Global Water and Wastewater Treatment Equipment Market Size, Share and Industry Analysis Report By Equipment (Membrane Separation, Biological, Disinfection, Sludge Treatment, Other Equipment), By Type(Filtration, Disinfection, Adsorption, Desalination, Testing, Others), Based on Process(Primary, Secondary, Tertiary), Based on Application(Municipal, Industrial, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 100178

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

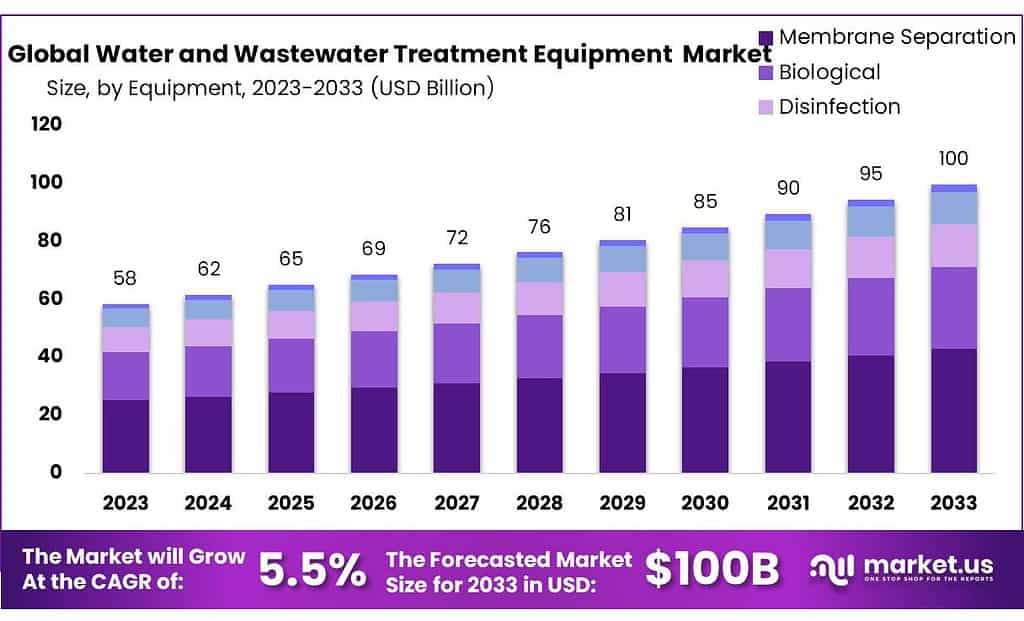

Water and Wastewater Treatment Equipment Market size is expected to be worth around USD 100 Billion by 2033 from USD 58 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2023 to 2033.

Wastewater Treatment Equipment encompasses a range of tools and technologies designed to clean wastewater, making it safe for environmental discharge or reuse. This equipment is essential for removing harmful substances, pollutants, and contaminants from water generated by households, industries, and businesses. The treatment process usually involves multiple stages, employing physical, chemical, and biological methods to ensure effective water purification.

Government regulations play a pivotal role in driving the growth of the water and wastewater treatment equipment market. For example, the U.S. Environmental Protection Agency (EPA) enforces stringent water quality standards through initiatives like the Clean Water State Revolving Fund (CWSRF), which allocated $1.1 billion in 2022 for wastewater treatment projects.

Similarly, the EU Water Framework Directive (WFD) mandates that member states achieve good water quality by 2027, which is driving significant investment in water treatment infrastructure across Europe.

In India, the National Mission for Clean Ganga (NMCG), initiated in 2014, is dedicated to cleaning the Ganges River and managing wastewater nationwide. The Indian government allocated $1.5 billion for water and wastewater treatment projects under this mission between 2020-2025.

Additionally, India’s Jal Jeevan Mission aims to provide universal access to clean drinking water by 2024, which will substantially increase demand for water treatment equipment in both urban and rural areas.

Trade in water treatment equipment is influenced by the global demand for advanced technologies. In 2021, global exports of water and wastewater treatment equipment were valued at around $12.5 billion (UN Comtrade).

The U.S. and Germany are the leading exporters, while regions like Asia-Pacific and Africa are emerging as key import markets, particularly for technologies like membrane filtration and advanced wastewater treatment systems.

Key Takeaways

- Water and Wastewater Treatment Equipment Market set to reach USD 100 billion by 2033, with a 5.5% CAGR from 2023.

- Membrane Separation technology captured 43.2% market share in 2023, vital for water purification.

