Global Wearable AI Market By Type (Smartwatches, Smart Eyewear, Smart Earwear, Others), By Component (Processor, Connectivity IC, Sensors), By Application (Consumer Electronics, Healthcare, Automotive, Military & Defense, Media & Entertainment, Others), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: March 2024

- Report ID: 116239

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

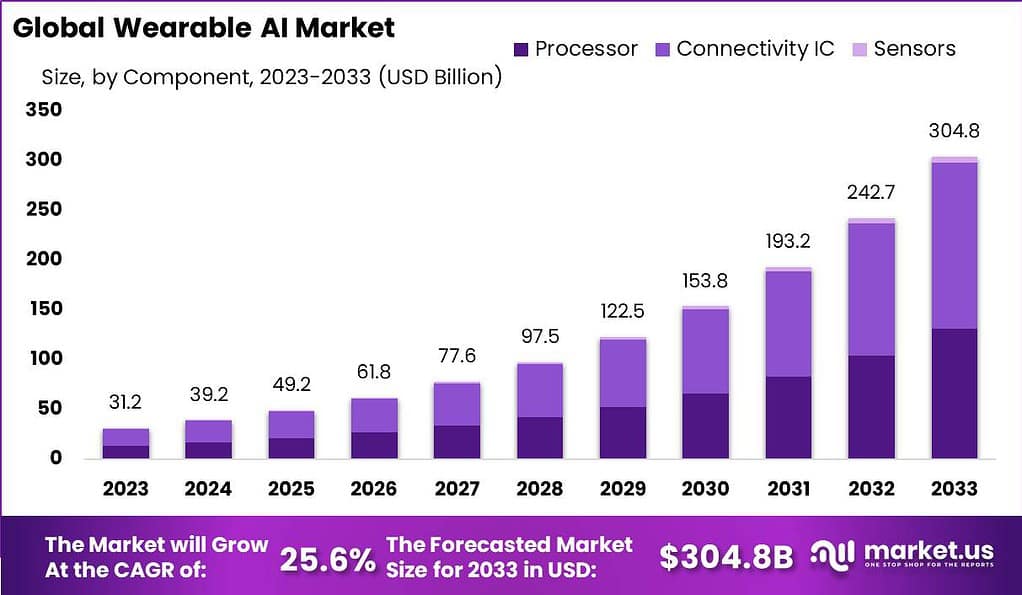

The Global Wearable AI Market size is expected to be worth around USD 304.8 Billion by 2033, from USD 31.2 Billion in 2023, growing at a CAGR of 25.6% during the forecast period from 2024 to 2033.

The wearable AI market, encompassing a range of devices integrated with artificial intelligence technologies, has seen substantial growth due to increasing consumer demand for smart wearables and the continuous advancement in AI technologies. These devices, including smartwatches, fitness trackers, earwear, and others, are designed to provide users with enhanced functionality, such as health monitoring, fitness tracking, and mobile connectivity, through the integration of AI algorithms.

The growth of the market can be attributed to several factors, including the proliferation of smartphones, the increasing awareness among consumers about health and fitness, and the rising adoption of AI technologies across various industries. Moreover, advancements in AI and machine learning technologies have enabled the development of more sophisticated and accurate wearable devices, further fueling market expansion.

Another significant driver is the growing consumer emphasis on health and wellness. In the wake of global health challenges, individuals are increasingly turning to technology to manage their health proactively. Wearable AI devices, with their ability to monitor vital signs, track physical activity, and even predict potential health issues, cater directly to this demand. This health-conscious consumer base is expanding, creating a robust market for wearable AI devices that offer detailed analytics and health insights.

The opportunities within the wearable AI market are vast and varied. For instance, there’s considerable potential for the development of devices that cater to niche markets or specific health conditions, providing tailored solutions that go beyond general fitness tracking. Furthermore, as AI technology advances, the possibility of integrating more sophisticated AI capabilities into wearables – such as enhanced cognitive computing, real-time emotional recognition, and more intricate health monitoring features – becomes feasible.

Key Takeaways

- Wearable AI Market size is expected to be worth around USD 304.8 Billion by 2033, from USD 31.2 Billion in 2023, growing at a CAGR of 25.6%

- Sensors segment dominated the wearable AI market in 2023, holding over 55% share.

- The consumer electronics segment, in 2023, held the dominant market position with over 33% share.

- North America, particularly the US, led the wearable AI market with over 27% share in 2023.

