Global Voice AI for Retail Market Size, Share, Industry Analysis Report By Component(Software/Platform and Services), By Application (Customer Service & Support, Marketing & Advertising, Product Discovery & Search, Inventory Management & Operations, Payment Processing & Checkout, and Other Applications), By Deployment (Cloud-based and On-Premises), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156890

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. Market Size

- By Component Analysis

- By Application Analysis

- By Deployment Analysis

- By End-User Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

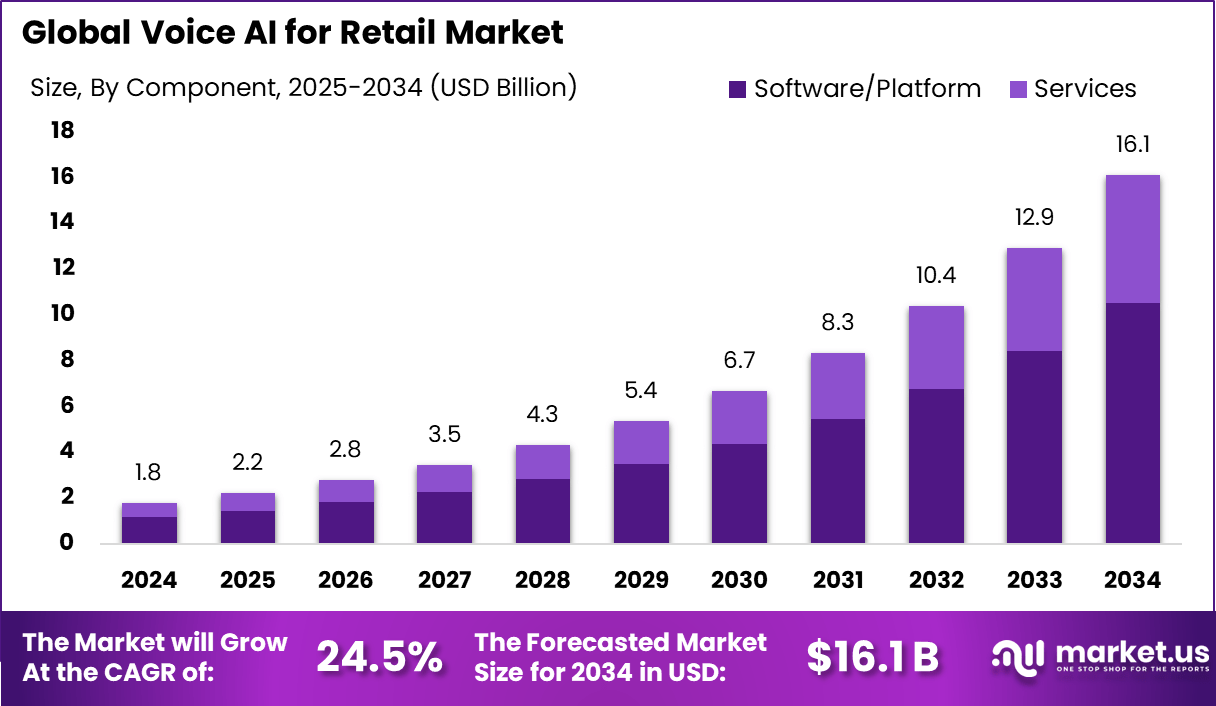

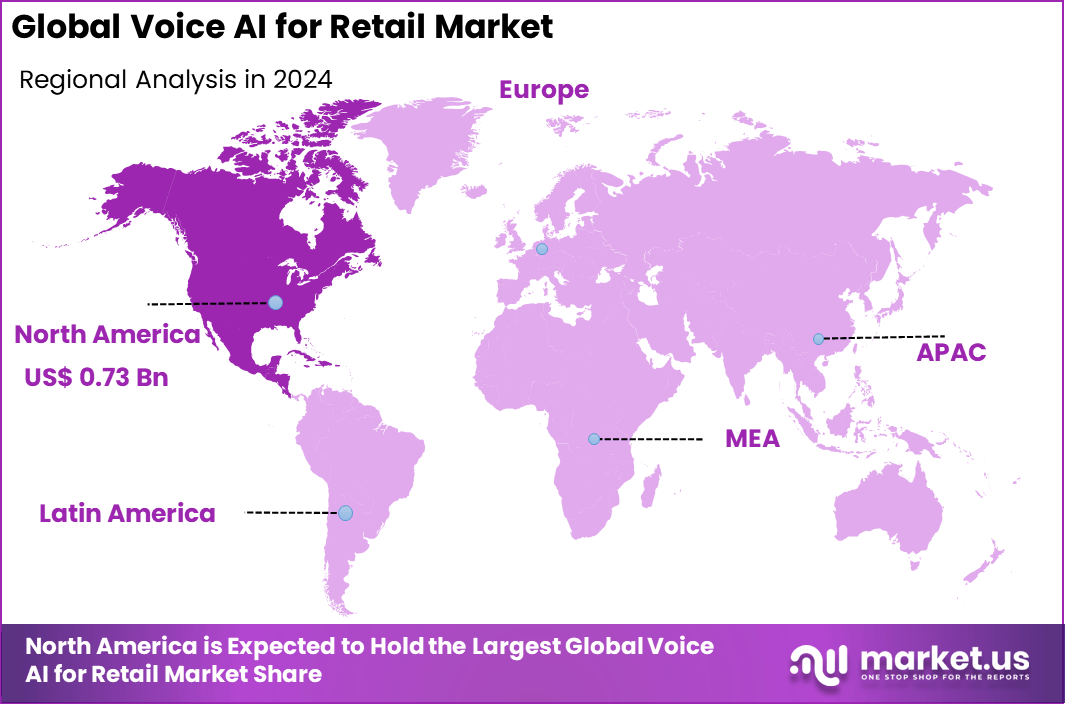

The Global Voice AI for Retail Market size is expected to be worth around USD 16.1 billion by 2034, from USD 1.8 billion in 2024, growing at a CAGR of 24.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.6% share, holding USD 0.73 billion in revenue.

Voice AI for the retail market is the use of artificial intelligence combined with natural language processing to enable computers to understand, interpret, and respond to human speech specifically within retail environments. This technology helps retailers enhance customer engagement by providing conversational, voice-based interactions that support tasks such as product search, personalized recommendations, order tracking, and customer service.

