Global Wetgas Meters Market Size, Share, And Business Benefits By Product Type (Natural Gas, Liquefied Petroleum Gas (LPG), Biogas), By Type (Stainless Steel Wetgas Meter, Brass Wetgas Meter), By Application (Onshore, Offshore), By End-Use (Industrial (Oil and Gas, Chemical, Others), Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153814

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

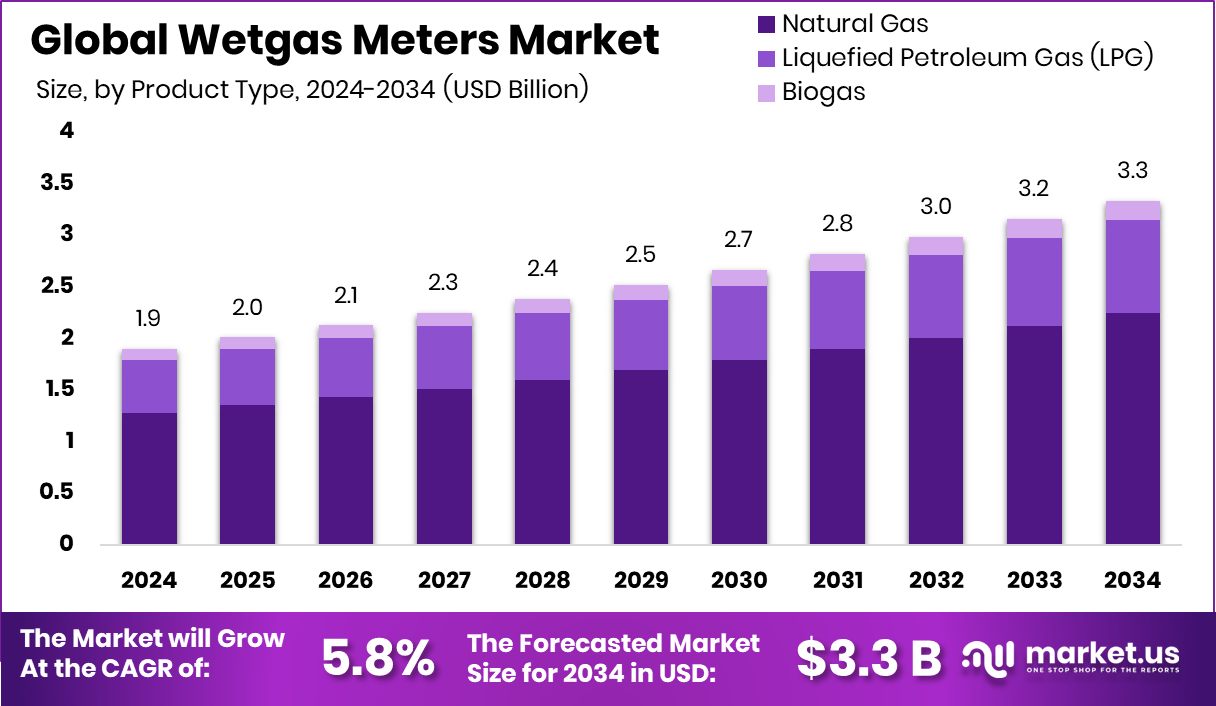

The Global Wetgas Meters Market is expected to be worth around USD 3.3 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Strong oilfield operations helped North America maintain a 47.2% market share globally.

Wetgas meters are specialized flow measurement devices designed to accurately measure gas flow in pipelines that contain small amounts of liquid, typically water or condensate. These meters are crucial in oil and gas production, where the extracted gas is often not entirely dry. Unlike traditional dry gas meters, wet gas meters can handle mixtures with varying levels of liquid without losing accuracy.

The wetgas meters market refers to the global ecosystem surrounding the manufacturing, distribution, and application of these meters in oil and gas operations. It includes upstream producers, equipment manufacturers, and service providers. The market is driven by the increasing need for accurate flow measurement in complex multiphase conditions, especially in deepwater and offshore fields.

