Global Winch Market Size, Share, Growth Analysis By Product Type (Electric Winches, Hydraulic Winches, Manual Winches, Pneumatic Winches), By Load Capacity (Light Duty (Up to 3,000 lbs), Medium Duty (3,000–10,000 lbs), Heavy Duty (Above 10,000 lbs)), By Application (Commercial Recovery, Mobile Crane, Military, Work Boat, Utility, Others), By End-User Industry (Automotive, Construction, Marine, Oil and Gas, Mining, Forestry, Agriculture, Others), By Distribution Channel (Direct Sale, Indirect Sale), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140612

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Load Capacity Analysis

- Application Analysis

- End-User Industry Analysis

- Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

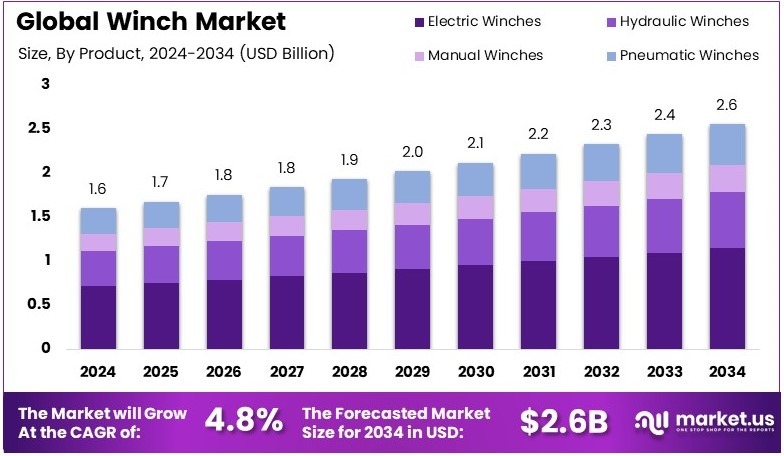

The Global Winch Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Winch is a mechanical device used to wind up or wind out a rope, cable, or chain. It operates using a spool and gear system. Winches are employed in lifting, pulling, and hoisting tasks in various industries. They provide controlled movement and facilitate heavy-duty operations in transportation and construction applications.

Winch market refers to the industry that manufactures and distributes winches. It involves producers, suppliers, and service providers. The market covers different winch types for various applications. It serves sectors such as transportation, construction, and maritime. The winch market emphasizes quality, durability, and safety in its product range across industries.

The winch market is poised for growth, driven by increasing demands in the automotive and construction sectors. In February 2025, new vehicle sales in the U.S. are expected to rise by 8.1%, reaching 1.01 million units. This surge in automotive demand directly enhances the market for winches, which are crucial for towing and recovery operations in vehicles.

Additionally, the U.S. construction industry is projected to grow by 5.6% in 2024, reaching a market size of $1.27 trillion. Significant legislative measures such as the Infrastructure Investment and Jobs Act, the Inflation Reduction Act, and the CHIPS Act support this growth. These developments boost the demand for heavy machinery and equipment, including winches, which are essential for lifting and hauling materials on construction sites.

Moreover, the winch market benefits from competitive manufacturer incentives and innovations that improve product efficiency and safety. On a broader scale, these dynamics foster economic activity and enhance sector-specific technologies.

The increased use of winches in construction and automotive applications supports small businesses and contributes to job creation. Government safety regulations and investment in infrastructure development further stabilize and drive the market, ensuring sustained growth and innovation in winch technology.

Key Takeaways

- The Winch Market was valued at USD 1.6 billion in 2024 and is expected to reach USD 2.6 billion by 2034, with a CAGR of 4.8%.

- In 2024, Electric Winches dominated the product type segment with 45%, due to their ease of use and efficiency in various applications.

- In 2024, Medium Duty (3,000–10,000 lbs) winches accounted for 50%, favored for their versatility in commercial and industrial use.

- In 2024, Commercial Recovery led the application segment with 40%, driven by increased demand for vehicle recovery solutions.

