Global Water Treatment Chemicals Market By Type (Coagulants and Flocculants, Corrosion Inhibitors, Scale Inhibitors, pH Adjusters and Stabilizers, Biocide and Disinfectant, Anti-Foaming Agents, Others), By Source (Bio-based, Synthetic), By Application (Wastewater Treatment, Boiler Water Treatment, Cooling Water Treatment, Raw Water Treatment, Desalination, Others), By End-use (Municipal, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 31750

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

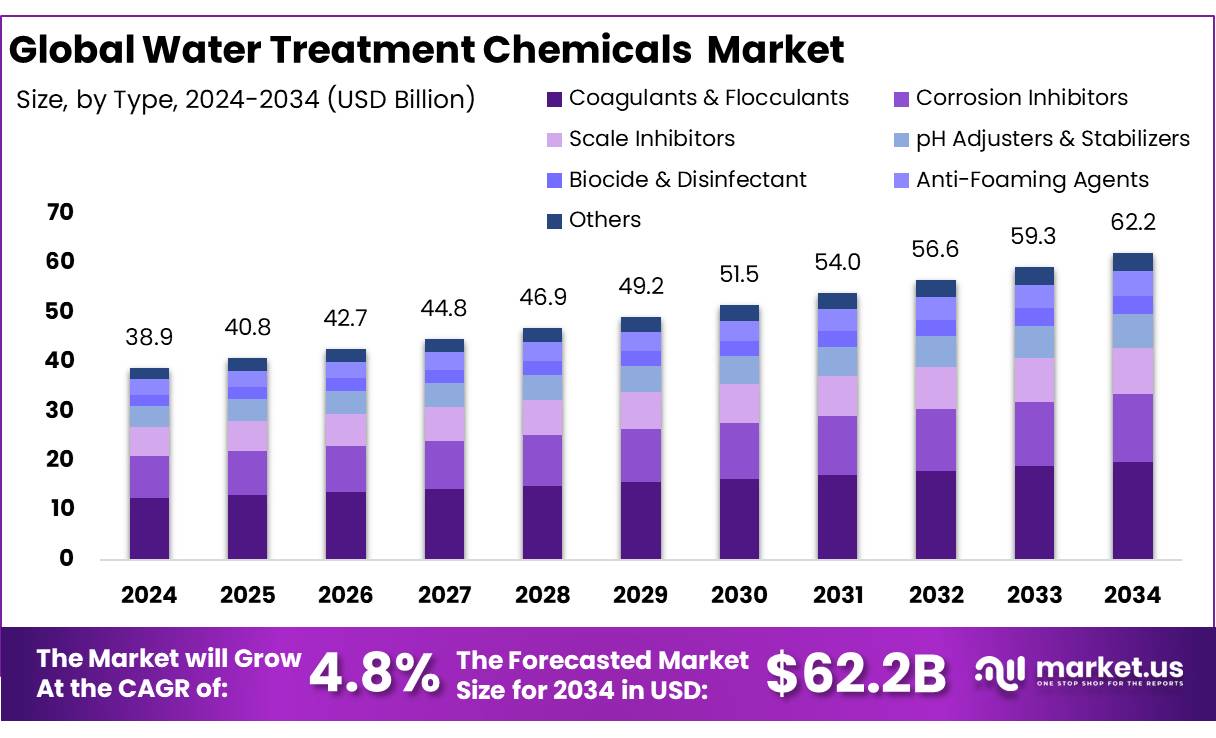

The Global Water Treatment Chemicals Market size is expected to be worth around USD 62.2 Billion by 2034, from USD 38.9 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Water treatment chemicals are specialized substances added to water during treatment processes to achieve essential outcomes such as disinfection, pH adjustment, scale and corrosion control, and the removal of harmful contaminants. These chemicals act as the backbone for modern water treatment operations, ensuring safe water for human consumption, industrial use, and environmental discharge. Their importance lies in maintaining public health, improving process efficiency, and meeting stringent environmental regulations.

