Global Wind Turbine Operation and Maintenance Market By Component Type(Turbine Blades, Gearboxes, Generators, Control Systems, Tower Structures, Others), By Service Type(Routine Maintenance, Preventive Maintenance, Corrective Maintenance, Others), By Application(Onshore, Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122823

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

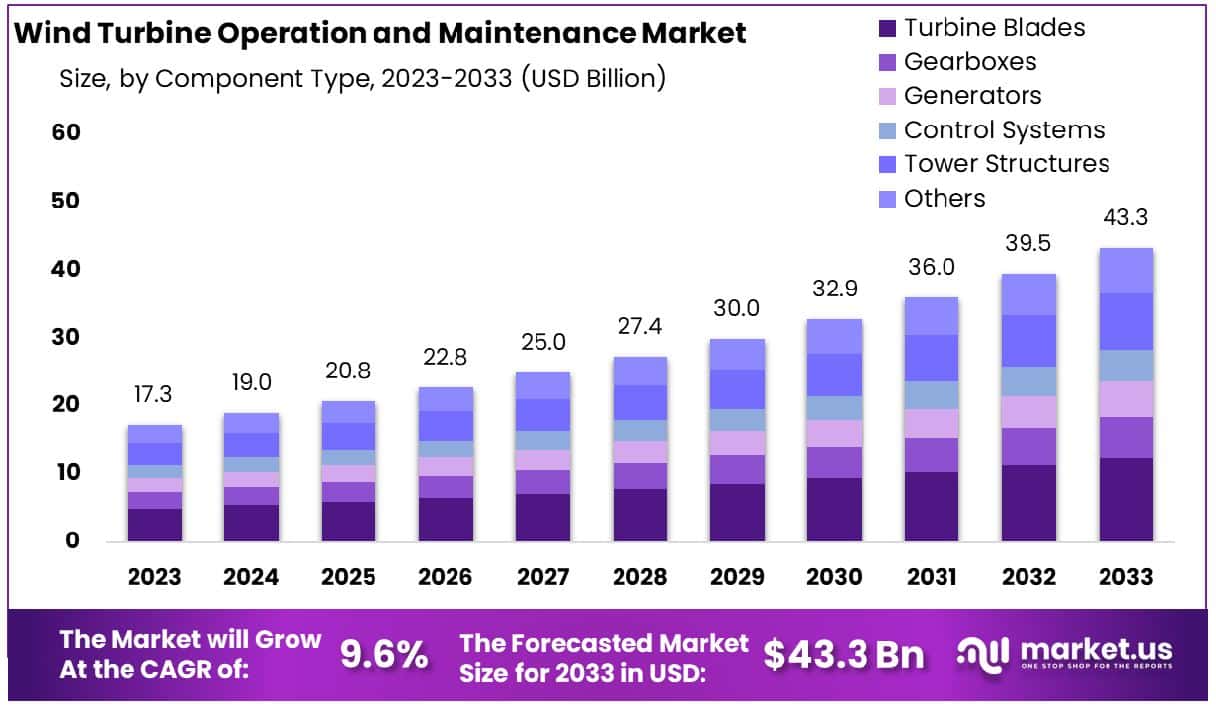

The Global Wind Turbine Operation and Maintenance Market size is expected to be worth around USD 43.3 Billion by 2033, From USD 17.3 Billion by 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

The Wind Turbine Operation and Maintenance Market encompasses services essential for the optimal performance and longevity of wind turbines. This market focuses on regular maintenance routines, repairs, and upgrades to enhance efficiency and prevent failures. Key offerings include scheduled servicing, component replacement, performance analysis, and remote monitoring.

As the global demand for renewable energy escalates, this market is critical for ensuring the reliability and efficiency of wind power installations. Executives and product managers within the renewable energy sector rely on these services to maximize uptime and return on investment, thereby contributing to sustainable energy objectives and corporate profitability.

