Global Water Tanker Truck Market Size, Share, Growth Analysis By Product (Rigid Tanker Trucks, Articulated Tanker Trucks, Trailer Tanker Trucks), By Capacity (Below 5,000 Gallons, 5,001 - 10,000 Gallons, 10,000 - 15,000 Gallons, Above 15,000 Gallons), By Fuel Type (Diesel, Gasoline, Alternative Fuels), By Material (Steel, Aluminum, Polyethylene, Fiberglass), By End Use (Government, Industrial, Commercial, Agriculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 156997

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

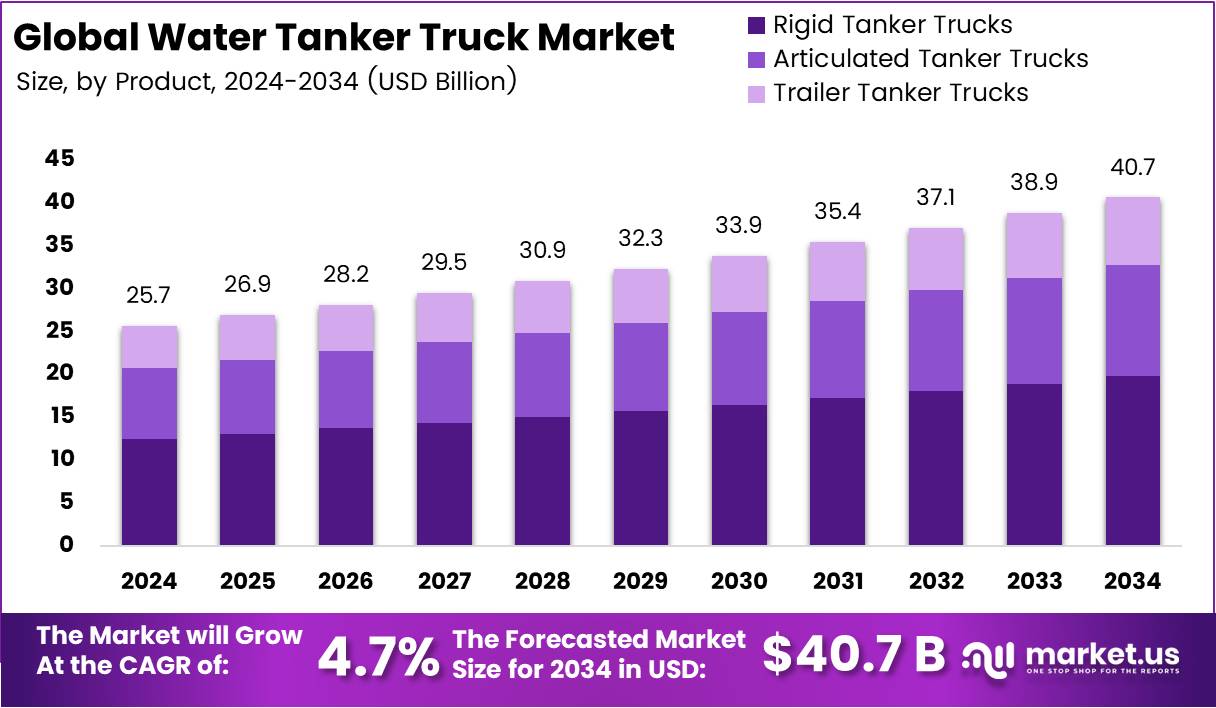

The Global Water Tanker Truck Market size is expected to be worth around USD 40.7 Billion by 2034, from USD 25.7 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The Water Tanker Truck Market is characterized by a steady growth trajectory, driven by increasing water distribution demands in urban and rural areas. Water tankers play a vital role in delivering water to locations with inadequate infrastructure. As regions face water shortages and droughts, the demand for water tanker trucks has surged, providing a critical solution for water transportation.

The market’s growth is significantly influenced by government regulations and investments aimed at improving water accessibility. Governments in both developed and developing regions are increasingly investing in infrastructure to enhance water distribution systems. These investments not only drive demand for water tanker trucks but also promote sustainability in water management practices.

In addition to government funding, there are opportunities for innovation within the water tanker truck sector. For instance, manufacturers are exploring eco-friendly alternatives, such as electric water tanker trucks. This trend aligns with global sustainability efforts, offering growth prospects for companies that can develop energy-efficient solutions. Moreover, advanced technologies like GPS tracking and automated systems are being incorporated into water tanker trucks, enhancing operational efficiency.