The top driving factors behind the adoption of Voice AI in retail include the increasing consumer preference for convenience and personalization, the capability of voice systems to handle large volumes of simultaneous interactions efficiently, and the shift towards 24/7 availability of customer support. Another major driver is the technology’s ability to reduce operational costs by automating routine inquiries and improving service consistency across all customer touchpoints.

According to Market.us, The Global Voice AI Agents Market is witnessing rapid growth as enterprises and consumers adopt conversational AI for enhanced communication and customer engagement. Valued at USD 2.4 Billion in 2024, the market is expected to reach nearly USD 47.5 Billion by 2034, advancing at a strong CAGR of 34.8% from 2025 to 2034.

Voice AI is transforming customer service and retail by improving efficiency and customer experience. According to verloop.io, a large telecom company reduced call handling time by 35% with Voice AI, while an IBM study recorded a 30% increase in customer satisfaction. Some solutions cut queue times by up to 50%, and half of consumers have already used voice assistants for support.

By 2026, 80% of businesses plan to adopt AI-driven voice technology, with early adopters reporting 20–30% lower operational costs. Consumer behavior is also shifting, as 71% use voice assistants for product research and 89% prefer brands that provide this support. Data from gnani.ai further shows that retailers using Voice AI see conversion rates rise by 15-30% through personalized interactions, alongside stronger customer satisfaction due to reduced wait times and more consistent service.

