Global Volute Pump Market Report By Pump Type (Single-Stage Volute Pumps, Multi-Stage Volute Pumps), By Discharge Direction (Horizontal Volute Pumps, Vertical Volute Pumps), By Application (Water and Wastewater, Chemical Processing, Oil and Gas, Power Generation, Agriculture, Industrial Manufacturing, Others), By Flow Rate (Low, Medium, High), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132084

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

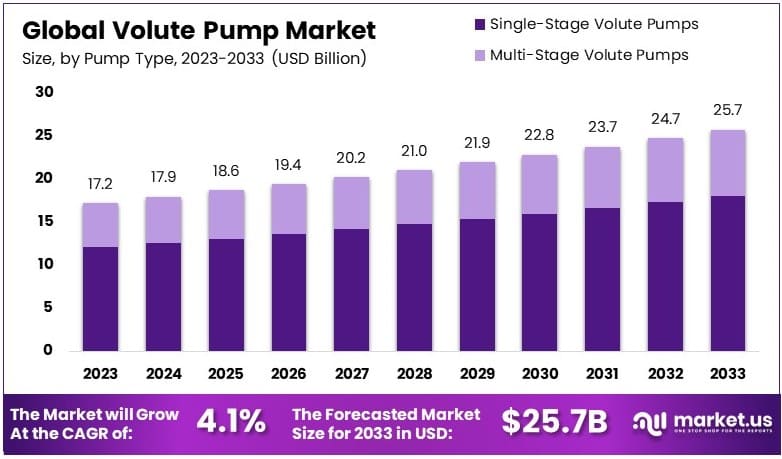

The Global Volute Pump Market size is expected to be worth around USD 25.7 Billion by 2033, from USD 17.2 Billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2024 to 2033.

A volute pump is a type of centrifugal pump with a spiral-shaped casing called a volute. It converts the kinetic energy of fluid into pressure energy, enabling efficient fluid transfer. These pumps are widely used in water supply, sewage treatment, and industrial processes for handling liquids.

The volute pump market involves the manufacturing and distribution of pumps with a spiral casing for fluid movement. It serves industries like water management, agriculture, and manufacturing. The market offers different sizes and capacities of pumps, designed to meet various fluid handling requirements across sectors.

Volute pumps are widely used in industries like water and wastewater treatment equipment, power generation, and agriculture due to their efficient handling of high flow rates and varying fluid conditions. It is driven by rising demand for water management solutions, energy production, and industrial processes.

The global need for effective wastewater treatment is a significant driver. As of 2022, about 48% of global wastewater is released untreated into the environment, highlighting a clear demand for better water treatment infrastructure.

Developed countries treat approximately 70% of wastewater, while treatment rates drop to 38% in upper-middle-income and 28% in lower-middle-income nations, according to UN Water. This disparity indicates growth opportunities, especially in emerging markets aiming to improve their water management systems.

The volute pump market is driven by increasing industrialization, the global push for improved water treatment, and growing energy needs. In 2023, global electricity generation reached nearly 29,478.97 TWh, creating demand for reliable and intelligent pump solutions in power plants.

As countries expand infrastructure to manage water resources more effectively, volute pumps are expected to play a vital role, especially in regions with underdeveloped wastewater systems.

Government investments in water management and clean energy are positively influencing the volute pump market. Policies promoting wastewater treatment and sustainable energy infrastructure drive demand for high-performance pumps.

For instance, low-income countries, where only 8% of wastewater undergoes treatment, present significant opportunities for growth as governments focus on improving sanitation and infrastructure.

Market competitiveness is high, with major players like Grundfos, KSB, and Flowserve maintaining strong positions through innovation and product efficiency. However, the market shows moderate saturation in developed regions, while untapped growth potential exists in Asia-Pacific and Africa, where water treatment and energy projects are expanding.