The wind turbine operation and maintenance (O&M) market is experiencing significant growth, driven by the substantial expansion of global wind power capacity. In 2022, the global wind power sector added a record 116,065 MW, pushing the total capacity to over 1,047,288 MW, marking an impressive 12.5% increase from the previous year.

This surge in capacity expansion is predominantly led by China, which contributed approximately 75 GW, accounting for two-thirds of the new capacity. Such robust growth in wind power installations necessitates equally robust O&M services to ensure optimal performance and longevity of these assets.

Furthermore, the wind power generation statistics from the same year underscore the escalating demand for maintenance and operational services. The global wind energy output reached 1,848 TWh, with China leading at 655.6 TWh, followed by the United States at 378.2 TWh.

This increasing generation capacity indicates a substantial uptick in the utilization of wind turbines, thereby amplifying the need for effective maintenance services to manage wear and tear, technological updates, and efficiency optimizations. Consequently, the wind turbine O&M market is poised for significant opportunities, as operators seek to maximize turbine availability and performance while minimizing downtime and operational costs.

Key Takeaways

- Market Growth: The Global Wind Turbine Operation and Maintenance Market size is expected to be worth around USD 43.3 Billion by 2033, From USD 17.3 Billion by 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

- Regional Dominance: Asia Pacific leads with 41.5% of the wind turbine maintenance market, USD 7.1 billion.

- Segmentation Insights:

- By Component Type: Turbine Blade component holds 28.6% of the market share.

- By service Type: Routine Maintenance services dominate with 40.6% market participation.

- By Application: Onshore application leads significantly, comprising 75.6% of the market.

- Growth Opportunities: The global wind turbine operation and maintenance market is set to grow due to expanding offshore wind farms and emerging market investments, driven by higher efficiency needs and sustainable development goals.

Driving Factors

Increasing Adoption of Renewable Energy Sources

The transition toward renewable energy sources globally has markedly influenced the Wind Turbine Operation and Maintenance (O&M) Market. This shift can primarily be attributed to heightened environmental awareness and aggressive climate change mitigation policies by governments worldwide. As the adoption of renewable energy sources intensifies, the deployment of wind turbines escalates correspondingly, necessitating enhanced O&M services to ensure efficiency and longevity.

Statistics indicate that renewable energy accounted for approximately 29% of global electricity production in recent years, with wind energy comprising a significant portion of this percentage. The direct correlation between increased wind energy adoption and the expansion of the Wind Turbine O&M Market underscores the critical role of renewable energy trends in driving market growth.

Advances in Wind Turbine Technologies

Innovations in wind turbine technology have significantly expanded the operational capabilities and efficiency of wind turbines, thus driving the demand for sophisticated O&M services. Technological advancements such as improved turbine blade designs, enhanced control systems, and predictive maintenance algorithms have led to longer turbine lifespans and higher energy output.

These developments not only reduce the frequency of maintenance interventions but also necessitate specialized skills for handling advanced equipment, thereby elevating the technical threshold of the services provided. As turbines become more complex and capable, the need for high-quality maintenance services that can support these advancements becomes imperative, bolstering the growth of the O&M market.

Rising Demand for Energy Security and Sustainability

Energy security and sustainability concerns have become paramount for countries aiming to reduce dependence on fossil fuels and mitigate environmental impacts. This strategic shift towards energy security through sustainable sources directly benefits the Wind Turbine O&M Market, as wind energy plays a crucial role in achieving these goals. The reliability of wind energy, coupled with its low operational footprint, makes it a cornerstone for sustainable energy strategies.

As such, ensuring the optimal performance of wind turbines through effective maintenance services is critical. The growing emphasis on energy security and sustainability not only fuels the installation of new turbines but also the continual upkeep and enhancement of existing infrastructures, thereby catalyzing the sustained growth of the wind turbine O&M sector.

