the quality of window and door frames, ensuring that products meet safety and performance criteria. Staying abreast of these regulations is crucial for maintaining compliance and capitalizing on government incentives promoting sustainable building practices.

By Type

Window Frame Dominates with 67.9% in 2024 Due to Robust Demand in Residential and Commercial Sectors

In 2024, Window Frames held a dominant market position, capturing more than a 67.9% share. This dominance is driven by the growing demand in both residential and commercial sectors, where window frames are a key component in construction and renovation projects. The surge in real estate development, especially in emerging economies, has contributed to the increasing adoption of window frames, particularly in new residential buildings and high-rise commercial structures. Furthermore, advancements in materials and designs have made window frames more durable and energy-efficient, making them increasingly popular for eco-conscious consumers. As the market continues to evolve, the demand for window frames is expected to remain high, with projections suggesting steady growth in the coming years.

By Material

uPVC Dominates with 32.1% in 2024 Due to Its Durability and Cost-Effectiveness

In 2024, uPVC held a dominant market position, capturing more than a 32.1% share. This material’s popularity continues to rise, particularly in the construction of windows and door frames, driven by its excellent durability, low maintenance, and cost-effectiveness. uPVC is highly resistant to environmental factors like moisture and temperature fluctuations, making it a preferred choice in regions with extreme weather conditions. The increasing trend of energy-efficient homes has also contributed to its growth, as uPVC frames provide superior insulation. Moreover, the material’s versatility in design and availability in a wide range of colors further boosts its demand in residential and commercial projects. As more construction projects emphasize sustainability and long-term durability, uPVC’s market share is expected to remain strong, continuing its growth in 2025 and beyond.

By Application

Residential Dominates with 67.6% in 2024 Due to Growing Housing Demand and Renovation Projects

In 2024, Residential held a dominant market position, capturing more than a 67.6% share. This segment’s strong performance is largely attributed to the continuous growth in residential construction and home renovation activities. As the demand for new homes increases, particularly in urban and suburban areas, the need for quality window and door frames continues to rise. Furthermore, the growing trend of home improvements and renovations is a significant factor, with homeowners seeking more durable, energy-efficient solutions. Residential projects are prioritizing materials like uPVC and wood, which offer both aesthetic appeal and energy-saving benefits. With the housing market expected to maintain its robust growth, the residential application segment is projected to sustain its dominance in 2025 and beyond.

By Distribution Channel

Distributor Dominates with 47.2% in 2024 Due to Extensive Network and Reach

In 2024, Distributor held a dominant market position, capturing more than a 47.2% share. This segment’s leadership is driven by the established distribution networks and the strong relationships between manufacturers and distributors. Distributors play a critical role in ensuring the availability of window and door frames across various regions, reaching a broad customer base, including contractors, builders, and retail outlets. Their extensive reach and ability to provide timely delivery and bulk orders have made them a preferred channel for both large-scale construction projects and smaller home renovations. As construction and renovation activities are expected to rise in 2025, the distributor segment is set to maintain its key position in the market, continuing to benefit from increased demand for building materials and timely supply chains.

Key Market Segments

By Type

- Door Frame

- Entry Doors

- Patio Doors

- French Doors

- Sliding Doors

- Bi-Fold Doors

- Garage Doors

- Window Frame

- Casement Windows

- Awning Windows

- Double-Hung Windows

- Slider Windows

- Picture Windows

- Bay Windows

- Skylights

By Material

- Metal

- Wood

- Glass

- Composite

- uPVC

- Others

By Application

- Residential

- New Residential

- Improvement & Repair

- Commercial

- New Commercial

- Improvement & Repair

By Distribution Channel

- Distributor

- Specialized Store

- Online

- Others

Drivers

Rising Demand for Energy-Efficient Building Materials Drives Window and Door Frame Market Growth

One of the major driving factors for the Window and Door Frame market is the growing demand for energy-efficient building materials. With increasing awareness about environmental issues and rising energy costs, homeowners and businesses are focusing on reducing energy consumption through better insulation. Window and door frames play a critical role in this, as energy-efficient frames help maintain interior temperatures, reduce the need for heating and cooling, and contribute to lower energy bills.