- ~32.2% of the wearable AI technology market is expected to be captured by the healthcare industry in 2023, as AI-enabled devices enhance remote patient monitoring and personalized healthcare.

- The Artificial Intelligence Market size is forecasted to reach around USD 2,745 billion by 2033, up from USD 177 Billion in 2023, growing at a CAGR of 36.8%.

- By 2024, the global count of wearable AI devices is projected to surpass 1 billion.

- Over 25% of wearable devices are anticipated to incorporate emotion AI for mental health monitoring by 2023.

- Analysts expect that over 30% of consumer wearable devices will feature on-device AI capabilities by 2024.

- AI in wearable medical devices is projected to enhance disease diagnosis accuracy by over 20% by 2024.

- More than 1 in 5 adults in the US regularly use wearable fitness trackers or smartwatches to monitor their health, with around 41% of Americans utilizing such technology.

- The sales of health wearables worldwide reached 223 million units in 2019, and are expected to hit 300 million by the end of 2023.

- Shipments of in-ear or over-ear smart audio devices increased significantly, from 48.6 million units in 2018 to an estimated 170.5 million units.

- In 2022, shipments of wearable devices exceeded 490 million units.

- Smartwatches constituted the largest share of the wearable AI market in 2022, at 57%.

- The Apple Watch held a dominant position in the smartwatch market with a 36.1% share in 2022.

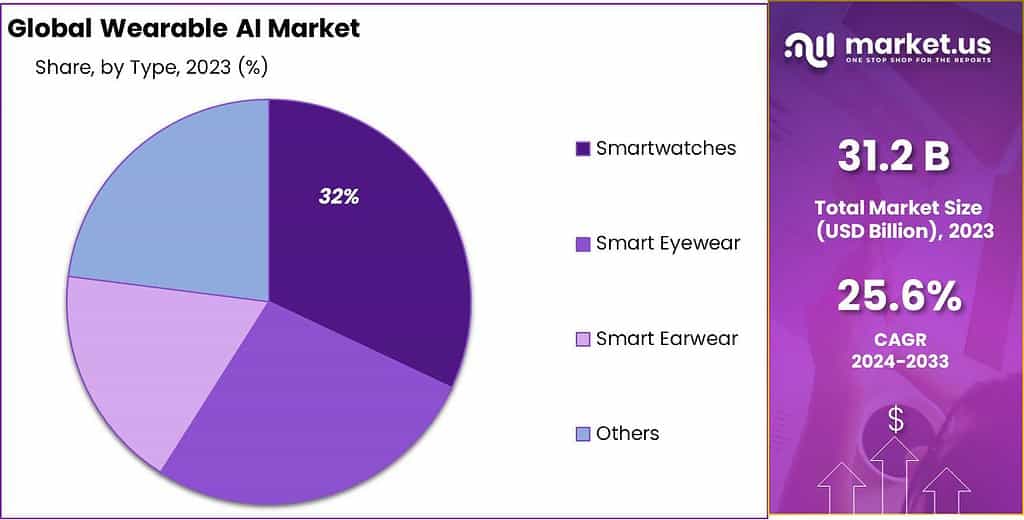

Type Analysis

In 2023, the Smartwatches segment held a dominant market position, capturing more than a 32% share of the global Wearable AI market. This prominence can be attributed to the multifaceted utility and widespread consumer adoption of smartwatches, which have transcended their initial role as timekeeping devices to become indispensable tools for health monitoring, communication, and productivity enhancement.

The integration of advanced AI technologies has significantly expanded the capabilities of smartwatches, enabling features such as personalized health insights, real-time fitness tracking, and seamless connectivity with other smart devices. This evolution has resonated well with health-conscious consumers and tech-savvy individuals, driving the segment’s growth.

Moreover, the surge in demand for smartwatches is supported by continuous innovation and product launches from leading tech companies, coupled with the increasing integration of AI to enhance user interaction and experience. The ability of smartwatches to process and analyze data in real-time, providing users with actionable insights into their health and fitness, positions them as a key driver in the wearable AI market.

Additionally, the proliferation of mobile connectivity and the expansion of the IoT ecosystem have further fueled the adoption of smartwatches, making them a central component in the broader network of connected devices. The smartwatches segment’s leadership in the wearable AI market is also underpinned by a growing emphasis on personal health and well-being, alongside the rising penetration of smartphones, which serve as a complementary device enhancing the functionality and appeal of smartwatches.