- Filtration and Adsorption Importance Captured 34.3% market share removes impurities, while adsorption tackles organic compounds and heavy metals.

- Primary Treatment Dominance Captured 49.3% market share in 2023, essential for removing solids and organic matter from wastewater.

- Municipal Application Dominance Captured 69.3% market share in 2023, crucial for ensuring public health and environmental protection.

- Asia Pacific Market Leadership Held a commanding 38.4% market share, driven by industrial activities and urbanization.

Equipment Analysis

In 2023, Membrane Separation held a dominant market position, capturing more than a 43.2% share. This technology, pivotal for separating harmful particles from water, has seen widespread adoption due to its efficiency and effectiveness. Its application ranges from industrial wastewater treatment to potable water purification, making it indispensable in today’s water treatment processes. The demand for membrane separation technology is expected to grow, driven by increasing environmental regulations and the need for high-quality water.

Following Membrane Separation, Biological Treatment methods emerged as the second-largest segment. These processes, leveraging natural organisms to break down pollutants, accounted for a significant portion of the market. The appeal of biological treatments lies in their sustainability and minimal chemical use, aligning with global trends towards eco-friendly practices. Their application in municipal and industrial wastewater treatment underscores their versatility and growing importance.

Disinfection technologies also played a crucial role in the market. This segment, essential for eliminating pathogens from water, ensures public health and safety. The adoption of disinfection methods, including UV radiation, chlorination, and ozonation, is critical in both drinking water and wastewater treatment facilities. With ongoing advancements, these technologies continue to evolve, offering more efficient and environmentally friendly solutions.

Sludge Treatment technologies, addressing the byproducts of water treatment, held a vital position in the market. The management of sludge is a critical challenge, with technologies focusing on volume reduction, stabilization, and resource recovery. Innovations in this segment not only aim to reduce environmental impact but also explore ways to convert waste into energy or useful materials, highlighting a shift towards circular economy principles.

By Type

In 2023, Filtration held a dominant market position, capturing more than a 34.3% share. This segment, crucial for removing impurities from water, utilizes a variety of methods such as sand filters, activated carbon, and membrane technologies. The widespread adoption of filtration techniques can be attributed to their versatility in treating both drinking water and wastewater, making them fundamental to ensuring clean water supply and environmental protection.

Disinfection followed as a key segment, vital for ensuring water safety by eliminating harmful pathogens. Technologies such as chlorination, ultraviolet (UV) light, and ozonation have been extensively employed. The importance of this segment is underscored by its role in preventing waterborne diseases, catering to both municipal water supplies and industrial applications. The continuous development of disinfection methods aims to improve efficiency while reducing chemical use and by-products.

Adsorption emerged as another significant technology within the market. This process, involving the removal of pollutants through chemical or physical attraction to solid surfaces, is especially effective for tackling organic compounds and heavy metals. The use of activated carbon is prevalent in this segment, favored for its effectiveness in purifying drinking water and treating industrial effluents. The adaptability and efficiency of adsorption technologies support their ongoing relevance in water treatment.

Desalination represented a critical solution for addressing global water scarcity by converting seawater into fresh water. Through methods such as reverse osmosis and distillation, desalination has become indispensable in regions lacking sufficient freshwater resources. The segment’s growth is propelled by technological advancements aimed at reducing energy consumption and environmental impact, marking it as a key area for future investment.

Testing equipment, essential for monitoring water quality and compliance with health standards, played a pivotal role. This segment encompasses a range of analytical tools and kits designed for detecting contaminants, pathogens, and chemical properties. The demand for accurate, rapid testing methods is driven by increasing regulatory requirements and public health concerns, highlighting the segment’s importance in the overall market.

Process Analysis

In 2023, Primary treatment held a dominant market position, capturing more than a 49.3% share. This initial phase, focusing on removing solids and organic matter from wastewater through sedimentation and flotation, is fundamental to the water treatment process. Its large market share reflects the essential nature of this step in preparing water for further purification.

As environmental regulations tighten and the volume of wastewater increases, the demand for efficient primary treatment solutions continues to grow. This segment’s importance is amplified by its role in reducing the load on subsequent treatment stages, thereby enhancing overall system efficiency.

Secondary treatment, which employs biological processes to further reduce organic matter and pollutants, is another critical component of the water treatment process. This stage involves the use of microorganisms to break down organic substances, making it essential for achieving the levels of water purity required by regulatory standards.