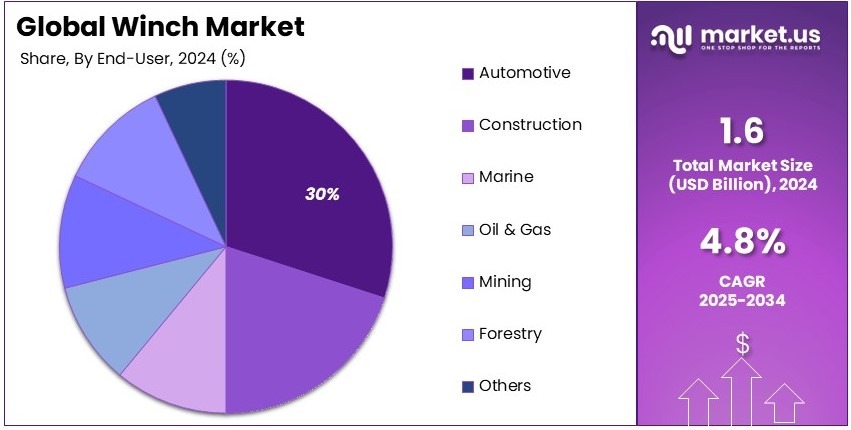

- In 2024, the Automotive sector held 30%, as winches are widely used in off-road and towing applications.

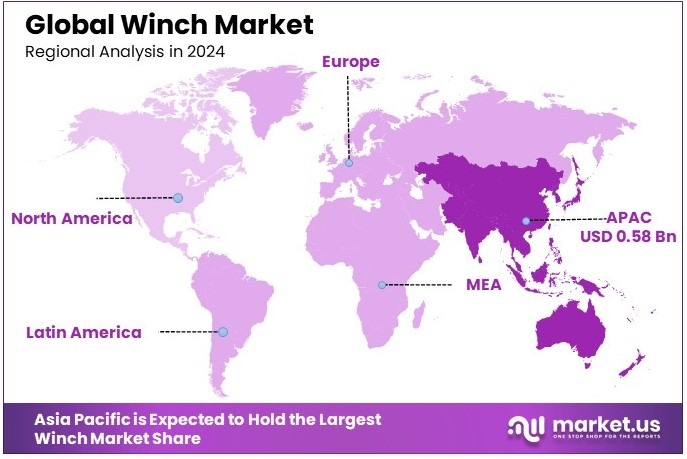

- In 2024, APAC dominated the market with 36.1% and a value of USD 0.58 billion, supported by strong demand from construction and automotive industries.

Product Type Analysis

Electric Winches dominate with 45.0% due to their efficiency and ease of use in various industries.

Electric winches are the most common type used across multiple sectors, such as construction, automotive, and marine. Their high efficiency, ease of operation, and minimal need for maintenance contribute to their dominance in the winch market. These winches are powered by electricity, making them more reliable and easier to operate than their manual counterparts.

Electric winches are preferred in situations where heavy lifting and pulling are required, such as in construction projects, where they can be used to move materials and equipment. Similarly, in the automotive sector, they are often used in towing and recovery operations.

Other product types include hydraulic winches, manual winches, and pneumatic winches. Hydraulic winches account for a smaller portion of the market, but they are crucial in high-performance applications, such as oil and gas extraction or marine activities.

Manual winches, although less efficient than electric or hydraulic options, are still used in some industries due to their simplicity and low cost. Pneumatic winches, which operate on compressed air, are primarily used in environments where electrical power is unavailable or impractical, such as in certain industrial settings. These winches play a vital role in specific applications but hold a smaller market share compared to electric and hydraulic winches.

Load Capacity Analysis

Medium Duty (3,000–10,000 lbs) dominates with 50.0% due to its broad application range.

The medium-duty winches are the most widely used, catering to a variety of industries and applications that require a balance between lifting power and portability. These winches are ideal for situations where moderate lifting capacity is needed, such as in construction, automotive, and marine operations.

In the automotive sector, for example, medium-duty winches are commonly used for vehicle recovery and pulling operations. In construction, they are essential for moving materials like heavy equipment or materials that need moderate lifting power. The versatility of medium-duty winches, combined with their ability to handle loads from 3,000 to 10,000 lbs, ensures they dominate the winch market.

On the other hand, light-duty winches (up to 3,000 lbs) hold a 30.0% share. These are mainly used in residential or light commercial applications, such as winching small boats or moving lighter machinery. Heavy-duty winches (above 10,000 lbs) make up the remaining 20.0%.

These are specialized tools used for very heavy lifting and are essential in industries like mining, construction, and heavy commercial vehicles. While they are crucial for demanding tasks, their application is more limited compared to medium-duty winches, which are suited for a wider range of general uses.