Key Takeaways

- The Volute Pump Market was valued at USD 17.2 billion in 2023 and is projected to reach USD 25.7 billion by 2033, with a CAGR of 4.1%.

- In 2023, Single-Stage Volute Pumps led the pump type segment, driven by widespread use in water and wastewater treatment.

- In 2023, Horizontal Volute Pumps dominated the discharge direction segment, favored for their stability and efficiency.

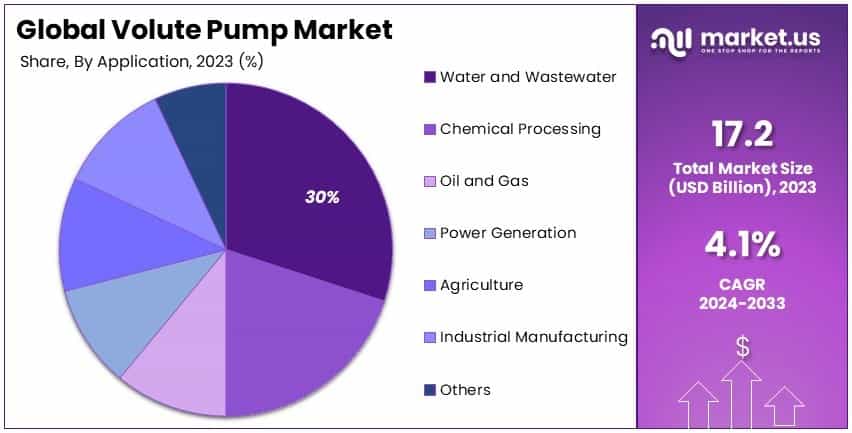

- In 2023, Water and Wastewater Treatment was the leading application, driven by infrastructure development.

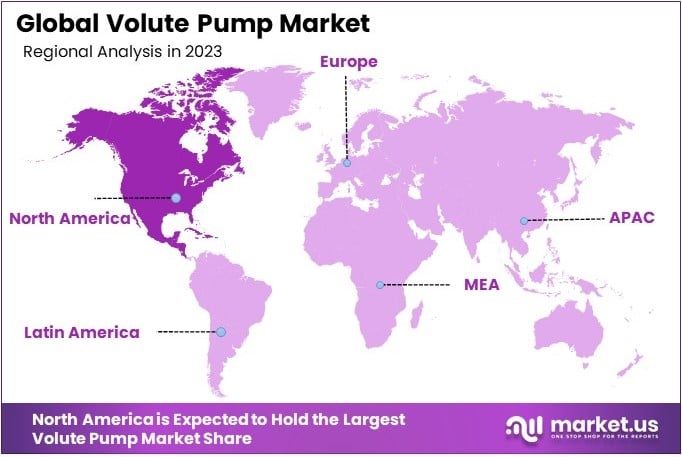

- In 2023, North America remained dominant, supported by strong demand in industrial and municipal water treatment.

Pump Type Analysis

Single-Stage Volute Pumps dominate due to their simplicity, reliability, and cost-effectiveness.

The “Pump Type” segment of the Volute Pump Market includes Single-Stage and Multi-Stage Volute Pumps. Single-Stage Volute Pumps lead the market due to their common use in applications needing moderate pressure, such as water circulation and heating systems.

These pumps are popular because of their simple design, which makes them easier to maintain and lowers operating costs. This simplicity makes them a preferred choice for many industries.

Single-Stage Volute Pumps work well in situations where a steady flow rate is needed. They are less complex than Multi-Stage Pumps, which are used when higher pressure is required, such as in boiler feed water applications. Although Multi-Stage Pumps are important for high-pressure tasks, they are more costly and complex, so they are used mainly in specialized applications.

Discharge Direction Analysis

Horizontal Volute Pumps dominate due to their ease of installation and maintenance.

In the “Discharge Direction” segment, volute pumps are divided into Horizontal and Vertical types. Horizontal Volute Pumps are more popular since they are easier to set up and require less maintenance.