The significance of secondary treatment lies in its ability to significantly improve water quality before it undergoes any final purification steps or is released back into the environment. Investments in this segment are driven by the need for technologies that can effectively balance performance, cost, and environmental impact.

Tertiary treatment, although capturing a smaller share of the market, plays a pivotal role in water purification, especially in contexts requiring high-quality effluent. This advanced treatment process includes filtration, disinfection, and removal of specific contaminants like nutrients. The growing importance of tertiary treatment is attributed to increasing demands for water recycling and reuse, as well as stricter environmental regulations.

Technologies within this segment are focused on achieving the highest levels of water quality, making them essential for applications such as industrial reuse, irrigation, and replenishing water bodies. The investment in tertiary treatment technologies underscores the commitment to sustainable water management and the protection of water resources for future generations.

Application Analysis

In 2023, Municipal applications held a dominant market position, capturing more than a 69.3% share. This sector, encompassing water treatment facilities serving cities and communities, is crucial for ensuring public health and environmental protection.

The high share reflects the extensive infrastructure required to supply clean water and treat wastewater in urban areas. Investments in upgrading and expanding municipal treatment systems are driven by growing populations, regulatory pressures, and the need to replace aging infrastructure. The focus within this segment is on technologies that can efficiently manage large volumes of water while meeting stringent quality standards.

The Industrial segment, while smaller, remains significant, addressing the specific needs of various sectors such as manufacturing, pharmaceuticals, power generation, and more. Industrial applications are characterized by their requirement for specialized treatment solutions to deal with a wide range of pollutants, including heavy metals, chemicals, and organic waste.

The importance of this segment is underscored by the dual need to ensure regulatory compliance and minimize environmental impact. Investments in water and wastewater treatment in the industrial sector are motivated by factors such as operational efficiency, resource recovery, and sustainable practices. The adoption of advanced treatment technologies in this segment is critical for industries aiming to reuse water and reduce discharge volumes, aligning with global sustainability goals.

Key Market Segments

Based on Equipment

- Membrane Separation

- Biological

- Disinfection

- Sludge Treatment

- Other Equipment

By Type

- Filtration

- Disinfection

- Adsorption

- Desalination

- Testing

- Others

Based on Process

- Primary

- Secondary

- Tertiary

Based on Application

- Municipal

- Industrial

- Other Applications

Driving Factors

Growing Demand for Clean Water and Wastewater Treatment

In 2022, the global population reached approximately 8 billion, according to the United Nations, with over 50% of people now living in urban areas. This rapid urbanization has led to an increased demand for clean water for drinking, sanitation, and industrial use. As a result, municipalities and industries are investing heavily in water treatment technologies.

The World Health Organization (WHO) estimates that nearly 2 billion people globally lack access to safe drinking water, further highlighting the need for improved water treatment solutions. Governments are responding with a mix of regulatory frameworks and funding, aiming to address these pressing challenges.

For example, the U.S. Environmental Protection Agency (EPA) allocated $1.1 billion through the Clean Water State Revolving Fund (CWSRF) in 2022 to support wastewater treatment projects. These funds help municipalities implement advanced treatment systems to reduce contaminants and improve water quality.

Similarly, the European Union has introduced regulations under the Water Framework Directive (WFD) to ensure that all European waters meet specific quality standards by 2027. This regulatory push is not only encouraging investment in water infrastructure but also accelerating the adoption of innovative water treatment technologies.

Impact of Government Initiatives and Investments

Government initiatives and funding play a significant role in driving the growth of the water and wastewater treatment equipment market. In many countries, governments are stepping up their investments in water infrastructure to meet the demands of population growth, industrialization, and climate change. These efforts are backed by regulations that push industries and municipalities to adopt better water management and treatment practices.

In India, the National Mission for Clean Ganga (NMCG), launched in 2014, is one of the largest initiatives aimed at improving water quality. With an investment of $1.5 billion allocated for water and wastewater treatment projects between 2020-2025, India is making substantial strides in cleaning and managing its water resources.

The European Union has also implemented substantial regulations that require member countries to adopt sustainable water treatment practices. For instance, under the EU Water Framework Directive (WFD), the EU aims to ensure that all water bodies achieve good status by 2027.

This directive has prompted EU governments to invest heavily in wastewater treatment plants, desalination technologies, and other advanced water treatment solutions. The regulatory landscape across these regions, combined with increasing public and private investments, is driving the demand for advanced water treatment equipment.