Application Analysis

Commercial Recovery dominates with 40.0% due to its widespread demand in towing and vehicle recovery.

Commercial recovery involves the use of winches for towing and rescuing vehicles in various industries, including automotive, construction, and emergency services. Winches are commonly used for vehicle recovery on highways, construction sites, and off-road areas.

In addition, they are essential in emergency response operations, particularly for pulling vehicles or equipment from dangerous situations. As such, commercial recovery has become one of the largest and most significant applications in the winch market, driven by the growing need for efficient and reliable recovery solutions.

Mobile crane applications follow closely, with 30.0% of the market share. Mobile cranes, commonly used in construction, rely on winches to lift and lower heavy equipment and materials. These winches are designed to be strong and durable, capable of handling high loads over extended periods. Military applications follow.

Winches used in military operations are tailored for pulling heavy military equipment, vehicles, and supplies across various terrains. Work boats and utility applications represent smaller segments. Work boats utilize winches for purposes such as anchoring and securing cargo, while utility winches are essential for tasks like pulling cables or pipes in remote areas.

End-User Industry Analysis

Automotive dominates with 30.0% due to the high demand for recovery and towing operations.

The automotive industry relies heavily on winches for vehicle recovery, towing, and lifting operations. These winches are essential for both roadside recovery and for more specialized applications, such as pulling vehicles from difficult or hazardous situations.

The high volume of vehicles on the road and the need for efficient towing services contribute to the significant demand for winches in this industry. In addition, the automotive sector’s growing focus on electric vehicles and advanced vehicle recovery systems will continue to boost the demand for winches in the coming years.

Construction follows, driven by the extensive use of winches for lifting and pulling materials and heavy equipment. Marine applications are also significant, where winches are indispensable for tasks such as anchoring ships, pulling nets, and moving heavy loads across vessels.

Oil & Gas and mining each play a role in the market, with winches used for tasks like pulling equipment or materials out of wells or mines. Forestry and agriculture are also key segments, where winches are used for harvesting, transporting logs, and other heavy lifting tasks. The others category, which includes industries like entertainment, also contributes to the market.

Distribution Channel Analysis

Direct Sale dominates with 70.0% due to its efficiency in reaching large industrial clients.

Direct sales are the preferred method of distribution for winches, especially in large-scale industries such as construction, mining, and oil & gas. Direct sales allow for tailored solutions, better customer support, and more efficient delivery times.

In many cases, winches are purchased directly from manufacturers or authorized distributors, ensuring that customers receive the proper guidance and support for installation and maintenance. This direct approach is particularly important in industries where the winches are used for heavy-duty applications that require technical expertise.

Indirect sales lead the market, accounting for a significant portion of the total. Indirect sales, typically conducted through retailers or resellers, are more common in the automotive, residential, and small-scale commercial sectors.

This method is preferred by smaller businesses or DIY enthusiasts who require winches for lighter, less frequent tasks. Indirect channels also help expand the reach of winch manufacturers, making their products available in locations where direct sales might not be feasible.

Key Market Segments

By Product Type

- Electric Winches

- Hydraulic Winches

- Manual Winches

- Pneumatic Winches

By Load Capacity

- Light Duty (Up to 3,000 lbs)

- Medium Duty (3,000–10,000 lbs)

- Heavy Duty (Above 10,000 lbs)

By Application

- Commercial Recovery

- Mobile Crane

- Military

- Work Boat

- Utility

- Others

By End-User Industry

- Automotive

- Construction

- Marine

- Oil & Gas

- Mining

- Forestry

- Agriculture

- Others

By Distribution Channel

- Direct Sale

- Indirect Sale

Driving Factors

Growing Demand Across Key Industries Drives Market Growth

The rising demand for winches in automotive, marine, and construction industries is a primary driver of the market. These sectors rely heavily on winches for lifting, hauling, and towing heavy loads, making them essential for operations in various applications, from construction sites to marine vessels.

Additionally, the increasing popularity of off-roading activities is significantly boosting the demand for winch systems. Off-road enthusiasts rely on winches for self-recovery and ensuring safety in challenging terrains. This trend is driving both the demand for recreational vehicle winches and the growth of winch technologies tailored for this market.

Growth in oil and gas exploration activities is another contributing factor. The need for heavy lifting and hauling during offshore and onshore exploration is increasing, creating further demand for high-performance winches capable of withstanding harsh environments and heavy loads.