The rise in offshore and deepwater exploration activities has increased the need for robust flow measurement solutions. As many oil fields mature, they produce higher water content, requiring wetgas meters for accurate flow monitoring. Additionally, the trend toward digital oilfields supports the integration of smart metering technologies, driving adoption further.

Demand is largely supported by the need for production efficiency and regulatory compliance. Accurate metering helps operators reduce operational risks and avoid penalties due to measurement inaccuracies. With natural gas being a transitional fuel, maintaining measurement accuracy in wet gas environments is essential for optimizing output and reducing waste.

Key Takeaways

- The Global Wetgas Meters Market is expected to be worth around USD 3.3 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the Wetgas Meters Market, natural gas applications dominate with a 67.3% share in 2024.

- Stainless steel wetgas meters held a leading 78.8% market share, favored for their durability and reliability.

- Onshore installations accounted for 79.2% of the Wetgas Meters Market due to easier accessibility and deployment.

- Industrial end-use led the Wetgas Meters Market, capturing 69.1% owing to rising energy measurement demands.

- The market in North America reached USD 0.8 billion due to rising gas demand.

By Product Type Analysis

Natural gas dominates the Wetgas Meters Market with a 67.3% share.

In 2024, Natural Gas held a dominant market position in the By Product Type segment of the Wetgas Meters Market, with a 67.3% share. This strong foothold can be attributed to the widespread use of wetgas meters in natural gas production fields, where the extracted gas often contains entrained liquids such as water or light hydrocarbons. The ability of these meters to provide precise, real-time flow measurements even in the presence of condensates has made them essential for natural gas operators focused on optimizing recovery and maintaining regulatory compliance.

The growing demand for natural gas as a cleaner transitional fuel, especially in power generation and industrial applications, has further supported the need for accurate flow measurement technologies. With many mature gas fields experiencing increased water cut, the deployment of wetgas meters has become critical for maintaining production efficiency and ensuring accurate allocation.

Additionally, natural gas infrastructure projects in offshore and deepwater environments increasingly require compact, reliable, and maintenance-friendly metering solutions—roles well-suited to wetgas meters.

By Type Analysis

Stainless steel wetgas meters lead with a strong 78.8% share.

In 2024, Stainless Steel Wetgas Meter held a dominant market position in the By Type segment of the Wetgas Meters Market, with a 78.8% share. This dominance is primarily due to the superior durability, corrosion resistance, and mechanical strength offered by stainless steel, which are critical in handling the harsh and variable conditions typical of wet gas environments.

The ability of stainless steel to withstand high pressures, temperature fluctuations, and exposure to corrosive substances makes it a preferred material for wetgas meter construction, particularly in offshore and deepwater installations where reliability is essential.

The extended operational lifespan and minimal maintenance requirements of stainless steel wetgas meters contribute to their high adoption rate, especially in fields where downtime results in significant revenue loss. Operators prioritize materials that ensure consistent and accurate flow measurement while withstanding multiphase flows containing water, gas, and light hydrocarbons.

Furthermore, stainless steel’s compatibility with advanced sensor technologies allows for integration with digital monitoring systems, which is increasingly important in modern field operations. The commanding 78.8% market share highlights the clear preference for stainless steel in wetgas metering applications, reaffirming its value in achieving measurement precision, operational efficiency, and long-term performance in challenging industrial settings.

By Application Analysis

Onshore applications account for 79.2% of the Wetgas Meters Market.

In 2024, Onshore held a dominant market position in the By Application segment of the Wetgas Meters Market, with a 79.2% share. This leading position is primarily driven by the high concentration of natural gas production and processing facilities located in onshore fields, where accurate flow measurement remains critical for managing multiphase outputs.

Onshore installations often deal with gas streams containing varying amounts of liquids due to aging reservoirs or enhanced recovery processes, making wetgas meters essential for precise volume allocation and performance monitoring.