There are multiple applicable sectors, including municipal water supply, industrial manufacturing, power generation, food and beverage, pharmaceuticals, and wastewater treatment facilities. In the global market, the demand for water treatment chemicals continues to rise, fueled by urbanization, industrial expansion, water scarcity, and increasing awareness of water quality issues. As developing regions improve access to clean water and developed markets adopt more advanced and eco-friendly treatment methods, water treatment chemicals remain a key component of global water management strategies.

Key Takeaways

- The global water treatment chemicals market was valued at USD 38.9 billion in 2024.

- The global water treatment chemicals market is projected to grow at a CAGR of 4.8% and is estimated to reach USD 62.2 billion by 2034.

- Among types, coagulants & flocculants accounted for the largest market share of 31.9%.

- Among sources, synthetic accounted for the majority of the market share at 79.3%.

- By application, wastewater treatment accounted for the largest market share of 34.5%.

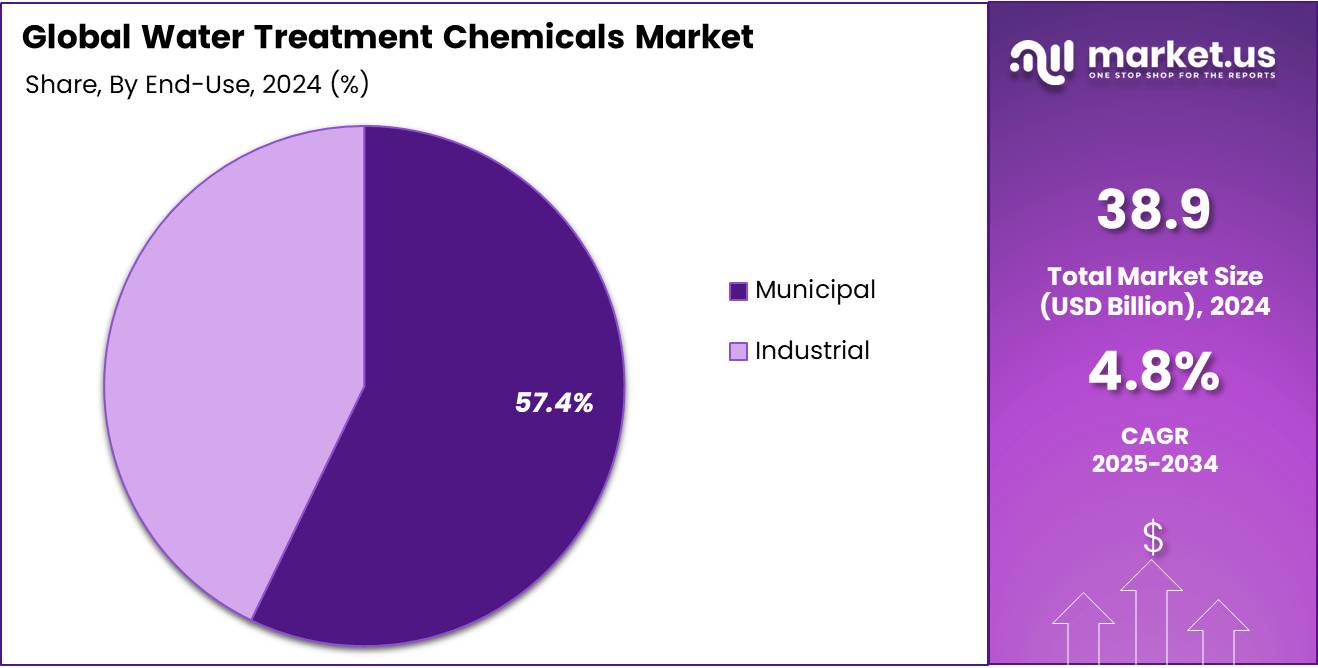

- By end-use, municipal accounted for the majority of the market share at 57.4%.