Technological Innovation and Advancements in Filtration

Technological innovation is another key factor propelling the market for water and wastewater treatment equipment. Advanced technologies like membrane filtration, reverse osmosis, and biological treatment processes are increasingly being deployed to meet the stringent water quality standards set by governments and environmental agencies. The demand for these innovative solutions is growing rapidly as industries and municipalities seek more efficient, cost-effective, and sustainable ways to treat water.

For instance, in 2021, Veolia North America and SUEZ introduced new membrane filtration technologies to improve water treatment efficiency. These advancements allow for higher water recovery rates, lower energy consumption, and reduced operational costs. The global membrane filtration market is expected to grow by 6.5% annually from 2021 to 2026, according to various industry reports, highlighting the increasing adoption of such technologies.

Furthermore, reverse osmosis (RO) systems are becoming a go-to solution for desalinating seawater in regions facing freshwater shortages. Countries like Saudi Arabia, UAE, and Israel are leading the way in adopting advanced desalination technologies.

Restraining Factors

High Capital and Operational Costs

One of the major restraining factors for the water and wastewater treatment equipment market is the high capital and operational costs associated with installing and maintaining advanced water treatment technologies. Although there is significant demand for clean water solutions globally, the high upfront and ongoing expenses involved in implementing effective water and wastewater treatment systems create a barrier for many municipalities and industries, particularly in developing regions.

Capital Investment and Installation Costs

The initial capital investment required for water treatment facilities is substantial. For instance, building a large-scale municipal wastewater treatment plant can cost anywhere from $50 million to $500 million, depending on the size, location, and technology used. This cost includes infrastructure development, purchase of equipment, and the installation of systems like membrane filtration technologies and reverse osmosis plants.

In addition to the construction costs, there are expenses related to land acquisition, permits, and labor, all of which add to the financial burden. Many developing countries or smaller cities struggle with these upfront costs, which is why some governments rely on funding from international organizations or public-private partnerships (PPPs) to implement water treatment projects.

Ongoing Operational and Maintenance Costs

Beyond the initial setup, the ongoing operational and maintenance (O&M) costs for water and wastewater treatment systems are also significant. According to the U.S. Environmental Protection Agency (EPA), the average annual operating cost for a typical municipal wastewater treatment plant in the U.S. is between $500,000 and $2 million depending on its size and complexity. These costs include electricity, labor, chemicals for water treatment, and equipment maintenance. As water treatment facilities grow in scale and complexity, operational costs can increase significantly.

For example, advanced technologies such as membrane filtration or reverse osmosis systems require specialized personnel for operation and frequent replacement of membranes, which can add an estimated $1 million per year in additional maintenance costs for larger plants.

Limited Funding and Budget Constraints

Governments and private organizations are often constrained by budget limitations when allocating funds for water treatment infrastructure. While global water treatment projects are important for public health, they are often competing for funding against other critical sectors, such as education, healthcare, and transportation.

This financial constraint is more pronounced in developing countries, where annual budgets for infrastructure development can be as low as 2-3% of GDP, leaving little room for large-scale water treatment projects.

Growth Opportunity

Expansion of Industrial Water Treatment Demand

A significant growth opportunity for the water and wastewater treatment equipment market is the rising demand for water treatment solutions across industrial sectors. Industries like food and beverage, pharmaceuticals, oil and gas, and textiles require advanced water treatment technologies to meet environmental regulations, reduce water consumption, and ensure the sustainability of their operations. This increasing demand for water treatment solutions in industrial applications is expected to drive market growth in the coming years.

Industrial Water Treatment Needs

Industries like food and beverage generate large volumes of wastewater during production processes, making them major consumers of water treatment equipment. For example, in the food processing sector, water is used in cleaning, cooking, and product formulation.

According to the Food and Agriculture Organization (FAO), the food industry accounts for about 22% of global industrial water use. These industries are under increasing pressure to adopt water recycling and treatment technologies that minimize waste and reduce costs. As a result, companies are investing in advanced treatment solutions such as membrane filtration, reverse osmosis systems, and electrocoagulation technologies to recycle water and reduce their environmental footprint.

Government Regulations and Investment

Governments around the world are tightening regulations on industrial wastewater treatment, creating a strong growth opportunity for water treatment companies. For instance, in India, the Central Pollution Control Board (CPCB) has been imposing stricter standards for industrial wastewater discharge, especially for industries like textiles and chemicals.

