Global Wheat Middling Market Size, Share, And Enhanced Productivity By Source (Conventional, Organic), By Animal (Ruminants, Poultry, Swine, Cattle), By Application (Animal Feed, Pet Food, Food and Beverages, Pharmaceutical, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176718

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

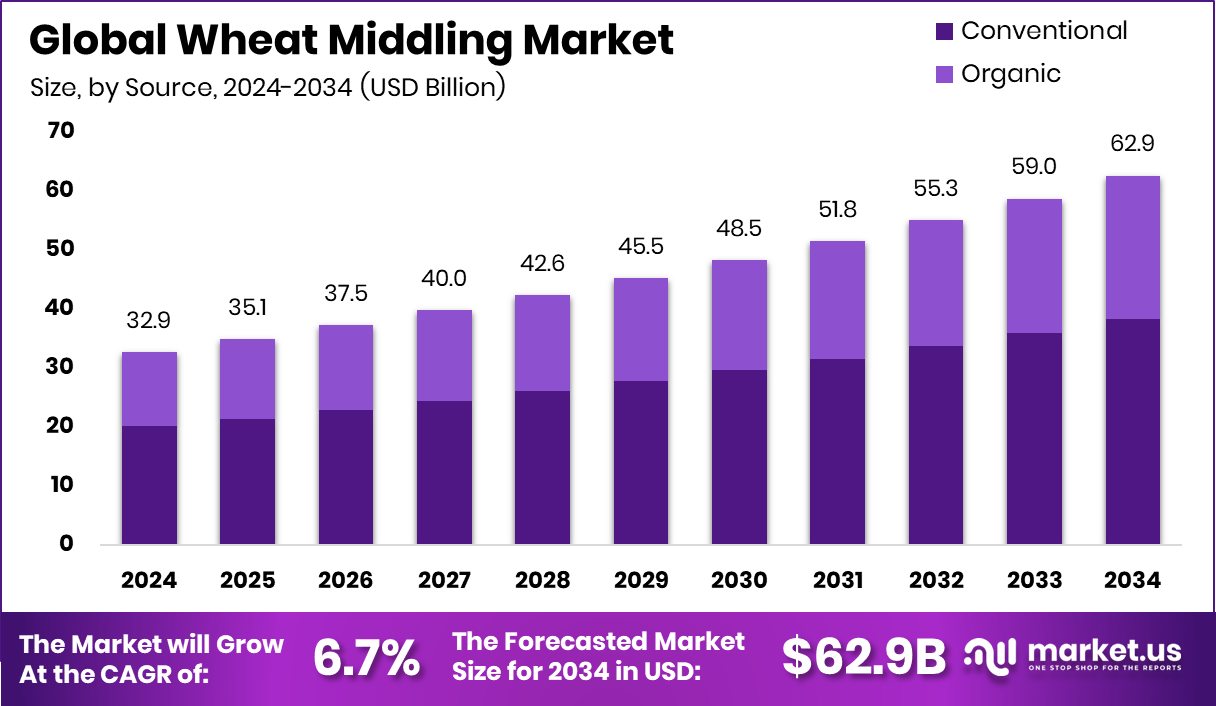

The Global Wheat Middling Market is expected to be worth around USD 62.9 billion by 2034, up from USD 32.9 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. In 2024, Asia Pacific dominated at 42.7%, generating USD 14.0 Bn.

Wheat middling is a coarse, fiber-rich by-product produced during wheat milling. It contains protein, starch, vitamins, and minerals, making it a valuable ingredient for livestock and poultry diets. The Wheat Middling Market represents the global trade and use of this ingredient across feed, food, and industrial applications. It is structured by source types such as conventional and organic, by animal categories including ruminants, poultry, swine, and cattle, and by applications like animal feed, pet food, food and beverages, pharmaceuticals, cosmetics, and other specialty uses.