Key Takeaways

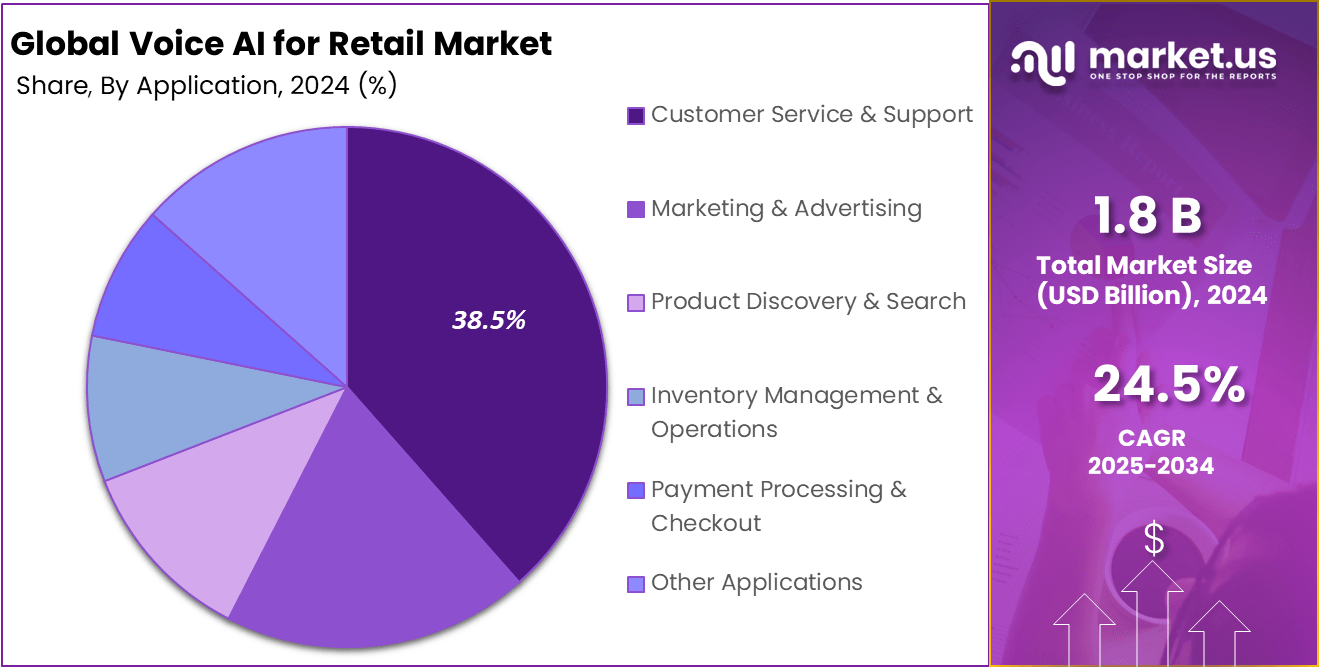

- The global voice AI for retail market is valued at USD 1.8 billion in 2024 and is projected to grow at a 24.5% CAGR (2025–2034), driven by the rapid adoption of voice-enabled retail solutions.

- Software/Platform solutions dominate with a 65.3% share in 2024, reflecting strong demand for cloud-native AI voice engines, orchestration layers, and conversational platforms.

- Customer Service & Support leads applications at 38.5%, underscoring the priority of enhancing call center efficiency, in-store assistance, and online self-service with voice AI.

- Cloud-based deployments account for 78.2% of the market, showing retailers’ preference for scalable, continuously updated, and integration-ready solutions over on-premises setups.

- E-commerce retailers hold the largest end-user share at 34.4%, as digital-first players leverage voice AI for product discovery, order management, and personalized shopping experiences.