Many facilities prefer horizontal pumps because they take up less vertical space and offer easier access for maintenance, without needing to remove overhead structures. Horizontal pumps are widely used in various applications, such as water treatment, where space is generally available.

On the other hand, Vertical Volute Pumps are common in deep well and sump applications, where the pump must be submerged. However, they are less frequently used due to their complex installation and maintenance requirements.

Application Analysis

Water and Wastewater Treatment applications dominate due to the essential need for reliable fluid handling.

The “Application” segment includes Water and Wastewater Treatment, Chemical Processing, Oil and Gas, Power Generation, Agriculture, Industrial Manufacturing, and others.

Water and Wastewater Treatment applications use volute pumps the most, as these services are crucial for both municipal and industrial needs. Volute pumps in these areas are essential for moving large volumes of water, whether untreated or treated, and are valued for their reliable operation and efficiency.

Other applications, like Chemical Processing and Oil and Gas, also rely heavily on volute pumps for fluid handling. However, due to the high volume and critical role of water and wastewater treatment, this segment remains the largest.

Flow Rate Analysis

Low Flow Rate volute pumps dominate due to their broad use in everyday water management systems.

In the “Flow Rate” segment, volute pumps are categorized by their ability to handle Low, Medium, and High flow rates.

Low Flow Rate pumps lead the market, especially in applications like heating, cooling, and domestic water supply, where high flow rates are not needed. These pumps are ideal for moving water efficiently without the complexity and cost of higher-capacity pumps.

Medium and High Flow Rate pumps are vital for industries that require large fluid volumes to move quickly, such as large-scale irrigation, flood control, and manufacturing. However, the widespread demand for Low Flow Rate pumps in common applications keeps them in the leading position.

Key Market Segments

By Pump Type

- Single-Stage Volute Pumps

- Multi-Stage Volute Pumps

By Discharge Direction

- Horizontal Volute Pumps

- Vertical Volute Pumps

By Application

- Water and Wastewater

- Chemical Processing

- Oil and Gas

- Power Generation

- Agriculture

- Industrial Manufacturing

- Others

By Flow Rate

- Low

- Medium

- High

Drivers

Increasing Demand in Wastewater Treatment Drives Market Growth

The increasing demand for wastewater treatment is a key driver of the volute pump market. As urbanization expands, there is a greater need for efficient water management systems. Volute pumps are widely used in these systems due to their ability to handle large volumes of water, supporting the growth of the market.

The growth of the oil & gas sector also contributes significantly. The sector relies on volute pumps for the transfer of fluids, which is crucial for extraction and processing operations. As the oil & gas industry expands, so does the demand for high-performance pumps.

Expanding industrial infrastructure further drives market growth. Industries such as manufacturing, chemicals, and food processing require reliable pumping solutions, making volute pumps essential components for operations.

Moreover, the rising focus on energy-efficient solutions boosts demand. With increasing awareness of energy conservation, volute pumps that offer energy-efficient performance are preferred by industries looking to reduce operational costs and comply with sustainability goals.

Restraints

High Initial Cost of Installation Restraints Market Growth

The high initial cost of installation is a major restraint in the volute pump market. The costs of acquiring and installing these pumps can be significant, especially for small and medium-sized enterprises (SMEs). This can limit their adoption, particularly in cost-sensitive regions.

Limited awareness in developing regions also slows market growth. In many emerging markets, knowledge of advanced pumping systems like volute pumps is limited, reducing their demand in key sectors such as wastewater management and industrial applications.

Fluctuations in raw material prices further impact the market. The cost of materials like steel and cast iron, which are used in manufacturing volute pumps, can vary due to global supply chain issues. This affects production costs and pricing, limiting affordability.

Maintenance complexity is another restraint. Volute pumps require regular maintenance to ensure efficiency, which can be challenging for operators with limited technical expertise.