Demand continues to rise as producers seek cost-effective, nutrient-dense ingredients. The pet food segment gains support from new initiatives such as the Pet Food Institute, announcing $1.4 million in Market Access Program funding, which encourages wider ingredient adoption. Growth also benefits from innovation, including a UK startup raising €8 million to convert CO₂ into animal feed, opening new supply opportunities.

Animal nutrition markets are advancing through stronger supply chain systems. Funding, such as BinSentry, raising $50 million and another $20 million secured for feed inventory technology, supports efficiency. Additional momentum comes from $6 million in federal funding for feed improvement and $3.6 million in grants boosting the Middle East sheep trade. Research investment, such as the Shapiro Administration’s $2.2 million support, strengthens long-term opportunities for wheat middlings across global agriculture.

Key Takeaways

- The Global Wheat Middling Market is expected to be worth around USD 62.9 billion by 2034, up from USD 32.9 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In the Wheat Middling Market, the conventional segment holds 38.6%, reflecting strong global usage patterns.

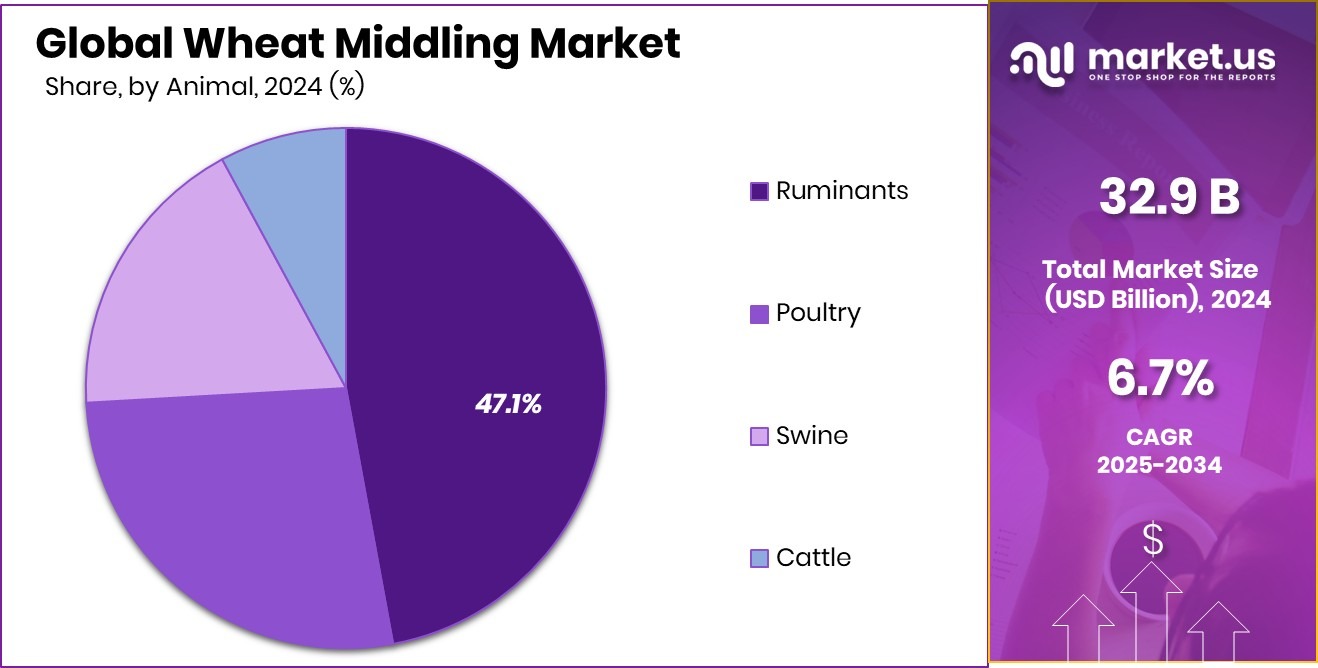

- Ruminants drive the Wheat Middling Market demand, contributing a dominant 47.1% share across livestock industries.