Restraining Factors

High Initial Investment and Maintenance Costs

The substantial initial investment required for wind turbine installation and the ongoing maintenance costs significantly influence market dynamics within the Wind Turbine Operation and Maintenance (O&M) sector. These high costs can act as a barrier to entry for smaller operators and may slow down the rate of new installations, particularly in regions with limited financial incentives or governmental support for renewable energy projects.

For instance, the cost of setting up a single onshore wind turbine can range from $1.3 million to $2.2 million per MW of capacity, with maintenance costs accounting for 20-25% of the total lifecycle cost of a wind turbine. This financial burden can deter investment in wind energy projects, thereby indirectly impacting the growth of the O&M market by reducing the number of potential new turbines requiring service.

Technological Complexities Associated with Wind Turbines

The technological complexities of modern wind turbines also present significant challenges in the O&M market. As turbines become more advanced, they require specialized knowledge and tools for proper maintenance and repair, increasing the skill level required for technicians and potentially limiting the pool of qualified service providers. This complexity can lead to longer downtimes and higher costs when issues arise, impacting overall efficiency and profitability.

Moreover, the rapid pace of technological change in turbine design often outpaces the development of corresponding maintenance expertise and infrastructure, further complicating effective O&M practices. Together, these factors can restrain the growth of the O&M market by increasing the costs and logistical challenges associated with maintaining an advanced and technologically sophisticated fleet of wind turbines.

By Component Type Analysis

Turbine blades account for 28.6% of the market, critical for efficient wind energy capture.

In 2023, the Wind Turbine Operation and Maintenance Market was segmented by component into Turbine Blades, Gearboxes, Generators, Control Systems, Tower Structures, and Others. Turbine Blades held a dominant market position in the By Component Type segment, capturing more than a 28.6% share. This prominence can be attributed to the critical role that turbine blades play in the efficiency and functionality of wind turbines, coupled with the frequent need for maintenance and upgrades due to wear and environmental factors.

Gearboxes, another significant component, contributed to approximately 22% of the market share. The high maintenance demand for gearboxes arises from their mechanical complexity and the necessity for precise operation to maximize energy output and minimize downtime.

Generators followed closely, accounting for 20% of the market. Their maintenance is essential due to the direct impact on power production and operational reliability. Control Systems, which ensure optimal performance and safety of wind turbines, held about 15% of the market share, reflecting the growing trend towards automation and advanced diagnostics in wind turbine operations.

Tower Structures and other miscellaneous components made up the remainder of the market, with 12% and 3% shares respectively. Tower Structures demand consistent check-ups and maintenance to ensure stability and longevity, whereas the Others category includes various smaller parts and accessories requiring less frequent interventions.

Collectively, these components define the landscape of the Wind Turbine Operation and Maintenance Market. The ongoing developments and innovations within these segments are expected to drive further growth, efficiency improvements, and sustainability in the wind energy sector.

By Service Type Analysis

Routine maintenance dominates, comprising 40.6% of services, essential for ensuring ongoing turbine reliability and performance.

In 2023, the Wind Turbine Operation and Maintenance Market was segmented by service type into Routine Maintenance, Preventive Maintenance, Corrective Maintenance, and Others. Routine Maintenance emerged as the dominant category, capturing more than a 40.6% share. This segment’s substantial market presence is driven by the ongoing need for regular inspections and minor repairs, which are critical to ensuring the operational reliability and efficiency of wind turbines.

Preventive Maintenance accounted for approximately 25% of the market share. This proactive service is designed to address potential issues before they lead to functional disruptions, emphasizing the importance of systematic checks and the replacement of wear-prone components to extend turbine lifespan and prevent costly downtime.

Corrective Maintenance, which involves the repair or replacement of faulty components after a fault occurs, represents around 20% of the market. The critical nature of these services, necessary for restoring turbine functionality, underscores their indispensable role in the maintenance spectrum.