The dominance of onshore applications also reflects the relatively easier accessibility and lower operational complexities compared to offshore environments, allowing for widespread adoption of wetgas metering systems. Operators onshore continue to prioritize cost-effective, durable, and low-maintenance solutions, and wetgas meters fulfill these criteria by enabling real-time diagnostics and efficient production management.

Moreover, with many national and private sector energy projects focused on expanding domestic gas output from onshore basins, the deployment of advanced metering infrastructure remains a top operational priority. The 79.2% market share underscores the central role of onshore operations in shaping the demand for wetgas meters, reaffirming the segment’s importance in sustaining accurate, reliable measurement standards across high-volume gas-producing fields.

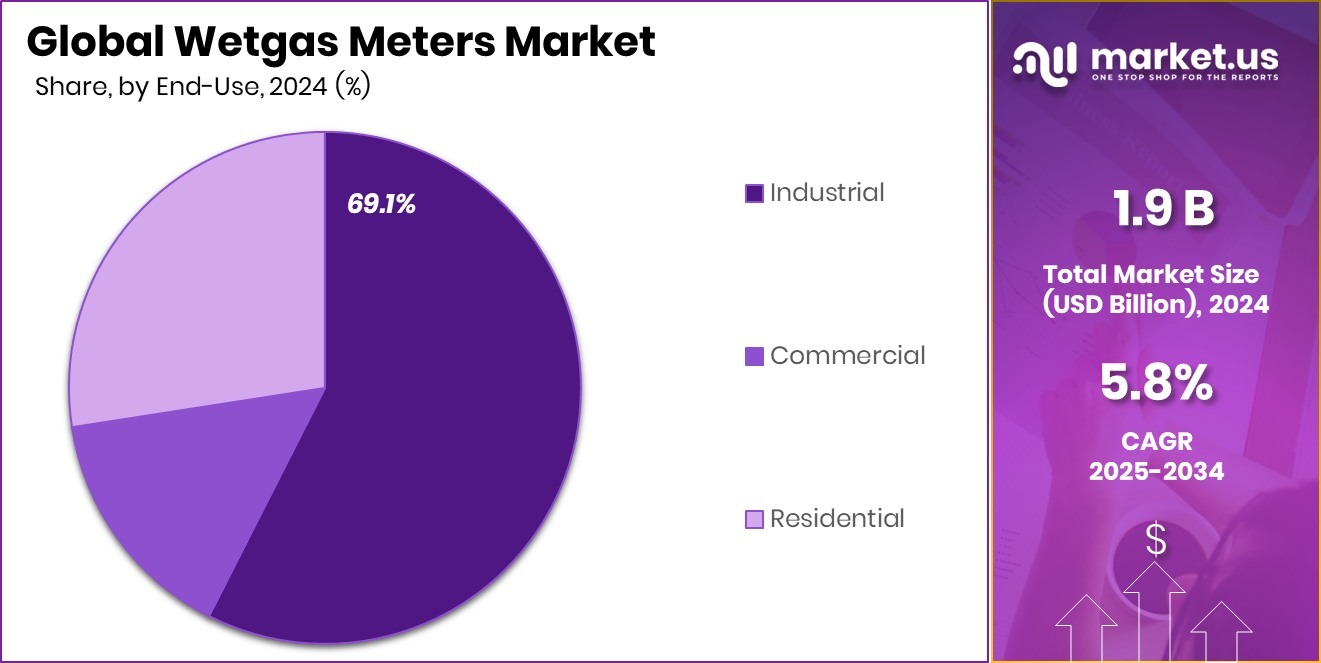

By End-Use Analysis

Industrial end-use contributes 69.1% to the Wetgas Meters Market growth.

In 2024, Industrial held a dominant market position in the By End-Use segment of the Wetgas Meters Market, with a 69.1% share. This leading share reflects the extensive use of wetgas meters across various industrial settings involved in gas production, processing, and distribution.