- The Wheat Middling Market grows as animal feed applications capture 59.2%, supporting expanding nutrition needs.

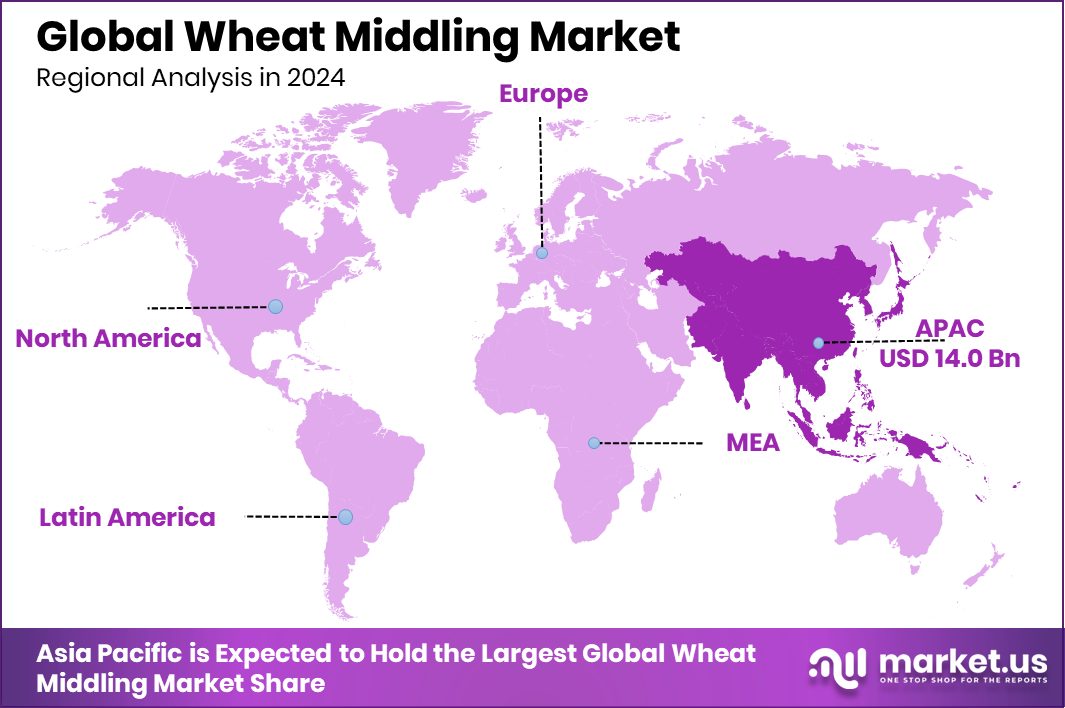

- Strong livestock expansion helped the Asia Pacific secure 42.7% and achieve USD 14.0 Bn.

By Source Analysis

Wheat Middling Market grows steadily as conventional sources capture a strong 38.6% share.

In 2024, the Wheat Middling Market continued to see strong demand for conventional sources, holding a dominant 38.6% share. Most livestock producers preferred conventional wheat middlings because of their steady availability, cost-effectiveness, and consistent nutrient profile. As feed manufacturers aimed to balance protein and fiber content, conventional wheat middlings became a dependable choice across both commercial and small-scale farming.

The market also benefited from rising global wheat processing volumes, which increased the supply of by-products used in feed formulations. In many developing regions, the affordability of conventional wheat middlings helped expand its usage among ruminant and non-ruminant producers. Overall, steady supply chains and competitive pricing kept the segment firmly ahead in 2024.

By Animal Analysis

Wheat Middling Market demand rises with ruminants contributing a dominant 47.1% share.

In 2024, ruminants represented the largest consumer group in the Wheat Middling Market, capturing a strong 47.1% share. Dairy and beef farmers relied heavily on wheat middlings due to their effective digestibility, moderate protein level, and balanced fiber composition. These factors made wheat middlings a reliable ingredient for improving milk yield and supporting healthy weight gain in cattle.