Opportunity

Expansion into Emerging Economies Provides Opportunities

Expansion into emerging economies offers significant growth opportunities for the volute pump market. As infrastructure development accelerates in regions like Asia-Pacific and Latin America, the demand for pumping solutions in water supply, agriculture, and industries rises, creating a favorable market environment.

The integration with smart pumping systems also presents growth opportunities. Smart volute pumps equipped with sensors and IoT capabilities enable real-time monitoring, improving efficiency and performance. This trend aligns with the global shift towards digital transformation in industries.

The demand for customized solutions drives further opportunities. Industries often require pumps tailored to specific applications, and manufacturers that offer customization can meet these needs, enhancing customer satisfaction and boosting sales.

Growth in the renewable energy sector, such as hydropower and solar-powered irrigation, also supports market expansion. Volute pumps play a vital role in these applications, contributing to sustainable water management practices.

Challenges

Intense Market Competition Challenges Market Growth

Intense market competition is a major challenge in the volute pump market. Numerous manufacturers offer similar products, leading to pricing pressures and reducing profit margins. This makes it difficult for smaller players to establish a foothold in the market.

Regulatory compliance requirements also challenge growth. Volute pumps used in sectors like wastewater treatment and chemicals must meet strict environmental and safety standards, increasing compliance costs and complicating market entry.

Rapid technological advancements add to the challenges. The constant evolution of pump technologies requires manufacturers to invest heavily in research and development to stay competitive. This can be particularly challenging for smaller companies with limited resources.

Variability in customer needs further complicates market growth. Different industries require specific pump features, making it challenging for manufacturers to offer versatile solutions that cater to diverse applications.

Growth Factors

Strategic Partnerships with Key Industries Are Growth Factors

Strategic partnerships with key industries drive growth in the volute pump market. Collaborations with sectors like wastewater management, oil & gas, and construction enhance product visibility and adoption.

The expansion of distribution channels supports market growth. By strengthening both direct and online sales channels, manufacturers can reach a broader audience and improve customer accessibility.

Continuous R&D investments are also critical growth factors. Advancements in pump technology, materials, and energy efficiency keep products competitive and appealing to customers.

Enhanced customer support services contribute to market growth. Providing technical assistance, training, and after-sales service improves user experience and customer retention.

Emerging Trends

Adoption of IoT-Enabled Pumps Is the Latest Trending Factor

The adoption of IoT-enabled pumps is a significant trend in the volute pump market. These pumps offer real-time data collection, predictive maintenance, and enhanced operational efficiency, making them popular among industries focused on digital transformation.

The focus on smart water management also drives trends. With growing concerns over water scarcity and sustainability, smart volute pumps play a crucial role in efficient water distribution and conservation efforts.

The development of eco-friendly pump designs aligns with global sustainability goals. Manufacturers are increasingly using materials and technologies that minimize environmental impact, supporting green initiatives across industries.

Demand for remote monitoring capabilities further shapes market trends. Remote monitoring allows operators to manage pump performance from a distance, improving convenience and reducing downtime.

Regional Analysis

North America Dominates the Market Share

North America leads the Volute Pump Market, driven by strong demand from water treatment, oil & gas, and industrial sectors. The region benefits from advanced infrastructure and increasing investments in wastewater management projects. The presence of leading manufacturers also supports North America’s market strength.

Market dynamics are shaped by well-developed industrial and municipal sectors that require reliable pumping solutions. The U.S. and Canada, with their focus on efficient water management and energy projects, generate consistent demand for volute pumps. Furthermore, technological innovations in pump design enhance efficiency, supporting market growth.

North America’s influence in the Volute Pump Market is expected to grow, driven by infrastructure upgrades and increasing energy sector investments. Adoption of advanced pump technologies and a focus on energy efficiency are likely to boost demand, potentially expanding the region’s market share in the coming years.