The Indian government’s focus on improving water management in industries is supported by initiatives such as the National Clean Energy Fund and the Atal Mission for Rejuvenation and Urban Transformation (AMRUT), which aim to upgrade water infrastructure across various sectors. The Jal Jeevan Mission launched by the Indian government to provide clean drinking water to rural areas is also indirectly boosting the demand for wastewater treatment technologies in industrial facilities.

Similarly, in the U.S., the Clean Water State Revolving Fund (CWSRF) allocated approximately $1.1 billion in 2022 to support wastewater treatment projects, many of which involved industrial applications. The growing investment in water treatment technologies and regulatory pressure to comply with environmental standards is expected to continue pushing industrial demand for advanced water treatment equipment.

Technological Advancements and Water Recycling

Another growth opportunity is the increasing adoption of water recycling and reuse technologies within industrial settings. As industries strive to reduce their environmental footprint and lower operational costs, water recycling systems are becoming more common.

Technologies such as membrane bioreactors, reverse osmosis, and ultrafiltration systems are being increasingly deployed across industries. The food and beverage sector alone has been identified as a major adopter of water recycling technologies, with companies such as Nestlé and Coca-Cola investing in systems to treat and reuse water in their production processes.

Latest Trends

Adoption of Membrane Filtration Technologies

One of the latest trends in the water and wastewater treatment equipment market is the growing adoption of membrane filtration technologies. These technologies are increasingly being used in both municipal and industrial sectors due to their effectiveness in treating contaminated water, improving water quality, and enabling water reuse.

Membrane technologies such as reverse osmosis (RO), ultrafiltration (UF), and microfiltration (MF) are gaining traction because they offer efficient removal of dissolved solids, bacteria, viruses, and other contaminants without the need for chemicals. This trend is being driven by the need for higher water quality standards and the growing demand for water recycling and reuse.

Industrial Demand for Membrane Filtration

Industries like food and beverage and pharmaceuticals are major adopters of membrane filtration technologies. For example, the food and beverage industry, which is one of the largest consumers of water, uses membrane filtration for processes such as product purification, wastewater treatment, and water recovery.

According to the Food and Agriculture Organization (FAO), the food sector accounts for about 22% of total industrial water usage globally. With increasing environmental regulations and the need for sustainability, more companies in this sector are turning to membrane filtration systems for more efficient wastewater treatment and water recovery.

The pharmaceutical industry also plays a significant role in driving this trend. The pharmaceutical sector generates wastewater containing chemicals, hormones, and other harmful substances that must be treated to meet regulatory standards. The adoption of membrane technologies allows companies to effectively treat and recover water from such wastewater, ensuring compliance with environmental standards.

According to the U.S. Environmental Protection Agency (EPA), membrane filtration systems are increasingly being used to remove contaminants from pharmaceutical wastewater, with some companies reporting up to 90% reduction in water discharge.

Government Regulations and Support

Government regulations are also contributing to the rise of membrane filtration technologies. Governments worldwide are setting stricter water quality standards and promoting water reuse to address the growing demand for clean water.

For instance, the European Union’s Water Framework Directive (WFD) requires member states to improve water quality and achieve good water status by 2027, pushing for more efficient water treatment technologies like membranes. In the U.S., the EPA has recognized membrane filtration as a critical technology for treating drinking water and wastewater, particularly in areas with water scarcity.