Industrial operations, particularly in sectors such as energy, petrochemicals, and heavy manufacturing, demand high-precision flow measurement systems to ensure efficient processing and compliance with safety and emission standards. The presence of wet gas mixtures—typically encountered in processing facilities and transmission lines—necessitates reliable metering solutions to manage production output accurately.

The preference for wetgas meters in industrial applications is also driven by the need to monitor complex multiphase flows, reduce measurement uncertainty, and optimize system performance. Industries place high value on equipment that offers durability, minimal maintenance, and adaptability to fluctuating flow conditions—all of which are provided by modern wetgas meters. Their integration into automated control systems further enhances real-time decision-making and operational efficiency.

Key Market Segments

By Product Type

- Natural Gas

- Liquefied Petroleum Gas (LPG)

- Biogas

By Type

- Stainless Steel Wetgas Meter

- Brass Wetgas Meter

By Application

- Onshore

- Offshore

By End-Use

- Industrial

- Oil and Gas

- Chemical

- Others

- Commercial

- Residential

Driving Factors

High Demand for Accurate Multiphase Flow Measurement

One of the main driving factors of the wetgas meters market is the rising demand for accurate multiphase flow measurement in gas fields. In many oil and gas wells, especially older ones, the extracted gas often contains small amounts of liquid, such as water or condensate. Traditional gas meters cannot measure this mixture precisely, which leads to errors in production data and revenue losses.

Wetgas meters solve this problem by measuring both gas and liquid content at the same time, giving more reliable results. This is very important for companies to ensure fair production allocation, reduce losses, and meet regulatory standards. As more wells face wet gas conditions, the use of wetgas meters continues to grow steadily.

Restraining Factors

High Installation and Maintenance Cost Limits Adoption

A major restraining factor for the wetgas meters market is the high cost of installation and maintenance. These meters are designed with advanced technologies to measure complex gas and liquid mixtures accurately, which makes them expensive to manufacture and install. Additionally, maintaining them in harsh environments such as high-pressure gas fields or corrosive settings requires skilled technicians and frequent servicing, adding to overall costs.

For small or budget-constrained operators, especially in developing regions, these expenses can be difficult to justify. As a result, many companies may continue using conventional metering systems, despite lower accuracy. This cost barrier slows down the wider adoption of wetgas meters across the industry, especially in price-sensitive operations or smaller-scale installations.

Growth Opportunity

Rapid Growth Opportunity: Expanding Digital Smart Meter Integration

The most promising growth opportunity in the wetgas meters market lies in the expanding integration of digital smart metering systems. As the energy sector undergoes digital transformation, companies are increasingly investing in smart, connected devices that enable real-time monitoring, data analytics, and automated process control.

When wetgas meters are equipped with digital sensors and connectivity, they provide continuous flow data even under multiphase conditions. This allows operators to quickly spot irregularities, optimize production efficiency, reduce downtime, and ensure accurate billing. Such connected systems are also compatible with remote diagnostics and predictive maintenance tools, lowering operational costs and enhancing reliability.

With global oil and gas facilities gradually moving toward digital oilfields, integrating smart wetgas metering is becoming a strategic priority—opening significant market potential for vendors and service providers in the upcoming years.

Latest Trends

Adoption of Compact Inline Ultrasonic Wetgas Meters

One of the latest noteworthy trends in the wetgas meters market is the growing adoption of compact inline ultrasonic wetgas meters. These meters use ultrasonic sound waves to measure the speed and composition of gas-liquid mixtures directly within the pipeline without requiring bulky external modules.

This compact inline design makes installation easier and reduces physical footprint, especially in tight or space-constrained environments like offshore platforms or modular processing units. Additionally, ultrasonic technology offers high accuracy and low maintenance, since there are no moving parts to wear out.