Technological advancements are also playing a key role in market growth. New innovations in materials, designs, and power sources are leading to the development of more efficient, durable, and versatile winch systems. These improvements are broadening the scope of winch applications, enhancing their attractiveness across various sectors.

Restraining Factors

High Costs, Awareness Gaps, and Environmental Concerns Restrain Market Growth

Despite its growth potential, the winch market faces several challenges. A significant restraint is the high cost of high-capacity and specialized winch systems. These systems, required for heavy-duty tasks in industries such as oil and gas, are often expensive to manufacture and maintain, limiting their accessibility for smaller businesses and users.

Limited consumer awareness regarding winch applications and capabilities also hinders market growth. Many potential customers are not fully aware of the diverse uses and benefits of winches, particularly in non-industrial settings, which may reduce demand.

Environmental factors further restrict the use of winches in certain terrains or conditions. For example, extreme weather, rugged landscapes, and other environmental obstacles may limit winch functionality and efficiency, especially in remote or challenging areas.

Regulatory restrictions on winch use in some jurisdictions present another challenge. In certain regions, winches are subject to strict safety and operational regulations, which can limit their widespread adoption and usage, especially in recreational or non-commercial applications.

Growth Opportunities

Expanding Applications and Safety Features Provide Growth Opportunities

The winch market presents significant growth opportunities, particularly in emerging sectors. One such opportunity lies in the renewable energy industry, particularly offshore wind energy. Winches are increasingly being utilized for the installation, maintenance, and operation of wind turbines, creating a new and growing demand for winch systems designed to handle the unique challenges of this sector.

The increasing demand for electric winches in both recreational and commercial vehicles is another key opportunity. Electric winches offer enhanced convenience, power efficiency, and ease of use, making them increasingly popular for vehicle recovery in off-road scenarios and for commercial towing operations.

Advancements in automation are driving further growth in the winch market. Automated winch systems can improve efficiency and reduce manual labor, making them appealing for large-scale industrial applications.

Additionally, there is rising demand for winches with enhanced safety features and remote control capabilities. Safety is a top priority across various industries, and winches that offer greater control, monitoring, and user safety are attracting more interest from consumers and businesses alike.

Emerging Trends

Lightweight Designs, Smart Technology, and Self-Recovery Winches Are Latest Trends

The winch market is evolving with several key trends that are shaping its future. One significant trend is the increasing focus on lightweight and portable winch designs. These winches offer greater versatility and are easier to transport, making them ideal for use in recreational vehicles, off-road adventures, and compact work environments.

The adoption of synthetic ropes over traditional steel cables is another emerging trend. Synthetic ropes are lighter, safer, and easier to handle, reducing the risk of injury and improving overall user experience. This shift is particularly relevant in recreational and off-road winching, where safety and convenience are top priorities.

The integration of wireless controls and smart technology in winch systems is also on the rise. Wireless controls allow for easier and more efficient operation, especially in remote or difficult-to-reach areas, while smart technology offers advanced features such as real-time monitoring, diagnostics, and performance tracking.

Finally, there is a growing popularity of self-recovery winches in off-road and recreational vehicles. These winches allow users to perform recovery operations independently, making them essential for off-roading enthusiasts who frequently encounter challenging terrains. These trends are driving innovation and adoption across multiple sectors of the winch market.

Regional Analysis

Asia Pacific Dominates with 36.1% Market Share

Asia Pacific (APAC) leads the Winch Market with a 36.1% share, valued at USD 0.58 billion. This strong market presence can be attributed to the rapid industrial growth, particularly in sectors like mining, construction, and oil & gas, where winches are widely used. Additionally, the increasing adoption of advanced technology and favorable economic conditions are boosting market demand.

Key factors driving APAC’s dominance include the region’s strong manufacturing base, expanding infrastructure, and growing demand from emerging economies like China and India. The region benefits from cost-effective labor and the presence of major manufacturing hubs.

As a result, there is a steady supply of high-quality winch products at competitive prices. APAC’s demand is further fueled by the expanding construction, mining, and oil & gas sectors, all of which rely on winches for heavy lifting and pulling operations.

Regional Mentions:

- North America: North America holds a significant portion of the Winch Market, driven by the oil and gas industry, which uses winches for exploration and extraction. The increasing need for heavy lifting and recovery applications, especially in offshore operations, is fueling demand for advanced winch systems.