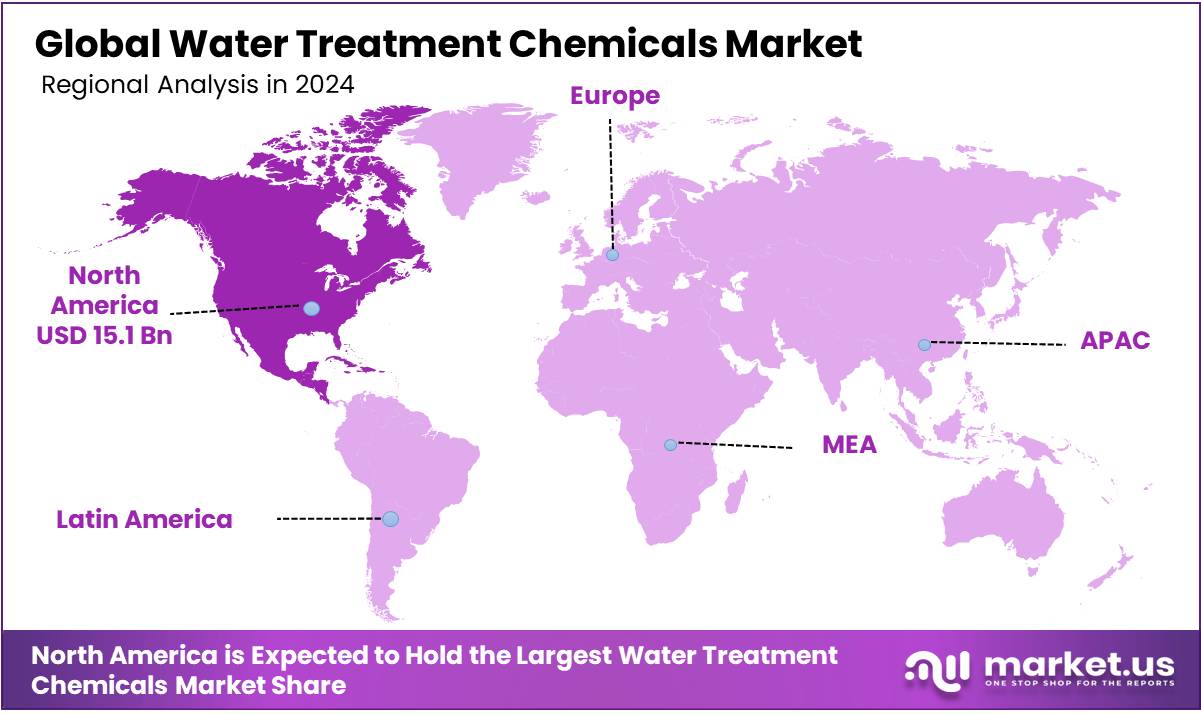

- North America is estimated as the largest market for water treatment chemicals with a share of 38.9% of the market share.

Type Analysis

The Water Treatment Chemicals Market Is Dominated by the Coagulants & Flocculants

The water treatment chemicals market is segmented based on type into coagulants & flocculants, corrosion inhibitors, scale inhibitors, pH Adjusters & stabilizers, biocide & disinfectant, anti-foaming agents, and others. In 2024, the coagulants & flocculants segment held a significant revenue share of 31.9%. Due to their effective in removing suspended solids by destabilizing and aggregating particles for easy separation.

Their combined action significantly reduces turbidity, a critical indicator of water quality, making them essential in drinking water purification. These chemicals offer a reliable, efficient solution for both potable and wastewater treatment. In wastewater applications, they achieve up to 90% reduction in suspended solids and organic loads. Their consistent performance and broad applicability drive their high demand in the industry.

Source Analysis

Based on the source, the market is further divided into bio-based and synthetic. The predominance of the synthetic, commanding a substantial 79.3% market share in 2024. Due to their key role across various industries, including chemical, pharmaceutical, power plants, and municipal water treatment. Common synthetic variants like aluminum sulfate, ferric chloride, and polyacrylamide are widely used for impurity removal, microbial control, and water quality enhancement.

These chemicals are cost-effective, easily manufactured, and available in diverse forms and characteristics, such as ionic charge and molecular weight. Their flexibility in liquid and dry formulations supports broad application in wastewater, boiler, cooling, and raw water treatment. This versatility and accessibility make them the most dominant source in the market.

Application Analysis

The Wastewater Treatment Application Commands a Major Market Share in the Water Treatment Chemicals Market.