Market players are also focusing on expanding their services in rural and remote areas, where water delivery systems are often underdeveloped. This creates substantial opportunities for businesses to target these underserved regions. The increasing focus on improving water supply chains in agriculture and construction sectors is another factor fueling market expansion.

However, challenges such as high operational costs and limited access to financing in certain regions can hinder market growth. To address this, stakeholders are exploring affordable financing options and leasing models for fleet management. Additionally, there is a rising demand for government incentives and subsidies to support businesses in this market.

The ongoing growth of the Water Tanker Truck Market is a direct result of the increasing emphasis on sustainable water management and distribution. As governments continue to invest in this sector, the market is expected to expand further. The focus on technological advancements and innovative solutions will also contribute to the market’s long-term growth.

Key Takeaways

- The Global Water Tanker Truck Market is expected to reach USD 40.7 Billion by 2034, growing at a CAGR of 4.7% from 2025 to 2034.

- Rigid Tanker Trucks held a 48.6% share in the By Product segment in 2024, owing to their durability and versatility.

- 5,001 – 10,000 Gallons dominated the By Capacity segment in 2024, with a 37.9% market share.

- Diesel held the largest share in the By Fuel Type segment in 2024, with a 73.5% market share.

- Steel was the leading material in the By Material segment in 2024, holding a 48.2% share.

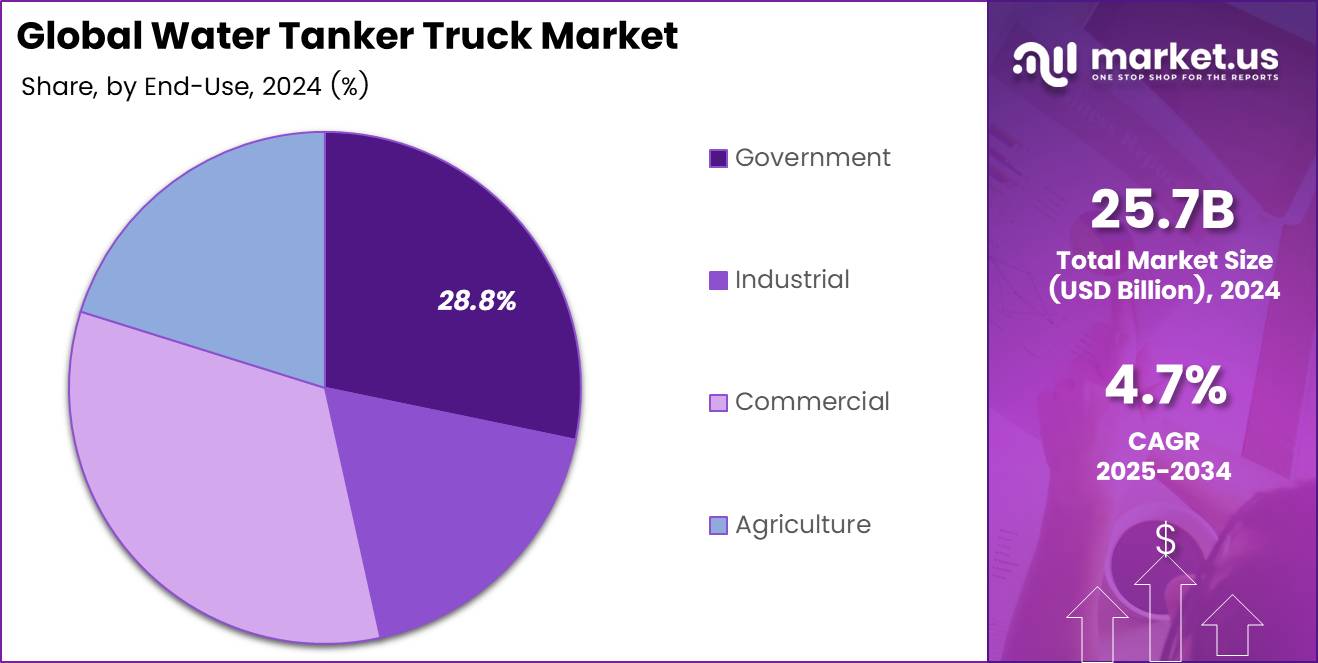

- The Government sector was the dominant end-use segment in 2024, accounting for 28.8% of the market share.