These features make inline ultrasonic wetgas meters especially appealing for onshore and offshore facilities with limited space and high uptime requirements. As industries focus on efficiency and reliability, compact inline ultrasonic meters are increasingly chosen over traditional bulkier alternatives.

Regional Analysis

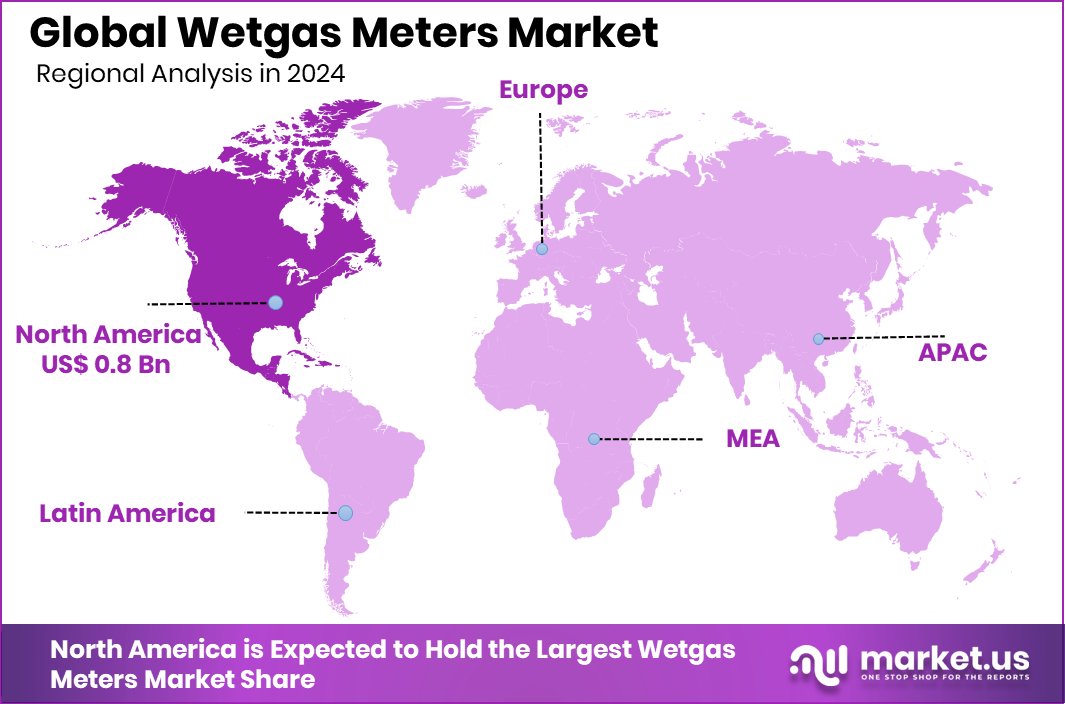

In 2024, North America accounted for a 47.2% share of the Wetgas Meters Market.

In 2024, North America held a dominant position in the global Wetgas Meters Market, accounting for 47.2% of the total market share, with an estimated value of USD 0.8 billion. This strong presence is attributed to the region’s well-established oil and gas infrastructure, especially in the United States and Canada, where mature gas fields often require accurate multiphase flow measurement solutions. The widespread deployment of wetgas meters in both onshore and offshore installations supports operational efficiency and compliance with production regulations, reinforcing the region’s leadership.

In Europe, the market is supported by strict environmental and safety standards, prompting operators to adopt advanced metering technologies for better process control. Countries with aging natural gas fields are investing in wet gas measurement tools to handle increased liquid content in gas streams.

Asia Pacific continues to emerge as a key growth region, with energy-producing countries focusing on upgrading measurement systems in complex field conditions. Increasing exploration activities in Southeast Asia and Australia also contribute to demand.