As technology continues to advance, smartwatches are expected to offer even more sophisticated AI-based applications and features, promising substantial growth opportunities for this segment. Manufacturers are increasingly focusing on customizing user experience and expanding the health and fitness capabilities of their products, thereby ensuring sustained interest and investment in smartwatches as a leading category within the wearable AI space.

Component Analysis

In 2023, the Sensors Segment held a dominant market position in the Wearable AI market, capturing more than a 55% share. This leadership can be attributed to the critical role sensors play in the functionality of wearable AI devices.

Sensors are the foundational components that enable these devices to interact with the user and the environment, collecting data on physical activities, health metrics, and environmental factors. The surge in demand for health and fitness monitoring devices, smartwatches, and wearable medical devices has significantly driven the expansion of the sensors segment.

The proliferation of sensors in wearable AI technology stems from their versatility and advancements in sensor technology. These improvements have enabled more accurate, reliable, and power-efficient sensors, making them indispensable in wearable AI applications. For instance, the integration of accelerometers, gyroscopes, heart rate sensors, and temperature sensors has enhanced the ability of wearables to offer personalized health tracking and insights.

Additionally, the growing consumer awareness and emphasis on health and wellness have propelled the demand for devices equipped with sophisticated sensors, capable of monitoring a wide array of physiological parameters.

Furthermore, the development of new sensor types and the miniaturization of existing sensors have facilitated the creation of more compact, comfortable, and aesthetically pleasing wearable AI devices. This evolution has made wearable technology more appealing to a broader consumer base, further fueling market growth. The emphasis on user experience and the demand for devices that seamlessly integrate into daily life while providing valuable data-driven insights are key factors underpinning the sensors segment’s dominant market share.

Application Analysis

In 2023, the Consumer Electronics segment held a dominant market position in the Wearable AI Market, capturing more than a 33% share. This leading status can be attributed to the increasing adoption of smart devices by consumers globally.

The demand for smartwatches, fitness trackers, and health monitoring devices, which are all integral components of consumer electronics, has surged. These devices, enhanced with artificial intelligence (AI), offer users personalized experiences by learning from their behaviors and preferences. This personalization, coupled with the convenience of having technology integrated into everyday wearables, has driven the segment’s growth.

Furthermore, the proliferation of Internet of Things (IoT) technology has significantly contributed to the expansion of the Consumer Electronics segment within the Wearable AI Market. IoT’s integration enables devices to connect and exchange data, improving user engagement and functionality of wearable devices.

Manufacturers are continuously innovating and launching advanced products, which further stimulates consumer interest and adoption rates. The growing awareness of health and fitness, driven by the COVID-19 pandemic, has also played a pivotal role in accelerating the demand for wearable AI devices in the consumer electronics sector.

Key Market Segments

By Type

- Smartwatches

- Smart Eyewear

- Smart Earwear

- Others

By Component

- Processor

- Connectivity IC

- Sensors

By Application

- Consumer Electronics

- Healthcare

- Automotive

- Military & Defense

- Media & Entertainment

- Others

Drivers

Increased awareness of health and fitness and advancements in wearable technology

The increased awareness of health and fitness among consumers stands as a primary driver of the market. This surge in health consciousness has led individuals to seek out wearable technology that can monitor vital health metrics, track fitness activities, and offer insights into their overall wellbeing.

Concurrently, advancements in wearable technology have significantly enhanced the functionality, accuracy, and user experience of these devices. Innovations such as improved sensors, artificial intelligence integration, and more intuitive interfaces have made wearable AI devices indispensable tools for health and fitness enthusiasts, thus propelling the market forward.

Restraint

Limited battery life

One major restraint faced by wearable technology is limited battery life. As wearable devices become more advanced and feature-rich, they require more power to operate. However, the compact size of these devices limits the capacity of their batteries, resulting in shorter battery life. This poses a challenge for users who rely on their wearables throughout the day and need to constantly recharge or replace the battery. Limited battery life restricts the continuous usage of these devices and may lead to user frustration.

Opportunities

Customization and personalization features

One significant opportunity in the wearable technology market is the integration of customization and personalization features. Every individual has unique fitness goals, preferences, and requirements. By providing customizable features, such as personalized fitness plans, targeted recommendations, and adjustable settings, wearable devices can cater to the specific needs of users. Customization and personalization not only enhance the user experience but also improve the effectiveness of the devices in helping individuals achieve their health and fitness goals.