Regional Analysis

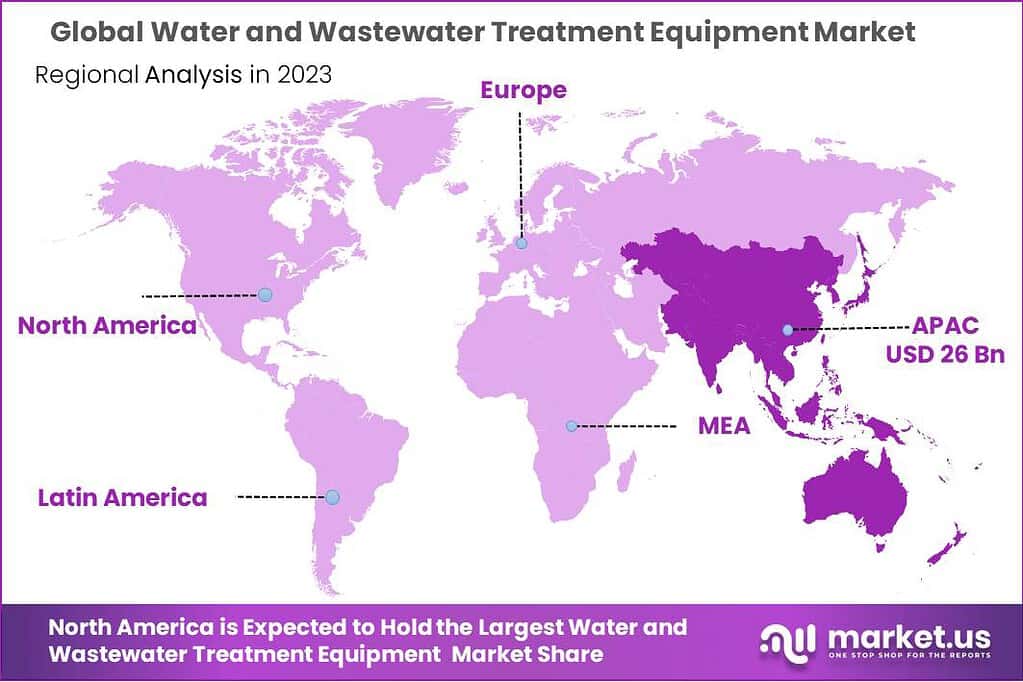

The Asia Pacific region stands as a dominant force in the global water and wastewater treatment equipment market, holding a commanding market share of 38.4%. This notable growth is attributed to the escalating demand for advanced water treatment solutions across various sectors, including municipal and industrial applications. The surge in industrial activities and urbanization, particularly in countries such as China, India, Japan, South Korea, Australia, and New Zealand, significantly contributes to the region’s market expansion.

In North America, the water and wastewater treatment equipment market is witnessing substantial growth, spurred by economic advancements and an increasing need for sustainable water management solutions. The consumer shift towards environmentally friendly practices, especially in the United States and Canada, plays a crucial role in propelling the market forward.

Europe is experiencing a robust growth phase in the water and wastewater treatment equipment market, driven by the growing demand for efficient water treatment technologies across various sectors, including municipal services and industrial processes. The region’s commitment to enhancing water quality and promoting sustainable water use practices positions Europe as a pivotal player in the global market landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Manufacturers of water and wastewater treatment equipment use several different approaches, such as mergers, acquisitions, joint ventures, new product developments, and geographic expansions, to increase their market penetration and meet the shifting technological demand for equipment from a range of applications.

Top Key Players

- Ecolab Inc.

- Aquatech International LLC

- Calgon Carbon Corporation

- DuPont

- Ecologix Environmental Systems, LLC

- Evonik Industries AG

- Evoqua Water Technologies LLC

- General Electric

- Koch Membrane Systems, Inc

- Lenntech B.V.

- Ovivo

- Parkson Corporation

- Pentair plc

- Samco Technologies, Inc.

- Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION)

- Veolia Group

- Xylem, Inc.

Recent Developments

- In January 2023, Veolia Water Technologies launched a new range of MBRs that are designed to be more energy-efficient and have a smaller footprint.

- In February 2023, Evoqua Water Technologies announced the development of a new AOP technology that is capable of removing a wide range of contaminants from wastewater, including PFAS chemicals.

- In March 2023, Xylem Inc. launched a new digital water management platform that uses AI and ML to help utilities optimize their water and wastewater treatment operations.

Report Scope

Report Features Description Market Value (2023) USD 58 Bn Forecast Revenue (2033) USD 100 Bn CAGR (2023-2033) 5.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Equipment(Membrane Separation, Biological, Disinfection, Sludge Treatment, Other Equipment), By Type(Filtration, Disinfection, Adsorption, Desalination, Testing, Others), Based on Process(Primary, Secondary, Tertiary), Based on Application(Municipal, Industrial, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ecolab Inc., Aquatech International LLC, Calgon Carbon Corporation, DuPont, Ecologix Environmental Systems, LLC, Evonik Industries AG, Evoqua Water Technologies LLC, General Electric, Koch Membrane Systems, Inc, Lenntech B.V., Ovivo, Parkson Corporation, Pentair plc, Samco Technologies, Inc., Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION), Veolia Group, Xylem, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water and Wastewater Treatment Equipment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Water and Wastewater Treatment Equipment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Ecolab Inc.

- Aquatech International LLC

- Calgon Carbon Corporation

- DuPont

- Ecologix Environmental Systems, LLC

- Evonik Industries AG

- Evoqua Water Technologies LLC

- General Electric

- Koch Membrane Systems, Inc

- Lenntech B.V.

- Ovivo

- Parkson Corporation

- Pentair plc

- Samco Technologies, Inc.

- Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION)

- Veolia Group

- Xylem, Inc.