The Middle East & Africa region benefits from large-scale gas extraction projects, where reliable metering is essential. Meanwhile, Latin America shows moderate growth potential, supported by ongoing investments in energy infrastructure and gas field development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AMETEK introduced its Dualstream FALCON multiphase wet gas flowmeter in late 2024, offering a cost-effective and reliable measurement solution tailored to gas condensate applications. This technology leverages pressure‑loss ratio algorithms and integrated FloCalculator systems to deliver high accuracy in challenging wet gas environments, while minimizing capital and operational expenditure. With proven deployments across more than 200 condensate fields, Dualstream is widely regarded as an industry benchmark for subsea and topside metering.

Apex Instruments is known for its Precision Wet Test Meters, which are widely used for calibration of gas metering systems. The company provides durable, EPA‑compliant sampling and flow test equipment such as bell‑provers and wet test drums designed for accuracy in laboratory and field calibration roles. Services include calibration via wet test meters and bell‑prover standards, ensuring measurement traceability aligned with regulatory requirements.

CX Instrument, while explicit product specifications or capabilities for CX Instrument were not publicly detailed in the accessible sources, the firm is included among major wet gas metering solution providers. Its mention alongside recognized vendors suggests involvement in wet gas measurement technologies or associated instrumentation.

DP Diagnostics focuses on advanced diagnostic solutions for differential pressure (DP) flow meters, including its CoVor and Prognosis systems. In particular, the CoVor meter supports wet gas measurement via combined vortex and cone DP metering, enabling detection of liquid loading, while the Prognosis diagnostic suite offers continuous verification of DP meter performance to reduce uncertainty and maintenance interventions. The firm also contributes to international wet gas metering standards.

Top Key Players in the Market

- AMETEK

- Apex Instruments Inc.

- CX Instrument

- DP Diagnostics

- Dr.Ing. RITTER Apparatebau GmbH and Co. KG

- EMCO Controls AS

- Emerson Electric Co.

- Expro

- Fluid Components LLC

- Force Technology

- Haimo Technologies Group Corp.

- Instrumentation and Scientific Instruments Pvt. Ltd.

- Krohne

- MaxiFlo

- SEIL ENTERPRISE Co.

Recent Developments

- In April 2025, Emerson unveiled the Flexim FLUXUS / PIOX 731 series, a non-intrusive clamp-on ultrasonic flow meter that includes Wet Gas Correction capability. This series offers precise volumetric and mass flow measurement for gas and liquids without penetrating the pipe, minimizing installation complexity and downtime. With features like disturbance correction and Advanced Meter Verification, it supports accurate wet gas stream measurement and dynamic mass/volume correction.

- In November 2024, AMETEK’s Solartron ISA unit launched the Dualstream FALCON multiphase wet‑gas flowmeter, designed specifically for gas‑condensate applications. This product uses a FloCalculator algorithm to offer accurate and cost‑effective measurement under harsh conditions. It is suitable for both onshore and offshore installations where accurate monitoring of gas mixed with liquid is required.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Natural Gas, Liquefied Petroleum Gas (LPG), Biogas), By Type (Stainless Steel Wetgas Meter, Brass Wetgas Meter), By Application (Onshore, Offshore), By End-Use (Industrial (Oil and Gas, Chemical, Others), Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AMETEK, Apex Instruments Inc., CX Instrument, DP Diagnostics, Dr.Ing. RITTER Apparatebau GmbH and Co. KG, EMCO Controls AS, Emerson Electric Co., Expro, Fluid Components LLC, Force Technology, Haimo Technologies Group Corp., Instrumentation and Scientific Instruments Pvt. Ltd., Krohne, MaxiFlo, SEIL ENTERPRISE Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMETEK

- Apex Instruments Inc.

- CX Instrument

- DP Diagnostics

- Dr.Ing. RITTER Apparatebau GmbH and Co. KG

- EMCO Controls AS

- Emerson Electric Co.

- Expro

- Fluid Components LLC

- Force Technology

- Haimo Technologies Group Corp.

- Instrumentation and Scientific Instruments Pvt. Ltd.

- Krohne

- MaxiFlo

- SEIL ENTERPRISE Co.