Among applications, the water treatment chemicals market is classified into boiler water treatment, cooling water treatment, wastewater treatment, raw water treatment, desalination, and others. As of the analysis from 2024, wastewater treatment held a dominant position with a 34.5% share. Due to its an essential role in removing contaminants, protecting equipment, and meeting environmental regulations. Chemicals such as coagulants, flocculants, disinfectants, and pH adjusters are critical for making wastewater safe for discharge or reuse.

Their use ensures effective pollutant removal, microbial control, and chemical balance. These processes are fundamental in both industrial and municipal settings. In municipal water treatment, coagulants and disinfectants are widely applied to ensure clean, safe drinking water. The widespread and continuous need for these applications makes wastewater treatment the leading segment in the water treatment chemical market.

End-Use Analysis

The Municipal Sector Is the Major End User of the Water Treatment Chemicals Market.

By end-use, the market is categorized into municipal and industrial. The municipal segment is emerging as the dominant user, holding 57.4% of the total market share in 2024. Due to their focus on providing safe and potable drinking water to the public.

Chemicals like disinfectants and coagulants are essential for removing harmful contaminants, controlling microbial growth, and preventing corrosion and scaling within water distribution systems. Their widespread use in municipal plants ensures public health and maintains water quality. The continuous demand for clean drinking water and infrastructure protection drives the strong presence of municipal applications in the market.

Key Market Segments

By Type

- Coagulants & Flocculants

- Inorganic Coagulants

- Organic Coagulants

- Flocculants

- Corrosion Inhibitors

- Anodic Inhibitors

- Cathodic Inhibitors

- Scale Inhibitors

- Organic Scale Inhibitors

- Inorganic Scale Inhibitors

- pH Adjusters & Stabilizers

- Biocide & Disinfectant

- Oxidizing Biocides

- Non-Oxidizing Biocides

- Disinfectant

- Anti-Foaming Agents

- Others

By Source

- Bio-based

- Synthetic

By Application

- Wastewater Treatment

- Boiler Water Treatment

- Cooling Water Treatment

- Raw Water Treatment

- Desalination

- Others

By End-Use

- Municipal

- Industrial

- Oil and Gas

- Food and Beverage

- Chemicals and Petrochemicals

- Pharmaceuticals

- Pulp and Paper

- Power Generation

- Others

Drivers

Rising demands for water treatment

The increasing global demand for effective water treatment solutions is driving significant growth in the Water treatment chemicals market. These chemicals play an important role in addressing water purification challenges, acting as powerful oxidizing coagulants, disinfectants, acids, bases, corrosion inhibitors, dechlorination chemicals, and fluoridation chemicals that remove organic and inorganic contaminants, bacteria, and metals such as iron and manganese from water sources. It is particularly effective in oxidizing low-level impurities like arsenic, which can then be removed through clarification and filtration, ensuring safe drinking water. Additionally, it helps eliminate unpleasant tastes, odors, and staining caused by phenols, sulfides, and other compounds, contributing to better water quality and improved public health.

- According to the World Health Organization report, 2 billion individuals lack access to safe drinking water, and half of the global population is projected to live in water-stressed areas by 2025. The need for efficient water purification processes has become more urgent

Additionally, increasing water scarcity and pollution, especially in regions facing environmental water stress, are other important contributors to the Water treatment chemicals market growth. Due to their ability to reduce the need for additional coagulants and enhance the clarification process, these chemical plays an important role in both municipal and industrial water treatment applications.

Moreover, these chemicals are not only utilized in drinking water treatment but also in wastewater treatment, soil and groundwater remediation, and various industrial processes such as metal surface treatment and equipment cleaning. As industries and governments worldwide prioritize sustainable water management and reduce wastewater contamination, the Water treatment chemicals continue growing, offering effective solutions for both environmental protection and public health.

- According to UNESCO’s 2017 report, globally, 80% of wastewater flows back into the ecosystem without being treated or reused. This statistic highlights the urgent need for water treatment plants, which drives the growing demand for water treatment chemicals.

- In addition, according to a World Health Organization report, by 2050, over 40% of the world’s population is expected to face water scarcity. This highlights the importance of wastewater and waste treatment as viable solutions to address freshwater shortages, thus increasing the demand for water treatment chemicals.