Challenge

Market saturation and intense competition

The main challenge faced by the wearable technology market is market saturation and intense competition. As the demand for wearables grows, numerous companies have entered the market with their own offerings. This has led to a saturated market with a wide range of products and brands competing for consumer attention. Differentiating products and gaining a competitive edge in such a crowded market is a significant challenge.Companies need to constantly innovate, offer unique features, and provide compelling value propositions to stand out from the competition and attract and retain customers. Additionally, pricing, marketing strategies, and establishing brand loyalty become crucial factors in overcoming the challenge of market saturation and intense competition.

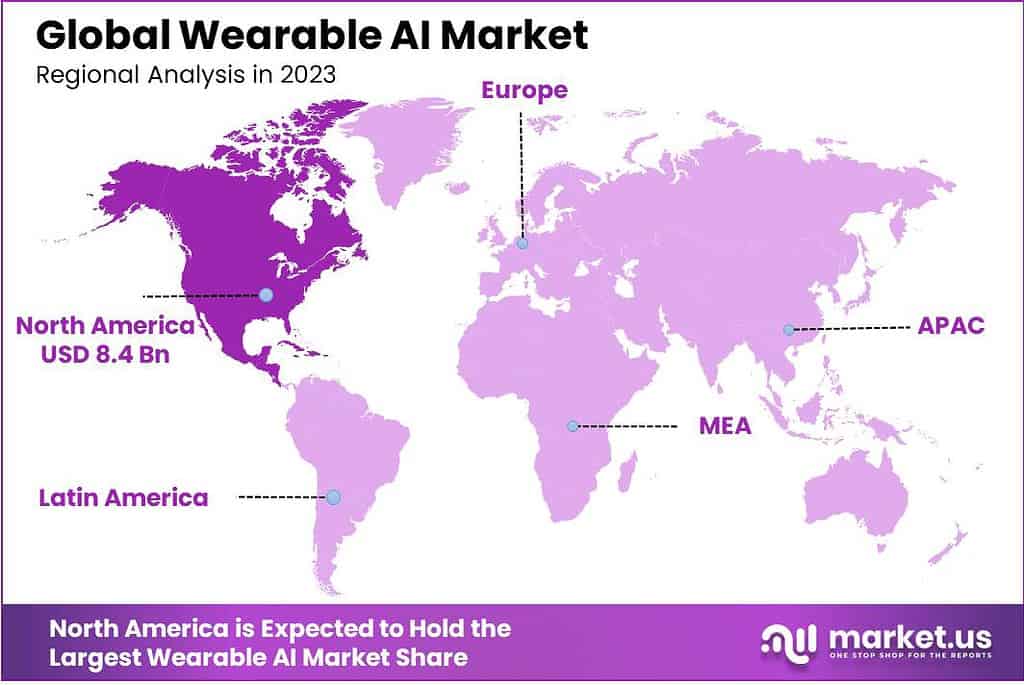

Regional Analysis

In 2023, North America held a dominant market position in the Wearable AI Market, capturing more than a 27% share. This leadership can be primarily attributed to the region’s robust technological infrastructure, high consumer purchasing power, and a strong presence of leading tech companies. The demand for Wearable AI in North America was valued at USD 8.4 billion in 2023 and is anticipated to grow significantly in the forecast period.

North America, particularly the United States, has always been at the forefront of technological innovation. The region’s consumers are quick to adopt new technologies, including wearable AI devices, driven by a keen interest in health and fitness, and a lifestyle that values the convenience and efficiency offered by such innovations.

Moreover, North America’s tech industry is supported by substantial investments in research and development, facilitating the rapid advancement of wearable technologies. The region’s regulatory environment, which is relatively favorable towards technological innovations, also plays a critical role in the swift adoption and integration of AI into consumer wearables. With a culture that embraces digital transformation, North America presents an ideal market for the introduction and growth of wearable AI applications, ranging from health monitoring to augmented reality experiences.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Wearable AI Market is characterized by the presence of several key players, each contributing to the industry’s growth through innovation, strategic partnerships, and expansion into new markets. An analysis of these key players reveals a competitive landscape where technological advancement and consumer engagement are paramount.

Amazon has expanded its reach into the wearable space with devices that integrate Alexa, facilitating voice-activated commands and bringing smart assistance to the user’s wrist. Fitbit, Inc., a pioneer in health and fitness wearables, continues to innovate with devices that offer detailed health monitoring and fitness tracking, appealing to health-conscious consumers. Garmin Ltd. stands out for its focus on precision and durability, especially in wearables catering to outdoor and fitness enthusiasts.