According to the U.S. Department of Energy, energy-efficient windows and doors can reduce household energy bills by up to 15%. This is driving demand for window and door frames made from materials such as uPVC, which are known for their superior insulation properties. In addition to reducing energy consumption, these frames also help in minimizing carbon footprints, which is increasingly important as more people seek eco-friendly home solutions.

Government initiatives also support this trend, with various countries introducing programs to encourage the use of energy-efficient materials in construction. For instance, in the United States, the Energy Star program promotes the adoption of energy-efficient windows, doors, and frames, offering incentives to homeowners and builders who choose products that meet high-efficiency standards. The European Union has also implemented strict energy performance regulations for new buildings, encouraging the use of advanced window and door frame technologies to improve energy conservation.

Restraints

High Initial Costs of Energy-Efficient Materials as a Restraining Factor for Window and Door Frame Market

A significant restraining factor for the Window and Door Frame market is the high initial cost associated with energy-efficient materials. While energy-efficient windows and door frames offer long-term savings on energy bills, the upfront investment can be substantial, particularly for high-quality products made from uPVC or composite materials. Many consumers and construction companies are deterred by these initial costs, especially when working with tight budgets or in economically challenging environments.

For example, energy-efficient windows can cost up to 2 to 3 times more than standard windows. According to the U.S. Department of Energy, the cost of installing energy-efficient windows can range between $300 and $1,500 per window, depending on the material and design. Although these windows provide significant savings in energy consumption over time, the initial financial burden remains a challenge for many homeowners, especially in markets with lower disposable incomes.

Additionally, while government initiatives and rebates can help offset some of these costs, the process to qualify for such programs can be complex and time-consuming. For example, the Energy Star program, which offers incentives for energy-efficient products, has specific requirements that may not always be accessible to all consumers, particularly in rural or economically disadvantaged areas.

Opportunity

Increased Focus on Sustainable Building Practices Presents Growth Opportunities for Window and Door Frame Market

A significant growth opportunity for the Window and Door Frame market lies in the increasing focus on sustainable building practices and green construction. As environmental awareness continues to rise globally, both consumers and builders are increasingly prioritizing energy-efficient and environmentally friendly materials in their construction projects. This growing demand for sustainable solutions presents a substantial opportunity for the window and door frame market, particularly for products made from recyclable materials like uPVC and composite materials, which contribute to energy savings and sustainability.

According to the U.S. Green Building Council (USGBC), green building technologies, including energy-efficient windows and doors, are becoming increasingly popular in both residential and commercial sectors. In fact, more than 40% of all new commercial and residential building projects in the United States are now pursuing green building certifications like LEED (Leadership in Energy and Environmental Design), which prioritize the use of eco-friendly materials. This trend is further supported by government incentives and policies, such as tax credits for energy-efficient home improvements and regulations aimed at reducing building carbon footprints.

As the construction industry embraces these sustainable practices, the window and door frame market stands to benefit greatly. Energy-efficient windows and doors, which provide superior insulation and reduce heating and cooling costs, are becoming essential in new building codes and regulations around the world. For example, the European Union’s Energy Performance of Buildings Directive (EPBD) is pushing for stricter energy efficiency standards, encouraging the adoption of energy-saving materials like uPVC frames in new buildings and renovations.

Trends

Integration of Smart Technologies in Window and Door Frames Enhances Energy Efficiency

A notable trend in the window and door frame market is the integration of smart technologies aimed at enhancing energy efficiency. As consumers and builders increasingly prioritize sustainability, manufacturers are incorporating features such as automated shading, smart locks, and sensors into window and door frames. These innovations allow for better control over indoor climates, leading to reduced energy consumption and improved comfort.

For instance, the U.S. Department of Energy highlights that heat gain and heat loss through windows are responsible for 25%–30% of residential heating and cooling energy use. By adopting energy-efficient windows equipped with smart technologies, homeowners can significantly mitigate these losses, contributing to lower energy bills and a reduced carbon footprint.

Government initiatives further support this trend. The ENERGY STAR program, for example, offers tax credits and rebates for energy-efficient windows and doors, incentivizing consumers to invest in these technologies. In 2024, ENERGY STAR certified windows were eligible for rebates up to $600, depending on the product’s efficiency rating.