Furthermore, growing industrialization, population growth, and agricultural demands have increased the need for freshwater resources, driving the demand for Water treatment chemicals in wastewater treatment, controlling harmful microbial growth, and reducing pollutants. This aligns with the increasing emphasis on sustainable and eco-friendly water management practices.

Moreover, with the rise of water treatment challenges such as the spread of waterborne diseases and the pollution of aquatic ecosystems, water treatment chemicals are used to offer cleaner and safer water production. The growing awareness of Water treatment chemicals’ benefits and effectiveness ensures that these chemicals will remain a key component in addressing global water treatment needs and ensuring public health.

- According to the World Health Organization, reports state that approximately 80% diseases around the world are waterborne.

- In addition, according to the latest data from the World Resources Institute (WRI), nearly 25% of the world’s population, around 1.7 billion people across 17 countries, are experiencing extreme water stress. Water contamination from pollutants such as heavy metals, pesticides, phenols, PAHs, PCBs, herbicides, fertilizers, dyes, and pathogens is a major contributor to the global water crisis and the spread of waterborne diseases.

Restraints

Availability of Alternative Water Treatment Technologies

The availability of alternative water treatment technologies is emerging as a significant factor restraining the growth of the global water treatment chemicals market. Driven by growing environmental awareness, stricter government regulations, and increasing concerns over the health risks associated with chemical-based treatments, the industry is gradually shifting toward more sustainable, eco-friendly solutions such as membrane separation, reverse osmosis, advanced filtration, sedimentation, and the use of microorganisms as compared to water treatments chemicals provide higher efficiency, lower environmental impact, and their ability to remove a wider range of contaminants, including emerging pollutants further shifting user towards alternative technologies limiting its market adoption.

Furthermore, these technologies offer effective water purification without the environmental and health hazards linked to traditional chemical usage. Chemicals used in conventional water treatment processes have been associated with adverse health effects, including the formation of harmful disinfection byproducts, increased cancer risk, liver and kidney damage, and dental fluorosis from excessive fluoride exposure. Additionally, chemical interactions with water infrastructure can lead to pipe corrosion and the leaching of toxic substances.

As consumers and industries become more aware of these risks, there is a noticeable shift in behavior and investment toward safer, non-chemical alternatives. Furthermore, governments across the world are implementing sustainable practices, imposing standard restrictions on some chemicals used. These government actions reflect a growing regulatory pressure on reducing the use of harmful chemical contaminants in drinking water, further limiting the adoption of the global water treatment chemical market. This growing adoption of advanced treatment technologies poses a challenge to the expansion of the chemical-based water treatment market, limiting its long-term growth potential.

- For instance, in April 2024, the U.S. Environmental Protection Agency (EPA) finalized the National Primary Drinking Water Regulations (NPDWR), setting enforceable Maximum Contaminant Levels (MCLs) for six PFAS chemicals. These rules are shifting users towards alternative water treatment technologies like membrane separation and reverse osmosis.

Opportunity

The Shift Toward Eco-Friendly Water Treatment Chemicals

The global water treatment chemicals market is experiencing a transformative shift driven by the increasing adoption of eco-friendly alternatives. This change is fueled by growing environmental regulations, water scarcity challenges, and an industrial demand for sustainable practices. As chemical plants and water utilities seek to minimize their ecological footprint, there is a notable move toward advanced, efficient, and environmentally responsible water treatment technologies. These solutions not only ensure regulatory compliance but also enhance operational efficiency, support water reuse initiatives, and help future-proof processes in an increasingly resource-constrained world.

Furthermore, traditional water treatment chemicals can pose significant risks to both ecosystems and human health. Compounds such as phosphates, synthetic polymers, and chlorine-based disinfectants can generate harmful byproducts like trihalomethanes (THMs) and contribute to water pollution. However, eco-friendly water treatment chemicals offer biodegradable, non-toxic, and sustainable alternatives that maintain high water quality without the adverse environmental impact. In addition, conventional chemical treatment is also energy-intensive, leading to high greenhouse gas emissions.