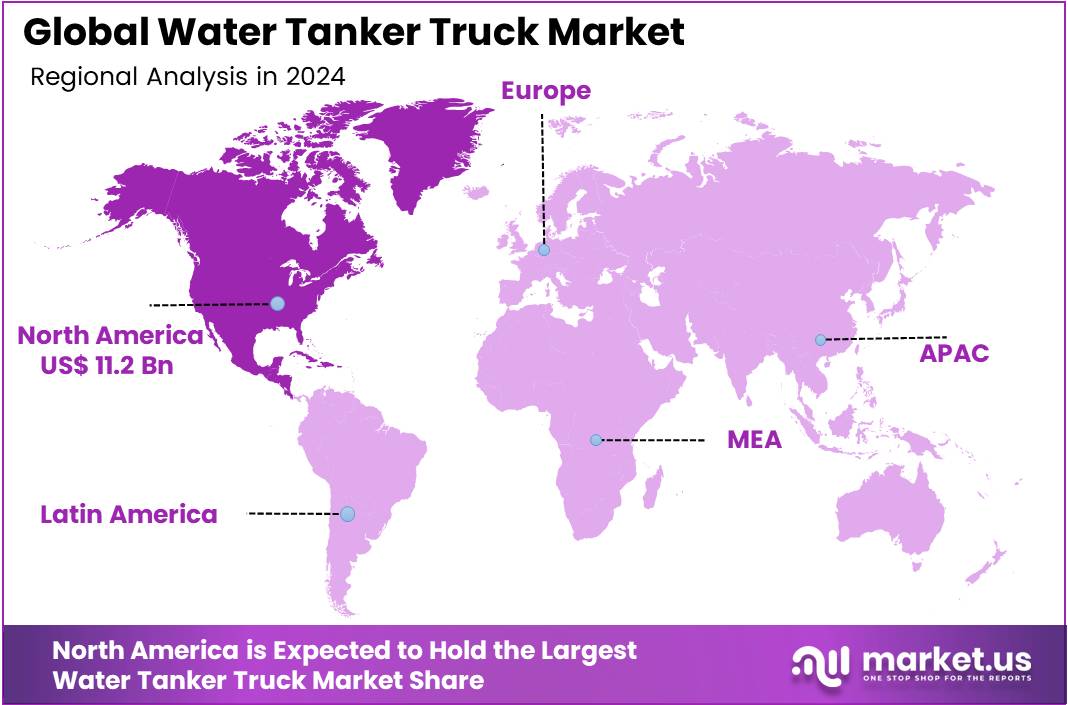

- North America led the market with 43.8% share, valued at USD 11.2 Billion, driven by urban infrastructure and government investments.

Product Analysis

Rigid Tanker Trucks dominate with 48.6% due to their structural durability and versatile applications.

In 2024, Rigid Tanker Trucks held a dominant market position in the By Product Analysis segment of Water Tanker Truck Market, with a 48.6% share. This leading position stems from their robust construction and ability to handle diverse water transportation requirements across multiple industries.

Rigid tanker trucks offer superior structural integrity compared to their counterparts, making them ideal for demanding operational environments. Their single-unit design provides enhanced stability during transport, reducing the risk of accidents and ensuring consistent water delivery. The maintenance requirements for rigid tanker trucks are generally lower, contributing to their cost-effectiveness over extended operational periods.

Articulated Tanker Trucks represent the second segment, offering increased payload capacity and flexibility for long-distance transportation. These vehicles excel in applications requiring maximum volume efficiency, particularly in industrial and municipal water supply operations.

Trailer Tanker Trucks constitute the remaining market share, providing specialized solutions for specific transportation needs. Their modular design allows for easy attachment and detachment, making them suitable for operations requiring frequent equipment changes or temporary water supply solutions.

Capacity Analysis

5,001 – 10,000 Gallons segment leads with 37.9% due to optimal balance between payload and operational efficiency.

In 2024, 5,001 – 10,000 Gallons held a dominant market position in the By Capacity Analysis segment of Water Tanker Truck Market, with a 37.9% share. This capacity range represents the sweet spot for most commercial and industrial water transportation applications.

The 5,001 – 10,000 gallon segment offers the ideal compromise between payload capacity and vehicle maneuverability. These trucks can efficiently serve medium to large-scale operations while maintaining reasonable fuel consumption and operational costs. Their size allows for effective navigation through urban environments and construction sites.

Below 5,000 Gallons trucks serve niche markets requiring smaller, more agile vehicles for specialized applications. These compact units excel in residential areas and tight spaces where larger vehicles cannot operate effectively.