Regional Analysis

North America Leads with 45.10% Share, Valued at $41.5 Billion in 2024

In 2024, North America dominated the global window and door frame market, capturing a substantial 45.10% share, equating to approximately USD 41.5 billion in market value. This leadership is primarily driven by robust construction activities across the United States and Canada, fueled by both new residential developments and extensive renovation projects.

The region’s growth is further supported by stringent energy efficiency regulations and a strong consumer preference for sustainable building materials. Government initiatives, such as the Energy Star program, have incentivized the adoption of energy-efficient windows and doors, contributing to increased demand. Additionally, the trend towards smart home integration has spurred interest in advanced window and door systems equipped with automation and energy-saving features.

The North American market’s dominance is also attributed to its advanced manufacturing capabilities and the presence of leading industry players. Companies like JELD-WEN, Andersen Corporation, and Pella Corporation have significantly influenced market dynamics through innovation and extensive distribution networks. As the region continues to prioritize sustainability and technological advancement in construction, North America’s position in the window and door frame market is expected to remain strong in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Andersen is a leading manufacturer in the window and door frame market, known for its high-quality products and innovation. With a broad range of windows and doors, including energy-efficient and sustainable solutions, Andersen serves both residential and commercial sectors. The company’s commitment to durability, aesthetic appeal, and energy efficiency has positioned it as a prominent player. Andersen’s strong presence across North America and its focus on customer satisfaction continue to drive its market growth.

ATIS is a prominent provider of window and door frame solutions, known for its focus on custom designs and advanced manufacturing techniques. The company specializes in creating high-performance frames for both residential and commercial projects, with a particular emphasis on energy efficiency and durability. ATIS also caters to clients with specific aesthetic preferences, offering a wide range of materials and finishes. Its reputation for innovation and quality has made it a trusted choice in the market.

Atrium Corporation is a major player in the window and door frame market, specializing in the production of vinyl and aluminum frames. The company’s product offerings include energy-efficient windows and doors designed to meet the needs of modern construction. Atrium serves residential, commercial, and multi-family markets, with a focus on providing solutions that improve energy savings, reduce maintenance, and enhance overall performance. Atrium’s extensive distribution network ensures its products are widely accessible.

Top Key Players in the Market

- Andersen

- ATIS

- Atrium Corporation

- B.G. Legno

- Century Plyboards

- Duroplast Extrusions Eurocell

- Fenesta Building Systems

- Glass-Rite

- JARIDA

- JELD-WEN

- Lixil Group Corporation

- MI Windows and Doors, LLC

- Milgard Manufacturing, Inc.

- Nawa International

- Pella Corporation

- Ply Gem Holdings, Inc.

- Schuco International KG.

- YKK Corporation

Recent Developments

In 2024 Andersen Corporation, the company achieved a significant milestone, distributing $50.8 million in profit-sharing to its 13,000 employees, reflecting a commitment to rewarding workforce dedication and performance .

In 2024 Atrium Corporation, the company was part of a group of leading manufacturers collectively holding a 10% to 15% share of the global market . Atrium offers a diverse product range, including the Series 450 double-hung windows and Series 312 sliding patio doors, designed for both new construction and replacement applications.

Report Scope

Report Features Description Market Value (2024) USD 92.1 Bn Forecast Revenue (2034) USD 137.6 Bn CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Door Frame, Window Frame), By Material (Metal, Wood, Glass, Composite, uPVC, Others), By Application (Residential, Commercial), By Distribution Channel (Distributor, Specialized Store, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Andersen, ATIS, Atrium Corporation, B.G. Legno, Century Plyboards, Duroplast Extrusions Eurocell, Fenesta Building Systems, Glass-Rite, JARIDA, JELD-WEN, Lixil Group Corporation, MI Windows and Doors, LLC, Milgard Manufacturing, Inc., Nawa International, Pella Corporation, Ply Gem Holdings, Inc., Schuco International KG., YKK Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Window and Door Frame MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Window and Door Frame MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Andersen

- ATIS

- Atrium Corporation

- B.G. Legno

- Century Plyboards

- Duroplast Extrusions Eurocell

- Fenesta Building Systems

- Glass-Rite

- JARIDA

- JELD-WEN

- Lixil Group Corporation

- MI Windows and Doors, LLC

- Milgard Manufacturing, Inc.

- Nawa International

- Pella Corporation

- Ply Gem Holdings, Inc.

- Schuco International KG.

- YKK Corporation