Google, Inc. has made significant strides with Wear OS, enhancing the functionality and compatibility of smartwatches, and its acquisition of Fitbit underscores its commitment to the wearable market. Huawei Technologies Co. Ltd. has gained a strong foothold with its range of smartwatches and fitness bands, known for their sleek designs and robust health tracking features. IBM’s entry into the wearable AI space, though less consumer-focused, emphasizes the application of AI and data analytics in enhancing wearable technologies.

Top Market Leaders

- Amazon

- Fitbit, Inc.

- Garmin Ltd.

- Google, Inc.

- Huawei Technologies Co. Ltd.

- IBM

- Motorola Solutions, Inc.

- Xiaomi Corporation

- Apple, Inc.

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Other key players

Recent Developments

- 2024: Xiaomi, a leading player in the consumer electronics sector from China, marked the global debut of its Redmi Buds 5 and Redmi Buds 5 Pro in January. These earbuds come equipped with active noise cancellation, with the Redmi Buds 5 featuring a 12.4mm driver unit and dual microphones that support AI noise cancellation technology. This launch is significant as it brings advanced audio features at competitive price points, enhancing Xiaomi’s position in the global market for wearable AI devices.

- 2023: Alphabet Inc., known for its pioneering technologies, introduced the Google Pixel Watch 2 in October. This device is notable for its enhanced performance, all-day battery life, dedicated Google Assistant integration, and comprehensive health features. Its eco-friendly design aligns with contemporary consumer preferences for sustainable and versatile wearable technology, further solidifying Alphabet Inc.’s footprint in this space.

- 2023: Also in October, Meta, another major player in the technology industry, launched the Meta Quest 3. This device stands out for its higher resolution, superior performance, and the introduction of breakthrough Meta Reality technology. The Quest 3’s slimmer and more comfortable form factor addresses the growing demand for high-performance wearable devices that offer immersive experiences without compromising on comfort.

Report Scope

Report Features Description Market Value (2023) USD 31.2 Bn Forecast Revenue (2033) USD 304.8 Bn CAGR (2024-2033) 25.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Smartwatches, Smart Eyewear, Smart Earwear, Others), By Component (Processor, Connectivity IC, Sensors), By Application (Consumer Electronics, Healthcare, Automotive, Military & Defense, Media & Entertainment, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amazon, Fitbit Inc., Garmin Ltd., Google Inc., Huawei Technologies Co. Ltd., IBM, Motorola Solutions Inc., Xiaomi Corporation, Apple Inc., Samsung Electronics Co. Ltd., Sony Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Wearable AI?Wearable AI refers to the integration of artificial intelligence technology into wearable devices such as smartwatches, fitness trackers, and augmented reality glasses. These devices utilize AI algorithms to provide personalized experiences, real-time data analysis, and enhanced functionality.

How big is Wearable AI Market?The Global Wearable AI Market size is expected to be worth around USD 304.8 Billion by 2033, from USD 31.2 Billion in 2023, growing at a CAGR of 25.6% during the forecast period from 2024 to 2033.

What are the Challenges in the Wearable AI Market?Challenges in the wearable AI market include privacy concerns related to data collection and analysis, battery life limitations, device interoperability, and the need for continuous innovation to stay ahead in a competitive market.

Which region accounted for the largest wearable AI market share?In 2023, North America held a dominant market position in the Wearable AI Market, capturing more than a 27% share.

Who are the key players in the wearable AI market?Some of the key market players operating in the wearable AI market are Amazon, Fitbit Inc., Garmin Ltd., Google Inc., Huawei Technologies Co. Ltd., IBM, Motorola Solutions Inc., Xiaomi Corporation, Apple Inc., Samsung Electronics Co. Ltd., Sony Corporation

How Can Businesses Leverage Wearable AI Technology?Businesses can leverage wearable AI technology to enhance employee productivity, improve customer engagement, streamline operations, and gain actionable insights from real-time data. By integrating wearable AI devices into their workflows, businesses can achieve greater efficiency and competitiveness in the market.

-

-

- Amazon

- Fitbit, Inc.

- Garmin Ltd.

- Google, Inc.

- Huawei Technologies Co. Ltd.

- IBM

- Motorola Solutions, Inc.

- Xiaomi Corporation

- Apple, Inc.

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Other key players