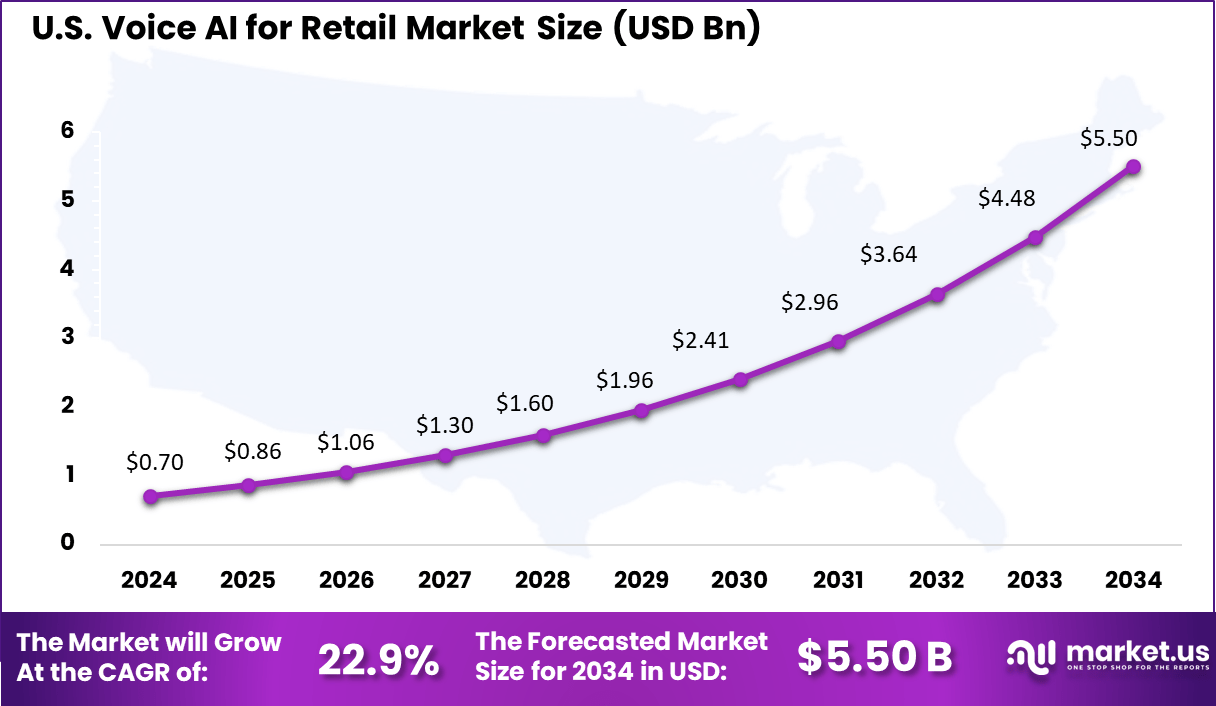

- North America leads with 40.6% share, with the US alone at USD 0.70 billion in 2024, growing at a 22.9% CAGR, fueled by early technology adoption and mature retail AI ecosystems.

Analysts’ Viewpoint

Investment opportunities in Voice AI for retail lie in developing advanced natural language understanding, voice biometrics for secure authentication, predictive replenishment systems linked to voice commands, and AI-powered voice agents capable of complex multi-turn conversations. Startups and technology providers focusing on seamless integration APIs, voice interaction analytics, and multilingual support technologies represent promising areas for investment.

The growing demand for personalized, real-time conversational commerce and the expansion of voice-enabled devices provide fertile ground for innovation and capital infusion. The business benefits realized from Voice AI in retail include increased customer satisfaction due to faster and more personalized service, improved operational efficiency via automation of routine queries, and enhanced data-driven decision-making through voice interaction analytics.

Retailers report higher average order values resulting from AI-driven recommendations and upselling, along with better handling of peak shopping periods without performance degradation. These advantages foster better customer retention and open new avenues for voice commerce as a channel. The regulatory environment for voice AI in retail requires careful attention to privacy and data security, particularly around voice data capture and storage.

Compliance with data protection laws such as GDPR and CCPA is critical to maintain consumer trust, as voice interactions can contain sensitive personal information. Retailers must implement secure handling, anonymization, and consent management mechanisms to meet regulatory demands. The evolving legal landscape around voice data continues to shape how retailers deploy voice AI technologies responsibly.

U.S. Market Size

The U.S. Voice AI for Retail Market is valued at USD 0.70 billion in 2024 and is expected to grow at a robust CAGR of 22.9%, driven by rising adoption of AI-powered voice solutions for enhancing customer experience and operational efficiency. U.S. retailers are integrating voice assistants, smart kiosks, and conversational AI platforms to enable frictionless shopping, personalized recommendations, and faster service.

Retailers are also employing voice analytics to derive actionable insights from millions of customer interactions; Home Depot uses voice bots to handle routine inquiries, reducing call center workloads and improving satisfaction. Over 40% of U.S. consumers have tried voice shopping, indicating strong market readiness.

Voice AI also supports curbside pickup coordination, loyalty programs, and omnichannel engagement, critical for post-pandemic retail strategies. For instance, Walmart uses voice-enabled shopping through Google Assistant, allowing customers to add items to their carts via simple voice commands, while Amazon’s Alexa powers seamless reordering and product search for Prime members.

In 2024, North America held a dominant market position, capturing more than 40.6% share and generating USD 0.73 billion revenue in the voice AI for retail market. The leadership of this region is supported by the rapid digital transformation of retail, driven by strong consumer demand for personalized and seamless shopping experiences.

Retailers in the United States and Canada have increasingly adopted voice-enabled technologies to improve customer engagement, from smart checkout systems to voice-based product search and recommendations. The high penetration of smart speakers, virtual assistants, and AI-powered chatbots across households and retail chains has further accelerated adoption, giving North America a clear edge over other regions.

By Component Analysis

Software/Platform (65.3% Market Share in 2024)

The software and platform component dominated the Voice AI for Retail market in 2024, capturing a significant 65.3% market share. This dominance is driven by the increasing adoption of intelligent voice recognition, natural language processing, and conversational AI platforms by retailers seeking to enhance customer interaction.

These software solutions provide the underlying infrastructure for voice-enabled applications, including automatic speech recognition (ASR), natural language understanding (NLU), and text-to-speech (TTS) components, empowering retailers to build customized voice experiences tailored to their brand and customer needs.