Rising herd populations across the Asia-Pacific and parts of Europe further strengthened demand. Feed mills also increased the inclusion of wheat middlings in compound rations, driven by cost pressures from fluctuating grain prices. As farmers sought economically viable feed inputs without compromising animal performance, ruminant adoption continued to expand through 2024.

By Application Analysis

Wheat Middling Market expands rapidly as animal feed applications hold 59.2% market share.

In 2024, the animal feed segment dominated the Wheat Middling Market with an impressive 59.2% share. As livestock and poultry producers prioritized balanced nutrition at a manageable cost, wheat middlings became one of the most widely used feed ingredients. It offered a practical blend of fiber, energy, and protein, making it suitable for cattle, poultry, swine, and small ruminants.

Growing industrial feed production supported wider usage, especially in regions expanding their dairy and meat industries. The push for cost-efficient feed alternatives encouraged mills to integrate wheat middlings into customized formulations. With global livestock populations increasing and farmers focusing on feed optimization, the animal feed application remained the primary growth pillar throughout 2024.

Key Market Segments

By Source

- Conventional

- Organic

By Animal

- Ruminants

- Poultry

- Swine

- Cattle

By Application

- Animal Feed

- Pet Food

- Food and Beverages

- Pharmaceutical

- Cosmetics and Personal Care

- Others

Driving Factors

Rising demand for affordable animal nutrition

The Wheat Middling Market is gaining momentum as producers look for reliable, affordable nutrition sources to support expanding livestock and pet populations. Wheat middlings offer a balanced mix of protein, fiber, and energy, making them a practical choice for cost-sensitive feed formulations. This demand grows stronger as pet nutrition brands continue to innovate, highlighted by Untamed raising €11.6 million to enhance human-grade feline food, setting higher expectations for ingredient quality and transparency.

As pet owners shift toward premium yet cost-effective diets, wheat middlings become an attractive option for manufacturers aiming to balance nutrition with affordability. Combined with rising global feed consumption, these conditions firmly support the market’s ongoing growth.

Restraining Factors

Limited supply during fluctuating wheat harvests

Despite strong demand, the Wheat Middling Market faces notable constraints, especially when wheat harvests fluctuate due to weather volatility and shifting global production patterns. These variations can affect both the availability and quality of middlings, causing challenges for feed manufacturers who rely on a steady supply. At the same time, the rise of alternative ingredients may shift some attention away from wheat by-products.

A recent example is PawCo Foods securing $2 million to develop plant-based dog food using AI-supported technology, reflecting a growing appetite for new protein sources in the pet nutrition sector. While wheat middlings remain essential for many feed applications, supply instability and ingredient diversification create pressure on long-term consistency.

Growth Opportunity

Expanding adoption in pet food manufacturing

New opportunities are emerging as pet food manufacturers broaden their ingredient lists to include more nutrient-dense, cost-efficient materials. Wheat middlings fit well into this shift, offering a sustainable and widely available option for brands seeking reliable fiber and energy sources. This segment benefits from increasing investments in pet food innovation, demonstrated by a dog food startup securing $17 million in fresh funding, signaling strong market confidence in new product development.

As premium and value-tier brands look for ingredients that enhance digestive health and texture while controlling production costs, wheat middlings become an appealing choice. Their multifunctional use across dry kibble, treats, and supplemental formulations creates room for meaningful expansion.

Latest Trends

Clean-label feed ingredients gaining traction

Clean-label preferences continue to reshape the Wheat Middling Market as consumers and feed manufacturers favor simpler, transparent ingredient lists. Wheat middlings benefit from this movement because they are minimally processed and naturally derived from wheat milling. The trend is strengthened by industry initiatives like the Pet Food Institute announcing $1.4 million in Market Access Program funding, which supports broader ingredient acceptance and global outreach.