The 10,000 – 15,000 Gallons segment caters to heavy-duty industrial applications requiring substantial water volumes. These vehicles are particularly valuable for large construction projects and industrial processes demanding continuous water supply.

Above 15,000 Gallons trucks represent the premium segment, serving specialized applications requiring maximum capacity. These vehicles typically operate in dedicated routes with specific infrastructure support requirements.

Fuel Type Analysis

Diesel dominates with 73.5% due to superior fuel efficiency and widespread infrastructure availability.

In 2024, Diesel held a dominant market position in the By Fuel Type Analysis segment of Water Tanker Truck Market, with a 73.5% share. This overwhelming preference reflects diesel’s proven performance advantages in heavy-duty commercial vehicle applications.

Diesel engines provide exceptional torque characteristics essential for water tanker operations, especially when fully loaded. The fuel efficiency of diesel engines significantly reduces operational costs, making them the preferred choice for fleet operators managing multiple vehicles. Additionally, diesel fuel’s energy density allows for extended operational range between refueling stops.

The extensive diesel refueling infrastructure across commercial routes ensures reliable fuel availability, minimizing operational disruptions. Diesel engines also demonstrate superior longevity and durability under demanding operational conditions typical of water tanker applications.

Gasoline-powered water tanker trucks serve specific market niches where diesel restrictions apply or lighter-duty applications are required. These vehicles typically operate in areas with gasoline-only fuel policies or specialized operational requirements.

Alternative Fuels represent the emerging segment, driven by environmental regulations and sustainability initiatives. This category includes electric, CNG, and hydrogen-powered vehicles, though adoption remains limited due to infrastructure and range considerations.

Material Analysis

Steel leads with 48.2% due to exceptional durability and proven reliability in demanding applications.

In 2024, Steel held a dominant market position in the By Material Analysis segment of Water Tanker Truck Market, with a 48.2% share. Steel’s dominance reflects its superior structural properties and long-established track record in heavy-duty applications.

Steel tankers offer unmatched durability and resistance to impact damage, crucial factors in demanding operational environments. The material’s strength allows for thinner wall construction while maintaining structural integrity, optimizing payload capacity. Steel’s weldability facilitates easy repairs and modifications, reducing lifecycle maintenance costs.

Aluminum tankers provide weight advantages that translate to increased payload capacity and improved fuel efficiency. These benefits make aluminum particularly attractive for long-distance transportation operations where weight regulations are critical factors.

Polyethylene tankers offer corrosion resistance and chemical compatibility advantages. These lightweight alternatives are particularly suitable for potable water applications where material purity is essential.

Fiberglass tankers combine corrosion resistance with moderate weight characteristics. These specialized units serve applications requiring specific chemical resistance properties while maintaining reasonable structural strength for commercial operations.

End Use Analysis

Government dominates with 28.8% due to its extensive infrastructure development projects and public utility services.

In 2024, Government held a dominant market position in By End Use Analysis segment of Water Tanker Truck Market, with a 28.8% share. This significant market presence stems from the government’s crucial role in maintaining public water supply systems, emergency response operations, and large-scale infrastructure projects across urban and rural areas.

The Industrial segment represents a substantial portion of the market demand, driven by manufacturing facilities, construction sites, and mining operations that require consistent water supply for their operational processes. These sectors rely heavily on water tanker trucks for dust suppression, equipment cleaning, and process water requirements.

Commercial applications form another important segment, encompassing hospitality businesses, educational institutions, healthcare facilities, and retail establishments. These entities often utilize water tanker services during peak demand periods or when municipal water supply faces temporary disruptions.

The Agriculture sector, while representing a smaller but vital segment, depends on water tanker trucks for irrigation support, livestock watering, and crop protection activities. This segment particularly benefits from mobile water delivery solutions in regions with limited water infrastructure or during drought conditions.

Key Market Segments

By Product

- Rigid Tanker Trucks

- Articulated Tanker Trucks

- Trailer Tanker Trucks

By Capacity

- Below 5,000 Gallons

- 5,001 – 10,000 Gallons

- 10,000 – 15,000 Gallons

- Above 15,000 Gallons

By Fuel Type

- Diesel

- Gasoline

- Alternative Fuels

By Material

- Steel

- Aluminum

- Polyethylene

- Fiberglass

By End Use

- Government

- Industrial

- Commercial

- Agriculture

Drivers

Increasing Demand for Clean Water Supply Drives Market Growth

The water tanker truck market is experiencing strong growth due to rising demand for clean water across different sectors. Cities around the world are expanding rapidly, creating more people who need reliable water supply systems. This urbanization puts pressure on existing water infrastructure, making water tankers essential for delivering clean water to areas where pipelines cannot reach.