Retailers prioritize software platforms because they offer scalability, integration flexibility, and continuous improvements through AI model training and updates. The software-centric approach allows businesses to deploy voice AI across various channels such as websites, mobile apps, and in-store kiosks, providing a seamless omnichannel customer experience.

By Application Analysis

Customer Service & Support (38.5% Market Share in 2024)

Customer service and support make up the leading application segment of the Voice AI for Retail market, holding a 38.5% share in 2024. Voice AI technologies in this area streamline customer interactions by providing instant responses to inquiries, handling returns, tracking orders, and offering product recommendations.

This reduces reliance on human agents and drastically cuts wait times, enabling 24/7 support availability that meets rising consumer expectations for speed and convenience. The transition to voice AI in customer service also improves scalability during peak shopping periods, such as holidays or sales events, when call volumes spike.

Retailers benefit from consistent service quality as AI systems maintain operational performance around the clock without fatigue or variability. The data generated from voice interactions further allows retailers to analyze customer sentiment and preferences, supporting continuous improvement in service levels and tailored marketing strategies.

By Deployment Analysis

Cloud-Based (78.2% Market Share in 2024)

The cloud-based deployment segment overwhelmingly dominated the Voice AI for Retail market with a 78.2% share in 2024. The prevalence of cloud infrastructure stems from its cost-effectiveness, rapid scalability, and ease of integration with other digital retail ecosystems. Cloud deployment enables retailers to quickly roll out voice AI functionalities without substantial upfront investments in hardware or IT maintenance.

Cloud solutions allow continuous updates and optimization of AI algorithms, ensuring that voice assistants perform at peak accuracy and can handle diverse customer queries efficiently. Additionally, the cloud’s flexibility supports multi-channel deployment across geographies and devices, facilitating global retail operations. As voice AI continually learns and improves, cloud-based delivery ensures retailers can harness the latest advancements without disruption.

By End-User Analysis

E-commerce Retailers (34.4% Market Share in 2024)

E-commerce retailers lead the end-user segment of the Voice AI for Retail market with a 34.4% share in 2024. This segment benefits extensively from voice AI’s ability to simplify shopping journeys, allowing customers to search products, place orders, check shipment status, and seek assistance through natural voice commands.

E-commerce platforms emphasize personalized, frictionless experiences, and voice AI fulfills these needs by providing conversational, hands-free interaction. Furthermore, e-commerce retailers leverage voice AI to increase operational efficiency by automating routine customer interactions, freeing human agents to focus on complex issues.

Voice AI also supports personalization at scale by remembering customer preferences and providing tailored product suggestions, enhancing engagement and loyalty. With rising consumer comfort with voice technology, e-commerce retailers see substantial conversion and satisfaction gains through AI-powered voice shopping experiences.

Key Market Segments

By Component

- Software/Platform

- Services

- Managed Services

- Professional Services

By Application

- Customer Service & Support

- In-Store

- Online

- Call Centers

- Marketing & Advertising

- Product Discovery & Search

- Inventory Management & Operations

- Payment Processing & Checkout

- Other Applications

By Deployment

- Cloud-based

- On-Premises

By End-User

- E-commerce Retailers

- Brick-and-Mortar Retailers

- Omnichannel Retailers

- Grocery & QSR (Quick Service Restaurants)

Driver Analysis

Personalization Enhances Customer Experience

Voice AI in retail greatly improves customer satisfaction through deep personalization. By analyzing customer data such as purchase history, browsing habits, and even voice tone, Voice AI systems generate tailored product recommendations and personalized interactions. This creates a shopping experience that feels intuitively customized, making customers feel understood and valued.

Retailers benefit from improved customer loyalty and higher average order values as Voice AI suggests complementary products and timely promotions matching customer preferences. This personalized approach results in stronger emotional connections between brands and shoppers, enhancing overall sales performance and competitive advantage.

Restraint Analysis

Privacy and Security Concerns

A significant restraint to Voice AI adoption in retail is customer concern over privacy and data security. Voice interactions often capture sensitive information like payment details and personal preferences, raising fears about data misuse or breaches.

Retailers must address these concerns by implementing strict data protection policies, transparent privacy statements, and secure infrastructure to protect customer voice data. Failure to adequately assure customers about privacy may slow adoption rates and reduce trust in voice-enabled retail services. These security and privacy challenges make integration more complex and require ongoing vigilance to maintain consumer confidence.

Opportunity Analysis

Expanding Omnichannel and Multimodal Integration

There is a growing opportunity for retailers to embed Voice AI within a broader omnichannel strategy that integrates voice, visual, and text interfaces. Voice AI can complement mobile apps, websites, and physical stores by providing seamless customer experiences across platforms.