By embracing sustainable, eco-friendly chemical formulations, industries and municipalities can reduce their carbon footprint, protect biodiversity, and mitigate the negative impacts of traditional water treatment chemicals. Additionally, many water treatments facilities around worlds embracing eco-friendly chemicals in water in various types of water treatments including boiler, cooling and raw water used Non-chemical coagulants, including natural polymers and other bio-based compounds, bio-organic flocculants, Unlike conventional coagulants such as metal salts and synthetic polymers, bio-organic flocculants are derived from natural sources.

These flocculants not only perform effectively in clarifying wastewater but also deliver considerable operational cost savings. Their adaptability across a range of applications, from process water to wastewater treatment, makes them a versatile and cost-effective choice for various industries.

- For instance, the New JerseyPequannock Water Treatment Facility in Newark implemented chitosan to enhance the filtration process, reducing the use of synthetic chemicals while improving water quality.

Trends

Growing Adoption Of Zero-Liquid Discharge And Water Reuse Technologies

The growing adoption of Zero Liquid Discharge (ZLD) and water reuse technologies is significantly transforming the global water treatment chemicals market. Driven by stricter environmental regulations and increasing water scarcity, industries are increasingly turning to ZLD systems to minimize wastewater discharge and promote sustainable water management.

These systems heavily depend on a range of water treatment chemicals, particularly during pretreatment, membrane separation, and crystallization processes. Chemicals such as ferric chloride, ferric sulfate, hydrochloric acid, caustic soda, lime, and various antiscalants are essential for removing heavy metals, hardness, silica, and other contaminants, as well as for preventing membrane fouling.

In a typical ZLD setup, treated effluent from sewage treatment plants (STPs) and effluent treatment plants (ETPs) is processed through advanced technologies like membrane bioreactors (MBRs), reverse osmosis (RO), and agitated thin film dryers (ATFDs). The resulting high-quality permeate water is reused in industrial applications such as boiler feed, cooling tower makeup, and fume hoods, eliminating discharge into municipal sewer systems.

Meanwhile, the rejected water is converted into solid waste through evaporation and disposed of as hazardous material in compliance with regulatory norms. Pretreatment, often involving clarifiers and chemical reactors, plays a crucial role in conditioning wastewater and improving the efficiency of downstream processes. As industries across sectors like power, textiles, pharmaceuticals, and chemicals increasingly implement ZLD systems, the demand for specialized water treatment chemicals continues to rise, making this trend a major driver of growth and innovation in the global market.

Geopolitical Impact Analysis

Geopolitical tensions, such as trade disputes and export restrictions, are disrupting the global water treatment chemical supply chain.

Recent Geopolitical factors, such as trade wars, regulatory changes, and global conflicts, are affecting the growth of the global water treatment chemical market. Ongoing tensions such as the China-US trade war and the Japan-South Korea trade dispute disrupt the global supply chain for raw materials and finished products, leading to increased costs and delays in production.

As water treatment chemicals are important chemicals in several industries, including the treatment of industrial boilers, cooling, wastewater, raw water treatment, and desalination, disruptions in their supply can lead to higher prices and supply chain delays in water treatment plants. Furthermore, export restrictions imposed by governments to safeguard national security or economic interests can have a significant impact on the water treatment chemical market. Such measures could prevent the international shipment of key materials used in its production, disrupting supply and increasing competition for available resources.

Countries may restrict exports of raw materials or chemicals to protect their domestic industries, affecting global manufacturers of water treatment chemicals. These restrictions on chemical exports during times of crisis can limit access to critical ingredients, raising costs for manufacturers and delaying production timelines. This shift in global supply chain dynamics is not only a challenge for the water treatment chemical market but also contributes to broader global economic instability, forcing companies to find alternative sources or adapt their strategies to manage the risks posed by such geopolitical uncertainties.

Additionally, sanctions imposed by various countries across the world are affecting the supply chain activities of the global water treatment chemical market. Anti-dumping activities on water treatment chemicals have intensified globally, with India and the United States imposing significant duties to counteract the impact of low-priced imports from major Asian exporters. These measures are intended to protect domestic industries and ensure fair trade, but they also reshape global supply chains and pricing in the water treatment chemicals market.