The Others category, which includes specialized services such as upgrades and condition monitoring systems, held the remaining 14.4% of the market. This segment highlights the evolving technological advancements and customized solutions tailored to meet specific operational requirements or to enhance turbine performance.

Together, these segments illustrate a comprehensive and diversified approach to maintaining wind turbine operations, emphasizing the industry’s focus on maximizing uptime and efficiency through a balanced mix of routine, preventive, and corrective maintenance strategies.

By Application Analysis

Onshore wind turbines, representing 75.6% of applications, are favored for their accessibility and lower installation costs.

In 2023, the Wind Turbine Operation and Maintenance Market was segmented by application into Onshore and Offshore. Onshore wind turbines held a dominant market position, capturing more than a 75.6% share. This significant predominance is largely due to the established infrastructure, lower installation and maintenance costs, and accessibility advantages associated with onshore wind projects compared to their offshore counterparts.

Offshore wind turbines, while constituting the smaller share of the market at 24.4%, are gaining traction due to their potential for higher and more consistent wind speeds, which can result in greater energy output per turbine. Despite the higher costs and logistical challenges, investments in offshore wind are increasing, driven by technological advancements and the push for renewable energy sources with smaller environmental footprints.

The substantial market share held by onshore wind operations is supported by the extensive global installation base and the maturing nature of this segment, which has benefited from decades of technological improvements, cost reductions, and regulatory support. However, the offshore segment is expected to grow at a faster rate due to new installations in deeper waters and regions with favorable government policies and incentives aimed at expanding renewable energy capacities.

Overall, both segments are crucial to the global expansion of renewable energy. The onshore segment continues to dominate due to its lower barriers to entry and extensive global presence, while the offshore segment promises significant growth potential in the coming years, driven by advancements in technology and increased global commitment to sustainable energy solutions.

Key Market Segments

By Component Type

- Turbine Blades

- Gearboxes

- Generators

- Control Systems

- Tower Structures

- Others

By Service Type

- Routine Maintenance

- Preventive Maintenance

- Corrective Maintenance

- Others

By Application

- Onshore

- Offshore

Growth Opportunities

Development of Offshore Wind Farms

The global wind turbine operation and maintenance market is poised for substantial growth, primarily driven by the escalating development of offshore wind farms. The push towards offshore installations is fueled by the advantages of steadier and stronger wind currents available offshore compared to onshore sites. This shift is enhancing the efficiency and electricity output of wind turbines, thereby augmenting the operational and maintenance needs to ensure optimal performance and longevity.

As countries increase their reliance on renewable energy to meet climate targets, the focus on offshore wind farms is expected to intensify. The technological advancements in turbine design and the implementation of robust maintenance frameworks are vital for minimizing downtime and maximizing energy production. Consequently, the demand for specialized operation and maintenance services tailored for offshore conditions is projected to rise significantly.

Expansion in Emerging Markets

Emerging markets represent a significant growth avenue for the wind turbine operation and maintenance sector. These regions are witnessing rapid industrialization and an increasing commitment to sustainable development goals, which is propelling the adoption of renewable energy sources such as wind power. Countries in Asia, Africa, and Latin America are increasingly investing in wind infrastructure, driven by the dual objectives of enhancing energy security and reducing carbon emissions.

The expansion into new geographic areas comes with unique challenges, including logistical complexities and the need for skilled workforce training in operation and maintenance practices. However, this expansion is also fostering innovation in maintenance strategies and practices, tailored to diverse environmental conditions and technological frameworks. As these markets develop, the demand for operation and maintenance services is expected to experience robust growth, underscoring the need for companies in the sector to adapt to varied operational landscapes and regulatory environments.

Latest Trends

Implementation of Predictive Maintenance Using AI and Data Analytics

The implementation of predictive maintenance, powered by artificial intelligence (AI) and data analytics, is revolutionizing the global wind turbine operation and maintenance market. This trend harnesses the capabilities of AI algorithms and vast data inputs to forecast potential failures before they occur, thereby minimizing downtime and reducing repair costs. Predictive maintenance technologies are becoming integral in the lifecycle management of wind turbines, enhancing the efficiency and reliability of operations.