As pet owners and livestock producers prioritize clarity, sustainability, and traceability, wheat middlings align well with modern expectations. This shift encourages more brands to incorporate wheat by-products into feed and pet nutrition, reflecting a broader industry push toward recognizable and trustworthy ingredient profiles.

Regional Analysis

Asia Pacific led the Wheat Middling Market with 42.7%, reaching USD 14.0 Bn.

In 2024, the Wheat Middling Market showed clear regional variation, with Asia Pacific emerging as the dominant region, holding 42.7% of the total share and reaching a value of USD 14.0 Bn. The region’s strong livestock base and expanding feed production capacity reinforced its leadership position.

North America followed with steady demand driven by large-scale commercial feed mills and consistent wheat processing output, supporting wheat middling availability. Europe maintained moderate growth, supported by stable dairy and cattle industries that continued to rely on fiber-rich feed ingredients.

Latin America showed rising usage as livestock farming expanded across key countries, while the Middle East & Africa demonstrated gradual adoption due to increasing interest in cost-efficient feed solutions.

Across all regions, wheat middlings remained widely integrated into feed formulations due to their affordability and nutritional balance, but the Asia Pacific firmly led the global landscape throughout the year.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland Company continued to influence the market through its wide milling network, consistent raw material sourcing, and integration across grain processing channels. Its ability to maintain supply reliability supported the stable availability of wheat middlings for feed manufacturers, especially in regions with growing livestock demand. ADM’s scale helped the market maintain predictable feed ingredient flows across key distribution points.

Meanwhile, Cargill, Incorporated, contributed significantly through its extensive global grain handling and processing infrastructure. The company’s close relationships with feed producers allowed wheat middlings to remain a preferred ingredient in cattle, poultry, and dairy nutrition. Cargill’s diversified product portfolio ensured that wheat middlings were efficiently positioned within broader feed solutions, supporting balanced use across both developed and emerging markets.

Lastly, Bunge Limited added market stability through its strong presence in agricultural commodities and grain processing. Bunge’s capabilities in wheat milling helped maintain consistent by-product generation, allowing feed producers to benefit from a dependable supply. Across 2024, these three companies collectively reinforced the structural foundation of the Wheat Middling Market, ensuring continuity, quality, and efficient distribution.

Top Key Players in the Market

- Archer Daniels Midland Company

- Cargill, Incorporated

- Bunge Limited

- General Mills, Inc.

- Ardent Mills

- Associated British Foods plc

- Grain Millers, Inc.

- Wilmar International Limited

- ConAgra Brands, Inc.

- Bay State Milling Company

Recent Developments

- In July 2025, Bunge completed its merger with Viterra Limited, creating a larger agribusiness company covering food, feed, and grain trading. Bunge now has a greater global reach and expanded crop handling capacity through this move.

- In September 2024, Cargill strengthened its animal feed production and distribution in the United States by acquiring two feed mills from Compana Pet Brands, located in Denver, Colorado, and Kansas City, Kansas. This move improves Cargill’s ability to serve livestock and ranch customers and expand production.

Report Scope

Report Features Description Market Value (2024) USD 32.9 Billion Forecast Revenue (2034) USD 62.9 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Conventional, Organic), By Animal (Ruminants, Poultry, Swine, Cattle), By Application (Animal Feed, Pet Food, Food and Beverages, Pharmaceutical, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Cargill, Incorporated, Bunge Limited, General Mills, Inc., Ardent Mills, Associated British Foods plc, Grain Millers, Inc., Wilmar International Limited, ConAgra Brands, Inc., Bay State Milling Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Company

- Cargill, Incorporated

- Bunge Limited

- General Mills, Inc.

- Ardent Mills

- Associated British Foods plc

- Grain Millers, Inc.

- Wilmar International Limited

- ConAgra Brands, Inc.

- Bay State Milling Company