Government agencies are investing heavily in water distribution systems to meet growing population needs. These investments include purchasing new water tanker fleets and upgrading existing ones. The focus on improving public health through better water access drives consistent demand for these vehicles.

Industrial sectors also contribute to market growth by requiring bulk water transportation for manufacturing processes, construction sites, and mining operations. Companies need large quantities of water for cooling systems, cleaning operations, and production activities. This industrial demand creates a steady revenue stream for water tanker operators and manufacturers, supporting overall market expansion in both urban and rural areas.

Restraints

Stringent Regulatory and Environmental Standards Create Market Challenges

The water tanker truck market faces significant challenges from strict government regulations and environmental standards. Companies must comply with water quality regulations, vehicle emission standards, and safety requirements. These rules increase operational costs and require regular inspections, certifications, and equipment upgrades that strain business budgets.

Finding skilled drivers and operators for water tankers remains a persistent problem. The specialized nature of water transportation requires trained personnel who understand safety protocols, equipment maintenance, and proper handling procedures. The shortage of qualified workers leads to higher labor costs and operational delays.

Fuel price fluctuations create unpredictable operational expenses for water tanker businesses. When fuel costs rise, companies face reduced profit margins and must either absorb higher costs or pass them to customers. This volatility makes financial planning difficult and can impact service pricing, potentially affecting demand for water tanker services in price-sensitive markets.

Growth Factors

Adoption of Smart Technology and IoT Creates New Growth Opportunities

Smart technology integration presents exciting growth opportunities in the water tanker truck market. GPS tracking systems, IoT sensors, and automated monitoring help companies optimize routes, track water quality, and improve delivery efficiency. These technologies reduce operational costs while enhancing customer service through real-time tracking and better scheduling.

Emerging markets in developing countries offer substantial growth potential as populations grow and infrastructure develops. These regions need reliable water distribution systems, creating demand for new water tanker fleets. Companies expanding into these markets can establish strong positions before competition intensifies.

Electric and hybrid water tanker models represent a growing opportunity as environmental concerns increase. These eco-friendly vehicles help companies meet sustainability goals while reducing fuel costs over time. Additionally, modular and customizable tanker designs allow businesses to adapt their fleets for specific customer needs, from small residential deliveries to large industrial applications, opening new market segments.

Emerging Trends

Shift Towards Automated and GPS-enabled Water Tankers Shapes Market Trends

The water tanker truck market is trending toward automated systems and GPS-enabled vehicles that improve operational efficiency. Modern tankers feature automated filling and dispensing systems that reduce labor requirements and minimize human error. GPS technology helps operators optimize delivery routes, track vehicle locations, and provide customers with accurate delivery times.

Water conservation has become a major focus, driving demand for more efficient distribution systems. Companies are investing in tankers with better sealing systems, precise measurement tools, and reduced spillage technology. These improvements help conserve precious water resources while reducing waste and operational costs.

Environmental concerns are pushing the industry toward eco-friendly transportation solutions. Solar-powered pumping systems, bio-degradable cleaning products, and emission-reducing technologies are becoming standard features. Innovation in tanker designs focuses on enhanced storage capacity, better insulation for temperature control, and improved delivery mechanisms that ensure water quality maintenance during transportation, meeting evolving customer expectations and regulatory requirements.

Regional Analysis

North America Dominates the Water Tanker Truck Market with a Market Share of 43.8%, Valued at USD 11.2 Billion

North America holds the largest share of the water tanker truck market, accounting for 43.8% of the global market, valued at USD 11.2 Billion. The region’s dominance is driven by the high demand for efficient water distribution systems and urban infrastructure development. Additionally, government investments in water distribution infrastructure and increasing industrial applications are contributing to sustained market growth.

Asia Pacific Water Tanker Truck Market Trends

Asia Pacific is expected to witness significant growth in the water tanker truck market, supported by rapid urbanization and infrastructure development. The region’s expanding industrial sector, particularly in countries like India and China, is driving demand for bulk water transportation solutions. Additionally, government investments in water supply systems and industrial growth are anticipated to continue fueling market expansion.