For example, customers might start a shopping conversation using voice commands, continue via chat, and finalize purchases on an app without repeating information. This multimodal integration enhances convenience and drives higher engagement.

Additionally, emerging tech like augmented reality combined with Voice AI can create immersive experiences where customers explore products visually while getting real-time voice assistance, opening new pathways for retail innovation and customer interaction.

Challenge Analysis

Technical Integration and Operational Complexity

Implementing Voice AI solutions in retail involves overcoming significant technical and operational challenges. Integration with existing retail systems such as inventory databases, customer management platforms, and e-commerce sites requires careful planning and robust IT infrastructure changes. Moreover, maintaining consistent voice service quality across multiple devices and platforms can be difficult.

Additional challenges include ensuring the natural, human-like quality of voice interactions and ongoing system training through machine learning to keep responses accurate and relevant. Retailers must invest considerable time and resources into deployment and continuous optimization to fully realize the benefits, which can be a barrier for less technologically mature organizations.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Key Player Analysis

In the Voice AI for Retail Market, global technology leaders such as Amazon, Google, Microsoft, and IBM play a central role. Their platforms offer advanced natural language processing and deep integration with cloud ecosystems. Retailers adopt these solutions to improve customer engagement, automate support, and drive personalized shopping experiences.

Specialized players including SoundHound Inc., Verint, Salesforce, Zebra Technologies, and Dasha AI contribute with niche expertise and sector-focused solutions. These companies provide advanced conversational AI, customer analytics, and omnichannel integration tools that address retail-specific challenges. Their systems are tailored to handle complex customer queries, streamline in-store operations, and support voice-enabled commerce.

Emerging innovators such as Voice AI, Gnani Innovations Private Limited, Retell AI, Dialzara LLC, 2X Solutions, and Yellow AI are also gaining attention. These companies bring agile models, regional language capabilities, and custom-built applications for diverse retail formats. Their growth is driven by rising demand for localized solutions and integration with mobile commerce.

Top Key Players in the Voice AI for Retail Market

- Amazon

- Microsoft

- IBM

- SoundHound Inc.

- Verint

- Salesforce

- Zebra Technologies

- Dasha AI

- Voice AI

- Gnani Innovations Private Limited

- Retell AI

- Dialzara LLC

- 2X Solutions

- Yellow AI

- Other Key Players

Recent Developments

- July 2025: Sodaclick and Intel launched the UAE’s first multilingual conversational AI at a KFC drive-thru, fluent in Arabic and English. Powered by Intel Core Ultra processors, it boosts upsells by 75%, increases orders by +8.5 AED, and delivers faster, personalized service, enhancing the overall drive-thru experience.

- May 2025: Solda.AI, founded in 2023 by Sergey Shalaev, raised $4 million in seed funding led by Accel to advance its multimodal AI voice agents for autonomous telesales. Serving finance, retail, transport, and telecom clients, including TBI Bank and Vivid Money, Solda.AI aims to revolutionize sales channels with scalable, human-like AI agents.

- May 2025: Amazon is testing AI-powered short-form audio product summaries on select U.S. items, voiced by “AI shopping experts”. Accessible via the app’s “Hear the highlights” button, these summaries use LLMs to discuss features, reviews, and web information, providing conversational, multitasking-friendly product insights alongside existing AI tools like Rufus and Interests.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 16.1 Bn CAGR(2025-2034) 24.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platform and Services), By Application (Customer Service & Support, Marketing & Advertising, Product Discovery & Search, Inventory Management & Operations, Payment Processing & Checkout, and Other Applications), By Deployment (Cloud-based and On-Premises), By End-User (E-commerce Retailers, Brick-and-Mortar Retailers, Omnichannel Retailers, and Grocery & QSR (Quick Service Restaurants) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon, Google, Microsoft, IBM, SoundHound Inc., Verint, Salesforce, Zebra Technologies, Dasha AI, Voice AI, Gnani Innovations Private Limited, Retell AI, Dialzara LLC, 2X Solutions, Yellow AI, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Voice AI for Retail MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Voice AI for Retail MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon

- Microsoft

- IBM

- SoundHound Inc.

- Verint

- Salesforce

- Zebra Technologies

- Dasha AI

- Voice AI

- Gnani Innovations Private Limited

- Retell AI

- Dialzara LLC

- 2X Solutions

- Yellow AI

- Other Key Players