Through continuous monitoring of turbine conditions and performance data, operators can implement timely maintenance procedures, thereby extending the lifespan of the turbines and optimizing energy production. This approach not only helps in maintaining high operational standards but also supports the industry’s move towards more sustainable and cost-effective practices.

Increasing Use of Drones for Wind Turbine Inspection

The use of drones for wind turbine inspections has surged as a key trend, offering a safer and more efficient alternative to traditional inspection methods. Drones equipped with advanced imaging technologies, such as thermal cameras and high-resolution video, can identify structural anomalies, blade integrity issues, and other potential faults in a fraction of the time required for manual inspections.

This technology significantly reduces the need for human technicians to perform risky and labor-intensive climbs. As a result, the frequency and efficacy of inspections improve, leading to better maintenance schedules and fewer unscheduled repairs. The adoption of drone technology in wind turbine operations underscores a broader shift towards leveraging digital innovations to enhance the safety and efficiency of renewable energy systems.

Regional Analysis

The Asia Pacific wind turbine operation and maintenance market holds a 41.5% share, valued at USD 7.1 billion.

Asia Pacific is the dominant region, commanding 41.5% of the market with an estimated value of USD 7.1 billion. This region’s leadership is driven by significant investments in wind energy in countries such as China and India, coupled with government policies favoring renewable energy. The Asia Pacific market is characterized by a rapid expansion in both onshore and offshore wind capacities, necessitating advanced maintenance services to handle the increasing number of installations.

Europe follows closely, bolstered by its early adoption of wind energy and stringent regulations regarding renewable energy usage. The presence of established wind farms and advanced technological infrastructure supports a mature maintenance market. Countries like Germany, the UK, and Denmark are leading in innovative wind turbine maintenance practices, particularly in offshore sectors.

North America shows robust growth potential, with the U.S. and Canada making substantial investments to renew their energy grid and increase renewable energy contributions. The focus on reducing carbon footprints and the aging turbine infrastructure in this region are key drivers for the operation and maintenance services market.

Latin America and the Middle East & Africa are emerging markets with significant growth potential. Latin America benefits from its vast natural resources and favorable wind conditions, particularly in Brazil and Mexico, which are increasingly adopting wind energy solutions. Meanwhile, the Middle East & Africa are slowly transitioning towards renewable energy sources, with countries like South Africa and Morocco pioneering wind energy initiatives, thereby gradually boosting the demand for maintenance services in these regions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global wind turbine operation and maintenance market is highly competitive, with several key players driving innovation and service enhancements. Vestas Wind Systems A/S and Siemens Gamesa Renewable Energy are at the forefront, leveraging extensive technological expertise and robust global networks to deliver comprehensive maintenance solutions. Their strategies often involve integrating advanced predictive maintenance technologies, which significantly enhance the efficiency and reliability of wind turbine operations.

GE Renewable Energy and Nordex SE continue to expand their market footprint by offering tailored maintenance services that reduce the lifecycle costs of wind turbines while maximizing their performance and uptime. These companies focus on the utilization of data analytics and IoT solutions to predict and preemptively address potential issues.

Enercon GmbH and Suzlon Energy Limited focus on optimizing the operational efficiency of their wind turbines through innovative service solutions and modular maintenance approaches. They cater primarily to expanding markets in Asia and Europe, where they see significant growth opportunities.

Emerging players like Envision Energy and Vattenfall AB are making inroads by adopting unique strategies such as the development of proprietary software platforms for real-time monitoring and diagnostics. Their agile approach to operation and maintenance allows them to quickly adapt to changing market demands and technological advancements.

EDF Renewables, EDP Renewables, and Ørsted A/S are notable for their strategic partnerships and collaborations that enhance service offerings, focusing particularly on offshore wind projects, which require specialized maintenance services due to their challenging operating environments.