Europe Water Tanker Truck Market Analysis

Europe’s water tanker truck market is expected to grow steadily, with a focus on sustainable water transportation solutions due to stringent environmental regulations. The region benefits from strong government support and investment in advanced infrastructure projects aimed at enhancing water distribution. Additionally, the rising demand for water in agriculture and industrial applications is contributing to the market’s growth.

Middle East and Africa Water Tanker Truck Market Overview

The Middle East and Africa region is experiencing growth in the water tanker truck market due to the need for efficient water supply systems in water-scarce areas. Significant investments from governments and private entities in water infrastructure projects are driving demand for water tanker trucks. Rising industrialization and urban development are also contributing to market growth in this region.

Latin America Water Tanker Truck Market Insights

Latin America is projected to see moderate growth in the water tanker truck market, supported by the need for reliable water transportation solutions in both urban and rural areas. The region’s increasing agricultural demand and industrial expansion are key drivers of market growth. However, the market is still limited by budget constraints and infrastructure challenges in certain countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Water Tanker Truck Company Insights

In 2024, Scania AB achieved a significant milestone by surpassing 100,000 vehicle deliveries, marking a 6% increase in sales compared to the previous year. This growth was particularly driven by strong demand in South America. Scania’s commitment to innovation is evident in its investment in electric vehicle development and the establishment of a new industrial hub in China, positioning the company for future market leadership.

Volvo Trucks maintained its position as Europe’s leading heavy truck manufacturer, capturing a 17.9% market share in 2024. Despite a slight decline in overall demand, Volvo’s focus on fuel efficiency, safety, and uptime continues to resonate with customers. The company’s strategic emphasis on zero-emission vehicles and sustainable transport solutions underscores its commitment to environmental responsibility.

Mercedes-Benz Trucks (Daimler Truck) experienced a 12% decrease in unit sales in 2024, primarily due to weaker demand in European and Asian markets. However, the company saw a 17% increase in battery-electric vehicle sales, indicating a positive shift towards sustainable transportation solutions. Daimler’s ongoing efforts to enhance operational efficiency and reduce costs reflect its adaptability in a challenging market environment.

MAN Truck & Bus faced a challenging year in 2024, with an 18% decline in unit sales attributed to a weak European market, regulatory challenges, and a mid-year model change. Despite these obstacles, MAN’s strategic focus on zero-emission vehicles and cost-cutting measures demonstrate its resilience and commitment to long-term sustainability.

Top Key Players in the Market

- Scania AB

- Volvo Trucks

- Mercedes-Benz Trucks (Daimler Truck)

- MAN Truck & Bus

- Hyundai Motor Company

- Iveco

- Dongfeng Motor Corporation

- Tata Motors Limited

- The Knapheide Manufacturing Company

- Warren Transport, Inc.

Recent Developments

- In Mar 2025, Caterpillar unveils the new Cat 789D autonomous water truck, marking a significant advancement in automation for mining and construction industries. The truck features cutting-edge technology for improved safety, efficiency, and reduced operational costs.

- In Aug 2025, NWC acquires trucks designed to clear and maintain sewer lines, enhancing its capabilities in waste management and urban infrastructure services. The acquisition supports the expansion of its service fleet to meet growing demand for efficient sewer maintenance.

- In Oct 2024, Re:Group announces its acquisition of the world-first autonomous Scania fleet and electric water truck for the Butcherbird Mine expansion. This move aligns with the company’s commitment to sustainability and automation in mining operations.

Report Scope

Report Features Description Market Value (2024) USD 25.7 Billion Forecast Revenue (2034) USD 40.7 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Rigid Tanker Trucks, Articulated Tanker Trucks, Trailer Tanker Trucks), By Capacity (Below 5,000 Gallons, 5,001 – 10,000 Gallons, 10,000 – 15,000 Gallons, Above 15,000 Gallons), By Fuel Type (Diesel, Gasoline, Alternative Fuels), By Material (Steel, Aluminum, Polyethylene, Fiberglass), By End Use (Government, Industrial, Commercial, Agriculture) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Scania AB, Volvo Trucks, Mercedes-Benz Trucks (Daimler Truck), MAN Truck & Bus, Hyundai Motor Company, Iveco, Dongfeng Motor Corporation, Tata Motors Limited, The Knapheide Manufacturing Company, Warren Transport, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Scania AB

- Volvo Trucks

- Mercedes-Benz Trucks (Daimler Truck)

- MAN Truck & Bus

- Hyundai Motor Company

- Iveco

- Dongfeng Motor Corporation

- Tata Motors Limited

- The Knapheide Manufacturing Company

- Warren Transport, Inc.