- Europe: Europe’s growth in the Winch Market is supported by its strong automotive and maritime industries. Increasing infrastructure projects and a focus on renewable energy, including offshore wind farms, contribute to steady market growth.

- Middle East & Africa: The Middle East & Africa show steady demand for winches, especially in oil and gas exploration. The region’s expansion in industrial activities and infrastructure development contributes to an increased need for lifting and pulling equipment in various sectors.

- Latin America: Latin America’s Winch Market is growing due to rising demand from the mining, construction, and oil industries. Countries like Brazil and Argentina are investing in infrastructure projects that require winch systems for various lifting, pulling, and recovery operations.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Winch Market is driven by key players such as Comeup Industries Inc., WARN Industries, Caterpillar Inc., and KITO Corporation, who dominate through advanced technology, high-quality products, and strong industry reputation.

Comeup Industries Inc. is a leading manufacturer of electric and hydraulic winches, renowned for its rugged and reliable products. The company offers a wide range of winches suitable for automotive, industrial, and marine applications. Comeup’s global presence, along with its emphasis on quality and innovation, allows it to maintain a strong position in the winch market.

WARN Industries is one of the most recognized names in the winch industry, particularly in the off-road and recreational vehicle markets. WARN manufactures high-performance winches for automotive, industrial, and military sectors. Its emphasis on durability, ease of use, and product innovation has made it a leader in the global winch market.

Caterpillar Inc. is a major player in the winch market, primarily known for its heavy-duty equipment used in construction, mining, and industrial sectors. Caterpillar offers winches integrated into its large machinery, designed for demanding lifting and hauling tasks. The company’s strong brand reputation for durability and performance in extreme conditions supports its market dominance.

KITO Corporation specializes in manufacturing both manual and electric winches. Known for its high-quality hoists and winches, KITO serves industries such as construction, manufacturing, and offshore applications. With an emphasis on safety, efficiency, and technological advancements, KITO continues to be a leading player in the global winch market.

These companies lead the winch market by offering durable, high-performance products across various sectors. Their continuous focus on innovation, reliability, and meeting customer demands helps them maintain a dominant position in the industry.

Major Companies in the Market

- Comeup Industries Inc.

- WARN Industries

- Caterpillar Inc.

- KITO Corporation

- JDN Monocrane GmbH

- Ingersoll Rand

- Peddinghaus Corporation

- Thern Inc.

- Superwinch LLC

- Harken Industrial

- Pulaski Winch

- Brevini Power Transmission (Motonav)

- Toyota Industries Corporation

Recent Developments

- Mountain Area Medical Airlift (MAMA) Foundation: On January 2025, the MAMA Foundation introduced its first helicopter with winch capabilities. The BK117 B-2 model will support search and rescue operations in challenging terrains and maritime environments.

- The Black Phoenix Group LLC and PACCAR Inc.: On November 2024, The Black Phoenix Group LLC finalized the acquisition of PACCAR Winch from PACCAR Inc. PACCAR Winch, known for its industrial winches, hoists, and drive systems under brands like BRADEN, CARCO, and Gearmatic, will continue operations under its existing management team.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electric Winches, Hydraulic Winches, Manual Winches, Pneumatic Winches), By Load Capacity (Light Duty (Up to 3,000 lbs), Medium Duty (3,000–10,000 lbs), Heavy Duty (Above 10,000 lbs)), By Application (Commercial Recovery, Mobile Crane, Military, Work Boat, Utility, Others), By End-User Industry (Automotive, Construction, Marine, Oil and Gas, Mining, Forestry, Agriculture, Others), By Distribution Channel (Direct Sale, Indirect Sale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Comeup Industries Inc., WARN Industries, Caterpillar Inc., KITO Corporation, JDN Monocrane GmbH, Ingersoll Rand, Peddinghaus Corporation, Thern Inc., Superwinch LLC, Harken Industrial, Pulaski Winch, Brevini Power Transmission (Motonav), Toyota Industries Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Comeup Industries Inc.

- WARN Industries

- Caterpillar Inc.

- KITO Corporation

- JDN Monocrane GmbH

- Ingersoll Rand

- Peddinghaus Corporation

- Thern Inc.

- Superwinch LLC

- Harken Industrial

- Pulaski Winch

- Brevini Power Transmission (Motonav)

- Toyota Industries Corporation