Regional Mentions:

- Europe: Europe’s volute pump market is driven by strong industrial activity, with demand concentrated in countries like Germany, the UK, and France. The region benefits from a focus on sustainable water management solutions.

- Asia-Pacific: Asia-Pacific experiences rapid growth in the volute pump market, driven by large-scale infrastructure projects and strong industrial demand. Countries like China, India, and Japan are major contributors.

- Middle East & Africa: The Middle East & Africa see steady demand for volute pumps, primarily from the oil & gas and water management sectors. Increasing investments in infrastructure drive market growth.

- Latin America: Latin America’s volute pump market grows due to rising demand in agriculture, water treatment, and industrial sectors. Countries like Brazil and Mexico lead regional demand, supported by ongoing infrastructure developments.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The volute pump market is led by four key players: Grundfos, Wilo SE, KSB SE & Co. KGaA, and Xylem Inc.. These companies drive the market with a focus on energy efficiency, advanced technologies, and global distribution networks.

Grundfos is a leading player in the volute pump market. It is known for its wide range of efficient and durable pumps, serving various industries, including water treatment, construction, and agriculture. Grundfos focuses on sustainability, offering energy-saving solutions that support market growth.

Wilo SE is a strong competitor, offering innovative volute pumps for applications such as building services, water management, and industrial use. Wilo’s emphasis on digital solutions and smart pumps enhances its competitive edge, making it popular among industrial users.

KSB SE & Co. KGaA holds a significant position in the volute pump market. The company offers robust pumps known for their reliability and efficiency. KSB focuses on research and development, aiming to provide high-performance pumps that meet diverse industry needs.

Xylem Inc. is a major player with a wide range of volute pumps for water management and industrial applications. Xylem emphasizes sustainability, offering energy-efficient solutions for water and wastewater treatment. Its global distribution network and strategic partnerships further strengthen its market presence.

These key players drive growth in the volute pump market through innovation, energy-efficient products, and a focus on sustainable solutions. Their efforts shape the future of the market by addressing global demands for water management and industrial efficiency.

Top Key Players in the Market

- Grundfos

- Wilo SE

- KSB SE & Co. KGaA

- Xylem Inc.

- Pentair plc

- Flowserve Corporation

- Sulzer Ltd

- Ebara Corporation

- Weir Group plc

- ITT Inc.

Recent Developments

- KSB Spain: In August 2023, KSB Spain implemented a pilot project in the Zamora region, integrating KSB Guard monitoring systems with Omega pumps to optimize irrigation across 17,000 hectares. The KSB Guard system provides real-time data on pump performance, enabling predictive maintenance and reducing downtime, resulting in more efficient water distribution and conservation in agricultural practices.

- Kirloskar Brothers Limited (KBL): In November 2021, KBL secured a patent for its double-suction concrete volute pumping assembly. The assembly features a concrete volute casing with a double-suction impeller, enhancing efficiency and reducing maintenance needs. This innovation is expected to benefit large-scale water management and irrigation systems.

Report Scope

Report Features Description Market Value (2023) USD 17.2 Billion Forecast Revenue (2033) USD 25.7 Billion CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pump Type (Single-Stage Volute Pumps, Multi-Stage Volute Pumps), By Discharge Direction (Horizontal Volute Pumps, Vertical Volute Pumps), By Application (Water and Wastewater, Chemical Processing, Oil and Gas, Power Generation, Agriculture, Industrial Manufacturing, Others), By Flow Rate (Low, Medium, High) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Grundfos, Wilo SE, KSB SE & Co. KGaA, Xylem Inc., Pentair plc, Flowserve Corporation, Sulzer Ltd, Ebara Corporation, Weir Group plc, ITT Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Grundfos

- Wilo SE

- KSB SE & Co. KGaA

- Xylem Inc.

- Pentair plc

- Flowserve Corporation

- Sulzer Ltd

- Ebara Corporation

- Weir Group plc

- ITT Inc.