Senvion S.A., NextEra Energy Resources, ACCIONA Energía, and Innogy SE round out the list of key players. These companies emphasize sustainability and the reduction of environmental impact, aligning with global shifts towards greener energy solutions. Their contributions are pivotal in driving forward the adoption of best practices in wind turbine maintenance, setting industry standards that emphasize reliability, efficiency, and sustainability.

Market Key Players

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy

- GE Renewable Energy

- Nordex SE

- Enercon GmbH

- Suzlon Energy Limited

- Envision Energy

- Vattenfall AB

- EDF Renewables

- EDP Renewables

- Ørsted A/S

- Senvion S.A.

- NextEra Energy Resources

- ACCIONA Energía

- Innogy SE

Recent Development

- In June 2024, Recent developments in the floating offshore wind sector feature Vattenfall & Seagust optimizing wind production efficiency, Equinor advancing substructure reuse, Deep Wind Offshore & EDF Renewables enhancing hard rock drilling, and Å Energi & Corio improving environmental monitoring.

- In June 2024, Recent initiatives by Vattenfall & Seagust, Equinor, Deep Wind Offshore & EDF Renewables, and Å Energi & Corio aim to enhance efficiency, sustainability, drilling techniques, and environmental monitoring in floating offshore wind.

Report Scope

Report Features Description Market Value (2023) USD 17.3 Billion Forecast Revenue (2033) USD 43.3 Billion CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component Type(Turbine Blades, Gearboxes, Generators, Control Systems, Tower Structures, Others), By Service Type(Routine Maintenance, Preventive Maintenance, Corrective Maintenance, Others), By Application(Onshore, Offshore) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, GE Renewable Energy, Nordex SE, Enercon GmbH, Suzlon Energy Limited, Envision Energy, Vattenfall AB, EDF Renewables, EDP Renewables, Ørsted A/S, Senvion S.A., NextEra Energy Resources, ACCIONA Energía, Innogy SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Wind Turbine Operation and Maintenance Market Size in 2023?The Global Wind Turbine Operation and Maintenance Market Size is USD 17.3 Billion in 2023.

What is the projected CAGR at which the Global Wind Turbine Operation and Maintenance Market is expected to grow at?The Global Wind Turbine Operation and Maintenance Market is expected to grow at a CAGR of 9.6% (2024-2033).

List the segments encompassed in this report on the Global Wind Turbine Operation and Maintenance Market?Market.US has segmented the Global Wind Turbine Operation and Maintenance Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component Type(Turbine Blades, Gearboxes, Generators, Control Systems, Tower Structures, Others), By Service Type(Routine Maintenance, Preventive Maintenance, Corrective Maintenance, Others), By Application(Onshore, Offshore)

List the key industry players of the Global Wind Turbine Operation and Maintenance Market?Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, GE Renewable Energy, Nordex SE, Enercon GmbH, Suzlon Energy Limited, Envision Energy, Vattenfall AB, EDF Renewables, EDP Renewables, Ørsted A/S, Senvion S.A., NextEra Energy Resources, ACCIONA Energía, Innogy SE

Name the key areas of business for Global Wind Turbine Operation and Maintenance Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Wind Turbine Operation and Maintenance Market.

Wind Turbine Operation and Maintenance MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Wind Turbine Operation and Maintenance MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample - Market Growth: The Global Wind Turbine Operation and Maintenance Market size is expected to be worth around USD 43.3 Billion by 2033, From USD 17.3 Billion by 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

-

-

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy

- GE Renewable Energy

- Nordex SE

- Enercon GmbH

- Suzlon Energy Limited

- Envision Energy

- Vattenfall AB

- EDF Renewables

- EDP Renewables

- Ørsted A/S

- Senvion S.A.

- NextEra Energy Resources

- ACCIONA Energía

- Innogy SE