- For instance, according to news published by the Hindu in March 2025, states that India has imposed an anti-dumping duty of up to $986 per tonne for five years on trichloroisocyanuric acid, a key water treatment chemical, imported from China and Japan to protect the domestic industry from cheap inbound shipments.

Regional Analysis

North America Held the Largest Share of the Global Water Treatment Chemicals Market

In 2024, North America dominated the global water treatment chemicals market, accounting for 38.9% of the total market share, driven by increasing demand for clean and safe water across municipal, industrial, and commercial sectors. The regional Strict environmental regulations regarding wastewater discharge and drinking water quality are pushing both public and private companies to invest in effective water treatment solutions.

Furthermore, regions’ aging water infrastructure in countries such as the United States and Canada is further increasing the use of these chemicals to maintain system efficiency and safety. Additionally, growing awareness of waterborne diseases and the need for sustainable water management practices are encouraging the adoption of advanced treatment chemicals. Industrial growth, as North America’s hub of the industrial sector their well well-established power generation, oil & gas, and food processing continuously discharge wastewater.

To manage these wastewater problems and reduce water pollution, regional industries are adopting water treatment chemicals. The presence of leading chemical manufacturers and ongoing innovations in treatment technologies continue to support North America’s dominant position in the global water treatment chemicals market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In The Water Treatment Chemicals Market Dominate The Market Through Strategic Innovation And Expanding Their Global Footprint.

Leading players in this market include Veolia Water Solutions and Technologies, Ecolab Inc., Berwind, Genesys International Ltd, Kemira Oyj, Kurita Water Industries Ltd, BASF SE, Dow Chemical Company, Solenis, and Italmatch Chemicals S.p.These players maintain their dominance by implementing various strategies such as innovation in product development, expanding their global footprint, forming strategic partnerships and acquisitions, and focusing on sustainability.

They invest in advanced technologies to improve efficiency and meet regulatory standards while offering a diverse product portfolio to cater to different industry needs. These approaches help them stay competitive and address the growing demand for effective water treatment solutions.

The Major Players in the Industry

- BASF SE

- Ecolab

- Nouryon

- Kemira Oyj

- Solenis

- Dow

- Solvay

- Kurita Water Industries Ltd.

- SNF

- Cortec Corporation

- Italmatch Chemicals

- Veolia

- Thermax Ltd

- Baker Hughes Company

- Buckman Laboratories International Inc.

- Other Key Players

Recent Development

- In February 2025, Kurita America announced a merger with Avista Technologies, effective April 1, 2025, aiming to integrate Avista’s membrane treatment expertise with Kurita’s comprehensive water solutions to strengthen their market position across North and Central America.

- In November 2023, Kemira announced a significant investment to expand its ferric sulfate production capacity by 70,000 tpa at the Goole, UK site, in response to stricter AMP 7–8 nutrient discharge regulations; this new line is expected to be in operation by the third quarter of 2025.

Report Scope

Report Features Description Market Value (2024) US$ 38.9 Bn Forecast Revenue (2034) US$ 62.2 Bn CAGR (2025-2034) 4.8 % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Coagulants and Flocculants, Corrosion Inhibitors, Scale Inhibitors, pH Adjusters and Stabilizers, Biocide and Disinfectant, Anti-Foaming Agents, Others), By Source (Bio-based, Synthetic), By Application (Wastewater Treatment, Boiler Water Treatment, Cooling Water Treatment, Raw Water Treatment, Desalination, Others), By End-use (Municipal, Industrial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Ecolab, Nouryon, Kemira Oyj, Solenis, Dow, Solvay, Kurita Water Industries Ltd., SNF, Cortec Corporation, Italmatch Chemicals, Veolia, Thermax Ltd, Baker Hughes Company, Buckman Laboratories International Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Water Treatment Chemicals MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Water Treatment Chemicals MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Ecolab

- Nouryon

- Kemira Oyj

- Solenis

- Dow

- Solvay

- Kurita Water Industries Ltd.

- SNF

- Cortec Corporation

- Italmatch Chemicals

- Veolia

- Thermax Ltd

- Baker Hughes Company

- Buckman Laboratories International Inc.

- Other Key Players